|

市場調查報告書

商品編碼

1851190

汽車電池管理系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Battery Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

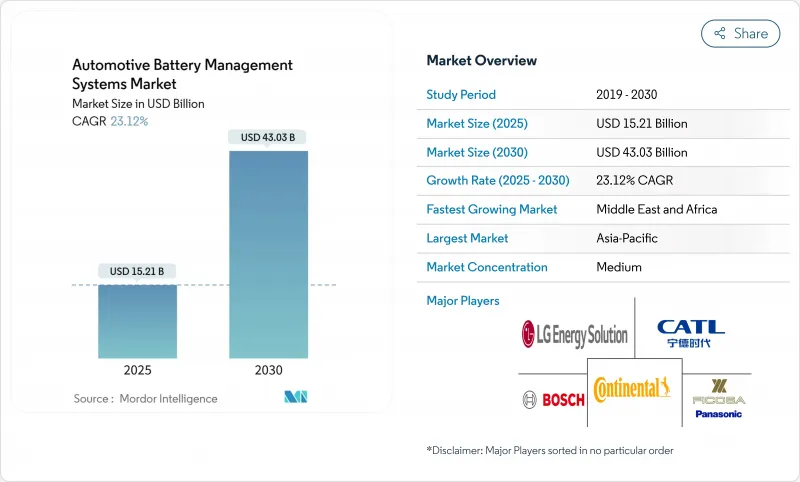

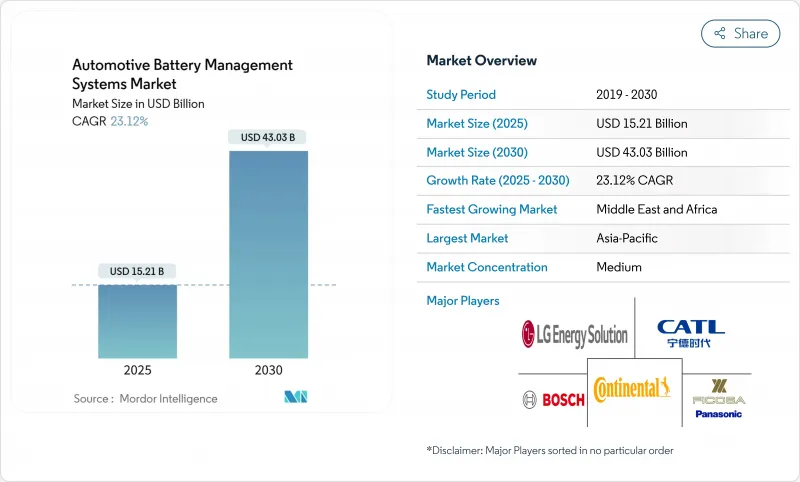

預計到 2025 年,汽車電池管理系統市場規模將達到 152.1 億美元,到 2030 年將達到 430.3 億美元。

這一成長反映了全球動力系統從內燃機向電動推進的轉變,電池管理系統 (BMS) 扮演著車輛中樞神經系統的角色。監管壓力,例如將於 2024 年應用於新款車型的 ISO 21434 網路安全標準,正在加速推動網路安全設計的需求。同時,從硬佈線向模組化和無線拓撲結構的快速過渡,正在減輕線束重量、提高能量密度並縮短組裝時間。例如,NXP 的超寬頻 BMS 等無線解決方案(將於 2025 年發布供 OEM 測試)展示了下一代架構如何兼顧安全性、效率和成本目標。不斷成長的電動車 (EV) 銷售目標、不斷下降的電池組成本以及磷酸鐵鋰 (LFP) 化學技術的廣泛應用,持續推動著設計升級,使電芯和模組層面的智慧化程度更高,從而鞏固了汽車電池管理系統市場的強勁成長勢頭。

全球汽車電池管理系統市場趨勢與洞察

全球擴大電動車銷售義務

零排放汽車(ZEV)政策正在歐盟和加州等地區實施,這提高了電池的耐用性、續航里程維持率和健康透明度的基準值。歐盟7排放標準將於2026年生效,而加州的「先進清潔汽車II」(Advanced Clean Car II)標準要求電池在行駛15萬英里後仍能維持80%的續航里程,這將迫使電池管理系統(BMS)供應商採用更複雜的健康分析和劣化建模技術。規則的統一將促使全球平台採用符合標準的單一架構,使原始設備製造商(OEM)能夠避免針對特定地區的客製化設計,從而推動汽車電池管理系統市場的發展。已經採用自適應演算法的供應商將獲得先發優勢,而傳統供應商則將面臨更長的檢驗週期和更高的成本。

降低電池組成本

鋰離子電池組價格的快速下降正在重塑成本結構。到2024年,主流磷酸鐵鋰電池組的平均價格將達到75美元/千瓦時,而鈉離子電池的試驗表明,其成本可低至10美元/千瓦時。隨著電芯價格的降低,原始設備製造商(OEM)可以將更大比例的電池預算分配給更智慧的電池管理系統(BMS)功能,例如預測分析和無線連接,而不是僅僅關注硬體成本的降低。這種向更高單包價值的轉變正在增強汽車電池管理系統市場對先進電池管理解決方案的需求。

因熱失控召回事件導致保固條款增加

備受矚目的火災事故導致了大規模召回,迫使汽車製造商增加保固準備金並採用保守的電池組設計。三星SDI的多品牌召回以及現代摩比斯開發的自熄模組凸顯了產業的緊迫性。絕緣、滅火和冗餘感測器的額外成本可能會減緩實驗性電池管理系統(BMS)功能的部署,並抑制汽車電池管理系統市場近期的成長。

細分市場分析

到2024年,電池感測器將佔據汽車電池管理系統35.41%的市場佔有率,並在2030年之前以24.66%的複合年成長率成長。涵蓋溫度、壓力、氣體排放和濕度等多物理場感測技術的廣泛應用,正助力原始設備製造商(OEM)從被動保護轉向即時預測診斷。隨著監管機構強制要求加強熱失控檢測,以及車隊營運商尋求更精細的數據以最佳化工作週期和保固範圍,電池感測器的應用將加速發展。將二氧化碳和氫氣感測器整合到模組級基板,可提升預警能力,有助於避免代價高昂的召回和停機。隨著電動車電池組電壓超過800V,高解析度分流器和霍爾效應感測器對於精確估算電池荷電狀態和健康狀態至關重要,這將確保該領域的長期成長。

電池級電壓精度現已達到±2mV,從而實現更精確的電荷均衡並延長電池組壽命,使得積體電路精度成為關鍵的採購標準。領先的晶片製造商正在將測量、均衡和通訊模組整合到單一晶粒上,從而縮小基板尺寸並簡化車輛認證流程。 「其他電子元件和材料」類別(包括導熱間隙填充材料、氣凝膠片和相變複合材料)隨著能量密度的提高而不斷擴大,對卓越的散熱和絕緣解決方案提出了更高的要求。

到2024年,模組化汽車電池管理系統市佔率將達到48.95%。在電池組層面分離感測和執行功能,可顯著提升系統可靠性,滿足商用車隊和高運轉率叫車的需求。此外,增量式硬體模組還支援快速的現場更換,從而提高車輛的運作。

隨著天線小型化、安全網狀通訊協定和認證射頻協定棧在生產中的成熟,無線電設計正迅速發展,預計從2025年到2030年將以35.17%的複合年成長率成長。取消菊鏈連接線束可減輕電池組重量,並釋放寶貴的空間以主動冷卻板和額外的電芯。同時,針對特定領域的分散式架構可滿足賽車運動和航太跨界專案中對極高冗餘度的需求,從而減少汽車電池管理系統市場的產品多樣性。

區域分析

亞太地區將繼續保持汽車電池管理系統市場的主導地位,預計到2024年將佔據61.33%的市場佔有率。中國從上游提煉到整車組裝的垂直整合電池價值鏈降低了成本結構,並加快了設計迭代速度。政府的採購補貼、主要城市的優惠車牌政策以及成熟的充電生態系統將推動電動車的普及,並增加電池管理系統的出貨量。隨著中國電芯和模組供應商在波蘭、匈牙利和內華達州等地建廠,供應鏈優勢也正擴展到歐洲和北美,從而確保了免稅准入並縮短了物流運輸路線。

中東和非洲地區雖然基數較低,但仍是成長最快的地區,預計到2030年複合年成長率將達到27.55%。杜拜、利雅德和開羅正在推廣電動公車走廊,並制定了最後一公里配送的電氣化目標,這需要耐熱的電池管理系統(BMS)設計。公私合作將推動併網電池的投資,並帶動二手車輛電池組和二手BMS軟體的銷售。

北美地區隨著抑制通膨的立法推動本土電池和組件製造的發展而勢頭強勁。 BMW、豐田和現代在卡羅來納州、喬治亞和安大略省的投資支持了電池管理系統(BMS)基板的在地採購,從而減少了對亞洲進口的依賴。歐洲在監管方面仍處於領先地位,即將推出的電池護照制度將推動可追溯性功能的實施,這將增加系統的複雜性和軟體內容。這些要求將提高單車收入,並使擁有安全雲端管道的供應商脫穎而出,從而維持汽車電池管理系統市場的整體健康前景。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全球擴大電動車銷售義務

- 降低電池組成本

- 從集中式拓撲結構過渡到模組化和無線拓撲結構

- 對磷酸鐵鋰化學品的激增需求需要先進的活性平衡技術。

- ISO 21434主導了對「網路安全型建築管理系統」的需求

- OEM廠商紛紛轉向內部設計BMS ASIC晶片,以降低智慧財產權授權費。

- 市場限制

- 熱召回事件增加保固條款

- 功率半導體嚴重短缺

- 2027 年後歐盟「電池護照」可追溯性負擔

- 基於人工智慧的預測性電池管理系統仍缺乏功能安全認證。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 電池積體電路

- 電池感應器

- 其他電子產品和材料

- 按拓撲學

- 集中

- 模組化的

- 去中心化

- 無線的

- 依推進類型

- 混合動力電動車(HEV)

- 插電式混合動力汽車(PHEV)

- 電池電動車(BEV)

- 燃料電池電動車(FCEV)

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型和大型商用車輛

- 二輪車和三輪車

- 非公路及特種車輛

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 埃及

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- LG Energy Solution

- CATL

- Panasonic(Ficosa)

- Robert Bosch GmbH

- Continental AG

- Texas Instruments

- Analog Devices

- Infineon Technologies

- NXP Semiconductors

- Renesas Electronics

- Hitachi Astemo

- Mitsubishi Electric

- Denso Corporation

- Preh GmbH

- Eaton Mobility(Eatron)

- Lithium Balance

- Sensata Technologies

- Eberspacher Vecture

- Rimac Technology

第7章 市場機會與未來展望

The automotive battery management system market size is valued at USD 15.21 billion in 2025 and is forecast to climb to USD 43.03 billion in 2030, reflecting a vigorous 23.12% CAGR.

This expansion mirrors the global pivot from internal-combustion engines toward electrified propulsion, where a battery management system (BMS) functions as the vehicle's central nervous system. Regulatory pressure, notably ISO 21434 cybersecurity rules that came into force for new vehicle models in 2024, is accelerating demand for cyber-secure designs. At the same time, rapid migration from hard-wired to modular and wireless topologies is trimming harness weight, boosting energy density, and shortening assembly time. Wireless solutions such as NXP's ultra-wideband BMS, released for OEM trials in 2025, exemplify how next-generation architectures can align safety, efficiency, and cost goals. Heightened electric-vehicle (EV) sales targets, falling battery pack cost, and mainstream adoption of lithium-iron-phosphate (LFP) chemistries continue to stimulate design upgrades that place more intelligence at the cell and module level, reinforcing a robust growth path for the automotive battery management system market.

Global Automotive Battery Management Systems Market Trends and Insights

EV sales mandates widening globally

Binding ZEV policies in regions such as the EU and California raise the baseline for durability, range retention, and transparency of battery health. Euro 7 rules will be effective in 2026, and California's Advanced Clean Cars II demands 80% range retention for 150,000 miles, compelling BMS suppliers to incorporate more refined state-of-health analytics and degradation modeling. Harmonizing rules incentivize global platforms to adopt one compliance-ready architecture, elevating the automotive battery management system market as OEMs avoid region-specific designs. Suppliers that already embed adaptive algorithms gain a head start, whereas legacy providers face added validation cycles and cost.

Falling cost of battery packs

Rapid declines in lithium-ion battery-pack prices are reshaping cost structures. Mainstream LFP packs averaged USD 75 per kWh in 2024, and pilot sodium-ion runs have demonstrated costs as low as USD 10 per kWh. As cells get cheaper, OEMs can allocate larger portions of the battery budget to smarter BMS functions, such as predictive analytics and wireless connectivity, rather than focusing solely on hardware cost reduction. This shift toward higher value content per pack reinforces demand for advanced battery management solutions across the automotive battery management system market.

Thermal-runaway recalls raising warranty reserves

High-profile fire events have led to sizable recalls, forcing automakers to boost warranty accruals and adopt conservative pack design. Samsung SDI's multi-brand recall and Hyundai Mobis' development of self-extinguishing modules underscore industry urgency. Added cost for insulation, fire suppression, and redundant sensors can slow deployment of experimental BMS functions, tempering near-term growth in the automotive battery management system market.

Other drivers and restraints analyzed in the detailed report include:

- Shift from centralized to modular and wireless topologies

- Soaring demand for LFP chemistry requiring advanced active balancing

- Acute power-semiconductor shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery Sensors captured 35.41% of the automotive battery management system market share in 2024, and the segment is forecast to post a 24.66% CAGR through 2030. Wider deployment of multi-physics sensing, covering temperature, pressure, off-gas, and humidity, allows OEMs to move from passive protection toward real-time predictive diagnostics. Adoption accelerates as regulators demand enhanced thermal-runaway detection and as fleet operators seek granular data to optimize duty cycles and warranty coverage. Integrating CO2 and H2 sensors into module-level boards improves early-warning capabilities, helping avoid costly recalls and downtime. As EV packs scale above 800 V, high-resolution shunt and Hall-effect sensors become indispensable for accurate state-of-charge and state-of-health estimation, cementing the segment's long-term expansion path.

Tight cell-level voltage accuracy, now reaching +-2 mV, enables finer charge balancing and extended pack life, making IC precision a decisive purchase criterion. Leading chipmakers have fused measurement, balancing, and communication blocks onto single dies, shrinking board footprints and simplifying automotive qualifications. The residual "Other electronics and materials" bucket, encompassing thermally conductive gap fillers, aerogel sheets, and phase-change composites, continues to broaden as energy density rises, calling for superior heat-spreading and insulation solutions.

In 2024, Modular arrangements accounted for 48.95% of the automotive battery management system market share, reflecting OEM preference for scalable sub-battery modules that can be rearranged without wholesale redesign. Box-level isolation of sensing and actuation delivers fault tolerance suited to commercial fleets and high-utilization ride-hailing vehicles. Incremental hardware blocks also facilitate rapid line-side replacement, lifting vehicle uptime.

Wireless designs are scaling rapidly, showing a 35.17% CAGR across 2025-2030 as antenna miniaturization, secure mesh protocols, and certified RF stacks reach production maturity. Eliminating daisy-chain harnesses cuts pack weight and opens valuable cubic centimeters for active cooling plates or extra cells. Centralized topologies continue in entry-price passenger cars, where minimal components trump expandability, whereas niche distributed architectures meet extreme redundancy mandates in motorsports and aerospace crossover programs, cushioning product diversity inside the automotive battery management system market.

The Automotive Battery Management System Market Report is Segmented by Component (Battery IC, Battery Sensors, and More), Topology (Centralized, Modular, and More), Propulsion Type (Hybrid Electric Vehicle (HEV), Battery Electric Vehicle (BEV), and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained a commanding 61.33% share of the automotive battery management system market in 2024. China's vertically integrated battery value chain-from upstream refining to final vehicle assembly-compresses cost structures and quickens design iterations. Government purchase incentives, favorable license-plate policies in megacities, and a mature charging ecosystem lift EV penetration and reinforce BMS unit shipments. Supply-chain leverage even extends to Europe and North America, as Chinese cell and module suppliers open factories in Poland, Hungary, and Nevada to secure tariff-free access and shorten logistics lanes.

The Middle East and Africa region, although emerging from a low base, is the fastest-growing region with a 27.55% CAGR through 2030. Dubai, Riyadh, and Cairo are rolling out e-bus corridors and last-mile delivery electrification targets that demand heat-tolerant BMS designs. Public-private alliances channel investment into grid-tied battery storage, creating adjacent sales for repurposed vehicle packs and second-life BMS software.

North America gains momentum as the Inflation Reduction Act galvanizes domestic cell and module manufacturing. Investments by BMW, Toyota, and Hyundai in the Carolinas, Georgia, and Ontario shrink reliance on Asian imports and underpin local sourcing of BMS boards. Europe remains a regulatory trailblazer, with the upcoming battery passport pushing traceability features that increase system complexity and software content. Such requirements elevate per-vehicle revenue and differentiate suppliers ready with secure cloud pipelines, sustaining a healthy overall outlook for the automotive battery management system market.

- LG Energy Solution

- CATL

- Panasonic (Ficosa)

- Robert Bosch GmbH

- Continental AG

- Texas Instruments

- Analog Devices

- Infineon Technologies

- NXP Semiconductors

- Renesas Electronics

- Hitachi Astemo

- Mitsubishi Electric

- Denso Corporation

- Preh GmbH

- Eaton Mobility (Eatron)

- Lithium Balance

- Sensata Technologies

- Eberspacher Vecture

- Rimac Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV sales mandates widening globally

- 4.2.2 Falling cost of battery packs

- 4.2.3 Shift from centralized to modular and wireless topologies

- 4.2.4 Soaring demand for LFP chemistry requiring advanced active balancing

- 4.2.5 ISO 21434-driven "cyber-secure BMS" demand

- 4.2.6 OEM move to in-house BMS ASIC design to cut IP royalty cost

- 4.3 Market Restraints

- 4.3.1 Thermal-runaway recalls raising warranty reserves

- 4.3.2 Acute power-semiconductor shortages

- 4.3.3 Post-2027 EU "battery-passport" traceability overheads

- 4.3.4 AI-based predictive BMS still lacks functional-safety certification

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Component

- 5.1.1 Battery IC

- 5.1.2 Battery Sensors

- 5.1.3 Other Electronics and Materials

- 5.2 By Topology

- 5.2.1 Centralized

- 5.2.2 Modular

- 5.2.3 Distributed

- 5.2.4 Wireless

- 5.3 By Propulsion Type

- 5.3.1 Hybrid Electric Vehicle (HEV)

- 5.3.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.3.3 Battery Electric Vehicle (BEV)

- 5.3.4 Fuel-Cell Electric Vehicle (FCEV)

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Medium and Heavy Commercial Vehicles

- 5.4.4 Two and Three-Wheelers

- 5.4.5 Off-Highway and Specialty Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 LG Energy Solution

- 6.4.2 CATL

- 6.4.3 Panasonic (Ficosa)

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Continental AG

- 6.4.6 Texas Instruments

- 6.4.7 Analog Devices

- 6.4.8 Infineon Technologies

- 6.4.9 NXP Semiconductors

- 6.4.10 Renesas Electronics

- 6.4.11 Hitachi Astemo

- 6.4.12 Mitsubishi Electric

- 6.4.13 Denso Corporation

- 6.4.14 Preh GmbH

- 6.4.15 Eaton Mobility (Eatron)

- 6.4.16 Lithium Balance

- 6.4.17 Sensata Technologies

- 6.4.18 Eberspacher Vecture

- 6.4.19 Rimac Technology

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment