|

市場調查報告書

商品編碼

1851386

3D感測器:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030年)3D Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

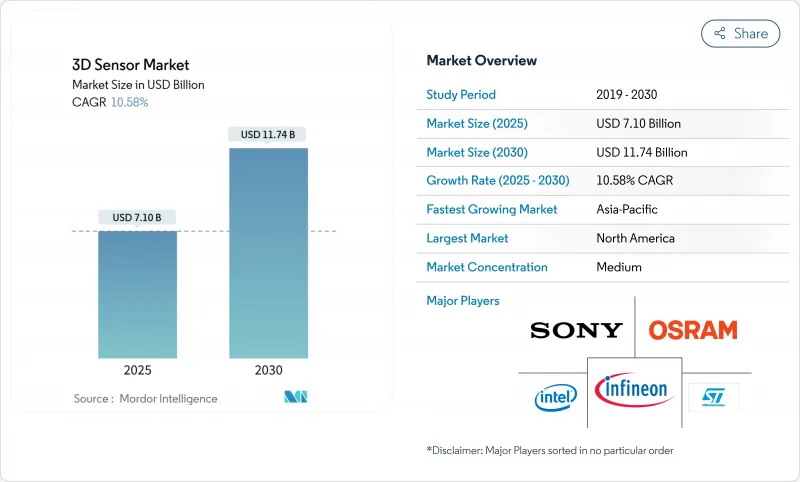

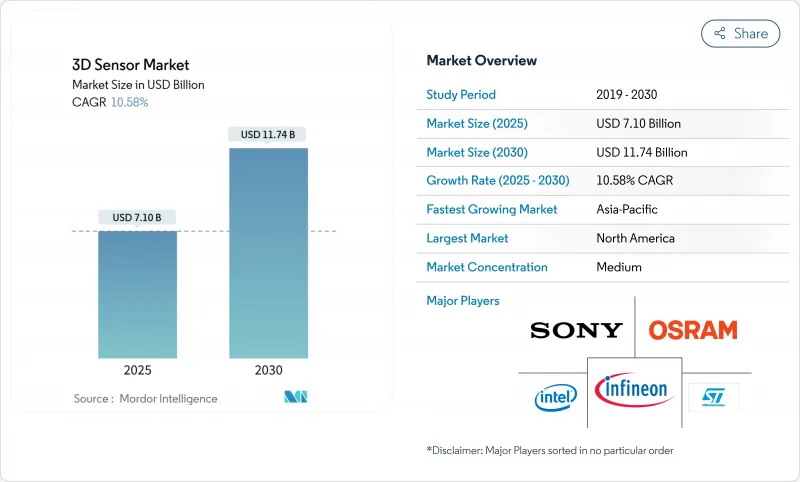

預計 3D 感測器市場將從 2025 年的 71 億美元成長到 2030 年的 117.4 億美元,複合年成長率為 10.58%。

家用電子電器、汽車安全、工業自動化以及新興混合實境平台對空間感知能力的需求不斷成長,推動了該技術的發展。光學元件的小型化、感測器邊緣處理的整合以及單位成本的下降,正在擴大其應用範圍。亞太地區的成長勢頭最為強勁,該地區強大的電子製造能力正在縮短從設計到生產的周期;而在中東,政府支持的智慧城市投資正在加速該技術的應用。競爭優勢正從獨立的硬體規格轉向整合的感測+軟體堆疊,以降低嵌入式環境中的延遲和功耗。

全球3D感測器市場趨勢與洞察

智慧型手機人臉臉部認證的應用有助於提升本地領導力。

預計到2026年,亞洲高階行動電話的3D臉部認證配戴率將超過65%,這將使其成為3D感測器市場中最大的單一應用領域。結構光學模組飛行時間模組如今能夠在各種光照條件下產生可靠的亞毫米級深度圖,從而實現安全支付、虛擬形象創建和個性化用戶介面。亞洲的原始設備製造商(OEM)正在將感測器移至螢幕下方,以節省空間,同時又不犧牲其可靠性。行動電話的大規模生產正在降低穿戴式裝置和智慧家居設備等相關領域的零件成本,從而形成良性循環的需求驅動機制。

汽車LiDAR改變了汽車安全的新標準

歐洲汽車製造商正積極部署基於雷射雷達(LiDAR)的高級駕駛輔助系統(ADAS),以應對2026年新車安全評估協會(NCAP)強制實施的行人自動緊急煞車系統。固態LiDAR設計可在200公尺範圍內達到公分級精度,滿足嚴格的汽車可靠性測試,同時降低材料成本。歐洲日益嚴格的監管趨勢,加上北美地區的自願性舉措,正在形成統一的要求標準,這將使全球一級感測器供應商受益。隨著成本的下降,雷射雷達的應用預計將從高階車型逐步擴展到中端車型,從而擴大其在各個細分市場的潛在應用範圍。

熱學挑戰阻礙了VCSEL陣列的小型化

為了在更小的空間內實現更高的光輸出,VCSEL發射器之間的間距越來越小,導致陣列中心元件的溫度可能比環境溫度高出50°C。更高的結溫會降低效率,並可能導致災難性故障。裝置製造商正在嘗試採用分路驅動電路和先進封裝技術,將熱量橫向引導至銅層,然後傳導至敏感光學元件。這些創新技術的應用可望緩解目前3D感測器市場面臨的挑戰,讓緊湊型消費性電子產品也能維持高效能。

細分市場分析

到2024年,影像感測器將佔總收入的62%,鞏固其在3D感測器市場的基礎地位。智慧型手機、工業檢測和機器人等應用領域對高解析度深度圖的需求強勁,這些應用需要亞毫米級精度和5公尺探測範圍的深度圖。多層背照式架構及片上HDR管線不斷提升訊號雜訊比。領先的供應商正在向300毫米晶圓生產線轉型,從而提高產量比率,並降低每百萬像素成本。

隨著非接觸式介面在資訊娛樂主機、互動式服務站和醫療設備中的普及,手勢姿態辨識感測器將以14.8%的複合年成長率快速成長至2030年。新型模組將飛行時間深度感測器、毫米波雷達和人工智慧推理整合於單塊基板,即使在光線變化的環境下也能識別複雜的手勢。亞太地區經驗豐富的OEM設計團隊正在進一步縮短開發週期,協助該領域佔據3D感測器市場的大部分佔有率。

位置感測器、慣性測量單元和熱電堆元件可滿足光學解決方案無法滿足的特定精度和環境要求,供應商之間的交叉授權已整合 IP,使其可供多個供應商的系統設計人員使用。

影像感測器子類別將在2024年成為最大的市場,規模達44億美元,並在2030年之前保持中等個位數的複合年成長率。背照式堆疊CMOS架構將佔該類別出貨量的約50%,這主要得益於對更高動態範圍和更低功耗的需求。儘管基數較小,但隨著公共和私人場所尋求減少與物體表面的共用,手勢姿態辨識模組預計到2030年將貢獻16億美元的收入。這一成長表明,多樣化的外形規格正在推動整個3D感測器市場的成長勢頭。

飛行時間感測器將在2024年佔總收入的46%,這反映了其成本和精度方面的優勢平衡。間接飛行時間感測器在消費性電子設備領域佔據主導地位,這得益於成熟的垂直腔面發射雷射(VCSEL)發射器和簡單的單光子Avalanche二極體(SPAD)接收器。直接飛行時間感測器具有皮秒級的時間解析度,在機器人和工業自動化領域佔據領先地位,這些領域需要更長的操作距離。將電容式深度運算引擎整合到與光電二極體相同的晶粒上,可降低延遲,並可為邊緣人工智慧模型提供動力,而無需與主機處理器進行往返通訊。

儘管目前雷射雷達解決方案的出貨量較小,但在汽車自動駕駛項目和基礎設施數位雙胞胎計劃的推動下,預計到2030年將以13.61%的複合年成長率成長。固態掃描、微電子機械光束控制和調頻連續波架構等技術在提升偵測距離的同時,減少了運動部件的數量。這些進步將降低每個點雲的成本,進而推動3D感測器市場從豪華車領域拓展到其他領域。

結構光光源仍然是近距離高清影像擷取的首選,例如人臉解鎖和工業計量。立體視覺和超音波在某些特定領域也佔有一席之地。立體視覺提供了一種基於鏡頭的替代方案,無需主動照明;而超音波在光路被灰塵或液體阻擋時表現出色。

3D感測器市場佔有率報告按產品(例如,位置感測器、影像感測器)、技術(例如,結構光、飛行時間)、終端用戶產業(例如,消費性電子、汽車)、組件(例如,紅外線VCSEL發射器)和地區(例如,北美、歐洲、亞洲)進行細分。市場預測以美元計價。

區域分析

到2024年,亞太地區將佔全球收入的38%,這反映了該地區半導體製造廠密度高、光學技術人員技術嫻熟以及垂直整合的供應鏈。中國將佔該地區銷售額的約40%,主要得益於國內智慧型手機OEM廠商積極採用自主研發的深孔模組。日本在精密玻璃模塑和晶圓級光學領域擁有卓越的實力,為工業機器人提供高精度感測器。韓國正利用其先進的封裝技術,將邏輯電路和感測電路整合到單一基板上,從而提升微型模組的散熱性能。

中東地區雖然起步較晚,但預計到2030年將達到12.87%的複合年成長率。各國智慧城市藍圖正在資助安裝深度感知街道設施、自動化零售亭和人工智慧醫療影像處理。海灣合作波灣合作理事會)的本土系統整合商正與歐洲和亞洲的組件供應商夥伴關係,以實現解決方案的本地化,從而滿足氣候和語言要求。零售業快速的採購週期正在加快從試點到量產的進程,為3D感測器市場帶來短期成長潛力。

北美仍然是雷射雷達研發的中心,這得益於其充滿活力的創投生態系統和國防部門主導的研究津貼。北美汽車零件製造商正主導晶片級光束控制技術的發展。儘管歐洲擁有嚴格的資料保護法律,但汽車和工業自動化領域的需求仍然旺盛,推動了邊緣個人資料處理感測器的設計。南美洲在安防和農業技術領域已開始早期應用雷射雷達技術,而非洲的應用主要限於需要強大感測解決方案的物流樞紐和採礦作業。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 智慧型手機臉部認證的普及(亞洲)

- 歐洲汽車LiDAR輔助高階駕駛輔助系統的部署

- AR/ VR頭戴裝置中深度感知攝影機的興起(美國)

- 協作機器人在電子產品組裝上的應用(韓國、台灣)

- 3D感測器在安防監控系統中的整合

- 面向智慧零售的邊緣人工智慧驅動的3D視覺(海灣合作理事會)

- 市場限制

- 小型化VCSEL陣列的溫度控管挑戰

- 出於隱私主導,歐盟加強了對深度攝影機的監管(歐盟人工智慧法)。

- 傳統飛行時間模組的高功耗

- 氮化鎵雷射半導體供應鏈的緊縮

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 專利情況

第5章 市場規模與成長預測

- 依產品

- 位置感測器

- 影像感測器(3D相機)

- 溫度感測器

- 加速計和慣性測量單元感測器

- 環境光和接近感測器

- 手勢姿態辨識感應器

- 透過技術

- 結構光

- 飛行時間(dToF 和 iToF)

- 立體視覺

- LiDAR(閃光式和FMCW式)

- 超音波

- 按行業

- 消費性電子產品

- 汽車與運輸

- 醫療保健和醫療設備

- 工業自動化與機器人

- 安全與監控

- 航太/國防

- 按組件

- 紅外線VCSEL發送器

- 深度影像感測器

- 系統晶片處理器

- 光學元件/濾光片

- 照明模組

- 軟體和演算法

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 英國

- 德國

- 法國

- 北歐國家(瑞典、挪威、丹麥、芬蘭)

- 中東

- GCC

- 土耳其

- 非洲

- 南非

- 奈及利亞

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Intel Corp.

- Sony Group Corp.

- ams OSRAM AG

- STMicroelectronics NV

- Infineon Technologies AG

- Lumentum Holdings Inc.

- Apple Inc.(PrimeSense)

- Samsung Electronics Co. Ltd.

- OmniVision Technologies Inc.

- Panasonic Holdings Corp.

- Cognex Corp.

- Sick AG

- LMI Technologies Inc.

- Teledyne e2v

- Qualcomm Inc.

- SoftKinetic(Sony DepthSense)

- Melexis NV

- Himax Technologies Inc.

- Velodyne Lidar Inc.

- XYZ Interactive Technologies

第7章 市場機會與未來展望

The 3D sensor market is valued at USD 7.1 billion in 2025 and is forecast to reach USD 11.74 billion by 2030, advancing at a 10.58% CAGR.

Growth is anchored in rising demand for spatial awareness across consumer electronics, automotive safety, industrial automation, and emerging mixed-reality platforms. Miniaturization of optical components, integration of on-sensor edge processing, and falling unit costs are enlarging the addressable base of applications. Regional momentum is strongest in Asia-Pacific, where deep electronics manufacturing capacity shortens design-to-production cycles, while government-backed smart-city spending is accelerating adoption in the Middle East. Competitive differentiation is now moving from discrete hardware specifications toward complete sensing-plus-software stacks that reduce latency and power consumption in embedded environments.

Global 3D Sensor Market Trends and Insights

Smartphone facial recognition adoption fuels regional leadership

Premium handsets in Asia are expected to pass a 65% attachment rate for 3D facial recognition by 2026, consolidating the 3D sensor market's largest single application base. Structured-light and Time-of-Flight modules now generate sub-millimeter depth maps reliable under varied lighting, enabling secure payments, avatar creation, and personalized UI. Asian OEMs have moved sensors beneath the display to save frontage without sacrificing robustness. Volume scaling in handset production is lowering component costs for adjacent sectors such as wearables and smart-home devices, reinforcing a virtuous demand cycle.

Automotive LiDAR transforms vehicle-safety benchmarks

European automakers are installing LiDAR-based ADAS ahead of the 2026 NCAP mandate for pedestrian automatic emergency braking. Solid-state designs deliver centimeter-level accuracy at up to 200 m, meeting stringent automotive reliability tests while shrinking bill-of-materials. The regulatory push in Europe is echoed by voluntary commitments in North America, creating a homogeneous requirements profile that benefits global tier-one sensor suppliers. As cost curves decline, LiDAR uptake is expected to cascade from premium models into mid-segment vehicles, enlarging the 3D sensor market addressable volume.

Thermal challenges hinder VCSEL array miniaturization

As VCSEL emitters are packed closer to achieve higher optical power in ever-smaller footprints, central elements in an array can run 50 °C hotter than ambient. Elevated junction temperatures degrade efficiency and risk catastrophic failure. Device makers are experimenting with segmented drive circuits and advanced packaging that routes heat laterally to copper layers before it reaches sensitive optics. Adoption of these innovations will moderate the current drag on the 3D sensor market by preserving performance inside compact consumer devices.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of depth-sensing cameras in mixed-reality headsets

- Collaborative robots advance precision electronics assembly

- EU AI Act creates compliance burdens for biometric sensing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Image Sensors accounted for 62% of 2024 revenue, confirming their foundational role in the 3D sensor market. Robust demand arises from smartphones, industrial inspection, and robotics that depend on high-resolution depth maps spanning 5 m ranges with sub-millimeter precision. Multi-stack backside-illuminated architectures and on-chip HDR pipelines continue to improve signal-to-noise ratios. Leading suppliers have shifted to 300 mm wafer lines, driving yield improvements that lower cost per megapixel.

Gesture-Recognition Sensors record the fastest expansion, advancing at a 14.8% CAGR to 2030 as touchless interfaces penetrate infotainment consoles, interactive kiosks, and healthcare devices. New modules fuse ToF depth, millimeter-wave radar, and AI inference on a single substrate, enabling recognition of complex hand poses under variable lighting. Upskilled OEM design teams in Asia-Pacific further shorten development cycles, helping this segment accumulate a higher share of the 3D sensor market.

Position Sensors, Inertial Measurement Units, and Thermopile elements round out the portfolio, each addressing specific accuracy or environmental requirements where optical methods face limits. Cross-licensing among suppliers is consolidating IP, ensuring multi-vendor availability for system designers.

The image-sensor subcategory represents the largest 3D sensor market size at USD 4.4 billion in 2024 and is on course for a mid-single-digit CAGR through 2030. Within this category, back-illuminated stacked CMOS architectures commanded roughly 50% of shipments, underscoring the move toward higher dynamic range at lower power. Gesture-recognition modules, despite a smaller base, are set to contribute USD 1.6 billion incremental revenue by 2030 as public and private spaces look to minimize shared-surface contact. This surge illustrates how diversified form factors collectively reinforce growth momentum across the 3D sensor market.

Time-of-Flight sensors generated 46% of total revenue in 2024, reflecting their favorable cost-to-accuracy balance. Indirect ToF dominates consumer devices thanks to mature VCSEL emitters and simple single-photon avalanche diode (SPAD) receivers. Direct ToF variants, with picosecond timing resolution, lead in robotics and industrial automation requiring longer working distances. Integration of capacitive depth-computation engines on the same die as photodiodes slashes latency, feeding edge-AI models without round-trips to host processors.

LiDAR solutions, though smaller in today's shipment volumes, are growing at a 13.61% CAGR through 2030, propelled by automotive autonomy programs and infrastructure digital-twin projects. Solid-state scanning, micro-electro-mechanical beam steering, and frequency-modulated continuous-wave architectures are improving range while lowering moving-part counts. These advances reduce cost per point cloud and, by extension, broaden the 3D sensor market beyond premium vehicles.

Structured-light remains a preferred choice for close-range, high-detail capture such as facial unlocking and industrial metrology. Stereo vision and ultrasound maintain footholds in specific niches-stereo offers a lens-based alternative without active illumination, while ultrasound succeeds where optical paths are obstructed by dust or fluid.

3D Sensor Market Share Report is Segmented by Product (Position Sensors, Image Sensors and More), Technology (Structured Light, Time-Of-Flight and More), End-User Vertical (Consumer Electronics, Automotive and More), Component (IR VCSEL Emitters, and More), and Geography (North America, Europe, Asia and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 38% of global revenue in 2024, reflecting the region's dense semiconductor fabs, skilled optics workforce, and vertically integrated supply chains. China accounts for about 40% of regional sales, bolstered by domestic smartphone OEMs that are aggressively adopting in-house depth modules. Japan excels in precision glass molding and wafer-level optics, feeding high-accuracy sensors for industrial robotics. South Korea leverages advanced packaging know-how to integrate logic and sensing into single substrates, improving thermal performance in compact modules.

The Middle East, though starting from a low base, is on course for a 12.87% CAGR through 2030. National smart-city roadmaps fund installations of depth-sensing street furniture, automated retail kiosks, and AI-enabled healthcare imaging suites. Domestic system integrators in the Gulf Cooperation Council are forging partnerships with European and Asian component vendors to localize solutions that meet climatic and linguistic requirements. Rapid procurement cycles in the retail sector are accelerating pilot-to-production timelines, providing near-term upside for the 3D sensor market.

North America remains the epicenter of LiDAR RandD, supported by a vibrant venture ecosystem and defense-driven research grants. Tier-one automotive suppliers here lead the push toward chip-scale beam steering. Europe sustains demand in automotive and industrial automation despite rigorous data-protection laws, spurring sensor designs that process personal data at the edge. South America shows early adoption in security and agritech, while Africa's deployments are mainly confined to logistics hubs and mining operations that require rugged sensing solutions.

- Intel Corp.

- Sony Group Corp.

- ams OSRAM AG

- STMicroelectronics N.V.

- Infineon Technologies AG

- Lumentum Holdings Inc.

- Apple Inc. (PrimeSense)

- Samsung Electronics Co. Ltd.

- OmniVision Technologies Inc.

- Panasonic Holdings Corp.

- Cognex Corp.

- Sick AG

- LMI Technologies Inc.

- Teledyne e2v

- Qualcomm Inc.

- SoftKinetic (Sony DepthSense)

- Melexis N.V.

- Himax Technologies Inc.

- Velodyne Lidar Inc.

- XYZ Interactive Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smartphone Facial Recognition Adoption (Asia)

- 4.2.2 Automotive LiDAR-Assisted ADAS Roll-outs (Europe)

- 4.2.3 Proliferation of Depth-Sensing Cameras in AR/VR Headsets (US)

- 4.2.4 Deployment of Collaborative Robots in Electronics Assembly (South Korea, Taiwan)

- 4.2.5 Integration of 3D Sensors in Security and Surveillance Systems

- 4.2.6 Edge-AI Powered 3D Vision for Smart Retail (GCC)

- 4.3 Market Restraints

- 4.3.1 Thermal Management Challenges in Miniaturised VCSEL Arrays

- 4.3.2 Privacy-Led Regulatory Scrutiny on Depth Cameras (EU AI Act)

- 4.3.3 High Power Consumption in Continuous Time-of-Flight Modules

- 4.3.4 Semiconductor Supply-Chain Tightness for Gallium-Nitride Lasers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Patent Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Position Sensors

- 5.1.2 Image Sensors (3D Cameras)

- 5.1.3 Temperature Sensors

- 5.1.4 Accelerometer and IMU Sensors

- 5.1.5 Ambient-Light and Proximity Sensors

- 5.1.6 Gesture-Recognition Sensors

- 5.2 By Technology

- 5.2.1 Structured Light

- 5.2.2 Time-of-Flight (dToF and iToF)

- 5.2.3 Stereo Vision

- 5.2.4 LiDAR (Flash and FMCW)

- 5.2.5 Ultrasound

- 5.3 By End-User Vertical

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive and Transportation

- 5.3.3 Healthcare and Medical Devices

- 5.3.4 Industrial Automation and Robotics

- 5.3.5 Security and Surveillance

- 5.3.6 Aerospace and Defence

- 5.4 By Component

- 5.4.1 IR VCSEL Emitters

- 5.4.2 Depth Image Sensors

- 5.4.3 System-on-Chip Processors

- 5.4.4 Optics and Filters

- 5.4.5 Illumination Modules

- 5.4.6 Software and Algorithms

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Nordics (Sweden, Norway, Denmark, Finland)

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.2 Turkey

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Nigeria

- 5.5.6 Asia-Pacific

- 5.5.6.1 China

- 5.5.6.2 Japan

- 5.5.6.3 South Korea

- 5.5.6.4 India

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Intel Corp.

- 6.4.2 Sony Group Corp.

- 6.4.3 ams OSRAM AG

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 Infineon Technologies AG

- 6.4.6 Lumentum Holdings Inc.

- 6.4.7 Apple Inc. (PrimeSense)

- 6.4.8 Samsung Electronics Co. Ltd.

- 6.4.9 OmniVision Technologies Inc.

- 6.4.10 Panasonic Holdings Corp.

- 6.4.11 Cognex Corp.

- 6.4.12 Sick AG

- 6.4.13 LMI Technologies Inc.

- 6.4.14 Teledyne e2v

- 6.4.15 Qualcomm Inc.

- 6.4.16 SoftKinetic (Sony DepthSense)

- 6.4.17 Melexis N.V.

- 6.4.18 Himax Technologies Inc.

- 6.4.19 Velodyne Lidar Inc.

- 6.4.20 XYZ Interactive Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment