|

市場調查報告書

商品編碼

1851234

聚氨酯:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Polyurethane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

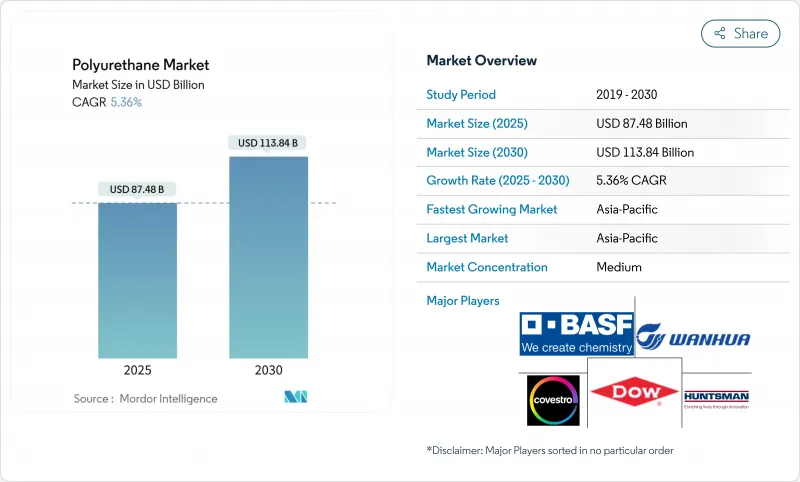

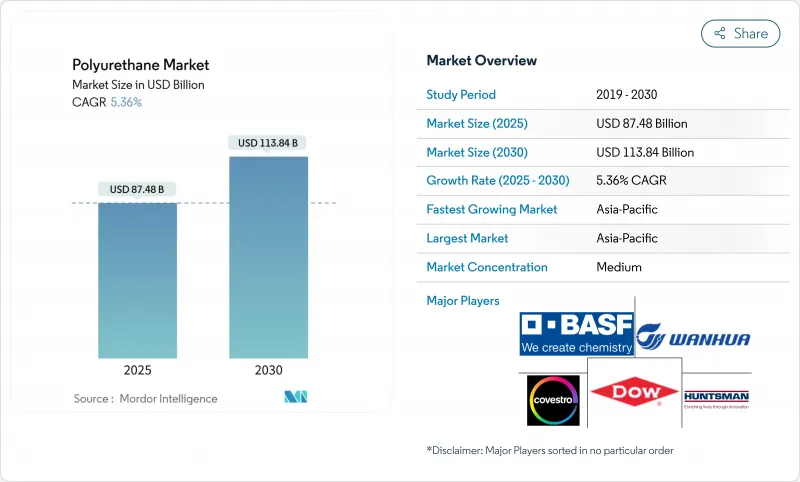

預計到 2025 年,聚氨酯市值將達到 874.8 億美元,到 2030 年將達到 1,138.4 億美元,2025 年至 2030 年的複合年成長率為 5.36%。

這一強勁成長得益於聚氨酯在建築、汽車、家具和電子等眾多行業的廣泛應用,這些行業都非常看重聚氨酯的隔熱性、輕盈性和耐用性。亞太地區以46%的銷售額領跑,主要得益於中國的大規模產能擴張和印度強勁的石化投資,而全球供應也持續向該地區傾斜。建築業在更嚴格的能源標準下維持了基準銷量,而汽車製造商則加快了對先進聚氨酯複合材料的需求,以減輕車輛重量並提高燃油效率。對生物基多元醇、封閉式回收技術和低VOC塗料的投資進一步推動了創新勢頭,這些技術能夠減少生命週期排放和監管風險。儘管MDI/TDI價格波動較大,且即將進行貿易調查,但聚氨酯市場仍受益於根深蒂固的價值鏈整合以及以永續發展為永續性的應用領域的不斷擴展。

全球聚氨酯市場趨勢與洞察

汽車輕量材料

汽車製造商正以纖維增強聚氨酯取代金屬零件,以減輕車身重量、滿足燃油經濟性法規並控制廢氣二氧化碳排放。陶氏化學的模壓聚氨酯片材可將每個座椅的佔地面積減少 50%,同時保持舒適性,證明循環利用的泡棉材料適合大規模生產。科思創的聲學最佳化車頂內襯和內裝件可在最小設計改動下降低噪音和揮發性有機化合物 (VOC) 排放,並改善車內空氣品質。使用這些複合材料的一級供應商表示,無需新的資本支出即可相容於組裝,這增強了其在 2030 年前的應用前景。

建築業和施工業的發展

全球能源標準如今強制要求更高的R值和更嚴格的氣密性要求,這直接髮揮了硬質聚氨酯在隔熱和蒸氣方面的優勢。亞太地區的建築熱潮,加上北美地區的維修獎勵政策,正促使建築師們採用輕薄但高性能的隔熱材料和板材式隔熱材料。製造商也積極回應,擴大產能,並推出二氧化碳改質硬質泡沫,以取代20%的化石多元醇,在不改變加工參數的情況下,減少從原料開採到產品出廠的排放。政策主導的勢頭正支撐著新建和維修市場需求的穩定成長。

MDI/TDI原料揮發性

MDI佔聚氨酯原料供應的41.20%,使得聚氨酯生產商極易受到苯和原油價格波動的影響。諸如萬華寧波工廠停產等計畫性檢修,以及針對2025年進入美國的中國產MDI的反傾銷措施,都導致了價格上漲和配額削減。加工商透過延長合約進行避險,但利潤率持續下降,下游生產線擴建的投資也被推遲,直到供應穩定為止。

細分市場分析

到2024年,軟質泡棉將佔聚氨酯市場佔有率的32%,並繼續憑藉其舒適性在床上用品、家具和汽車座椅領域的主導。預計到2030年,軟質聚氨酯泡棉市場規模將以6.07%的複合年成長率成長,這主要得益於黏彈性升級帶來的壓力分佈改善,以及依賴快速壓縮和回彈泡棉的「床墊裝箱」履約模式的興起。生產商正在提升泡棉的回彈性和透氣性,從而生產出更薄、更符合高階人體工學需求的床墊。回收商正在改進酸解工藝,以82%的回收率再生多元醇,推動該產業邁向循環供應鏈模式。

硬質泡沫材料位居第二,因其每英吋R值高且單次密封即可達到氣密性,而成為建築隔熱材料的首選。在牆體空腔限制厚度的維修計劃中,硬質泡沫材料的快速應用將推動極端氣候和溫帶氣候市場對硬質泡沫材料的持續需求。 CASE子領域(塗料、黏合劑、密封劑、彈性體)拓展了聚氨酯在減震、工業地板材料和耐腐蝕襯裡的效用。熱塑性聚氨酯(TPU)在鞋類和電子產品機殼的市場佔有率不斷成長,這主要得益於路博潤公司以生質能為平衡原料的ESTANE RNW等級產品,該產品可將生產過程中的碳排放量減少高達59%。

區域分析

到2024年,亞太地區將佔全球聚氨酯市場收入的46%,其中中國既是生產中心也是消費中心。萬華等本土領導企業正積極擴大MDI和多元醇的產能,而印度價值870億美元的石化產品管道項目將提升該地區的原料安全,並促進衍生產品的成長。公共和私人建設的蓬勃發展,以及汽車產業的快速成長,將確保該地區在2030年維持6.01%的最高複合年成長率。

北美市場成熟且充滿創新活力,緊隨其後。美國正轉向使用高R值隔熱材料進行房屋維修,並尋求循環利用的汽車座椅泡沫,以實現企業環保目標。諸如針對中國製造的MDI的反傾銷調查(將於2025年啟動)等政策舉措,正在重塑籌資策略,並鼓勵對國內生產能力的投資。加拿大的淨零排放建築計畫也進一步支撐了該地區強勁的需求。

歐洲聚氨酯市場正受到嚴格的化學品法規的影響。即將生效的 PFAS 法規迫使製造商廣泛重新思考配方,這使得擁有先進添加劑研發能力和快速合規流程的供應商更具優勢。同時,綠色公共採購標準獎勵低 VOC 和低碳產品,引導製造商轉向生質能平衡和二氧化碳排放量更低的等級。

南美洲和中東及非洲地區雖然在聚氨酯市場中所佔佔有率較小,但基礎設施、家具和包裝的需求推動了市場成長。巴西正在擴大國內石化產品生產以降低進口依賴,沙烏地阿拉伯則利用其原料優勢探索聚氨酯出口。來自較大市場的技術和最佳實踐的擴散,正幫助新興地區快速達到國際永續性標準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車產業對輕質高性能複合材料的需求不斷成長

- 來自建築和建設產業的需求增加

- 來自床上用品、地毯和靠墊行業的需求增加

- 節能材料的需求日益成長

- 轉向使用低揮發性有機化合物(VOC)和水性聚氨酯

- 市場限制

- MDI/TDI原料價格波動與間二甲苯和原油價格波動有關

- 歐盟REACH法規和中國RoHS法規對含PFAS的聚氨酯添加劑的規定

- 環境問題

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 硬泡沫

- 軟性泡沫

- CASE(被覆劑、黏合劑、密封劑、彈性體)

- 熱塑性聚氨酯(TPU)

- 其他類型

- 按原料

- 二苯基甲烷二異氰酸酯(MDI)

- 甲苯二異氰酸酯(TDI)

- 聚醚多元醇

- 聚酯多元醇

- 其他(生物基多元醇)

- 按最終用戶行業分類

- 家具

- 建築/施工

- 電子產品和家用電器

- 車

- 鞋類

- 包裹

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BASF SE

- Carpenter Co.

- Covestro AG

- DIC Corporation

- Dow

- Huntsman International LLC

- INOAC Corporation

- LANXESS

- Mitsui Chemicals Inc.

- Momentive

- PPG Industries, Inc.

- Rogers Corporation

- Saint-Gobain

- Sekisui Chemical Co., Ltd.

- Sheela Foam Ltd.

- The Lubrizol Corporation

- Tosoh Corporation

- Wanhua

第7章 市場機會與未來展望

The polyurethane market size is estimated at USD 87.48 billion in 2025 and is projected to reach USD 113.84 billion by 2030, expanding at a 5.36% CAGR during 2025-2030.

This solid growth is anchored in the material's broad adoption across construction, automotive, furniture, and electronics, each valuing polyurethane's insulation, lightweighting, and durability advantages. Asia-Pacific's 46% revenue lead-supported by large-scale capacity additions in China and robust petrochemical investments in India-continues to tilt global supply toward the region. The building sector sustains baseline volume through stricter energy codes, while automotive producers accelerate demand for advanced polyurethane composites to lower vehicle weight and boost fuel efficiency. Innovation momentum is reinforced by investments in bio-based polyols, closed-loop recycling technologies, and low-VOC coatings that reduce lifecycle emissions and regulatory exposure. Even amid MDI/TDI price swings and upcoming trade investigations, the polyurethane market benefits from entrenched value-chain integration and a growing roster of sustainability-driven applications.

Global Polyurethane Market Trends and Insights

Lightweight Materials in Automotive

Automakers are swapping metal components for fiber-reinforced polyurethane to trim curb weight, meet fuel-economy mandates, and curb tailpipe CO2. Dow's molded PU seats slash the embodied footprint by 50% per seat while preserving comfort, proving the readiness of circular-grade foams for mass production. Acoustically optimized headliners and interior trim from Covestro cut noise and volatile organic compound (VOC) release, raising cabin-air quality with minimal redesign effort. Tier-1 suppliers integrating these composites report assembly-line compatibility without new capital outlays, reinforcing adoption prospects through 2030.

Building & Construction Growth

Global energy codes now specify higher R-values and tighter air-sealing, which play directly to rigid polyurethane's thermal and vapor control strengths. Asia-Pacific's construction boom, coupled with North American retrofit incentives, keeps architects reliant on thin-but-high-performing spray and boardstock insulation. Manufacturers respond by widening capacity and launching CO2-modified rigid foams that substitute 20% of fossil polyol, lowering cradle-to-gate emissions without shifting processing parameters. The policy-led momentum supports steady demand expansion across new-build and retrofit markets.

MDI/TDI Feedstock Volatility

MDI's 41.20% raw-material share ties polyurethane producers to benzene and crude-oil swings. Scheduled turnarounds, such as Wanhua's Ningbo outage, and antidumping actions on Chinese MDI entering the United States in 2025 inject price spikes and allocation cuts. Processors hedge with longer contracts, yet margin compression persists, delaying downstream investment in expansion lines until supply stabilizes.

Other drivers and restraints analyzed in the detailed report include:

- Bedding & Furniture Demand

- Energy-Efficiency Requirements

- Regulatory Restrictions on Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible foam captured 32% of polyurethane market share in 2024, maintaining a comfort-driven edge across bedding, furniture, and automotive seating. The polyurethane market size for flexible foam is projected to rise at 6.07% CAGR through 2030, aided by viscoelastic upgrades that improve pressure redistribution and by "bed-in-a-box" fulfillment models that hinge on compressed, quick-recovery foams. Producers enhance resilience and airflow, enabling thinner mattress builds that match premium ergonomic expectations. Recyclers refine acidolysis processes that reclaim polyol streams at 82% yield, moving the segment closer to circular supply loops.

Rigid foam takes second position, favored in construction insulation for its high R-value per inch and ability to deliver air-sealing in a single pass. Adoption accelerates in retrofit projects where wall cavities constrain thickness, reinforcing sustained volume demand in temperate as well as extreme-climate markets. CASE sub-segments (coatings, adhesives, sealants, elastomers) extend polyurethane's utility to vibration damping, industrial flooring, and corrosion-resistant linings. Thermoplastic polyurethane (TPU) wins share in footwear and electronics enclosures, buoyed by Lubrizol's biomass-balanced ESTANE RNW grade that cuts manufacturing carbon by up to 59%.

The Polyurethane Market Report Segments the Industry by Type (Rigid Foam, Flexible Foam, and More), Raw Material (Methylene Diphenyl Di-Isocyanate (MDI), Toluene Di-Isocyanate (TDI), Polyether Polyols, and More), End-User Industry (Furniture, Building and Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 46% of polyurethane market revenue in 2024, with China acting as both production nucleus and consumption powerhouse. Local leaders such as Wanhua aggressively scale MDI and polyol capacity, while India's USD 87 billion petrochemical pipeline amplifies regional feedstock security and derivative growth. Public and private construction booms, paired with rapid motorization, ensure the region retains the highest 6.01% CAGR through 2030.

North America follows with a mature yet innovative market. The United States leans on high R-value insulation for residential retrofits and pursues circular-grade automotive seating foams to meet corporate environmental targets. Policy moves-such as the 2025 antidumping investigation on Chinese MDI-reshape sourcing strategies and encourage domestic capacity investments. Canada's net-zero building agenda further anchors steady regional demand.

Europe's polyurethane market is shaped by stringent chemical regulations. The looming PFAS restriction compels wide-ranging formulation revisions, favoring suppliers with advanced additive R&D and rapid regulatory compliance processes. At the same time, green public-procurement criteria reward low-VOC and low-carbon products, nudging manufacturers toward biomass-balanced and CO2-modified grades.

South America, the Middle East, and Africa represent smaller slices of the polyurethane market yet grow from infrastructure, furniture, and packaging demand. Brazil promotes domestic petrochemicals expansion to reduce import dependence, while Saudi Arabia leverages feedstock advantage to explore polyurethane exports. Technology and best-practice diffusion from larger markets help emerging regions fast-track compliance with international sustainability benchmarks.

- BASF SE

- Carpenter Co.

- Covestro AG

- DIC Corporation

- Dow

- Huntsman International LLC

- INOAC Corporation

- LANXESS

- Mitsui Chemicals Inc.

- Momentive

- PPG Industries, Inc.

- Rogers Corporation

- Saint-Gobain

- Sekisui Chemical Co., Ltd.

- Sheela Foam Ltd.

- The Lubrizol Corporation

- Tosoh Corporation

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Lightweight and High-performance Composites from the Automotive Industry

- 4.2.2 Increasing Demand from the Building and Construction Industry

- 4.2.3 Increasing Demand from the Bedding, Carpet, and Cushioning Industries

- 4.2.4 Growing Demand for Energy-Efficient Materials

- 4.2.5 Shift Towards Low-VOC (Volatile Organic Compounds) and Waterborne Polyurethanes

- 4.3 Market Restraints

- 4.3.1 Volatility in MDI/TDI Feedstock Linked to Meta-Xylene and Crude Oil Price Swings

- 4.3.2 EU REACH and China RoHS Limits on PFAS-Based PU Additives

- 4.3.3 Environmental Concerns

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Type

- 5.1.1 Rigid Foam

- 5.1.2 Flexible Foam

- 5.1.3 CASE (Coatings, Adhesives, Sealants and Elastomers)

- 5.1.4 Thermoplastic Polyurethane (TPU)

- 5.1.5 Other Types

- 5.2 By Raw Material

- 5.2.1 Methylene Diphenyl Di-isocyanate (MDI)

- 5.2.2 Toluene Di-isocyanate (TDI)

- 5.2.3 Polyether Polyols

- 5.2.4 Polyester Polyols

- 5.2.5 Others (Bio-based Polyols)

- 5.3 By End-user Industry

- 5.3.1 Furniture

- 5.3.2 Building and Construction

- 5.3.3 Electronics and Appliances

- 5.3.4 Automotive

- 5.3.5 Footwear

- 5.3.6 Packaging

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Russia

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Carpenter Co.

- 6.4.3 Covestro AG

- 6.4.4 DIC Corporation

- 6.4.5 Dow

- 6.4.6 Huntsman International LLC

- 6.4.7 INOAC Corporation

- 6.4.8 LANXESS

- 6.4.9 Mitsui Chemicals Inc.

- 6.4.10 Momentive

- 6.4.11 PPG Industries, Inc.

- 6.4.12 Rogers Corporation

- 6.4.13 Saint-Gobain

- 6.4.14 Sekisui Chemical Co., Ltd.

- 6.4.15 Sheela Foam Ltd.

- 6.4.16 The Lubrizol Corporation

- 6.4.17 Tosoh Corporation

- 6.4.18 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Increasing Demand for Bio-based Polyurethane