|

市場調查報告書

商品編碼

1851225

氟聚合物薄膜:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Fluoropolymer Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

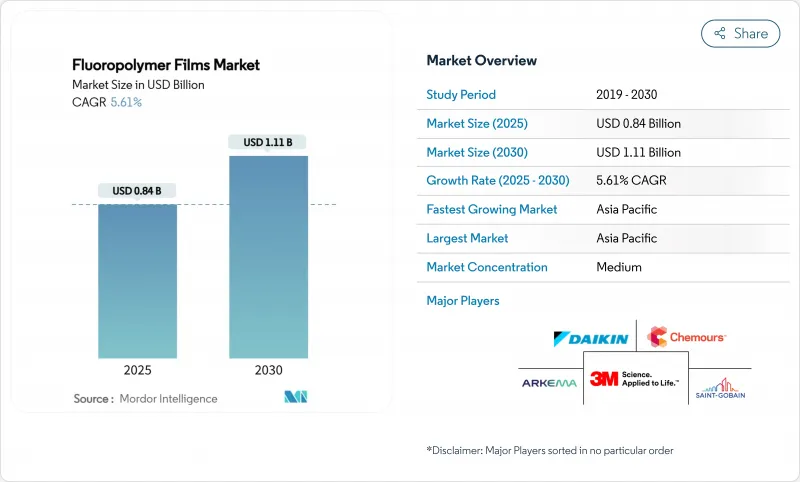

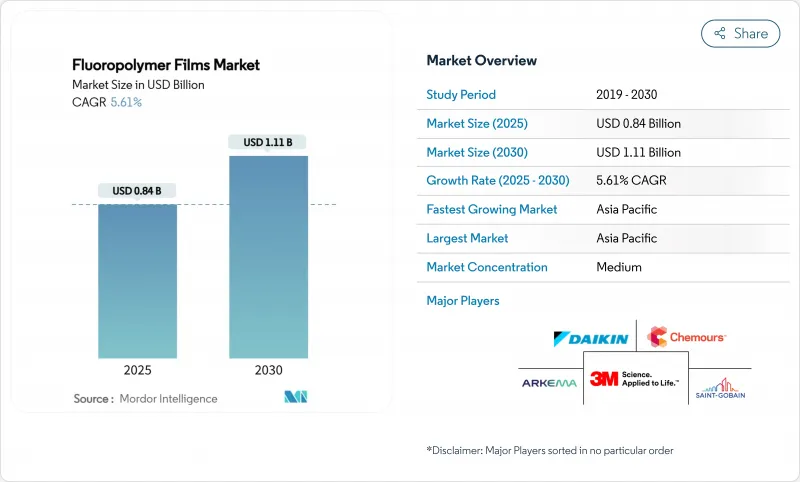

預計到 2025 年,氟聚合物薄膜市場規模將達到 8.4 億美元,到 2030 年將達到 11.1 億美元,預測期內(2025-2030 年)複合年成長率為 5.61%。

這一成長前景主要得益於其不可替代的性能優勢,特別是化學惰性、低表面能和寬溫穩定性,這些優勢持續抵消全氟和多氟烷基物質 (PFAS) 日益成長的監管壓力。光伏 (PV)、輕型電動車 (EV) 和半導體污染防護的快速普及仍然是三大最具影響力的需求促進因素。現有製造商正在拓展產品系列,以滿足關鍵任務應用的需求,而非僅僅追求產量;下游客戶也越來越願意為產品的耐用性和安全性買單。亞太地區保持著結構性的成本優勢和靠近終端應用市場的地理優勢;北美買家優先考慮高純度和可追溯性;歐洲政策制定者正在推動符合 PFAS 標準的化學品的創新。預計在未來五年內,這些因素將共同推動氟聚合物薄膜市場穩定成長,而非指數級成長。

全球氟聚合物薄膜市場趨勢與洞察

光伏太陽能電池正面和背面薄膜的需求加速成長

在軟性太陽能發電系統中,透明、耐候的氟聚合物層壓板取代了厚重的玻璃。低水蒸氣透過率的鈣鈦礦基組件即使經過2000小時的濕度和耐熱性測試,仍能維持84%的效率,進而將組件保固期延長至25年。亞太地區的消費佔有率反映了光電模組的主導地位,而美國的社區太陽能政策則進一步推高了需求高峰。因此,阻隔膜仍然是氟聚合物薄膜市場中最大的應用領域。

藥品和醫療包裝的採用率不斷提高

生技藥品和個人化療法需要嚴格的防潮和化學屏障。科慕公司認為,聚四氟乙烯(PTFE)和聚偏二氟乙烯(PVDF)等級的材料因其低析出物和高生物相容性,是預填充式注射器和微導管的必備材料。美國FDA關於容器密封性的指導意見促使製藥公司指定使用高純度氟聚合物內襯來保護敏感的活性成分。這與歐盟附件1的修訂相吻合,推動了對醫用薄膜的需求。

加強全球 PFAS 法規

美國環保署 (EPA) 已禁止生產 329 種 PFAS,且未經審查,並將 PFOA 和 PFOS 列為有害物質。明尼蘇達州和加州將從 2025 年 1 月起禁止在部分消費品中使用 PFAS,歐盟的 REACH 法規提案旨在限制 10,000 多種物質的濃度超過閾值值。合規成本和潛在的替代風險將使含氟聚合物薄膜市場的預期總合年成長率 (CAGR) 降低 1.4 個百分點。

細分市場分析

聚四氟乙烯(PTFE)的市佔率為46.55%。其高熔體黏度和無與倫比的化學惰性使其廣泛應用於半導體製造腔室、墊片和高頻電纜。台灣和美國工廠的持續擴建支撐了市場需求的韌性。儘管監管政策即將發生變化,但PTFE的低摩擦係數也使其用於外科器械襯墊。

到2030年,氟化乙烯丙烯(FEP)將成為成長最快的聚合物家族,複合年成長率(CAGR)將達到6.09%。較低的熔融溫度使得熔融擠出管材、可配色片材以及用於家用電器機殼的3D列印耗材得以廣泛應用。阿科瑪推出的FluorX耗材展示了FEP如何克服聚四氟乙烯(PTFE)在積層製造上應用受限的加工難題。使用者看重其光學透明度和200°C的連續使用溫度,這促使其在軟性印刷電路領域得到更廣泛的應用。

氟聚合物薄膜報告按類型(聚四氟乙烯 (PTFE)、聚二氟亞乙烯(PVDF)、其他)、應用(阻隔膜、離型膜、微孔膜、安全膜)、最終用戶產業(汽車/航太/國防、建築、包裝、工業、電子/半導體、其他)和地區(亞太地區、北美、歐洲、南美、中東/非洲)進行細分。

區域分析

到2024年,亞太地區將貢獻全球48.62%的收入,其中氟聚合物薄膜市場規模預計將以6.20%的複合年成長率成長,為該地區最高。中國一體化的光伏供應鏈消耗大量的PVF背板和ETFE面板,而政府激勵措施正在加速屋頂太陽能維修。印度的電子製造業扶持計畫將推動國內對高純度PTFE膠帶的採購,進而提高基準需求。日本的汽車平台正在向800V架構轉型,因此更傾向於使用PEEK和PTFE介電薄膜以改善溫度控管。

北美受益於強勁的半導體資本投資和醫療設備創新。根據美國《晶片製造法案》(CHIPS Act),晶片製造廠正在提升無塵室標準,推動了對聚四氟乙烯(PTFE)和氟乙烯(FEP)耗材的需求。從密西根州到喬治亞,電動車平台都需要用於車身白板的複合離型膜。

歐洲在監管嚴格性和氣候政策之間尋求平衡。德國和西班牙的綠色氫電解槽初步試驗正在使用含氟聚合物PEM膜。德國和法國的汽車原始設備製造商(OEM)正在使用ETFE車頂蒙皮來減輕重量。然而,歐盟範圍內提案的PFAS法規造成了不確定性,促使生產商投資於閉合迴路捕集和廢氣減排技術。這些措施雖然增加了合規成本,但卻維持了供應。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 光伏太陽能電池正面和背面薄膜的需求加速成長

- 藥品和醫療包裝的採用率不斷提高

- 電動車推動了輕質複合複合材料脫模膜的普及

- 綠色氫電解槽中的氟聚合物質子交換膜

- 用於電子航空固態電池的微孔聚四氟乙烯隔膜

- 市場限制

- 全球範圍內加強對 PFAS 的監管

- 原物料成本不穩定

- 無氟高阻隔多層膜的興起

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 聚四氟乙烯(PTFE)

- 聚二氟亞乙烯(PVDF)

- 氟化乙烯丙烯(FEP)

- 乙烯-四氟乙烯(ETFE)

- 全氟烷氧基烷烴(PFA)

- 聚偏氟乙烯(PVF)

- 其他

- 透過使用

- 阻隔膜

- 發行影片

- 微孔膜

- 安全膜

- 按最終用戶行業分類

- 汽車、航太與國防

- 建造

- 包裹

- 產業

- 電子和半導體

- 其他(紡織品、平面設計)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- 3M

- AGC Inc.

- Arkema

- Daikin Industries Ltd.

- DuPont

- Fluortek AB

- Honeywell International Inc.

- Jiangsu Meilan Chemical Co. Ltd

- Nitto Denko Corporation

- Saint-Gobain

- Solvay

- The Chemours Company

- TORAY INDUSTRIES, INC.

- Zeus Industrial Products Inc.

第7章 市場機會與未來展望

The Fluoropolymer Films Market size is estimated at USD 0.84 billion in 2025, and is expected to reach USD 1.11 billion by 2030, at a CAGR of 5.61% during the forecast period (2025-2030).

This growth outlook underscores how irreplaceable performance attributes, notably chemical inertness, low surface energy, and wide-temperature stability, continue to outweigh mounting regulatory pressures on per- and polyfluoroalkyl substances (PFAS). Rapid photovoltaic (PV) build-out, electric-vehicle (EV) light-weighting, and semiconductor contamination control remain the three most influential demand engines. Incumbent producers are widening product portfolios for mission-critical applications rather than chasing volume alone, while downstream customers signal rising willingness to pay for durability and safety assurances. Asia Pacific retains structural cost advantages and end-use proximity, Northern American buyers prioritize high-purity and traceability, and European policy makers drive innovation in PFAS-compliant chemistries. Together, these forces point to a steady, rather than exponential, expansion path for the fluoropolymer films market over the next five years.

Global Fluoropolymer Films Market Trends and Insights

Accelerating Demand for PV Solar Front-Sheet and Back-Sheet Films

Flexible PV installations rely on transparent and weather-resistant fluoropolymer laminates to displace heavier glass. Lower water-vapor-transmission rates help perovskite modules retain 84% efficiency after 2,000 hours of damp-heat testing, extending module warranties to 25 years. Asia Pacific's consumption share mirrors its photovoltaic assembly dominance, while U.S. community-solar policies reinforce demand peaks. Consequently, barrier films remain the largest application slice of the fluoropolymer films market.

Rising Pharmaceutical and Medical Packaging Adoption

Biologics and personalized therapies require stringent moisture and chemical barriers. Chemours confirms that PTFE and PVDF grades remain essential in pre-filled syringes and micro-catheters because of their low extractables and biocompatibility. U.S. FDA guidance on container-closure integrity pushes drug makers to specify high-purity fluoropolymer liners to protect sensitive actives. Matching trends in EU Annex 1 revisions strengthen demand for medical-grade films.

Global PFAS Regulatory Tightening

The U.S. EPA has barred production of 329 PFAS without agency review and designated PFOA and PFOS as hazardous substances. Minnesota and California ban PFAS in select consumer products from January 2025, while an EU REACH proposal seeks to restrict more than 10,000 substances above threshold concentrations. Compliance costs and potential substitution risks collectively shave 1.4 percentage points off the forecast CAGR for the fluoropolymer films market.

Other drivers and restraints analyzed in the detailed report include:

- EV-Led Uptake of Release Films for Lightweight Composites

- Fluoropolymer Proton-Exchange Membranes in Green-Hydrogen Electrolysers

- Volatile Feedstock Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polytetrafluoroethylene (PTFE) held a 46.55% share. High melt viscosity yet unmatched chemical inertness anchors its use in semiconductor fabrication chambers, gasket sheets, and high-frequency cables. Continued fab expansions in Taiwan and the United States support demand resilience. The material's low friction coefficient also keeps PTFE relevant in surgical device liners despite looming regulatory review.

Fluorinated Ethylene-Propylene's (FEP) 6.09% CAGR positions it as the fastest-growing polymer family through 2030. Lower melt temperature enables melt-extruded tubing, color-matchable sheets, and increasingly 3-D printed filaments for consumer electronics housings. Arkema's FluorX filament release illustrates how FEP addresses processing constraints that limit PTFE uptake in additive manufacturing. Users value optical clarity combined with 200 °C continuous-use temperature, broadening adoption in flexible printed circuits.

The Fluoropolymer Films Report is Segmented by Type (Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), and More), Application (Barrier Films, Release Films, Microporous Films, and Security Films), End-User Industry (Automotive/Aerospace/Defense, Construction, Packaging, Industrial, Electronics/Semiconductor, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia Pacific generated 48.62% of global sales in 2024, with the fluoropolymer films market size expanding at a region-leading 6.20% CAGR. China's integrated PV supply chain consumes vast volumes of PVF backsheets and ETFE frontsheets, while government incentives accelerate rooftop-solar retrofits. India's electronics manufacturing scheme promotes domestic sourcing of high-purity PTFE tapes, elevating baseline demand. Japan's automotive platforms shift to 800-V architectures, favouring PEEK and PTFE dielectric films for improved thermal management.

North America benefits from strong semiconductor capital expenditure and medical-device innovation. Chip fabs under the U.S. CHIPS Act upgrade clean-room standards, driving PTFE and FEP consumables. EV platforms from Michigan to Georgia require composite release films for body-in-white panels.

Europe balances regulatory stringency with climate-policy pull. Green-hydrogen electrolyser pilots in Germany and Spain incorporate fluoropolymer PEMs. Automotive OEMs in Germany and France integrate ETFE roof skins for weight savings. Yet proposed EU-wide PFAS restrictions inject uncertainty, prompting producers to invest in closed-loop recovery and waste-gas abatement. Such measures sustain supply, albeit at higher compliance cost.

- 3M

- AGC Inc.

- Arkema

- Daikin Industries Ltd.

- DuPont

- Fluortek AB

- Honeywell International Inc.

- Jiangsu Meilan Chemical Co. Ltd

- Nitto Denko Corporation

- Saint-Gobain

- Solvay

- The Chemours Company

- TORAY INDUSTRIES, INC.

- Zeus Industrial Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Demand for PV Solar Front-Sheet and Back-Sheet Films

- 4.2.2 Rising Pharmaceutical and Medical Packaging Adoption

- 4.2.3 EV-Led Uptake of Release Films for Lightweight Composites

- 4.2.4 Fluoropolymer Proton-Exchange Membranes in Green-Hydrogen Electrolysers

- 4.2.5 Microporous PTFE Separators for Solid-State E-Aviation Batteries

- 4.3 Market Restraints

- 4.3.1 Global PFAS Regulatory Tightening

- 4.3.2 Volatile Feedstock Costs

- 4.3.3 Rise of Fluorine-Free High-Barrier Multilayer Films

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Polytetrafluoroethylene (PTFE)

- 5.1.2 Polyvinylidene Fluoride (PVDF)

- 5.1.3 Fluorinated Ethylene-Propylene (FEP)

- 5.1.4 Ethylene Tetrafluoroethylene (ETFE)

- 5.1.5 Perfluoroalkoxy Alkane (PFA)

- 5.1.6 Polyvinyl Fluoride (PVF)

- 5.1.7 Others

- 5.2 By Application

- 5.2.1 Barrier Films

- 5.2.2 Release Films

- 5.2.3 Microporous Films

- 5.2.4 Security Films

- 5.3 By End-User Industry

- 5.3.1 Automotive, Aerospace and Defense

- 5.3.2 Construction

- 5.3.3 Packaging

- 5.3.4 Industrial

- 5.3.5 Electronics and Semiconductor

- 5.3.6 Others (Textiles, Graphics)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Daikin Industries Ltd.

- 6.4.5 DuPont

- 6.4.6 Fluortek AB

- 6.4.7 Honeywell International Inc.

- 6.4.8 Jiangsu Meilan Chemical Co. Ltd

- 6.4.9 Nitto Denko Corporation

- 6.4.10 Saint-Gobain

- 6.4.11 Solvay

- 6.4.12 The Chemours Company

- 6.4.13 TORAY INDUSTRIES, INC.

- 6.4.14 Zeus Industrial Products Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment