|

市場調查報告書

商品編碼

1851229

隔音隔熱材料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Acoustic Insulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

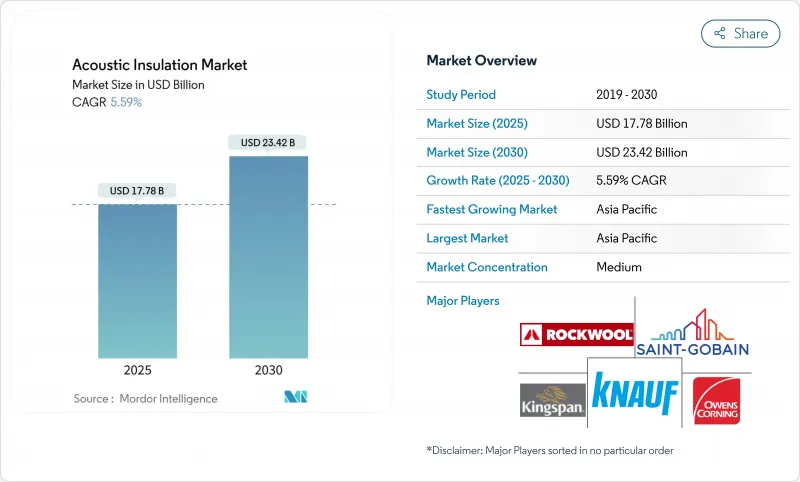

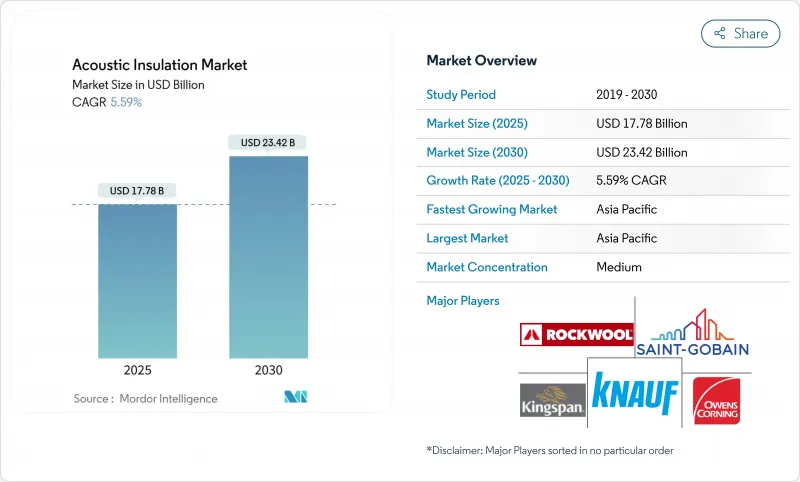

2025年,隔音隔熱材料市場規模預估為177.8億美元,預估至2030年將達234.2億美元,預測期(2025-2030年)複合年成長率為5.59%。

各大地區的監管機構正在收緊噪音法規,促使住宅、商業和工業計劃更早採用隔音材料。亞太地區的都市化、已開發國家開放式辦公空間的普及以及建築節能規範中聲學舒適性的納入,正推動噪音控制從事後考慮轉變為核心設計標準。礦物棉憑藉其優異的防火性能和高吸音性,繼續保持領先地位;而隨著暖通空調工程師尋求輕質、防潮的解決方案,聚合物泡沫正在縮小與礦物棉的差距。同時,製造商正致力於研發低碳配方和經認證的生物基材料,以使聲學性能與綠色建築目標保持一致,這些因素共同塑造了隔音隔熱材料市場的競爭格局。

全球隔音隔熱材料市場趨勢及洞察

亞洲基礎建設熱潮需要消除噪音

中國、印度和東南亞對鐵路、機場和綜合用途建築的大規模投資,推動了對輕薄高性能隔音屏障的需求。中國GB 50118建築規範的修訂,要求開發商自2025年1月起達到更嚴格的隔音等級(STC)基準值,這迫使隔音隔熱材料市場迅速擴大經測試系統的供應。印度對其國家建築規範的逐步修訂也反映了這一監管趨勢,將聲學性能納入早期設計和競標階段,而不是等到後期修訂。隨著多用戶住宅、高架地鐵和物流走廊等場所的噪音影響日益受到關注,建築師開始選擇混合礦物棉和聚合物泡沫複合材料,以提供頻寬的隔音效果。製造商正將生產集中在成長走廊附近,以降低交通噪音並縮短大型基礎設施項目的前置作業時間。因此,合規驅動的採購正在加速產品價值的轉變,從基礎的散裝卷材轉向將隔音、隔熱和防火性能整合到單一產品線的認證系統。這項措施旨在為隔音隔熱材料市場確保長期需求底線,同時將銷售管道再形成為以規格主導的模式。

政府法規控制噪音污染

政策框架正從簡單的分貝限制轉向以健康為基礎的綜合指標,迫使規範制定者記錄吸聲係數、隔音等級(STC)和生命週期概況。歐盟更新了《環境噪音指令》和關於車輛噪音的第540/2014號法規,要求成員國在2026年前完成主要公路、鐵路和機場走廊的噪音測繪和治理。在美國,針對環保署(EPA)的持續訴訟,旨在強制執行一些長期擱置的噪音控制法律,這重新引發了關於國家標準的爭論,並促使一些已經要求對混合用途許可證進行聲學調查的市政當局更加積極地採取行動。隨著法規的日益嚴格,採購團隊現在要求第三方合規認證,這使得擁有完整文件的供應商能夠獲得更高的價格溢價。一些歐盟成員國認可礦棉空腔屏障作為隔熱和隔音隔間,這種雙重價值提案增強了隔音材料在市場上的隔熱材料。

不穩定的石油化學原料會影響發泡塑膠的成本平衡。

異氰酸酯和發泡價格上漲,導致聚合物泡沫和礦物棉之間的成本差距不斷擴大,擾亂了既定的計劃預算。在價格敏感型市場,當發泡聚苯乙烯泡沫塑膠(Styrofoam)價格飆升時,承包商替代低等級纖維氈,導致聚氨酯和擠塑聚苯乙烯生產線的短期需求下降。為了應對這項挑戰,研究團隊正在利用再生PET、甘蔗渣多元醇和生物二氧化碳膨鬆劑來改善泡沫材料,以抵消原油價格波動的影響。然而,規模化生產仍然不穩定,預計這種波動將持續到2026年,這將限制泡沫材料的廣泛應用,儘管其性能仍然備受認可。

細分市場分析

2024年,礦物棉的銷售額將佔總銷售額的38%,這主要得益於其固有的防火性能、強大的低頻吸音能力以及符合不斷發展的安全標準。 ROCKWOOL公司預計,2024年售出的岩棉系統將節省818太瓦時(TWh)的生命週期能源,同時改善全球180萬名學生的學習環境。玻璃絨也將緊隨其後,因為它重量輕、成本效益高,而且易於現場切割,尤其適用於坡屋頂的房屋。聚合物發泡體的複合年成長率(CAGR)最高,達到6%,因為暖通空調工程師優先考慮濕度控制和對複雜風管形狀的靈活適應性,但原料價格波動減緩了其普及速度。天然纖維類別在低碳建築計劃中不斷進步,例如IndiTherm氈墊在50毫米厚度下可實現40分貝的降噪效果,並且具有負隱含碳排放。經過生物基認證的改質黏合劑(可去除甲醛)有助於礦物棉抵禦競爭壓力,而隔音隔熱材料市場也維持著材料多樣性的平衡。

區域分析

亞太地區預計到2024年將佔全球收入佔有率的36%,並預計在2030年之前維持7.50%的複合年成長率。這主要得益於中國、印度和新興東協經濟體大力推動大型鐵路走廊、智慧城市區域和高層叢集。在中國,日益嚴重的噪音問題引發了社區的強烈不滿,促使地方政府收緊了建築幕牆的隔音等級標準,從而帶動了高密度岩棉幕牆嵌件的大量訂單。同樣,在政府激勵措施的支持下,印度的城市住房建設也從可選升級為強制要求,推動了玻璃絨捲材和輕質隔間套件的需求。

2024年,北美將為全球銷售做出顯著貢獻,這主要得益於辦公大樓的大規模維修以及市政噪音法規執行力度的加大。市政負責人越來越要求對混合用途建築許可證進行噪音影響評估,而建築師則採用混合礦棉和再生PET板材來平衡成本和LEED認證積分。在人口密度高的城市地區,由於建築面積比限制了建築幕牆面厚度,用於幕牆橫樑的高級氣凝膠膠帶正日益受到歡迎。

歐盟環境噪音指令要求在2026年前更新噪音地圖和行動計畫。多用戶住宅和交通樞紐正受益於礦物棉空腔隔間牆和符合嚴格防火等級的高降噪等級(NRC)天花板的廣泛應用。中東和非洲地區正經歷強勁成長,尤其是波灣合作理事會成員國,它們在體育場館、地鐵和機場航站大樓中採用了世界一流的聲學標準。在南美洲,巴西的公寓維修中大量使用玻璃絨氈,推動了隔音材料的銷售顯著成長;而隨著人們對隔音意識的提高,阿根廷也正在逐步採用模組化牆板。這些多元化的區域動態凸顯了隔音隔熱材料的全球覆蓋範圍,並使其能夠抵禦週期性波動。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲基礎建設熱潮推動噪音治理法規訂定

- 政府推出法規遏制噪音污染,住宅用戶數量激增

- 新興國家需求不斷成長

- 開放式辦公空間的興起推動了吸音天花板和隔間板的發展

- 市場限制

- 揮發性石油化學原料會影響發泡塑膠的成本平衡。

- 新興市場氣凝膠毯安裝技術差距

- 多層複合廢棄物流的可回收壓力

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依材料類型

- 礦物棉

- 玻璃絨

- 聚合物泡沫

- 自然的

- 按安裝區域

- 牆壁和隔間

- 地板和地板下

- 天花板和屋頂

- 暖通空調風管及管道包裹

- 按最終用戶行業分類

- 住宅建設

- 商業建築

- 運輸

- 產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- 3M

- Armacell

- Aspen Aerogels, Inc.

- BASF SE

- Cabot Corporation

- CSR Pty Limited

- Fletcher Insulation

- Huntsman International LLC

- Hush Acoustics

- Johns Manville

- Kingspan Group

- Knauf Group

- Owens Corning

- Recticel Insulation

- ROCKWOOL A/S

- Saint-Gobain

- Siderise Group

- Sika AG

- Trelleborg AB

- Xella International(Etex Group)

第7章 市場機會與未來展望

The Acoustic Insulation Market size is estimated at USD 17.78 billion in 2025, and is expected to reach USD 23.42 billion by 2030, at a CAGR of 5.59% during the forecast period (2025-2030).

Regulatory authorities in every major region are tightening noise-control rules, propelling early-stage specification of sound-dampening materials in residential, commercial, and industrial projects. Urbanization in Asia-Pacific, the proliferation of open-plan offices in developed economies, and the integrating of acoustic comfort into building energy codes have moved noise mitigation from an afterthought to a core design criterion. Mineral wool retains leadership because it offers robust fire resistance and high sound absorption, and polymeric foams are closing the gap as HVAC engineers demand lightweight, moisture-tolerant solutions. Meanwhile, manufacturers are pursuing carbon-reduced formulations and certified biobased content to align acoustic performance with green-building targets, a combination shaping the competitive playbook in the acoustic insulation market.

Global Acoustic Insulation Market Trends and Insights

Infrastructure Boom-Driven Noise Mitigation Mandates in Asia

Massive investment in rail, airport, and mixed-use real estate across China, India, and Southeast Asia is amplifying demand for low-profile yet high-performance acoustic barriers. China's updated GB 50118 building code introduces stricter STC thresholds that developers must meet from January 2025, forcing the acoustic insulation market to supply tested systems at scale. India's phased amendments to its National Building Code replicate this regulatory momentum, locking acoustics into early design and tender stages instead of late-cycle fixes. Multi-tower housing, elevated metro lines, and logistics corridors are now heavily scrutinized for community noise impact, which is pushing architects toward hybrid mineral-wool and polymeric-foam composites that block wide frequency ranges. Manufacturers are localizing production near growth corridors to cut transport noise during logistics and to shorten lead times for large infrastructure lots. Consequently, compliance-driven procurement is accelerating value migration from basic bulk rolls toward certified systems that bundle acoustic, thermal, and fire performance attributes within one product line. This activity is securing a long-run demand floor for the acoustic insulation market while re-shaping sales channels toward specification-led models.

Government Regulations for Controlling Noise Pollution

Policy frameworks are moving beyond simple decibel caps to holistic health-based indicators, forcing specifiers to document absorption coefficients, STC ratings, and life-cycle profiles. The European Union has refreshed the Environmental Noise Directive and Regulation No 540/2014 on vehicle noise, obliging member states to map and treat major road, rail, and airport corridors by 2026. In the United States, ongoing litigation against the EPA to enforce the dormant Noise Control Act has reignited debate on national standards, energizing municipalities that already require acoustic studies for mixed-use permitting. As regulations solidify, procurement teams now demand third-party certificates that prove compliance, opening premium price territory for suppliers with complete documentation packages. Coupling of acoustic standards with energy codes is also growing; several EU states now recognise mineral-wool cavity barriers as both thermal and sound partitions, generating dual-value propositions that fortify pricing power in the acoustic insulation market.

Volatile Petrochemical Feedstock Impacting Foamed-Plastic Cost Parity

Surging prices for isocyanates and blowing agents widen cost differentials between polymeric foams and mineral wool, disrupting established project budgets. Contractors in price-sensitive markets now substitute lower-grade fibre batts when foam quotes spike, trimming short-term demand for polyurethane and extruded polystyrene lines. In response, research teams are reformulating foams with recycled PET, sugarcane bagasse polyols, and bio-CO2 expansion to insulate against crude-oil price swings. Yet scale-up remains uneven, and volatility is expected to persist through 2026, tempering foam uptake even as performance credentials remain strong.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Demand from Emerging Economies

- Growth of Open-Plan Offices Spurring Ceiling & Partition Acoustic Panels

- Installation Skill Gap for Aerogel Blankets in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mineral wool generated 38% of 2024 revenue, propelled by inherent fire resistance, robust low-frequency absorption, and compatibility with evolving safety codes. ROCKWOOL estimates that stone-wool systems sold in 2024 will save 818 TWh of lifetime energy while enhancing learning conditions for 1.8 million students worldwide. Glass-wool follows closely thanks to lightweight, cost efficiency, and ease of cutting on job sites, especially in pitched-roof housing. Polymeric foams post the quickest 6% CAGR as HVAC engineers prioritise moisture control and flexible fit for complex duct geometries, though feedstock volatility moderates uptake. Natural-fiber categories are advancing in low-carbon building schemes, with products like IndiTherm batts delivering a 40 dB reduction at 50 mm thickness and negative embodied carbon scores. Reformulated binders that eliminate formaldehyde and achieve biobased certification are helping mineral wool withstand competitive pressure, ensuring the acoustic insulation market maintains balanced material diversity.

The Acoustic Insulation Market Report is Segmented by Material Type (Mineral Wool, Glass Wool, and More), Installation Zone (Wall and Partition, Floor and Sub-Floor, and More), End-User Industry (Residential Construction, Commercial Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with a 36% revenue share in 2024, and the region is forecast to log a 7.50% CAGR through 2030 as China, India, and emerging ASEAN economies advance mega-rail corridors, smart-city zones, and high-rise residential clusters. China's community backlash against elevated noise has spurred local authorities to enforce stricter facade STC benchmarks, translating into bulk orders for dense stone-wool curtain-wall inserts. India's urban housing drive, backed by state incentives, similarly elevates acoustic compliance from optional to mandatory, swelling demand for glass-wool rolls and lightweight partition kits.

In 2024, North America significantly contributed to global revenue, driven by proactive office retrofits and heightened enforcement of municipal noise ordinances. Municipal planners increasingly require noise-impact studies for mixed-use permits, and architects respond with hybrid mineral-wool and recycled-PET panels to balance cost and LEED credits. Premium aerogel tapes for curtain-wall spandrels are gaining traction in dense city cores where floor-area ratios pressure facade thickness.

Europe remains a key player in regulatory advancements, with the EU's Environmental Noise Directive driving the requirement for updated noise maps and action plans by 2026. Multi-family housing and transport hubs are benefiting significantly, utilizing mineral-wool cavity barriers and high-NRC ceiling clouds that comply with stringent fire classifications. The Middle East and Africa region is experiencing robust growth, particularly in Gulf Cooperation Council states, which are incorporating world-class acoustic standards into their stadiums, metros, and airport terminals. South America contributes notably to sales, with Brazil leading through condominium retrofits favoring glass-wool batts, while Argentina is gradually adopting modular wall panels as awareness increases. This diverse regional landscape highlights the global scope of the acoustic insulation market and provides resilience against market cyclicality

- 3M

- Armacell

- Aspen Aerogels, Inc.

- BASF SE

- Cabot Corporation

- CSR Pty Limited

- Fletcher Insulation

- Huntsman International LLC

- Hush Acoustics

- Johns Manville

- Kingspan Group

- Knauf Group

- Owens Corning

- Recticel Insulation

- ROCKWOOL A/S

- Saint-Gobain

- Siderise Group

- Sika AG

- Trelleborg AB

- Xella International (Etex Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure Boom-Driven Noise Mitigation Mandates in Asia

- 4.2.2 Government Regulations for Controlling Noise Pollution and Surge in Adoption in Residential Application

- 4.2.3 Rise in Demand from Emerging Economies

- 4.2.4 Growth of Open-Plan Offices Spurring Ceiling and Partition Acoustic Panels

- 4.3 Market Restraints

- 4.3.1 Volatile Petrochemical Feedstock Impacting Foamed-Plastic Cost Parity

- 4.3.2 Installation Skill Gap for Aerogel Blankets in Emerging Markets

- 4.3.3 Recycling Compliance Pressures on Multilayer Composite Waste Streams

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Mineral Wool

- 5.1.2 Glass Wool

- 5.1.3 Polymeric Foams

- 5.1.4 Natural

- 5.2 By Installation Zone

- 5.2.1 Wall and Partition

- 5.2.2 Floor and Sub-Floor

- 5.2.3 Ceiling and Roof

- 5.2.4 HVAC Duct and Pipe Wrap

- 5.3 By End-User Industry

- 5.3.1 Residential Construction

- 5.3.2 Commercial Construction

- 5.3.3 Transportation

- 5.3.4 Industrial

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Armacell

- 6.4.3 Aspen Aerogels, Inc.

- 6.4.4 BASF SE

- 6.4.5 Cabot Corporation

- 6.4.6 CSR Pty Limited

- 6.4.7 Fletcher Insulation

- 6.4.8 Huntsman International LLC

- 6.4.9 Hush Acoustics

- 6.4.10 Johns Manville

- 6.4.11 Kingspan Group

- 6.4.12 Knauf Group

- 6.4.13 Owens Corning

- 6.4.14 Recticel Insulation

- 6.4.15 ROCKWOOL A/S

- 6.4.16 Saint-Gobain

- 6.4.17 Siderise Group

- 6.4.18 Sika AG

- 6.4.19 Trelleborg AB

- 6.4.20 Xella International (Etex Group)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Demand for Aesthetic Prospects and Fire-resistant Properties of Acoustic Insulation