|

市場調查報告書

商品編碼

1851336

高密度聚苯乙烯(HDPE):市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)High-density Polyethylene (HDPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

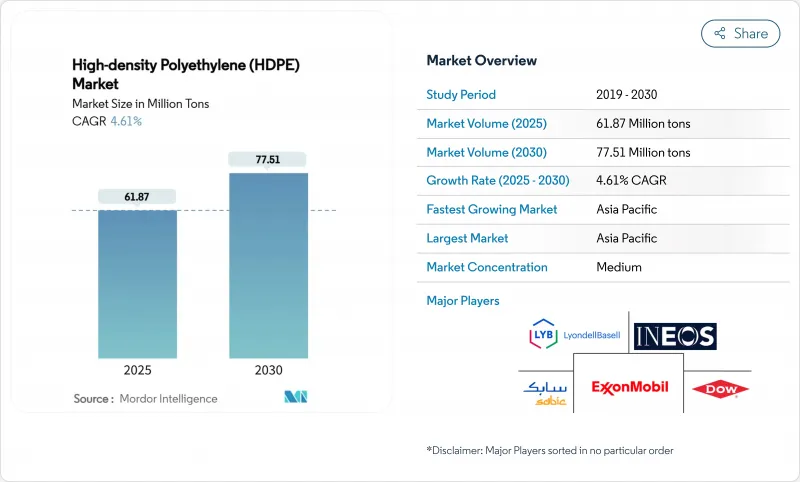

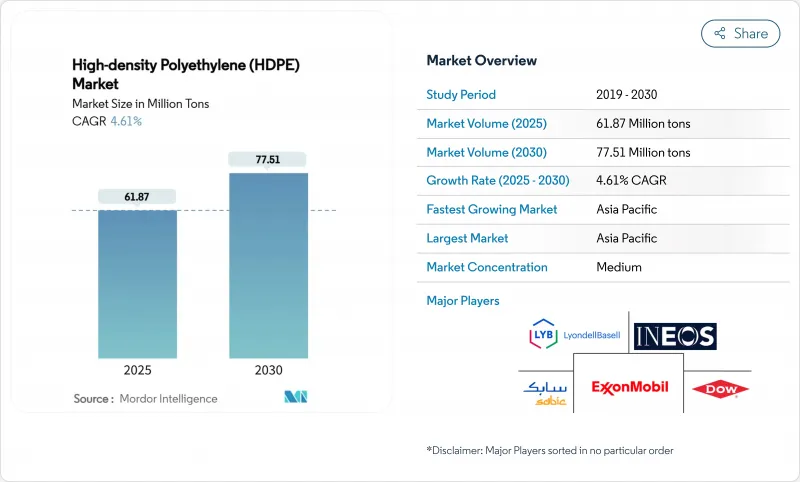

預計到 2025 年,高密度聚苯乙烯(HDPE) 市場規模將達到 6,187 萬噸,到 2030 年將達到 7,751 萬噸,預測期(2025-2030 年)複合年成長率為 4.61%。

強而有力的基礎設施投資、不斷擴大的化學回收供應鏈以及氫兼容管道系統的日益普及,都支撐著這一發展趨勢。同時,終端用戶也因高密度聚苯乙烯)材料固有的耐久性、耐化學性和可回收性而繼續青睞HDPE解決方案。印度和東協公共住宅計畫的加速推進、食品吹塑成型在電子商務配送領域的應用,以及用於低碳天然氣供應網路的PE-100-RC管道網路的部署,都在擴大HDPE市場的潛在需求。化學回收商將混合廢棄物轉化為原生級rHDPE,增強了供應安全,降低了原料價格波動,並促進了循環經濟的發展。儘管市場競爭較為分散,但將裂解產能與先進回收技術結合的垂直整合型製造商在成本和永續性方面仍具有優勢。

全球高密度聚苯乙烯(HDPE)市場趨勢及洞察

水利基礎設施維修計畫中對承壓和非承壓塑膠管道的需求不斷成長

在供水管網現代化改造計劃中,高密度聚乙烯(HDPE)管線因其百年使用壽命和非開挖施工優勢而備受青睞,可降低30%至40%的土木工程成本。美國土木工程師協會強調了HDPE管道在老舊供水管中的耐腐蝕性。在印度,原生聚乙烯品質標準將於2024年強制執行,這將加強關鍵供水應用中的材料完整性。 HDPE管道因其柔韌性而受到計劃設計人員的青睞,該彈性使其能夠適應地基移動並降低洩漏風險。公共部門的資金籌措週期跨越多個五年計劃,確保了HDPE管道供應量的穩定和市場成長的可預測性。透過採用非開挖施工方法,HDPE管道在降低總資本成本方面優於混凝土和球墨鑄鐵管道。

吹塑成型食品包裝在新興電商通路的拓展

電子商務的快速發展對包裝提出了更高的要求,即包裝必須能夠承受複雜的物流運輸,同時也要確保食品品質。食品級高密度聚乙烯(HDPE)容器已通過嚴格的遷移測試並獲得美國食品藥物管理局(FDA)的批准,成為乳製品、調味品和常溫飲料的首選包裝。歐盟將於2025年3月生效的新規將要求食品接觸塑膠具備全面的可追溯性,但HDPE生產商目前已達到這些標準。透過薄壁吹塑成型成型製程實現輕量化,減少了樹脂用量,這既符合企業的排放目標,又能維持市場需求,增強HDPE市場的韌性。

禁止使用單一塑膠製品並加強課稅

包裝法規的日益嚴格導致歐洲和北美部分地區對一次性高密度聚乙烯(HDPE)產品的需求下降。然而,HDPE的可回收性降低了其在多用途應用中的政策風險,且現有的回收管道使其相比缺乏機械回收途徑的多層薄膜更具吸引力。加工商正在重新設計瓶蓋和分配系統,以符合重量閾值並減少體積損失。因此,法規正在減緩HDPE市場的成長速度,但並未逆轉此趨勢。

細分市場分析

到2024年,片材和薄膜將佔高密度聚乙烯(HDPE)市場佔有率的41.10%,這主要得益於穩定的包裝需求以及下游加工商對吹膜製程的熟練掌握。永續包裝目標的實現正在推動單一材料薄膜設計的發展,HDPE優於混合聚合物。

儘管管道和管材在HDPE市場中所佔佔有率較小,但在2025年至2030年間,其複合年成長率將達到6.13%,成為成長最快的領域,這主要得益於供水基礎設施維修、氫氣天然氣天然氣網建設以及非開挖式更新等項目的推動。不斷上漲的洩漏損失罰款促使公共產業轉向採用具有均質熔接接頭和百年使用壽命的HDPE管道。工業薄膜、地工止水膜和購物袋等產品構成了HDPE產品組合,即使在建築支出放緩的情況下,也能維持樹脂的基準銷售。

高密度聚苯乙烯(HDPE) 市場報告按應用(管道和管材、板材和薄膜、剛性模塑產品及其他應用)、樹脂等級(PE-80、PE-100、PE-100-RC 及其他)、最終用戶行業(包裝、建築和施工、農業、運輸、電氣和電子及其他)以及地區(亞太地區細分、北美地區和歐洲)以及地區(亞太地區細分、歐洲)以及地區(亞太地區和歐洲地區)以及地區(亞太地區和歐洲)。

區域分析

預計到2024年,亞太地區將佔據全球高密度聚乙烯(HDPE)市場42.68%的佔有率,並在2030年之前保持5.62%的複合年成長率,這主要得益於中國下游薄膜出口的成長和印度基礎設施建設的蓬勃發展。該地區的綜合性生產商受益於煤製烯烴和石腦油裂解轉化製程的靈活性,有效緩解了乙烯價格的波動。然而,供應過剩正對區域利潤率構成壓力,導致需要定期進行庫存調整以平衡庫存。

北美高密度聚乙烯(HDPE)市場受益於化學回收投資的激增,這些投資傾向於使用乙烷作為原料,並提高了再生樹脂的供應量。儘管其成長速度低於亞太地區,但對高附加價值管道、薄膜和醫用級HDPE的需求支撐了市場成長。

歐洲仍以政策主導,氫氣網路建設促使高密度聚乙烯(HDPE)轉向PE-100-RC管道計劃,並透過化學品回收合作確保再生原料供應。同時,HDPE的高可回收性使其被廣泛應用於可重複使用容器和化學品桶中。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 水利基礎設施維修計畫中對承壓和非承壓塑膠管道的需求不斷成長

- 食品級吹塑包裝在新興電子商務通路的拓展

- 東協和印度的永續公共住宅和大型基礎設施投資

- 氫氣天然氣網的部署需要PE-100-RC管道

- 化學回收廠將混合廢棄物轉化為原生級RHDPE

- 市場限制

- 加速實施一次性塑膠禁令及稅收措施

- 乙烯原料價格波動與原油價格相關

- 加速材料發展趨勢:消費品硬包裝中聚丙烯無規共聚物的轉化

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過使用

- 管道和管材

- 片材和薄膜

- 硬產品

- 其他用途

- 依樹脂等級

- PE-80

- PE-100

- PE-100-RC

- 超高分子量HDPE

- 按最終用戶行業分類

- 包裹

- 建築/施工

- 農業

- 運輸

- 電氣和電子

- 工業機械

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BASF

- Borealis AG

- Braskem

- Chevron Phillips Chemical

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation, USA

- Indian Oil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals, Inc.

- NOVA Chemicals Corporate

- PTT Global Chemical Public Company Limited

- Qatar Chemical Company Ltd

- Reliance Industries Limited

- SABIC

- Sasol

- Sinopec

- TotalEnergies

- Westlake Corporation

第7章 市場機會與未來展望

The High-density Polyethylene Market size is estimated at 61.87 Million tons in 2025, and is expected to reach 77.51 Million tons by 2030, at a CAGR of 4.61% during the forecast period (2025-2030).

Strong infrastructure spending, widening chemical-recycling supply chains, and rising adoption of hydrogen-ready pipe systems anchor this trajectory, while the material's intrinsic durability, chemical resistance, and recyclability keep end-users committed to high-density polyethylene solutions. Accelerated public-housing programs across India and ASEAN, expanding food-grade blow-molding in e-commerce distribution, and the rollout of PE-100-RC pipe networks for low-carbon gas grids collectively widen the HDPE market's addressable demand. Chemical recyclers diverting mixed-waste streams into virgin-grade rHDPE strengthen supply security, temper feedstock volatility, and reinforce circular-economy mandates. Moderately fragmented competition persists, yet vertically integrated producers that pair cracker capacity with advanced recycling retain cost and sustainability advantages.

Global High-density Polyethylene (HDPE) Market Trends and Insights

Rising Demand for Pressure and Non-Pressure Plastic Pipes in Water-Infrastructure Retrofit Programmes

Water-network modernisation projects prioritise HDPE pipes because they combine a 100-year service life with trenchless installation capability that cuts civil works costs by 30-40%. The American Society of Civil Engineers underscores HDPE's corrosion resistance for ageing distribution lines. India's 2024 quality-standard mandate for virgin polyethylene reinforces material integrity in critical water applications. Project designers favour HDPE because its flexibility accommodates ground movement, reducing leakage risk. Public-sector funding cycles spanning multiple five-year plans guarantee steady pipe volumes, ensuring predictable growth for the HDPE market. Integration of trenchless methods further differentiates HDPE from concrete and ductile-iron alternatives by lowering total installed costs.

Expansion of Food-Grade Blow-Molded Packaging in Emerging E-Commerce Channels

Rapid e-commerce penetration demands packaging that survives complex logistics while protecting food quality. Food-grade HDPE containers pass stringent migration tests and hold FDA clearance, making them default choices for dairy, condiments, and shelf-stable beverages. European Union regulations, effective March 2025, require extensive traceability for food-contact plastics, a standard that HDPE producers already meet. Weight-reduction via thin-wall blow-molding lowers resin usage, aligns with corporate emission targets, and sustains demand, reinforcing the HDPE market's resilience.

Escalating Anti-Single-Use-Plastic Regulations and Taxation

Tighter packaging rules compress demand for disposable HDPE articles in Europe and parts of North America. However, HDPE's recyclability mitigates policy risk in multi-use applications, and well-established collection streams preserve its appeal versus multi-layer films that lack mechanical-recycling pathways. Converters are redesigning closures and dispensing systems to remain within weight thresholds, limiting volume loss. Consequently, regulation restrains but does not reverse HDPE market growth.

Other drivers and restraints analyzed in the detailed report include:

- Sustained Public-Housing and Mega-Infrastructure Spend Across ASEAN and India

- Roll-out of Hydrogen-Ready Gas Grids Requiring PE-100-RC Pipes

- Volatile Crude-Oil-Linked Ethylene Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sheets and Films held 41.10% of the 2024 HDPE market share, underpinned by steady packaging demand and downstream converter familiarity with blown-film processes. Sustainable packaging targets stimulate mono-material film designs that favour HDPE over mixed polymers.

Pipes and Tubes, although a smaller slice of the HDPE market size, posted the sharpest 6.13% CAGR for 2025-2030 on the back of water-infrastructure retrofits, hydrogen-ready gas grids, and trenchless renewals. Rising leak-loss penalties push utilities toward HDPE piping thanks to its homogenous fusion joints and 100-year service life. Industrial films, geomembranes, and carrier bags round out the portfolio, sustaining baseline resin offtake when construction spending softens.

The High-Density Polyethylene (HDPE) Market Report is Segmented by Application (Pipes and Tubes, Sheets and Films, Rigid Articles, and Other Applications), Resin Grade (PE-80, PE-100, PE-100-RC, and More), End-User Industry (Packaging, Building and Construction, Agriculture, Transportation, Electrical and Electronics, and More), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 42.68% of the 2024 HDPE market share and is forecast to record a 5.62% CAGR to 2030, propelled by Chinese downstream film exports and India's infrastructure boom. Integrated producers in the region benefit from coal-to-olefins and naphtha-cracker flexibility, buffering ethylene volatility. However, oversupply periods have compressed regional margins, prompting scheduled maintenance to balance inventories.

North America's HDPE market benefits from ethane-advantaged feedstock and a wave of chemical-recycling investments that elevate circular-resin availability. While growth rates are lower than Asia-Pacific, value-added pipe, film, and medical-grade demand sustains profit pools.

Europe remains policy-driven; its hydrogen-network build-out channels HDPE into PE-100-RC pipe projects and chemical-recycling alliances that secure recycled feedstock. Anti-single-use-plastic mandates depress thin-wall rigid packaging volumes, yet high recyclability keeps HDPE firmly in multi-use, returnable crates and chemical drums.

- BASF

- Borealis AG

- Braskem

- Chevron Phillips Chemical

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation, U.S.A.

- Indian Oil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- NOVA Chemicals Corporate

- PTT Global Chemical Public Company Limited

- Qatar Chemical Company Ltd

- Reliance Industries Limited

- SABIC

- Sasol

- Sinopec

- TotalEnergies

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Pressure and Non-Pressure Plastic Pipes in Water-Infrastructure Retrofit Programmes

- 4.2.2 Expansion of Food?Grade Blow-Moulded Packaging in Emerging E-Commerce Channels

- 4.2.3 Sustained Public-Housing and Mega-Infrastructure Spend across ASEAN and India

- 4.2.4 Roll-Out of Hydrogen-Ready Gas Grids Requiring PE-100-RC Pipes

- 4.2.5 Chemical Recycling Plants Shifting Mixed-Waste Streams into Virgin-Grade RHDPE

- 4.3 Market Restraints

- 4.3.1 Escalating Anti-Single-Use-Plastic Regulations and Taxation

- 4.3.2 Volatile Crude-Oil-Linked Ethylene Feedstock Pricing

- 4.3.3 Accelerated Materials-Switch to PP Random Copolymers in Consumer Rigid Packaging

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Pipes and Tubes

- 5.1.2 Sheets and Films

- 5.1.3 Rigid Articles

- 5.1.4 Other Applications

- 5.2 By Resin Grade

- 5.2.1 PE-80

- 5.2.2 PE-100

- 5.2.3 PE-100-RC

- 5.2.4 Ultra-High-Molecular-Weight HDPE

- 5.3 By End-User Industry

- 5.3.1 Packaging

- 5.3.2 Building and Construction

- 5.3.3 Agriculture

- 5.3.4 Transportation

- 5.3.5 Electrical and Electronics

- 5.3.6 Industrial Machinery

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Borealis AG

- 6.4.3 Braskem

- 6.4.4 Chevron Phillips Chemical

- 6.4.5 Dow

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Formosa Plastics Corporation, U.S.A.

- 6.4.8 Indian Oil Corporation

- 6.4.9 INEOS

- 6.4.10 LG Chem

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Mitsui Chemicals, Inc.

- 6.4.13 NOVA Chemicals Corporate

- 6.4.14 PTT Global Chemical Public Company Limited

- 6.4.15 Qatar Chemical Company Ltd

- 6.4.16 Reliance Industries Limited

- 6.4.17 SABIC

- 6.4.18 Sasol

- 6.4.19 Sinopec

- 6.4.20 TotalEnergies

- 6.4.21 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment