|

市場調查報告書

商品編碼

1851165

滴灌:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Drip Irrigation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

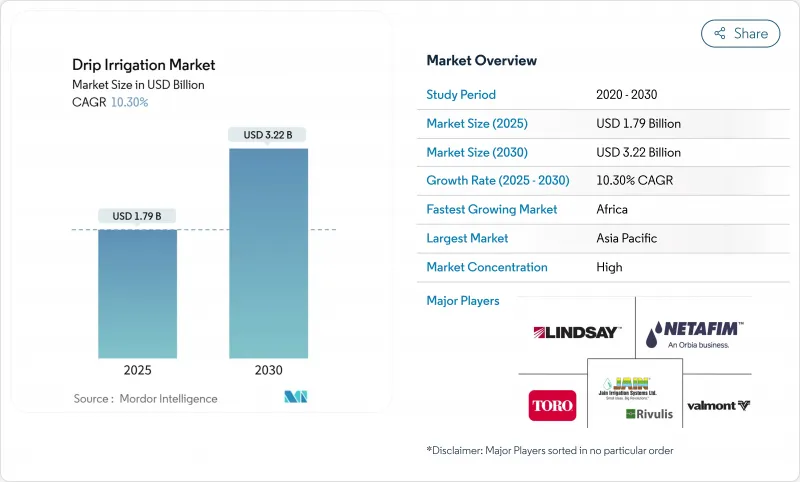

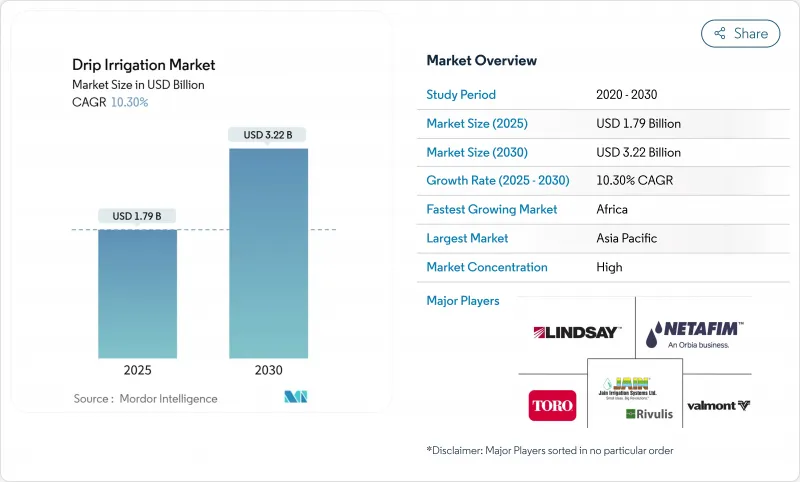

預計滴灌市場將從 2025 年的 17.9 億美元成長到 2030 年的 32.2 億美元,複合年成長率為 10.3%。

市場擴張的關鍵促進因素包括日益成長的水資源短缺問題、溫室種植的發展以及政府強制推行節水灌溉系統的法規。透過策略併購實現的產業整合正在增強技術實力,而與數位農業平台的整合則將感測器技術、雲端分析和壓力補償式發送器應用於開放式和保護性種植環境中。製造商正在推出全面的資金籌措和農藝服務方案,以鼓勵小型農場採用相關技術。市場細分顯示,歐洲蘊藏著巨大的成長機遇,亞太地區市場影響顯著,中東和非洲的法規結構也較為有利,其中地下灌溉系統和智慧控制器在產品細分市場擴張中佔據主導地位。

全球滴灌市場趨勢與洞察

水資源短缺的威脅

水資源短缺是滴灌市場成長的主要驅動力,與噴灌相比,根部灌溉系統可消費量高達50%。地下水位下降和市政用水限制迫使農民採用精準灌溉方法,以最大限度地減少徑流和蒸發。研究表明,乾旱時期用水配額減少與滴灌普及率提高之間存在直接關聯。除了節水之外,這項技術還具有其他優勢,例如減少雜草生長和降低葉部病害發生率,從而提高盈利並支持市場的持續擴張。

有利的政府政策和補貼

公共津貼計畫影響各市場滴灌技術的普及率。在西班牙,150萬公頃灌溉網路的現代化改造使局部滴灌系統佔總灌溉面積的比例提升至48.23%。印度、以色列和沿岸地區的成本分攤補貼正在降低初始投資並縮短投資回收期。瓦倫西亞的一項研究發現,小型合作社的維護成本可能超過補貼金額,這凸顯了涵蓋設備和持續維護成本的全面性補貼項目的重要性。不斷上漲的水價和政策獎勵共同推動滴灌市場的成長。

高初始資本投入

高昂的初始成本仍然是滴灌市場發展的一大障礙,尤其是在小農戶眾多且信貸管道有限的地區。例如,土壤濕度探頭等基本設備的價格高達25,000印度盧比(約300美元),超出了大多數小農戶的經濟承受能力。儘管多邊銀行推出了靈活的融資方案,例如按需付費貸款和設備租賃計劃,但不同地區的採用率仍然參差不齊。此外,儘管人們越來越關注水資源短缺問題,但補貼和統一的水價政策降低了投資滴灌系統的經濟獎勵。

細分市場分析

由於安裝簡單、維護高效且無需大量挖掘,地表滴灌系統預計到2024年將佔據滴灌市場62.0%的佔有率。農民正在利用地表滴灌管線高效改造中心支軸式噴灌系統,無需專用設備即可立即節約用水。商業農場正在將地表滴灌系統與葉面噴霧結合,以維持作物最佳生長溫度,確保系統能夠適應多種作物和土壤類型。

地下灌溉系統目前規模雖小,但預計到2030年將以11.8%的複合年成長率成長。這些系統能夠保護灌溉基礎設施免受機械損壞,同時最大限度地減少水分蒸發,尤其是在乾旱地區。華盛頓大學的一項研究表明,安裝在地下15公分處的發送器可顯著減少地表徑流。不斷上漲的水費以及日益嚴格的監管要求,正在提升地下灌溉系統的經濟效益,並鞏固其在滴灌市場的戰略地位。

預計到2024年,發送器將佔總銷售額的28.5%,這反映了它們在提供均勻水流方面的重要作用。改良的精密成型和壓力補償技術有助於在較長的支管上保持穩定的出水速率,從而降低所需的揚程,並使每台泵浦能夠覆蓋更大的灌溉區域。

智慧灌溉組件,例如雲端連接控制器、土壤濕度感測器和灌溉閥門,正以14.6%的複合年成長率成長。美國環保署(EPA)的數據顯示,智慧控制器可將計畫灌溉量減少20%至43%,而整合土壤感測器系統可在乾旱期間減少高達72%的消費量。硬體成本的降低和智慧型手機介面的改進正在推動其普及。隨著農民將產量與資源利用聯繫起來,數據主導的洞察將加速控制器的普及,從而擴大數位化細分市場的佔有率。

區域分析

受印度和中國應對地下水枯竭的努力推動,亞太地區預計在2024年將佔總收入的34.9%。 Jain Irrigation利用其農藝顧問團隊,結合衛星影像和現場遠端檢測,管理52種作物、850萬英畝的灌溉面積。政府補貼和免息貸款正促使農民採用配備數位監測功能的整合式滴灌系統。不斷上漲的投入成本和農村人口向城市遷移的趨勢正在加速滴灌系統的普及,進一步鞏固了Jain在亞太滴灌市場的領先地位。

預計到2030年,非洲將以12.1%的複合年成長率實現最快成長。多邊發展計畫正在支持小農戶使用太陽能灌溉系統,以解決電力基礎設施不足的問題。麻省理工學院的GEAR實驗室在肯亞和摩洛哥開展的舉措正在最佳化系統,以降低運作壓力、提高電池效率並降低沙質土壤條件下的抽水成本。肯亞、埃塞俄比亞和摩洛哥的出口花卉和蔬菜種植者正在實施雲端基礎的監控系統,以滿足歐洲的可追溯性要求,從而推動區域市場成長。

歐洲市場反映了嚴格的水資源指令以及農業人口老化的問題。歐洲市場的成長反映了節水法規的實施和農業人口結構的變化。西班牙已撥款歐盟「下一代」農業發展基金,用於10萬公頃農地的現代化改造,同時也應對農業人口老化所帶來的挑戰。製造商正在開發介面簡潔、易於操作且具備遠端更新功能的控制器。水價改革提高了營運成本,促使傳統農民採用滴灌系統,從而維持了穩定的市場需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 水資源短缺的威脅

- 有利的政府政策和補貼

- 高價值溫室蔬菜的綜合灌溉需求

- 透過從中心支軸式噴灌改為滴灌來降低勞動成本

- 地中海葡萄園正在適應氣候變遷的影響

- 大型農場正從傳統的漫灌方式過渡到微灌系統

- 市場限制

- 高初始資本投入

- 複雜裝置造成的滴灌損害

- 新興市場售後服務網路不發達

- 水費的不確定性和有限的投資報酬率

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 應用

- 地表滴灌

- 地下滴灌

- 按組件

- 發送器/滴頭

- 滴灌管和輸液管

- 篩選

- 壓力泵

- 閥門和管件

- 控制器和感測器

- 配件(地釘、連接件、插頭)

- 作物類型

- 田間作物

- 蔬菜作物

- 果園作物

- 葡萄園

- 其他作物(經濟作物和觀賞作物)

- 最終用戶

- 商業農場

- 溫室和苗圃

- 住宅花園及其狀況

- 運動場和高爾夫球場

- 按銷售管道

- 直銷

- 經銷商和分銷商

- 線上零售

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 中東和非洲

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 最常採用的策略

- 市佔率分析

- 公司簡介

- Jain Irrigation Systems Ltd.(Rivulis Irrigation Ltd.)

- The Toro Company

- Netafim Limited(An Orbia Business)

- Rain Bird Corporation

- Valmont Industries, Inc.

- Chinadrip Irrigation Equipment Co. Ltd

- Antelco Pty Ltd

- Sistema Azud

- Metzer Group(Adam Partners)

- DripWorks Inc.

- Mahindra EPC Irrigation Ltd

- Irritec SpA

- Hunter Industries Inc.

第7章 市場機會與未來展望

The drip irrigation market is projected to increase from USD 1.79 billion in 2025 to USD 3.22 billion by 2030, registering a CAGR of 10.3%.

The market expansion is primarily attributed to intensifying water scarcity concerns, greenhouse farming development, and the implementation of government regulations mandating water-efficient irrigation systems. Industry consolidation through strategic mergers has enhanced technological capabilities, while integration with digital farming platforms incorporates sensor technology, cloud analytics, and pressure-compensating emitters in both open-field and protected cultivation environments. Manufacturing companies are implementing comprehensive financing and agronomic service packages to facilitate adoption among small-scale agricultural operations. The market demonstrates substantial growth opportunities in Europe, considerable market presence in Asia-Pacific, and favorable regulatory frameworks in the Middle East and Africa, with subsurface irrigation systems and smart controllers dominating product segment expansion.

Global Drip Irrigation Market Trends and Insights

Threat of Water Scarcity

Water stress is the primary driver of drip irrigation market growth, as root-zone delivery systems reduce water consumption by up to 50% compared to overhead sprinklers. Declining aquifer levels and municipal water restrictions are pushing agricultural producers to adopt precision irrigation methods that minimize runoff and evaporation. Research demonstrates a direct relationship between reduced water allocations during drought periods and increased drip irrigation adoption. The technology provides additional benefits beyond water conservation, including decreased weed growth and lower foliar disease incidence, which improve profitability and support continued market expansion.

Favorable Policies and Subsidies from the Government

Public funding programs influence drip irrigation adoption rates across markets. Spain's modernization of 1.5 million hectares of irrigation networks increased localized systems to 48.23% of the total irrigated area. Cost-share grants in India, Israel, and the Gulf regions reduce initial investments and payback periods. Research from Valencia indicates that maintenance costs can exceed subsidy benefits for small cooperatives, highlighting the importance of comprehensive programs covering both equipment and ongoing maintenance expenses. The combination of increasing water tariffs and policy incentives continues to drive growth in the drip irrigation market.

High Initial Capital Investments

High initial costs remain a significant barrier in the drip irrigation market, particularly in regions with small farm holdings and limited credit access. The cost of essential equipment, such as a soil-moisture probe at INR 25,000 (USD 300), exceeds the financial capacity of most smallholder farmers. Although multilateral banks have introduced flexible financing options like pay-as-you-grow loans and equipment leasing programs, adoption rates vary across regions. Additionally, subsidized or flat-rate water pricing reduces the financial incentive to invest in drip irrigation systems, despite increasing water scarcity concerns.

Other drivers and restraints analyzed in the detailed report include:

- Integrated Fertigation Demand for High-Value Greenhouse Vegetables

- Labor Cost Reduction Through Pivot-to-Drip Irrigation Conversion

- Damages in Drip Irrigation Due to the Complex Set-up

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surface installations comprised 62.0% of the drip irrigation market in 2024, attributed to their straightforward installation, efficient maintenance, and reduced excavation requirements. Agricultural operators implement surface lines to convert pivot systems effectively, generating immediate water conservation benefits without specialized equipment. Commercial farms integrate surface drip systems with foliar misters to maintain optimal crop temperature control, ensuring system versatility across multiple crops and soil compositions.

Subsurface systems, despite their current smaller market presence, are projected to achieve a CAGR of 11.8% through 2030. These installations minimize water evaporation, particularly in arid regions, while protecting irrigation infrastructure from mechanical damage. Research conducted by Washington universities indicates that emitters positioned 15 cm below ground substantially reduce surface runoff. The combination of escalating water costs and enhanced regulatory requirements strengthens the economic viability of subsurface systems, establishing their strategic importance in the drip irrigation market.

Emitters accounted for 28.5% of revenue in 2024, reflecting their essential role in delivering uniform water flow. Improvements in precision molding and pressure compensation technology help maintain consistent discharge rates across extended lateral lines, reducing pressure head requirements and enabling broader field coverage per pump.

Smart irrigation components, including cloud-connected controllers, moisture sensors, and irrigation valves, are growing at a 14.6% CAGR. Smart controllers reduce scheduled irrigation by 20-43%, while integrated soil-sensor systems can decrease water consumption by up to 72% during drought conditions, according to EPA data. Reduced hardware costs and improved smartphone interfaces facilitate adoption. As agricultural operators correlate yields with resource utilization, the resulting data-driven insights accelerate controller adoption, increasing the digital segment's share of the drip irrigation market.

The Drip Irrigation Market Report is Segmented by Application (Surface Drip Irrigation and More), by Component (Emitters / Drippers, and More), by End-User (Commercial Farms, and More), by Crop Type (Field Crops, and More), by Sales Channel (Direct Sales, and More), and by Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific accounts for 34.9% of 2024 revenue, driven by India and China's initiatives to address groundwater depletion. Jain Irrigation manages 8.5 million acres across 52 crops, using agronomic advisory teams that combine satellite imagery with in-field telemetry. Government subsidies and zero-interest loans encourage farmers to adopt integrated drip-fertigation systems with digital monitoring capabilities. Increasing input costs and rural-urban migration accelerate adoption rates, strengthening Asia-Pacific's dominant position in the drip irrigation market.

Africa posts the fastest 12.1% CAGR forecast through 2030. Multilateral development programs support solar-powered irrigation systems for small-scale farmers, addressing limited power infrastructure. MIT's GEAR Lab initiatives in Kenya and Morocco optimize systems for reduced operating pressure, improving battery efficiency, and reducing water pumping costs in sandy soil conditions. The region's export-oriented floriculture and vegetable producers in Kenya, Ethiopia, and Morocco implement cloud-based monitoring systems to meet European traceability requirements, driving regional market growth.

Europe's market reflects stringent water directives alongside aging farmer demographics. Europe's market growth reflects water conservation regulations and demographic shifts in farming. Spain allocates Next Generation EU funding to modernize 100,000 hectares, while addressing challenges of an aging farming population, with 59% of Spanish farmers over 55 and only 18% having formal ICT training. Manufacturers develop user-friendly controllers with simplified interfaces and remote update capabilities. Water pricing reforms increase operational costs, encouraging traditional farmers to adopt drip irrigation systems, and maintaining steady market demand.

- Jain Irrigation Systems Ltd. (Rivulis Irrigation Ltd.)

- The Toro Company

- Netafim Limited (An Orbia Business)

- Rain Bird Corporation

- Valmont Industries, Inc.

- Chinadrip Irrigation Equipment Co. Ltd

- Antelco Pty Ltd

- Sistema Azud

- Metzer Group (Adam Partners)

- DripWorks Inc.

- Mahindra EPC Irrigation Ltd

- Irritec SpA

- Hunter Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Threat of Water Scarcity

- 4.2.2 Favorable Policies and Subsidies from the Government

- 4.2.3 Integrated Fertigation Demand for High-Value Greenhouse Vegetables

- 4.2.4 Labor Cost Reduction Through Pivot-to-Drip Irrigation Conversion

- 4.2.5 Mediterranean Vineyards Adapt to Climate Change Impacts

- 4.2.6 Large-Scale Farms Shifting from Traditional Flood Irrigation to Micro-Irrigation Systems

- 4.3 Market Restraints

- 4.3.1 High Initial Capital Investments

- 4.3.2 Damages in Drip Irrigation Due to the Complex Set-up

- 4.3.3 Underdeveloped After-Sales Service Networks in Emerging Markets

- 4.3.4 Water-Tariff Uncertainties and Curtailing ROI

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Surface Drip Irrigation

- 5.1.2 Subsurface Drip Irrigation

- 5.2 By Component

- 5.2.1 Emitters / Drippers

- 5.2.2 Drip Tubes and Lines

- 5.2.3 Filters

- 5.2.4 Pressure Pumps

- 5.2.5 Valves and Fittings

- 5.2.6 Controllers and Sensors

- 5.2.7 Accessories (Stake, Joiners, and Plugs)

- 5.3 Crop Types

- 5.3.1 Field Crops

- 5.3.2 Vegetable Crops

- 5.3.3 Orchard Crops

- 5.3.4 Vineyards

- 5.3.5 Other Crops (Commercial and Ornamental Plants)

- 5.4 By End-User

- 5.4.1 Commercial Farms

- 5.4.2 Greenhouses and Nurseries

- 5.4.3 Residential Gardens and Landscapes

- 5.4.4 Sports Fields and Golf Courses

- 5.5 By Sales Channel

- 5.5.1 Direct Sales

- 5.5.2 Dealer and Distributor

- 5.5.3 Online Retail

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Spain

- 5.6.2.6 Italy

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of the Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Israel

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.6 Egypt

- 5.6.5.7 Rest of the Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Jain Irrigation Systems Ltd. (Rivulis Irrigation Ltd.)

- 6.3.2 The Toro Company

- 6.3.3 Netafim Limited (An Orbia Business)

- 6.3.4 Rain Bird Corporation

- 6.3.5 Valmont Industries, Inc.

- 6.3.6 Chinadrip Irrigation Equipment Co. Ltd

- 6.3.7 Antelco Pty Ltd

- 6.3.8 Sistema Azud

- 6.3.9 Metzer Group (Adam Partners)

- 6.3.10 DripWorks Inc.

- 6.3.11 Mahindra EPC Irrigation Ltd

- 6.3.12 Irritec SpA

- 6.3.13 Hunter Industries Inc.