|

市場調查報告書

商品編碼

1851421

北美碳纖維:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)North America Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

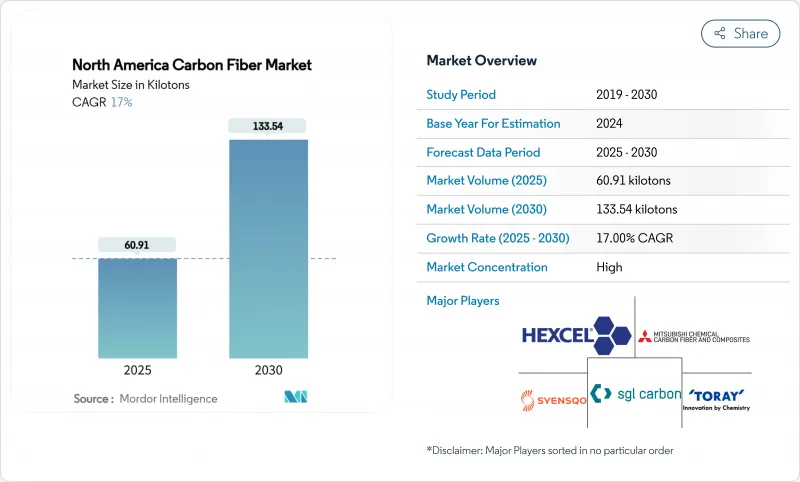

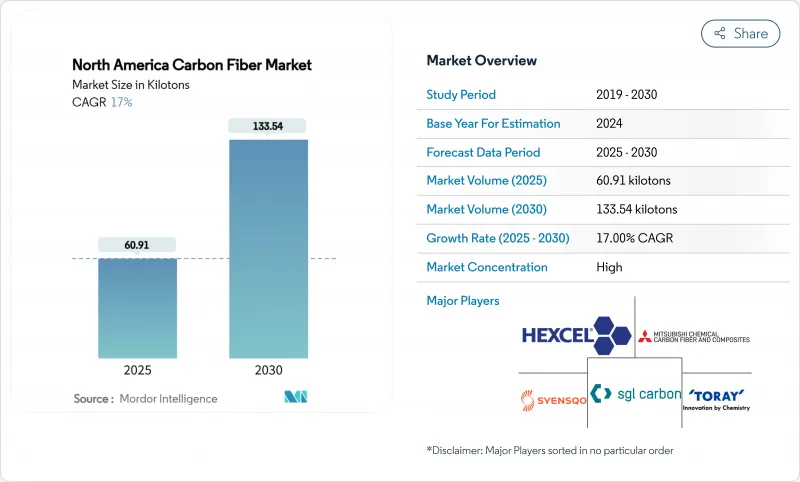

預計北美碳纖維市場規模將在 2025 年達到 60.91 千噸,在 2030 年達到 133.54 千噸,在預測期(2025-2030 年)內達到 17% 的複合年成長率。

隨著航太生產的復甦、電動車製造商減輕車身重量以及可再生能源公司生產更長的風力渦輪機葉片,需求將會增加。儘管聚丙烯腈 (PAN) 仍然是原料供應的主導,但石油瀝青替代品的快速成長表明價格主導的替代趨勢。隨著汽車製造商和風力發電機原始設備製造商 (OEM) 尋求減少生命週期排放,再生纖維正日益受到關注。在美國,Hexcel 和 Toray 已擴大產能並提高了本地供給能力,但前體採購和資本密集度仍然是風險因素。為了成功競爭,企業需要多元化的終端用途組合、靈活的生產線以及與客戶的緊密合作,而不是依賴傳統的航太生產規模。

北美碳纖維市場趨勢與洞察

輕型車輛需求不斷成長

汽車電氣化使北美碳纖維市場成為新型輕量化策略的核心。正如通用汽車(GM)的初步試驗所示,汽車製造商正在使用自動化纖維鋪放線將結構部件整合到關鍵車型中。美國能源局提供的聯邦研發資金正在加速用於電池組外殼的延展性碳纖維複合材料的開發。燃油經濟法規和消費者對續航里程的預期,支撐著大規模生產平台的持續多年需求。

加速在航太和國防領域的應用

航太繼續引領北美碳纖維市場,因為下一代飛機和高超音速防禦系統需要高模量纖維。東麗公司向美國太空總署的HiCAM專案供應熱固性和熱塑性預浸料,以加速複合材料機翼的製造速度。柯林斯太空公司投資2億美元,擴大其位於斯波坎的碳碳煞車片產能;通用電氣太空公司承諾在美國複合材料零件生產領域累計約10億美元,從而增強其長期需求前景。

監理主導的原物料供應風險

美國白宮和加拿大政府的關鍵資料審查表明,對聚丙烯腈(PAN)前驅體進口的審查力度正在加大。政策變化,例如出口管制清單和更嚴格的環境授權,可能會加劇北美碳纖維市場的供應緊張,並增加合規成本。

細分市場分析

到2024年,PAN將佔據北美碳纖維市場91.83%的佔有率。該細分市場受益於其成熟的強度重量比和完善的供應鏈。同時,由於汽車和建築業的買家將成本置於極限抗張強度之上,石油瀝青和人造絲預計將以18.91%的複合年成長率成長。 Advanced Carbon Products LLC公司已開發出中間相瀝青碳纖維前驅體,與傳統的PAN基製造方法相比,可大幅降低成本。

需求的變化有利於那些提供多元化前驅體選擇的供應商。瀝青的產量比率超過70%,而聚丙烯腈(PAN)的產率僅為55%,因此在相同的爐內能耗下,瀝青的每公斤成本更低。對於壓力容器和民用基礎設施等大眾市場應用而言,這些經濟優勢使得替代前驅體成為越來越可靠的選擇。

由於航太和國防領域對可追溯性有著極高的要求,預計到2024年,原生纖維將佔據北美碳纖維市場76.21%的佔有率。然而,再生纖維預計將以19.05%的複合年成長率成長。 Vartega公司已成功研發出機械性質與原生纖維相當,但成本僅為原生纖維一半,且二氧化碳排放降低96-99%的再生纖維。

原始設備製造商 (OEM) 對再生中間體的接受度正在提高。波音公司使用 KyronTEX 側壁板表明,使用再生纖維可以滿足嚴格的客艙內裝要求。使用再生纖維的汽車射出成型化合物可將成品零件成本降低高達 30%,從而促進其大規模應用。

北美碳纖維市場報告按原料(聚丙烯腈 (PAN)、石油瀝青、人造絲)、類型(原生碳纖維 (VCF)、再生碳纖維 (RCF))、應用(複合材料、纖維、其他)、終端用戶產業(航太與國防、替代能源、其他)和地區(美國、加拿大、其他)進行細分。市場預測以噸為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 輕型車輛需求不斷成長

- 在航太和國防領域加速應用

- 在風力發電領域不斷擴大應用

- 高性能運動用品的擴張

- 大型移動車輛氫氣儲存槽的採用情況

- 市場限制

- 高額研發和資本支出

- 監理主導的原物料供應風險

- 回收基礎設施有限,品質參差不齊。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按原料

- 聚丙烯腈(PAN)

- 石油瀝青和人造絲

- 按類型

- 原生碳纖維(VCF)

- 再生碳纖維(RCF)

- 透過使用

- 複合材料

- 紡織品

- 微電極

- 催化劑

- 按最終用戶行業分類

- 航太/國防

- 替代能源

- 車

- 建築和基礎設施

- 體育用品

- 其他終端用戶產業(海事和航運)

- 按地區

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- A&P Technology, Inc.

- ACP Composites Inc.

- DowAksa

- Gurit Services AG

- Hexcel Corporation

- HS HYOSUNG USA

- Jiangsu Hengshen Co., Ltd.

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Present Advanced Composites Inc.

- SGL Carbon

- Syensqo

- TEIJIN LIMITED

- Toray Industries Inc.

- Vartega Inc.

第7章 市場機會與未來展望

The North America Carbon Fiber Market size is estimated at 60.91 kilotons in 2025, and is expected to reach 133.54 kilotons by 2030, at a CAGR of 17% during the forecast period (2025-2030).

Demand rises as aerospace production recovers, electric-vehicle makers cut curb weight and renewable-energy firms build longer wind blades. Polyacrylonitrile (PAN) continues to lead raw-material supply, yet fast-growing petroleum-pitch alternatives signal price-driven substitution. Recycled fibers gain traction because automakers and wind-turbine OEMs seek lower life-cycle emissions. United States output expansions by Hexcel and Toray improve local availability, but precursor sourcing and capital intensity still pose risk. Competitive success now depends on diversified end-use portfolios, agile production lines and close customer integration, rather than reliance on legacy aerospace volumes.

North America Carbon Fiber Market Trends and Insights

Rising Demand from Lightweight Vehicles

Automotive electrification positions the North America carbon fiber market at the center of new lightweight strategies. Automakers use automated-fiber-placement lines to integrate structural parts in mainstream models, as shown by General Motors' pilot trials. Federal R&D funding from the U.S. Department of Energy accelerates ductile carbon-fiber composite development for battery-pack housings. Regulations on fuel economy and consumer range expectations underpin sustained multi-year demand across volume platforms.

Accelerating Usage in Aerospace and Defense

Aerospace keeps its lead within the North America carbon fiber market because next-generation aircraft and hypersonic defense systems require high-modulus fiber. Toray supplies thermoset and thermoplastic prepregs for NASA's HiCAM program to improve fast-build composite wings. Collins Aerospace invested USD 200 million to enlarge Spokane carbon-carbon brake capacity, while GE Aerospace earmarked almost USD 1 billion for U.S. composite part production, reinforcing long-cycle demand visibility.

Regulatory-Driven Supply Risk for Raw Materials

Critical-material reviews by the White House and the Canadian government signal heightened scrutiny of PAN precursor imports. Policy shifts, such as export-control lists or stricter environmental permits, could pinch supply and raise compliance costs for the North America carbon fiber market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Utilization from Wind Energy Sector

- Expansion of High-Performance Sporting Goods

- Limited Recycling Infrastructure and Quality Variance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PAN commanded 91.83% of the North America carbon fiber market in 2024. The segment benefits from proven strength-to-weight ratios and well-understood supply chains. Petroleum-pitch and rayon, in contrast, are set to grow at an 18.91% CAGR because auto and construction buyers prioritize lower cost over ultimate tensile strength. Advanced Carbon Products LLC has developed a mesophase pitch carbon fiber precursor, offering a significant cost-saving opportunity compared to the conventional PAN-based production method.

Demand shifts favor suppliers that diversify precursor choice. Higher yield rates that exceed 70% for pitch versus 55% for PAN can cut per-kilogram costs when furnace energy remains constant. For mass-market uses such as pressure vessels or civil infrastructure, these economics make alternative precursors increasingly credible options.

Virgin fiber retained 76.21% share of the North America carbon fiber market size in 2024 because aerospace and defense require full traceability. Recycled fiber, however, is projected to post a 19.05% CAGR. Vartega reached mechanical properties comparable to virgin fiber but at half the cost and 96-99% lower CO2 footprint.

OEM acceptance of recycled intermediates is rising. Boeing's use of KyronTEX sidewall panels shows that strict cabin-interior requirements can be met with reclaimed content. Automotive injection-molding compounds with recycled strands now cut finished-part cost by up to 30%, spurring volume adoption.

The North America Carbon Fiber Market Report is Segmented by Raw Material (Polyacrylonitrile (PAN), Petroleum Pitch and Rayon), Type (Virgin Carbon Fiber (VCF), Recycled Carbon Fiber (RCF)), Application (Composite Materials, Textiles, and More), End-User Industry (Aerospace and Defense, Alternative Energy, and More), and Geography (United States, Canada, and More). The Market Forecasts are Provided in Terms of Volume (tons).

List of Companies Covered in this Report:

- A&P Technology, Inc.

- ACP Composites Inc.

- DowAksa

- Gurit Services AG

- Hexcel Corporation

- HS HYOSUNG USA

- Jiangsu Hengshen Co., Ltd.

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Present Advanced Composites Inc.

- SGL Carbon

- Syensqo

- TEIJIN LIMITED

- Toray Industries Inc.

- Vartega Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from Lightweight Vehicles

- 4.2.2 Accelerating Usage in Aerospace and Defense

- 4.2.3 Growing Utilization from Wind Energy Sector

- 4.2.4 Expansion of High-Performance Sporting Goods

- 4.2.5 Adoption in Hydrogen Storage Tanks for Heavy-Duty Mobility

- 4.3 Market Restraints

- 4.3.1 High Research and Development, and Capital Expenditure

- 4.3.2 Regulatory-Driven Supply Risk for Raw Materials

- 4.3.3 Limited Recycling Infrastructure and quality variance

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Raw Material

- 5.1.1 Polyacrylonitrile (PAN)

- 5.1.2 Peroleum Pitch and Rayon

- 5.2 By Type

- 5.2.1 Virgin Carbon Fiber (VCF)

- 5.2.2 Recycled Carbon Fiber (RCF)

- 5.3 By Application

- 5.3.1 Composite Materials

- 5.3.2 Textiles

- 5.3.3 Micro-electrodes

- 5.3.4 Catalysis

- 5.4 By End-user Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Alternative Energy

- 5.4.3 Automotive

- 5.4.4 Construction and Infrastructure

- 5.4.5 Sporting Goods

- 5.4.6 Other End-user Industries (Marine and Maritime)

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 A&P Technology, Inc.

- 6.4.2 ACP Composites Inc.

- 6.4.3 DowAksa

- 6.4.4 Gurit Services AG

- 6.4.5 Hexcel Corporation

- 6.4.6 HS HYOSUNG USA

- 6.4.7 Jiangsu Hengshen Co., Ltd.

- 6.4.8 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.9 Present Advanced Composites Inc.

- 6.4.10 SGL Carbon

- 6.4.11 Syensqo

- 6.4.12 TEIJIN LIMITED

- 6.4.13 Toray Industries Inc.

- 6.4.14 Vartega Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment