|

市場調查報告書

商品編碼

1851223

混合雲端:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Hybrid Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

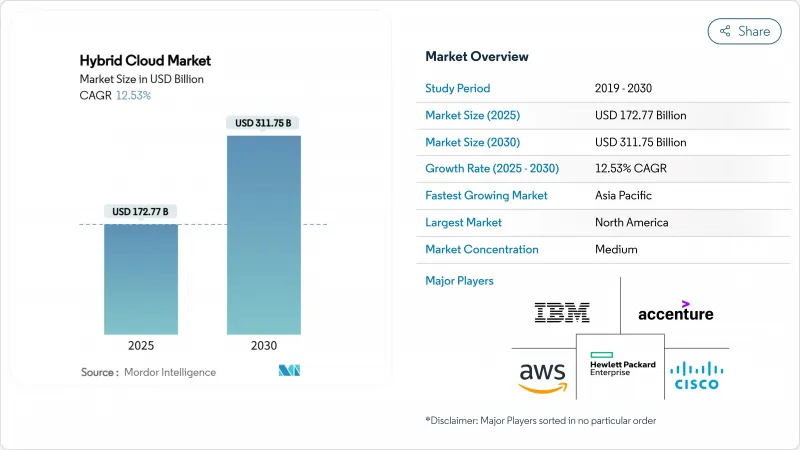

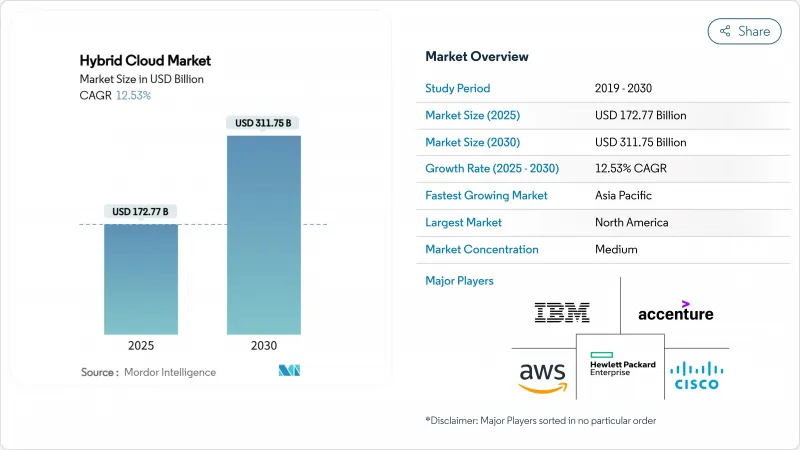

預計到 2025 年,混合雲端市場規模將達到 1,727.7 億美元,到 2030 年將達到 3,117.5 億美元,2025 年至 2030 年的複合年成長率為 12.53%。

生成式人工智慧工作負載尤其需要邊緣運算資源和集中式運算資源之間的緊密協作,這促使企業轉向分散式架構,以平衡運維控制和雲端原生速度。不斷擴展的主權規則、多重雲端偏好以及日益成熟的容器編配框架正在推動對混合部署模式的需求。邊緣運算投資降低了人工智慧推理延遲,同時出於合規性考慮,數據仍保留在企業內部。領先的資料中心營運商正在將基礎設施項目與企業脫碳目標相結合,並將永續性納入其採購標準。超大規模資料中心和專業邊緣計劃的策略性收購正在增強混合雲端市場的競爭差異化。

全球混合雲端市場趨勢與洞察

大型企業多重雲端採用率激增

如今,混合環境是多重雲端策略的基石,87% 的企業跨多個雲端服務供應商運行工作負載。平台團隊正在標準化工具,以減少重複支出並提高管治的一致性。財務營運實務也不斷完善,旨在減少混合雲端市場的浪費。供應商則透過提供統一的計費儀表板來回應,這些儀表板將使用情況對應到成本中心。隨著多重雲端成熟度的提高,工作負載的無縫遷移已成為混合雲端市場的核心採購標準。

資料主權架構的需求日益成長

具體到歐洲,84% 的公司正在使用或計劃在未來 12 個月內使用主權雲端解決方案。澳洲和亞洲部分地區也採用了類似的規則,迫使服務提供者推出區域特定的控制平面。超大規模雲端服務商目前正在整合機密運算和僅限歐盟地區的支援模式,以維持其在混合雲端市場的佔有率。因此,合規性的複雜性正在推動對架構設計的需求,這種設計既能將敏感資料保留在特定司法管轄區內,又能利用全球規模來處理監管較少的工作負載。

遷移複雜性與遺留系統整合成本

現代化計劃常常會發現未記錄的依賴關係,導致工期和預算超支。大型銀行在為混合環境重構核心支付系統時,都報告了嚴重的成本超支。如今,73% 的公司選擇重構而非直接遷移,雖然延長了工期,但卻提高了系統的彈性。儘管持續整合管道和 API 閘道在一定程度上緩解了這些障礙,但技術債仍然是混合雲端市場短期內發展的一大阻力。

細分市場分析

預計到2024年,解決方案將維持65.5%的混合雲端市場佔有率,業務收益到2030年將以15.3%的複合年成長率成長。企業尋求多重雲端編配、主權映射和AI堆疊調優的專家指導,是推動高速成長的主要因素。 Rackspace和AWS已推出快速遷移服務計劃,將專業服務與工具捆綁在一起,以縮短切換時間。

託管式財務營運、容器安全和平台運維的需求正推動服務提供者擴展其服務範圍。 Nutanix 推出了企業級人工智慧平台,將軟體和諮詢服務結合,以應對技能短缺問題。這些趨勢表明,隨著企業將複雜性外包,服務將在市場區隔中佔據更大的佔有率。

預計從2025年到2030年,IaaS將以14.1%的複合年成長率成長,而SaaS則憑藉企業套件的普及,維持54.7%的市場佔有率。生成式人工智慧訓練需要配備豐富GPU的集群,客戶通常會在IaaS的基礎上進行客製化調優。為了凸顯IaaS的多功能性, Oracle擴展了其分散式雲端產品線,推出了Roving Edge設備,將電腦部署在環境惡劣的地區。

平台即服務 (PaaS) 提供了一座策略橋樑,在提供抽象層的同時,也支援自訂運行時。 Snowflake 已將其平台與 Azure OpenAI 服務整合,以簡化分析開發人員的模型使用。人工智慧和市場推廣工作流程的整合將繼續在混合雲端市場中將這三種模式連結起來。

混合雲端市場按組件(解決方案、服務)、服務模式(IaaS、PaaS、SaaS)、組織規模(大型企業、中小企業)、最終用戶行業(政府及公共部門、醫療保健及生命科學、銀行、金融服務及保險業、其他)及地區進行細分。市場預測以美元計價。

區域分析

北美地區預計到 2024 年將佔據 25.8% 的營收佔有率,這得益於其密集的超大規模雲端佈局,簡化了多重雲端。聯邦隱私法規仍然可控,使企業能夠自由最佳化混合雲端市場的工作負載部署。

亞太地區到2030年將以13.2%的複合年成長率領先,主要得益於新增容量和對數位服務日益成長的需求。微軟已承諾在日本投資29億美元建造新的人工智慧和雲端中心,以滿足不斷成長的推理需求。隨著國內成長放緩,中國服務提供者正積極尋求國際擴張。目前,該地區的資料中心總容量已達12,206兆瓦,在運作中容量達14,338兆瓦,這將為混合雲端市場的未來成長提供有力支撐。

歐洲依然保持強勁勢頭,84% 的公司已經部署或計劃部署主權雲端框架。微軟推出了層級構造主權解決方案,包括邏輯隔離、本地金鑰控制和歐盟本地支援團隊。俄羅斯和沙烏地阿拉伯加強了資料在地化法律,這增加了複雜性,但也為本地專家創造了機會。在中東和非洲以及南美等新興市場,隨著海底電纜線路和可再生能源計劃的減少以及混合雲端市場的擴張,投資正在加速成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 大型企業多重雲端採用率激增

- 資料主權架構的需求日益成長

- GenAI工作負載加速需要接近性雲邊緣

- 邊緣原生容器編排管理框架日趨成熟

- 企業對成本最佳化和財務營運能力的興趣日益濃厚

- 綠色資料中心指令推動混合模式回歸

- 市場限制

- 遷移複雜性與遺留系統整合成本

- 雲端原生安全和財務營運技能短缺

- 隱性出口費用經濟限制了工作負載的可移植性

- 地緣政治資料本地化規則使架構碎片化

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 服務

- 按服務模式

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

- 按組織規模

- 主要企業

- 小型企業

- 按最終用戶行業分類

- 政府/公共部門

- 醫療保健和生命科學

- 銀行、金融服務和保險(BFSI)

- 零售與電子商務

- 資訊通訊技術和電訊

- 製造業

- 媒體與娛樂

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- VMware Inc.

- Oracle Corporation

- Alibaba Cloud

- Dell Technologies Inc.

- Rackspace Technology Inc.

- Accenture PLC

- Equinix Inc.

- Fujitsu Ltd.

- NTT Communications Corporation

- DXC Technology Company

- Lumen Technologies Inc.

- Panzura Inc.

- Flexera Software LLC

- Intel Corporation

- Nutanix Inc.

- Red Hat(IBM)

- NetApp Inc.

- Citrix Systems(Cloud Software Group)

第7章 市場機會與未來展望

The hybrid cloud market is valued at USD 172.77 billion in 2025 and is forecast to reach USD 311.75 billion by 2030, reflecting a 12.53% CAGR during 2025-2030.

Enterprises are steering toward distributed architectures that balance operational control with cloud-native speed, especially as generative-AI workloads require tight linkage between edge and centralized compute resources. Growing sovereignty rules, multicloud preferences, and maturing container orchestration frameworks spur demand for hybrid deployment models. Edge computing investments shorten latency for AI inference while retaining on-premises data for compliance. Large data-center operators are aligning infrastructure projects with corporate decarbonization targets, adding sustainability as a procurement criterion. Strategic acquisitions by hyperscalers and specialized edge providers intensify competitive differentiation across the hybrid cloud market.

Global Hybrid Cloud Market Trends and Insights

Surge in Multicloud Adoption Among Large Enterprises

Hybrid environments now underpin deliberate multicloud strategies, with 87% of enterprises operating workloads across more than one provider.Platform teams standardize tooling to curb redundant spend and improve governance consistency. Financial-operations practices are embedded at design stages to cut waste in the hybrid cloud market. Vendors respond by offering unified billing dashboards that map usage to cost centers. As multicloud maturity rises, seamless workload portability becomes a core purchase criterion for the hybrid cloud market.

Rising Demand for Data-Sovereign Architectures

Strict privacy regimes reshuffle workload placement decisions, particularly in Europe where 84% of organizations either use or plan sovereign cloud solutions within 12 months.Australia and parts of Asia adopt similar rules, pressing providers to launch region-specific control planes. Specialized sovereign offerings promise residency, key management, and local operator staffing. Hyperscalers now integrate confidential computing and dedicated EU support models to retain share in the hybrid cloud market. Compliance complexity therefore fuels demand for architecture designs that keep sensitive data in jurisdiction while leveraging global scale for less regulated workloads.

Migration Complexity and Legacy Integration Costs

Modernization projects often reveal undocumented dependencies that inflate timelines and budgets. Large banks report significant overruns when refactoring core payment systems for hybrid environments. Seventy-three percent of enterprises now refactor rather than lift-and-shift, extending schedules yet delivering better resilience. Continuous integration pipelines and API gateways partly mitigate the hurdle, but technical debt remains a near-term drag on the hybrid cloud market.

Other drivers and restraints analyzed in the detailed report include:

- GenAI Workload Acceleration Needs Cloud-Edge Proximity

- Green Datacenter Mandates Push Hybrid Repatriation

- Skills Shortage in Cloud-Native Security and FinOps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services revenue is forecast to rise at 15.3% CAGR through 2030, even though solutions retained 65.5% hybrid cloud market share in 2024. The higher growth stems from enterprises requesting expert guidance for multicloud orchestration, sovereignty mapping, and AI stack tuning. Rackspace and AWS launched Rapid Migration Offer programs that bundle tooling with professional services to shorten cut-over durations.

Demand for managed FinOps, container security, and platform operations pushes providers to expand service lines. Nutanix introduced an Enterprise AI platform that blends software with consulting to offset skills shortages. These trends suggest the services segment will account for a larger slice of hybrid cloud market size as organizations outsource complexity.

IaaS is projected to grow at 14.1% CAGR during 2025-2030, while SaaS keeps 54.7% share thanks to entrenched enterprise suites. Generative-AI training needs GPU-rich clusters that customers often build on IaaS for custom tuning. Oracle extended its distributed cloud line with Roving Edge devices that place compute in austere locations, underscoring the versatility of IaaS.

Platform-as-a-Service occupies a strategic bridge, offering abstraction yet permitting custom runtimes. Snowflake linked its platform with Azure OpenAI Service to simplify model usage for analytics developers. The convergence of AI and development workflows will keep all three models interlinked within the hybrid cloud market.

Hybrid Cloud Market is Segmented by Component (Solutions, Services), Service Model (IaaS, Paas, Saas), Organization Size (Large Enterprises, Smes), End-User Industry (Government and Public Sector, Healthcare and Life Sciences, BFSI, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 25.8% revenue share in 2024 and benefits from dense hyperscaler footprints that simplify multicloud adoption. TP ICAP plans to shift 80% of systems to AWS by 2026 while creating AI labs for capital-markets innovation. Federal privacy rules remain manageable, allowing firms to optimize workload placement freely across the hybrid cloud market.

Asia-Pacific exhibits the steepest 13.2% CAGR through 2030, driven by capacity additions and rising digital-service demand. Microsoft pledged USD 2.9 billion for new AI and cloud zones in Japan to address growing inference requirements. China's providers pursue overseas expansion as domestic growth moderates. Regional data-center capacity now totals 12,206 MW in operation with 14,338 MW under build, underpinning future hybrid cloud market growth.

Europe advances at a steady clip as 84% of firms either deploy or plan sovereign cloud framework adoption. Microsoft rolled out a layered sovereignty solution spanning logical isolation, local key control, and EU-native support teams. Stricter data-localization laws in Russia and Saudi Arabia add complexity but also create opportunities for regional specialists. Emerging markets across MEA and South America accelerate investment as submarine cable routes and renewable energy projects reduce barriers, expanding the hybrid cloud market.

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- VMware Inc.

- Oracle Corporation

- Alibaba Cloud

- Dell Technologies Inc.

- Rackspace Technology Inc.

- Accenture PLC

- Equinix Inc.

- Fujitsu Ltd.

- NTT Communications Corporation

- DXC Technology Company

- Lumen Technologies Inc.

- Panzura Inc.

- Flexera Software LLC

- Intel Corporation

- Nutanix Inc.

- Red Hat (IBM)

- NetApp Inc.

- Citrix Systems (Cloud Software Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in multicloud adoption among large enterprises

- 4.2.2 Rising demand for data-sovereign architectures

- 4.2.3 GenAI workload acceleration needs cloud-edge proximity

- 4.2.4 Edge-native container orchestration frameworks mature

- 4.2.5 Rising enterprise focus on cost optimization and FinOps capabilities

- 4.2.6 Green datacenter mandates push hybrid repatriation

- 4.3 Market Restraints

- 4.3.1 Migration complexity and legacy integration costs

- 4.3.2 Skills shortage in cloud-native security and FinOps

- 4.3.3 Hidden egress-fee economics limit workload portability

- 4.3.4 Geo-political data localization rules fragment architectures

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Service Model

- 5.2.1 Infrastructure as a Service (IaaS)

- 5.2.2 Platform as a Service (PaaS)

- 5.2.3 Software as a Service (SaaS)

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Government and Public Sector

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Banking, Financial Services and Insurance (BFSI)

- 5.4.4 Retail and E-Commerce

- 5.4.5 Information and Communication Technology and Telecom

- 5.4.6 Manufacturing

- 5.4.7 Media and Entertainment

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC

- 6.4.4 IBM Corporation

- 6.4.5 Cisco Systems Inc.

- 6.4.6 Hewlett Packard Enterprise Company

- 6.4.7 VMware Inc.

- 6.4.8 Oracle Corporation

- 6.4.9 Alibaba Cloud

- 6.4.10 Dell Technologies Inc.

- 6.4.11 Rackspace Technology Inc.

- 6.4.12 Accenture PLC

- 6.4.13 Equinix Inc.

- 6.4.14 Fujitsu Ltd.

- 6.4.15 NTT Communications Corporation

- 6.4.16 DXC Technology Company

- 6.4.17 Lumen Technologies Inc.

- 6.4.18 Panzura Inc.

- 6.4.19 Flexera Software LLC

- 6.4.20 Intel Corporation

- 6.4.21 Nutanix Inc.

- 6.4.22 Red Hat (IBM)

- 6.4.23 NetApp Inc.

- 6.4.24 Citrix Systems (Cloud Software Group)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment