|

市場調查報告書

商品編碼

1851347

智慧標籤:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Smart Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

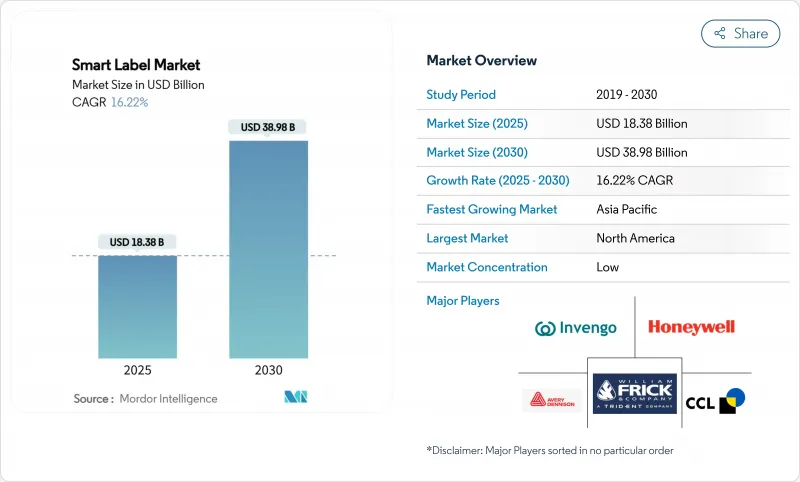

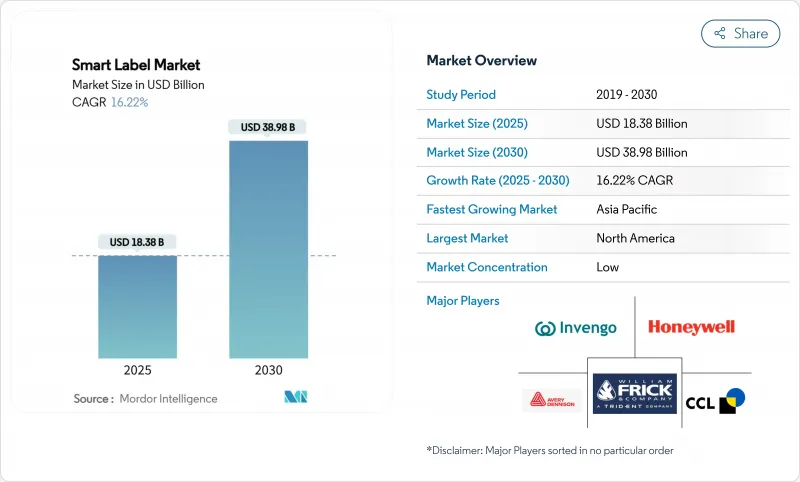

預計到 2025 年,智慧標籤市場規模將達到 183.8 億美元,到 2030 年將達到 389.8 億美元,年複合成長率為 16.22%。

這一成長反映了監管要求、無線射頻識別 (RFID) 和近距離場通訊(NFC) 技術的進步,以及對端到端供應鏈透明度日益成長的需求。美國食品藥物管理局 (FDA) 的《藥品供應鏈安全法案》下的藥品序列化、歐盟的《包裝和包裝廢棄物法規》(PPWR)(其中包含數位產品護照的概念)以及沃爾瑪等零售商主導的RFID 項目,共同構成了一項不容妥協的合基準。企業正在透過整合雲端分析、區塊鏈認證和環境物聯網感測器來應對這項挑戰,這些技術將被動標籤轉化為數據豐富的資產,從而實現跨行業的即時庫存可見性、動態定價和狀態監控。

全球智慧標籤市場趨勢與洞察

RFID技術在庫存視覺化方面的應用日益廣泛

沃爾瑪強制要求在數千個庫存單元上安裝超高頻 (UHF) RFID 標籤,迫使供應商維修生產線,推動了整個產業對 RAIN RFID 編碼解決方案的投資。供應商能夠持續掌握庫存資訊,並將這些資訊直接導入製造執行系統 (MES),從而減少物料短缺,並提高數位雙胞胎調度效率。高通計劃將 RAIN RFID 嵌入智慧型手機,這將很快使每台消費性電子設備都成為讀取器,從而無需固定的掃描器基礎設施,並加速小型零售商的採用。同時,更小的天線現在支援 10 英尺的讀取範圍,從而實現無縫結帳,改善客戶體驗。

藥品供應鏈中對防偽措施的需求日益成長

當《藥品供應鏈安全法案》(DSCSA)於2024年11月全面生效時,貿易夥伴將被要求在產品交付前驗證序列化標識符,這就需要對標籤進行升級,使其結合NFC晶片、區塊鏈加密和電子紙顯示防篡改資訊和劑量資訊。例如,Ynvisible公司的ConnectedLabel每年可對超過一百萬個藥品包裝進行近乎即時的溫度追蹤。在美國以外,印度已強制要求在暢銷藥品上使用QR碼,這標誌著序列化正從合規性轉向差異化,以保障病人安全。

小型零售商的初始硬體和整合成本較高

ESL標籤每個成本為11-12美元,因此在數千個SKU上部署需要大量資金投入。小型零售商還必須為POS系統升級和員工培訓預留預算,儘管ESL標籤具有節省人力成本的潛力,但其普及速度仍然較慢。訂閱模式正在興起,但仍處於起步階段。

細分市場分析

到2024年,RFID將佔據智慧標籤市場38.32%的佔有率,這得益於其在零售和物流領域成熟的擴充性。 NFC目前規模較小,但預計將以20.13%的複合年成長率成長,因為它利用了智慧型手機在全球的普及,實現了觸碰式驗證。因此,與NFC相關的智慧標籤市場規模將快速成長,尤其是在透過區塊鏈整合實現防篡改奢侈品認證方面。電子商品防盜系統依然強勁,而感測標籤則憑藉其在低溫運輸和環境合規應用方面的潛力而日益成長。整體而言,技術變革正從被動識別轉向多功能感測器和互動工具。

意法半導體 (STMicroelectronics) 的 ST25Connect 專案進一步增強了消費者互動體驗,使 NFC 標籤能夠應用於醫療設備、葡萄酒、化妝品等領域,在提供個人化內容的同時收集互動分析資料。將低成本感測器整合到嵌體中,進一步模糊了追蹤、狀態監測和客戶通訊之間的界限,推動 RFID 和 NFC 技術走向融合創新之路。

預計到2024年,零售業將維持31.03%的收入佔有率,反映出門市已開始廣泛採用RFID項目,且電子標籤(ESL)覆蓋範圍不斷擴大。然而,醫療保健和製藥智慧標籤市場規模將以19.67%的複合年成長率成長,成為所有產業中成長最快的產業。序列化期限和溫控物流的需求正促使醫院、藥房和委託製造嵌入智慧標籤,以實現端到端的可追溯性。物流供應商和第三方物流公司(3PL)也正在採用蜂窩和藍牙低功耗(BLE)混合標籤,以實現交付文件的即時自動化。

費森尤斯卡比的「資料矩陣+RFID」舉措展示了在重症監護醫院環境中,藥物核查如何減少人為錯誤。臨床試驗的數位化標籤消除了因語言差異導致的人工重新貼標,提高了患者依從性,並簡化了監管審核。食品和飲料製造商也積極進行類似工作,以應對美國食品藥物管理局(FDA)的《食品安全現代化法案》(FSMA)第204條關於可追溯性的強制性要求。

智慧標籤市場報告按技術(RFID、EAS、NFC、感測標籤、ESL 等)、最終用戶(零售、醫療保健、物流、製造等)、組件(整合電路、電池、天線等)、應用(追蹤、安全、低溫運輸、定價等)、外形規格(貼紙、吊牌等)和地區(北美、歐洲、亞太、中東和非洲、南美)進行細分。市場預測以美元計價。

區域分析

2024年,北美將佔全球銷售額的37.84%,這主要得益於美國在零售業率先採用RFID技術以及具有法律約束力的DSCSA序列化藍圖。聯邦政府持續投資,力爭2030年將國內半導體產量提高三倍,將緩解近期導致晶片短缺而延誤的局面。加拿大和墨西哥將受益於近岸外包的增加和跨境貿易的整合,而艾利丹尼森在克雷塔羅投資1億美元的工廠將滿足日益成長的智慧標籤需求。

歐洲是全球第二大區域集團,其發展主要受永續性相關法規的推動。即將訂定的《可回收物和廢棄物條例》(PPWR)將強制要求使用數位識別碼來評估可回收性,而德國的電動車電池護照試點計畫則鞏固了RFID技術在汽車價值鏈中的應用。Konica Minolta預測,到2027年,歐洲RFID標籤市場規模將達到25億歐元(約28億美元)。

亞太地區是成長最快的地區,預計到2030年複合年成長率將達到18.73%。中國向7000家食品生產商推廣2D條碼、印度的塑膠廢棄物QR碼溯源以及日本的工業5.0獎勵都為該地區的發展注入了強勁動力。 5G的擴展和計畫中的6G將為環境物聯網提供網路骨幹,並支援無電池感測器的大規模應用。儘管存在地緣政治風險,但台灣和韓國晶片製造地的集中優勢使其在供應方面佔據優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大RFID在庫存可見性方面的應用

- 藥品供應鏈中對防偽措施的需求日益成長

- 全通路零售的興起需要即時定價。

- 擴大物聯網物流的應用

- 用於低溫運輸完整性的印刷式無電池感測器標籤的出現

- 歐盟ESG包裝強制令(PPWR 2026)加速智慧標籤整合

- 市場限制

- 小型零售商的初始硬體和整合成本較高

- 缺乏通用的互通性標準

- 半導體供應限制正在減緩UHF頻段射頻識別積體電路的供應。

- 資料隱私法規限制了NFC消費者互動分析

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方/消費者的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

第5章 市場規模與成長預測

- 透過技術

- RFID

- 電子商品防盜系統(EAS)

- 近距離場通訊(NFC)

- 感測標籤(溫度、氣體等)

- 電子貨架標籤(ESL)

- 其他新興技術(2D碼、藍牙低功耗)

- 按最終用戶行業分類

- 零售

- 醫療保健和製藥

- 物流/運輸

- 製造業和工業

- 飲食

- 其他終端用戶產業

- 按組件

- 微控制器/積體電路

- 電池和電源裝置

- 天線和收發器

- 感應器

- 軟體和中介軟體

- 基材和保護材料

- 透過使用

- 資產和庫存追蹤

- 防盜和安全

- 低溫運輸監測

- 動態定價和促銷

- 品牌認證與消費者參與

- 在製品管理

- 按標籤外形規格

- 濕式嵌體/貼紙標籤

- 吊牌

- 套模標籤

- 紡織品和服裝標籤

- 可列印軟性感測器標籤

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲、紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Avery Dennison Corporation

- CCL Industries Inc.

- Zebra Technologies Corp.

- Honeywell International Inc.

- SATO Holdings Corp.

- William Frick & Company

- Invengo Information Technology Co. Ltd.

- Scanbuy Inc.

- Alien Technology LLC

- Roambee Corporation

- Smartrac(NXP)

- SES-imagotag SA

- Pricer AB

- Thinfilm Electronics ASA

- Digimarc Corporation

- Tapwow LLC

- Stora Enso Oyj

- Identiv Inc.

- Impinj Inc.

- Checkpoint Systems Inc.

- Confidex Ltd.

- NXP Semiconductors NV

第7章 市場機會與未來展望

The smart label market size is valued at USD 18.38 billion in 2025 and is forecast to reach USD 38.98 billion by 2030, advancing at a 16.22% CAGR.

This growth reflects the intersection of regulatory mandates, advances in radio-frequency identification (RFID) and near-field communication (NFC) technologies, and rising demand for end-to-end supply-chain transparency. Pharmaceutical serialization under the FDA's Drug Supply Chain Security Act, the European Union's Packaging and Packaging Waste Regulation (PPWR) that embeds digital-product-passport concepts, and retailer-driven RFID programs such as Walmart's have together created a non-negotiable compliance baseline. Companies are responding by integrating cloud analytics, blockchain authentication, and ambient IoT sensors that convert passive labels into data-rich assets, enabling real-time inventory visibility, dynamic pricing, and condition monitoring across industries.

Global Smart Label Market Trends and Insights

Growing RFID Adoption for Inventory Visibility

Walmart's mandate for ultra-high-frequency (UHF) RFID tags on thousands of stock-keeping units has pushed suppliers to retrofit production lines, catalyzing sector-wide investment in RAIN RFID encoding solutions. Suppliers gain perpetual stock visibility that feeds directly into manufacturing execution systems, reducing material shortages and unlocking digital-twin scheduling efficiencies. Qualcomm's plan to embed RAIN RFID in smartphones will soon turn every consumer device into a reader, eliminating the need for fixed scanner infrastructure and accelerating small-retailer adoption. Meanwhile, antenna miniaturization now supports 10-foot read ranges, enabling frictionless checkout zones that elevate customer experience.

Rising Demand for Anti-Counterfeiting in Pharma Supply Chains

Full enforcement of the DSCSA in November 2024 requires trading partners to verify serialized identifiers before product hand-off, prompting label upgrades that combine NFC chips, blockchain encryption, and e-paper displays for tamper evidence and dosage information. Ynvisible's ConnectedLabel, for instance, supports near real-time temperature tracking on over 1 million pharma packs annually. Outside the United States, India has ordered QR codes on the top-selling medicines, illustrating how serialization is moving from compliance exercise to patient-safety differentiator.

High Initial Hardware and Integration Costs for Small Retailers

ESLs cost USD 11-12 per tag, creating steep capital requirements when rolled out across thousands of SKUs. Smaller retailers must also budget for point-of-sale upgrades and staff training, delaying adoption despite labor-saving potential. Subscription models are emerging but remain nascent.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Omnichannel Retail Requiring Real-Time Pricing

- Increasing Penetration of IoT-Enabled Logistics

- Semiconductor Supply Constraints Delaying UHF RFID IC Availability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

RFID accounted for 38.32% of the smart label market share in 2024, underpinned by proven scalability in retail and logistics. NFC, though smaller today, is projected for 20.13% CAGR because it exploits the global ubiquity of smartphones for tap-to-verify experiences. The smart label market size tied to NFC therefore shows the steepest absolute dollar expansion, especially in luxury authentication where blockchain integration delivers tamper-evident provenance. Electronic article surveillance remains steady, whereas sensing labels gain momentum through cold-chain and environmental compliance use cases. Overall, technology migration is moving from passive identification toward multifunction sensors and engagement tools.

Greater consumer interactivity is being unlocked by STMicroelectronics' ST25Connect program, enabling NFC tags in medical devices, wine, and cosmetics to deliver personalized content while capturing engagement analytics. Integrating low-cost sensors within inlays further blurs lines between tracking, condition monitoring, and customer communication, placing RFID and NFC on convergent innovation paths.

Retail retained 31.03% revenue share in 2024, reflecting early adoption of store-wide RFID programs and growing ESL footprints. However, the smart label market size linked to healthcare and pharmaceuticals is set to grow at 19.67% CAGR, the fastest across industries. Serialization deadlines and the need for temperature-controlled logistics drive hospitals, pharmacies, and contract manufacturers to embed smart labels for end-to-end traceability. Logistics providers and 3PLs also deploy hybrid cellular-BLE labels to automate hand-off documentation in real time.

Fresenius Kabi's Data Matrix plus RFID initiative illustrates how medication verification cuts human error in high-acuity hospital environments. Digital display labels for clinical trials eliminate manual relabeling across language variants, improving patient compliance and simplifying regulatory audits. Similar dynamics extend to food and beverage players gearing up for the FDA's FSMA 204 traceability mandates.

The Smart Label Market Report is Segmented by Technology (RFID, EAS, NFC, Sensing Labels, ESL, and More), End-User (Retail, Healthcare, Logistics, Manufacturing, and More), Component (ICs, Batteries, Antennas, and More), Application (Tracking, Security, Cold-Chain, Pricing, and More), Form Factor (Stickers, Tags, and More), and Geography (North America, Europe, APAC, MEA, South America). Market Forecasts in Value (USD).

Geography Analysis

North America held 37.84% of global revenue in 2024, anchored by the United States' early adoption of RFID in retail and the legally binding DSCSA serialization roadmap. Continued federal investment aimed at tripling domestic semiconductor output by 2030 will reduce chip shortages that have recently slowed deployment schedules. Canada and Mexico benefit from integrated cross-border commerce as near-shoring picks up, while Avery Dennison's USD 100 million Queretaro facility is set to meet rising regional demand for smart labels.

Europe represents the second-largest regional block, buoyed by sustainability-centric regulation. The forthcoming PPWR mandates digital identifiers for recyclability scoring, and Germany's battery-passport pilot for electric vehicles solidifies RFID within automotive value chains. Konica Minolta forecasts the European RFID label market to reach EUR 2.5 billion (USD 2.8 billion) by 2027, reflecting widespread adoption in consumer goods, healthcare, and industrial sectors.

Asia-Pacific is the fastest-growing geography with an 18.73% CAGR through 2030. China's 2D-barcode rollout across 7,000 food producers, India's QR-code traceability for plastic waste, and Japan's industry-5.0 incentives together generate outsized momentum. Growing 5G and planned 6G coverage provides the network backbone for ambient IoT, supporting large-volume adoption of battery-free sensors. Chip manufacturing concentration in Taiwan and South Korea offers supply advantages, although geopolitical risk remains a variable.

- Avery Dennison Corporation

- CCL Industries Inc.

- Zebra Technologies Corp.

- Honeywell International Inc.

- SATO Holdings Corp.

- William Frick & Company

- Invengo Information Technology Co. Ltd.

- Scanbuy Inc.

- Alien Technology LLC

- Roambee Corporation

- Smartrac (NXP)

- SES-imagotag SA

- Pricer AB

- Thinfilm Electronics ASA

- Digimarc Corporation

- Tapwow LLC

- Stora Enso Oyj

- Identiv Inc.

- Impinj Inc.

- Checkpoint Systems Inc.

- Confidex Ltd.

- NXP Semiconductors N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing RFID adoption for inventory visibility

- 4.2.2 Rising demand for anti-counterfeiting in pharma supply chains

- 4.2.3 Expansion of omnichannel retail requiring real-time pricing

- 4.2.4 Increasing penetration of IoT-enabled logistics

- 4.2.5 Emergence of printed battery-free sensor labels for cold-chain integrity

- 4.2.6 EU ESG packaging mandates (PPWR 2026) accelerating smart-label integration

- 4.3 Market Restraints

- 4.3.1 High initial hardware and integration costs for small retailers

- 4.3.2 Lack of universal interoperability standards

- 4.3.3 Semiconductor supply constraints delaying UHF RFID IC availability

- 4.3.4 Data-privacy regulations limiting NFC consumer-engagement analytics

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 RFID

- 5.1.2 Electronic Article Surveillance (EAS)

- 5.1.3 Near Field Communication (NFC)

- 5.1.4 Sensing Labels (Temp, Gas, etc.)

- 5.1.5 Electronic Shelf Label (ESL)

- 5.1.6 Other Emerging (QR, BLE)

- 5.2 By End-user Industry

- 5.2.1 Retail

- 5.2.2 Healthcare and Pharmaceuticals

- 5.2.3 Logistics and Transportation

- 5.2.4 Manufacturing and Industrial

- 5.2.5 Food and Beverage

- 5.2.6 Other End-user Industry

- 5.3 By Component

- 5.3.1 Micro-controllers / ICs

- 5.3.2 Batteries and Power Units

- 5.3.3 Antennas and Transceivers

- 5.3.4 Sensors

- 5.3.5 Software and Middleware

- 5.3.6 Substrate and Protective Materials

- 5.4 By Application

- 5.4.1 Asset and Inventory Tracking

- 5.4.2 Anti-theft and Security

- 5.4.3 Cold-chain Monitoring

- 5.4.4 Dynamic Pricing and Promotion

- 5.4.5 Brand Authentication and Consumer Engagement

- 5.4.6 Work-in-Process Management

- 5.5 By Label Form Factor

- 5.5.1 Wet-inlay / Sticker Labels

- 5.5.2 Hang Tags

- 5.5.3 In-mold Labels

- 5.5.4 Textile and Apparel Labels

- 5.5.5 Printable Flexible Sensor Labels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries Inc.

- 6.4.3 Zebra Technologies Corp.

- 6.4.4 Honeywell International Inc.

- 6.4.5 SATO Holdings Corp.

- 6.4.6 William Frick & Company

- 6.4.7 Invengo Information Technology Co. Ltd.

- 6.4.8 Scanbuy Inc.

- 6.4.9 Alien Technology LLC

- 6.4.10 Roambee Corporation

- 6.4.11 Smartrac (NXP)

- 6.4.12 SES-imagotag SA

- 6.4.13 Pricer AB

- 6.4.14 Thinfilm Electronics ASA

- 6.4.15 Digimarc Corporation

- 6.4.16 Tapwow LLC

- 6.4.17 Stora Enso Oyj

- 6.4.18 Identiv Inc.

- 6.4.19 Impinj Inc.

- 6.4.20 Checkpoint Systems Inc.

- 6.4.21 Confidex Ltd.

- 6.4.22 NXP Semiconductors N.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment