|

市場調查報告書

商品編碼

1851278

旋轉泵:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Rotary Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

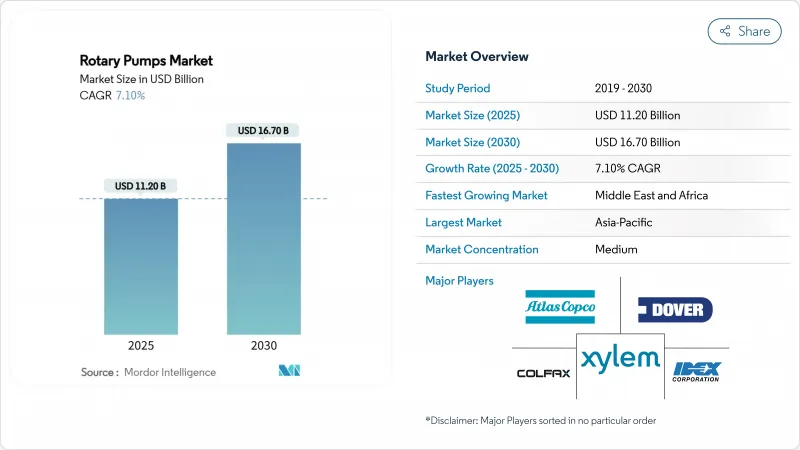

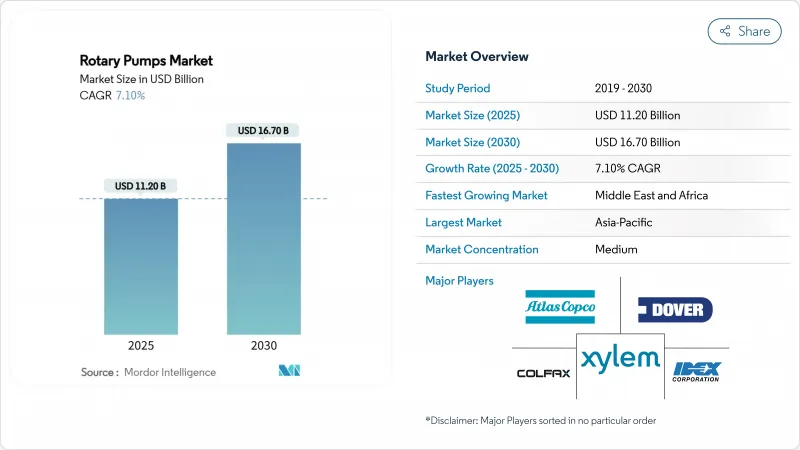

預計旋轉泵市場將從 2025 年的 112 億美元成長到 2030 年的 167 億美元,複合年成長率為 7.1%。

中東棕地改造升級的增加、中國煉油產能的突破性成長以及巴西新一代FPSO的投產,正推動符合API-676標準、能夠處理高黏度和多相流體的設備的需求。美國《食品安全現代化法案》和歐洲衛生指令中嚴格的原位清洗(CIP)要求,促使食品級齒輪和偏心盤設計得到廣泛應用。石化營運商也在將旋轉泵與智慧感測器整合,以提高運作並減少火炬燃燒。採用乾氣或無密封配置的技術升級,有助於用戶滿足日益嚴格的VOC排放法規,而26年的FPSO租約則保障了長期服務契約,從而拓展了售後市場機遇。

全球旋轉幫浦市場趨勢與洞察

能源領域棕地改造升級

中東各國國家石油公司正在成熟油田進行現代化改造,以延長資產壽命並維持產量。科威特石油公司正在對大勃根地地區的14個石油開採中心進行改造,安裝新的分離裝置,這需要使用能夠耐受乳化液和高含砂量的旋轉泵。阿布達比海上石油公司正在對扎庫姆西部和中央超級油田進行改造,以維持每日產量42.5萬桶。沙烏地阿美公司最佳化了其庫賴斯中央工廠的穩定器底部泵,以在處理日產量126.3萬桶的同時降低能耗。這些維修採用了符合API 676標準的雙螺桿泵和齒輪泵,並升級了冶金工藝和變速驅動裝置,以應對富含聚合物的流體和蒸氣注入溫度。供應商正透過替換項目獲得售後收入,這些項目用數位化監控的新設備替換了使用了幾十年的老舊設備。

提高石化產品產能

中國持續建構煉化一體化項目,包括玉龍煉油廠計劃預計2024年原油日加工量將達到1,480萬桶,2025年將達到40萬桶。這些項目依賴旋轉泵進行石腦油加氫處理、液化石油氣輸送和聚合物進料,導致停機時間波及整個廠區。印度計畫投資1,420億美元用於石化產業,以期到2030年將產能提升至4,600萬噸,其中納亞拉能源公司在瓦迪納爾投資80億美元的乙烷裂解裝置是亮點計畫。印度石油公司、印度石油化學公司和印度斯坦石油公司等國營煉油企業都在增建聚丙烯生產線,這些生產線需要能夠處理240度C熔融單體的螺旋泵和齒輪泵。全電動煉油理念和零燃燒排放政策正在推動無密封磁力驅動裝置的應用,以減少逸散性排放。

亞洲一些非正規商販出售的低成本假冒零件氾濫。

未經認證的葉輪、襯套和密封套件進入供應鏈會帶來安全隱患,並縮短平均故障間隔時間。 ADMA-OPCO 的防偽項目旨在培訓檢驗員,並將供應商列入認證名單。中國原始設備製造商 (OEM) 的研發投入仍不足銷售額的 2%,這限制了品質改進,而這些改進本可以彌補人們對仿冒品的認知差距。買家傾向於選擇進口泵,這助長了灰色市場的滋生,假冒零件以假亂真,並危及保固。

細分市場分析

由於其堅固耐用的設計適用於中等黏度應用,外齒輪幫浦預計在2024年將佔據旋轉幫浦市場32%的佔有率。雙螺桿幫浦將以7.71%的複合年成長率實現最快的成長,因為FPSO上部模組和聚合物應用需要平穩的流動和最小的脈動。從2019年到2024年,外齒輪幫浦的年均成長率為3.2%,而雙螺桿幫浦的年均成長率為6.8%,反映出市場對更高性能的需求正在成長。內齒輪月牙泵適用於對物料輸送要求較為溫和的糖果甜點和製藥批次。葉片幫浦繼續應用於汽車潤滑油迴路,但面臨能源效率的挑戰。工業物聯網(IIoT)賦能的齒輪箱的興起,使操作人員能夠監控間隙並調整轉速以避免氣蝕。

在提高採收率的應用中,雙螺桿組件具有更高的抗剪切性和抗氣鎖性。符合SMU編碼的API-676設備以更低的轉速運行,從而延長了密封件的使用壽命。與雲分析的整合可在流量漂移發生之前偵測到磨損,從而減少非計劃性停機時間。 OEM廠商透過採用HVOF塗層轉子來增強產品競爭力,該塗層可抵抗聚合物磨損。對於成本敏感的混合撬裝設備,外齒輪式仍然是首選,因為標準化零件可減少維護。專利活動主要集中在螺旋螺桿輪廓上,這種輪廓可降低噪音,並在不增加佔地面積的情況下實現更高的排出壓力。

預計到2024年,石油和天然氣產業將維持27.5%的旋轉幫浦市場佔有率,因為煉油廠、管線和儲槽區對符合API標準的設備需求強勁。然而,隨著FSMA和EC1935法規對衛生要求的日益嚴格,食品飲料產業預計將在2030年之前以7.91%的複合年成長率實現最快成長。 2019年至2024年,石油和天然氣產業的年均成長率為4.1%,而食品飲料產業的年均成長率為6.9%。發電業也推動需求成長,Flowserve連續三個季度核能訂單超過1億美元便印證了這一點。化學和石化企業正在指定使用無密封泵來處理溫度高於200°C的腐蝕性單體。

一家食品加工企業在米德爾頓釀酒廠的生產效率提升50%後,正改用不銹鋼內齒輪泵來輸送巧克力和糖漿。一家歐洲精釀啤酒生產商正在使用Inox Spa公司的低剪切LOBE泵來維持酵母的活性。一家水務公司正在評估可節能30%的旋轉葉片鼓風機,而高速渦輪鼓風機在大型工廠中也具有競爭力。一家石化製造商正在將旋轉泵與數位雙胞胎相結合,以模擬空化現象並安排維護時間,使其與裂解裝置的檢修週期相匹配。

區域分析

到2024年,亞太地區將佔據旋轉泵市場38.4%的佔有率,其中中國將引領市場,年銷售量超過1,350萬台。北京對節能齒輪傳動裝置和城市供水計劃的補助支持了市場需求。印度1,420億美元的石化計畫將活性化國內泵浦製造業發展,並吸引全球OEM廠商的授權合約。日本將為半導體清洗生產線供應精密計量泵,韓國造船廠將在超大型油輪(VLCC)機艙內採用符合API-676標準的雙螺桿泵。

中東地區複合年成長率最高,達7.81%,這主要得益於科威特和阿布達比對分離裝置的升級改造,以及沙烏地阿美公司更新泵浦以降低能耗。棕地正在採用能夠處理含砂乳液而不產生氣蝕的螺旋泵。卡達天然氣公司正在投資用於液化天然氣蒸發的低流量內齒輪泵,並積極應對甲烷排放法規。各國龍頭企業正在製定在地化率閾值,推動在達曼和Muscat建造新的組裝中心。

北美市場成熟且技術先進。 《食品安全現代化法案》(FSMA)的實施推動了酪農和釀造行業齒輪泵銷量的成長,而頁岩氣生產商則採用磁力耦合泵來控制揮發性有機化合物(VOC)。蘇爾壽公司在南卡羅來納州伊斯利投資1000萬瑞士法郎,擴大其潛水泵產品線,以履行「建設美國」計畫的義務。一家加拿大油砂營運商用雙螺桿泵替換了其稀釋泵,該泵可在零下溫度下處理30%體積分數的氣體。

歐洲關注排放氣體。 TA-Luft法規修訂鼓勵煉油廠採用乾氣密封,該地區的精釀啤酒廠也採用了衛生型旋轉葉片泵。挪威的電氣化海上油田指定使用無密封注入幫浦以減少甲烷排放。歐盟「地平線」計畫的津貼支持化學泵數位雙胞胎研究。

南美洲受惠於巴西價值80億美元的FPSO(浮式生產儲卸油裝置)熱潮。 P-85型浮式生產儲卸油裝置的在地採購達到25%,從而提振了對巴西製造的機械加工套管的需求。阿根廷的瓦卡穆爾塔頁岩氣田正在開發天然氣處理廠,這些工廠需要高壓螺旋泵。哥倫比亞的生物柴油擴建計畫涉及安裝用於棕櫚油原料的不銹鋼齒輪泵。

撒哈拉以南非洲地區雖然基數較小,但正面臨維修技能短缺的問題,這限制了先進螺旋泵的普及應用。奈及利亞的模組化煉油廠正在選擇低成本的外部齒輪箱,而南非的礦用泵正在加裝工業物聯網感測器以防範盜竊。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

第5章 市場概覽

- 市場促進因素

- 能源領域的棕地維修將推動對高黏度流體處理設備的需求(中東地區)

- 中國和印度的石化產能擴張需要符合API-676標準的旋轉泵

- 巴西海上FPSO建造業復甦,雙螺旋泵訂單增加

- 隨著美國《食品安全現代化法案》(FSMA)強制要求原位清洗,食品級齒輪幫浦越來越受歡迎。

- 越來越多的歐洲精釀啤酒廠安裝設備支援低剪切LOBE泵

- 市場限制

- 亞洲非正規供應商提供的低成本仿冒零件供應充足

- 歐盟嚴格的揮發性有機化合物(VOC)排放法規限制了旋轉泵浦機械軸封的選擇。

- 地方政府水質淨化廠離心式處理方案的初始成本較高

- 撒哈拉以南非洲地區缺乏螺旋泵幫浦維護的熟練工人

- 價值/供應鏈分析

- 監管和技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第6章 市場規模與成長預測

- 按類型

- 外齒輪

- 內齒輪

- 雙螺桿

- 三螺絲

- 葉片

- 按最終用戶行業分類

- 石油和天然氣(上游、中游、下游)

- 發電(傳統型、核能、可再生能源)

- 化工和石油化工

- 飲食

- 水和污水

- 透過排氣壓力

- 小於 10 巴

- 10-25 bar

- 25-100 bar

- 超過100巴

- 按泵送能力(立方米/小時)

- 小於50立方米/小時

- 51-150m3/h

- 151-500m3/h

- 超過500立方公尺/小時

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第7章 競爭情勢

- 市場集中度

- 策略性舉措(併購、合資、產能擴張、合約)

- 市佔率分析

- 公司簡介

- Dover Corporation(Pump Solutions Group)

- IDEX Corporation(Viking Pump)

- Colfax Corporation(IMO/Allweiler)

- SPX Flow Inc.

- Xylem Inc.

- Atlas Copco AB

- Gardner Denver Holdings Inc.

- Pfeiffer Vacuum Technology AG

- ULVAC Inc.

- Busch SE

- Flowserve Corporation

- KSB SE & Co. KGaA

- Netzsch Pumpen & Systeme GmbH

- Alfa Laval AB

- PCM SA

- Seepex GmbH

- ITT Inc.

- Sulzer Ltd.

- DESMI A/S

- Kirloskar Brothers Ltd.

- Verder Group

- Roto Pumps Ltd.

- Tuthill Corporation

- Blackmer(PSG brand)

- Vogelsang GmbH & Co. KG

- Roper Technologies Inc.(Roper Pump Company)

- Leistritz AG

- Eureka Pumps AS

第8章:市場機會與未來展望

- 閒置頻段與未滿足需求評估

The rotary pumps market is valued at USD 11.2 billion in 2025 and is forecast to reach USD 16.7 billion by 2030, advancing at a 7.1% CAGR.

Rising brownfield upgrades across Middle East oil assets, China's record refining throughput, and Brazil's new-generation FPSOs are expanding demand for API-676 compliant units capable of handling high-viscosity and multiphase fluids. Strict clean-in-place mandates under the US Food Safety Modernization Act and Europe's hygienic directives spur uptake of food-grade gear and eccentric-disc designs. Energy-sector retrofit programs favour pump replacement studies that cut energy use and emissions, while petrochemical operators integrate rotary pumps with smart sensors to improve uptime and reduce flaring. Technology upgrades toward dry-gas or seal-less configurations help users meet tightening VOC rules, and aftermarket opportunities grow as 26-year FPSO charters guarantee long service contracts.

Global Rotary Pumps Market Trends and Insights

Energy-sector brownfield upgrades

Middle East national oil companies are modernizing mature fields to extend asset life and sustain production. Kuwait Oil Company is overhauling 14 gathering centers in Greater Burgan with new separation trains that need rotary pumps tolerant of emulsions and high sand content. Abu Dhabi Marine Operating Company is modifying the Zakum West and Central super complexes to keep 425,000 barrels per day flowing, which requires pumps engineered for variable viscosity crude under corrosive offshore conditions. Saudi Aramco optimised stabilizer bottom pumps at the Khurais central plant, cutting energy while processing 1,263,000 barrels per day. These retrofits specify API-676 compliant twin-screw and gear pumps with upgraded metallurgy and variable-speed drives that manage polymer-rich fluids and steam-injection temperatures. Suppliers gain aftermarket revenues from swap-out programs that replace decades-old units with digitally monitored models.

Petrochemical capacity additions

China processed 14.8 million barrels per day of crude in 2024 and keeps adding integrated refinery-petrochemical complexes, including the 400,000 barrels per day Yulong project scheduled for 2025. Such hubs rely on rotary pumps for naphtha hydrotreating, LPG transfer, and polymer feed handling where downtime cascades across the site. India plans USD 142 billion in petrochemical investment that will push capacity to 46 million tonnes by 2030, highlighted by Nayara Energy's USD 8 billion ethane cracker at Vadinar. Public refiners IndianOil, BPCL, and HPCL are each adding polypropylene trains that demand screw and gear pumps able to handle molten monomers at 240 °C. All-electric refinery concepts and zero-flaring mandates drive adoption of seal-less magnetic-drive units that curb fugitive emissions.

Availability of low-cost counterfeit spares from unorganised Asian vendors

Uncertified impellers, bushings, and seal kits entering supply chains threaten safety and shorten mean-time-between-failure. ADMA-OPCO's counterfeit-prevention program trains inspectors and locks vendors to approved lists. Chinese OEMs still invest less than 2% of sales in RandD, constraining quality upgrades that could combat counterfeit perception gaps. Buyers choose imported pumps, reinforcing a grey market where fake parts appear genuine and undermine warranties.

Other drivers and restraints analyzed in the detailed report include:

- Recovery of offshore FPSO construction

- Food-grade gear pump uptake under FSMA

- Strict VOC-emission rules limiting mechanical-seal selection for rotary pumps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

External-gear pumps held 32% of the rotary pumps market share in 2024 due to their robust design for medium-viscosity duties. Twin-screw units deliver the fastest 7.71% CAGR as FPSO topsides and polymer services need smooth flow with minimal pulsation. From 2019-2024, external-gear variants posted 3.2% annual growth, while twin-screw advanced at 6.8%, reflecting a shift toward higher performance. Internal-gear crescent pumps cater to confectionery and pharma batches that demand gentle handling. Vane pumps continue in automotive lube circuits but face energy-efficiency pressure. The rise of IIoT-ready gearboxes lets operators monitor clearances and adjust speed to avoid cavitation.

Adoption of twin-screw assemblies in enhanced oil recovery improves shear tolerance and gas-locking resistance. SMU-coded API-676 machines run at lower RPM, extending seal life. Integration with cloud analytics flags wear well before flow-rate drift, cutting unplanned downtime. OEMs differentiate with HVOF-coated rotors that survive polymer abrasives. External-gear models remain favoured in cost-sensitive blender skids were standardised parts lower maintenance. Patent activity focuses on helical screw profiles that reduce noise and allow higher discharge pressures without increasing footprint.

The oil and gas segment retained 27.5% share of the rotary pumps market in 2024 as refineries, pipelines, and tank farms demand API-compliant equipment. However, food and beverage post the quickest 7.91% CAGR through 2030 as FSMA and EC1935 rules tighten hygiene expectations. From 2019-2024, oil and gas grew 4.1% annually, while food and beverage rose 6.9%. Power generation also lifts demand, illustrated by Flowserve's >USD 100 million nuclear orders in three straight quarters. Chemical and petrochemical operators specify seal-less pumps that handle corrosive monomers at temperatures above 200 °C.

Food processors switch to stainless internal-gear pumps for chocolate and syrup transfer, citing 50% productivity gains at Midleton Distilleries. Craft brewers in Europe adopt low-shear lobe pumps from INOXPA that sustain yeast viability. Water utilities evaluate rotary lobe blowers that cut energy by 30%, but high-speed turbos compete on large plants. Petrochemical majors integrate rotary pumps with digital twins to simulate cavitation and schedule maintenance around cracker turnarounds.

Rotary Pumps Market Report is Segmented by Type (External-Gear, Internal-Gear, and More), End-User Industry (Oil and Gas, Power Generation, and More), Discharge Pressure (Up To 10 Bar, 10-25 Bar, 25-100 Bar, Above 100 Bar), Pump Capacity (Up To 50, 51-150, 151-500, Above 500), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 38.4% share of the rotary pumps market in 2024, led by China's sale of more than 13.5 million pump units yearly. Beijing's subsidies for energy-efficient gear drives and urban water projects underpin demand. India's USD 142 billion petrochemical plan lifts domestic pump manufacturing and draws global OEM licensing deals. Japan supplies precision metering pumps for semiconductor rinse lines, while South Korea's shipyards adopt API-676 twin-screw units for VLCC engine rooms.

The Middle East posts the fastest 7.81% CAGR as Kuwait and Abu Dhabi upgrade separation trains and Saudi Aramco cuts energy via pump rerates. Brownfield work favours screw pumps that handle sand-laden emulsions without cavitation. QatarGas invests in low-flow internal-gear pumps for LNG boil-off, tackling methane regulations. National champions create local-content thresholds that drive new assembly hubs in Dammam and Muscat.

North America is a mature but technologically advanced market. FSMA rules raise gear-pump sales in dairy and brewing, while shale producers fit magnetically coupled pumps to curb VOCs. Sulzer invested CHF 10 million in Easley, South Carolina, adding submersible lines to meet Build America mandates. Canada's oil-sands operators swap diluent pumps for twin-screw models that handle 30% gas volume fraction at sub-zero temperatures.

Europe emphasizes emissions. Revised TA-Luft pushes refineries toward dry-gas seals, and the region's craft breweries adopt hygienic rotary lobe pumps. Norway's electrified offshore fields specify seal-less water-injection pumps to limit methane. EU grants under Horizon programs support digital-twin research for chemical pumps.

South America benefits from Brazil's USD 8 billion FPSO spree. Local content at 25% on P-85 lifts demand for Brazilian-machined casings. Argentina's Vaca Muerta shale develops gas-processing plants that need high-pressure screw pumps. Colombia's biodiesel expansion installs stainless steel gear pumps for palm oil feedstock.

Sub-Saharan Africa grows from a small base but faces maintenance skill gaps that limit adoption of advanced screw pumps. Nigerian modular refineries choose low-cost external-gear units, while South Africa's mining pumps retrofit IIoT sensors to combat theft.

- Dover Corporation (Pump Solutions Group)

- IDEX Corporation (Viking Pump)

- Colfax Corporation (IMO / Allweiler)

- SPX Flow Inc.

- Xylem Inc.

- Atlas Copco AB

- Gardner Denver Holdings Inc.

- Pfeiffer Vacuum Technology AG

- ULVAC Inc.

- Busch SE

- Flowserve Corporation

- KSB SE & Co. KGaA

- Netzsch Pumpen & Systeme GmbH

- Alfa Laval AB

- PCM SA

- Seepex GmbH

- ITT Inc.

- Sulzer Ltd.

- DESMI A/S

- Kirloskar Brothers Ltd.

- Verder Group

- Roto Pumps Ltd.

- Tuthill Corporation

- Blackmer (PSG brand)

- Vogelsang GmbH & Co. KG

- Roper Technologies Inc. (Roper Pump Company)

- Leistritz AG

- Eureka Pumps AS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

5 MARKET OVERVIEW

- 5.1 Market Drivers

- 5.1.1 Energy-sector brown-field upgrades driving high-viscosity fluid handling demand (Middle East)

- 5.1.2 Petrochemical capacity additions in China and India requiring API-676 compliant rotary pumps

- 5.1.3 Recovery of offshore FPSO construction in Brazil boosting twin-screw pump orders

- 5.1.4 Food-grade gear pump uptake amid U.S. FSMA clean-in-place mandates

- 5.1.5 Rising European craft-brewery installations favoring low-shear lobe pumps

- 5.2 Market Restraints

- 5.2.1 Availability of low-cost counterfeit spares from unorganised Asian vendors

- 5.2.2 Strict VOC-emission rules limiting mechanical-seal selection for rotary pumps in EU

- 5.2.3 High upfront cost versus centrifugal alternatives in municipal water plants

- 5.2.4 Skilled-labour shortage for screw-pump maintenance in Sub-Saharan Africa

- 5.3 Value / Supply-Chain Analysis

- 5.4 Regulatory or Technological Outlook

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitutes

- 5.5.5 Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Type

- 6.1.1 External-Gear

- 6.1.2 Internal-Gear

- 6.1.3 Twin-Screw

- 6.1.4 Triple-Screw

- 6.1.5 Vane

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas (Upstream, Midstream, Downstream)

- 6.2.2 Power Generation (Conventional, Nuclear, Renewables)

- 6.2.3 Chemicals and Petrochemicals

- 6.2.4 Food and Beverage

- 6.2.5 Water and Waste-water

- 6.3 By Discharge Pressure

- 6.3.1 Up to 10 bar

- 6.3.2 10-25 bar

- 6.3.3 25-100 bar

- 6.3.4 Above 100 bar

- 6.4 By Pump Capacity (m3/h)

- 6.4.1 Up to 50

- 6.4.2 51-150

- 6.4.3 151-500

- 6.4.4 Above 500

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 South Korea

- 6.5.3.5 Rest of Asia-Pacific

- 6.5.4 Middle East

- 6.5.4.1 Israel

- 6.5.4.2 Saudi Arabia

- 6.5.4.3 United Arab Emirates

- 6.5.4.4 Turkey

- 6.5.4.5 Rest of Middle East

- 6.5.5 Africa

- 6.5.5.1 South Africa

- 6.5.5.2 Egypt

- 6.5.5.3 Rest of Africa

- 6.5.6 South America

- 6.5.6.1 Brazil

- 6.5.6.2 Argentina

- 6.5.6.3 Rest of South America

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves (M&A, JV, Capacity Expansion, Contracts)

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 7.4.1 Dover Corporation (Pump Solutions Group)

- 7.4.2 IDEX Corporation (Viking Pump)

- 7.4.3 Colfax Corporation (IMO / Allweiler)

- 7.4.4 SPX Flow Inc.

- 7.4.5 Xylem Inc.

- 7.4.6 Atlas Copco AB

- 7.4.7 Gardner Denver Holdings Inc.

- 7.4.8 Pfeiffer Vacuum Technology AG

- 7.4.9 ULVAC Inc.

- 7.4.10 Busch SE

- 7.4.11 Flowserve Corporation

- 7.4.12 KSB SE & Co. KGaA

- 7.4.13 Netzsch Pumpen & Systeme GmbH

- 7.4.14 Alfa Laval AB

- 7.4.15 PCM SA

- 7.4.16 Seepex GmbH

- 7.4.17 ITT Inc.

- 7.4.18 Sulzer Ltd.

- 7.4.19 DESMI A/S

- 7.4.20 Kirloskar Brothers Ltd.

- 7.4.21 Verder Group

- 7.4.22 Roto Pumps Ltd.

- 7.4.23 Tuthill Corporation

- 7.4.24 Blackmer (PSG brand)

- 7.4.25 Vogelsang GmbH & Co. KG

- 7.4.26 Roper Technologies Inc. (Roper Pump Company)

- 7.4.27 Leistritz AG

- 7.4.28 Eureka Pumps AS

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-Need Assessment