|

市場調查報告書

商品編碼

1851360

熱電偶溫度感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Thermocouple Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

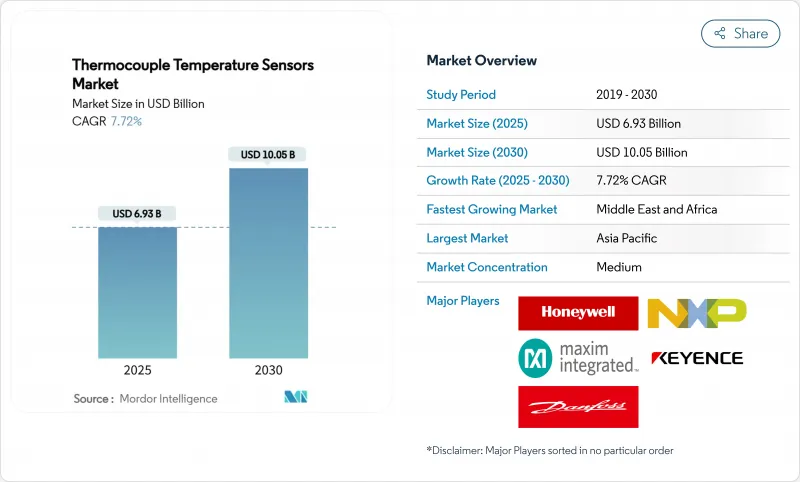

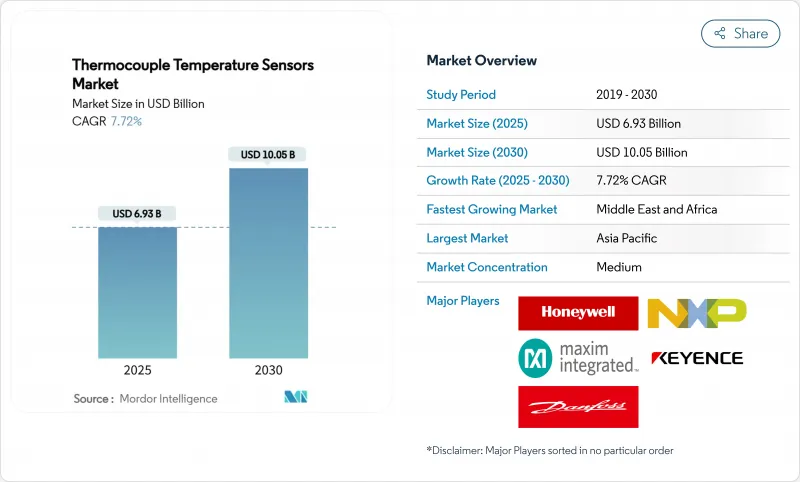

熱電偶溫度感測器市場預計到 2025 年將達到 69.3 億美元,到 2030 年將達到 100.5 億美元,年複合成長率為 7.72%。

即時熱數據能夠提升效率、安全性和產量比率,這推動了相關產業的需求成長。工業4.0改裝、綠色氫電解槽、液化天然氣基礎設施和電動車電池超級工廠的擴張,都促進了K型、N型和T型探頭的應用場景日益豐富。同時,諸如EtherNet/IP協定等數位網路標準正在將傳統感測器轉變為智慧節點,為預測性維護平台提供資料支援。來自亞洲低成本進口產品和光纖替代方案的競爭日益激烈,而更嚴格的電機效率測試和強制性嵌入式監控等新的監管要求,也在推動這一趨勢。

全球熱電偶溫度感測器市場趨勢與洞察

預測性維護推動多點熱電偶的應用

擁抱工業4.0標準的工廠營運商正在用多點熱電偶陣列取代單單點感測器感測器,從而產生詳細的溫度圖。結合機器學習演算法,這些陣列可在故障發生前數週偵測到漂移和熱點,將非計劃性停機時間減少高達30%。歐洲工廠引領改裝浪潮,北美汽車製造商和化學加工商也紛紛效仿,因為CEN研討會協議18038為數據驅動型維護制定了藍圖。計算成本的下降以及ODVA的即插即用EtherNet/IP協定縮短了整合時間,推動了該技術的廣泛應用。隨著越來越多的工廠採用熱感分析標準,能夠將感測器與分析服務捆綁銷售的供應商將獲得更高的利潤。

綠氫能推動對高溫監測的需求

固體氧化物電解槽規模的擴大已將動作溫度範圍推至 800°C 以上,在此閾值下,N 型和升級版 K 型探頭的性能優於其他金屬基感測器。連續溫度曲線分析可保護電堆免受縮短壽命的熱循環影響,而加州能源委員會的津貼也激發了全球對溫度控制通訊協定的興趣。亞洲電解槽供應商正在指定使用可承受氫氣暴露的焊接礦物絕緣 (MI) 組件,從而在熱電偶溫度感測器市場打造了一個高階產品層級。隨著歐洲氣候政策資金湧入綠色氫能產業叢集,對超穩定探頭的整體需求正在將潛在銷售市場遠遠擴展到試點工廠之外。

價格下跌對歐美製造商來說是一個挑戰。

自2023年以來,來自中國和印度的低成本K型和J型探針的激增,已使平均售價下降了15%至20%,擠壓了佔總產量一半以上的標準組裝的利潤空間。亞洲供應商也以30%至40%的折扣出售MI電纜,迫使傳統品牌專注於專業設計和服務密集合約。美國分銷商報告稱,由於終端用戶預期價格會進一步下降而推遲更換,存貨周轉速度正在放緩。鎳和鉻的短期通膨加劇了歐洲公司的成本控制難題,而買家不願承擔額外費用,這進一步限制了收入成長。

細分市場分析

K型熱電偶溫度感測器憑藉其-200°C至+1350°C的通用量程,預計到2024年將保持35%的市場佔有率。此量程涵蓋了主要的製造業、食品工業和暖通空調迴路,即使商品化導致淨利率下降,K型熱電偶仍然非常適合大批量訂單。同時,N型熱電偶憑藉其抗氧化性能,在航太測試台和氫反應器領域贏得了訂單,預計到2030年將以8.9%的複合年成長率成長。原始設備製造商(OEM)預計,延長校準週期將帶來生命週期成本節約,使採購部門能夠抵消較高的初始成本。新興的R、S和B合金目前仍主要面向高階超高溫應用,但鉑絲純度正在逐步提高,因此在半導體外延生產線中得到了應用,因為在1200°C下控制漂移是重中之重。

材料科學的最新進展正在擴大其應用範圍。薄膜沉澱如今可將微米級熱電偶網格嵌入陶瓷基板中,從而實現晶圓溫度的即時測量。供應商正轉向使用氧化鋁隔熱材料和Fibro Platinum熱電偶絲,這些材料能夠承受1600°C的連續高溫,使玻璃、耐火材料和積層製造窯爐能夠取代傳統的光學高溫計。 T型熱電偶在-200 度C液化天然氣(LNG)商用的微型細分市場中蓬勃發展,在該領域,精度比成本更為重要。總而言之,這些發展增強了高階熱電偶市場對批量價格壓縮的抵禦能力。

接地型產品仍佔據OEM廠商產品目錄的主導地位,可達到毫秒級的反應時間。然而,伺服驅動器和變頻馬達系統對電氣隔離的需求日益成長,促使採購轉向非接地型產品。非接地型產品可將接地迴路雜訊降低90%,而反應速度僅損失20%。半導體製造商指定使用此類產品來保護敏感的測量電子元件免受雜訊電流的影響。裸露的結仍然用於實驗室玻璃器皿和非加壓試驗鑽機,但其脆弱性限制了其市場佔有率。隨著工廠為預測性維護而重新佈線,控制工程師更傾向於採用混合設計,例如部分隔離的微型結,以平衡電磁相容性和動態響應。

雷射焊接尖端結構的進步提高了疲勞壽命,使非接地磁阻式探頭能夠承受高振動渦輪級。供應商正在添加微型連接器和環氧樹脂灌封鹽,以提高密封完整性,同時不影響熱滯後。一些電池製造商正在採用具有陶瓷珠接頭的夾式皮膚感測器來監測電池外殼溫度,將接頭創新引入家用電子電器領域。儘管受到矽基晶片的衝擊,這種跨行業的學習仍然使熱電偶溫度感測器市場保持活力。

熱電偶溫度感測器市場按熱電偶類型、接點類型(接地接點、非接地接點、其他)、溫度範圍(低於0°C、0°C至350°C、其他)、探頭配置(珠狀導線、礦物絕緣(MI)電纜、其他)、終端用戶產業(石油天然氣、發電、其他)和地區進行細分。市場預測以美元計價。

區域分析

由於製造業基地密集,亞太其他地區佔據了熱電偶溫度感測器市場42%的佔有率。高精度探頭被應用於中國的電池窯爐和日本的晶片工廠,而鉑合金探頭則被韓國指定用於OLED玻璃熔融區。印度的石化企業正在訂購更多標準的K型和J型探頭,同時對在地採購的需求也在成長,這促使了合資企業的出現。該地區的低成本工廠正在生產商品化探頭,這些探頭隨後被輸送到全球供應鏈,對其他地區的價格造成了不利影響。

中東將成為成長最快的地區,到2030年複合年成長率將達到9.5%。沙烏地阿美公司在達曼的一家工廠獲得許可,可就地生產MI探頭和熱電偶套管。投資項目涵蓋石化中心、太陽熱能發電發電廠和海水淡化裝置等,這些項目都需要能夠承受從低溫到1000°C高溫的耐用感測器。本地組裝縮短了前置作業時間,使供應商能夠更好地滿足國內市場的需求,並重塑熱電偶溫度感測器市場的分銷管道。

北美在航太、液化天然氣和先進製造業領域佔有重要佔有率。墨西哥灣沿岸一家新建的液化工廠正在訂購用於-162 度C低溫環境的T型管,而噴射引擎原始設備製造商(OEM)正在對用於1200 度C燃燒室的貴金屬探針進行認證。歐盟汽車法規2019/1781強制要求對效率聲明進行熱電偶整合檢驗,德國一家氫氣試驗廠則要求對固體氧化物電解池(SOEC)的電堆進行900°C的測量。南美洲和非洲雖然仍處於起步階段,但與採礦、紙漿和造紙以及化肥廠尋求製程升級相關的需求正在成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 工業4.0向預測性維護的轉變促使歐洲工廠採用多點熱電偶

- 在亞太地區擴大綠色氫電解槽(監測溫度高於 800°C)的建設

- 北美液化天然氣再氣化終端的建設正在推進,需要T型低溫探針。

- 中國電動車電池超級工廠窯爐安裝需要高精度K型感測器

- 歐盟法規 2019/1781 加強了馬達效率測試,並強制要求內建熱電偶。

- 市場限制

- 由於來自低成本亞洲供應鏈的商品化鉀肥和鉀肥進口,價格走低

- 高電磁干擾航太引擎中光纖感測器被取代的威脅

- 超過1200°C的校準漂移限制了其在半導體外延線的應用。

- 鎳和鉻供應波動擾亂了歐洲MI電纜探頭的生產。

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- PESTEL 分析

第5章 市場規模與成長預測

- 熱電偶型

- J型

- T型

- N型

- E型

- R 型和 S 型

- B型

- 其他

- 按連線類型

- 接地連接

- 未接地接線盒

- 裸露的接線盒

- 按溫度範圍

- 零度以下

- 0度至350度

- 350度至700度

- 超過700度

- 透過探針配置

- 串珠線

- 礦物絕緣(MI)電纜

- 熱電偶套管和保護管

- 表面和滲透

- 靈活/客製化線束

- 按最終用戶行業分類

- 石油和天然氣

- 發電業務

- 化工和石油化工

- 金屬和採礦

- 飲食

- 汽車/電動車電池

- 航太/國防

- 半導體和電子學

- 醫療保健和生命科學

- 暖通空調和建築自動化

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 策略趨勢

- 市佔率分析

- 公司簡介

- Omega Engineering(Spectris plc)

- Emerson Electric Co.

- Endress+Hauser Group

- Honeywell International Inc.

- ABB Ltd

- Yokogawa Electric Corp.

- WIKA Alexander Wiegand SE

- TE Connectivity Ltd.

- Watlow Electric Manufacturing Co.

- Fluke Corporation

- Siemens AG

- JUMO GmbH and Co. KG

- Tempsens Instruments

- Pyromation Inc.

- Durex Industries

- Thermo Fisher Scientific Inc.

- GHM Group(Greisinger)

- TC Ltd(UK)

- Thermo Electric Instrumentation

- Tip TEMP

第7章 市場機會與未來展望

The thermocouple temperature sensors market size is valued at USD 6.93 billion in 2025 and is forecast to reach USD 10.05 billion by 2030, reflecting a 7.72% CAGR.

Demand stems from industries where real-time thermal data underpins efficiency, safety and yield-especially at temperatures where RTDs and thermistors fall short. Expansion in Industry 4.0 retrofits, green-hydrogen electrolysers, LNG infrastructure and EV battery gigafactories is elevating use cases that favour Type K, N and T probes. At the same time, digital networking standards such as EtherNet/IP profiles are turning legacy sensors into smart nodes that feed predictive-maintenance platforms. Intensifying competition comes from low-cost Asian imports and fiber-optic alternatives, yet regulatory mandates for tighter motor-efficiency tests and embedded monitoring add fresh tailwinds.

Global Thermocouple Temperature Sensors Market Trends and Insights

Predictive maintenance driving multi-point thermocouple adoption

Factory operators adopting Industry 4.0 standards are replacing single-point sensors with multi-point thermocouple strings that create detailed thermal maps. When paired with machine-learning algorithms, these arrays detect drift or hotspots weeks ahead of a fault, reducing unplanned downtime by up to 30%. European plants pioneered the retrofit wave, yet North American automakers and chemical processors are following as CEN Workshop Agreement 18038 offers a blueprint for data-driven maintenance. Broader adoption is fuelled by falling computing costs and ODVA's plug-and-play EtherNet/IP profiles that shrink integration time. As more plants normalize thermal profiling, suppliers able to bundle sensors with analytics services capture higher margins.

Green hydrogen driving high-temperature monitoring demand

Scaling of solid-oxide electrolyser cells pushes operating zones beyond 800 °C, a threshold where Type N and upgraded Type K probes outclass other metal-based sensors. Continuous profiling guards against thermal cycling that shortens stack life, and California Energy Commission grants have sharpened global attention on temperature-control protocols. Asian electrolyser vendors now specify pre-welded mineral-insulated (MI) assemblies rated for hydrogen exposure, creating a premium tier within the thermocouple temperature sensors market. As European climate-policy funds funnel into green-hydrogen clusters, collective demand for ultra-stable probes widens the addressable sales pool well past pilot plants.

Price erosion challenging Western manufacturers

A surge of low-cost K and J probes from China and India has cut average selling prices by 15-20% since 2023, squeezing margins on standard assemblies that make up over half of unit volumes. Asian vendors also ship MI cables at 30-40% discounts, forcing legacy brands to pivot toward specialized designs or service-heavy contracts. Distributors in the United States report inventory turns slowing as end users defer replacements in anticipation of further price drops. Short-cycle inflationary spikes in nickel and chromium amplify cost control woes for European firms, yet buyers remain reluctant to shoulder surcharges, deepening the restraint on revenue growth.

Other drivers and restraints analyzed in the detailed report include:

- LNG infrastructure expansion boosts cryogenic sensor demand

- EV battery manufacturing driving precision temperature control

- Fiber-optic sensors threatening high-EMI applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Type K maintained a 35% hold on the thermocouple temperature sensors market share in 2024 on versatility across -200 °C to +1350 °C. That span covers mainstream manufacturing, food processing and HVAC loops, positioning the variant for volume contracts even as commoditization trims margins. Type N, however, is capturing orders in aerospace test stands and hydrogen reactors at an 8.9% CAGR through 2030, aided by immunity to green-rot oxidation. OEMs see life-cycle savings from longer calibration intervals, swinging purchasing departments toward higher upfront costs. Emerging R, S and B alloys remain priced for boutique ultra-high-temperature work, but incremental breakthroughs in platinum wire purity are nudging them into semiconductor epitaxy lines where 1200 °C drift control is paramount.

Recent material science gains widen adoption envelopes. Thin-film deposition now embeds micron-scale thermocouple grids on ceramic substrates, serving real-time wafer temperature measurement. Suppliers highlight alumina insulation and Fibro Platinum wire for 1600 °C continuous service, enabling glass, refractory and additive-manufacturing kilns to retire legacy optical pyrometers. Type T retains a thriving micro-niche at -200 °C LNG duties where accuracy trumps cost. Collectively, these moves reinforce the premium segments' resilience against bulk price compression.

Grounded junction models still dominate OEM catalogues because they achieve millisecond response times. Yet the push for electrical isolation in servo drives and variable-frequency motor systems moves procurement toward ungrounded versions that damp ground-loop noise by 90% while sacrificing only 20% response speed. Semiconductor fabricators specify these variants to shield sensitive measurement electronics from stray currents. Exposed junctions continue in lab glassware and non-pressurized pilot rigs but carry limited share due to fragility. As factories re-wire for predictive maintenance, control engineers balance electromagnetic compatibility against dynamic response, favouring hybrid designs such as partially insulated mini junctions.

Advances in laser-welded tip construction lift fatigue life, letting ungrounded MI probes survive high-vibration turbine stages. Vendors add miniature connectors and epoxy potting salts that improve seal integrity without hampering thermal lag. Some battery producers adopt clip-on skin sensors-essentially exposed junctions set in ceramic beads-to audit cell casing temperatures, pulling junction innovation into consumer-electronics territory. These cross-industry learnings keep the thermocouple temperature sensors market vibrant despite encroachment from silicon-based chips.

Thermocouple Temperature Sensors Market Segmented by Thermocouple Type, Junction Type (Grounded Junction, Ungrounded Junction and More), Temperature Range (Below 0 °C, 0 °C - 350 °C and More), Probe Configuration (Beaded-Wire, Mineral-Insulated (MI) Cable and More) End-User Industry (Oil and Gas, Power Generation and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 42% command of the thermocouple temperature sensors market rests on its dense manufacturing base. China's battery kilns and Japan's chip fabs consume high-accuracy probes, while South Korea specifies platinum alloys for OLED glass melt zones. India's petrochemical expansion adds orders for standard K and J variants yet increasingly demands local content, spurring joint ventures. Low-cost plants across the region manufacture commoditized probes that flow into global supply chains, creating price headwinds elsewhere.

The Middle East posts the quickest regional climb at 9.5% CAGR through 2030. Saudi Aramco-approved facilities in Dammam now produce MI probes and thermowells domestically. Investment flows span petrochemical hubs, solar-thermal farms and desalination units, all requiring rugged sensors from cryogenic to 1000 °C zones. Local assembly shortens lead times and helps suppliers meet in-country value mandates, reshaping distribution networks in the thermocouple temperature sensors market.

North America maintains substantial share via aerospace, LNG and advanced manufacturing. New liquefaction trains along the Gulf Coast order Type T strings for -162 °C service, whereas jet-engine OEMs qualify noble-metal probes for 1200 °C combustors. Europe's uptake hinges on regulatory stimuli; EU Motor Regulation 2019/1781 obliges embedded thermocouple verification for efficiency labelling, and hydrogen pilot plants in Germany necessitate 900 °C measurement of SOEC stacks. South America and Africa remain nascent but show upticks tied to mining, pulp-and-paper and fertilizer plants seeking process upgrades.

- Omega Engineering (Spectris plc)

- Emerson Electric Co.

- Endress+Hauser Group

- Honeywell International Inc.

- ABB Ltd

- Yokogawa Electric Corp.

- WIKA Alexander Wiegand SE

- TE Connectivity Ltd.

- Watlow Electric Manufacturing Co.

- Fluke Corporation

- Siemens AG

- JUMO GmbH and Co. KG

- Tempsens Instruments

- Pyromation Inc.

- Durex Industries

- Thermo Fisher Scientific Inc.

- GHM Group (Greisinger)

- TC Ltd (UK)

- Thermo Electric Instrumentation

- Tip TEMP

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Shift toward predictive maintenance in Industry 4.0 boosting multi-point thermocouple retrofits across European factories

- 4.1.2 Expansion of green-hydrogen electrolyzes build-outs (>800 C monitoring) in Asia Pacific

- 4.1.3 LNG regasification terminal build-outs requiring cryogenic Type-T probes in North America

- 4.1.4 EV battery gigafactory kiln installations in China demanding high-accuracy Type-K sensors

- 4.1.5 EU Regulation 2019/1781 mandating tighter motor-efficiency tests and embedded thermocouples

- 4.2 Market Restraints

- 4.2.1 Price erosion from commoditized K and J imports out of low-cost Asian supply chains

- 4.2.2 Substitution threat from fiber-optic sensors in high-EMI aerospace engines

- 4.2.3 Calibration drift >1 200 C limiting use in semiconductor epitaxy lines

- 4.2.4 Nickel and chromium supply volatility disrupting MI-cable probe output in Europe

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Thermocouple Type

- 5.1.1 Type J

- 5.1.2 Type T

- 5.1.3 Type N

- 5.1.4 Type E

- 5.1.5 Type R and S

- 5.1.6 Type B

- 5.1.7 Others

- 5.2 By Junction Type

- 5.2.1 Grounded Junction

- 5.2.2 Ungrounded Junction

- 5.2.3 Exposed Junction

- 5.3 By Temperature Range

- 5.3.1 Below 0 C

- 5.3.2 0 C 350 C

- 5.3.3 350 C 700 C

- 5.3.4 Above 700 C

- 5.4 By Probe Configuration

- 5.4.1 Beaded-Wire

- 5.4.2 Mineral-Insulated (MI) Cable

- 5.4.3 Thermowell and Protection Tube

- 5.4.4 Surface and Penetration

- 5.4.5 Flexible / Custom Harness

- 5.5 By End-User Industry

- 5.5.1 Oil and Gas

- 5.5.2 Power Generation

- 5.5.3 Chemicals and Petrochemicals

- 5.5.4 Metals and Mining

- 5.5.5 Food and Beverage

- 5.5.6 Automotive and EV Battery

- 5.5.7 Aerospace and Defense

- 5.5.8 Semiconductor and Electronics

- 5.5.9 Healthcare and Life Sciences

- 5.5.10 HVAC and Building Automation

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Nigeria

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Omega Engineering (Spectris plc)

- 6.3.2 Emerson Electric Co.

- 6.3.3 Endress+Hauser Group

- 6.3.4 Honeywell International Inc.

- 6.3.5 ABB Ltd

- 6.3.6 Yokogawa Electric Corp.

- 6.3.7 WIKA Alexander Wiegand SE

- 6.3.8 TE Connectivity Ltd.

- 6.3.9 Watlow Electric Manufacturing Co.

- 6.3.10 Fluke Corporation

- 6.3.11 Siemens AG

- 6.3.12 JUMO GmbH and Co. KG

- 6.3.13 Tempsens Instruments

- 6.3.14 Pyromation Inc.

- 6.3.15 Durex Industries

- 6.3.16 Thermo Fisher Scientific Inc.

- 6.3.17 GHM Group (Greisinger)

- 6.3.18 TC Ltd (UK)

- 6.3.19 Thermo Electric Instrumentation

- 6.3.20 Tip TEMP

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis