|

市場調查報告書

商品編碼

1851232

巨量資料即服務:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Big Data As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

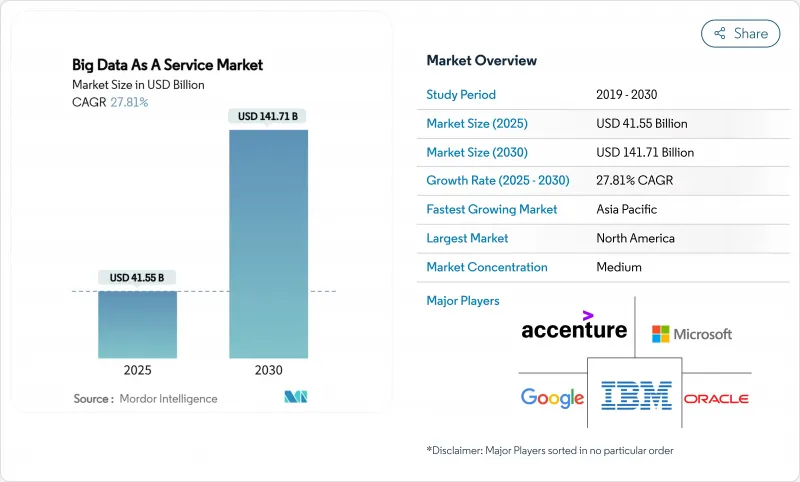

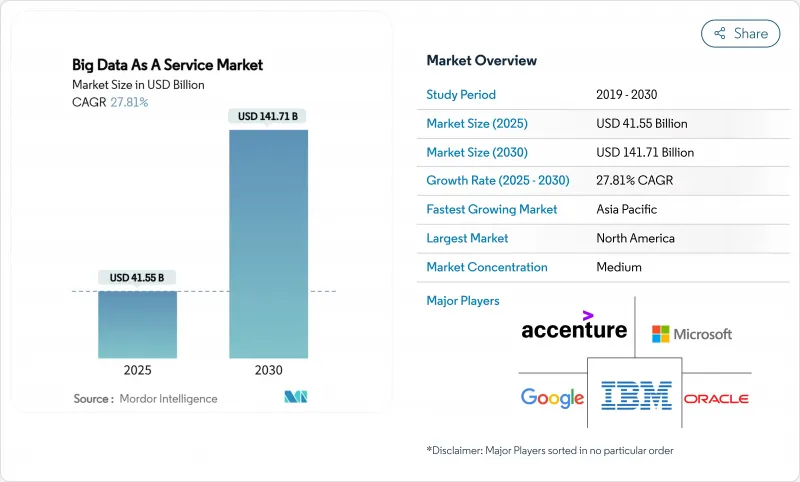

據估計,巨量資料即服務市場規模在 2025 年將達到 415.5 億美元,預計到 2030 年將達到 1,417.1 億美元,在預測期(2025-2030 年)內複合年成長率為 27.81%。

預計2025年,巨量資料即服務)市場規模將達到415.5億美元,2030年將達到1,417.1億美元,複合年成長率(CAGR)為27.81%。隨著企業以基於使用量的雲端分析取代資本密集的本地部署系統,並靈活支援人工智慧工作負載,市場需求將持續成長。生成式人工智慧試點計畫的激增、工業IoT部署的不斷成長以及全球向計量收費的轉變,使得巨量資料即服務的應用門檻正在降低。因此,超大規模資料中心供應商每年投資超過1,050億美元用於新增容量,以滿足其彈性資料處理需求。儘管北美仍保持領先地位,但亞太地區正展現出最強勁的成長勢頭,這主要得益於製造商和金融機構加速雲端遷移。這些因素共同支撐著巨量資料即服務市場在未來十年保持強勁的發展前景。

全球巨量資料即服務市場趨勢與洞察

雲端採用和數據爆炸

像3M這樣的製造商透過在其生產線上部署Azure SQL Edge,將異常檢測時間縮短了40%,從而展現了彈性處理在營運方面的顯著優勢。到2025年,全球年度雲端支出將超過8,250億美元,其中85%的公司將使用多重雲端環境來支援分析計劃。維護本地Hadoop叢集每年可能需要花費200萬至500萬美元,而基於使用量的BDaaS(業務資料即服務)則可以根據工作負載的規模進行緊密擴展。在網路邊緣,物聯網感測器產生的資料量超過了傳統管道的處理能力,迫使企業採用分散式架構,在更靠近資料來源的位置執行運算,同時與雲端分析平台同步。

生成式人工智慧分析的需求

如今,大規模語言模型與 SQL 引擎一起,已成為大多數企業發展藍圖上的標配。銀行機構估計,GenAI 全面運作後,每年將創造 2,000 億至 3,400 億美元的新收入,從而推動對非結構化資料處理業務即服務 (BDaaS) 的大規模投資。 Snowflake 預計,人工智慧工作負載將佔其 2024 會計年度 26.7 億美元收入的 38%,並正與 Anthropic、NVIDIA 和微軟合作,將人工智慧訓練直接嵌入其資料雲中。 AWS 已報告數十億美元的人工智慧運轉率,凸顯了其在單一租戶中攝取、轉換數據並將其交付給機器學習管道的平台發展勢頭強勁。 GenAI 與搜尋結合,將進一步實現企業文件的商業化,並從閒置的內容庫中創造新的收入來源。

資料隱私與網路安全風險

75% 的國家強制要求在地化,導致雲端架構碎片化,營運成本上升。諸如 GDPR、中國的雲端服務法 (CSL) 和美國的《雲端法案》等相互重疊的法規迫使跨國公司建構複雜的資料管治層,使整體擁有成本增加高達 25%。金融機構還必須將交易資料儲存在境內,這限制了供應商的選擇,並延長了採購週期。雖然這些障礙在某些情況下會減緩遷移速度,但很少是可逆的。服務提供者擴大提供合約條款來應對區域集群和法律差異,這可以緩解(但無法消除)這些不利因素。

細分市場分析

到2024年,Hadoop即服務(Hadoop-as-a-Service)將佔據巨量資料即服務)市場42%的佔有率,這表明批次和資料湖架構對現有企業仍然具有價值。然而,分析即服務(Analytics-as-a-Service)預計將以30.61%的複合年成長率(CAGR)成為成長最快的產品,因為企業正在採用整合BI儀表板、機器學習筆記本和向量搜尋且無需叢集維護的託管環境。預計到2025年,分析領域的支出成長將佔總支出成長的50%,並在2030年之前保持領先地位。資料平台即服務(Data Platform-as-a-Service)介於原始基礎設施和端到端分析套件之間,在需要客製化管治控制的監管場景中仍然至關重要。

客戶越來越傾向於以分析所需時間而非硬體利用率來衡量成功。 Snowflake 推出的 Cortex AISQL 預示著未來分析師可以使用自然語言查詢生命週期管理 (LLM),並從儲存事務資料的相同介面獲得受管治的答案。這種融合模糊了 ETL、資料倉儲和分析之間的傳統界限,迫使供應商整合各項功能。因此,在預測期內,巨量資料即服務)市場將從以基礎設施為先的品牌定位轉向強調提案支援的即時。

受超大規模雲端服務商定價策略的推動,公共雲端將在2024年佔據63%的收入佔有率,而混合雲端將以29.51%的複合年成長率實現最快成長。企業希望能夠靈活地將敏感記錄保存在私人區域,同時在需求高峰期將分析任務擴展到公共邊緣。混合雲方案還能降低廠商鎖定風險,並支持合規性,因為75%的司法管轄區都對資料居住規則有明確規定。因此,預計從2025年到2030年,混合雲解決方案的巨量資料即服務將成長三倍以上。

多重雲端架構如今已成為主流,85% 的公司至少使用兩家雲端服務供應商來經營巨量資料業務。 Snowflake 最近已與 AWS、Azure 和 Google Cloud 上的 Apache Iceberg 檔案進行了整合。在配備物聯網閘道器的工廠中,混合部署方案會在本地硬體上處理異常評分,然後將聚合結果傳輸送到雲端模型進行歷史趨勢分析。諸如此類的模式將使混合部署成為下一代分析的基石。

巨量資料即服務市場報告按服務模式(Hadoop 即服務 (HaaS)、分析即服務 (AaaS) 等)、部署方式(公共雲端、私有雲端等)、最終用戶行業垂直領域(銀行、金融服務和保險、製造業、IT 和通訊等)以及地區進行細分。

區域分析

到2024年,北美將佔據巨量資料即服務市場39%的佔有率,這主要得益於根深蒂固的雲端服務供應商、資金籌措以及數據主導的商業文化。美國和加拿大的公司是早期採用者,目前正致力於改善財務營運(FinOps)實踐,以應對不斷上漲的人工智慧運算成本。歐洲則受到GDPR強制規定的驅動,傾向於能夠保證可審核的託管服務。儘管隱私法規嚴格,但該地區仍維持著15%左右的成長率。

亞太地區引領潮流,預計將以27.85%的複合年成長率成長。中國、印度和東南亞各國政府都在支持國家雲端計劃,製造業的數位化也為業務數據即服務(BDaaS)管道注入了新的數據。阿里雲和騰訊雲等本土超大規模雲端服務供應商正在投資跨區域可用區,消除以往依賴全球雲端服務供應商所帶來的延遲損失。作為物聯網的早期採用者,日本和韓國目前正在嘗試基於區域資料保護框架建構的企業級全人工智慧(GenAI)。

拉丁美洲和中東及非洲地區雖然起步較早,但已展現出令人矚目的絕對成長動能。巴西的金融科技公司和墨西哥的零售商正在將工作負載轉移到巨量資料即服務(BDaaS)平台,因為他們的資本預算無法支援大型自架叢集。墨西哥灣沿岸的石油公司正在鑽機上運作混合型BDaaS邊緣節點,用於預測性維護;非洲的電信業者則利用按需付費模式,無需前期資本投入即可推出客戶分析專案。這些新興市場正在推動巨量資料即服務市場的收入成長,從而擴大其全球影響力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要主要發現

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 雲端採用和數據爆炸

- 比本地部署巨量資料堆疊更具成本效益的替代方案

- 生成式人工智慧分析的需求

- 面向物聯網密集型垂直產業的邊緣到雲端資料架構

- 資料本地化規則旨在促進 BDaaS 中的區域節點發展

- 與財務營運相關的消費定價模式

- 市場限制

- 資料隱私與網路安全風險

- 遺留系統整合複雜性

- 仔細審視超大規模資料中心的碳足跡

- 財務營運與數據工程人才缺口

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按服務模式

- Hadoop-as-a-Service(HaaS)

- 分析即服務 (AaaS)

- 數據平台即服務 (DPaaS)

- 透過部署

- 公有雲

- 私有雲端

- 混合雲

- 按最終用戶行業分類

- BFSI

- 資訊科技和電訊

- 醫療保健和生命科學

- 零售與電子商務

- 製造業

- 能源與電力

- 政府和公共部門

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services

- Microsoft

- Google Cloud

- IBM

- Oracle

- SAP

- Hewlett Packard Enterprise

- SAS Institute

- Accenture

- Teradata

- Cloudera

- Snowflake

- Databricks

- Dell Technologies

- Splunk

- Palantir

- Informatica

- Huawei Cloud

- Alibaba Cloud

- Tencent Cloud

- Wipro

第7章 市場機會與未來展望

The Big Data As A Service Market size is estimated at USD 41.55 billion in 2025, and is expected to reach USD 141.71 billion by 2030, at a CAGR of 27.81% during the forecast period (2025-2030).

The big data as a service market reached USD 41.55 billion in 2025 and is forecast to climb to USD 141.71 billion by 2030, reflecting a compound annual growth rate of 27.81%. Demand escalates as enterprises replace capital-intensive on-premises systems with usage-based cloud analytics that flex with artificial-intelligence workloads. A surge in generative-AI pilots, wider industrial IoT rollouts, and a global shift toward pay-as-you-go pricing have narrowed adoption barriers. Hyperscale providers have therefore invested more than USD 105 billion each year in new capacity to meet elastic data-processing needs. North America retains leadership, yet Asia-Pacific shows the steepest trajectory as manufacturers and financial institutions accelerate cloud migrations. Together, these forces uphold a strong outlook for the big data as a service market through the decade.

Global Big Data As A Service Market Trends and Insights

Cloud Adoption and Exploding Data Volumes

Organizations now generate 2.5 quintillion bytes each day, volumes that exceed the practical limits of on-premises clusters.Manufacturers such as 3M cut anomaly-detection time by 40% after installing Azure SQL Edge on production lines, showing the operational impact of elastic processing. Annual global cloud spending topped USD 825 billion in 2025, and 85% of enterprises use multi-cloud environments to support analytics projects. Savings are evident: maintaining local Hadoop farms can cost USD 2-5 million per year, while usage-based BDaaS scales strictly with workload size. At the network edge, IoT sensors produce more data than traditional pipes can carry, forcing firms to adopt distributed architectures that keep compute near the source while synchronizing to cloud analytics platforms.

Generative-AI-Ready Analytics Demand

Large language models now sit beside SQL engines in most enterprise road maps. Banking institutions estimate USD 200-340 billion in new annual profit once GenAI is fully operational, driving heavy BDaaS investments for unstructured-data processing. Snowflake attributes 38% of its USD 2.67 billion fiscal-2024 revenue to AI workloads and has partnered with Anthropic, NVIDIA, and Microsoft to embed AI training directly in its data cloud. AWS already reports multi-billion-dollar AI run rates, underscoring the momentum toward platforms that can ingest, transform and serve data to ML pipelines in a single tenancy. Retrieval-augmented generation further monetizes enterprise documents, creating new revenue streams from dormant content libraries.

Data Privacy and Cybersecurity Risks

Seventy-five percent of countries enforce localization mandates that fragment cloud architectures and inflate operating expenses. Overlapping rules from GDPR, China's CSL and the US CLOUD Act force multinational firms to build complex data-governance layers, lifting total ownership cost by up to 25%. Financial institutions must further store transactional data onshore, restricting vendor options and raising procurement cycles. These hurdles slow some migrations but rarely reverse them; providers increasingly offer region-specific clusters and contract clauses that address legal variance, tempering the headwind but not eliminating it.

Other drivers and restraints analyzed in the detailed report include:

- Edge-to-Cloud Data Fabrics for IoT-Rich Verticals

- FinOps-Linked Consumption Pricing Models

- Talent Gap in FinOps and Data Engineering

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hadoop-as-a-Service retained 42% of the big data as a service market in 2024, indicating that batch processing and data-lake architectures still hold value for established enterprises. However, Analytics-as-a-Service is forecast to grow at 30.61% CAGR, the quickest pace among offerings, as firms favor managed environments that merge BI dashboards, ML notebooks and vector search without cluster maintenance. In 2025, the analytics segment captured 50% share of the big data as a service market size for incremental spending and is projected to widen its lead through 2030. Data Platform-as-a-Service remains relevant in regulated scenarios that need custom governance controls, occupying a middle ground between raw infrastructure and end-to-end analytics suites.

Clients increasingly measure success by time-to-insight rather than hardware utilization. Snowflake's launch of Cortex AISQL signals a future where an analyst can query LLMs with plain language and receive governed answers from the same pane of glass that stores transactional data. This convergence blurs the historical divide between ETL, warehousing and analytics, pushing vendors to consolidate features. Over the forecast period, the big data as a service market will therefore pivot from infrastructure-first branding to value propositions built around immediacy of decision support.

Public cloud commanded 63% of revenue in 2024, driven by hyperscaler pricing, but hybrid cloud will rise fastest at 29.51% CAGR. Organizations seek the flexibility to keep sensitive records in private zones while bursting analytics to the public edge during demand spikes. Hybrid options also mitigate vendor lock-in and support compliance when 75% of jurisdictions impose data-residency rules. As a result, the big data as a service market size for hybrid solutions is projected to more than triple between 2025 and 2030.

Multi-cloud architectures are now mainstream: 85% of enterprises employ at least two providers for big-data tasks. Snowflake's recent integration with Apache Iceberg files across AWS, Azure and Google Cloud enables identical queries on any venue, encouraging workload portability. For plants with IoT gateways, hybrid layouts process anomaly scores on local hardware, then forward aggregates to cloud models for historical trend building. Such patterns will entrench hybrid deployments as the backbone of next-generation analytics.

The Big Data As A Service Market Report is Segmented by Service Model (Hadoop-As-A-Service (HaaS), Analytics-As-A-Service (AaaS), and More), Deployment (Public Cloud, Private Cloud, and More), End User Industry (BFSI, Manufacturing, IT and Telecom, and More), and Geography.

Geography Analysis

North America controlled 39% of the big data as a service market in 2024, buoyed by entrenched cloud providers, venture funding and data-driven business cultures. Enterprises in the United States and Canada were early adopters and now focus on refining FinOps practices to tame runaway AI compute bills. Europe follows, propelled by GDPR obligations that favor managed services able to guarantee auditability. Despite stringent privacy rules, the region still grows in mid-teens percentages because providers certify regional clusters and encryption-key sovereignty.

Asia-Pacific is the pacesetter, projected to expand at a 27.85% CAGR. Governments in China, India and Southeast Asia champion national cloud programs while manufacturing digitalization piles new data into BDaaS pipelines. Local hyperscalers such as Alibaba Cloud and Tencent Cloud invest in cross-regional availability zones, removing latency penalties once tied to global providers. Japan and South Korea, early IoT adopters, now experiment with enterprise-grade GenAI built on regional data guardianship frameworks.

Latin America and the Middle East and Africa are earlier in the curve yet show promising absolute growth. Brazilian fintech firms and Mexican retailers shift workloads to BDaaS because capital budgets cannot support large self-hosted clusters. Gulf oil producers run hybrid BDaaS edge nodes on rigs for predictive maintenance, while African telecoms leverage consumption pricing to launch customer-analytics programs without front-loading capital. Collectively, these emerging markets contribute incremental revenue that broadens the global footprint of the big data as a service market.

- Amazon Web Services

- Microsoft

- Google Cloud

- IBM

- Oracle

- SAP

- Hewlett Packard Enterprise

- SAS Institute

- Accenture

- Teradata

- Cloudera

- Snowflake

- Databricks

- Dell Technologies

- Splunk

- Palantir

- Informatica

- Huawei Cloud

- Alibaba Cloud

- Tencent Cloud

- Wipro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud adoption and exploding data volumes

- 4.2.2 Cost-effective alternatives to on-prem big-data stacks

- 4.2.3 Generative-AI-ready analytics demand

- 4.2.4 Edge-to-cloud data fabrics for IoT-rich verticals

- 4.2.5 Data-localization rules fueling regional BDaaS nodes

- 4.2.6 FinOps-linked consumption pricing models

- 4.3 Market Restraints

- 4.3.1 Data privacy and cybersecurity risks

- 4.3.2 Legacy integration complexity

- 4.3.3 Carbon-footprint scrutiny on hyperscale DCs

- 4.3.4 Talent gap in FinOps and data engineering

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Model

- 5.1.1 Hadoop-as-a-Service (HaaS)

- 5.1.2 Analytics-as-a-Service (AaaS)

- 5.1.3 Data Platform-as-a-Service (DPaaS)

- 5.2 By Deployment

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By End User Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 Retail and E-commerce

- 5.3.5 Manufacturing

- 5.3.6 Energy and Power

- 5.3.7 Government and Public Sector

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 ASEAN

- 5.4.4.6 Rest of Asia Pacific

- 5.4.5 Middle East

- 5.4.5.1 GCC

- 5.4.5.2 Turkey

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Microsoft

- 6.4.3 Google Cloud

- 6.4.4 IBM

- 6.4.5 Oracle

- 6.4.6 SAP

- 6.4.7 Hewlett Packard Enterprise

- 6.4.8 SAS Institute

- 6.4.9 Accenture

- 6.4.10 Teradata

- 6.4.11 Cloudera

- 6.4.12 Snowflake

- 6.4.13 Databricks

- 6.4.14 Dell Technologies

- 6.4.15 Splunk

- 6.4.16 Palantir

- 6.4.17 Informatica

- 6.4.18 Huawei Cloud

- 6.4.19 Alibaba Cloud

- 6.4.20 Tencent Cloud

- 6.4.21 Wipro

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment