|

市場調查報告書

商品編碼

1851419

金融服務桌面虛擬化:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Financial Services Desktop Virtualization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

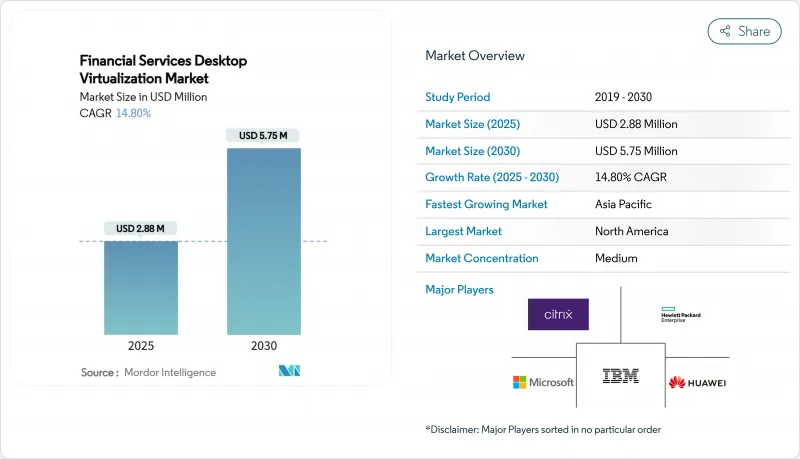

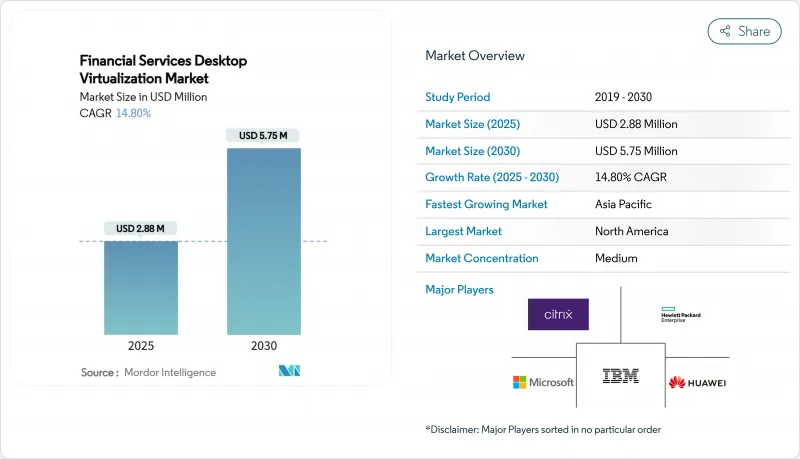

預計到 2025 年金融服務桌面虛擬化市場規模將達到 288 萬美元,到 2030 年將達到 575 萬美元,預測期內複合年成長率將達到 14.8%。

隨著銀行、保險公司和金融科技公司越來越重視符合零信任要求、GPU加速風險分析和嚴格資料居住規定的安全虛擬桌面環境,市場需求正在成長。一級金融機構正從資本支出模式轉向按需付費模式,促使供應商將合規工具和高效能圖形功能整合到其產品中。儘管亞太地區憑藉金融業的快速數位化和對雲端準則的支持而佔據主導地位,但北美仍然是最大的採用者,這得益於其成熟的交易和監管基礎設施[CMCGLOBAL.COM.VN]。供應商競爭的核心在於如何透過雲端編配在超低延遲交易員桌面和提升營運效率之間取得平衡。

全球金融服務桌面虛擬化市場趨勢與洞察

一級銀行雲端遷移策略的普及程度

領先銀行正基於混合雲端藍圖重建其桌面環境,以提高系統彈性並降低整體擁有成本。敏感的交易平台仍保留在本地,而後勤部門桌面則遷移到雲端訂閱模式,從而能夠為承包商、測試團隊和災害復原演練提供動態資源配置。因此,採購模式正從硬體更新周期轉向與業務成果相符的營運支出合約。這種轉變加速了雲端原生安全控制的標準化,並促進了跨虛擬會話整合審核追蹤功能。隨著金融機構在 24 至 36 個月內分階段推進遷移,能夠將傳統資料中心與多重雲端編配連接起來的供應商的需求日益成長。

向零信任安全框架的轉型正在加速。

金融機構現在堅持要求所有虛擬桌面連線都必須持續進行身份驗證,並整合多因素身份驗證 (MFA)、行為分析和基於會話的風險評分。交易員使用生物識別和位置控制登錄,如果出現異常情況,資料存取將被阻止,合規團隊可以即時審核擊鍵層級的歷史記錄。這些功能將虛擬桌面基礎架構 (VDI) 的選擇標準從效能提升到原生零信任架構的契合度。因此,擁有網路安全和虛擬化綜合專業知識的專業整合商正在收取更高的諮詢費,平台藍圖也擴大納入用於威脅情報來源的 API 介面。

與傳統大型主機整合的複雜性

許多銀行仍然使用幾十年前的大型主機來處理高價值交易。將這些系統橋接到現代虛擬桌面基礎架構 (VDI) 平台需要客製化中間件、冗餘身分驗證路徑和延遲解決方案,導致部署週期長達 6-12 個月,預算增加兩位數。對稀缺的 COBOL 專家和專有工具的依賴降低了供應商的議價能力,減緩了創新速度,與數位原民化同行相比,價值實現速度也更慢。

細分市場分析

2024年,託管虛擬桌面將維持47.1%的收入佔有率,而桌面即服務(DaaS)的複合年成長率將達到17.8%,持續削弱現有市場的主導地位。 DaaS憑藉其按使用量計費的模式,能夠適應諮詢、交易和合規部門常見的員工人數波動趨勢,因此正在迅速發展。服務提供者將監管日誌記錄和GPU選項捆綁在一起,使中型銀行能夠在不大幅增加資本支出的情況下獲得企業級技術堆疊。託管共用桌面產品憑藉標準化應用程式佔據了一定的市場,而遠端桌面服務則為分店提供傳統的Windows工作負載。

隨著DaaS供應商預先整合零信任和災難復原方案,金融服務桌面虛擬化市場受益匪淺,部署時間從數月縮短至數週。多租用戶控制平面可自動執行修補程式和漏洞掃描,從而減輕審核壓力。相較之下,對於那些保單禁止異地資料的機構而言,本地部署的HVD設施仍然具有吸引力,但其更新周期會推高整體成本。因此,前瞻性的買家傾向於採用混合採購模式,將核心交易桌面遷移到私有雲端,同時將後台使用者遷移到公有DaaS平台。

至2024年,本地部署將佔金融服務桌面虛擬化市場佔有率的58.4%,而雲端執行個體在2030年之前將維持在16.2%。銀行正在透過將敏感資料集隔離在本地,並將季節性或低風險工作負載卸載到超大規模資料中心來平衡其對資料主權的擔憂。混合編配平台會根據延遲、合規性標籤和成本來調度桌面資源。

隨著監管機構發布更清晰的加密、金鑰管理和審核存取指南,降低風險感知,雲端加速發展將進一步加快。保險公司透過在更靠近客戶的雲端進行理賠裁決來改善客戶體驗,同時將核心精算模型保留在私有環境中。由於保險公司不願意被單一平台鎖定,因此能夠跨 AWS、Azure 和 GCP 實現統一保單執行的供應商正在贏得市場佔有率。

金融服務桌面虛擬化市場報告按桌面交付平台(託管虛擬桌面 (HVD)、託管共用桌面 (HSD) 等)、部署類型(本地部署、雲端部署、混合部署)、組織規模(大型企業、中小企業)、最終用戶(零售和商業銀行、資本市場和交易等)以及地區對行業進行細分。

區域分析

預計到2024年,北美將以41.2%的市佔率領跑,這主要得益於零信任架構的早期應用、交易中心的集中以及紐約、芝加哥和多倫多等地大規模GPU虛擬化試點計畫的開展。金融機構正大力投資提升系統韌性,包括在大都會圈建構雙活桌面對,以滿足聯邦政府關於業務永續營運的指導方針。亞秒級容錯移轉和傳輸中加密已成為標準規範,支出也轉向監控和自動化修復,以防範勒索軟體攻擊。

亞太地區以12.7%的複合年成長率成為成長最快的地區,這主要得益於新加坡、澳洲和日本監管機構明確了雲端使用規則,鼓勵銀行實現分店技術現代化並推出行動優先服務。金融集團正在部署混合桌面網格,將本地資料中心單元與區域超大規模資料中心容量結合,因此能夠快速拓展至鄰近市場。印度和東南亞的金融科技生態系統透過待開發區計畫進一步推動了需求,這些計畫突破了傳統系統的限制。

在歐洲,GDPR合規性和能源效率要求正推動穩定的設備更新換代。法蘭克福和巴黎的銀行正著力部署符合ESG目標的精簡型用戶端,以低功耗終端取代老舊的PC,並將這些終端與集中式虛擬桌面整合。嚴格的資料主權法規正在刺激對特定國家雲端區域和加密金鑰託管的投資。在中東和非洲,杜拜和約翰尼斯堡雖然金融自由區尚處於起步階段,但正在加速推進,鼓勵發放數位化優先的銀行執照。在南美洲,巴西和智利的金融機構正在試行為客服中心客服人員部署雲端桌面,同時將核心應用程式保留在本地。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 雲端遷移策略在頂級銀行中日益受到重視

- 向零信任安全框架的轉型正在加速。

- 資本市場交易大廳實施混合辦公模式

- ESG驅動的節能型精簡型用戶端需求

- 利用GPU擴展風險分析工作負載

- AI-PC 終端的激增使得本地推理卸載成為可能。

- 市場限制

- 傳統大型主機整合的複雜性

- 雲端原生 VDI 操作方面的技能差距

- 供應商集中風險

- 監管資料駐留要求推高了部署成本。

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 透過桌面交付平台

- 託管虛擬桌面 (HVD)

- 託管共用桌面 (HSD)

- Desktop-as-a-Service(DaaS)

- Remote Desktop Services(RDS)

- 透過部署模式

- 本地部署

- 雲

- 混合

- 按組織規模

- 主要企業

- 中小企業

- 最終用戶

- 零售銀行

- 資本市場與交易

- 保險

- 金融科技和支付服務提供者

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Citrix Systems, Inc.

- Microsoft Corporation

- VMware, Inc.

- Amazon Web Services, Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Dell Technologies Inc.

- Huawei Technologies Co., Ltd.

- Oracle Corporation

- Google LLC

- Parallels International GmbH(Corel)

- NComputing Co., Ltd.

- Evolve IP, LLC

- Ericom Software Ltd.

- Workspot, Inc.

- Nerdio, Inc.

- Anunta Tech Inc.

- Accops Systems Pvt. Ltd.

- XTIUM(ATSG)

- DXC Technology Company

第7章 市場機會與未來展望

The financial services desktop virtualization market size stands at USD 2.88 million in 2025 and is projected to reach USD 5.75 million by 2030, posting a 14.8% CAGR over the forecast period.

Demand rises as banks, insurers, and FinTechs converge on secure virtual desktop environments that satisfy zero-trust mandates, GPU-accelerated risk analytics, and stringent data-residency rules. Tier-1 institutions are shifting from capital spending to consumption-based models, pushing vendors to embed compliance tooling and high-performance graphics in offerings. Asia-Pacific outpaces other regions on account of rapid financial-sector digitization and supportive cloud guidelines, while North America remains the largest adopter owing to mature trading and regulatory infrastructures [CMCGLOBAL.COM.VN]. Vendor competition centers on balancing ultra-low-latency trader desktops with operational efficiency gains from cloud orchestration.

Global Financial Services Desktop Virtualization Market Trends and Insights

Widespread Cloud-Migration Strategies Among Tier-1 Banks

Large banks refactor desktop estates around hybrid-cloud blueprints to improve resilience and cut ownership costs. Sensitive trading platforms stay on-premises, while back-office desktops shift to cloud subscription models, enabling dynamic provisioning for contractors, test teams, and disaster-recovery drills . Procurement therefore pivots from hardware refresh cycles to operating-expense contracts aligned with business outcomes. The shift accelerates standardization on cloud-native security controls and drives embedded audit-trail functionality across virtual sessions. Vendors capable of bridging legacy data centers with multi-cloud orchestration capture heightened demand as institutions roll out phased migrations over 24-36 months.

Accelerated Move to Zero-Trust Security Frameworks

Financial firms now insist that every virtual desktop connection authenticates continuously, integrating MFA, behavioral analytics, and session-based risk scoring. Traders log in with biometrics and location controls that inhibit data access when anomalies arise, while compliance teams audit keystroke-level histories in real time. These capabilities elevate VDI selection criteria beyond performance to encompass native zero-trust alignment. Consequently, specialist integrators with combined cybersecurity and virtualization expertise command premium consulting rates, and platform roadmaps increasingly embed API hooks for threat-intelligence feeds.

Legacy Mainframe Integration Complexity

Many banks still process high-value transactions on decades-old mainframes. Bridging these systems to modern VDI stacks demands custom middleware, doubled authentication paths, and latency work-arounds that add 6-12 months to roll-outs and raise budgets by double-digit percentages. Dependence on scarce COBOL specialists and proprietary tooling reduces vendor leverage and slows innovation, hampering time-to-value compared to digital-native peers.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid-Work Mandates for Capital-Market Trading Floors

- Growing GPU-Enabled Risk-Analytics Workloads

- Skills Gap in Cloud-Native VDI Operations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hosted Virtual Desktop retained 47.1% revenue share in 2024, yet Desktop-as-a-Service posts a 17.8% CAGR that steadily erodes incumbent dominance. DaaS gains ground because fee-for-use pricing aligns with volatile head-count swings common in advisory, trading, and compliance units. Service providers bundle regulatory logging and GPU options, letting mid-tier banks access enterprise-grade stacks without capital expenditure spikes. Hosted Shared Desktop products occupy niche environments with standardized apps, while Remote Desktop Services deliver legacy Windows workloads in branches.

The financial services desktop virtualization market benefits as DaaS vendors pre-integrate zero-trust and disaster-recovery playbooks, shortening deployment from months to weeks. Multi-tenant control planes automate patching and vulnerability scans, easing audit pressures. In contrast, on-premises HVD estates still appeal to institutions whose policies prohibit off-site data but face refresh cycles that elevate total cost. Forward-looking buyers therefore favor hybrid procurement, sinking core trading desktops into private clouds while diverting clerical users to public DaaS.

On-premises estates held 58.4% financial services desktop virtualization market share in 2024, but cloud instances compound at 16.2% through 2030. Banks reconcile sovereignty concerns by ring-fencing sensitive data sets locally, then off-loading seasonal or low-risk workloads to hyperscalers. Hybrid orchestration platforms schedule desktops based on latency, compliance tags, and cost.

Cloud acceleration intensifies as regulators publish clearer guidance on encryption, key management, and audit access, lowering perceived risk. Insurers run claims adjudication in cloud regions close to customers for better experience, while core actuarial models remain in private zones. Vendors that deliver uniform policy enforcement across AWS, Azure, and GCP win share as institutions resist platform lock-in.

The Financial Services Desktop Virtualization Market Report Segments the Industry Into Desktop Delivery Platform (Hosted Virtual Desktop (HVD), Hosted Shared Desktop (HSD), and More), Deployment Mode (On-Premise, Cloud and Hybrid), Organization Size (Large Enterprises, and Small and Mid-Sized Enterprises (SMEs)), End-User (Retail and Commercial Banking, Capital Markets and Trading, and More), and Geography.

Geography Analysis

North America led with 41.2% market share in 2024, powered by early zero-trust adoption, dense trading hubs, and large-scale GPU virtualization pilots in New York, Chicago, and Toronto. Institutions invest heavily in resilience, building active-active desktop pairs across metro zones to satisfy Federal guidelines on business continuity. Sub-second failover and encryption-in-transit are baseline specifications, and spending shifts toward monitoring and automated remediation to guard against ransomware.

Asia-Pacific records the fastest 12.7% CAGR, as regulators in Singapore, Australia, and Japan clarify cloud usage rules, encouraging banks to modernize branch technology and launch mobile-first services. Financial groups deploy hybrid desktop grids blending local data-center pods with regional hyperscaler capacity, allowing rapid expansion into adjacent markets. FinTech ecosystems in India and Southeast Asia further fuel demand through green-field builds that leapfrog legacy limitations.

Europe experiences steady replacement cycles driven by GDPR compliance and energy-efficiency mandates. Banks in Frankfurt and Paris emphasize thin-client rollouts tied to ESG targets, swapping aging PCs for low-wattage endpoints that integrate with centralized virtual desktops. Stringent data-sovereignty statutes spur investments in country-specific cloud regions and encryption key escrow. Middle East and Africa show nascent but accelerating uptake in Dubai and Johannesburg, where financial free zones incentivize digital-first banking licenses. South America advances selectively, with Brazilian and Chilean lenders piloting cloud desktops for contact-centre agents while core applications stay on-premises.

- Citrix Systems, Inc.

- Microsoft Corporation

- VMware, Inc.

- Amazon Web Services, Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Dell Technologies Inc.

- Huawei Technologies Co., Ltd.

- Oracle Corporation

- Google LLC

- Parallels International GmbH (Corel)

- NComputing Co., Ltd.

- Evolve IP, LLC

- Ericom Software Ltd.

- Workspot, Inc.

- Nerdio, Inc.

- Anunta Tech Inc.

- Accops Systems Pvt. Ltd.

- XTIUM (ATSG)

- DXC Technology Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Widespread cloud-migration strategies among Tier-1 banks

- 4.2.2 Accelerated move to zero-trust security frameworks

- 4.2.3 Hybrid-work mandates for capital-market trading floors

- 4.2.4 ESG-driven demand for energy-efficient thin clients

- 4.2.5 Growing GPU-enabled risk-analytics workloads

- 4.2.6 Proliferation of AI-PC endpoints enabling local inference off-loading

- 4.3 Market Restraints

- 4.3.1 Legacy mainframe integration complexity

- 4.3.2 Skills gap in cloud-native VDI operations

- 4.3.3 Concentrated vendor-dependency risk

- 4.3.4 Regulatory data-residency requirements raising deployment cost

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Desktop Delivery Platform

- 5.1.1 Hosted Virtual Desktop (HVD)

- 5.1.2 Hosted Shared Desktop (HSD)

- 5.1.3 Desktop-as-a-Service (DaaS)

- 5.1.4 Remote Desktop Services (RDS)

- 5.2 By Deployment Mode

- 5.2.1 On-Premises

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Mid-sized Enterprises (SMEs)

- 5.4 By End-User

- 5.4.1 Retail and Commercial Banking

- 5.4.2 Capital Markets and Trading

- 5.4.3 Insurance

- 5.4.4 FinTech and Payment Providers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Citrix Systems, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 VMware, Inc.

- 6.4.4 Amazon Web Services, Inc.

- 6.4.5 Hewlett Packard Enterprise Development LP

- 6.4.6 IBM Corporation

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Huawei Technologies Co., Ltd.

- 6.4.9 Oracle Corporation

- 6.4.10 Google LLC

- 6.4.11 Parallels International GmbH (Corel)

- 6.4.12 NComputing Co., Ltd.

- 6.4.13 Evolve IP, LLC

- 6.4.14 Ericom Software Ltd.

- 6.4.15 Workspot, Inc.

- 6.4.16 Nerdio, Inc.

- 6.4.17 Anunta Tech Inc.

- 6.4.18 Accops Systems Pvt. Ltd.

- 6.4.19 XTIUM (ATSG)

- 6.4.20 DXC Technology Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment