|

市場調查報告書

商品編碼

1851237

汽車連接器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

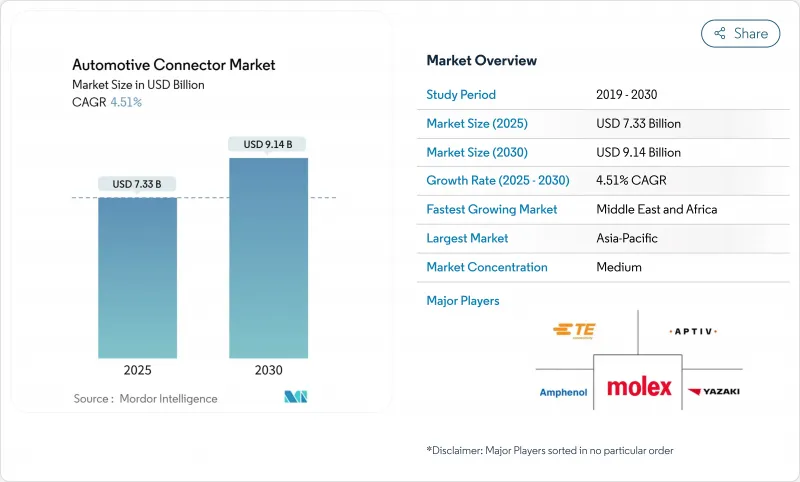

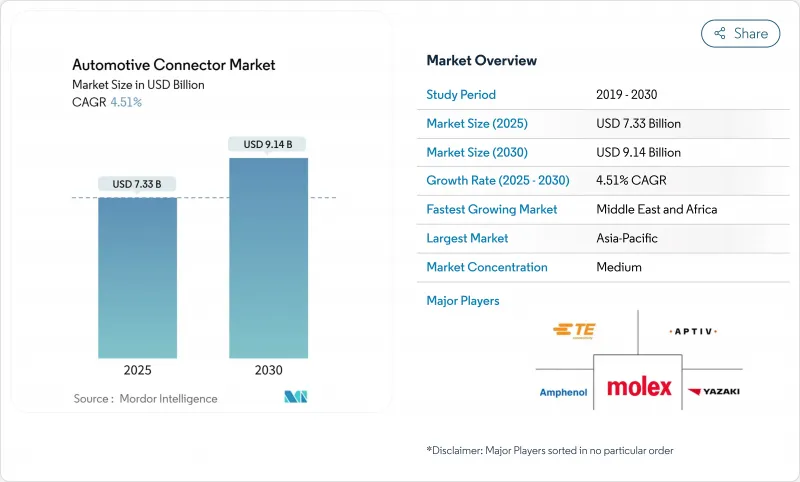

預計到 2025 年,汽車連接器市場規模將達到 73.3 億美元。

預計到 2030 年,該市場規模將達到 91.4 億美元,年複合成長率為 4.51%,因為汽車平台正在向電氣化和軟體定義架構轉型。

這是因為與內燃機動力傳動系統相關的需求趨於平穩,而高壓高速資料互連的需求卻在不斷成長。從分散式ECU向分區電子結構的轉變正在縮短線束長度並減輕車輛重量。日益複雜的連接器使那些不具備高密度混合訊號能力的傳統供應商面臨被淘汰的風險。更嚴格的安全法規、資料豐富的ADAS功能以及800V電池系統正在推動對密封式高性能介面的需求成長,這些介面能夠傳輸電力和多Gigabit訊號,同時滿足IP67/IP6K9K標準。隨著OEM廠商對容錯鏈路、空中升級和網路安全資料路徑的需求不斷成長,那些能夠將半導體級製造精度與軟體整合支援相結合的供應商將成為最終的贏家。

全球汽車連接器市場趨勢與洞察

加速電氣化和高壓電動動力傳動系統總成

向 48V 和 800V 電氣架構的轉變從根本上改變了連接器的要求,以支援電動渦輪增壓、能量回收煞車以及超越傳統 12V 系統的高功率充電功能。 Aptiv 的高壓互連產品目前支援 400V 至 1000V 的電壓範圍,電流承載能力高達 250A,滿足了產業向更快充電和更高效率轉型的需求。

48V輕混系統的出現帶來了雙電壓架構的挑戰,對連接器提出了更高的要求,以安全地分離和管理12V舊有系統和48V電源傳輸網路。 TE Connectivity的AMP+HVA 280系統正是這一發展趨勢的體現,它整合了高壓互鎖和兩級浮動鎖存器,可在高達850V的應用中提供更高的安全性。隨著這股電氣化浪潮從乘用車擴展到商用車,伊頓的電源連接解決方案能夠實現大型應用中的高效能傳輸,並支援更廣泛的交通電氣化需求。在單一車輛內管理多個電壓域的複雜性,推動了對能夠保持隔離、提供診斷功能並確保在各種運行條件下故障安全運行的精密連接器系統的需求。

加強全球安全和排放法規

法律規範日益強制要求配備先進的安全系統,例如歐盟要求新車必須具備自動緊急煞車和前向碰撞警報,這直接推動了連接器對感測器整合和即時數據處理的需求。美國國家公路交通安全管理局 (NHTSA) 推動的車對車通訊標準也對能夠支援 5.9GHz DSRC 和蜂窩 V2X通訊協定的高頻率、低延遲連接器提出了新的要求。 CISPR 25 電磁相容性標準也日益嚴格,尤其是在 10GHz 以上的傳導輻射方面,這迫使連接器製造商整合先進的屏蔽和濾波功能。

隨著軟體定義汽車的普及,這些需求也日益凸顯,因為空中升級和持續監控系統需要具備更高訊號完整性和網路安全安全功能的連接器。中國的新能源汽車指令和加州的先進清潔汽車II法規在連接器規格方面造成了區域差異,尤其是在電池管理系統和充電基礎設施方面,這迫使全球供應商開發能夠適應不同法規環境且兼顧成本效益的平台靈活解決方案。

銅和金屬商品價格波動劇烈

供應緊張以及可再生能源和電動汽車行業需求的激增推高了銅價,給汽車連接器供應鏈帶來了巨大的成本壓力。電動車所需的銅遠高於傳統的內燃機汽車,每輛電動車大約需要83公斤銅,而傳統汽車只需23公斤。 Copperweld的雙金屬解決方案,包括銅包鋁和銅包鋼導體,預計在保持電氣性能的同時,將銅的使用量減少高達83%。銅礦開採集中在政治不穩定的地區,進一步加劇了供應鏈風險。同時,貿易摩擦和出口限制進一步加劇了價格波動,迫使汽車原始設備製造商(OEM)實施套期保值策略和簽訂長期供應契約,這可能會限制其在連接器採購和設計最佳化方面的靈活性。

細分市場分析

到2024年,動力傳動系統應用仍將佔據汽車連接器市場33.60%的最大佔有率,這反映出引擎管理、變速箱控制和燃油噴射系統在內燃機和混合動力傳動系統中仍然至關重要。然而,在監管機構對先進安全功能的要求以及行業向更高水平車輛自動化邁進的推動下,高級駕駛輔助系統(ADAS)和自動駕駛系統將成為成長最快的細分市場,2025年至2030年的複合年成長率將達到17.8%。

隨著安全氣囊系統、電子穩定控制系統和碰撞避免技術的日益整合,安全應用將受益匪淺。同時,車身線束和配電系統也將適應區域架構的實施,將多種功能整合到更少、更精密的控制單元中。隨著消費者對高階配置的期望在所有車型領域不斷提高,舒適性、便利性和娛樂系統也將穩步成長。同時,導航和儀表應用也將不斷發展,以支援高解析度顯示器和擴增實境介面。

電動車專用充電和能量管理應用的出現,代表著傳統汽車連接器市場中一個全新的類別,凸顯了產業向電動動力傳動系統總成轉型的根本性轉變。這種細分市場的轉變反映了汽車系統從機械系統向電子系統的更廣泛過渡,傳統的動力傳動系統,因為這些系統需要同時即時處理來自多個感測器來源的資料。

到2024年,乘用車將佔據汽車連接器市場54.20%的佔有率,這得益於其高產量和單車電子含量的不斷提高。然而,摩托車將成為成長最快的細分市場,到2030年複合年成長率將達到11.5%。輕型商用車的需求將保持穩定,這主要得益於電子商務的成長和最後一公里配送的最佳化。同時,中型和重型商用車對先進車載資訊服務和車輛管理系統的需求日益成長,這需要堅固耐用、高性能的連接器解決方案。這些應用需要達到IP67/IP6K9K防護等級,並且能夠在遠超乘用車要求的極端溫度範圍內運行,因此商用車領域正在推動連接器耐久性和環境適應性的創新。

摩托車的成長反映了都市化趨勢以及監管機構對擁擠城市中心電動交通的支持,從而催生了對小型、輕巧且針對空間受限應用最佳化的連接器的需求。隨著營運商努力降低營運成本並遵守排放法規,商用車電氣化正在加速。這推動了對支援快速充電和高能量密度電池系統的高壓連接器的需求。隨著自動駕駛技術沿著不同的發展路徑前進,乘用車和商用車之間的差異將變得越來越重要,由於可控的駕駛環境和專用基礎設施投資,商用車應用可能會更快地實現更高水準的自動化。

區域分析

亞太地區將繼續保持領先地位,預計到2024年將佔據汽車連接器市場38.60%的佔有率。這主要得益於其密集的電子供應鏈、全球最大的汽車產量以及各國支持電動車和電動巴士的政策。中國汽車製造商正在自主生產線束,並邀請二線連接器廠商在技術轉移條款的框架下成立本地合資企業。日本現有企業正在推廣CASE項目,例如住友商事的“30VISION”,並推出針對800V平台最佳化的緊湊型、低插入力連接器。韓國供應商正將其電池技術應用於支援電芯到電池組架構的大電流基板端子。東南亞國家通用壓接的人事費用較低,但由於市場對能夠抵禦熱帶暴雨的IP67防護等級連接器的需求不斷成長,東南亞汽車連接器市場正在價格分佈擴張。

中東和非洲地區目前規模較小,但隨著主權財富基金建造電動車工廠和充電走廊,預計2030年將達到15.20%的複合年成長率。沙烏地阿拉伯正在培育電動車叢集,並優先在當地採購高壓電纜。利奧尼位於阿加迪爾的新工廠代表了北非地區線束產業的發展動能。極端高溫和粉塵環境推動了對耐高溫液晶聚合物(LCP)外殼和增強型墊片法蘭的需求。區域性含量法規鼓勵跨國公司對國產聚合物化合物進行認證,這提高了靈活性,但也增加了重複檢驗的必要性。

北美和歐洲是成熟且充滿創新活力的地區。美國原始設備製造商 (OEM) 正在將免手動 3 級晶片組整合到高階車型中,推動了 20Gbps 板級連接器和矽級潔淨室製程的供應。歐洲的氣候目標正在加速 400kW 快速充電站的建設,並強制要求使用內建溫度感測器的 1000V 接觸器。 TE Connectivity 的綠色庫存計劃可重複利用過剩庫存,從而減少廢棄物掩埋和碳排放。 2024 年供應鏈衝擊促使鍍錫和塑膠成型製程回流國內,確保了汽車連接器市場的策略自主性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速電氣化和更高電壓的電動動力傳動系統

- 快速普及ADAS和自動駕駛功能

- 軟體定義車輛需要高速資料鏈路。

- 加強全球安全和排放法規

- 向分區式電子/電氣架構的轉變將推動更高密度連接器的發展。

- 車載資訊娛樂和連接單元的普及

- 市場限制

- 銅和金屬商品價格波動

- 高性能樹脂(PPS、LCP)短缺

- 嚴苛汽車環境下的可靠性挑戰

- 超過 10Gbps 訊號傳輸速度下的電磁干擾合規性挑戰

- 價值/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(單位:美元)

- 透過使用

- 動力傳動系統

- 安全保障

- 車身線路和電源分配

- 舒適、便利和娛樂

- 導航與儀器

- 高級駕駛輔助系統與自主系統

- 充電和能源管理(電動車)

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型和重型商用車輛

- 摩托車

- 巴士和長途客車

- 依推進類型

- 內燃機(ICE)汽車

- 混合動力電動車(HEV)

- 插電式混合動力汽車(PHEV)

- 電池電動車(BEV)

- 燃料電池電動車(FCEV)

- 依連接器類型

- 線對線

- 線對基板

- 基板

- iO 和循環

- FFC/FPC 和微型

- 高速/高電壓

- 連接密封件不包含在內

- 密封

- 不防水

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 印尼

- 越南

- 菲律賓

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- TE Connectivity Ltd

- Yazaki Corporation

- Aptiv PLC

- Molex Inc.(Koch Industries)

- Sumitomo Wiring Systems Ltd

- Luxshare Precision Industry Co., Ltd

- Hirose Electric Co., Ltd

- JST Mfg Co., Ltd

- Amphenol Corporation

- Furukawa Electric Co., Ltd

- Rosenberger Hochfrequenztechnik GmbH

- Leoni AG

第7章 市場機會與未來展望

The automotive connector market size stands at USD 7.33 billion in 2025. It is forecast to reach USD 9.14 billion by 2030, advancing at a 4.51% CAGR as vehicle platforms move toward electrified and software-defined architectures.

Growth remains moderate on the surface, yet the mix changes quickly: demand linked to internal-combustion powertrains plateaus while high-voltage and high-speed data interconnects scale up. The shift from distributed ECUs to zonal electronic structures compresses harness length, trimming vehicle weight. It raises connector complexity, creating displacement risk for legacy suppliers that lack high-density, mixed-signal capabilities. Rigorous safety regulations, data-rich ADAS features, and 800 V battery systems propel orders for sealed, high-performance interfaces that carry power and multi-gigabit signals while meeting IP67/IP6K9K ratings. Suppliers that combine semiconductor-grade manufacturing precision with software integration support are positioned to win as OEMs demand fault-tolerant links, over-the-air updatability, and cyber-secure data paths.

Global Automotive Connector Market Trends and Insights

Accelerating Electrification and Higher-Voltage E-Powertrains

The transition to 48V and 800V electrical architectures fundamentally reshapes connector requirements, moving beyond traditional 12V systems to support electric turbocharging, regenerative braking, and high-power charging capabilities. Aptiv's high-voltage interconnects now support voltage ranges from 400V to 1000V with current capacities up to 250A, addressing the industry's shift toward faster charging and improved efficiency.

The emergence of 48V mild hybrid systems creates a dual-voltage architecture challenge, requiring connectors to safely isolate and manage 12V legacy systems and 48V power delivery networks. TE Connectivity's AMP+ HVA 280 system exemplifies this evolution, featuring integrated high-voltage interlocks and two-stage floating latches for enhanced safety in applications up to 850V. This electrification wave extends beyond passenger vehicles to commercial fleets, where Eaton's power connection solutions enable efficient energy transfer in heavy-duty applications, supporting the broader transportation electrification mandate. The complexity of managing multiple voltage domains within a single vehicle drives demand for sophisticated connector systems that can maintain isolation, provide diagnostic capabilities, and ensure fail-safe operation across diverse operating conditions.

Stricter Global Safety and Emission Mandates

Regulatory frameworks increasingly mandate advanced safety systems, with the EU requiring autonomous emergency braking and forward collision warning in new vehicles, directly driving connector demand for sensor integration and real-time data processing. The NHTSA's push for vehicle-to-vehicle communication standards creates new requirements for high-frequency, low-latency connectors capable of supporting 5.9 GHz DSRC and cellular V2X protocols. CISPR 25 electromagnetic compatibility standards have become increasingly stringent, particularly for conducted emissions above 10 GHz, forcing connector manufacturers to integrate advanced shielding and filtering capabilities.

The shift toward software-defined vehicles amplifies these requirements, as over-the-air updates and continuous monitoring systems demand connectors with enhanced signal integrity and cybersecurity features. China's New Energy Vehicle mandate and California's Advanced Clean Cars II regulation create regional variations in connector specifications, particularly for battery management systems and charging infrastructure, requiring global suppliers to develop platform-flexible solutions that can adapt to diverse regulatory environments while maintaining cost efficiency.

Volatile Copper and Metal Commodity Prices

Copper prices are rising, driven by supply constraints and surging demand from renewable energy and electric vehicle sectors, creating significant cost pressures across the automotive connector supply chain. Electric vehicles require significantly more copper than traditional ICE vehicles, with each EV containing approximately 83 kilograms of copper compared to 23 kilograms in conventional vehicles, amplifying the impact of price volatility on automotive connector costs. Copperweld's bimetallic solutions, including Copper-Clad Aluminum and Copper-Clad Steel conductors, offer potential alternatives that can reduce copper usage by up to 83% while maintaining electrical performance characteristics. The concentration of copper mining in politically unstable regions creates additional supply chain risks. At the same time, trade tensions and export restrictions further exacerbate price volatility, forcing automotive OEMs to implement hedging strategies and long-term supply contracts that may limit flexibility in connector sourcing and design optimization.

Other drivers and restraints analyzed in the detailed report include:

- Surge in In-Vehicle Infotainment and Connectivity Units

- Rapid ADAS and Autonomous Functionality Penetration

- Shortage of High-Performance Resins (PPS, LCP)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powertrain applications maintain the largest market share at 33.60% of the automotive connector market size in 2024, reflecting the continued importance of engine management, transmission control, and fuel injection systems across both ICE and hybrid powertrains. However, ADAS and autonomous systems emerge as the fastest-growing segment at 17.8% CAGR from 2025-2030, driven by regulatory mandates for advanced safety features and the industry's progression toward higher levels of vehicle automation.

Safety and security applications benefit from the increasing integration of airbag systems, electronic stability control, and collision avoidance technologies. At the same time, body wiring and power distribution segments adapt to zonal architecture implementations that consolidate multiple functions into fewer, more sophisticated control units. Comfort, convenience, and entertainment systems experience steady growth as consumer expectations for premium features expand across all vehicle segments. At the same time, navigation and instrumentation applications evolve to support high-resolution displays and augmented reality interfaces.

The emergence of charging and energy management applications specifically for electric vehicles represents a new category that didn't exist in traditional automotive connector markets, highlighting the industry's fundamental transformation toward electrified powertrains. This segmentation shift reflects the broader transition from mechanical to electronic vehicle systems, where traditional powertrain connectors face displacement by high-voltage, high-current solutions capable of managing battery systems, DC-DC converters, and regenerative braking networks. The rapid growth in ADAS applications creates opportunities for connector suppliers with expertise in high-frequency, low-latency transmission, as these systems require real-time processing of sensor data from multiple sources simultaneously.

Passenger cars command 54.20% of the automotive connector market share in 2024, benefiting from high production volumes and increasing electronic content per vehicle. Yet, two-wheelers represent the fastest-growing segment at 11.5% CAGR through 2030. Light commercial vehicles maintain steady demand driven by e-commerce growth and last-mile delivery optimization. Meanwhile, medium and heavy commercial vehicles increasingly adopt advanced telematics and fleet management systems that require ruggedized, high-performance connector solutions. The commercial vehicle segments drive innovation in connector durability and environmental resistance, as these applications demand IP67/IP6K9K ratings and operation across extreme temperature ranges that exceed passenger car requirements.

The growth in two-wheelers reflects urbanization trends and regulatory support for electric transportation in congested city centers, creating demand for compact, lightweight connectors optimized for space-constrained applications. Commercial vehicle electrification accelerates as fleet operators seek to reduce operating costs and meet emission regulations. This drives demand for high-voltage connectors supporting rapid charging and energy-dense battery systems. The segmentation between passenger and commercial vehicles becomes increasingly relevant as autonomous driving technologies develop along different trajectories, with commercial applications potentially achieving higher automation levels sooner due to controlled operating environments and dedicated infrastructure investments.

The Automotive Connector Market Report is Segmented by Application (Powertrain, Safety and Security, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion Type (ICE Vehicles, Hybrid Electric Vehicles, and More), Connector Type (Wire-To-Wire, Wire-To-Board, and More), Connection Sealing (Sealed and Unsealed), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained leadership with 38.60% of the automotive connector market revenue in 2024, thanks to dense electronics supply chains, the world's highest vehicle output, and state policies favoring electric cars and buses. Chinese OEMs build zonal harnesses in-house, pulling tier-two connector makers into local joint ventures under technology-transfer clauses. Japanese incumbents pursue CASE programs such as Sumitomo's "30VISION," launching compact, low-insertion-force models optimized for 800 V platforms. Korean suppliers channel battery know-how into high-current board terminals that support cell-to-pack architectures. Southeast Asian nations offer lower labor costs for commodity crimping yet increasingly demand IP67 ratings for tropical downpours, widening the automotive connector market across price tiers.

The Middle East and Africa, while small today, are poised for a 15.20% CAGR through 2030 as sovereign wealth funds seed electric-vehicle plants and charging corridors. Saudi Arabia bankrolls EV clusters and sources high-voltage cabling locally; Leoni's new Agadir plant exemplifies North-African wire harness momentum. Harsh heat and dust provoke demand for high-temperature LCP housings and reinforced gasket flanges. Regional content rules push multinationals to qualify domestic polymer compounds, adding resilience yet demanding duplicate validation runs.

North America and Europe represent mature but innovation-rich arenas. United States OEMs integrate hands-free Level 3 stacks on premium trims, spurring the supply of 20 Gbps board connectors and silicon-grade cleanroom processes. Europe's climate targets accelerate 400 kW fast-charge hubs, obliging 1,000 V contactors with embedded temperature sensors. Both regions chase circular-economy mandates; TE Connectivity's Green Stock program repurposes excess inventory, cutting landfill waste and carbon footprints. Supply chain shocks during 2024 catalyzed the on-shoring of tin plating and plastic molding to secure strategic autonomy within the automotive connector market.

- TE Connectivity Ltd

- Yazaki Corporation

- Aptiv PLC

- Molex Inc. (Koch Industries)

- Sumitomo Wiring Systems Ltd

- Luxshare Precision Industry Co., Ltd

- Hirose Electric Co., Ltd

- J.S.T. Mfg Co., Ltd

- Amphenol Corporation

- Furukawa Electric Co., Ltd

- Rosenberger Hochfrequenztechnik GmbH

- Leoni AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating electrification and higher-voltage e-powertrains

- 4.2.2 Rapid ADAS and autonomous functionality penetration

- 4.2.3 Software-defined vehicles requiring high-speed data links

- 4.2.4 Stricter global safety and emission mandates

- 4.2.5 Shift to zonal e/e architectures driving high-density connectors

- 4.2.6 Surge in in-vehicle infotainment and connectivity units

- 4.3 Market Restraints

- 4.3.1 Volatile copper and metal commodity prices

- 4.3.2 Shortage of high-performance resins (PPS, LCP)

- 4.3.3 Reliability challenges in harsh automotive environments

- 4.3.4 EMI compliance hurdles at more than 10 Gbps signal speeds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Powertrain

- 5.1.2 Safety and Security

- 5.1.3 Body Wiring and Power Distribution

- 5.1.4 Comfort, Convenience and Entertainment

- 5.1.5 Navigation and Instrumentation

- 5.1.6 ADAS and Autonomous Systems

- 5.1.7 Charging and Energy Management (EV)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Two-Wheelers

- 5.2.5 Bus and Coach

- 5.3 By Propulsion Type

- 5.3.1 Internal Combustion Engine (ICE) Vehicles

- 5.3.2 Hybrid Electric Vehicles (HEV)

- 5.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 5.3.4 Battery Electric Vehicles (BEV)

- 5.3.5 Fuel-Cell Electric Vehicles (FCEV)

- 5.4 By Connector Type

- 5.4.1 Wire-to-Wire

- 5.4.2 Wire-to-Board

- 5.4.3 Board-to-Board

- 5.4.4 I/O and Circular

- 5.4.5 FFC/FPC and Micro

- 5.4.6 High-Speed / High-Voltage

- 5.5 By Connection Sealing

- 5.5.1 Sealed

- 5.5.2 Unsealed

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Indonesia

- 5.6.4.6 Vietnam

- 5.6.4.7 Philippines

- 5.6.4.8 Australia

- 5.6.4.9 New Zealand

- 5.6.4.10 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Nigeria

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TE Connectivity Ltd

- 6.4.2 Yazaki Corporation

- 6.4.3 Aptiv PLC

- 6.4.4 Molex Inc. (Koch Industries)

- 6.4.5 Sumitomo Wiring Systems Ltd

- 6.4.6 Luxshare Precision Industry Co., Ltd

- 6.4.7 Hirose Electric Co., Ltd

- 6.4.8 J.S.T. Mfg Co., Ltd

- 6.4.9 Amphenol Corporation

- 6.4.10 Furukawa Electric Co., Ltd

- 6.4.11 Rosenberger Hochfrequenztechnik GmbH

- 6.4.12 Leoni AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment