|

市場調查報告書

商品編碼

1851311

管狀包裝:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Tube Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

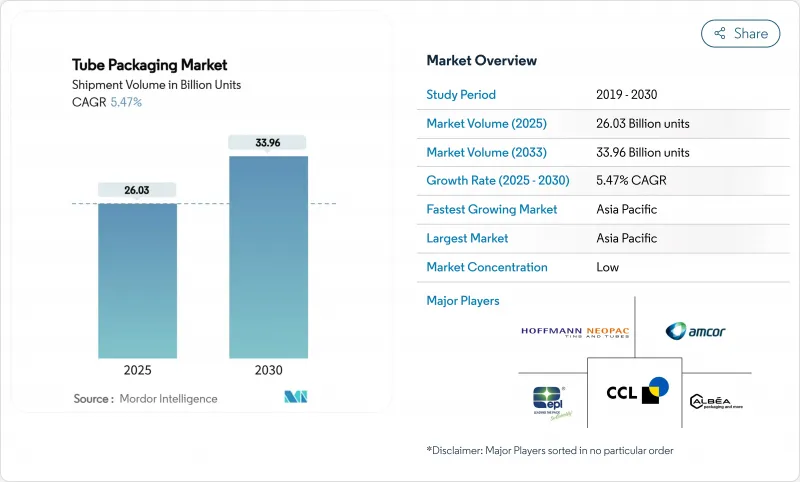

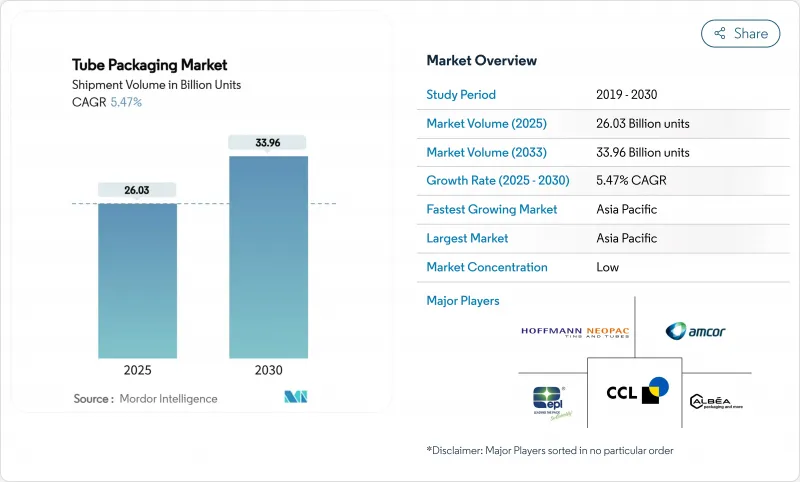

預計到 2025 年,管狀包裝市場規模將達到 260.3 億個,到 2030 年將達到 339.6 億個,年複合成長率為 5.47%。

2030年實現可回收的法規,加上消費者對永續解決方案日益成長的需求,正迫使製造商投資單一材料和再生材料產品。紙板和生物基軟管的成長速度最快,年複合成長率達8.53%,而塑膠產品因加工基礎設施完善,仍維持銷售領先地位。終端用途正多元化發展,涵蓋已調理食品和非處方藥,隨著品牌優先考慮便利性和精準劑量,收入來源也隨之拓寬。持續不斷的併購活動,例如安姆科和貝瑞全球84億美元的合併案,正在重塑競爭動態,並加速阻隔技術的創新,從而減少對多層塑膠的依賴。

全球管狀包裝市場趨勢與洞察

個人護理和化妝品需求不斷成長

隨著美妝品牌不斷優質化,它們更傾向於使用能夠保護嬌嫩配方並實現精準取用的軟管包裝。 Albea 正在縮短從概念到上市的周期,同時積極採用可回收材料,並力爭在 2030 年前實現碳排放量減少 46% 的目標。高露潔的透明 PET 潤唇膏軟管採用 EveryDrop 塗層,可有效提升產品排放,進而增強使用者體驗,提升品牌忠誠度。此外,提高材料來源和碳足跡的透明度,也有助於打造更能引起環保意識消費者共鳴的行銷策略。

消費者對永續包裝的偏好日益成長

家用口腔護理品牌正從複合層壓包裝轉向完全可回收的高密度聚苯乙烯包裝,目前在英國已成為主流,並可用於路邊配送。 Neopac 成為首家獲得 RecyClass EN 15343 認證的歐洲軟管製造商,證明了其產品中可追溯的再生材料含量,並鞏固了其競爭地位。諸如此類的里程碑事件將永續發展永續性規轉化為市場差異化,推動軟管包裝市場朝著更高價值的創新方向發展。

替代產品的供應情況

立式袋兼具輕盈、易開啟和減少材料用量等優點,正吸引醬料和調味品品牌放棄管狀包裝,預計到2029年市場規模將達到470億美元。瑪氏食品的可回收紙質單份包裝進一步展示了其他包裝形式如何滿足永續性和份量控制的需求。憑藉此類創新,管狀包裝製造商正專注於其功能優勢,例如精準計量和高阻氧阻隔性,以防止容量損失。

細分市場分析

到2024年,塑膠包裝將佔據軟管包裝市場68.14%的佔有率,這主要得益於成本效益高的擠出生產線和廣泛的品牌認知。在眾多塑膠中,高密度聚苯乙烯和聚丙烯具有跨產業的通用性,能夠滿足從乳霜到凝膠等各種黏度的產品需求。複合材料(結合了聚合物和鋁層)繼續為口腔清潔用品配方提供保護,因為這類產品對保持風味至關重要。鋁管雖然仍處於小眾市場,但憑藉其在保存易揮發性藥物活性成分和對氧氣敏感的食品方面的卓越性能,正以高價佔據一席之地。

然而,紙板和生物基解決方案的表現優於整體管狀包裝市場,複合年成長率高達 8.53%,這主要得益於 PPWR 加速了向可再生基材的轉型。 Huhtamaki 的 OmniLock Ultra 阻隔紙提供類似鋁的防護性能,同時又可回收。 Amcor 的專利產品 AmFiber 高性能紙同樣瞄準食品和醫療保健產業,證明纖維基結構能夠滿足嚴格的濕度限制。隨著應用範圍的擴大,塑膠在絕對銷量上的領先優勢預計將會縮小,儘管它們仍保持著規模優勢。

預計到2024年,擠壓軟管和折疊式軟管將佔出貨量的65.34%,複合年成長率(CAGR)為7.43%。衝擊擠壓鋁製軟管可防止皮膚科乳膏中空氣滲入,而共擠壓塑膠軟管則可減輕重量並提升外觀吸引力。由於其優異的阻隔性,貼合加工擠壓軟管仍然是口腔護理領域的標準包裝。

扭轉式和精準分裝設計在處方皮膚科和高階化妝品領域發揮特殊作用,因為在這些領域,劑量精準度至關重要。諸如套模貼標聚丙烯軟管等創新技術將裝飾和結構整合於一體,提高了生產線效率和可回收性。憑藉豐富的密封和裝飾選擇,擠壓式包裝始終具有極強的適應性,鞏固了我們在軟管包裝市場的領先地位。

區域分析

亞太地區將在2024年以38.43%的市佔率引領管狀包裝市場,預計2030年將維持9.21%的複合年成長率。中國和印度快速消費品產業的強勁成長、可支配收入的增加以及都市區方式的轉變,都推動了對便於攜帶的個人護理用品和單份調味品的需求。越南造紙業的目標是到2026年實現35億美元的銷售額,這標誌著該地區正朝著纖維基包裝的方向發展。

北美和歐洲的回收利用產業日益成熟,但仍面臨更嚴格的回收目標、籌資策略重組和資本配置的挑戰。歐盟的聚丙烯廢液回收指令(PPWR)迫使加工商改造生產線,轉向單一材料生產,這使得能夠承擔多年改造費用的綜合企業更具優勢。在美國和加拿大,品牌對減少碳排放的承諾正在推動試驗計畫,在當地零售商測試高回收率的管材。

拉丁美洲和中東是新興的機會區,不斷壯大的中產階級將推動包裝食品市場的成長。到2028年,巴西的包裝食品市場規模預計將達到1,686億美元,將帶動對分量控制醬料和調味膏的需求。同時,ALPLA進軍泰國、非洲和波灣合作理事會成員國市場,凸顯了在進口關稅和物流成本高昂的市場中,本地供應的戰略重要性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 個人護理和化妝品需求不斷成長

- 消費者對永續包裝的偏好日益成長

- 由於強制回收,單一材料管材的使用量增加

- 對便利性和多樣性的需求日益成長

- 全球快速消費品資本支出正推動混合屏障技術的發展

- 市場限制

- 替代產品的供應情況

- 原料短缺和成本波動

- 產品相容性有限會阻礙市場滲透。

- 供應鏈分析

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 原料分析

第5章 市場規模與成長預測

- 依產品類型

- 塑膠管

- 聚乙烯(PE)管

- 聚丙烯(PP)管

- 其他塑膠管

- 鋁管

- 積層軟管

- 紙板/生物管

- 塑膠管

- 按包裝類型

- 擠壓並推

- 捻

- 按最終用途行業分類

- 化妝品和個人護理

- 製藥

- 食物

- 其他終端用戶產業

- 透過分銷管道

- 直銷

- 間接銷售

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲、紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- EPL Limited

- Albea Group

- Hoffmann Neopac AG

- CCL Industries Corp.

- Tubex Aluminium Tubes

- Huhtamaki Oyj

- Montebello Packaging

- LINHARDT Group GmbH

- CTLpack Group, SLU

- Plastube Inc.

- Unette Corporation

- Scandolara SpA

- Alltub Deutschland GmbH

- TUBETTIFICIO PERFEKTUP Srl

- AptarGroup Inc.

- Witoplast Kisielinscy Joint Stock Company

- Mpack Poland Sp. zoo

- Viva Healthcare Packaging

- Gp Plast Sp. z..oo

- EPL Poland Sp. zoo

- Elpes sp. zoo

- ALPLA WERKE ALWIN LEHNER GMBH and CO KG

第7章 市場機會與未來展望

The tube packaging market size stands at 26.03 billion units in 2025 and is projected to reach 33.96 billion units by 2030, advancing at a 5.47% CAGR.

Regulatory mandates that require recyclability by 2030, combined with rising consumer demand for sustainable solutions, are compelling manufacturers to invest in mono-material and recycled-content formats. Paperboard and bio-based tubes record the fastest growth at 8.53% CAGR, while plastic formats retain volume leadership because of established processing infrastructure. End-use diversification into ready-to-eat foods and over-the-counter pharmaceuticals broadens revenue streams as brands prioritize convenience and precise dosing. Continued merger activity, led by Amcor's USD 8.4 billion combination with Berry Global, is reshaping competitive dynamics and accelerating innovation in barrier technologies that limit reliance on multi-layer plastics.

Global Tube Packaging Market Trends and Insights

Rising Demand in Personal Care and Cosmetics

Beauty brands continue to premiumize product lines, which favors tubes that protect sensitive formulations and allow controlled dispensing. Albea has trimmed concept-to-launch cycles while integrating recycled content, pursuing a 46% carbon-reduction target for 2030. Colgate's clear PET Elixir tube with EveryDrop coating improves product evacuation, underscoring user experience gains that strengthen brand loyalty. Visibility into material provenance and carbon footprint is also improving, supporting marketing narratives that resonate with eco-conscious shoppers.

Growing Consumer Preferences for Sustainable Packaging

Household-name oral care brands have shifted from composite laminates toward fully recyclable high-density polyethylene formats that can enter mainstream kerbside streams in the United Kingdom. Neopac became the first European tube maker to earn RecyClass EN 15343 certification, validating traceable recycled content and strengthening its competitive edge. Such milestones convert sustainability compliance into market differentiation, pushing the tube packaging market toward higher-value innovations.

Availability of Substitutes

Stand-up pouches, which combine light weight, easy opening, and reduced material use, are projected to hit USD 47 billion by 2029, drawing sauce and condiment brands away from tubes. MasterFoods' recyclable paper single-dose pack further illustrates how alternate formats can satisfy sustainability and portion-control priorities. These innovations pressure tube producers to highlight functional strengths, such as precise dosing and high oxygen barrier, to prevent volume erosion.

Other drivers and restraints analyzed in the detailed report include:

- Recyclability Mandates Boosting Mono-material Tubes

- Rising Demand for Convenience and Versatility

- Raw Material Shortages and Fluctuating Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic formats accounted for 68.14% of tube packaging market share in 2024, supported by cost-efficient extrusion lines and universal brand familiarity. Within plastics, high-density polyethylene and polypropylene accommodate diverse viscosities, from creams to gels, ensuring cross-industry versatility. Laminates that stack polymer and aluminum layers continue to protect oral-care formulas where flavor retention is essential. Aluminum tubes, though niche, preserve volatile pharmaceutical actives and oxygen-sensitive foods, reinforcing a premium-priced foothold.

Paperboard and bio-based solutions, however, outpace the broader tube packaging market at an 8.53% CAGR as the PPWR accelerates the shift toward renewable substrates. Huhtamaki's OmniLock Ultra barrier paper delivers aluminum-like protection while remaining curbside-recyclable. Amcor's patented AmFiber Performance Paper similarly targets food and healthcare segments, proving that fiber-based structures can satisfy strict moisture limits. As adoption widens, plastic's volume lead is expected to narrow in absolute terms, even if it retains scale advantages.

Squeeze and collapsible tubes represented 65.34% of 2024 shipments and are projected to rise at a 7.43% CAGR, reflecting strong consumer affinity for one-handed dispensing. Impact-extruded aluminum versions ensure zero air ingress for dermatological creams, whereas co-extruded plastic variants lower weight and enhance graphic appeal. Laminated squeeze tubes remain the oral-care standard because of flavor-barrier proficiency.

Twist and precision-applicator designs fill specialized roles in prescription dermatology and luxury cosmetics where dosage accuracy is paramount. Innovations such as in-mold-label polypropylene tubes merge decoration and structure in a single step, improving line efficiency and recyclability. The breadth of sealing and decoration options keeps squeeze formats adaptable, cementing their lead in the tube packaging market.

The Tube Packaging Market Report is Segmented by Product Type (Plastics Tubes, Aluminum Tubes, Laminated Tubes, Paperboard/Bio-Based Tubes), Packaging Type (Squeeze and Collapsible, Twist), End-Use Industry (Cosmetics and Personal Care, Pharmaceutical, Food, Other End-Use Industry), Distribution Channel (Direct Sales, Indirect Sales), and Geography. The Market Forecasts are Provided in Terms of Volume (Units).

Geography Analysis

Asia-Pacific led the tube packaging market in 2024 with a 38.43% volume share and is expected to advance at 9.21% CAGR through 2030. Robust FMCG expansion in China and India, higher disposable income, and urban lifestyles underpin demand for travel-friendly personal care items and single-serve condiments. Vietnam's paper segment, on course for USD 3.5 billion revenue by 2026, illustrates regional momentum toward fiber-based packaging.

North America and Europe, while mature, are navigating stricter recycling targets that reshape sourcing strategies and capital allocation. The EU PPWR compels converters to retrofit lines for mono-material output, favoring integrated giants able to fund multi-year overhauls. In the United States and Canada, brand commitments to carbon reduction drive pilot programs that test high-recycled-content tubes at regional retailers.

Latin America and the Middle East are emerging opportunity zones as rising middle-class populations fuel packaged food growth. Brazil's packaged-food market could reach USD 168.6 billion by 2028, spurring demand for portion-controlled sauces and flavored pastes. Concurrently, ALPLA's facility roll-outs in Thailand, Africa, and the Gulf Cooperation Council underline the strategic importance of local supply in markets where import duties and logistics add cost layers.

- Amcor plc

- EPL Limited

- Albea Group

- Hoffmann Neopac AG

- CCL Industries Corp.

- Tubex Aluminium Tubes

- Huhtamaki Oyj

- Montebello Packaging

- LINHARDT Group GmbH

- CTLpack Group, S.L.U.

- Plastube Inc.

- Unette Corporation

- Scandolara S.p.A.

- Alltub Deutschland GmbH

- TUBETTIFICIO PERFEKTUP S.r.l.

- AptarGroup Inc.

- Witoplast Kisielinscy Joint Stock Company

- Mpack Poland Sp. z.o.o.

- Viva Healthcare Packaging

- Gp Plast Sp. z..o.o.

- EPL Poland Sp. z.o.o.

- Elpes sp. z.o. o.

- ALPLA WERKE ALWIN LEHNER GMBH and CO KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand in Personal Care and Cosmetics

- 4.2.2 Growing consumer preferences for sustainable Packaging

- 4.2.3 Recyclability mandates boosting mono-material tubes

- 4.2.4 Rising Demand for Convenience and Versatility

- 4.2.5 Global FMCG CAPEX push into hybrid-barrier technologies

- 4.3 Market Restraints

- 4.3.1 Availability of Substitutes

- 4.3.2 Raw Material Shortages and Fluctuating cost

- 4.3.3 Limited Product Compatibility Restricting Market Penetration

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Raw Material Analysis

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Plastics Tubes

- 5.1.1.1 Polyethylene (PE) Tubes

- 5.1.1.2 Polypropylene (PP) Tubes

- 5.1.1.3 Other Plastic Tubes

- 5.1.2 Aluminum Tubes

- 5.1.3 Laminated tubes

- 5.1.4 Paperboard/Bio- Based tubes

- 5.1.1 Plastics Tubes

- 5.2 By Packaging Type

- 5.2.1 Squeeze and Collapsible

- 5.2.2 Twist

- 5.3 By End-Use Industry

- 5.3.1 Cosmetics and Personal Care

- 5.3.2 Pharmaceutical

- 5.3.3 Food

- 5.3.4 Other End-use Industry

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 EPL Limited

- 6.4.3 Albea Group

- 6.4.4 Hoffmann Neopac AG

- 6.4.5 CCL Industries Corp.

- 6.4.6 Tubex Aluminium Tubes

- 6.4.7 Huhtamaki Oyj

- 6.4.8 Montebello Packaging

- 6.4.9 LINHARDT Group GmbH

- 6.4.10 CTLpack Group, S.L.U.

- 6.4.11 Plastube Inc.

- 6.4.12 Unette Corporation

- 6.4.13 Scandolara S.p.A.

- 6.4.14 Alltub Deutschland GmbH

- 6.4.15 TUBETTIFICIO PERFEKTUP S.r.l.

- 6.4.16 AptarGroup Inc.

- 6.4.17 Witoplast Kisielinscy Joint Stock Company

- 6.4.18 Mpack Poland Sp. z.o.o.

- 6.4.19 Viva Healthcare Packaging

- 6.4.20 Gp Plast Sp. z..o.o.

- 6.4.21 EPL Poland Sp. z.o.o.

- 6.4.22 Elpes sp. z.o. o.

- 6.4.23 ALPLA WERKE ALWIN LEHNER GMBH and CO KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment