|

市場調查報告書

商品編碼

1851430

分散式控制系統:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Distributed Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

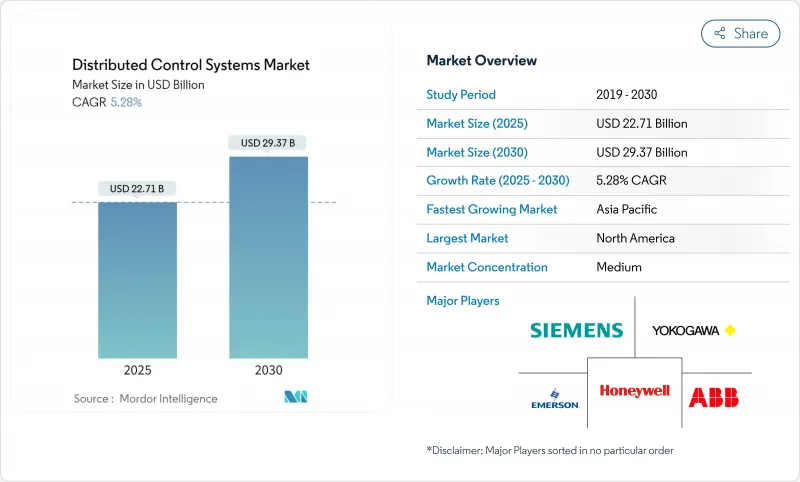

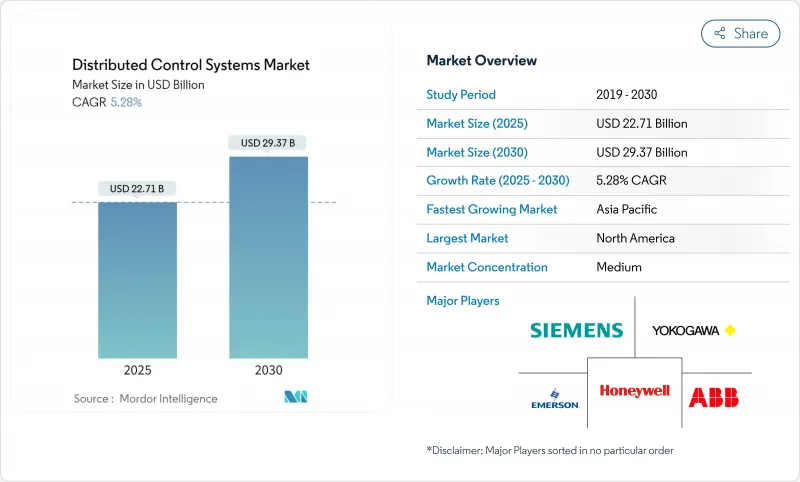

預計到 2025 年,分散式控制系統市場規模將達到 227.1 億美元,到 2030 年將達到 293.7 億美元,複合年成長率為 5.28%,凸顯了對高可靠性流程自動化的持續需求。

綠色氫氣生產、碳捕獲計劃、核能發電的增加以及製藥業向連續生產模式的轉變都在推動成長。供應商正在擴展軟體定義架構、數位雙胞胎整合和邊緣連接,以釋放營運效益,而規模較小的工廠則採用降低准入門檻的小型化平台。日益成長的網路安全需求、認證工程師的短缺以及半導體行業仍然存在的限制正在減緩成長速度,但並未阻礙擴張。競爭的焦點集中在預測性維護、模組化部署和訂閱授權模式上,以分散資本支出。

全球分散式控制系統市場趨勢與洞察

能源轉型推動了對綠色氫能和碳捕獲、利用與封存(CCUS)設施的分散式控制系統(DCS)的需求。

到2024年,綠色氫氣產能將達到1,640萬噸,每座新建廠部署一套複雜的控制平台,成本在200萬至1,000萬美元之間。分散式控制系統(DCS)架構必須能夠適應間歇性再生能源,確保氫氣安全,並適應電解槽效率的快速提升(預計五年內將提升20%至30%)。供應商正在將模組化控制節點打包,這些節點可根據工廠建設階段進行擴展,使營運商無需徹底更換即可進行升級。雖然歐洲和中東地區在早期應用方面處於領先地位,但北美開發人員正在迅速發布與《通貨膨脹降低法案》獎勵相關的詢價單(RFQ)。由於投資週期較長,2030年後仍有大量分散式控制系統市場計劃正在籌備中。

核能和小型模組化反應器計劃需要網路安全等級的分散式控制系統 (DCS)。

監管機構現在要求所有新核子反應爐都必須採用具有認證空氣間隙控制系統(DCS)。美國美國核能管理委員會(NRC)於2025年收緊了網路安全法規,提高了認證成本,並對符合標準的平台徵收了溢價。小型模組化反應器(SMR)供應商正在指定採用數位安全通道,以縮短實體佈線、加快建造進度並支援遠距離診斷。歐洲和中國正在標準化類似的框架,海灣國家也在增加核能機組以實現海水淡化脫碳。長達18個月或更久的認證週期阻礙了新進者,並鞏固了現有供應商在分散式控制系統市場的地位。

與現代PLC/SCADA替代方案相比,初始資本支出較高。

開放式流程自動化試點計畫已證實,與傳統分散式控制系統(DCS)相比,成本可節省 52%,這吸引了資金緊張的中小型業者。供應商則透過訂閱許可、靈活的 I/O 和預製建立庫來減少硬體數量,以應對這項挑戰。然而,高昂的價格仍導致東協、拉丁美洲和非洲部分地區的計劃延期,使分散式控制系統市場成長放緩了 0.8 個百分點。

細分市場分析

2024年,硬體在分散式控制系統市場中佔據55%的佔有率,這反映出終端用戶偏好經過現場驗證的控制器、通用I/O和冗餘網路。受能源和化學品更換週期的推動,硬體分散式控制系統市場規模達125億美元。供應商現在提供的可配置I/O切片支援在任何通道上接收類比、數位和HART訊號,從而減少高達30%的機櫃數量。通用卡還支援後期設計變更,這對於面臨工期緊張的EPC承包商來說極具吸引力。控制器平台能夠加快綠色氫能工廠中密集PID迴路的循環速度,即使在可再生能源供電波動的情況下也能確保精度。

軟體收入雖然規模不大,但正以每年 7.9% 的速度成長,這得益於營運商對分析、虛擬化和 OT-IT 融合的積極採用。嵌入歷史資料層的模型預測演算法能夠微調設定點,從而降低 2-5% 的能耗。虛擬化伺服器在單一虛擬機器管理程式上託管多個控制域,以便於容錯移轉和修補程式管理。服務組合也在不斷發展:艾默生的現場工程師可確保關鍵績效指標 (KPI) 的達成,而 ABB 的生命週期軟體計畫則包含網路安全加固和警報系統最佳化更新。

混合架構融合了中央監控節點和分散式邊緣控制器,預計到2024年將佔據分散式控制系統市場46%的佔有率。工廠可以採用這種拓撲結構,逐步遷移傳統I/O,保留現有佈線,並在無需全面維修的情況下添加新的分析功能。在典型的改裝中,本地虛擬機器承載邏輯,而確定性乙太網路環連接現場模組,從而實現低於50微秒的延遲。混合架構也簡化了網路安全區域分類,在隔離安全迴路的同時,仍允許透過安全代理進行資料存取。

隨著製藥、液化天然氣和核能等終端用戶對零計劃外停機時間的需求日益成長,完全冗餘、高可用性設計正以9.2%的複合年成長率快速發展。冗餘設計涵蓋控制器、電源、開關,甚至包括GPS同步時間戳,以確保事件順序的準確性。西門子在奧迪生產線上展示了虛擬PLC,實現了伺服器間工作負載的遷移,且運動控制不中斷。雖然集中式控制器仍然服務於渦輪機島和間歇式消化器等確定性循環比靈活性更重要的應用場景,但隨著模組化數位化工廠在新資本投資中佔據主導地位,它們在分散式控制系統市場的佔有率正在下降。

分散式控制系統 (DCS) 市場報告按組件(硬體、軟體、服務)、最終用戶行業(發電、石油天然氣、其他)、架構(集中式控制器系統、其他)、部署模式(本地部署、其他)、工廠規模(小型(小於 5000 個 I/O)、其他)和地區(北美、歐洲、其他)對產業進行細分。市場預測以美元計價。

區域分析

到2024年,亞太地區將佔據分散式控制系統(DCS)市場38%的佔有率,這主要得益於中國煉油和化工產能的成長以及印度基礎設施的快速發展。儘管像Supcon這樣的區域供應商正在贏得城市供水和中型化學項目,但數十億美元的液化天然氣(LNG)和核能計劃仍然由全球大型企業主導。北京的智慧製造計畫將資助DCS數據與企業人工智慧連結的維修,從而擴大軟體的普及應用。印度的生產獎勵(PLI)正在促使製藥和電池工廠從一開始就採用模組化、可擴展的DCS。隨著彈性包裝生產線和生質柴油設備的增加,東南亞將維持中等個位數的成長。

中東地區將以7.1%的複合年成長率成為成長最快的地區,這主要得益於沙烏地阿拉伯的「2030願景」。該計畫旨在實現該國40%電網的自動化,並建立綠色氫能產業叢集。海灣合作理事會(GCC)成員國已承諾投入3.1兆美元用於資本計劃,每個項目都從設計初就融入了營運技術(OT)與資訊科技(IT)的整合。隨著本地整合商與跨國公司合作以完成在地化指標,分散式控制系統市場的供應商生態系統正在不斷擴大。

北美正在對其老化的電力和化學基礎設施進行現代化改造,美國能源部和國土安全部的計畫已將網路安全納入資金籌措的先決條件。 《通膨控制法案》將獎勵碳捕獲和無污染燃料,而這些領域正是分散式控制系統(DCS)的重度使用者。歐洲正優先考慮永續性,其加工廠正在採用先進的分析技術來降低能耗並達到「適合55歲人群」的目標。南美洲正在投資銅和鋰礦開採,並將邊緣連接控制系統引入偏遠地區;而非洲則正在推動海水淡化和電網升級,並將當地可再生納入能源結構,以創造兩位數以上的電力需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 能源轉型推動了對綠色氫能和碳捕獲、利用與封存(CCUS)設施的分散式控制系統(DCS)的需求。

- 核能和小型模組化反應器計劃需要網路安全等級的分散式控制系統。

- 海上浮式液化天然氣計畫的複雜性推動了高可靠性分散式控制系統的應用。

- 製藥連續生產推動模組化批次DCS系統的應用

- 數位雙胞胎整合DCS用於棕地預測性維護

- 礦業遠端操作中心加速邊緣連接分散式控制系統

- 市場限制

- 與現代PLC/SCADA替代方案相比,初始投資較高

- DCS認證工程師和生命週期服務人員短缺

- 高效能控制器硬體所需的半導體供不應求

- 網路安全認證和合規的漫長週期

- 價值/供應鏈分析

- 監管或技術環境

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業產能和投資趨勢

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 建築設計

- 集中式控制器系統

- 混合/分散式混合系統

- 全冗餘高可用性系統

- 按部署模式

- 本地部署

- 雲端/邊緣主機

- 按行業

- 發電業務

- 火力發電廠

- 可再生能源和電池儲能電站

- 核能發電廠

- 石油和天然氣

- 上游

- 中游

- 下游和煉油廠

- 化工/石油化工

- 採礦和金屬

- 紙漿和造紙

- 製藥和生命科學

- 飲食

- 用水和污水

- 其他行業

- 發電業務

- 按工廠規模(控制器 I/O)

- 小規模(少於 5,000 個 I/O)

- 中(5,000-15,000 I/O)

- 大型(I/O少於15,000)

- 按地區

- 北美洲

- 美國

- 加拿大

- 加勒比海

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 北歐國家

- 其他歐洲地區

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International Inc.

- Siemens AG

- Yokogawa Electric Corporation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Valmet Oyj

- Azbil Corporation

- Omron Corporation

- Novatech LLC

- Toshiba Corporation

- Hitachi, Ltd.

- GE Digital(General Electric Co.)

- Fuji Electric Co., Ltd.

- Supcon Technology Co., Ltd.

- Hollysys Automation Technologies Ltd.

- Endress+Hauser Group Services AG

- BandR Industrial Automation GmbH

第7章 市場機會與未來展望

The distributed control systems market is valued at USD 22.71 billion in 2025 and is forecast to reach USD 29.37 billion by 2030 at a 5.28% CAGR, underscoring enduring demand for high-reliability process automation.

The green-hydrogen build-out, carbon-capture projects, nuclear power additions, and the pharmaceutical shift to continuous production anchor growth. Vendors are expanding software-defined architectures, digital-twin integration, and edge connectivity to unlock operational gains, while small plants adopt scaled-down platforms that lower entry costs. Rising cybersecurity requirements, shortages of certified engineers, and residual semiconductor constraints temper the pace but do not derail the expansion. Competitive momentum centers on predictive maintenance, modular deployment, and subscription licensing that spread capital outlays.

Global Distributed Control Systems Market Trends and Insights

Energy Transition Drives DCS Demand in Green Hydrogen and CCUS Facilities

Green-hydrogen capacity announcements reached 16.4 million tons in 2024 and each new plant installs sophisticated control platforms valued at USD 2-10 million. DCS architectures must handle intermittent renewable power, ensure hydrogen safety, and flex for rapid electrolyzer efficiency gains forecast at 20-30% within five years. Vendors are packaging modular control nodes that scale with plant phases, letting operators upgrade without wholesale rip-and-replace. Europe and the Middle East lead early adoption, but North American developers are quickly issuing RFQs tied to Inflation Reduction Act incentives. The long investment horizon underpins a stable pipeline of distributed control systems market projects well beyond 2030.

Nuclear and SMR Projects Requiring Cyber-secure Safety-Classified DCS

Regulators now demand air-gapped, safety-class DCS with certified redundancy for every new reactor. The U.S. Nuclear Regulatory Commission tightened cyber rules in 2025, raising qualification costs but also locking in premium pricing for compliant platforms. SMR vendors specify digital safety channels that shorten physical wiring runs, cut construction schedules, and support remote diagnostics. Europe and China are standardizing on similar frameworks, while Gulf countries add nuclear units to decarbonize desalination. Certification cycles that run 18 months or more keep new entrants out and reinforce the position of incumbent suppliers in the distributed control systems market.

High Up-front CAPEX versus Modern PLC/SCADA Alternatives

Open process automation pilots show 52% cost savings over classic DCS builds, tempting small and mid-tier operators that weigh every capital dollar Vendors counter with subscription licenses, flexible I/O, and pre-engineered libraries that trim hardware counts. Yet sticker shock still postpones projects in ASEAN, Latin America, and parts of Africa, shaving 0.8 percentage points off distributed control systems market growth.

Other drivers and restraints analyzed in the detailed report include:

- Offshore Floating LNG Complexity Elevates High-Reliability DCS Adoption

- Pharma Continuous Manufacturing Spurs Modular Batch DCS Installations

- Scarcity of DCS-Certified Engineers and Lifecycle Service Staff

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware retained a 55% distributed control systems market share in 2024, reflecting end-user preference for field-proven controllers, universal I/O, and redundant networks. The distributed control systems market size for hardware hit USD 12.5 billion, buoyed by replacement cycles in energy and chemicals. Vendors now ship configurable I/O slices that accept analog, digital, or HART signals on any channel, cutting cabinet counts by up to 30%. Universal cards also support late-stage design changes, a compelling feature for EPC contractors facing tight schedules. Controller platforms add fast cycle times for high-density PID loops in green hydrogen plants, safeguarding accuracy when power supply fluctuates with renewables.

Software revenue, though smaller, is rising 7.9% per year as operators embrace analytics, virtualization, and OT-IT convergence. Model-predictive algorithms embedded in historian layers fine-tune setpoints and shave energy consumption 2-5%. Virtualized servers host multiple control domains on a single hypervisor, easing failover and patch management. Service portfolios evolve as well: Emerson's factory resident engineers guarantee KPIs, while ABB's lifecycle software plans bundle cyber hardening and alarm-rationalization updates. This pivot reshapes value capture across the distributed control systems market, shifting focus from capital goods to recurring service streams.

Hybrid architectures blended centralized supervisory nodes with distributed edge controllers to secure 46% of the distributed control systems market size in 2024. Plants adopt this topology to migrate legacy I/O in phases, preserve wiring, and layer new analytics without wholesale rip-and-replace. In a typical retrofit, on-premise virtual machines host logic while deterministic Ethernet rings connect field modules, yielding latency under 50 microseconds. Hybrid layouts also simplify cybersecurity zoning, keeping safety loops isolated yet data-accessible via secure proxies.

Fully redundant high-availability designs grow fastest at 9.2% CAGR as pharma, LNG, and nuclear end-users mandate zero unplanned downtime. Redundancy spans controllers, power, switches, and even GPS-synchronized time stamps to maintain sequence-of-events accuracy. Siemens demonstrated a virtual PLC in a production Audi line that migrated workloads between servers without interrupting motion control. Centralized controllers still serve turbine islands and batch digesters where deterministic cycles trump flexibility, but their share of the distributed control systems market declines as modular digital plants dominate new capex.

Distributed Control System (DCS) Market Report Segments the Industry Into by Component (Hardware, Software, Services), by End-User Vertical (Power Generation, Oil & Gas, and More), Architecture (Centralized Controller Systems and More), Deployment Model(On-Premise and More), Plant Size(Small ( Less Than 5000 I/O) and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 38% share of the distributed control systems market in 2024, anchored by China's refining and chemicals capacity and India's rapid infrastructure build-out. Regional suppliers like Supcon win municipal water and mid-tier chemical jobs, yet global majors still dominate multi-billion-dollar LNG and nuclear projects. Beijing's smart-manufacturing program funds retrofits that couple DCS data with enterprise AI, expanding software pull-through. India's PLI incentives spur pharmaceutical and battery plants that specify modular, scalable DCS from day one. Southeast Asian economies add flexible packaging lines and biodiesel units, sustaining mid-single-digit growth.

The Middle East posts the fastest 7.1% CAGR, powered by Saudi Arabia's Vision 2030, which automates 40% of the kingdom's grid and builds green-hydrogen clusters. GCC states commit to USD 3.1 trillion in capital projects, each embedding OT-IT convergence from design. Local integrators partner with multinationals to meet localization quotas, broadening the vendor ecosystem within the distributed control systems market.

North America modernizes aging power and chemicals infrastructure, embedding cybersecurity as a funding prerequisite under DOE and DHS programs. The Inflation Reduction Act funnels incentives to carbon capture and clean fuels, both heavy DCS users. Europe emphasizes sustainability; process plants deploy advanced analytics to trim energy and comply with Fit-for-55 targets. South America invests in copper and lithium mining that uses edge-connected control for remote sites, while Africa rolls out desalination and grid upgrades blending local renewables, creating pockets of double-digit demand.

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International Inc.

- Siemens AG

- Yokogawa Electric Corporation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Valmet Oyj

- Azbil Corporation

- Omron Corporation

- Novatech LLC

- Toshiba Corporation

- Hitachi, Ltd.

- GE Digital (General Electric Co.)

- Fuji Electric Co., Ltd.

- Supcon Technology Co., Ltd.

- Hollysys Automation Technologies Ltd.

- Endress+Hauser Group Services AG

- BandR Industrial Automation GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy Transition Drives DCS Demand in Green Hydrogen and CCUS Facilities

- 4.2.2 Nuclear and SMR Projects Requiring Cyber-secure Safety-Classified DCS

- 4.2.3 Offshore Floating LNG Complexity Elevates High-Reliability DCS Adoption

- 4.2.4 Pharma Continuous Manufacturing Spurs Modular Batch DCS Installations

- 4.2.5 Digital-Twin-Integrated DCS for Predictive Maintenance in Brownfields

- 4.2.6 Remote Operations Centres in Mining Accelerate Edge-Connected DCS

- 4.3 Market Restraints

- 4.3.1 High Up-front CAPEX versus Modern PLC/SCADA Alternatives

- 4.3.2 Scarcity of DCS-Certified Engineers and Lifecycle Service Staff

- 4.3.3 Semiconductor Supply Crunch for High-Performance Controller Hardware

- 4.3.4 Lengthy Cyber-security Certification and Compliance Cycles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Capacity and Investment Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Architecture

- 5.2.1 Centralized Controller Systems

- 5.2.2 Hybrid / Distributed Hybrid Systems

- 5.2.3 Fully Redundant High-Availability Systems

- 5.3 By Deployment Model

- 5.3.1 On-Premise

- 5.3.2 Cloud / Edge-Hosted

- 5.4 By Industry Vertical

- 5.4.1 Power Generation

- 5.4.1.1 Thermal Power Plants

- 5.4.1.2 Renewable and Battery Storage Plants

- 5.4.1.3 Nuclear Power Plants

- 5.4.2 Oil and Gas

- 5.4.2.1 Upstream

- 5.4.2.2 Midstream

- 5.4.2.3 Downstream and Refineries

- 5.4.3 Chemicals and Petrochemicals

- 5.4.4 Mining and Metals

- 5.4.5 Pulp and Paper

- 5.4.6 Pharmaceuticals and Life Sciences

- 5.4.7 Food and Beverage

- 5.4.8 Water and Wastewater

- 5.4.9 Other Industries

- 5.4.1 Power Generation

- 5.5 By Plant Size (Controller I/O)

- 5.5.1 Small ( greater than 5 000 I/O)

- 5.5.2 Medium (5 000 - 15 000 I/O)

- 5.5.3 Large (less than 15 000 I/O)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 Caribbean

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Argentina

- 5.6.3.3 Rest of South America

- 5.6.4 Europe

- 5.6.4.1 Germany

- 5.6.4.2 United Kingdom

- 5.6.4.3 France

- 5.6.4.4 Italy

- 5.6.4.5 Nordics

- 5.6.4.6 Rest of Europe

- 5.6.5 Middle East

- 5.6.5.1 UAE

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Qatar

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.7 Asia-Pacific

- 5.6.7.1 China

- 5.6.7.2 Japan

- 5.6.7.3 India

- 5.6.7.4 South Korea

- 5.6.7.5 ASEAN

- 5.6.7.6 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ABB Ltd.

- 6.4.2 Emerson Electric Co.

- 6.4.3 Honeywell International Inc.

- 6.4.4 Siemens AG

- 6.4.5 Yokogawa Electric Corporation

- 6.4.6 Schneider Electric SE

- 6.4.7 Mitsubishi Electric Corporation

- 6.4.8 Rockwell Automation, Inc.

- 6.4.9 Valmet Oyj

- 6.4.10 Azbil Corporation

- 6.4.11 Omron Corporation

- 6.4.12 Novatech LLC

- 6.4.13 Toshiba Corporation

- 6.4.14 Hitachi, Ltd.

- 6.4.15 GE Digital (General Electric Co.)

- 6.4.16 Fuji Electric Co., Ltd.

- 6.4.17 Supcon Technology Co., Ltd.

- 6.4.18 Hollysys Automation Technologies Ltd.

- 6.4.19 Endress+Hauser Group Services AG

- 6.4.20 BandR Industrial Automation GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment