|

市場調查報告書

商品編碼

1851300

染料和顏料:市場佔有率分析、行業趨勢、統計數據、成長預測(2025-2030 年)Dyes And Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

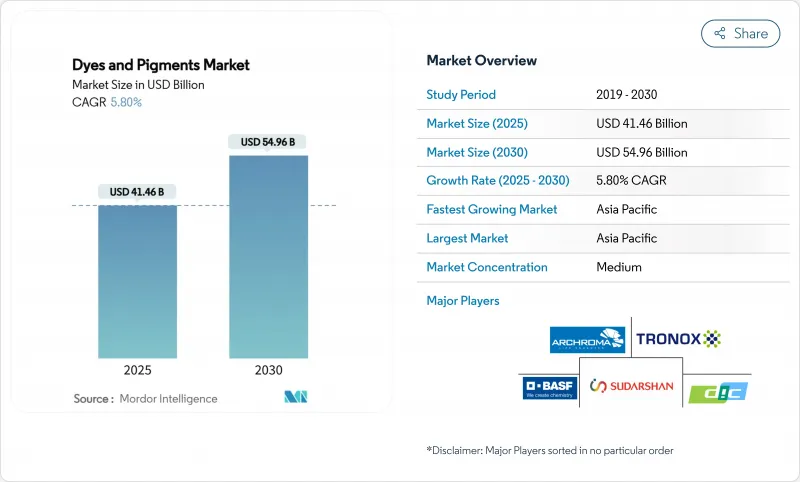

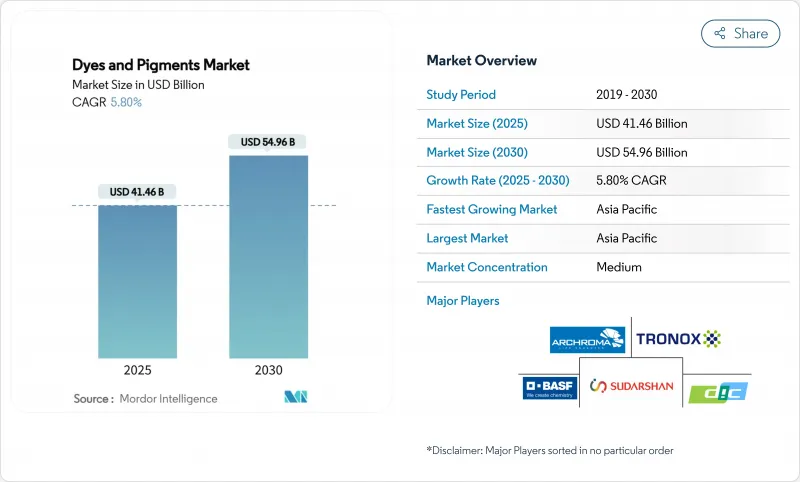

預計到 2025 年,染料和顏料市場規模將達到 414.6 億美元,到 2030 年將達到 549.6 億美元,預測期(2025-2030 年)複合年成長率為 5.80%。

日益嚴格的環境法規、製造業技術的快速應用以及亞太地區持續的產能擴張正在推動這一趨勢。亞太地區在顏料生產方面處於主導,這得益於基礎設施建設的投入,從而帶動了油漆、被覆劑和塑膠行業顏料消費量的成長。液態分散技術能夠實現更精細的顆粒分佈,適用於3D列印和水性塗料系統,目前正廣泛應用。關鍵供應商的整合,例如蘇達山化學收購赫巴赫集團,顯示在原料價格波動的情況下,企業正在進行產品組合最佳化。雖然天然色素的商業性化應用尚未完全實現,但嚴格的REACH和EPA法規正在加速生物基化學品的研發,以實現供應來源的多元化。

全球染料和顏料市場趨勢及洞察

亞太地區對油漆和塗料的需求不斷成長

亞太地區的基礎設施建設正在推動建築和防護塗料中二氧化鈦和氧化鐵顏料的生產。區域政策舉措,例如中國《2035年低碳發展規劃》,優先發展水性配方,正在加速溶劑型分散體的替代品。朗盛擴大了其氧化鐵產能,並發布了環境產品聲明,以滿足環境標籤要求。跨國塗料製造商正與區域配方商合作,並制定本地化的顏色標準,以確保符合監管要求並加快產品進入市場。

擴大紡織品生產

中國、印度和越南紡織品產能的擴張正在重塑對活性染料和分散染料的需求,尤其是對具有防潮和抗菌整理功能的產業用紡織品的需求。印度的目標是到2025年實現450億美元的紡織品出口額,並鼓勵工廠採用能減少消費量和擴大色域的數位印花平台。昂高集團收購亨斯邁紡織效應公司,整合了來自42個國家的5,000名員工,並建構了一個將高性能染料與永續性認證結合的產品組合。隨著快時尚品牌揭露其環境足跡,包括染料再生系統和墊片批量處理在內的循環經濟舉措正獲得越來越多的支持。苧麻和棉織物節能染色過程的研究不斷提高織物的均勻性和固色率。

REACH 和 EPA 對重金屬顏料的嚴格限制

鎘、六價鉻和鉛化合物在油漆和塑膠中的容許量接近零,REACH法規將聚合物基質中鎘的含量限制在0.01 wt%。將於2024年生效的紋身墨水法規將監管範圍擴大到4000多種物質,包括酞菁藍15和綠7,這促使負責人探索有機替代品。美國《化妝品監管現代化法案》允許FDA要求提供安全數據並召回含顏料產品,增加了合規成本。擁有無鉻黃色顏料和釩酸鉍替代品產品組合的公司正在監管市場中佔據越來越大的佔有率。隨著市場轉向更安全的化學品,重金屬顏料製造商面臨銷售量下降和利潤率壓縮的困境。

細分市場分析

預計到2024年,染料將佔全球染料和顏料市場的57.10%,到2030年將以5.98%的複合年成長率成長。活性染料因其強大的共用鍵,在棉和苧麻應用領域佔據主導地位,滿足了電子商務對色彩鮮豔服裝的需求。由於丹麥法規限制芳香胺含量不得超過0.003 wt%,偶氮染料的使用受到限制,不能用於童裝。

在染料細分領域,特種應用正在不斷拓展,從螢光增白劑到用於雷射打標塑膠的近紅外線吸收劑,不一而足。同時,顏料在需要耐腐蝕性和耐熱性的功能性塗料中也日益普及。隨著奈米工程混合著色劑兼具熔膠般的亮麗色彩和可溶性級的耐光性,這兩類產品之間的技術界限正變得模糊不清。致力於獲得「從搖籃到搖籃」認證的品牌正轉向無金屬配方,從而促進跨領域的創新。

到2024年,合成色素將佔總銷售量的85.17%,憑藉其可預測的簾子強度、寬廣的色域和成本效益,將繼續保持領先地位。石油基中間體支援大規模生產,以滿足快時尚和包裝加工商的即時物流。受消費者對潔淨標示的偏好和監管獎勵的推動,天然替代品將以7.12%的複合年成長率成長。

微生物發酵技術的進步使得利用廢棄甘油生產甜菜鹼和類胡蘿蔔素成為可能,從而提高了供應安全性。合成生產商正投資於木質纖維素衍生的生物芳烴,以利用可再生資源來分散風險。生物基靛藍和蒽醌中間體的試驗生產線正進入檢驗階段。相關人員寄望於歐盟的碳邊境調節機制,以懲罰高碳足跡進口產品,並使低碳合成路線在經濟上更具吸引力。

區域分析

亞太地區將主導染料和顏料市場,預計到2024年將佔據47.41%的市場佔有率,並持續成長至2030年,年複合成長率將達到6.22%。中國計劃在2025年實現70%的紡織自動化,這將推動對數位化液體染料的需求,此類染料能夠縮短生產週期並減少用水量。區域顏料供應的投資,例如VOXCO顏料公司投資6000萬美元擴大鉻黃和鉬橙的生產規模,旨在開拓出口市場並縮短全球客戶的前置作業時間。

儘管監管嚴格,歐洲的戰略地位依然舉足輕重。對中國二氧化鈦徵收反傾銷稅,為法國、德國和荷蘭的國內生產商打開了市場大門,重新調整了採購格局。德國仍然是二氧化鈦的重要來源國,而特諾克斯公司關閉其荷蘭工廠則反映了密集型生產流程的成本壓力。

北美市場成熟且充滿活力,美國環保署 (EPA) 的 VOC 標準正在推動水性配方升級。朗盛銷售用於磷酸鋰鐵的磷酸鐵中間體,並正將其顏料產品拓展至電池應用領域。

在南美洲,巴西的氧化鐵生產為國內建築業提供了支持;而在中東和非洲,沙烏地阿拉伯的NEOM等計劃推動了對顏料以及氣候適應型建築幕牆塗料的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區對油漆和塗料的需求不斷成長

- 擴大紡織品生產

- 基礎建設主導建築顏料(水泥和瓦片)需求成長

- 轉向低揮發性有機化合物、水性配方

- 在積層製造中使用染料浸漬絲

- 市場限制

- REACH 和 EPA 對重金屬顏料的嚴格限制

- 原油衍生原料價格波動劇烈

- 禁止在兒童服裝中使用某些偶氮染料

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 染料

- 反應性

- 分散

- Vat

- 硫

- 酸

- Azo

- 顏料

- 有機顏料

- 無機顏料

- 染料

- 起源

- 合成

- 天然/生物基

- 按劑型

- 粉末

- 顆粒狀

- 液體分散體

- 按最終用戶行業分類

- 油漆和塗料

- 紡織品

- 印刷油墨

- 塑膠

- 其他終端使用者產業(建築材料、紙漿和造紙、化妝品和個人護理)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Altana AG

- BASF

- Archroma

- artience Co., Ltd.

- Bodal Chemicals Ltd

- Cathay Industries

- DIC Corporation

- Flint Group

- ISHIHARA SANGYO KAISHA, LTD.

- Kronos Worldwide, Inc.

- Lanxess

- Meghmani Group

- Merck KGaA

- Sudarshan Chemical Industries Limited

- Tronox Holdings plc

- Venator Materials PLC

- Vibrantz

第7章 市場機會與未來展望

The Dyes and Pigments Market size is estimated at USD 41.46 billion in 2025, and is expected to reach USD 54.96 billion by 2030, at a CAGR of 5.80% during the forecast period (2025-2030).

Strengthening environmental rules, rapid technology adoption in manufacturing, and continuous capacity additions across Asia-Pacific drive this trajectory. Asia-Pacific commands production leadership, underpinned by infrastructure spending that amplifies pigment consumption in paints, coatings, and plastics. Liquid dispersion technologies enable finer particle distribution for 3D printing and waterborne coating systems, strengthening their foothold. Consolidation among key suppliers, exemplified by Sudarshan Chemical's purchase of Heubach Group, points to portfolio optimization amid raw-material price volatility. Natural colorant commercial viability is still emerging; however, stricter REACH and EPA rules are accelerating research and development around bio-based chemistries that diversify the supply base.

Global Dyes And Pigments Market Trends and Insights

Growing Demand from Paints and Coatings in APAC

Asia-Pacific infrastructure pipelines are propelling titanium dioxide and iron oxide pigment volumes in architectural and protective coatings. Regional policy initiatives that prioritize waterborne formulations, such as China's 2035 low-carbon guideline, accelerate substitutions away from solvent-borne dispersions. LANXESS expanded iron-oxide capacities and published Environmental Product Declarations that help specifiers meet ecolabel requirements. Multinational paint makers partner with regional formulators to localize color standards, ensuring regulatory alignment and faster market entry.

Expanding Textile Production

Textile capacity additions in China, India, and Vietnam are reshaping demand for reactive and disperse dyes, particularly for technical textiles with moisture-management and antimicrobial finishes. India targets USD 45 billion in textile exports by 2025, encouraging mills to adopt digital printing platforms that cut water consumption and broaden color gamut. Archroma's acquisition of Huntsman Textile Effects merged 5,000 employees across 42 countries, creating a portfolio that combines high-performance dyes with sustainability certifications. Circularity initiatives, including dye reclamation systems and Cold Pad-Batch processing, are gaining traction as fast-fashion brands disclose environmental footprints. Research into energy-saving dyeing routes for ramie and cotton fabrics continues to improve levelness and fixation rates.

Stringent REACH and EPA Restrictions on Heavy-Metal Pigments

Cadmium, chromium VI, and lead compounds face near-zero tolerance in coatings and plastics, with REACH limiting cadmium in polymer matrices to 0.01 wt%. Tattoo-ink rules effective in 2024 widened the scope to more than 4,000 substances, including phthalocyanine Blue 15 and Green 7, pushing formulators to explore organic alternatives. The US Modernization of Cosmetics Regulation Act grants the FDA the ability to request safety data and recall pigment-containing products, elevating compliance costs. Companies holding portfolios of chromium-free yellows or bismuth vanadate substitutes are gaining share in regulated markets. Heavy-metal pigment producers confront shrinking volumes and margin compression as markets pivot to safer chemistries.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure-Led Rise in Construction Pigments

- Shift Toward Low-VOC, Water-Borne Formulations

- Volatile Crude-Derived Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dyes control 57.10% of the global dyes and pigments market in 2024 and will advance at 5.98% CAGR to 2030, fueled by penetrating textile, leather, and paper workflows that need molecular-level color dispersion. Reactive dyes dominate cotton and ramie applications due to strong covalent bonding, supporting e-commerce demand for vibrant apparel. Azo dye proliferation is now curbed in children's wear, with Danish rules capping aromatic amines at 0.003 wt%.

The dyes subsegment showcases a widening specialty range, from fluorescent optical brighteners to near-infrared absorbers for laser-markable plastics. Meanwhile, pigments keep gaining ground in functional coatings that demand corrosion resistance or thermal control. Technological barriers between the two categories blur as nano-engineered hybrid colorants deliver soluble-like brilliance with pigment-level lightfastness. Brands pursuing cradle-to-cradle certification gravitate toward metal-free recipes, stimulating cross-disciplinary innovation.

Synthetic colorants represented 85.17% of total volume in 2024 and continue to lead due to predictable shade strength, wide color coverage, and cost efficiency. Petroleum-based intermediates support high-scale production that meets just-in-time logistics for fast-fashion and packaging converters. Natural alternatives grow at a 7.12% CAGR, buoyed by consumer preference for clean labels and regulatory incentives.

Microbial fermentation advances enable production of betalains and carotenoids from waste glycerol, enhancing supply security. Synthetic producers are hedging with renewable routes, investing in bio-aromatics derived from lignocellulose. Pilot lines for bio-based indigo and anthraquinone intermediates are entering validation stages. Stakeholders anticipate carbon-border adjustment mechanisms in the EU that could penalize high-footprint imports, making low-carbon synthetic routes financially attractive.

The Dyes and Pigments Market Report is Segmented by Product Type (Dyes and Pigments), Source (Synthetic and Natural/Bio-based), Formulation (Powder, Granular, and Liquid Dispersion), End-User Industry (Paints and Coatings, Textiles, Printing Inks, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the dyes and pigments market, holding 47.41% share in 2024 and expanding at 6.22% CAGR through 2030. China's program to reach 70% textile automation by 2025 fuels orders for digitally compatible liquid dyes that shorten batch cycles and cut water usage. Regional pigment supply investments, such as VOXCO Pigments' USD 60 million expansion in chrome yellow and molybdate orange, target export markets and reduce lead times for global customers.

Europe retains strategic significance despite stringent regulation. Anti-dumping duties on Chinese titanium dioxide recalibrate sourcing, offering openings for domestic producers in France, Germany, and the Netherlands. Germany remains a critical source of iron oxides, while Tronox's idling of a Dutch plant reflects cost pressures in energy-intensive processes.

North America is mature yet dynamic, with EPA VOC standards catalyzing waterborne formulation upgrades. LANXESS markets iron-phosphate intermediates for lithium iron phosphate cathodes, expanding pigment reach into battery applications.

South America leans on Brazil's iron oxide output, supporting domestic construction. The Middle East and Africa observe pigment demand growth from megaprojects such as Saudi Arabia's NEOM, combined with coatings demand for climate-resilient facades.

- Altana AG

- BASF

- Archroma

- artience Co., Ltd.

- Bodal Chemicals Ltd

- Cathay Industries

- DIC Corporation

- Flint Group

- ISHIHARA SANGYO KAISHA, LTD.

- Kronos Worldwide, Inc.

- Lanxess

- Meghmani Group

- Merck KGaA

- Sudarshan Chemical Industries Limited

- Tronox Holdings plc

- Venator Materials PLC

- Vibrantz

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from Paints and Coatings in APAC

- 4.2.2 Expanding Textile Production

- 4.2.3 Infrastructure-Led Rise in Construction Pigments (Cement and Roof Tiles)

- 4.2.4 Shift Toward Low-VOC, Water-Borne Formulations

- 4.2.5 Adoption of Dye-Infused Filaments for Additive Manufacturing

- 4.3 Market Restraints

- 4.3.1 Stringent REACH and EPA Restrictions on Heavy-Metal Pigments

- 4.3.2 Volatile Crude-Derived Feedstock Prices

- 4.3.3 Ban on Certain Azo Dyes in Children's Apparel

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Dyes

- 5.1.1.1 Reactive

- 5.1.1.2 Disperse

- 5.1.1.3 Vat

- 5.1.1.4 Sulfur

- 5.1.1.5 Acid

- 5.1.1.6 Azo

- 5.1.2 Pigments

- 5.1.2.1 Organic Pigments

- 5.1.2.2 Inorganic Pigments

- 5.1.1 Dyes

- 5.2 By Source

- 5.2.1 Synthetic

- 5.2.2 Natural / Bio-based

- 5.3 By Formulation

- 5.3.1 Powder

- 5.3.2 Granular

- 5.3.3 Liquid Dispersion

- 5.4 By End-user Industry

- 5.4.1 Paints and Coatings

- 5.4.2 Textiles

- 5.4.3 Printing Inks

- 5.4.4 Plastics

- 5.4.5 Other End-user Industries (Construction Materials, Paper and Pulp, Cosmetics and Personal Care)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Altana AG

- 6.4.2 BASF

- 6.4.3 Archroma

- 6.4.4 artience Co., Ltd.

- 6.4.5 Bodal Chemicals Ltd

- 6.4.6 Cathay Industries

- 6.4.7 DIC Corporation

- 6.4.8 Flint Group

- 6.4.9 ISHIHARA SANGYO KAISHA, LTD.

- 6.4.10 Kronos Worldwide, Inc.

- 6.4.11 Lanxess

- 6.4.12 Meghmani Group

- 6.4.13 Merck KGaA

- 6.4.14 Sudarshan Chemical Industries Limited

- 6.4.15 Tronox Holdings plc

- 6.4.16 Venator Materials PLC

- 6.4.17 Vibrantz

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment