|

市場調查報告書

商品編碼

1851213

水刀切割機:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Waterjet Cutting Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

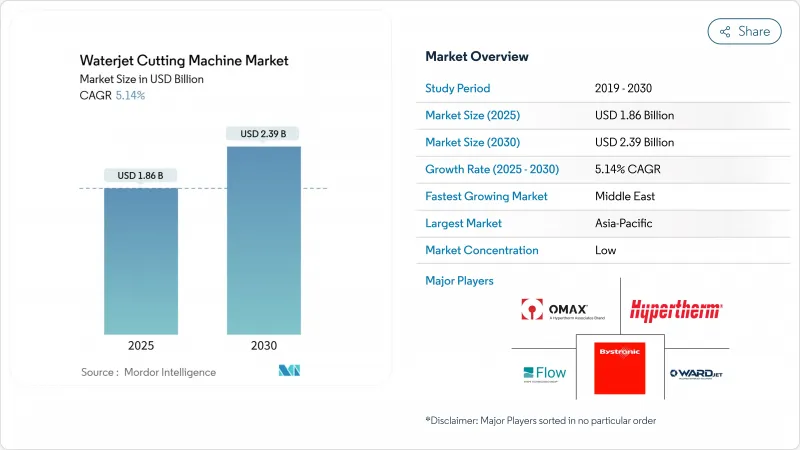

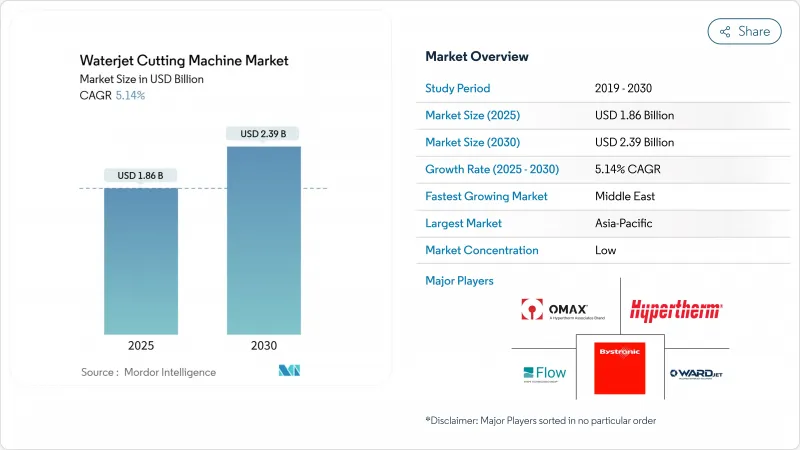

據估計,水刀切割機市場規模將在 2025 年達到 18.6 億美元,在 2030 年達到 23.9 億美元,預測期內(2025-2030 年)複合年成長率為 5.14%。

預計2025年,水刀切割機市場規模將達到18.6億美元,2030年將達23.9億美元,年複合成長率為5.14%。航太、汽車和醫療製造業對非熱高精度切割的持續需求,即使在技術日趨成熟的情況下,也將推動市場成長。壓力超過6000個大氣壓(atm)的超高壓系統樹立了新的性能標桿,能夠快速加工碳纖維複合材料和難以切割的電動車合金。雖然亞太地區仍是銷售量領導者,但中東地區的產業多元化正在推動該地區實現最快的成長。未來的競爭優勢將不再僅僅體現在價格上,而是更多地體現在泵浦效率、自動化軟體和服務產品上。

全球水刀切割機市場趨勢及洞察

五軸和機器人水刀系統在精密加工領域的快速普及

先進的運動控制技術將傳統的2D切割轉變為真正的3D製造,一次裝夾即可取代多個下游工序。具有主動公差補償功能的動態水刀頭可在保持邊緣品質的同時,將加工週期縮短2-4倍。運作壓力高達90,000 PSI的關節機器人可整合汽車生產單元中的倒角和穿孔工序,從而緩解對勞動力技能的要求,並實現無人值守生產。公差為+2µm的微型水刀平台的演示,拓展了其在外科植入的應用,體現瞭如今在生產車間即可達到的精密加工水平。

電動車和電動交通零件中難加工合金的使用日益增多

鈦合金、高強度鋼和複合材料疊層製成的電池外殼、結構樑和馬達鐵芯,得益於水刀冷切的特性,可避免熱影響區。此技術切割厚度可達 24 英寸,無需二次銑削加工,從而縮短電動車底盤零件的生產週期。 90,000 PSI 的泵壓可提供穿透厚疊層所需的能量密度,而整合的排樣軟體則可在合金成本不斷上漲的情況下最大限度地提高材料利用率。

增壓器密封件在 6kbar 以上系統中的使用壽命限制。

隨著噴射壓力的增加,密封件疲勞會加速,僅25萬次沖程就可能需要維護,這使得大批量複合材料加工變得更加複雜。預測性診斷可以減少非計劃性停機,但無法完全解決材料科學方面的難題,這些難題阻礙了9萬磅/平方英吋泵浦的全班運作。

細分市場分析

磨料平台鞏固了在水刀切割機市場的領先地位,預計2024年將佔82.54%的銷售額。該平台能夠以+0.001英寸的精度切割24英寸厚的Inconel合金板,因此被廣泛應用於航太蒙皮和重型機械框架等領域。另一方面,純水切割機正憑藉其符合美國)標準的設計,在衛生包裝生產線中嶄露頭角,並以7.5%的複合年成長率領先市場,有效避免了交叉污染並縮短了清潔時間。

磨料射流在硬質基材上表現出色,而僅使用噴嘴的系統則主要針對易損的食品、藥品薄膜和發泡體應用,因此二者的發展軌跡有所不同。監管機構對衛生要求的日益重視,加上耗材成本低廉,使得純水刀成為加工商尋求溫和、無殘留切割方式的理想選擇。市場各細分領域的動態變化不斷擴大潛在市場,同時又不會蠶食現有產業的優勢地位。

由於加工車間對平板輪廓加工的需求強勁,三軸工作台仍佔全球出貨量的一半。然而,隨著倒角、錐度補償和3D雕刻等功能減少夾具數量並提高首件精度,五軸工具機的複合年成長率 (CAGR) 達到 7.8%。自動化傾斜頭與 CAD/CAM 套件結合,現在可以一次性完成 CFRP 機翼的輪廓加工,取代了成本高昂的多工位加工。

機器人單元定位高階,將多關節臂與超高壓幫浦結合,可實現儀表板修整、電池組排氣和派餅轉子槽加工等無限延伸作業。同時,微型水刀系統可實現小於 50 μm 的切割寬度,彌合了電火花加工和機械微銑削之間的差距。總體而言,操作複雜性的提升正在重新定義水刀切割機市場的能力上限。

區域分析

亞太地區依託中國、印度、日本和東協地區密集的製造業生態系統,預計2024年將佔全球銷售量的37.8%。政府支持在地化高附加價值製造業的舉措,以及電動車產量的激增,都在支持長期需求。國內汽車製造商提供具有成本競爭力的車型,而西方品牌則憑藉超高精度設備保持市場佔有率,這體現了進口車和國產車並存的層級構造。

中東地區預計以7.3%的複合年成長率(CAGR)在2030年前超越其他所有地區。諸如沙烏地阿拉伯「2030願景」等主權計畫正在向航太、造船和可再生基礎設施領域注入資金,而這些領域都需要先進的切割技術。全球泵浦業專家與海灣國家製造商簽署的本地化協議,標誌著水刀切割機市場區域供應鏈的形成。

北美地區受製造業回流和國防採購的推動,維持較高的裝置容量價值。航太複合材料機翼蒙皮、艦艇推進器殼體和客製化車輛改裝的需求穩定,而墨西哥的加工出口走廊則提供了不斷成長的待開發區機會。在歐洲,嚴格的環境指令正促使買家轉向符合歐盟廢棄物和噪音標準的節能型閉合迴路系統。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 五軸和機器人水刀系統在精密加工領域的快速普及

- 電動車和自動駕駛汽車零件中難加工合金的應用日益廣泛

- 北美金屬工廠的資本支出週期受工廠回流主導

- 模組化增壓幫浦降低了每次切割的營業成本

- 擴大超高壓(6000巴以上)噴射技術在航太複合材料的應用

- 食品和藥品包裝領域從等離子和雷射製程轉變為其他製程轉變:ESG主導

- 市場限制

- 增壓器密封件在 6kbar 以上系統中的使用壽命限制。

- 設施級噪音和泥漿處理合規成本(歐盟)

- 亞洲低成本二氧化碳雷射切割台的供應情況

- 由於供應鏈不穩定,磨料採購/物流成本增加。

- 自2023年起,北歐採石場的石榴石磨料將出現短缺

- 價值/供應鏈分析

- 技術展望

- 監理展望

- 產業吸引力—五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 地緣政治趨勢對水刀切割機市場的影響

第5章 市場規模與成長預測

- 依產品類型

- 磨料切割機和水刀切割機

- 純(非磨蝕性)水刀切割機

- 按軸/配置

- 三軸工作台

- 五軸工作台

- 其他(機器人(多關節臂)水刀單元、超精密水刀系統)

- 按壓力範圍

- 低壓(低於 4200 巴,約 60,000 磅/平方英吋)

- 中壓(4200-6000 巴,約 60,000-87,000 磅/平方英吋)

- 超高壓(超過 6000 巴,超過 87000 磅/平方英吋)

- 按泵類型

- 直驅幫浦

- 液壓增壓泵

- 按最終用戶行業分類

- 車

- 航太/國防

- 電子與半導體

- 金屬加工

- 建築和採礦

- 醫療設備

- 其他(紡織、皮革、食品和飲料加工)

- 透過切割材料

- 金屬

- 石材、陶瓷、磁磚

- 玻璃

- 其他(塑膠、複合材料、橡膠、泡沫等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 秘魯

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- Nordix(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東協(印尼、泰國、菲律賓、馬來西亞、越南)

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 土耳其

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Flow International Corporation

- OMAX Corporation

- Hypertherm Inc.

- Bystronic Group

- WardJet LLC

- Techni Waterjet

- KMT Waterjet Systems

- Jet Edge Inc.

- Resato International BV

- Dardi International Corp.

- Waterjet Sweden AB

- Semyx LLC

- Hornet Cutting Systems

- Lincoln Electric(Torchmate)

- Koike Aronson Inc.

- CMS SpA(SCM Group)

- Mitsubishi Electric Corp.

- APW(Shenyang)

- Kennametal Inc.

- GMA Garnet Pty Ltd.

- CERATIZIT SA*

第7章 市場機會與未來展望

The Waterjet Cutting Machine Market size is estimated at USD 1.86 billion in 2025, and is expected to reach USD 2.39 billion by 2030, at a CAGR of 5.14% during the forecast period (2025-2030).

The waterjet cutting machine market stood at USD 1.86 billion in 2025 and is forecast to reach USD 2.39 billion in 2030, advancing at a 5.14% compound annual growth rate. Consistent demand for non-thermal, high-precision cutting in aerospace, automotive, and medical manufacturing sustains expansion even as the technology matures. Ultra-high-pressure systems above 6,000 bar set the performance frontier, enabling rapid processing of carbon-fiber composites and hard-to-machine EV alloys. Asia-Pacific retains volume leadership, while Middle East industrial diversification drives the fastest regional upswing. Competitive differentiation pivots on pump efficiency, automation software, and service reach instead of headline price.

Global Waterjet Cutting Machine Market Trends and Insights

Rapid Penetration of 5-Axis & Robotic Waterjet Systems in Precision Fabrication

Advanced motion control transforms conventional 2D cutting into true 3D manufacturing, allowing a single setup to replace multiple downstream operations. Dynamic Waterjet heads equipped with active tolerance compensation now deliver 2-4 X faster cycle times while preserving edge quality. Articulated robots running at 90,000 PSI integrate beveling and piercing in automotive cell production, easing labor-skill constraints and enabling lights-out shifts. Demonstrations of +-2 µm tolerances in micro-waterjet platforms extend the application envelope to surgical implants, reflecting the tool-room precision now achievable on shop floors.

Rising Adoption for Hard-to-Machine Alloys in EV & E-Mobility Parts

Battery housings, structural beams, and motor cores fabricated from titanium, high-strength steels, and composite stacks benefit from the waterjet's cold-cut attribute that avoids heat-affected zones. Cut thickness capability up to 24 inches removes secondary milling, lowering takt times for EV chassis components. Pump pressures of 90,000 PSI provide the energy density needed for thick stack piercing, while integrated nesting software maximizes material utilization amid elevated alloy costs.

Intensifier Seal-Life Limitations in Greater Than 6 k Bar Systems

Seal fatigue accelerates with rising jet pressures, triggering maintenance cycles after only 250,000 strokes and complicating high-volume composite machining. Predictive diagnostics mitigate unscheduled stops yet do not fully resolve the materials-science hurdle that restrains full-shift utilization of 90,000 PSI pumps.

Other drivers and restraints analyzed in the detailed report include:

- Reshoring-Led Capex Cycle in North American Metal Shops

- Modular Intensifier Pumps Reducing Operating Cost Per Cut

- Facility-Level Noise & Slurry Disposal Compliance Costs (EU)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Abrasive platforms captured 82.54% of 2024 revenue, reinforcing their status as the workhorse of the waterjet cutting machine market. Their capability to slice 24-inch-thick Inconel plates at +-0.001-inch tolerances underpins adoption in aerospace skins and heavy equipment frames. Conversely, pure-water variants gain ground in sanitary packaging lines, advancing at a 7.5% CAGR as USDA-compliant designs avoid cross-contamination and reduce wash-down time.

Growth trajectories diverge because abrasive jets excel on rigid substrates whereas nozzle-only systems target delicate food, pharma film, and foam tasks. Regulatory emphasis on hygiene, plus lower consumables cost, positions pure waterjet as an entry path for processors seeking gentle, residue-free cutting. The cross-segment dynamic ensures that the waterjet cutting machine market continues broadening its addressable base without cannibalizing its industrial stronghold.

Three-axis tables still represent half of global shipments, reflecting entrenched demand for flat-plate profiling in job shops. Yet 5-axis machines post a 7.8% CAGR as beveling, taper compensation, and 3D sculpting shrink fixture counts and boost first-part accuracy. Automated tilt heads linked to CAD-CAM suites now contour CFRP wing spars in one pass, replacing costly, multi-station milling.

Robotic cells sit in the premium tier, pairing articulated arms with ultra-high-pressure pumps to deliver endless reach for dashboard trimming, battery pack venting, and pie-shaped rotor slots. Micro-waterjet systems, meanwhile, push into sub-50-µm kerf widths, bridging the gap between EDM and mechanical micro-milling. Collectively, motion complexity upgrades are redefining the capability ceiling of the waterjet cutting machine market.

The Waterjet Cutting Machine Market is Segmented by Product Type (Abrasive and Pure (Non-Abrasive)), by Axis/Configuration (3-Axis, and Others), by Pressure Range (Low, Medium, and Ultra-High), by Pump Type (Direct-Drive and Hydraulic Intensifier), by End-User Industry (Automotive, and Others), by Material Cut (Metals, and Others), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 37.8% of worldwide revenue in 2024, underpinned by dense manufacturing ecosystems in China, India, Japan, and the ASEAN bloc. Government initiatives championing localized high-value production, together with surging EV output, anchor long-term demand. Domestic OEMs offer cost-competitive models, but Western brands retain share in ultra-high-precision installations, illustrating a two-tier import-local mix.

The Middle East is poised to outpace all regions at a 7.3% CAGR to 2030. Sovereign programs such as Saudi Vision 2030 funnel capital into aerospace, shipbuilding, and renewable infrastructure, each requiring advanced cutting methods. Localization agreements between global pump specialists and Gulf manufacturers signal an emergent regional supply chain for the waterjet cutting machine market.

North America sustains high installed-base value through reshoring tailwinds and defense procurement. Aerospace composite wingskins, naval propulsion housings, and custom vehicle mods keep demand stable, while Mexico's maquiladora corridors add greenfield opportunities. Europe remains technology-intensive yet price-pressured, with strict environmental directives steering buyers toward energy-efficient, closed-loop systems that satisfy EU waste and noise norms.

- Flow International Corporation

- OMAX Corporation

- Hypertherm Inc.

- Bystronic Group

- WardJet LLC

- Techni Waterjet

- KMT Waterjet Systems

- Jet Edge Inc.

- Resato International BV

- Dardi International Corp.

- Waterjet Sweden AB

- Semyx LLC

- Hornet Cutting Systems

- Lincoln Electric (Torchmate)

- Koike Aronson Inc.

- CMS SpA (SCM Group)

- Mitsubishi Electric Corp.

- APW (Shenyang)

- Kennametal Inc.

- GMA Garnet Pty Ltd.

- CERATIZIT SA*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid penetration of 5-axis & robotic waterjet systems in precision fabrication

- 4.2.2 Rising adoption for hard-to-machine alloys in EV & a-mobility parts

- 4.2.3 Reshoring-led cap-ex cycle in North American metal shops

- 4.2.4 Modular intensifier pumps reducing operating cost per cut

- 4.2.5 Growing use of ultra-high-pressure (greater than 6 k bar) jets in aerospace composites

- 4.2.6 ESG-driven shift away from plasma & laser in food and pharma packaging

- 4.3 Market Restraints

- 4.3.1 Intensifier seal-life limitations in greater than 6 k bar systems

- 4.3.2 Facility-level noise & slurry disposal compliance costs (EU)

- 4.3.3 Availability of low-cost CO2 laser tables in Asia

- 4.3.4 Rising abrasive procurement/ logistics costs due to supply chain volatility

- 4.3.5 Scarcity of garnet abrasives in Nordic quarries post-2023 bans

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Geopolitical Trends on Waterjet Cutting Machine Market

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Product Type

- 5.1.1 Abrasive Waterjet Cutting Machines

- 5.1.2 Pure (Non-abrasive) Waterjet Cutting Machines

- 5.2 By Axis / Configuration

- 5.2.1 3-axis Tables

- 5.2.2 5-axis Tables

- 5.2.3 Others (Robotic (Articulated-arm) Waterjet Cells, Micro-precision Waterjet Systems)

- 5.3 By Pressure Range

- 5.3.1 Low Pressure (Less than 4200 bar | Less than ~60,000 psi)

- 5.3.2 Medium Pressure (4200 - 6000 bar | ~60,000-87,000 psi)

- 5.3.3 Ultra-High Pressure (Greater than 6000 bar | Greater than ~87,000 psi)

- 5.4 By Pump Type

- 5.4.1 Direct-drive Pumps

- 5.4.2 Hydraulic Intensifier Pumps

- 5.5 By End-user Industry

- 5.5.1 Automotive

- 5.5.2 Aerospace & Defense

- 5.5.3 Electronics & Semiconductors

- 5.5.4 Metal Fabrication

- 5.5.5 Construction & Mining

- 5.5.6 Medical Devices

- 5.5.7 Others (Textile & Leather, Food & Beverage Processing)

- 5.6 By Material Cut

- 5.6.1 Metals

- 5.6.2 Stone, Ceramic & Tiles

- 5.6.3 Glass

- 5.6.4 Others (Plastics & Composites, Rubber, Foam, etc.)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Peru

- 5.7.2.4 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.7.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.7.3.8 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 Australia

- 5.7.4.5 South Korea

- 5.7.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.7.4.7 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Qatar

- 5.7.5.4 Kuwait

- 5.7.5.5 Turkey

- 5.7.5.6 Egypt

- 5.7.5.7 South Africa

- 5.7.5.8 Nigeria

- 5.7.5.9 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, ...)}

- 6.4.1 Flow International Corporation

- 6.4.2 OMAX Corporation

- 6.4.3 Hypertherm Inc.

- 6.4.4 Bystronic Group

- 6.4.5 WardJet LLC

- 6.4.6 Techni Waterjet

- 6.4.7 KMT Waterjet Systems

- 6.4.8 Jet Edge Inc.

- 6.4.9 Resato International BV

- 6.4.10 Dardi International Corp.

- 6.4.11 Waterjet Sweden AB

- 6.4.12 Semyx LLC

- 6.4.13 Hornet Cutting Systems

- 6.4.14 Lincoln Electric (Torchmate)

- 6.4.15 Koike Aronson Inc.

- 6.4.16 CMS SpA (SCM Group)

- 6.4.17 Mitsubishi Electric Corp.

- 6.4.18 APW (Shenyang)

- 6.4.19 Kennametal Inc.

- 6.4.20 GMA Garnet Pty Ltd.

- 6.4.21 CERATIZIT SA*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment