|

市場調查報告書

商品編碼

1851299

卵磷脂:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Lecithin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

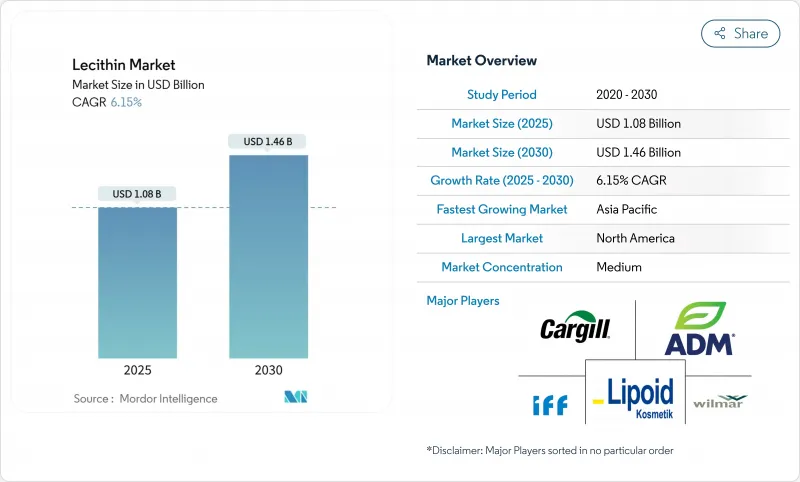

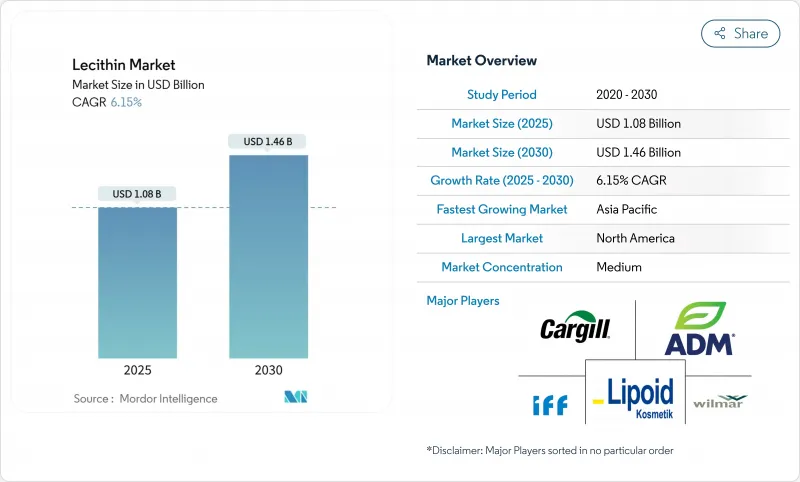

預計到 2025 年卵磷脂市場規模將達到 10.8 億美元,到 2030 年將達到 14.6 億美元,2025 年至 2030 年的複合年成長率為 6.15%。

由於加工食品中天然乳化劑的使用日益增多、嚴格的潔淨標示法規以及藥用級磷脂的普及,市場需求持續穩定成長。同時,製藥公司正將卵磷脂應用於藥物傳遞和認知健康產品領域,推高了高純度卵磷脂的平均售價。向日葵卵磷脂因其非基因改造特性和在潔淨標示配方中不含致敏物質的特性而經歷了顯著成長。由於消費者對基因改造成分的擔憂日益加劇,北美和歐洲的食品飲料生產商正從大豆卵磷脂轉向向日葵卵磷脂。向日葵卵磷脂風味中性且磷脂含量高,非常適合用於植物來源乳製品、烘焙產品和糖果甜點。製藥業也在增加向日葵卵磷脂在脂質體藥物遞送系統的應用,而對高純度和可追溯性的需求正在推動高純度卵磷脂市場的成長。

全球卵磷脂市場趨勢與洞察

加工食品對乳化劑和穩定劑的需求日益成長

加工食品產業正轉向使用天然乳化劑,卵磷脂成為維持產品穩定性並滿足潔淨標示要求的關鍵成分。消費者對便利、保存期限長、即食食品的偏好日益成長,推動了對能夠維持產品一致性、改善質地並延長保存期限的乳化劑和穩定劑的需求。卵磷脂提取自大豆、葵花籽和雞蛋等天然來源,具有乳化劑、分散劑和保濕劑等多種功能,為生產商提供了多功能性和成本效益。潔淨標示運動鼓勵食品生產商選擇卵磷脂等天然添加劑而非合成添加劑,從而提升了市場需求。消費者在加工包裝食品上的支出依然強勁,美國勞工統計局預測,2023年美國家庭在烘焙產品上的平均支出將達到574美元。

在動物飼料應用中採用率不斷提高

動物營養應用是卵磷脂需求的重要成長領域,這主要得益於監管部門的核准及其在提高牲畜生產力方面的有效性。食品藥物管理局(FDA) 的《聯邦法規》第 21 篇第 573 部分確認了卵磷脂作為動物飼料的安全性,為飼料生產商提供了清晰的法規結構,並確保了整個行業的統一實施。卵磷脂中的磷脂質能夠改善單胃動物的脂肪消化,進而提高牲畜的生長速度和飼料轉換率。水產養殖業是卵磷脂等功能性飼料成分需求的主要驅動力。根據聯合國糧食及農業組織 (FAO) 的數據,2022/23 年度全球水產養殖產量將達到 1.309 億噸,使水產養殖總產量達到 2.232 億噸,比 2020 年增加 4%。這種成長推動了對永續植物性飼料的需求,以取代水產養殖和牲畜飼料產業中的傳統飼料成分。

原物料價格波動

卵磷脂市場面臨原物料價格波動帶來的重大限制,尤其是大豆、葵花籽和雞蛋的價格波動。這些主要原料來源易受多種因素影響,包括天氣、地緣政治議題、貿易政策和供應鏈中斷。例如,美國、巴西和烏克蘭等主要產區的極端天氣和乾旱會降低作物產量,並影響生產所需原料的供應和成本。此外,由於卵磷脂來自油籽加工,食用油市場的波動也會影響卵磷脂的價格。大豆油和葵花籽油需求的變化,以及消費模式的轉變和生質燃料法規的調整,都會影響卵磷脂的供應和價格。這種波動性為生產者維持穩定的成本結構和利潤率帶來了挑戰。製造成本的增加也會影響卵磷脂相對於合成乳化劑的競爭力,尤其是在價格敏感型市場。

細分市場分析

到2024年,大豆卵磷脂將佔據65.49%的市場佔有率,這主要得益於其成本效益,而這又得益於成熟的供應鏈和全球大豆加工基礎設施。向日葵卵磷脂是成長最快的來源,預計從2025年到2030年將以7.89%的複合年成長率成長,因為其非基因改造特性和不含致敏物的特性符合消費者對健康的偏好和不斷成長的市場需求。雞蛋卵磷脂預計將在需要卓越功能性的特殊應用領域中保持其地位,尤其是在製藥和高階食品領域,同時在高價值領域也展現出良好的業績記錄。

在供應鏈中斷影響傳統原料來源的情況下,菜籽卵磷脂已成為可行的替代方案,為製造商提供了更大的採購彈性。包括油菜籽卵磷脂在內的替代成分,正透過監管部門的核准擴大市場佔有率,例如嘉吉公司獲得了美國食品藥物管理局(FDA) 的「公認安全」(GRAS) 認定,使其能夠更廣泛地應用於有機和非基因改造配方中。

到2024年,食品級卵磷脂將佔據57.15%的市場佔有率,主要服務於加工食品行業,用作烘焙、糖果甜點和乳製品中的乳化劑。該成分在食品加工過程中具有極高的通用性。受其在藥物遞送系統和營養保健品配方中日益廣泛的應用推動,預計2025年至2030年間,藥用級卵磷脂的複合年成長率將達到9.37%。由於卵磷脂具有良好的安全性,並已獲得美國食品藥物管理局(FDA)核准用於多種用途,其在製藥領域的應用將持續成長。監管部門的核准將進一步增強整個製藥製劑市場的成長潛力。

其他等級的卵磷脂,包括用於化妝品和工業用途的卵磷脂,隨著製造商將卵磷脂應用於非傳統領域,也蘊藏成長機會。像美國卵磷脂公司這樣的企業,正透過開發大豆和向日葵卵磷脂的專用絲胺酸(包括磷脂醯絲氨酸),推動醫藥級卵磷脂市場的發展。這些配方符合嚴格的藥品品質標準和規範。高價值的衍生物使供應商能夠在醫藥應用領域獲得更高的溢價和利潤率。

區域分析

2024年,北美將佔據卵磷脂市場的主導地位,佔有率達35.69%,這主要得益於美國食品藥物管理局(FDA)嚴格的法規,該法規鼓勵使用天然乳化劑。由於對大豆和菜籽壓榨設施的大量投資以及植物來源食品的日益普及,該地區保持著均衡的產能。消費者在膳食補充劑上的高支出推動了優質磷脂在腦健康產品中的應用。亞太地區預計在2025年至2030年間達到最高的複合年成長率(CAGR),達到8.72%。中國膳食補充劑產業的擴張以及印度烘焙連鎖店的發展將推動對標準卵磷脂和優質卵磷脂產品的需求。

亞太地區是成長最快的地區,預計2025年至2030年複合年成長率將達到8.72%。該地區營養保健品市場不斷擴張,消費者可支配收入的增加推動了高階原料的普及。中國營養保健品市場,尤其是卵磷脂在認知健康和心血管保健產品的應用,是該地區需求成長的主要驅動力。亞太地區龐大的加工食品製造業對具成本效益的乳化解決方案有著巨大的需求,同時,消費者對卵磷脂健康益處的認知不斷提高,也促進了高階卵磷脂在各種應用中的使用。

歐洲在銷售和價值兩方面保持平衡。歐洲食品安全局 (EFSA) 的法規以及對基因改造作物的擔憂正在推動對向日葵和油菜籽卵磷脂的需求。在地理政治問題解決之前,東歐生產商受益於其與向日葵產區的地理優勢。南美洲是重要的供應基地,巴西擁有龐大的大豆產量。中東和非洲由於食品加工業的擴張以及消費者對功能性成分意識的提高,蘊藏著巨大的成長潛力。然而,與成熟市場相比,基礎設施的限制和法律規範的不完全仍然限制著這些市場的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加工食品對乳化劑和穩定劑的需求日益成長

- 在動物飼料應用中採用率不斷提高

- 在製藥和營養保健品產業中不斷拓展的應用

- 來自植物性和純素食品產業的需求不斷成長

- 消費者對潔淨標示天然食品原料的需求不斷成長

- 天然化妝品配方中應用日益廣泛

- 市場限制

- 原物料價格波動

- 消費者對基因改造食品的負面看法

- 替代乳化劑與界面活性劑之間的競爭

- 液態卵磷脂產品的保存期限有限

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按來源

- 大豆

- 向日葵

- 蛋

- 油菜籽

- 其他資訊來源

- 按年級

- 食品級

- 醫藥級

- 其他

- 按形式

- 液體

- 粉末

- 其他

- 自然

- 有機的

- 傳統的

- 透過使用

- 飲食

- 麵包糖果甜點

- 乳製品

- 飲料

- 其他食品和飲料

- 餵食

- 營養補充品

- 製藥

- 化妝品和個人護理

- 其他應用

- 飲食

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 荷蘭

- 義大利

- 瑞典

- 波蘭

- 比利時

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 印尼

- 泰國

- 新加坡

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 秘魯

- 其他南美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 沙烏地阿拉伯

- 埃及

- 摩洛哥

- 土耳其

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市場排名分析

- 公司簡介

- Archer Daniels Midland Company

- Cargill Inc.

- Bunge Limited

- International Flavors & Fragrances, Inc.

- Wilmar International

- Lipoid GmbH

- Sternchemie GmbH and Co KG

- VAV Life Sciences Pvt Ltd

- American Lecithin Company

- The Scoular Company

- Ciranda Inc.

- Sonic Biochem

- Lecico GmbH

- Clarkson Specialty Lecithins

- Fishmer Lecithin

- AAK

- GIIAVA Industrial Biotech

- SternWywiol Gruppe

- Emerson Resources

- Austrade Ingredients

第7章 市場機會與未來展望

The lecithin market size is valued at USD 1.08 billion in 2025 and is forecast to reach USD 1.46 billion by 2030, advancing at a 6.15% CAGR during 2025-2030.

Rising uptake of natural emulsifiers in processed foods, stringent clean-label regulations, and deepening penetration of pharmaceutical-grade phospholipids keep demand on a solid upward path. In parallel, pharmaceutical companies extend lecithin's reach into drug-delivery and cognitive-health products, lifting average selling prices in the high-purity segment. Sunflower lecithin is experiencing significant growth due to its non-GMO status and allergen-free properties in clean-label formulations. Food and beverage manufacturers in North America and Europe are transitioning from soy-based to sunflower-derived lecithin as consumers become more concerned about genetically modified ingredients. The neutral flavor profile and high phospholipid content of sunflower lecithin make it suitable for plant-based dairy, bakery, and confectionery products. The pharmaceutical industry is also increasing its use of sunflower lecithin in liposomal drug delivery systems, where high purity and traceability requirements drive growth in the high-purity lecithin segment.

Global Lecithin Market Trends and Insights

Rising Need for Emulsifiers and Stabilizers in Processed Foods

The processed food industry is shifting toward natural emulsifiers, making lecithin an essential ingredient for maintaining product stability while meeting clean-label requirements. The increasing consumer preference for convenient, shelf-stable, and ready-to-eat food products has created a higher demand for emulsifying and stabilizing agents that maintain consistency, improve texture, and extend shelf life. Lecithin, extracted from natural sources such as soybeans, sunflower seeds, and eggs, serves multiple functions as an emulsifier, dispersing agent, and wetting agent, providing manufacturers with versatility and cost efficiency. The clean-label movement has encouraged food producers to choose natural additives like lecithin over synthetic alternatives, increasing its market demand. Consumer spending on processed and packaged foods remains strong, as evidenced by U.S. households spending an average of USD 574 on bakery products in 2023, according to the Bureau of Labor Statistics .

Increased Adoption in Animal Feed Applications

Animal nutrition applications represent a significant growth area for lecithin demand, supported by regulatory approvals and demonstrated benefits in livestock productivity. The Food and Drug Administration (FDA)'s 21 CFR Part 573 regulations confirm lecithin's safety for animal feed applications, providing a clear regulatory framework for feed manufacturers and ensuring consistent implementation across the industry . The phospholipid content in lecithin improves fat digestion in monogastric animals, resulting in better growth rates and feed efficiency in livestock operations. The aquaculture industry has become a major driver of demand for functional feed ingredients like lecithin. The Food and Agriculture Organization of the United Nations (FAO) reports that global aquaculture production reached 130.9 million tons in 2022/23, contributing to a total fisheries and aquaculture output of 223.2 million tons, representing a 4% increase from 2020 . This growth has increased pressure on aquafeed and animal feed industries to incorporate sustainable, plant-based alternatives to conventional feed ingredients.

Fluctuating Raw Material Prices

The lecithin market faces significant constraints due to fluctuating raw material prices, particularly soybeans, sunflower seeds, and eggs. These primary sources are vulnerable to various factors, including weather conditions, geopolitical issues, trade policies, and supply chain disruptions. For instance, extreme weather events or droughts in major producing regions such as the United States, Brazil, or Ukraine can reduce crop yields, affecting the availability and cost of lecithin production materials. The volatility in the broader edible oil market also influences lecithin prices, as lecithin is derived from oilseed processing. Changes in soybean or sunflower oil demand, whether from shifting consumption patterns or biofuel regulations, affect lecithin supply and pricing. This instability creates challenges for manufacturers in maintaining stable cost structures and profit margins. The increased production costs also affect lecithin's competitiveness against synthetic emulsifiers, particularly in price-sensitive markets.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Applications in Pharmaceutical and Nutraceutical Industries

- Growing Demand from Plant-Based and Vegan Food Sectors

- Negative Consumer Perception of GMO Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Soy lecithin holds a dominant 65.49% market share in 2024, supported by established supply chains and cost benefits from the global soybean processing infrastructure. Sunflower lecithin represents the fastest-growing source segment with a projected 7.89% CAGR during 2025-2030, driven by its non-GMO status and allergen-free characteristics that align with consumer health preferences and increasing market demands. Egg lecithin maintains its position in specialized applications requiring superior functionality, particularly in pharmaceutical and premium food products, while demonstrating consistent performance in high-value segments.

Rapeseed lecithin has emerged as a viable alternative during supply chain disruptions affecting conventional sources, offering manufacturers additional sourcing flexibility. Alternative sources, including canola lecithin, have expanded their market presence through regulatory approvals, such as Cargill's Food and Drug Administration (FDA) Generally Recognised as Safe (GRAS) determination, enabling broader use in organic and non-GMO formulations.

Food grade lecithin holds 57.15% market share in 2024, primarily serving the processed food industry with emulsification solutions across bakery, confectionery, and dairy applications. The ingredient demonstrates significant versatility in food processing operations. Pharmaceutical grade lecithin projects a 9.37% CAGR during 2025-2030, driven by its increasing use in drug delivery systems and nutraceutical formulations. The pharmaceutical segment expands through lecithin's proven safety profile and Food and Drug Administration (FDA) approval for various applications. The regulatory acceptance strengthens market growth potential across pharmaceutical formulations.

Additional grades, including cosmetic and industrial applications, present growth opportunities as manufacturers implement lecithin in non-traditional uses. Companies such as American Lecithin Company advance the pharmaceutical-grade segment by developing specialized derivatives, including phosphatidylserine from soy and sunflower lecithins. These formulations comply with stringent pharmaceutical quality standards and specifications. The high-value derivatives enable suppliers to benefit from premium pricing and enhanced profit margins in pharmaceutical applications.

The Lecithin Market is Segmented by Source (Soy, Sunflower, and More), by Grade (Food Grade, Pharmaceutical Grade, and Others), by Form (Liquid, Powder, and Others), by Nature (Organic, and Conventional), by Application (Food and Beverage, Animal Feed, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a dominant 35.69% share of the lecithin market in 2024, supported by strict Food and Drug Administration (FDA) regulations favoring natural emulsifiers. The region maintains balanced capacity through significant investments in soybean and canola crushing facilities and increased plant-based food product launches. High consumer spending on supplements drives the adoption of premium phospholipids in brain-health products. Asia-Pacific demonstrates the highest growth rate with an 8.72% CAGR during 2025-2030. The expansion of China's supplement industry and India's bakery chains drives demand for both standard and premium lecithin products.

Asia-Pacific emerges as the fastest-growing region with a CAGR of 8.72% during 2025-2030, driven by expanding nutraceutical markets and rising disposable incomes that enable premium ingredient adoption. China's dietary supplement market, particularly for lecithin applications in cognitive health and cardiovascular wellness products, contributes significantly to regional demand expansion. The region's processed food manufacturing base generates substantial demand for cost-effective emulsification solutions, while increasing consumer awareness of health benefits supports premium lecithin usage in various applications.

Europe maintains a balanced approach between volume and value segments. European Food Safety Authority (EFSA) regulations and GMO concerns drive demand toward sunflower and rapeseed lecithin. Eastern European producers benefit from proximity to sunflower production regions, pending resolution of geopolitical issues. South America serves as a key supply center, leveraging Brazil's substantial soybean production. The Middle East and Africa present growth potential due to the expansion of food processing industries and rising consumer awareness of functional ingredients. However, infrastructure constraints and underdeveloped regulatory frameworks continue to limit market growth compared to mature markets.

- Archer Daniels Midland Company

- Cargill Inc.

- Bunge Limited

- International Flavors & Fragrances, Inc.

- Wilmar International

- Lipoid GmbH

- Sternchemie GmbH and Co KG

- VAV Life Sciences Pvt Ltd

- American Lecithin Company

- The Scoular Company

- Ciranda Inc.

- Sonic Biochem

- Lecico GmbH

- Clarkson Specialty Lecithins

- Fishmer Lecithin

- AAK

- GIIAVA Industrial Biotech

- SternWywiol Gruppe

- Emerson Resources

- Austrade Ingredients

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising need for emulsifiers and stabilizers in processed foods

- 4.2.2 Increased adoption in animal feed applications

- 4.2.3 Expanding applications in pharmaceutical and nutraceutical industries

- 4.2.4 Growing demand from plant-based and vegan food sectors

- 4.2.5 Consumer demand for clean-label and natural food ingredients

- 4.2.6 Increased adoption in natural cosmetics formulations

- 4.3 Market Restraints

- 4.3.1 Fluctuating Raw Material Prices

- 4.3.2 Negative consumer perception of GMO ingredients

- 4.3.3 Competition from alternative emulsifiers and surfactants

- 4.3.4 Limited shelf life of liquid lecithin products

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Soy

- 5.1.2 Sunflower

- 5.1.3 Egg

- 5.1.4 Rapeseed

- 5.1.5 Other Sources

- 5.2 By Grade

- 5.2.1 Food Grade

- 5.2.2 Pharmaceutical Grade

- 5.2.3 Others

- 5.3 By Form

- 5.3.1 Liquid

- 5.3.2 Powder

- 5.3.3 Others

- 5.4 By Nature

- 5.4.1 Organic

- 5.4.2 Conventional

- 5.5 By Application

- 5.5.1 Food and Beverage

- 5.5.1.1 Bakery and Confectionery

- 5.5.1.2 Dairy Products

- 5.5.1.3 Beverages

- 5.5.1.4 Other Food and Beverages

- 5.5.2 Animal Feed

- 5.5.3 Dietary Supplements

- 5.5.4 Pharmaceuticals

- 5.5.5 Cosmetics and Personal Care

- 5.5.6 Other Application

- 5.5.1 Food and Beverage

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Spain

- 5.6.2.5 Netherlands

- 5.6.2.6 Italy

- 5.6.2.7 Sweden

- 5.6.2.8 Poland

- 5.6.2.9 Belgium

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Indonesia

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Colombia

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 South Africa

- 5.6.5.3 Nigeria

- 5.6.5.4 Saudi Arabia

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill Inc.

- 6.4.3 Bunge Limited

- 6.4.4 International Flavors & Fragrances, Inc.

- 6.4.5 Wilmar International

- 6.4.6 Lipoid GmbH

- 6.4.7 Sternchemie GmbH and Co KG

- 6.4.8 VAV Life Sciences Pvt Ltd

- 6.4.9 American Lecithin Company

- 6.4.10 The Scoular Company

- 6.4.11 Ciranda Inc.

- 6.4.12 Sonic Biochem

- 6.4.13 Lecico GmbH

- 6.4.14 Clarkson Specialty Lecithins

- 6.4.15 Fishmer Lecithin

- 6.4.16 AAK

- 6.4.17 GIIAVA Industrial Biotech

- 6.4.18 SternWywiol Gruppe

- 6.4.19 Emerson Resources

- 6.4.20 Austrade Ingredients