|

市場調查報告書

商品編碼

1851175

滅鼠劑:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Rodenticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

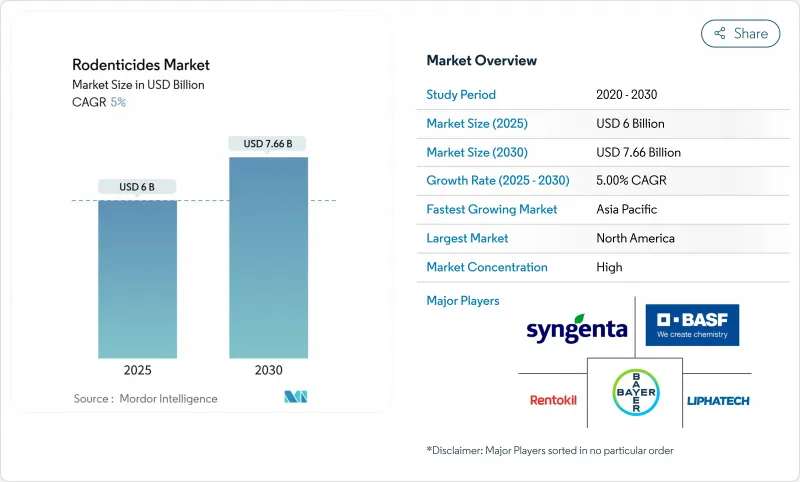

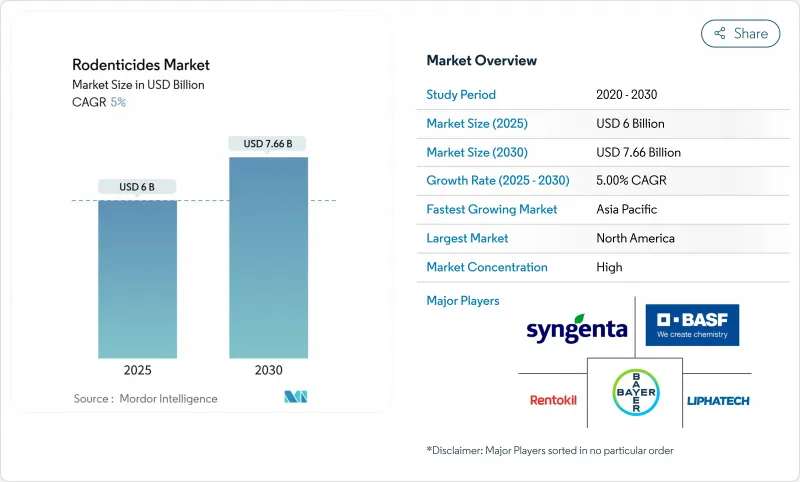

預計到 2025 年,滅鼠劑市場規模將達到 60 億美元,到 2030 年將達到 76.6 億美元,在此期間的複合年成長率為 5.0%。

氣候變遷導致囓齒動物數量激增、糧食安全缺口擴大以及公共衛生標準日益嚴格,推動了農業、商業和居民領域對滅鼠劑的強勁需求。全球食品貿易中更嚴格的衛生法規以及城市氣候暖化導致的囓齒動物繁殖季節延長,促使人們需要可靠的化學和非化學解決方案。加州和英國限制第二代抗凝血劑(SGARs)的監管政策轉變,加速了低毒性Flocoumafen和生育控制產品的創新。包括物聯網誘餌站在內的數位化監測,降低了害蟲防治人員的人事費用,同時也為製造商提供了產品差異化的新途徑。佔據全球滅鼠劑市場約73%佔有率的前五大公司的整合,凸顯了規模對於滿足不斷變化的合規和管理要求的重要性。

全球滅鼠劑市場趨勢與洞察

生物安全商品貿易標準的激增

貿易協定日益要求採用經認證的滅鼠通訊協定,以防止跨境害蟲傳播,迫使糧食碼頭、倉庫和航運公司採用專業滅鼠劑和綜合蟲害管理 (IPM) 方案。歐盟和北美也推出了類似的規定,將出口資格與無害蟲儲存證明書掛鉤,並鼓勵出口商使用符合《SGAR 管理準則》的防篡改誘餌盒。這些措施避免了價值數百萬美元的貨物被隔離,使專業滅鼠劑成為保障貿易連續性的前線工具。經合組織-糧農組織農業展望預測,到 2032 年,消費量將以每年 1.3% 的速度成長,經濟獎勵不斷擴大,這加劇了本已不堪重負的物流網路的壓力。

不斷成長的糧食需求和農業生產力

不斷成長的卡路里需求和氣候變遷導致的產量波動,使得糧食和園藝系統面臨更嚴重的收穫後。亞洲水稻種植區的田間研究表明,基於生態學的滅鼠措施可使產量提高6%至15%,農民收入提高15%以上,從而為滅鼠劑投資帶來豐厚的回報。在非洲,各國政府正在補貼大規模的磷化鋅宣傳活動,因為大量的鼠患可使玉米減產高達48%。聯合國糧食及農業組織發現,筒倉結構改進結合有針對性的化學防治,可顯著減少倉儲損失。氣候變遷將延長鼠類繁殖期,促使種植者從局部處理轉向計劃性噴灑,推動滅鼠劑市場的長期成長。

抗藥性害蟲增加

基因突變,特別是Vkorc1基因的突變,會削弱第一代和第二代抗凝血劑的效力,增加治療成本並延長疫情持續時間。黎巴嫩的實地研究證實,儘管對滅鼠劑銷售的監測有限,小鼠和大鼠仍產生了抗藥性。紐西蘭的一項研究在先前未接觸過滅鼠劑的孤立族群中檢測到了溴敵隆的抗藥性,表明這種抗藥性是由於基因漂變導致的自然抗藥性。加州地鬆鼠已對脈衝式敵鼠酮和Chlorophacinone產生了耐受性,迫使人們改用磷化鋅或膽鈣化醇混合物。抗藥性導致服務呼叫量增加,推動了對診斷技術的投資,並限制了傳統化學製劑的發展。

細分市場分析

至2024年,抗凝血劑將佔滅鼠劑銷售額的66.0%,鞏固其在滅鼠劑市場的領先地位。即使監管機構降低了允許的濃度,抗凝血劑對抗藥性鼠株的單劑量殺滅效果仍然使其在倉庫和食品加工廠中廣泛應用。雖然溴敵隆等第二代分子持續受到專家的青睞,但在磷化鋅和膽鈣化醇混合物的推動下,預計到2030年,非抗凝血劑類滅鼠劑的需求將以7.8%的複合年成長率成長。研究表明,磷化鋅可將田間鼠群數量減少58.15%,優於傳統的第一代化合物。

同時,Bromethalin和士的寧在抗凝血劑抗藥性日益嚴重的穴居鼠類系統中找到了獨特的效用。在低收入地區,金屬磷化物受到的監管阻力抑制了其更廣泛的應用,但特殊需求支撐著適度的需求。總體而言,市場多元化使市場領導者免受任何單一監管收緊政策的影響,從而保持了滅鼠劑市場的適應性。

由於其耐候性強且符合新加坡農藥管理條例 (SGAR) 規定的防篡改站要求,塊狀滅鼠劑預計在 2024 年將佔 45.0% 的市場需求。專家們讚賞其較長的戶外使用壽命,從而減少了返工次數。顆粒狀滅鼠劑將緊隨其後,佔 40.5%,因其適用於稻田和連作作物的機械化施用而備受青睞。液體濃縮滅鼠劑市場預計將以 7.4% 的複合年成長率成長,隨著精準噴灑設備和誘餌袋的日益普及,其增速將超過整個行業的平均水平。

石蠟塊在田間維持了100%的活性成分回收率,但五週內出現了50%的分層現象,促使人們改進錨定系統。膏劑和凝膠劑在高階零售和餐旅服務業等需要隱藏施用的場所獲得了更多市場佔有率。由於擔心漂移,粉劑的使用量正在下降,但在糧食設施的燻蒸洞穴應用中仍然適用。即用型小袋滿足了家庭用戶對便利性的需求,但SGAR(穀類農藥殘留)許可門檻的不斷提高正促使DIY市場轉向第一代活性成分和生育片劑。

區域分析

北美地區預計在2024年將保持36%的最大區域市場佔有率,這反映出該地區擁有成熟的法律規範、專業蟲害控制服務的高普及率以及不斷擴大的商業和工業應用。該地區的領先地位源於倉庫和加工廠嚴格的食品安全法規、需要系統性蟲害管理的大規模農業生產以及為囓齒動物滋生創造理想條件的都市化模式。預計到2030年,該市場將以4.1%的複合年成長率成長,主要受氣候變遷導致的都市區囓齒動物數量增加和應用技術進步的推動,但同時也受到環境法規的限制。美國環保署於2024年11月發布的《綜合滅鼠劑策略》將提供更清晰的監管框架,並增加有針對性的緩解措施以保護瀕危物種。

亞太地區是成長最快的區域市場,預計到2030年將以6.2%的複合年成長率成長,這主要得益於快速的都市化、農業擴張以及開發中國家日益增強的糧食安全意識。中國的鼠害防治計畫主要依賴敵鼠酮防治本地鼠類,以及磷化鋅防治田間害蟲,並由地方機構協調在都市區地區進行大規模宣傳活動。生態學滅鼠方法已使多個國家的糧食產量提高了6%至15%,農民收入提高了15%以上,從而推動了該方法的推廣應用。

到2030年,隨著歐盟法規的協調統一,產品標籤標準化得到推廣,環保配方研發也得到推動,歐洲的複合年成長率將達到3.8%。英國將於2024年7月起禁止在戶外使用Bromadiolone和敵鼠靈,並將產品系列轉向膽鈣化醇和Flocoumafen。受城市發展、農業擴張以及針對囓齒類疾病的公共衛生措施的推動,中東和非洲的複合年成長率將分別達到5.5%和4.9%。拉丁美洲以5.2%的複合年成長率領先,巴西以生物安全為中心的貿易法規支撐了穩定的需求。撒哈拉以南非洲地區逐步轉向以生態學為基礎的囓齒類動物管理,標誌著其策略演變,儘管急性疫情爆發時仍需使用傳統滅鼠劑。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 生物安全產品貿易標準的普及

- 不斷成長的糧食需求和不斷提高的農業生產力

- 大規模、垂直整合農業的傳播

- 城市鼠患迅速蔓延與氣候變遷有關

- 採用單劑量環保標章的第二代抗凝血劑

- 囓齒動物傳播通用感染疾病預防計畫的撥款

- 市場限制

- 抗藥性害蟲增加

- 環境和人類危害

- 加強SGAR戶外使用的監管

- 增加不孕症治療選擇

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 非抗凝血滅鼠劑

- Bromethalin

- 膽鈣化醇

- 磷化鋅

- 士的寧

- 抗凝血滅鼠劑

- 第一代

- 華法林

- Chlorophacinone

- 地法西酮

- Coumatetralyl

- 第二代

- 敵草酸

- 溴敵隆

- 弗羅科梅文

- Bromadiolone

- 非抗凝血滅鼠劑

- 按形式

- 堵塞

- 顆粒

- 粉末

- 糊狀物和凝膠

- 濃縮液

- 透過使用

- 農業

- 倉庫和儲存設施

- 商業和工業地產

- 住宅大樓

- 按發行格式

- 害蟲防治員 (PCO)

- 零售/DIY頻道

- 政府病媒控制計劃

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BASF SE

- Bayer AG

- Syngenta AG

- Liphatech

- Rentokil Initial plc

- Neogen Corporation

- JT Eaton

- Bell Laboratories

- SenesTech Inc.

- PelGar International

- Impex Europa

- Russell IPM

- Truly Nolen

- Vebi Istituto Biochimico

- Fumakilla

- UPL Limited

- Detia Degesch GmbH

第7章 市場機會與未來展望

The rodenticides market stands at USD 6.0 billion in 2025 and is forecast to reach USD 7.66 billion by 2030, advancing at a 5.0% CAGR over the period.

Rising climate-driven rodent populations, widening food-security gaps, and tightening public-health standards keep demand resilient across agricultural, commercial, and residential settings. Stringent sanitation rules in global food trade, combined with extended breeding seasons in warmer urban environments, amplify the need for reliable chemical and non-chemical solutions. Regulatory shifts restricting second-generation anticoagulant rodenticides (SGARs) in California and the United Kingdom accelerate innovation in low-toxicity flocoumafen and fertility-control products. Digital monitoring, including IoT-enabled bait stations, is lowering labor costs for pest-control operators while giving manufacturers new avenues to differentiate offerings. Consolidation among the top five suppliers, holding roughly 73% of the global rodenticides market, underscores the importance of scale in meeting evolving compliance and stewardship expectations.

Global Rodenticides Market Trends and Insights

Surge in Bio-secure Commodity Trade Standards

Trade agreements increasingly require certified rodent-control protocols to prevent cross-border pest transmission, compelling grain terminals, warehouses, and shipping lines to adopt professionally applied rodenticides and integrated pest-management (IPM) plans. Parallel mandates in the European Union and North America tie export eligibility to pest-free storage certificates, prompting exporters to deploy tamper-resistant bait boxes that comply with SGAR stewardship codes. These measures shield multi-million-dollar consignments from quarantine holds, making professional-grade rodenticides a frontline tool in safeguarding trade continuity. The economic incentive widens as the OECD-FAO Agricultural Outlook anticipates 1.3% annual consumption growth through 2032, intensifying pressure on already-stretched logistics networks.

Increasing Demand for Food and Agricultural Productivity

Rising calorie needs and climate-induced yield volatility expose grain and horticulture systems to heavier post-harvest losses, which can reach 30-40% in emerging markets when rodent control is inadequate. Field studies across Asian rice belts show ecologically based rodent management lifting yields 6-15% and farm incomes beyond 15%, a compelling return on rodenticide investments. In Africa, multimammate rats shave as much as 48% from maize harvests, pushing governments to subsidize broad-acre zinc-phosphide campaigns. The Food and Agriculture Organization confirms that combining structural silo upgrades with targeted chemical control sharply curtails storage losses. As climate shifts stretch breeding seasons, growers scale up from spot treatments to programmatic applications, reinforcing long-run volume growth in the rodenticides market.

Rise in the Number of Resistant Pests

Genetic mutations, particularly in the Vkorc1 gene, undermine first- and second-generation anticoagulants, raising treatment costs and prolonging infestation timelines. Lebanese fieldwork confirmed resistance in house mice and rats despite limited oversight of rodenticide sales. New Zealand studies detected brodifacoum tolerance in isolated populations lacking prior exposure, hinting at spontaneous resistance via genetic drift. California ground squirrels now survive diphacinone and chlorophacinone pulses, compelling rotation to zinc-phosphide or cholecalciferol mixtures. Resistance inflates service calls and drives investment in diagnostics, tempering volume growth for legacy chemistries.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Large-scale Vertically Integrated Farming

- Rapid Urban Rodent Infestations Linked to Climate Change

- Environmental and Human Health Hazards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anticoagulants secured 66.0% of 2024 revenue, underpinning the rodenticides market leadership story. Their single-dose lethality against resistant strains anchors usage in warehouses and food plants even as regulators trim permissible concentrations. Second-generation molecules such as brodifacoum stay favored among professionals, yet non-anticoagulant classes clock a 7.8% CAGR to 2030, pulling demand toward zinc phosphide and cholecalciferol hybrids. Studies show zinc phosphide trimmed field populations by 58.15%, eclipsing traditional first-generation outcomes.

In parallel, bromethalin and strychnine hold niche utility for burrow systems where anticoagulant resistance soars. Regulatory headwinds against metal phosphides in low-income regions temper broader adoption, yet specialized needs sustain modest demand. Overall, portfolio diversification lets market leaders buffer exposure to any single regulatory clampdown, keeping the rodenticides market adaptable.

Blocks retained a commanding 45.0% slice of 2024 demand thanks to weather resistance and compatibility with tamper-proof stations mandated under SGAR stewardship. Professionals appreciate their longevity outdoors, limiting callbacks. Pellets followed at 40.5%, favored for mechanical broadcast across rice paddies and row crops. The rodenticides market size attributable to liquid concentrates is forecast to grow 7.4% CAGR, outpacing overall sector expansion as precision spray rigs and bait baggers gain traction.

Field work shows paraffin blocks kept 100% active-ingredient recovery in open air, though 50% detached within five weeks, prompting innovation in anchor systems. Pastes and gels win share in high-visibility retail and hospitality settings, where discreet application matters. Powders are declining due to drift concerns but retain relevance for fumigant burrow dusting in grain facilities. Ready-to-use sachets answer homeowner calls for simplicity, yet rising licensing barriers on SGARs tilt the DIY aisle toward first-generation actives or fertility tablets.

The Rodenticides Market Report is Segmented by Type (Non-Anticoagulant Rodenticides, and Anticoagulant Rodenticides), Form (Blocks, Pellets, Powders, and More), Application (Agricultural Fields, Warehouses and Storage Facilities, and More), Mode of Distribution (Pest Control Operators (PCO), and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained the largest regional market share at 36% in 2024, reflecting mature regulatory frameworks, high adoption of professional pest control services, and substantial commercial and industrial applications. The region's leadership stems from stringent food-safety regulations in warehousing and processing facilities, extensive agricultural operations requiring systematic pest management, and urbanization patterns that create ideal conditions for rodent infestations. Growth is projected at 4.1% CAGR through 2030, constrained by environmental regulations yet supported by climate-driven urban rodent population rises and advances in application technology. The Environmental Protection Agency's comprehensive rodenticide strategy, released in November 2024, delivers regulatory clarity while adding targeted mitigation measures for endangered-species protection.

Asia-Pacific represents the fastest-growing regional segment at a 6.2% CAGR to 2030, propelled by rapid urbanization, agricultural expansion, and heightened food security awareness in developing economies. China's rodent programs rely heavily on diphacinone for commensal species and zinc phosphide for field pests, with provincial agencies coordinating large-scale campaigns across urban and rural zones. Ecologically-based rodent management has lifted cereal yields by 6-15% and farm income by more than 15% across multiple nations, reinforcing adoption momentum.

Europe advances at a 3.8% CAGR through 2030 as harmonized EU rules encourage standardized product labeling and spur the development of eco-friendly formulations. The United Kingdom's ban on outdoor bromadiolone and difenacoum, effective July 2024, shifts product portfolios toward cholecalciferol and flocoumafen. Africa and the Middle East post 5.5% and 4.9% CAGRs, respectively, driven by urban growth, expanding agriculture, and public health measures aimed at rodent-borne diseases. Latin America moves ahead at a 5.2% CAGR, with Brazil's bio-security-centered trade rules underpinning steady demand. A gradual shift toward ecologically based rodent management in Sub-Saharan Africa signals a strategic evolution, yet acute outbreaks still necessitate conventional rodenticides.

- BASF SE

- Bayer AG

- Syngenta AG

- Liphatech

- Rentokil Initial plc

- Neogen Corporation

- JT Eaton

- Bell Laboratories

- SenesTech Inc.

- PelGar International

- Impex Europa

- Russell IPM

- Truly Nolen

- Vebi Istituto Biochimico

- Fumakilla

- UPL Limited

- Detia Degesch GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in bio-secure commodity trade standards

- 4.2.2 Increasing demand for food and agricultural productivity

- 4.2.3 Proliferation of large-scale, vertically-integrated farming

- 4.2.4 Rapid urban rodent infestations linked to climate change

- 4.2.5 Adoption of single-dose, eco-labeled second-generation anticoagulants

- 4.2.6 Subsidized rodent-borne zoonosis prevention programs

- 4.3 Market Restraints

- 4.3.1 Rise in the number of resistant pests

- 4.3.2 Environmental and human-health hazards

- 4.3.3 Tightening restrictions on outdoor SGAR use

- 4.3.4 Growing availability of fertility-control alternatives

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Non-Anticoagulant Rodenticides

- 5.1.1.1 Bromethalin

- 5.1.1.2 Cholecalciferol

- 5.1.1.3 Zinc Phosphide

- 5.1.1.4 Strychnine

- 5.1.2 Anticoagulant Rodenticides

- 5.1.2.1 First-Generation

- 5.1.2.1.1 Warfarin

- 5.1.2.1.2 Chlorophacinone

- 5.1.2.1.3 Diphacinone

- 5.1.2.1.4 Coumatetralyl

- 5.1.2.2 Second-Generation

- 5.1.2.2.1 Difenacoum

- 5.1.2.2.2 Brodifacoum

- 5.1.2.2.3 Flocoumafen

- 5.1.2.2.4 Bromadiolone

- 5.1.1 Non-Anticoagulant Rodenticides

- 5.2 By Form

- 5.2.1 Blocks

- 5.2.2 Pellets

- 5.2.3 Powders

- 5.2.4 Pastes and Gels

- 5.2.5 Liquid Concentrates

- 5.3 By Application

- 5.3.1 Agricultural Fields

- 5.3.2 Warehouses and Storage Facilities

- 5.3.3 Commercial and Industrial Premises

- 5.3.4 Residential Buildings

- 5.4 By Mode of Distribution

- 5.4.1 Pest Control Operators (PCOs)

- 5.4.2 Retail/DIY Channels

- 5.4.3 Government Vector-Control Programs

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Syngenta AG

- 6.4.4 Liphatech

- 6.4.5 Rentokil Initial plc

- 6.4.6 Neogen Corporation

- 6.4.7 JT Eaton

- 6.4.8 Bell Laboratories

- 6.4.9 SenesTech Inc.

- 6.4.10 PelGar International

- 6.4.11 Impex Europa

- 6.4.12 Russell IPM

- 6.4.13 Truly Nolen

- 6.4.14 Vebi Istituto Biochimico

- 6.4.15 Fumakilla

- 6.4.16 UPL Limited

- 6.4.17 Detia Degesch GmbH