|

市場調查報告書

商品編碼

1851348

物聯網測試:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)IoT Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

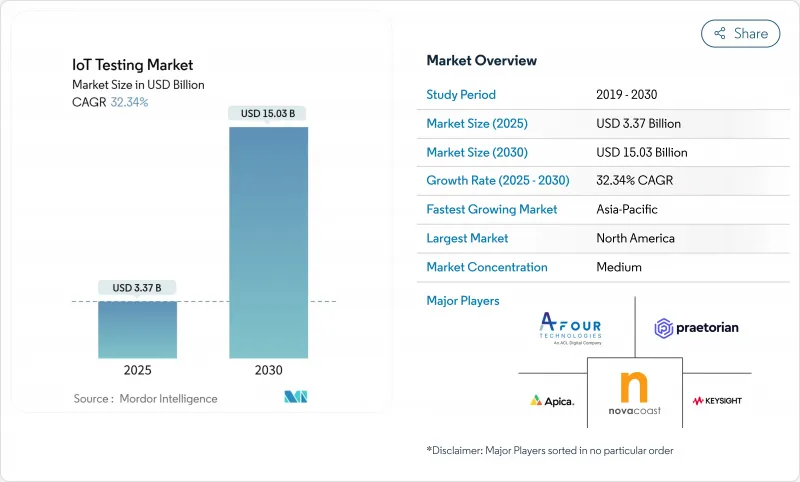

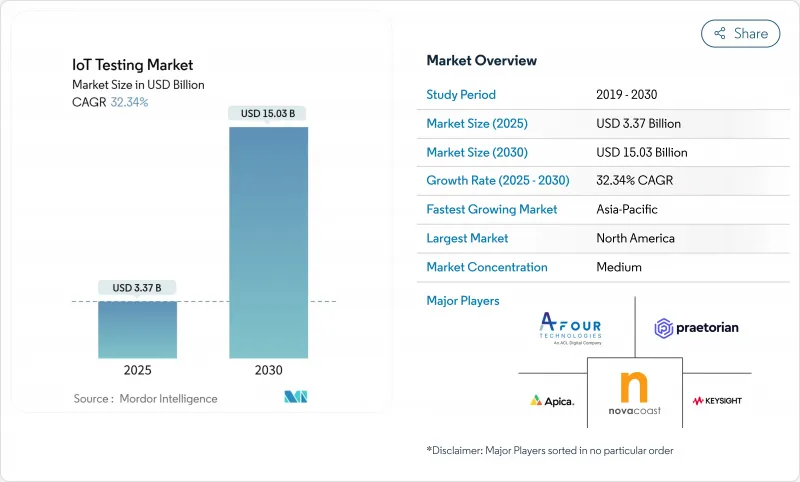

預計到 2025 年,物聯網測試市場規模將達到 33.7 億美元,到 2030 年將達到 150.3 億美元,預測期(2025-2030 年)複合年成長率為 32.34%。

這種快速擴張反映了日益成長的數位轉型目標、不斷加強的網路安全要求以及互聯終端在工業和消費環境中的廣泛普及。由於單一設備故障可能導致生產線停工、引發安全事故,並造成數百萬美元的監管罰款,企業正從被動響應式檢驗模型。 5G 和邊緣運算帶來的低延遲需求,推動了對能夠捕捉關鍵任務工作負載中毫秒效能變化的測試平台的需求。同時,數位雙胞胎環境使開發人員能夠在軟體中模擬設備的整個生命週期,同時保持與現實世界的可追溯性,從而降低了硬體成本。

全球物聯網測試市場趨勢與洞察

物聯網互聯終端數量爆炸性成長

據報道,到2024年8月,中國將擁有25.7億台活躍的物聯網設備,這凸顯了規模的轉變,並推動了測試矩陣呈指數級成長。智慧工廠可能包含多種設備,例如Zigbee感測器、LoRaWAN閘道器和5G RedCap機器人,這迫使檢驗團隊確保所有通訊協定組合之間的無縫互通性。現代和三星已經展示了私有的5G RedCap生產線,需要進行低於10毫秒延遲的檢驗。隨著混合代際設備數量的成長,每個新的設備SKU都會增加需要認證的組合數量,迫使企業投資可擴展且不犧牲覆蓋範圍的整合測試自動化框架。因此,物聯網測試市場必須在一個可配置的環境中支援傳統的4G模組和未來的5G終端。

日益嚴格的安全和隱私法規

自2025年8月起,歐盟無線電設備指令將要求所有連網產品在銷售前通過網路安全合規性測試。統一的EN 18031系列標準規定了網路保護、資料隱私和詐騙預防的測試案例,將合規性工作量擴展到功能檢查之外。在沿岸地區,沙烏地阿拉伯和阿拉伯聯合大公國強制實施的生物識別SIM卡註冊正在重塑連接性測試通訊協定。缺乏內部安全專業知識的公司擴大將檢驗工作外包,推動了物聯網測試市場對託管服務提供者的需求。

設備和通訊協定的複雜性日益增加

現代配置融合了多種設備,包括 Wi-Fi 6E 感測器、藍牙 5.4 信標、LoRaWAN 計量器、NB-IoT 追蹤器和 5G RedCap 數據機,每種設備都需要不同的工具。預計到 2030 年,汽車半導體的成本將達到每輛車 1200 美元,這將使控制單元和遠端資訊處理閘道中的檢驗點數量翻倍。每項新通訊協定都會增加現有測試矩陣的複雜性,延長測試週期,並為資源有限的實驗室帶來挑戰。除非自動化、虛擬化和人工智慧驅動的優先排序能夠縮短測試週期,否則這種複雜性可能會減緩物聯網測試市場的成長。

細分市場分析

到2024年,專業服務將佔總收入的61%,因為企業將利用外部專家來滿足其在通訊協定、安全性和合規性方面的多方面需求。專業服務的優勢在於其在5G、RedCap和歐盟網路安全合規性測試方面擁有深厚的專業知識儲備。然而,由於製造商和車隊營運商傾向於選擇能夠保證全天候實驗室服務的訂閱協議,託管服務預計將以每年18.7%的速度成長。 HCL Technologies 2024會計年度的營收為133億美元,顯示其託管測試業務組合實現了強勁成長。這種轉變正在重新定義物聯網測試市場的交付模式,並擴大對完全外包檢驗中心的需求。

預計到2030年,託管服務物聯網測試市場規模將從2025年的13.1億美元飆升至60.5億美元。全球系統整合商正在投資建立可遠端存取的設備集群。

2024年,功能檢驗仍將維持27.3%的最高收入成長,因為計劃仍以連線性和資料流檢查為起點。然而,到2030年,安全測試將維持22.5%的複合年成長率。物聯網測試市場需依照EN 18031和美國FDA上市前申報的要求,執行滲透測試、韌體完整性掃描和加密通道評估。 Applus+於2024年開設了一家新的歐洲網路安全實驗室,以快速滿足對ETSI 303 645認證的需求。

到 2030 年,光是安全服務就可能佔據 31% 的市場。同時,對於 5G URLLC 場景至關重要的效能壓力測試和網路切換測試,即使不會呈指數級成長,也將繼續保持其重要性。

物聯網測試市場報告按服務類型(專業和託管)、測試類型(功能測試、效能測試、網路測試、相容性測試、安全測試、可用性測試)、應用(智慧建築和家庭自動化、毛細管網路管理、其他)、最終用戶產業(零售、製造、醫療保健、能源和公共產業、IT 和電信、其他)以及地區進行細分。

區域分析

北美地區在物聯網測試領域遙遙領先,預計2024年營收將成長38.6%,這主要得益於企業採用DevOps流程,將測試貫穿從設計到生產的整個流程。聖安東尼奧的SmartSA舉措正在進行市政級試點,所有路燈感測器在現場部署前都必須通過互通性和安全驗證。物聯網測試市場受益於成熟的認證體係以及財力雄厚的航太、汽車和工業自動化客戶。

亞太地區預計將以15.8%的複合年成長率實現最快成長。中國的雄安10Gbps骨幹網路和北京的車路雲試點計畫正在推動對大規模合規實驗室的需求。日本的「社會5.0」計畫和韓國1.01億美元的國家智慧城市基金正在增加數千台設備,這些設備必須根據特定地區的電訊和隱私法規進行配置。隨著本地供應商整合雲端原生自動化技術,到2030年,亞太地區的物聯網測試市場規模可能超過50億美元。

在以規則為先的方針支持下,歐洲持續保持強勁成長。無線電設備指令中的網路安全條款要求在CE認證前,必須由第三方實驗室進行滲透測試。預計2023年,智慧電錶普及率將達到電力60%,天然氣45%,這將促使公用事業供應商持續進行檢驗工作。北歐通訊業者正攜手打造5G物聯網實驗室,其中挪威電信位於卡爾斯克魯納的設施可為全球設備製造商提供即插即用的瑞典網路存取。這個框架使歐洲物聯網測試市場以合規為中心,並具備強大的韌性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 物聯網互聯終端數量爆炸性成長

- 日益嚴格的安全和隱私法規

- 向 DevOps 和持續測試管線的轉變

- 5G/邊緣運算的低延遲應用案例

- 採用基於數位雙胞胎的“虛擬檢測”

- 節能設備的永續性要求

- 市場限制

- 設備和通訊協定的複雜性日益增加

- 缺乏全球互通性標準

- 缺乏多重接入邊緣測試平台

- 資料主權規則減緩了跨境測試

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 考試類型概述

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠疫情及疫情後影響評估

第5章 市場規模與成長預測

- 按服務類型

- 專業的

- 管理

- 按測試類型

- 功能測試

- 性能測試

- 網路測試

- 相容性測試

- 安全測試

- 可用性測試

- 透過使用

- 智慧建築與家庭自動化

- 毛細血管網路管理

- 智慧公用事業(能源/水)

- 車用通訊系統與連網汽車

- 智慧製造/工業IoT(IIoT)

- 按最終用戶行業分類

- 零售

- 製造業

- 衛生保健

- 能源與公共產業

- 資訊科技和電訊

- 政府與智慧城市

- 運輸與物流

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- Strategic Initiatives and Funding

- 市佔率分析

- 公司簡介

- IBM

- Keysight Technologies

- HCL Technologies

- Cognizant

- Capgemini

- Infosys

- Tata Consultancy Services

- Accenture

- Wipro

- Qualitest Group

- Spirent Communications

- AFour(ACL Digital)

- Apica Systems

- Praetorian Security

- Novacoast

- Trustwave(Singtel)

- Happiest Minds

- Vector Informatik

- Eurofins Digital Testing

- SmartBear

- VIAVI Solutions

第7章 市場機會與未來展望

The IoT Testing Market size is estimated at USD 3.37 billion in 2025, and is expected to reach USD 15.03 billion by 2030, at a CAGR of 32.34% during the forecast period (2025-2030).

This rapid expansion mirrors rising digital-transformation targets, stricter cybersecurity mandates, and the swelling universe of connected endpoints that now permeate industrial and consumer settings. Enterprises are migrating from reactive to predictive validation models because a single device failure can stall production lines, trigger safety incidents, and invite regulatory penalties running into millions. Low-latency requirements born of 5G and edge computing are intensifying demand for testbeds that can capture millisecond-level performance variations in mission-critical workloads. At the same time, digital-twin environments are cutting hardware costs by letting developers model full device lifecycles in software while maintaining traceability to real-world conditions.

Global IoT Testing Market Trends and Insights

Explosion in Connected IoT Endpoints

China reported 2.57 billion active IoT terminals by August 2024, underscoring the scale shift that now drives exponentially larger test matrices. A single smart factory can blend Zigbee sensors, LoRaWAN gateways, and 5G RedCap robots, forcing validation teams to assure seamless interoperability across every protocol permutation. Hyundai and Samsung have already proven private 5G RedCap production lines that demand sub-10 millisecond latency verification. As mixed-generation fleets proliferate, each new device SKU multiplies the combinations that must be certified, compelling enterprises to invest in unified test-automation frameworks able to scale without sacrificing coverage. The IoT testing market must therefore support legacy 4G modules and future 5G endpoints in one configurable environment.

Escalating Security and Privacy Regulations

From August 2025, the European Union's Radio Equipment Directive obliges every internet-connected product to pass cybersecurity conformance testing before sale. The harmonized EN 18031 series now prescribes network protection, data privacy, and fraud-prevention test cases, expanding compliance workloads well beyond functional checks. In the Gulf region, mandatory biometric SIM registration in Saudi Arabia and the UAE is reshaping connectivity-test protocols. Enterprises unable to field in-house security expertise are increasingly outsourcing validation, steering demand toward managed-service providers inside the IoT testing market.

Rising Device/Protocol Complexity

Contemporary deployments mix Wi-Fi 6E sensors, Bluetooth 5.4 beacons, LoRaWAN meters, NB-IoT trackers, and 5G RedCap modems, each demanding distinct tooling. Automotive semiconductor content is projected to hit USD 1,200 per car by 2030, doubling validation points across control units and telematics gateways. Every new protocol stacks onto the existing matrix, lengthening test cycles and challenging resource-constrained labs. Unless automation, virtualization, and AI-enabled prioritization shrink cycle times, this complexity could slow spend within the IoT testing market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward DevOps and Continuous Testing Pipelines

- 5G/Edge-Computing Driven Low-Latency Use-Cases

- Lack of Global Interoperability Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Professional services dominated 2024 revenue with a 61% stake as enterprises leaned on external specialists for multifaceted protocol, security, and compliance needs. Their strength stems from deep benches versed in 5G, RedCap and EU cyber-conformance testing. Managed services, however, are forecast to rise 18.7% annually because manufacturers and fleet operators prefer subscription contracts that guarantee 24/7 lab capacity. HCL Technologies reported USD 13.3 billion FY24 revenue, attributing strong growth to its managed testing portfolios. This transition is redefining delivery models across the IoT testing market and widening demand for fully outsourced validation centers.

The IoT testing market size for managed services is projected to jump from USD 1.31 billion in 2025 to USD 6.05 billion by 2030, mirroring the steep complexity curve that favors dedicated external labs. Global system integrators are investing in remote-accessible device farms so clients can queue tests around the clock without shipping hardware.

Functional validation retained the largest 27.3% revenue slice in 2024 because projects still begin with connectivity and data-flow checks. Nevertheless, security testing is expected to post a 22.5% CAGR through 2030. The IoT testing market must now execute penetration simulations, firmware-integrity scans, and encrypted-channel evaluations aligned with EN 18031 and US FDA pre-market submissions. Applus+ opened a new European cyber-lab in 2024 to fast-track ETSI 303 645 certification demand.

Security services alone could capture 31% IoT testing market share by 2030 as regulatory fines push device makers to bake validation into every build. In parallel, performance-stress and network-handover tests stay critical for 5G URLLC scenarios, keeping them relevant, though not as fast-growing.

The IoT Testing Market Report is Segmented by Service Type (Professional and Managed), Testing Type (Functional Testing, Performance Testing, Network Testing, Compatibility Testing, Security Testing, and Usability Testing), Application (Smart Building and Home Automation, Capillary Networks Management, and More) End-User Industry (Retail, Manufacturing, Healthcare, Energy and Utilities, IT and Telecom, and More), and Geography.

Geography Analysis

North America led with 38.6% revenue in 2024 as enterprises adopted DevOps pipelines that embed testing from design through production. San Antonio's SmartSA initiative demonstrates municipal-grade pilots where every lamp-post sensor must clear interoperability and security gates before field deployment. The IoT testing market benefits from established certification ecosystems and well-funded aerospace, automotive, and industrial-automation clients.

Asia Pacific is predicted to post the fastest 15.8% CAGR. China's Xiong'an 10 Gbps backbone and Beijing's vehicle-road-cloud pilots elevate demand for massive-scale conformance labs. Japan's Society 5.0 and South Korea's USD 101 million national smart-city fund are adding thousands of devices that must be profiled under region-specific telecom and privacy rules. The IoT testing market size in Asia Pacific could cross USD 5 billion by 2030 as local vendors integrate cloud-native automation.

Europe maintains solid growth anchored in its rule-first posture. Radio Equipment Directive cybersecurity clauses require third-party labs to run penetration tests before CE marking. Smart-meter rollouts hit 60% for electricity and 45% for gas in 2023, driving sustained validation work for utility suppliers. Nordic telcos are opening shared 5G IoT labs, exemplified by Telenor's Karlskrona facility that grants global device makers plug-and-play access to Swedish networks. These frameworks ensure the IoT testing market in Europe remains compliance-centric and resilient.

- IBM

- Keysight Technologies

- HCL Technologies

- Cognizant

- Capgemini

- Infosys

- Tata Consultancy Services

- Accenture

- Wipro

- Qualitest Group

- Spirent Communications

- AFour (ACL Digital)

- Apica Systems

- Praetorian Security

- Novacoast

- Trustwave (Singtel)

- Happiest Minds

- Vector Informatik

- Eurofins Digital Testing

- SmartBear

- VIAVI Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion in connected IoT endpoints

- 4.2.2 Escalating security and privacy regulations

- 4.2.3 Shift toward DevOps and continuous testing pipelines

- 4.2.4 5G/edge-computing driven low-latency use-cases

- 4.2.5 Digital-twin-based "virtual testing" adoption

- 4.2.6 Sustainability mandates for energy-efficient devices

- 4.3 Market Restraints

- 4.3.1 Rising device/protocol complexity

- 4.3.2 Lack of global interoperability standards

- 4.3.3 Scarcity of multi-access edge test beds

- 4.3.4 Data-sovereignty rules slowing cross-border testing

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Testing Types Overview

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Assessment of COVID-19 and Post-Pandemic Impacts

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Professional

- 5.1.2 Managed

- 5.2 By Testing Type

- 5.2.1 Functional Testing

- 5.2.2 Performance Testing

- 5.2.3 Network Testing

- 5.2.4 Compatibility Testing

- 5.2.5 Security Testing

- 5.2.6 Usability Testing

- 5.3 By Application

- 5.3.1 Smart Building and Home Automation

- 5.3.2 Capillary Networks Management

- 5.3.3 Smart Utilities (Energy / Water)

- 5.3.4 Vehicle Telematics and Connected Vehicles

- 5.3.5 Smart Manufacturing / Industrial IoT (IIoT)

- 5.4 By End-user Industry

- 5.4.1 Retail

- 5.4.2 Manufacturing

- 5.4.3 Healthcare

- 5.4.4 Energy and Utilities

- 5.4.5 IT and Telecom

- 5.4.6 Government and Smart Cities

- 5.4.7 Transportation and Logistics

- 5.4.8 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Initiatives and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM

- 6.4.2 Keysight Technologies

- 6.4.3 HCL Technologies

- 6.4.4 Cognizant

- 6.4.5 Capgemini

- 6.4.6 Infosys

- 6.4.7 Tata Consultancy Services

- 6.4.8 Accenture

- 6.4.9 Wipro

- 6.4.10 Qualitest Group

- 6.4.11 Spirent Communications

- 6.4.12 AFour (ACL Digital)

- 6.4.13 Apica Systems

- 6.4.14 Praetorian Security

- 6.4.15 Novacoast

- 6.4.16 Trustwave (Singtel)

- 6.4.17 Happiest Minds

- 6.4.18 Vector Informatik

- 6.4.19 Eurofins Digital Testing

- 6.4.20 SmartBear

- 6.4.21 VIAVI Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment