|

市場調查報告書

商品編碼

1851261

電動汽車電池系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Battery Systems For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

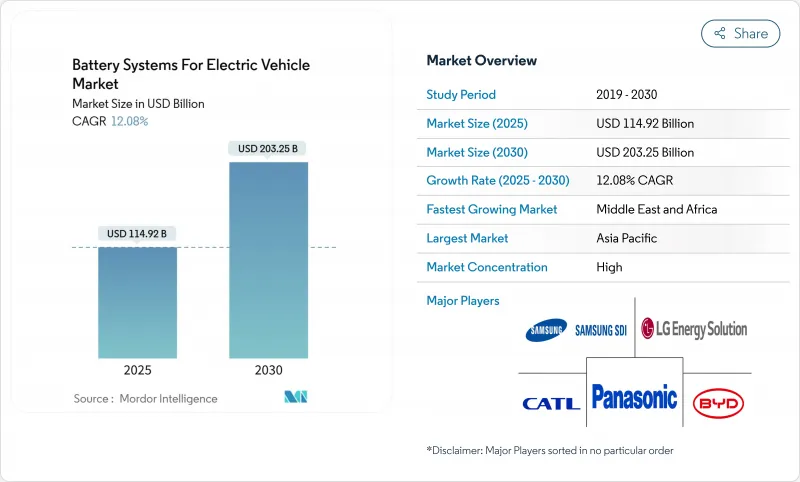

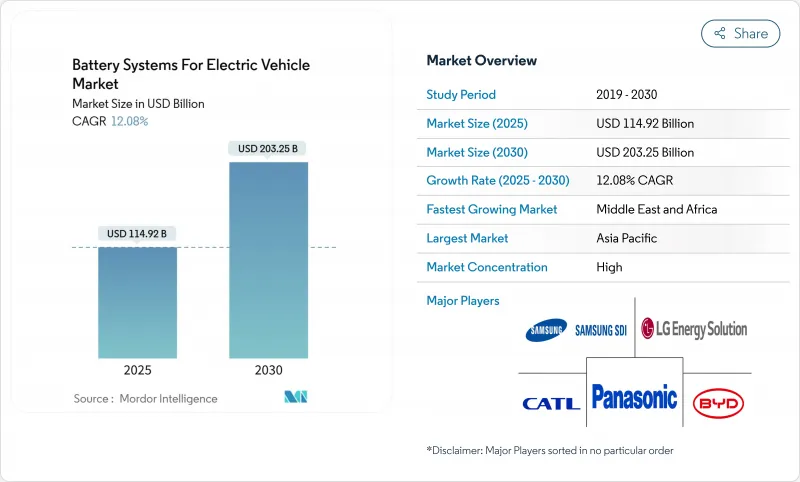

預計到 2025 年,電動車電池系統市場規模將達到 1,149.2 億美元,到 2030 年將擴大到 2,032.5 億美元,複合年成長率為 12.08%。

北美和歐洲的獎勵主導推廣目標、鋰離子電池化學成本的快速下降以及亞洲、北美和歐洲垂直整合的超級工廠的部署,都為這一擴張提供了支撐。固態電池技術的突破也為市場帶來益處,這些突破有望提高能量密度和安全性;同時,結合鋰離子、鈉離子和電容器的多化學電池組提供了更大的設計靈活性。儘管美國和歐盟的監管框架收緊了在地化含量限制,但中國製造商仍利用磷酸鋰鐵的成本優勢來擴大市場佔有率,競爭仍然激烈。供應鏈分化、熱失控召回事件以及關鍵礦物價格波動等因素雖然會抑制市場前景,但不會阻礙其持續成長的動能。

全球電動汽車電池系統市場趨勢與洞察

政府獎勵和零排放強制規定

法律規範透過設定電力傳動系統的最低銷量來加速需求成長。美國為符合條件的車輛提供高達7500美元的稅額扣抵,並逐年提高國產車輛的零件含量門檻。加州的「先進清潔汽車II」(Advanced Clean Car II)法規要求汽車製造商在2025年實現22%的零排放汽車銷量,並在2035年實現100%的零排放汽車銷量。英國強制要求到2030年電動車銷量佔比達到80%,而加拿大則力爭在2035年實現100%的電動車銷量。由於違規將面臨巨額罰款,大多數汽車製造商都簽訂了多年期的電池回收協議,從而為電池製造商提供了銷售量保障和現金流可見度。

鋰離子電池成本下降和能量密度提高

由於學習曲線效應和材料替代,成本持續下降。多家領先的電池製造商的目標是將電池組成本從2024年的每千瓦時118美元降至2026年的每千瓦時60美元以下。富矽負極可提高能量密度,使比容量提升25%至50%,而磷酸鋰鐵透過先進的塗層技術提高了體積能量密度。成本的快速下降擴大了目標市場,涵蓋入門級乘用車、摩托車和對成本敏感的商用車。

關鍵礦產的供應和價格波動

專注於上游精煉會使製造商面臨地緣政治風險。中國精煉了全球80%的磷酸鋰鐵正極材料,而鈷的主要產地只有一個國家。預計到2030年,鋰的需求將增加五倍,但礦場核准的延誤意味著價格波動正在擠壓電池製造商的淨利率。多元化措施需要數年才能見效,這增加了對關鍵供應商的依賴,並降低了價格的透明度。

細分市場分析

到2024年,鋰離子電池技術將佔據電動車電池系統市場94.12%的佔有率,並將在2030年之前保持銷量領先地位。電池組層面的快速創新正推動能量密度邁向300Wh/kg邁進,同時將成本降至60美元/kWh以下。該領域的製造生態系統涵蓋材料、電芯規格和回收流程,從而增強了規模優勢,並降低了新車製造商的准入門檻。

固態電池將以39.92%的複合年成長率(CAGR)實現最高成長,這主要得益於陶瓷隔膜能夠抑制枝晶生長,並將1000次循環後的容量損失限制在5%以內。其卓越的儲能能力使其能夠實現緊湊的電池組設計,從而釋放車內空間並減輕車輛重量,這對於高性能和遠距車型至關重要。固態電池的商業性化取決於自動化燒結和高壓層壓生產線的成熟,這些生產線預計將在本十年後半段將生產成本降低到與傳統鋰離子電池持平的水平。

到2024年,鎳錳鈷電池將佔據電動車電池系統市場規模的61.38%,並在對續航里程要求極高的高階乘用車和輕型卡車領域佔據主導地位。持續降低鈷含量和採用富錳配方有助於減少價格上漲和道德採購的風險。

磷酸鋰鐵因其安全性高、原料供應充足且成本低廉而迅速普及,在廉價型轎車和重型商用車領域均有應用。鈉離子電池以44.16%的複合年成長率成長,可在低至-40°C的溫度下工作,並能承受頻繁的快速充電循環。其近乎零鋰含量降低了價格風險,並有助於在鋰蘊藏量匱乏的地區利用國內資源。鈉離子和鋰離子混合電池組在保持性能的同時最佳化了成本,並且隨著能量密度達到200Wh/kg,它們構成了一種可以作為過渡到完全鈉離子電池架構的方案。

區域分析

由於從礦物加工到電池組裝和整車製造的穩定供應鏈,亞太地區將在2024年維持64.32%的電動車電池系統市場佔有率。光是中國一國就將在2030年前推動顯著成長,這主要得益於強勁的國內需求和出口激增,尤其是對東南亞和拉丁美洲的出口。日本將推進固體研究,而韓國將轉向高錳化學以重振競爭力。協調一致的政府獎勵和基礎建設支出將繼續加強區域生態系統。

北美將成為第二大市場,《通膨削減法案》將向清潔能源領域注入3,690億美元資金,提高關鍵礦產資源基準值,並打造一系列強勁的新型超級工廠和中游煉油計劃。同樣,在綠色新政協議和歐洲電池聯盟的推動下,歐洲正以9.40%的複合年成長率穩步發展。策略自主將推動由公私合營企業資助的在地化正極材料生產和電池組裝。德國正主導一項研究夥伴關係,以推動富矽負極材料的發展,而西班牙和法國則專注於大眾市場的磷酸鋰鐵。

中東和非洲地區正經歷最高的成長,複合年成長率達15.74%。沙烏地阿拉伯將投資60億美元建造一座綜合電池產業園區,以實現經濟多元化並確保下游汽車製造業的發展。阿拉伯聯合大公國的目標是到2035年達到25%的電動車普及率,並沿著酋長國間高速公路建造充電走廊。加納、摩洛哥和盧安達的早期計劃正受益於發展援助機構提供的優惠資金籌措和技術援助,這為非洲大陸二輪車和輕型商用車的區域電氣化奠定了基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府獎勵和零排放強制規定

- 鋰離子電池成本下降和能量密度提高

- OEM超級工廠建設及供貨協議

- 擴大快速充電網路

- Vehicle-to-Grid計畫將電池貨幣化

- 與電池健康分析相關的保險折扣

- 市場限制

- 關鍵礦產的供應和價格波動

- 熱失控召回和安全意識

- 貿易壁壘和本地化含量限制擾亂供應鏈

- LFP/Na離子化學回收經濟性的不確定性

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 電池製造能力分析

- 電池回收和二次利用分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依電池類型

- 鋰離子

- 鎳氫化物

- 鉛酸電池

- 超級電容器

- 固態及其他

- 電池化學

- NMC

- NCA

- LFP

- LMO

- 鈉離子和新興物質

- 按車輛類型

- 搭乘用車

- 商用車輛

- 透過推進技術

- 電池電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車(HEV)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 泰國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Contemporary Amperex Technology Co., Limited.(CATL)

- BYD Co. Ltd.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co., Ltd.

- SK On Co., Ltd.

- AESC Group Ltd.

- CALB

- Gotion High-tech Co., Ltd.

- EVE Energy Co., Ltd.

- Farasis Energy Europe GmbH

- Northvolt AB

- ProLogium Technology Co., Ltd

- QuantumScape Battery, Inc.

- Solid Power Inc.

- StoreDot

- SES AI Corp.

- Hitachi Energy Ltd.

- Johnson Controls International plc

第7章 市場機會與未來展望

The battery systems for electric vehicles market stands at USD 114.92 billion in 2025 and is forecast to climb to USD 203.25 billion by 2030, reflecting a 12.08% CAGR by 2030.

Incentive-driven adoption targets in North America and Europe, rapid cost declines in lithium-ion chemistry, and vertically integrated gigafactory roll-outs across Asia, North America, and Europe underpin this expansion. The market also benefits from solid-state break-throughs that promise higher energy density and safety, while multi-chemistry packs combining lithium-ion with sodium-ion or ultracapacitors widen design flexibility. Competitive intensity remains high as Chinese producers use lithium iron phosphate cost advantages to win share, even as regulatory frameworks in the United States and the European Union tighten local-content demands. Supply-chain bifurcation, thermal-runaway recalls, and critical-mineral volatility temper the outlook but do not derail the secular growth trajectory.

Global Battery Systems For Electric Vehicle Market Trends and Insights

Government Incentives and Zero-Emission Mandates

Regulatory frameworks accelerate demand by anchoring minimum sales volumes for electric drivetrains. The United States offers tax credits up to USD 7,500 per qualifying vehicle and escalates domestic-content thresholds each year. California's Advanced Clean Cars II rule obliges automakers to reach 22% zero-emission sales in 2025 and 100% by 2035. The United Kingdom mandates 80% electric sales by 2030, while Canada targets 100% by 2035. Because non-compliance triggers sizable penalties, most vehicle makers lock in multi-year battery offtake contracts, providing cell manufacturers with volume security and cash-flow visibility.

Declining Li-ion Costs and Energy Density Gains

Learning-curve effects and materials substitution continue to drive cost trajectories downward. Several top-tier cell makers aim to push pack costs below USD 60 per kWh by 2026, versus USD 118 per kWh in 2024. Energy density climbs through silicon-rich anodes that raise specific capacity by 25-50%, while lithium iron phosphate improves volumetric density with refined cathode coatings. Rapid cost declines widen the total addressable market into entry-level passenger cars, two-wheelers, and cost-sensitive commercial fleets.

Critical-Mineral Supply and Price Volatility

Concentration in upstream refining exposes manufacturers to geopolitical risk. China refines 80% of global lithium iron phosphate cathode material, while one country produces the majority of cobalt. Demand for lithium is expected to grow five-fold by 2030, yet mine approvals lag, forcing price swings that compress cell-maker margins. Diversification efforts require several years to materialize, extending dependence on dominant suppliers and undermining price visibility.

Other drivers and restraints analyzed in the detailed report include:

- OEM Giga-factory Build-outs and Supply Pacts

- Fast-charging Network Expansion

- Thermal-Runaway Recalls and Safety Perception

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-ion technology held 94.12% of the battery systems for electric vehicles market share in 2024 and remains the volume leader through 2030. Rapid pack-level innovation drives gravimetric densities toward 300 Wh/kg while trimming cost below USD 60 per kWh. The segment's entrenched manufacturing ecosystem spans materials, cell formats, and recycling streams, reinforcing scale advantages and lowering entry barriers for new vehicle OEMs.

Solid-state cells record the highest 39.92% CAGR, propelled by ceramic separators that curb dendrite growth and cut capacity fade to 5% after 1,000 cycles. Their superior energy storage enables compact pack designs that free cabin space and trim curb weight, key factors in high-performance or extended-range models. Commercial readiness hinges on automated sintering and high-pressure lamination lines that slash production cost to parity with conventional lithium-ion by the late decade.

Nickel manganese cobalt chemistry accounted for 61.38% of the battery systems for the electric vehicles market size in 2024, anchoring its position in premium passenger cars and light trucks that demand maximum range. Continuous cobalt-content reduction and manganese-rich formulations cut exposure to price spikes and ethical sourcing concerns.

Lithium iron phosphate rises sharply on the back of robust safety, abundant raw material supply, and lower cost, attracting budget segments and heavy-duty commercial vehicles. Sodium-ion cells, growing at 44.16% CAGR, unlock cold-temperature operation down to -40 °C and tolerate frequent fast-charge cycles. Their near-zero lithium content buffers price risk and allows domestic resource utilization in regions lacking lithium reserves. Hybrid packs combining sodium-ion and lithium-ion optimize cost while maintaining performance, creating an architecture bridge toward full sodium-ion transition once density reaches 200 Wh/kg.

The Battery Systems for Electric Vehicles Market Report is Segmented by Battery Type (Lithium-Ion, Nickel-Metal Hydride, and More), Battery Chemistry (NMC, NCA, LFP, and More), Vehicle Type (Passenger Cars and Commercial Vehicles), Propulsion Technology (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific maintained 64.32% share of the battery systems for electric vehicles market in 2024, anchored by an integrated supply chain that stretches from mineral processing through cell assembly to vehicle manufacturing. China alone supports a significant growth through 2030 as domestic demand remains strong and exports surge, particularly to Southeast Asia and Latin America. Japan advances solid-state research while Korea pivots toward high-manganese chemistries to regain competitiveness. Government incentive alignment and coordinated infrastructure spending continue to reinforce the regional ecosystem.

North America registers the second-largest market, the Inflation Reduction Act channels USD 369 billion in clean-energy funding and sets escalating critical-mineral thresholds, creating a robust pipeline of new gigafactories and mid-stream refining projects. Similarly, Europe advances at 9.40% CAGR on the back of its Green Deal policies and the European Battery Alliance. Strategic autonomy drives localized cathode production and cell assembly funded by public-private joint ventures. Germany leads research partnerships that push silicon-rich anodes, whereas Spain and France focus on mass-market lithium iron phosphate.

The Middle East & Africa region posts the highest regional growth at 15.74% CAGR. Saudi Arabia invests USD 6 billion in an integrated battery complex to diversify its economy and secure downstream automotive manufacturing. The United Arab Emirates targets 25% electric vehicle penetration by 2035, anchoring charging-corridor build-outs along inter-emirate highways. Early-stage projects in Ghana, Morocco, and Rwanda benefit from concessional finance and development-agency technical assistance, positioning the continent for localized two-wheeler and light-commercial electrification.

- Contemporary Amperex Technology Co., Limited. (CATL)

- BYD Co. Ltd.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co., Ltd.

- SK On Co., Ltd.

- AESC Group Ltd.

- CALB

- Gotion High-tech Co., Ltd.

- EVE Energy Co., Ltd.

- Farasis Energy Europe GmbH

- Northvolt AB

- ProLogium Technology Co., Ltd

- QuantumScape Battery, Inc.

- Solid Power Inc.

- StoreDot

- SES AI Corp.

- Hitachi Energy Ltd.

- Johnson Controls International plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt incentives and zero-emission mandates

- 4.2.2 Declining Li-ion costs and energy density gains

- 4.2.3 OEM giga-factory build-outs and supply pacts

- 4.2.4 Fast-charging network expansion

- 4.2.5 Vehicle-to-grid programs monetizing batteries

- 4.2.6 Insurance discounts linked to battery-health analytics

- 4.3 Market Restraints

- 4.3.1 Critical-mineral supply and price volatility

- 4.3.2 Thermal-runaway recalls and safety perception

- 4.3.3 Trade barriers and local-content rules disrupting supply chains

- 4.3.4 Uncertain recycling economics for LFP / Na-ion chemistries

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Battery Manufacturing Capacity Analysis

- 4.8 Battery Recycling and Second-Life Analysis

- 4.9 Porter's Five Forces

- 4.9.1 Threat of New Entrants

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Bargaining Power of Suppliers

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Nickel-metal-hydride

- 5.1.3 Lead-acid

- 5.1.4 Ultracapacitors

- 5.1.5 Solid-state and others

- 5.2 By Battery Chemistry

- 5.2.1 NMC

- 5.2.2 NCA

- 5.2.3 LFP

- 5.2.4 LMO

- 5.2.5 Sodium-ion and emerging

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Propulsion Technology

- 5.4.1 Battery Electric Vehicle (BEV)

- 5.4.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.4.3 Hybrid Electric Vehicle (HEV)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Russia

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Thailand

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Contemporary Amperex Technology Co., Limited. (CATL)

- 6.4.2 BYD Co. Ltd.

- 6.4.3 LG Energy Solution Ltd.

- 6.4.4 Panasonic Holdings Corporation

- 6.4.5 Samsung SDI Co., Ltd.

- 6.4.6 SK On Co., Ltd.

- 6.4.7 AESC Group Ltd.

- 6.4.8 CALB

- 6.4.9 Gotion High-tech Co., Ltd.

- 6.4.10 EVE Energy Co., Ltd.

- 6.4.11 Farasis Energy Europe GmbH

- 6.4.12 Northvolt AB

- 6.4.13 ProLogium Technology Co., Ltd

- 6.4.14 QuantumScape Battery, Inc.

- 6.4.15 Solid Power Inc.

- 6.4.16 StoreDot

- 6.4.17 SES AI Corp.

- 6.4.18 Hitachi Energy Ltd.

- 6.4.19 Johnson Controls International plc

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment