|

市場調查報告書

商品編碼

1851235

自動化加氣混凝土(AAC):市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Autoclaved Aerated Concrete (AAC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

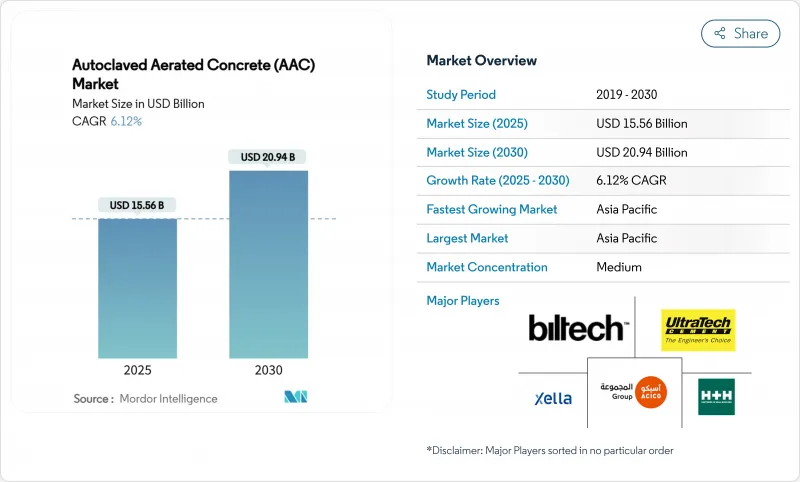

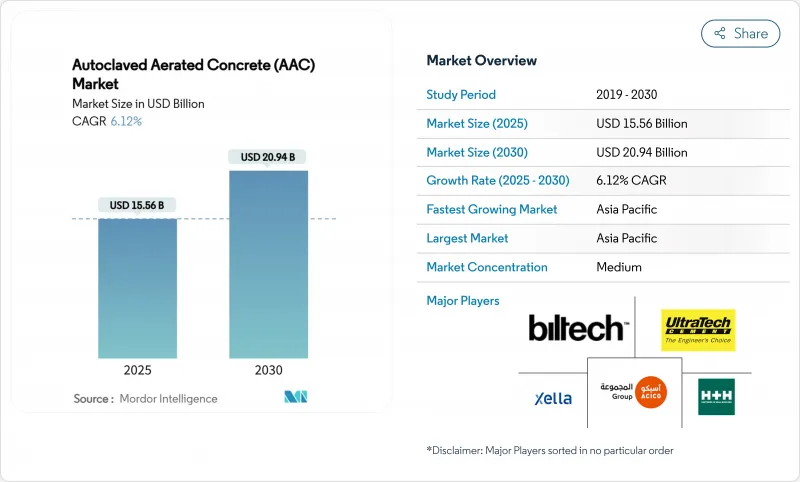

預計到 2025 年,高壓釜氣混凝土市場規模將達到 155.6 億美元,到 2030 年將達到 209.4 億美元,預測期(2025-2030 年)複合年成長率為 6.12%。

綠建築規範、對抗震結構日益成長的需求以及模組化建築的快速普及推動了加氣混凝土(AAC)的成長,這些因素都凸顯了AAC的輕質和節能特性。雖然砌塊仍然是傳統的砌磚材料,但隨著預製構件重新定義計劃工期,預製板的應用也日益普及。亞太地區的需求量佔全球近一半,這主要得益於都市化和基礎建設;而北美和歐洲則面臨嚴格的能源和抗震法規。製造商正在擴大產能並實現工廠自動化,以滿足激增的需求、最佳化成本結構並加強區域供應鏈。

全球自動化加氣混凝土(AAC)市場趨勢與洞察

新建和重建工程的需求不斷成長

新興經濟體住宅和商業建築的激增使得輕質材料對於降低地基荷載和縮短計劃至關重要。自動加氣混凝土(AAC)的重量可減輕30-40%,從而實現薄型化和更快的樓層間移動。印度的房屋建設蓬勃發展,本土製造商BigBloc Construction正在擴大產能,以滿足都市區日益成長的房屋批准需求。維修工程也青睞AAC,因為其精準的砌塊設計簡化了維修,且不會維修建築結構。其四小時的防火等級提高了商業維修的合規性,而其防黴基質則使其在潮濕氣候下更具吸引力。這些因素共同推動了自動加氣混凝土市場的持續成長。

嚴格的綠建築法規和LEED認證的採用

旨在減少建築隱含碳排放的政策正在改變世界各地的材料選擇。美國政府已撥款1.6億美元用於永續材料基準測試,明確鼓勵採用加氣混凝土(AAC)。美國環保署(EPA)的2024年低碳標籤為製造商提供了一條清晰的途徑來量化其氣候優勢,從而提高競標在公共計劃投標中的得分。 H+H美國的目標是到2050年實現淨零排放營運,與歐盟的脫碳目標保持一致。加氣混凝土厚度為200毫米,R值為1.43,可節省10-20%的營運能耗,並含有回收的飛灰,符合循環經濟標準。

與粘土塊和混凝土塊相比,初始成本較高

由於建築商優先考慮採購價格而非全生命週期成本節約,人們對加氣混凝土(AAC)價格較高的認知阻礙了其廣泛應用。然而,在印度主要城市,傳統紅磚的價格最近已比加氣混凝土高出約20%,促使買家轉向更輕的替代方案。 2025年關稅上調(鋼材價格將上漲10-25%,混凝土價格將上漲3-7%)縮小了加氣混凝土的成本差距。部分地區工廠數量有限,將導致交付價格上漲15-20%。宣傳宣傳活動強調加氣混凝土可節能30%並減少勞動成本,正逐步改變採購決策,使其更重視整體擁有成本。

細分市場分析

到2024年,砌塊將佔總銷售額的54.78%,這反映了承包商數十年來對其的熟悉程度以及廣泛的分銷網路。同時,隨著建築商轉向預製外牆,到2030年,板材的複合年成長率將達到7.81%。板材的蓬勃發展體現了建設產業日益工業化的趨勢。工廠預製的模組運抵現場即可使用,從而減少廢棄物並縮短工期。板材因其接縫更少,能夠形成更嚴密的保溫層並降低空氣滲透損失,因此備受高層住宅建築的青睞。

在低層住宅領域,砌塊結構仍佔據主導地位,尤其是在勞動力充足且現場施工技術盛行的市場。然而,板材技術的創新動能絲毫沒有減弱的跡象。鋼筋混凝土牆板正在承擔承重任務,導熱係數為0.11 W/mK的屋頂模組滿足了零能耗建築的目標。自動化鋸木生產線和機器人搬運技術正在降低板材生產成本,並推動高壓釜加氣混凝土(AAC)市場從手工砌塊鋪設轉變為工業板材組裝。

區域分析

亞太地區預計到2024年將佔全球銷售額的46.78%,並將在2030年前以7.28%的複合年成長率加速成長。中國和印度是主要的需求驅動力,這主要得益於大型住宅大型企劃和國家基礎建設規劃。政府對低碳建築規範的誘因進一步推動了加氣混凝土(AAC)的普及。日本和韓國因其抗震性能而採用加氣混凝土,而澳洲則因其住宅能源標準而維持了穩定的市場佔有率。亞太地區原料的高度自給自足以及不斷提高的自動化程度,使其成本競爭力得以維持,從而鞏固了該地區的市場主導地位。

在北美,美國西部地區日益嚴格的防火要求以及各氣候區對建築圍護結構日益嚴苛的要求,正推動著自動加氣混凝土(AAC)的復興。美國)的低碳排放標籤促進了公共採購,而加拿大修訂後的能源標準也為這一趨勢注入了動力。墨西哥的住房獎勵策略與區域情況相輔相成,共同推動了自動加氣混凝土市場的強勁成長。

歐洲成熟的建築市場正受惠於嚴格的碳排放目標:德國和英國正積極維修建築改造,而北歐市場則朝著近零能耗標準邁進。歐盟綠色交易的融資將支持工廠升級和新生產線的建設。隨著物流和資料中心建設的蓬勃發展,對防火隔熱外殼的需求日益成長,中東歐地區的建築市場也因此出現閒置頻段成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新建和重建需求不斷成長

- 嚴格的綠建築法規和LEED認證的採用

- 政府對低碳材料的獎勵

- 模組化異地建造的興起

- 對抗震輕質磚塊的需求

- 市場限制

- 與粘土磚和混凝土磚相比,初始成本較高。

- 承重應用中的結構限制

- 鋁粉發泡供應及價格波動

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 堵塞

- 控制板

- 楣

- 瓦

- 其他(U型塊、樓板/屋頂構件)

- 透過施工方法

- 現場石匠

- 預製件/模組

- 透過使用

- 住宅

- 商業的

- 工業的

- 其他用途(道路、公用設施圍護結構、隔音屏障)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 波蘭

- 荷蘭

- 羅馬尼亞

- 捷克共和國

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 以色列

- 卡達

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ACICO Group

- AERCON AAC

- Asahi Kasei Corporation

- Bauroc AS

- Biltech Building Elements Limited

- BirlaNu Limited

- Eastland Building Materials Co., Ltd

- Eco Green

- Ecostone AAC

- H+H UK Limited

- JK Lakshmi Cement Ltd.

- Renacon

- SOLBET

- Starken AAC Sdn Bhd

- STT Turk Gazbeton

- Thomas Armstrong(Concrete Blocks)Ltd

- UAL Industries Limited

- UltraTech Cement Ltd.

- Xella International

第7章 市場機會與未來展望

The Autoclaved Aerated Concrete Market size is estimated at USD 15.56 billion in 2025, and is expected to reach USD 20.94 billion by 2030, at a CAGR of 6.12% during the forecast period (2025-2030).

Growth is fueled by tightening green-building mandates, rising demand for seismic-resilient structures, and the rapid adoption of modular construction, all of which highlight AAC's lightweight, energy-efficient profile. Blocks continue to dominate traditional masonry, yet panels are gaining momentum as prefabrication revamps project timelines. Asia-Pacific commands nearly half of global demand on the back of urbanization and infrastructure outlays, while North America and Europe capitalize on strict energy and seismic codes. Manufacturers are scaling capacity and automating plants to match demand spikes, improve cost structures, and strengthen regional supply chains.

Global Autoclaved Aerated Concrete (AAC) Market Trends and Insights

Growing Demand from New-Build & Renovation Construction

Surging residential and commercial starts in emerging economies have made lightweight materials indispensable because they lower foundation loads and shorten project cycles. AAC cuts dead weight by 30-40%, enabling slimmer foundations and quicker floor-to-floor progress, which is vital in dense city cores. India's housing drive illustrates the trend; domestic producer BigBloc Construction is expanding capacity to keep pace with elevated urban housing approvals. Renovation schemes also prefer AAC because its precision blocks streamline retrofits without reforging structure lines. Four-hour fire ratings boost compliance in commercial refurbishments, and its mold-proof matrix appeals in humid climates. Together, these factors underpin sustained Autoclaved Aerated Concrete market growth.

Stringent Green-Building Codes & LEED Adoption

Policies aimed at curbing embodied carbon are reshaping material selection worldwide. The US government's USD 160 million funding for sustainable-materials benchmarking explicitly encourages AAC uptake. EPA's 2024 low-carbon label gives manufacturers a clear route to quantify climate advantages, enhancing bid scores on public projects. Europe mirrors the shift; H+H UK is targeting net-zero operations by 2050, in line with EU decarbonization goals. With an R-value of 1.43 for 200 mm thickness, AAC delivers 10-20% operational energy savings and incorporates recycled fly ash, satisfying circular-economy criteria.

High Upfront Cost vs. Clay & Concrete Blocks

Perceptions of premium pricing hinder AAC's penetration where contractors prioritize purchase price over life-cycle savings. However, traditional red bricks recently became roughly 20% more expensive than AAC in key Indian metros, nudging buyers toward the lighter alternative. Material-price volatility is reshaping comparisons; 2025 tariffs elevated steel by 10-25% and concrete by 3-7%, eroding AAC's cost differential. Limited local plants in some regions still inflate delivered prices by 15-20%. Education campaigns stressing 30% energy-bill reductions and lower labor needs are gradually reframing procurement decisions around total cost of ownership.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Low-Carbon Materials

- Modular Off-Site Construction Uptake

- Volatile Supply & Price of Aluminum Powder Foaming Agent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Blocks held 54.78% of 2024 revenue, reflecting decades of contractor familiarity and broad distribution networks. In parallel, panels are charting a 7.81% CAGR through 2030 as builders pivot toward prefabricated envelopes. The panel boom embodies the construction industry's industrialization push: factory-cut modules arrive field-ready, reducing waste and compressing schedules. Developers favor panels in tall residential towers because fewer joints mean tighter thermal envelopes and lower infiltration losses.

The blocks segment remains central to low-rise housing, especially in markets where labor is abundant and on-site techniques dominate. Yet panel innovation is relentless. Reinforced wall panels now handle load-bearing duties, and roof modules with thermal conductivity of 0.11 W/mK meet zero-energy-building targets. Automated saw lines and robotic handling have cut panel-fabrication costs, underpinning an Autoclaved Aerated Concrete market shift from craft-based block laying to industrial panel assembly.

The Autoclaved Aerated Concrete Market Report is Segmented by Product Type (Block, Panel, Lintel, Tile, Others), Construction Method (On-Site Masonry, Prefabricated/Modular), Application (Residential, Commercial, Industrial, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 46.78% of global revenue in 2024 and is accelerating at 7.28% CAGR to 2030. China and India anchor demand, driven by housing mega-projects and state infrastructure pipelines. Government incentives for low-carbon building methods further tip specifications toward AAC. Japan and South Korea adopt AAC for seismic safety, while Australia's home-energy codes sustain steady uptake. High regional self-sufficiency in raw materials and rising automation keep unit costs competitive, cementing Asia-Pacific's dominance.

North America is experiencing a renaissance in AAC usage, propelled by wildfire resilience requirements in the western United States and stricter building envelopes across climate zones. The EPA's low-embodied-carbon label is catalyzing public procurement, and Canada's national energy code revision amplifies momentum. Mexico's housing stimulus complements the regional picture, leading to a robust Autoclaved Aerated Concrete market trajectory.

Europe's mature landscape benefits from stringent carbon targets: Germany and the UK aggressively retrofit buildings, while Nordic markets edge toward near-zero-energy codes. EU Green Deal financing supports plant upgrades and new lines. Central and Eastern Europe provide white-space growth as booming logistics and data-center construction seek fire-safe, thermally efficient shells.

- ACICO Group

- AERCON AAC

- Asahi Kasei Corporation

- Bauroc AS

- Biltech Building Elements Limited

- BirlaNu Limited

- Eastland Building Materials Co., Ltd

- Eco Green

- Ecostone AAC

- H+H UK Limited

- JK Lakshmi Cement Ltd.

- Renacon

- SOLBET

- Starken AAC Sdn Bhd

- STT Turk Gazbeton

- Thomas Armstrong (Concrete Blocks) Ltd

- UAL Industries Limited

- UltraTech Cement Ltd.

- Xella International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand from new-build & renovation construction

- 4.2.2 Stringent green-building codes & LEED adoption

- 4.2.3 Government incentives for low-carbon materials

- 4.2.4 Modular off-site construction uptake

- 4.2.5 Demand for seismic-resilient lightweight blocks

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. clay & concrete blocks

- 4.3.2 Structural limitations in load-bearing applications

- 4.3.3 Volatile supply & price of aluminum powder foaming agent

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Block

- 5.1.2 Panel

- 5.1.3 Lintel

- 5.1.4 Tile

- 5.1.5 Others (U-blocks, floor/roof elements)

- 5.2 By Construction Method

- 5.2.1 On-site masonry

- 5.2.2 Prefabricated/modular

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Other Applications (roads, utility enclosures, noise-barrier walls)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 ASEAN

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Poland

- 5.4.3.8 Netherlands

- 5.4.3.9 Romania

- 5.4.3.10 Czech Republic

- 5.4.3.11 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Israel

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 ACICO Group

- 6.4.2 AERCON AAC

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 Bauroc AS

- 6.4.5 Biltech Building Elements Limited

- 6.4.6 BirlaNu Limited

- 6.4.7 Eastland Building Materials Co., Ltd

- 6.4.8 Eco Green

- 6.4.9 Ecostone AAC

- 6.4.10 H+H UK Limited

- 6.4.11 JK Lakshmi Cement Ltd.

- 6.4.12 Renacon

- 6.4.13 SOLBET

- 6.4.14 Starken AAC Sdn Bhd

- 6.4.15 STT Turk Gazbeton

- 6.4.16 Thomas Armstrong (Concrete Blocks) Ltd

- 6.4.17 UAL Industries Limited

- 6.4.18 UltraTech Cement Ltd.

- 6.4.19 Xella International

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment