|

市場調查報告書

商品編碼

1851344

歐洲行動雲:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Europe Mobile Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

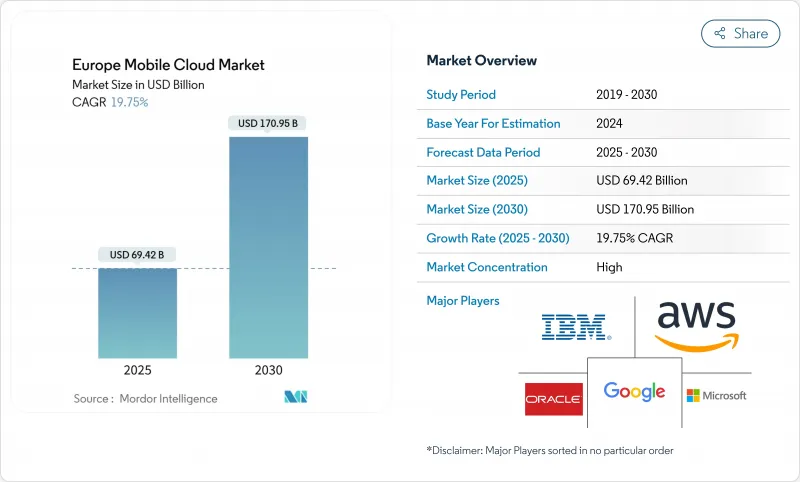

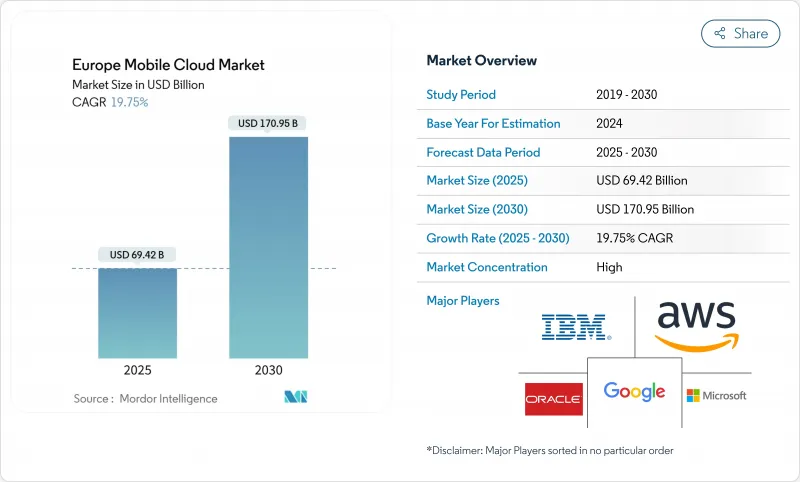

歐洲行動雲市場預計到 2025 年將達到 694.2 億美元,到 2030 年將擴大到 1,709.5 億美元,複合年成長率為 19.75%。

主權雲端框架的日益普及、5G獨立組網(SA)覆蓋範圍的擴大以及企業對低延遲移動工作負載日益成長的關注,都推動了這一發展趨勢。此外,5G SA網路已實現低於10毫秒的往返延遲,從而催生了對即時工業、遊戲和金融科技等應用場景的新需求。通訊業者與雲端平台的合作,例如德國電信與NVIDIA合作的工業AI雲平台,顯示通訊業者正在轉型為AI工作負載的基礎設施供應商。同時,監管機構對超大規模雲端服務商市場支配力的審查,促使其進行價格結構調整,包括取消出口費用,從而降低了雲端平台切換門檻,並促進了多重雲端策略的發展。

歐洲移動雲市場趨勢與洞察

歐盟27國主權雲區的發展

歐盟委員會的 EuroStack 計畫旨在 2030 年部署 10,000 個分散式邊緣雲端節點,創建符合嚴格資料居住規定的本地處理點。 Orange 和 Capgemini 於 2024 年推出的 Bleu 平台,旨在根據 SecNumCloud 規則提供微軟技術,這表明合規優先的服務能夠吸引敏感工作負載。即將推出的歐盟雲端服務計畫將根據主權和安全標準對服務提供者進行認證,加速先前託管在歐盟境外的敏感產業資料的回流。同時,歐盟資料法要求供應商在 2027 年 1 月前取消轉換費用,從而削弱鎖定效應,並獎勵競爭性生態系統的發展。隨著公共機構調整採購規則,歐洲業者預計與受監管產業相關的雲端需求將顯著成長。

增強型 5G SA 部署可降低行動雲端延遲

全球已有超過60家營運商,包括德國、英國、義大利和西班牙的營運商,推出了商用5G SA網路。網路切片技術能夠預先定義延遲和頻寬等級,以滿足行動雲端應用的需求,並透過加值服務層級直接實現獲利。德國電信的5G+遊戲試點計畫已成功實現了雲端遊戲流量端到端延遲低於10毫秒。 GSMA預測,到2030年,5G將為歐洲經濟貢獻1,640億歐元,其中大部分將依賴SA部署。核心網路升級,例如O2 Telefónica的雲端原生雙模核心網,進一步減少了維護停機時間,並支援持續的功能發布。

對超大規模資料中心營運商市場力量的批評日益增多(CMA 和 EU DMA)

英國競爭與市場管理局 (CMA) 發現,AWS 和微軟各自控制英國國內 30% 至 40% 的雲端支出,並提案了戰略市場地位義務,這可能迫使它們調整互通性和價格。競爭改革每年可為英國企業節省 4.3 億英鎊。隨著布魯塞爾《數位市場法案》的實施,「安全隔離網閘」平台將受到額外的合規約束,例如將軟體授權與雲端使用量掛鉤的限制。在最終裁決公佈之前,AWS 和微軟都已調整了自身行為,提前取消了客戶更換供應商的退出費用。雖然這些讓步有利於客戶,但可能會擠壓供應商的利潤空間,並減緩近期的投資步伐。

細分市場分析

到2024年,企業工作負載將佔歐洲行動雲端市場收入的67%,因為企業優先考慮效能保證和自主合規性。像BBVA這樣的金融機構指出,在切換到雲端原生資料平台後,分析時間縮短了94%。這些可衡量的成果證明了高額合約價格的合理性,並刺激了持續的基礎設施投資。消費者採用率雖然目前規模較小,但正以19.90%的複合年成長率快速成長,主要得益於雲端遊戲訂閱和行動娛樂方案的推動。德國電信(Telefonica)已將其100萬5G用戶遷移到AWS核心雲,從而融合了企業和消費者價值鏈,並證明差異化的網路服務能夠同時實現這兩個領域的盈利。儘管企業仍然是歐洲行動雲端市場的基礎,但消費者的成長使收入來源更加多元化,並為企業的預算週期提供了緩衝。

消費者主導的成長日益依賴位於人口中心附近的邊緣運算節點,從而降低圖形密集型遊戲和視訊串流的抖動。網路營運商受益於批發流量的成長,超大規模資料中心將內容快取分發到大都會圈的各個存取點。同時,企業買家正在擴大其多重雲端佈局以降低廠商鎖定風險,沃達豐則透過維持其三大供應商之間的「商業性張力」來實現成本節約。先進的財務營運(FinOps)儀表板按業務部門追蹤使用情況,並確保所有工作負載都在最佳性價比範圍內運作。這種雙管齊下的演進使歐洲行動雲端產業保持了強大的韌性。

預計到2024年,遊戲業務將佔總營收的32%,複合年成長率(CAGR)為22.60%。德國電信的5G+遊戲服務展示了網路切片如何確保在行動寬頻速度下實現穩定的影格速率。金融和商業應用,尤其是那些透過安全、低延遲網路傳輸的即時風險分析應用,其價值位居第二。資本市場核心企業對演算法交易的確定性延遲有著迫切的需求,這推動了對邊緣最佳化區域的需求。

隨著遠距學習平台和診斷人工智慧工作負載遷移到雲端,教育和醫療保健應用在雲端領域的佔有率持續成長。監管機構允許敏感的醫療資料儲存在主權雲端區域中,使服務提供者能夠在不違反隱私法的情況下部署人工智慧驅動的影像處理。娛樂平台也像遊戲一樣利用邊緣運算資源,實現自我調整比特率影片的流暢播放。這些多樣化的應用場景正在推動歐洲行動雲市場的成長,確保不斷成長的雲端容量能夠找到買家。

歐洲行動雲市場報告按使用者(企業和消費者)、應用程式(遊戲、娛樂、教育、其他)、服務模式(SaaS、PaaS、其他)、部署模式(公共雲端、私有雲端、其他)和國家進行細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 在歐盟27國範圍內發展主權雲圈

- 增強型 5G SA 部署可降低行動雲端延遲

- 企業用於管理多重雲端成本的FinOps工具的激增

- 邊緣雲端夥伴關係實現網路 API通訊業者

- 人工智慧輔助的行動應用開發和營運加速了雲端遷移速度。

- 德國和北歐的綠色資料中心稅收優惠政策

- 市場限制

- 加強對超大規模資料中心營運商市場力量的審查(CMA 和 EU DMA)

- 跨國資料傳輸的合規成本(Schrems II、GDPR)

- 能源價格波動對資料中心營運成本帶來壓力。

- 認證雲端安全專業人員短缺

- 價值鏈分析

- 監管環境

- 技術展望(5G SA、Edge、GenAI)

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 使用者

- 企業

- 消費者

- 透過使用

- 遊戲

- 金融與商業

- 娛樂

- 教育

- 衛生保健

- 旅行

- 按服務模式

- 軟體即服務(SaaS)

- 平台即服務 (PaaS)

- 基礎設施即服務 (IaaS)

- 按配置模型

- 公共雲端

- 私有雲端

- 混合雲端

- 按國家/地區

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Corporation

- SAP SE

- Deutsche Telekom(T-Systems)

- Vodafone Group

- Orange Business Services

- Telefonica Tech

- Oracle Corporation

- Salesforce Inc.

- Akamai Technologies

- OVHcloud

- Rackspace Technology

- Cloudflare Inc.

- Alibaba Cloud

- Tencent Cloud

- Huawei Cloud

- Nokia Cloud and Network Services

- Kyndryl Holdings

第7章 市場機會與未來展望

Europe mobile cloud market value reached USD 69.42 billion in 2025 and is forecast to rise to USD 170.95 billion by 2030, registering a 19.75% CAGR.

Rising adoption of sovereign-cloud frameworks, expanding 5G standalone (SA) coverage, and intensifying enterprise focus on low-latency mobile workloads underpin this trajectory. National data-sovereignty mandates are forcing workload repatriation from extra-regional hyperscale zones to EU-hosted platforms, while 5G SA networks already deliver sub-10 millisecond round-trip latency, opening fresh demand for real-time industrial, gaming and fintech use cases. Telco-cloud alliances-such as Deutsche Telekom's NVIDIA-powered industrial AI cloud-illustrate how telecom operators are transforming into infrastructure suppliers for AI workloads. At the same time, regulatory scrutiny of hyperscaler market power is prompting price realignments, including the removal of egress fees, which lowers switching barriers and encourages multi-cloud strategies.

Europe Mobile Cloud Market Trends and Insights

Development of Sovereign-Cloud Zones Across EU-27

The European Commission's EuroStack programme targets 10,000 distributed edge-cloud nodes by 2030, creating local processing points that satisfy strict data-residency statutes. Orange and Capgemini's Bleu platform was launched in 2024 to offer Microsoft technology under SecNumCloud rules, proving that compliance-first offerings can attract sensitive workloads. The forthcoming EU Cloud Services Scheme will certify providers against sovereignty and security standards, accelerating repatriation of critical-sector data previously hosted outside the bloc. Simultaneously, the EU Data Act obliges vendors to abolish switching fees by January 2027, undermining lock-in economics and incentivizing a competitive ecosystem. As public agencies adapt procurement rules, European operators expect a sizeable uplift in cloud demand tied to regulated industries.

Intensifying 5G SA Roll-out Lowers Mobile-Cloud Latency

More than 60 operators worldwide have launched commercial 5G SA networks, including installations across Germany, the UK, Italy, and Spain. Network slicing allows predefined latency and bandwidth classes that match mobile-cloud application requirements, directly monetised through premium service tiers. Deutsche Telekom's 5G+ Gaming pilot has already proven sub-10 millisecond end-to-end latency for cloud gaming traffic. The GSMA projects EUR 164 billion in European economic value from 5G by 2030, most of which depends on SA deployment. Core-network upgrades, such as O2 Telefonica's cloud-native dual-mode core, further cut maintenance downtime and enable continuous feature releases.

Rising Scrutiny of Hyperscaler Market Power (CMA and EU DMA)

The UK Competition and Markets Authority found AWS and Microsoft each control 30-40 % of domestic cloud spend, proposing Strategic Market Status obligations that could force interoperability and pricing remedies. The watchdog estimates competitive reforms might save UK businesses GBP 430 million annually. Parallel Digital Markets Act enforcement in Brussels adds further compliance layers for "gatekeeper" platforms, including limits on tying software licences to cloud consumption. Both AWS and Microsoft have pre-emptively eliminated egress fees for customers switching providers, demonstrating behavioural adjustments ahead of final rulings. While such concessions help clients, they compress provider margins and may reduce near-term investment pace.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Enterprise FinOps Tooling for Multi-Cloud Cost Control

- Telco Edge-Cloud Partnerships Monetising Network APIs

- Cross-Border Data-Transfer Compliance Costs (Schrems II and GDPR)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Enterprise workloads produced 67% of 2024 Europe mobile cloud market revenue as corporates prioritised performance guarantees and sovereignty compliance. Financial institutions such as BBVA highlighted time-to-insight gains-94% faster analytics-after pivoting to cloud-native data platforms. These measurable outcomes justify premium contract values and spur continued infrastructure investment. Consumer adoption, while smaller, is expanding briskly at a 19.90% CAGR due to cloud gaming subscriptions and mobile entertainment bundles. Telefonica Germany moved 1 million 5G users onto AWS core cloud, blending enterprise and consumer value chains, proving that differentiated network services can monetise both segments. Although enterprises remain the bedrock of the Europe mobile cloud market, consumer growth diversifies revenue and cushions against corporate budget cycles.

The consumer-driven upswing is increasingly tied to edge-compute nodes situated near population centres, reducing jitter for graphics-intensive titles and video streaming. Network operators benefit from incremental wholesale traffic, while hyperscalers distribute content caches across metropolitan points of presence. Meanwhile, enterprise buyers widen multi-cloud footprints to mitigate lock-in, with Vodafone registering cost savings by maintaining "commercial tension" across three large providers. Advanced FinOps dashboards track usage by business unit, ensuring every workload runs in the optimal cost-performance zone. This dual-track evolution keeps the Europe mobile cloud industry resilient

Gaming secured a 32% slice of 2024 revenue and is projected to expand at 22.60% CAGR, propelled by pay-as-you-go cloud gaming services that remove local hardware constraints. Deutsche Telekom's 5G+ Gaming offer demonstrates how network slicing guarantees frame-rate consistency at mobile broadband speeds. Finance and business applications rank second in value, powered by real-time risk analytics delivered over secure, low-latency pipes. Enterprises in capital-markets hubs depend on deterministic latency for algorithmic trading, steering demand toward edge-optimised zones.

Education and healthcare applications continue gaining share as remote-learning platforms and diagnostic AI workloads migrate to cloud. Regulators permit sensitive health data to reside in sovereign cloud zones, enabling providers to roll out AI-powered imaging without contravening privacy law. Entertainment platforms capitalise on the same edge footprints that gaming uses, streaming adaptive-bitrate video without buffering. Collectively, these diverse use cases reinforce growth across the Europe mobile cloud market, ensuring that incremental capacity finds ready buyers.

The Europe Mobile Cloud Market Report is Segmented by User (Enterprise and Consumer), Application (Gaming, Entertainment, Education, and More), Service Model (Software-As-A-Service (SaaS), Platform-As-A-Service (PaaS), and More), Deployment Model (Public Cloud, Private Cloud, and More), and Country.

List of Companies Covered in this Report:

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Corporation

- SAP SE

- Deutsche Telekom (T-Systems)

- Vodafone Group

- Orange Business Services

- Telefonica Tech

- Oracle Corporation

- Salesforce Inc.

- Akamai Technologies

- OVHcloud

- Rackspace Technology

- Cloudflare Inc.

- Alibaba Cloud

- Tencent Cloud

- Huawei Cloud

- Nokia Cloud and Network Services

- Kyndryl Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development of sovereign-cloud zones across EU-27

- 4.2.2 Intensifying 5G SA roll-out lowers mobile-cloud latency

- 4.2.3 Surge in enterprise FinOps tooling for multi-cloud cost control

- 4.2.4 Telco edge-cloud partnerships monetising network APIs

- 4.2.5 AI-assisted mobile app dev-ops shrinks time-to-cloud

- 4.2.6 Green-datacentre tax incentives in Germany and Nordics

- 4.3 Market Restraints

- 4.3.1 Rising scrutiny of hyperscaler market power (CMA and EU DMA)

- 4.3.2 Cross-border data-transfer compliance costs (Schrems II, GDPR)

- 4.3.3 Energy-price volatility squeezing datacentre OPEX

- 4.3.4 Shortage of certified cloud-security professionals

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (5G SA, Edge, GenAI)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By User

- 5.1.1 Enterprise

- 5.1.2 Consumer

- 5.2 By Application

- 5.2.1 Gaming

- 5.2.2 Finance and Business

- 5.2.3 Entertainment

- 5.2.4 Education

- 5.2.5 Healthcare

- 5.2.6 Travel

- 5.3 By Service Model

- 5.3.1 Software-as-a-Service (SaaS)

- 5.3.2 Platform-as-a-Service (PaaS)

- 5.3.3 Infrastructure-as-a-Service (IaaS)

- 5.4 By Deployment Model

- 5.4.1 Public Cloud

- 5.4.2 Private Cloud

- 5.4.3 Hybrid Cloud

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Microsoft Azure

- 6.4.3 Google Cloud

- 6.4.4 IBM Corporation

- 6.4.5 SAP SE

- 6.4.6 Deutsche Telekom (T-Systems)

- 6.4.7 Vodafone Group

- 6.4.8 Orange Business Services

- 6.4.9 Telefonica Tech

- 6.4.10 Oracle Corporation

- 6.4.11 Salesforce Inc.

- 6.4.12 Akamai Technologies

- 6.4.13 OVHcloud

- 6.4.14 Rackspace Technology

- 6.4.15 Cloudflare Inc.

- 6.4.16 Alibaba Cloud

- 6.4.17 Tencent Cloud

- 6.4.18 Huawei Cloud

- 6.4.19 Nokia Cloud and Network Services

- 6.4.20 Kyndryl Holdings

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment