|

市場調查報告書

商品編碼

1851154

感知無線電:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Cognitive Radio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

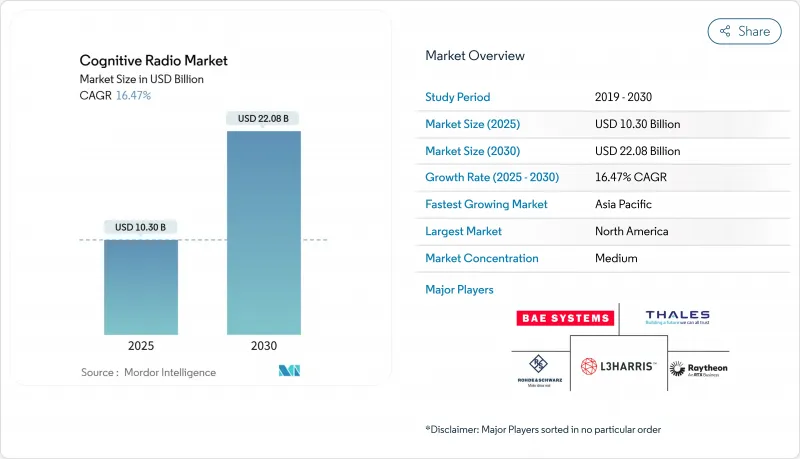

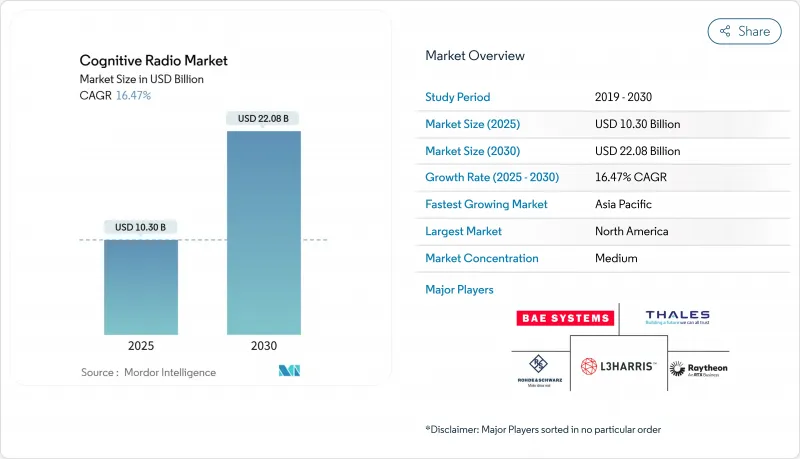

感知無線電市場規模預計在 2025 年達到 103 億美元,預計到 2030 年將達到 220.8 億美元,在預測期(2025-2030 年)內複合年成長率為 16.47%。

加速成長的促進因素包括中高頻段頻譜日益短缺、基於人工智慧的感知演算法的進步,以及迫切需要以動態頻譜共用的方式協調5G和早期6G網路。各國政府支持頻譜共用指令,並為測試平台分配大量研究預算,而國防機構則透過檢驗大規模演示來規避商業應用風險。 《晶片和整合產品法案》(CHIPS Act)下的半導體激勵措施正在增強國內硬體能力,毫米波5G的推出推動了對能夠實現敏捷波束控制和瞬時頻譜的無線電設備的需求。隨著晶片組價格上漲以及人工智慧工作負載從雲端轉移到無線邊緣,供應商正透過利用垂直整合的設計和多元化的材料籌資策略來確保利潤。

全球感知無線電市場趨勢與洞察

對頻譜最佳化的需求日益成長

流量成長已使傳統頻譜分配捉襟見肘,促使監管機構優先考慮依賴認知感知技術的動態共用策略。僅民用寬頻無線服務的一項規則更新,就使超過7,200萬美國用戶能夠在不影響現有雷達的情況下獲得覆蓋。新型感知引擎可在毫秒內掃描大範圍區域,聯邦政府投入16億美元用於支持旨在減少聯邦和商業衝突的研究。中頻段走廊仍是5G的熱點區域,承載著氣象雷達和國防系統,同時保持5G智慧型手機的良好傳播特性。供應商正在展示將直接射頻採樣與片上人工智慧推理相結合的晶片組,以即時發現頻譜空隙。這些進步使通訊業者能夠在不獲得昂貴的新許可證的情況下增加容量,從而支持感知無線電市場的長期擴張。

擴大5G服務與應用程式的部署

高密度的5G網路覆蓋範圍需要靈活的頻譜管理,才能在有限的頻譜資源內維持吞吐量目標。中國已建成超過22.87萬個基地台,並預計在2025年實現60%的用戶普及率。日本已發放153張4.7GHz頻段的本地私有5G牌照,展示了情境感知無線電如何在狹窄的區域頻道中建構工廠網路。 6G的整合感知和通訊概念整合了雷達和資料鏈路,進一步壓縮了頻譜預算。廠商正投入數十億美元開發以人工智慧為基礎的核心軟體,利用即時頻譜智慧來控制網路流量。隨著這些部署的成熟,感知無線電市場將在行動網路參考設計中扮演更重要的角色。

缺乏健全的運算安全基礎設施

動態無線電技術擴大了攻擊面,因為攻擊者可以攔截感測資料並篡改機器學習模型。早期基於區塊鏈的共享試點項目面臨交易吞吐量有限和頻譜交易速度緩慢的問題。國防機構正在測試電磁誘餌以掩蓋其活動,而對抗性人工智慧的對策仍然是一個活躍的研究領域。量子金鑰分發技術展現出一定的潛力,但目前只能在短距離內保護千位元級的資料流,無法滿足實際應用需求。在可擴展、低延遲的安全保障措施出現之前,關鍵基礎設施所有者採取觀望態度,避免近期部署。

細分市場分析

頻譜感知和分配將在2024年佔全球收入的38%,鞏固其作為所有部署必須整合的基礎層地位。高速探測器符合FCC關於毫秒雷達防護的規定。關鍵任務效能需求促使供應商將直接射頻採樣與邊緣AI加速器相結合,以提供近乎瞬時的頻譜佔用情況洞察。認知路由目前規模較小,但隨著AI引擎在選擇路由時開始關聯鏈路品質、用戶移動性和延遲預算,其正以18.70%的複合年成長率快速成長。動態路由調整對於車聯網(C-V2X)部署至關重要,因為瞬間的通道波動可能會危及道路安全警報。企業也將這些原理應用於工廠機器人,以確保在金屬密集的廠房內實現可靠的無線覆蓋。

就市場規模而言,感知功能目前對感知無線電市場規模的貢獻超過了路由功能,後者透過將原始佔用數據轉化為可執行的決策,為整個系統增添了價值。隨著 6G 測試平台整合感知和通訊,供應商正將這兩種功能捆綁到單一協定堆疊中,推高了平均售價。位置偵測和 QoS 最佳化也實現了兩位數的成長,這主要得益於 RadioLLM 等能夠主動預測擁塞的框架。緊急和衛星應用構成了產品組合的重要組成部分,它們受益於多軌道切換機制,該機制使緊急應變能夠在地面網路故障時從地面鏈路切換到太空鏈路。

由於對寬頻轉換器、現場可編程閘陣列和波束控制天線陣列的持續需求,硬體業務在2024年貢獻了46%的收入。像AD9084這樣的直接射頻採樣晶片現在可以一步完成數百兆赫茲頻譜的數位化,從而縮小了系統尺寸。這種硬體基礎使得軟體價值得以快速提升,也解釋了軟體和韌體17.10%的複合年成長率。供應商正在整合容器化微服務,並持續在現場重新訓練頻譜模型,將智慧從雲端轉移到邊緣。隨著通訊業者尋求系統整合商來根據本地傳播條件調整人工智慧模型,服務收入將會成長。

在預測期內,隨著競爭的無線電模組雜訊係數和功率輸出趨於一致,軟體優勢將逐漸削弱硬體差異化。因此,供應商將更加重視韌體更新韌體延長產品使用壽命,而無需更換電路板。對於用戶而言,這將把資本支出轉化為營運支出,並簡化升級路徑,從而推動軟體感知無線電市場佔有率的上升。天線技術也不斷創新,雙頻饋源和封裝式電子控制可控天線陣列支援多軌道衛星漫遊。

感知無線電市場報告按應用(頻譜感知和分配、位置檢測、認知路由、其他)、組件(硬體、軟體和韌體、服務)、頻譜頻段(HF/VHF/UHF [低於 1 GHz]、SHF [1-6 GHz]、EHF [高於 6 GHz、毫米波])、最終用戶行業(IT 和通訊、ITes、物流和國防運輸、地區和其他國防運輸)。

區域分析

北美將佔2024年收入的37%,並且仍然是監管改革的標竿市場。國家頻譜策略累計66億美元用於半導體擴張,以及低、中、高頻段動態共用的試點計畫。像L3Harris這樣的國防承包商的訂單積壓超過330億美元,其中包括用於聯合全局作戰的頻譜感知平台。民用市場的高普及率反映了積極的固定無線部署,這些部署在彌合農村寬頻差距的同時,也保障了現有的公共服務。

亞太地區預計將以17.60%的複合年成長率成長,這主要得益於用戶對龐大潛在用戶群的追求,以及各國政府將6G領先地位視為戰略資產。中國密集的5G大型基地台層和6G測試平台需要能夠同時相容於中波和毫米波資源的無線電設備,而日本和韓國則鼓勵為工廠和港口發放私有5G牌照。一項三方技術協議將重點放在彈性供應鏈和開放式無線接入網(RAN)實驗的研究。

歐洲正憑藉廠商研發實力和歐盟範圍內的協調統一向前發展。愛立信已為2024年人工智慧原生架構投入44億歐元,泰雷茲已獲得價值253億歐元的國防通訊相關訂單。歐盟的「地平線歐洲」計劃正與是德科技合作檢驗6G無線電原型,並加速從實驗室到現場的過渡進程。歐洲電信標準化協會(ETSI)框架下的跨境合作降低了認證成本,並支持跨市場設備發布策略,從而確保區域成長穩定且波動性更小。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 最佳化頻譜利用的需求日益成長

- 擴大5G服務與應用程式的部署

- 物聯網連接設備的快速成長將推動動態頻譜的需求。

- 政府授權動態頻譜共用框架

- 人工智慧驅動的頻譜感知演算法正在日趨成熟

- 私人6G測試平台將加速研發資金投入

- 市場限制

- 缺乏強大的電腦安全基礎設施

- 關於二次頻率使用權的規定含糊不清

- 認知型射頻前端需要高資本投入

- 經過實地驗證的感知無線電晶片組十分罕見。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 買方/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過使用

- 頻譜感知與分配

- 位置偵測

- 認知路由

- 服務品質最佳化

- 其他用途

- 按組件

- 硬體(RF收發器、軟體定義無線電模組、天線)

- 軟體和韌體

- 服務

- 按頻寬

- 高頻/甚高頻/超高頻(低於1GHz)

- SHF(1-6 GHz)

- 極高頻(6GHz以上,毫米波)

- 按最終用戶行業分類

- 通訊領域

- 資訊科技與資訊科技服務

- 政府/國防

- 運輸與物流

- 能源與公共產業

- 其他行業

- 依網路類型

- 機會頻譜接入(OSA)

- 頻譜共用

- 協作網路

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corp.

- Rohde and Schwarz GmbH and Co KG

- Shared Spectrum Company

- L3Harris Technologies

- Huawei Technologies Co. Ltd.

- NuRAN Wireless Inc.

- Keysight Technologies

- Vecima Networks Inc.

- Northrop Grumman Corp.

- Ericsson AB

- Nokia Corp.

- Qorvo Inc.

- Analog Devices Inc.

- National Instruments Corp.

- Curtis-Wright Corp.

- Viasat Inc.

- Cobham Ltd.

- Elbit Systems Ltd.

第7章 市場機會與未來展望

The Cognitive Radio Market size is estimated at USD 10.30 billion in 2025, and is expected to reach USD 22.08 billion by 2030, at a CAGR of 16.47% during the forecast period (2025-2030).

Accelerated growth comes from widening mid- and high-band spectrum shortages, progress in artificial-intelligence-based sensing algorithms, and the pressing need to orchestrate 5G and early 6G networks on a dynamic, shared-spectrum basis. Governments endorse spectrum-sharing mandates and channel sizable research budgets toward testbeds, while defense agencies validate large-scale demonstrations that de-risk commercial adoption. Semiconductor incentives under the CHIPS Act bolster domestic hardware capacity, and millimeter-wave 5G rollouts push demand for radios capable of agile beam steering and split-second spectrum hand-offs. As chipset prices rise and AI workloads shift from the cloud to the radio edge, suppliers answer with vertically integrated designs and diversified raw-material sourcing strategies to preserve margins.

Global Cognitive Radio Market Trends and Insights

Growing Need to Optimize Spectrum Utilization

Traffic growth is exhausting legacy allocations, prompting regulators to prioritize dynamic sharing policies that hinge on cognitive sensing. Citizens Broadband Radio Service rule updates alone unlocked service to 72 million more U.S. users without harming incumbent radars. New sensing engines scan wide swaths in milliseconds, and a USD 1.6 billion federal budget backs research aimed at reducing federal-commercial conflicts. Mid-band corridors remain the epicenter because they hold favorable propagation for 5G smartphones yet also host weather radars and defense systems. Vendors showcase chipsets that couple direct-RF sampling with on-chip AI inference to spot spectral holes on the fly. These advances let operators raise capacity without expensive new licenses, supporting the cognitive radio market's long-run expansion.

Rising Deployment of 5G Service Applications

Dense 5G footprints require agile frequency management to sustain throughput targets within finite spectrum blocks. China surpassed 228,700 base stations and is headed for 60% user penetration by 2025, relying on cognitive scheduling to coordinate mid- and high-band carriers. Japan issued 153 local 4.7 GHz licenses for private 5G, proving how context-aware radios enable factory networks inside tightly zoned channels. Integrated Sensing and Communication concepts for 6G merge radar and data links, further tightening spectral budgets. Vendors funnel multi-billion-dollar R&D into AI-native core software that uses real-time spectrum intelligence to steer traffic. As these deployments mature, the cognitive radio market secures a larger role in mobile-network reference designs.

Lack of Robust Computational Security Infrastructure

Dynamic radios broaden the attack surface because adversaries can spoof sensing data or tamper with machine-learning models. Early blockchain-based sharing pilots achieve limited transaction throughput, slowing spectrum trades. Defense agencies test electromagnetic decoys to mask activity, but adversarial-AI countermeasures remain under active research. Quantum key distribution shows promise yet currently secures only kilobit-level streams over short ranges, falling short of field requirements. Until scalable, low-latency safeguards arrive, critical-infrastructure owners adopt wait-and-see postures that temper near-term uptake.

Other drivers and restraints analyzed in the detailed report include:

- Government Mandates for Dynamic Spectrum Sharing Frameworks

- AI-Powered Spectrum Sensing Algorithms Mature

- Regulatory Ambiguity on Secondary Spectrum Usage Rights

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spectrum Sensing & Allocation controlled 38% of global 2024 revenue, solidifying its role as the prerequisite layer that every deployment must integrate. High-speed detectors satisfy FCC rules that demand incumbent radar protection within milliseconds. Mission-critical performance needs pushed vendors to combine direct-RF sampling with edge AI accelerators, gifting operators near-instant insight into spectrum occupancy. Cognitive Routing, while smaller today, is scaling at an 18.70% CAGR as AI engines start to correlate link quality, user mobility, and latency budgets during path selection. Dynamic route adjustment becomes indispensable to vehicle-to-everything (C-V2X) rollouts, where split-second channel variation can jeopardize road-safety alerts. Enterprises extend these principles to factory floor robots, ensuring reliable wireless coverage in metal-dense halls.

In quantitative terms, the cognitive radio market size contributions from sensing surpass routing for now yet routing augments overall system value because it turns raw occupancy data into actionable decisions. As 6G testbeds merge sensing and communications, vendors bundle both features within a single stack, expanding average selling prices. Location Detection and QoS Optimization also post double-digit growth, aided by frameworks such as RadioLLM that forecast congestion before it happens. Emergency and satellite applications round out the portfolio, benefiting from multi-orbit handover mechanisms that let first responders switch from terrestrial to space links when terrestrial networks falter.

Hardware collected 46% of 2024 sales thanks to continued demand for wideband converters, field-programmable gate arrays, and beam-steered antenna arrays. Direct-RF sampling chips such as the AD9084 now digitize hundreds of megahertz of spectrum in a single step, shrinking system footprints. That hardware base enables rapid gains in software value, explaining the 17.10% CAGR booked by Software & Firmware. Vendors embed containerized microservices that continuously retrain spectrum models onsite, moving intelligence from the cloud to the edge. Services revenue rises as carriers seek system integrators to calibrate AI models for local propagation realities.

Over the forecast horizon, software gains steadily erode hardware-only differentiation because competing radio modules deliver similar noise figures and power outputs. Suppliers therefore, highlight firmware update pipelines that extend field lifetimes without swapping boards. For users, this converts capex into opex and smooths upgrade paths that keep the cognitive radio market share of software on an upward glide path. Antenna innovation also marches ahead: electronically steerable arrays packaged with dual-band feeds support multi-orbit satellite roaming.

Cognitive Radio Market Report is Segmented by Application (Spectrum Sensing and Allocation, Location Detection, Cognitive Routing, and More), Component (Hardware, Software and Firmware, and Services), Spectrum Band (HF/VHF/UHF [Less Than 1 GHz], SHF [1-6 GHz], and EHF [More Than 6 GHz, Mmwave]), End-User Industry (Telecommunications, IT and ITes, Government and Defense, Transportation and Logistics, and More), and Geography.

Geography Analysis

North America held 37% of 2024 revenue and remains the reference market in regulatory innovation. The National Spectrum Strategy earmarks USD 6.6 billion for semiconductor buildouts and pilots that vet dynamic sharing across low-, mid-, and high-bands. Defense contractors such as L3Harris carry order backlogs topping USD 33 billion that include spectrum-aware platforms for joint-all-domain operations. High civilian uptake mirrors aggressive fixed-wireless rollouts that bridge rural broadband gaps while preserving incumbent public-safety services.

Asia Pacific is projected to rise at a 17.60% CAGR as operators chase large addressable subscriber bases and governments treat 6G leadership as a strategic asset. China's dense 5G macro-cell layer and 6G testbeds require radios able to juggle mid- and millimeter-wave assets, while Japan and South Korea incentivize private-5G licenses for factories and ports. Tri-lateral technology pacts among the three nations concentrate research funding on resilient supply chains and open-RAN experimentation.

Europe advances on the strength of vendor R&D and pan-EU harmonization. Ericsson allocated EUR 4.4 billion to AI-native architectures in 2024, and Thales secured EUR 25.3 billion in orders tied to defense communications. The EU's Horizon Europe projects partner with Keysight to validate 6G radio prototypes, accelerating lab-to-field transition timelines. Cross-border alignment under ETSI reduces certification costs and supports multi-market equipment release strategies, cementing steady but less volatile regional growth.

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corp.

- Rohde and Schwarz GmbH and Co KG

- Shared Spectrum Company

- L3Harris Technologies

- Huawei Technologies Co. Ltd.

- NuRAN Wireless Inc.

- Keysight Technologies

- Vecima Networks Inc.

- Northrop Grumman Corp.

- Ericsson AB

- Nokia Corp.

- Qorvo Inc.

- Analog Devices Inc.

- National Instruments Corp.

- Curtis-Wright Corp.

- Viasat Inc.

- Cobham Ltd.

- Elbit Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing need to optimize spectrum utilization

- 4.2.2 Rising deployment of 5G service applications

- 4.2.3 Surge in IoT-connected devices driving dynamic spectrum demand

- 4.2.4 Government mandates for dynamic spectrum sharing frameworks

- 4.2.5 AI-powered spectrum sensing algorithms mature

- 4.2.6 Private 6G testbeds accelerating research and development funding

- 4.3 Market Restraints

- 4.3.1 Lack of robust computational security infrastructure

- 4.3.2 Regulatory ambiguity on secondary spectrum usage rights

- 4.3.3 High capex for cognitive-enabled RF front-ends

- 4.3.4 Scarcity of field-proven cognitive radio chipsets

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Spectrum Sensing and Allocation

- 5.1.2 Location Detection

- 5.1.3 Cognitive Routing

- 5.1.4 QoS Optimisation

- 5.1.5 Other Applications

- 5.2 By Component

- 5.2.1 Hardware (RF Transceivers, SDR Modules, Antennas)

- 5.2.2 Software and Firmware

- 5.2.3 Services

- 5.3 By Spectrum Band

- 5.3.1 HF/VHF/UHF (Less than 1 GHz)

- 5.3.2 SHF (1-6 GHz)

- 5.3.3 EHF (More than 6 GHz, mmWave)

- 5.4 By End-user Industry

- 5.4.1 Telecommunication

- 5.4.2 IT and ITeS

- 5.4.3 Government and Defense

- 5.4.4 Transportation and Logistics

- 5.4.5 Energy and Utilities

- 5.4.6 Other Industries

- 5.5 By Network Type

- 5.5.1 Opportunistic Spectrum Access (OSA)

- 5.5.2 Spectrum Sharing

- 5.5.3 Cooperative Networks

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 UAE

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BAE Systems plc

- 6.4.2 Thales Group

- 6.4.3 Raytheon Technologies Corp.

- 6.4.4 Rohde and Schwarz GmbH and Co KG

- 6.4.5 Shared Spectrum Company

- 6.4.6 L3Harris Technologies

- 6.4.7 Huawei Technologies Co. Ltd.

- 6.4.8 NuRAN Wireless Inc.

- 6.4.9 Keysight Technologies

- 6.4.10 Vecima Networks Inc.

- 6.4.11 Northrop Grumman Corp.

- 6.4.12 Ericsson AB

- 6.4.13 Nokia Corp.

- 6.4.14 Qorvo Inc.

- 6.4.15 Analog Devices Inc.

- 6.4.16 National Instruments Corp.

- 6.4.17 Curtis-Wright Corp.

- 6.4.18 Viasat Inc.

- 6.4.19 Cobham Ltd.

- 6.4.20 Elbit Systems Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment