|

市場調查報告書

商品編碼

1851379

泡殼包裝:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Blister Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

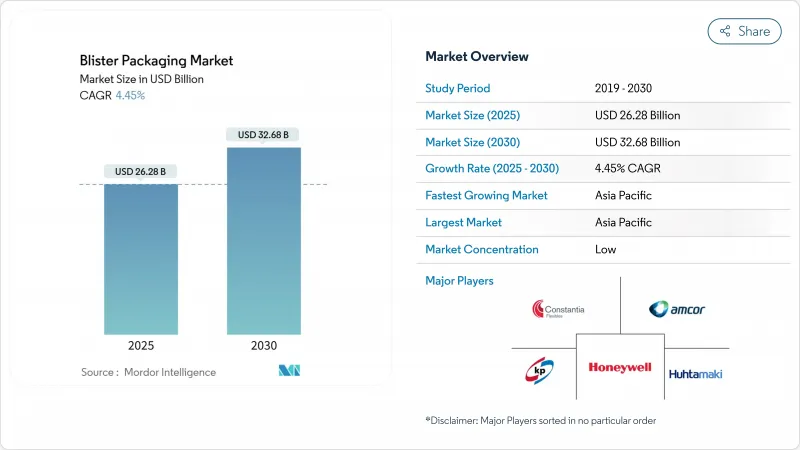

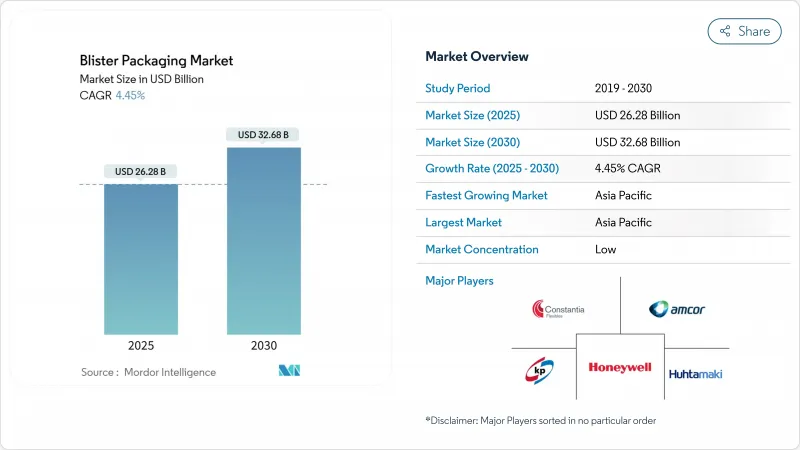

預計到 2025 年,泡殼包裝市場規模將達到 262.8 億美元,到 2030 年將達到 326.8 億美元,預測期內複合年成長率為 4.45%。

處方藥、非處方藥以及日益複雜的生技藥品的強勁需求支撐著這一成長,同時,單劑量包裝在醫院、長期護理機構和零售管道中持續取代大瓶裝藥品。監管壓力,特別是歐盟第2025/40號法規(要求到2030年實現全面回收)和美國FDA加強的防篡改規定,正在推動一波合規主導的創新浪潮,在原料成本波動的情況下,企業需要更高的定價和淨利率保障。由於中國和印度的生產規模,亞太地區引領全球需求,而北美和歐洲則憑藉序列化、智慧包裝和永續性升級,開闢了高價值的細分市場。同時,以安姆科以84.3億美元收購貝瑞全球為代表的產業整合,標誌著業界正朝著靈活、穩健和智慧的整合解決方案轉變,以服務跨國製藥客戶。

全球泡殼包裝市場趨勢與洞察

老年人口不斷增加和慢性病盛行率上升

到2030年,全球60歲以上人口將激增56%,這將推動對易於使用的泡殼包裝的需求,此類包裝既能提高用藥依從性,又能提供防篡改功能。像Drug Plastics Group這樣的加工商正在將專為老年人設計的泡殼包裝(例如更大的字體、顏色編碼和更小的開啟力度)商業化,其按壓式封口設計可將所需的開啟力度減少約四分之一。糖尿病和心血管疾病等慢性病也進一步推動了多劑量包裝的普及,因為此類包裝能夠為複雜的用藥方案提供清晰的視覺提示,並增強泡殼包裝專家獲得高價的動力。

單劑量包裝和病人依從性包裝的需求

醫院、藥局和居家醫療機構正日益將報銷與用藥依從性指標掛鉤,這提升了泡殼包裝單劑量製劑的重要性。 Parata 的自動化設備可直接與電子健康記錄平台整合,減少配藥錯誤,同時簡化重新包裝流程。 FDA 提議強制提案非處方速溶口腔崩壞藥使用單劑量包裝,凸顯了監管機構對單劑量包裝安全性的認可。製藥品牌也正利用單劑量泡殼包裝實現差異化,這種包裝兼具品牌知名度和防篡改功能,是瓶裝藥品無法比擬的。

PVC和鋁價格不穩定

中國計劃於2025年將PVC進口關稅從1%提高到5.5%,這增加了下游加工商的樹脂成本,並凸顯了它們對政策變化的脆弱性。印度加工商60%的PVC原料依賴進口,因此避險和後向整合是其風險管理的核心,它們仍然面臨風險。此外,鋁箔價格也隨能源市場波動,對規模較小、無法簽訂多年合約的中小型泡殼企業帶來壓力。

細分市場分析

預計到2024年,熱成型將佔全球銷售額的64.33%,年均成長率達5.67%。製藥廠商青睞熱成型製程低廉的模具成本、快速的生產線速度以及與多種薄膜基材的兼容性。博朗機械的Quad系列熱成型機每小時可成型高達25萬個封蓋,同時能耗降低約四倍,從而提高合約包裝商的生產效率,並延續泡殼包裝市場的成長動能。 GEA推出的模組化設備如今也針對小型實驗室開放,使供應商不再侷限於大型跨國公司。

冷成型鋁箔雖然市佔率較小,但對於對水分和光敏感的分子而言仍然至關重要。當穩定性測試需要接近零水蒸氣透過率時,藥品製造商通常會指定使用鋁-鋁結構。隨著生技藥品和高效價成分的興起,冷成型鋁箔的應用基礎不斷擴大,推動了更薄鋁箔和混合複合材料的研發,這些材料能夠在不影響阻隔性的前提下減輕重量。這些進步共同拓展了該技術,並鞏固了泡殼包裝市場作為大批量學名藥和利基特藥通用包裝平台的地位。

憑藉成熟的供應鏈和易於熱成型的特性,包括PVC、PET和PP在內的塑膠薄膜將在2024年佔據泡殼銷售額的68.26%。然而,對化石基材料的日益嚴格的審查正在推動紙基解決方案的快速成長,預計到2030年將以7.34%的複合年成長率成長。 TekniPlex公司現已推出透明、可回收的中等阻隔PET泡殼,其再生材料含量高達30%,這充分展現了加工商如何在符合藥典規範的同時,促進循環經濟。

像Roller公司的EcoVolve-30這樣的紙板參與企業,利用纖維和功能性塗層來承受生產線的高溫,並保護片劑免受潮氣侵蝕。雖然潮氣敏感度限制了多種替代方案的選擇,但品牌所有者正透過使用紙張包裝維生素、營養補充劑和保存期限較短的產品來提升其環保性。隨著時間的推移,材料科學的突破有望使混合纖維-聚合物複合材料能夠滿足更高阻隔性性能的要求,從而推動泡殼包裝市場規模的成長,並符合監管機構對再生材料含量的要求。

區域分析

到2024年,亞太地區將佔全球收入的41.34%,以7.56%的複合年成長率超越其他所有地區。這主要得益於中國和印度擴大活性藥物成分(API)生產規模並向西方品質標準接軌。藥明康德在泰興新建的API生產基地及其在新加坡的擴建計劃,正是該地區製造地不斷擴大的例證,直接推動了當地對符合標準的泡殼生產線的需求。中國將進口PVC關稅提高至5.5%,將加強東亞泡殼包裝市場供應鏈的在地化,並進一步促進國內薄膜擠出技術的發展。

北美依然是科技領域的領導者。美國食品藥物管理局 (FDA) 嚴格的序列化和防篡改法規確保了智慧包裝形式的高利潤率,而生物製藥的填充需求則推動了機械設備的投資。 PMMI 預測,到 2027 年,包裝器材的銷售額將達到歷史新高,其中製藥應用將超過食品飲料行業。安姆科收購貝瑞全球,將軟性包裝和剛性包裝的能力整合到一個平台,提供了北美小型加工商無法比擬的規模和垂直整合能力。

歐洲面臨一些最嚴格的永續性法規。歐盟2025/40號法規強制要求PET包裝到2030年實現可回收利用,且回收率達30%,這推動了對循環設計領域的投資。 TekniPlex公司透明、可回收的中等阻隔性泡殼包裝展現了符合EMA嚴格阻隔性能規範的合規途徑。臨床試驗包裝也符合歐盟536/2014號法規的要求。 Catalent公司已在其位於日本滋賀縣的工廠安裝了一條高速泡殼線,以支持廣泛地區試驗,並凸顯合規主導需求的全球性特徵。因此,儘管材料選擇不斷變化,歐洲泡殼包裝的市場佔有率仍然保持強勁。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 老年人口不斷增加和慢性病盛行率上升

- 單劑量包裝和病人依從性包裝的需求

- 加強對防篡改格式的監管

- 智慧型泡殼包裝,附NFC/QR碼追蹤功能

- 個人化藥品泡殼泡殼線

- 永續性推動了PVC維修PE的需求。

- 市場限制

- PVC和鋁價格不穩定

- 加強對聚氯乙烯廢棄物/回收的監管

- PVDC樹脂供應瓶頸

- 非處方條狀包裝和袋裝產品的替代品

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 透過流程

- 熱成型

- 冷成型

- 材料

- 塑膠薄膜(PVC、PET、PP、PE、rPET、COP 等)

- 鋁(鋁鋁箔,PTP箔)

- 紙和紙板

- 依產品類型

- 卡片式/正面密封泡殼

- 泡殼泡殼

- 陷阱與全套卡片泡殼

- 兒童安全/老人友善包裝

- 按最終用戶行業分類

- 製藥

- 營養補充品

- 消費性電子產品和硬體

- 個人護理和化妝品

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲、紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- WestRock Company

- Constantia Flexibles GmbH

- Klockner Pentaplast Group

- Sonoco Products Company

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Tekni-Plex, Inc.

- Dow Inc.

- Uflex Ltd.

- Huhtamaki Oyj

- Winpak Ltd.

- Bilcare Ltd.

- Bemis Company LLC(Amcor)

- Lotte Aluminium Co., Ltd.

- Toyo Aluminium KK

- Pharma Packaging Solutions

- R-Pharm Germany GmbH

- FormPaks Ltd.

- Zhejiang Hualian Pharmaceutical Co.

第7章 市場機會與未來展望

The blister packaging market size stands at USD 26.28 billion in 2025 and is set to climb to USD 32.68 billion by 2030, translating into a steady 4.45% CAGR over the forecast horizon.

Robust demand from prescription drugs, over-the-counter medications, and increasingly complex biologics underpins this growth, while unit-dose formats continue to displace bulk bottles across hospital, long-term-care, and retail channels. Regulatory pressure-most notably the European Union's Regulation 2025/40 mandating full recyclability by 2030 and the U.S. FDA's strengthened tamper-evident rules-has sparked a wave of compliance-driven innovation that commands premium pricing and protects margins even as raw-material costs fluctuate. Asia-Pacific leads global demand thanks to China and India's manufacturing scale, while North America and Europe shape high-value niches through serialization, smart packs, and sustainability upgrades. Meanwhile, industry consolidation-typified by Amcor's USD 8.43 billion purchase of Berry Global-signals a pivot toward integrated flexible, rigid, and intelligent solutions that can serve multinational pharmaceutical clients.

Global Blister Packaging Market Trends and Insights

Growing Geriatric Population and Chronic-Disease Prevalence

The global cohort aged 60 and above will surge 56% by 2030, intensifying demand for user-friendly blister packs that improve medication adherence while offering tamper evidence. Senior-centric designs-larger print, color coding, and low opening force-are being commercialized by converters such as Drug Plastics Group, whose Pop & Click closure reduces required hand pressure by roughly a quarter. Chronic conditions like diabetes and cardiovascular disease further amplify multi-dose pack adoption, enabling clear visual cues for complex regimes and reinforcing premium price realization for blister specialists.

Demand for Unit-Dose and Patient-Adherence Packs

Hospitals, pharmacies, and home-health providers increasingly link reimbursement to adherence metrics, elevating the role of blister-based unit-dose packs. Automated equipment from Parata now integrates directly with electronic health-record platforms, cutting dispensing errors while simplifying repack operations. The FDA's proposal to require single-unit containers for orally disintegrating OTC forms underscores regulatory endorsement of unit-dose safety benefits. Pharmaceutical brands also leverage unit-dose blisters for differentiation, combining brand visibility with tamper-evidence that bottles cannot replicate.

Volatile PVC and Aluminium Prices

China's jump in PVC import tariffs from 1% to 5.5% in 2025 lifted resin costs for downstream converters, spotlighting vulnerability to policy shifts. Indian converters remain exposed since 60% of their PVC feedstock is sourced abroad, making hedging and backward integration central to risk management. Aluminium foil prices also swing with energy markets, straining smaller blister firms that lack the scale to lock in multi-year contracts.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Tamper-Evident Formats

- Smart Blister Packs with NFC/QR for Track-and-Trace

- Tightening PVC Disposal/Recycling Legislation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoforming commanded 64.33% of global revenues in 2024 and will grow 5.67% a year as drug makers favor its low tooling cost, fast line speeds, and compatibility with diverse film substrates. Brown Machine's Quad-Series thermoformers now deliver up to 250,000 lids per hour while trimming energy use by roughly one-quarter, giving contract packers productivity gains that sustain the blister packaging market's momentum. Smaller laboratories gain access through modular machines introduced by GEA, broadening supplier bases beyond large multinationals.

Cold-form foil, though a minority share, is indispensable for moisture- or light-sensitive molecules. Drug makers often specify aluminium-aluminium structures when stability studies demand near-zero water vapor transmission. As biologics and high-potency actives proliferate, cold form's installed base expands, intensifying R&D into thinner foils and hybrid lamination that cut weight without compromising barrier. Together, these advances widen the technology palette, reinforcing the blister packaging market as a versatile platform for both mass-production generics and niche specialty drugs.

Plastic films, led by PVC, PET, and PP, accounted for 68.26% of blister revenues in 2024 thanks to mature supply chains and easy thermoformability. Yet heightened scrutiny of fossil-based materials is spurring rapid incremental gains for paper-based solutions, which log a 7.34% CAGR through 2030. TekniPlex now offers transparent recyclable mid-barrier PET blisters containing 30% recycled content, illustrating how converters preserve pharmacopoeial compliance while advancing circularity.

Paperboard entrants such as Rohrer's EcoVolve-30 use fiber plus functional coatings to withstand line forming temperatures and protect moisture-tolerant tablets. Although moisture sensitivity limits broad substitution, brand owners deploy paper variants in vitamins, nutraceuticals, and short shelf-life SKUs, bolstering eco-credentials. Over time, material science breakthroughs are expected to let hybrid fiber-polymer laminates secure higher-barrier categories, reinforcing the blister packaging market size trajectory and aligning with regulatory recycled-content mandates.

The Blister Packaging Market Report is Segmented by Process (Thermoforming, Cold Forming), Material (Plastic Films, Aluminium, Paper and Paperboard), Product Type (Carded/Face-Seal Blisters, Clamshell Blisters, Trapped and Full-Card Blisters, and More), End-User Industry (Pharmaceuticals, Nutraceuticals and Dietary Supplements, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 41.34% of 2024 revenue and will outpace all regions at 7.56% CAGR as China and India scale active-pharmaceutical-ingredient output and align with Western quality standards. WuXi STA's new Taixing API site and proposed Singapore expansion exemplify regional manufacturing build-out, directly lifting local demand for compliant blister lines. China's tariff hike on imported PVC to 5.5% further encourages domestic film extrusion, reinforcing supply-chain localization that underpins the blister packaging market in East Asia.

North America remains a technological bellwether. Stringent FDA serialization plus tamper-evidence rules sustain premium margins for intelligent formats, while machinery capex expands in anticipation of biologic fill-finish demand. PMMI projects packaging-machinery sales will hit record highs by 2027, with pharmaceutical applications outperforming food and beverage. Amcor's Berry Global acquisition consolidates flexible and rigid capabilities inside a single platform, ensuring scale and vertical reach that smaller North American converters will find hard to match.

Europe confronts the most aggressive sustainability legislation. Regulation 2025/40 enforces recyclability and 30% recycled content in PET packs by 2030, directing investment into circular-ready designs. TekniPlex's showcase of transparent recyclable mid-barrier blisters demonstrates compliance pathways that still satisfy stringent EMA barrier specifications. Clinical-trial packs also adapt to EU 536/2014, prompting Catalent to equip its Shiga, Japan, site with high-speed blister lines that serve pan-regional studies and underscore the global nature of compliance-driven demand. Consequently, the blister packaging market share in Europe remains resilient even as material choices evolve.

- Amcor plc

- WestRock Company

- Constantia Flexibles GmbH

- Klockner Pentaplast Group

- Sonoco Products Company

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Tekni-Plex, Inc.

- Dow Inc.

- Uflex Ltd.

- Huhtamaki Oyj

- Winpak Ltd.

- Bilcare Ltd.

- Bemis Company LLC (Amcor)

- Lotte Aluminium Co., Ltd.

- Toyo Aluminium K.K.

- Pharma Packaging Solutions

- R-Pharm Germany GmbH

- FormPaks Ltd.

- Zhejiang Hualian Pharmaceutical Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing geriatric population and chronic-disease prevalence

- 4.2.2 Demand for unit-dose and patient-adherence packs

- 4.2.3 Regulatory push for tamper-evident formats

- 4.2.4 Smart blister packs with NFC / QR for track-and-trace

- 4.2.5 Personalized-medicine small-batch blister lines

- 4.2.6 PVC-to-PE retrofit demand driven by sustainability

- 4.3 Market Restraints

- 4.3.1 Volatile PVC and aluminium prices

- 4.3.2 Tightening PVC disposal / recycling legislation

- 4.3.3 PVDC-resin supply bottlenecks

- 4.3.4 OTC stick-pack and sachet substitution

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Process

- 5.1.1 Thermoforming

- 5.1.2 Cold Forming

- 5.2 By Material

- 5.2.1 Plastic Films (PVC, PET, PP, PE, rPET, COP, others)

- 5.2.2 Aluminium (ALU-ALU, PTP foil)

- 5.2.3 Paper and Paperboard

- 5.3 By Product Type

- 5.3.1 Carded / Face-Seal Blisters

- 5.3.2 Clamshell Blisters

- 5.3.3 Trapped and Full-Card Blisters

- 5.3.4 Child-Resistant / Senior-Friendly Packs

- 5.4 By End-User Industry

- 5.4.1 Pharmaceuticals

- 5.4.2 Nutraceuticals and Dietary Supplements

- 5.4.3 Consumer Electronics and Hardware

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Other End-user Industry

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 WestRock Company

- 6.4.3 Constantia Flexibles GmbH

- 6.4.4 Klockner Pentaplast Group

- 6.4.5 Sonoco Products Company

- 6.4.6 DuPont de Nemours, Inc.

- 6.4.7 Honeywell International Inc.

- 6.4.8 Tekni-Plex, Inc.

- 6.4.9 Dow Inc.

- 6.4.10 Uflex Ltd.

- 6.4.11 Huhtamaki Oyj

- 6.4.12 Winpak Ltd.

- 6.4.13 Bilcare Ltd.

- 6.4.14 Bemis Company LLC (Amcor)

- 6.4.15 Lotte Aluminium Co., Ltd.

- 6.4.16 Toyo Aluminium K.K.

- 6.4.17 Pharma Packaging Solutions

- 6.4.18 R-Pharm Germany GmbH

- 6.4.19 FormPaks Ltd.

- 6.4.20 Zhejiang Hualian Pharmaceutical Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment