|

市場調查報告書

商品編碼

1851148

墊片和密封件:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Gaskets And Seals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

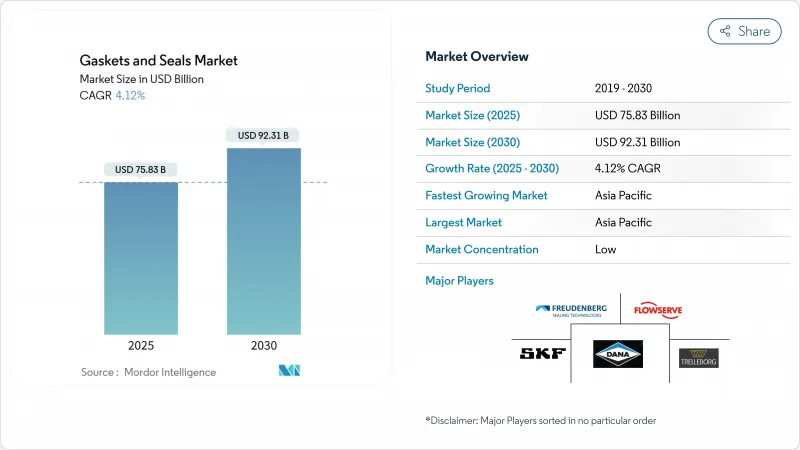

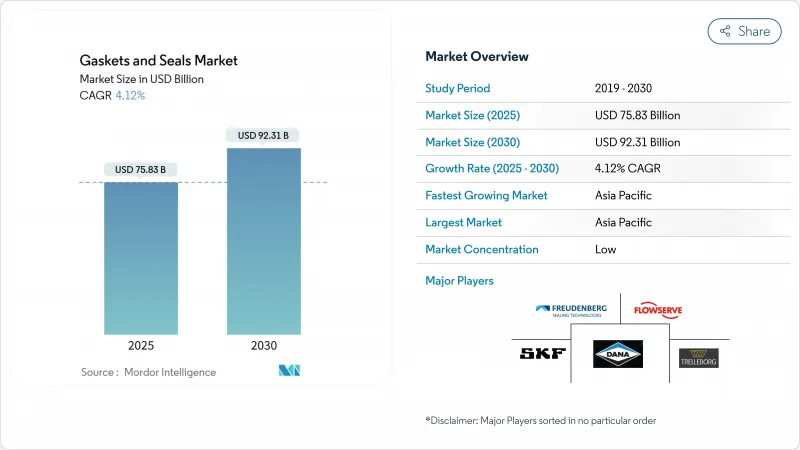

據估計,到 2025 年,墊圈和密封件市場規模將達到 758.3 億美元,預計到 2030 年將達到 923.1 億美元,預測期(2025-2030 年)的複合年成長率為 4.12%。

來自石油天然氣、化學、汽車電氣化和工業自動化領域的強勁需求預計將繼續推動穩定成長。材料的快速創新,尤其是在生物基彈性體和不含 PFAS 的化合物領域,正在消除曾經限制永續選擇的性能權衡。數位化監控將靜態部件轉換為資料點,從而實現預測性維護服務,減少計劃外停機時間並創造新的收入來源。製造商正透過潤滑管理和服務合約採購來確保長期的售後價值。氟橡膠原料供應鏈的壓力正在推動雙重籌資策略和對替代化學材料的加速探索,從而降低價格衝擊的風險。

全球墊片及密封件市場趨勢及洞察

石油和天然氣產業對墊片和密封件的需求日益成長

非常規蘊藏量的探勘和日益嚴格的安全法規迫使營運商採用能夠承受極端壓力和腐蝕性介質的先進密封解決方案。由於其優異的耐化學腐蝕性,丁腈橡膠和氟化橡膠O型環現已成為防噴器和油井的標準配置。防止洩漏的機械軸封排放減少產品損失和溫室氣體排放,同時確保符合相關法規。 Pipetec公司的DeltaV-Seal等專用產品可為法蘭連接提供長達10年的緻密氣質保。液化天然氣出口終端的應用最為廣泛,因為這些終端的停機成本正在迅速成長。對中東和北美中游資產的資本投資已將中東市場與能源基礎設施的成長緊密聯繫在一起。

化工和石化行業的需求不斷成長

製程複雜性的提高和化學產品系列的不斷擴展,使得密封件需要應對更苛刻的溶劑、氧化劑和酸,因此對材料的兼容性提出了更高的要求。軟性石墨密封件目前能夠在高溫反應器中承受高達 5400°F 的高溫。製造商正在針對會腐蝕傳統化合物的綠色化學原料,並客製化全氟橡膠混合物。亞洲已宣布的總額達 870 億美元的新增石化產能投資表明,一旦這些工廠投入運作,將需要大量的靜態和動態密封。整合供應商正在將工程密封組件與預測性監控模組捆綁銷售,從而鎖定未來的售後市場合約。隨著化學企業向脫碳轉型,這些舉措將支撐墊片和密封件市場的發展。

定期保養和潤滑

工業機械操作人員力求延長運轉時間,但密封件仍需依賴適當的潤滑來避免過早磨損。潤滑不足導致的軸承故障仍然是停機的主要原因。 SKF 透過收購 John Sample Group 的潤滑和流體管理業務來彌補這一缺口,並提供整合潤滑方案。雖然自潤滑設計已經存在,但其高昂的初始成本限制了其在高價值機械以外的應用。小型加工廠往往會延遲預防性維護,使操作人員面臨密封件突然洩漏的風險。這種對定期維護的需求阻礙了免維護解決方案的快速推廣,並最終導致終端用戶營業成本的增加。

細分市場分析

到2024年,密封件銷售額將佔總銷售額的67%,預計到2030年將以5.3%的複合年成長率成長,這主要得益於旋轉機械的升級和電動車平台的擴張。由於波動性較大的能源和化學市場對可靠性的要求不斷提高,泵浦和壓縮機的軸封將迎來強勁的銷售成長。透過溫度測量推斷摩擦力的軟感測器技術無需拆卸即可提供即時訊息,從而降低維護成本並增強用戶信心。

墊片對於靜態連接仍然至關重要,創新重點在於能夠承受氫氣管道熱循環的全金屬設計。一體式 DeltaV 密封件無需安裝後保持扭矩,簡化了試運行操作。雖然該細分市場的絕對收入相對較低,但隨著營運商使用高級產品維修老舊設備,不斷上漲的單位成本推動了墊片和密封件市場價值的成長。設備製造商在報價時擴大指定墊片密封套件,以確保交叉相容性並最大限度地減少重新訂購的複雜性。

到2024年,金屬將佔墊片和密封件市場規模的35%。不銹鋼螺旋纏繞墊片和Inconel彈簧密封件仍是重型應用的首選。然而,橡膠化合物預計將成為成長最快的材料,預計複合年成長率將達到6.3%。 TFE在超低摩擦閥門領域保持著戰略優勢,而對PFAS的審查正在推動對改性PEKK和PEEK混合物的並行測試。結合金屬載體和彈性體覆層的混合材料解決方案預計將在預測期內獲得更大的市場佔有率,以平衡剛度和回彈性,從而應對不同的熱膨脹係數。

製造商正根據材料來源對產品線進行細分,為買家提供透明的選擇,以滿足其內部永續性目標。大型買家,尤其是在歐洲,正將生命週期分析閾值納入競標,更傾向於能夠檢驗生物基成分的供應商。這些動態促進了墊圈和密封件市場的差異化,形成了獎勵生物來源減排成果的價格區間。

區域分析

亞太地區將在2024年佔據墊片和密封件市場的主導地位,收入佔有率將達到47%,並預計到2030年將以6.2%的複合年成長率成長。中國、印度和東南亞的工業化計畫將推動大量旋轉設備的生產,而這些設備依賴軸封和墊片組件。在印度,政府對石化設施的激勵措施正在刺激新的需求,該地區的供應商正在調整其產品組合,以符合嚴格的在地採購要求。

美國深水探勘和北美頁岩氣加工需要堅固耐用的密封材料來防止井噴,這推高了平均售價。感知響應密封件的應用範圍已擴展到食品加工和紙漿造紙廠,證明了數位化維護平台的商業性價值。墨西哥蓬勃發展的汽車工業正在大量吸收模壓密封件,這在一定程度上得益於強制執行區域含量標準的貿易協定。

歐洲是一個成熟但又主導創新的市場,汽車製造商正在大力推進耐火電池模組墊片的研發,而公路設備製造商則在監管期限之前轉向使用不含 PFAS 的液壓密封件。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 石油和天然氣產業對墊片和密封件的需求日益成長

- 來自化工和石化行業的需求不斷成長

- 汽車產業需求增加

- 工業自動化的興起

- 航太和國防投資激增

- 市場限制

- 定期保養和潤滑

- 氟橡膠原料(HF 和 F-烯烴)價格波動

- 嚴格的品質標準

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品

- 墊片

- 金屬墊片

- 橡膠墊圈

- 軟木墊圈

- 不含石棉的墊片

- 螺旋纏繞墊片

- 其他墊片(半金屬墊片)

- 海豹

- 軸封

- 模製密封件

- 汽車車體密封件

- 其他密封件(前叉密封件、活塞密封件)

- 墊片

- 材料

- 纖維

- 石墨和軟石墨

- PTFE

- 橡皮

- 其他

- 按銷售管道

- OEM

- 售後市場/MRO

- 透過使用

- 航太/國防

- 汽車OEM廠商

- 電子學

- 石油和天然氣

- 發電業務

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AMG Sealing

- BRUSS

- Cooper Standard

- Dana Limited

- Datwyler Holding Inc.

- Dechengwang

- ElringKlinger AG

- Enpro Inc.(Garlock)

- Flowserve Corporation

- Freudenberg Sealing Technologies

- IGP

- James Walker Group

- KLINGER Holding

- NICHIAS Corporation

- PARKER HANNIFIN CORP

- Phelps

- SKF

- Smiths Group plc(John Crane)

- Tenneco Inc.

- Trelleborg AB

第7章 市場機會與未來展望

The Gaskets And Seals Market size is estimated at USD 75.83 billion in 2025, and is expected to reach USD 92.31 billion by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

Robust demand from oil and gas, chemical processing, automotive electrification, and industrial automation will continue reinforcing steady expansion. Rapid material innovation, particularly in bio-based elastomers and PFAS-free compounds, removes performance trade-offs that once limited sustainable options. Digital monitoring transforms static components into data points, enabling predictive maintenance services that cut unplanned downtime and create new revenue streams. Manufacturers are responding with acquisitions in lubrication management and service agreements that lock in long-term aftermarket value. Supply chain pressures surrounding fluoro-rubber feedstocks are prompting dual-sourcing strategies and accelerated research into alternative chemistries, reducing vulnerability to price shocks.

Global Gaskets And Seals Market Trends and Insights

Increase in the Use of Gaskets and Seals in the Oil and Gas Industry

The exploration of unconventional reserves and tighter safety rules is pushing operators to specify advanced sealing solutions that survive extreme pressures and aggressive media. Nitrile and Viton O-rings are now standard in blowout preventers and wellheads due to their strong chemical resistance. Mechanical seals that prevent fugitive emissions support regulatory compliance while reducing lost product and greenhouse-gas releases. Purpose-built products such as Pipeotech's DeltaV-Seal provide a 10-year gas-tight warranty for flange connections. Adoption is strongest in liquefied natural gas export terminals, where downtime costs escalate rapidly. Capital spending on midstream assets across the Middle East and North America keeps the gaskets and seals market firmly linked to energy infrastructure growth.

Growing Demand from the Chemical and Petrochemical Sectors

Process intensification and wider chemical portfolios expose sealing materials to harsher solvents, oxidizers, and acids, requiring greater material compatibility. Flexible graphite seals now support temperatures up to 5,400°F in high-temperature reactors. Manufacturers are tailoring perfluoroelastomer blends for green-chemistry feedstocks that attack legacy compounds. Investment announcements totaling USD 87 billion for new Asian petrochemical capacity indicate large volumes of static and dynamic seals will be needed once plants come online. Integrated suppliers bundle engineered sealing sets with predictive monitoring modules, locking in future aftermarket contracts. Together, these moves sustain the gaskets and seals market even as chemical companies decarbonize.

Regular Maintenance and Lubrication

Industrial operators strive to extend runtimes, yet seals still rely on correct lubrication to avoid premature wear. Bearing failures linked to lubricant starvation remain a top cause of downtime. SKF addressed this gap by acquiring John Sample Group's lubrication and flow-management businesses to deliver integrated lubrication programs. Although self-lubricating designs exist, higher upfront costs limit widespread adoption outside high-value machinery. Smaller processing plants often delay preventive maintenance, exposing operators to sudden seal leaks. This need for routine service restrains rapid scaling of maintenance-free solutions and adds operating cost for end-users.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand from the Automotive Industry

- Surge in Aerospace and Defense Investments

- Volatility in Fluoro-Rubber Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Seals held 67% of 2024 revenue and are projected to post a 5.3% CAGR through 2030 as rotating machinery upgrades and electric-vehicle platforms expand. Shaft seals for pumps and compressors see strong unit growth because reliability requirements tighten in volatile energy and chemical markets. Soft-sensor technology that infers friction power from temperature readings offers real-time insight without disassembly, lowering service costs and boosting user confidence.

Gaskets remain integral to static joints, and innovation is focused on all-metal designs that withstand thermal cycling in hydrogen pipelines. One-piece DeltaV-Seal units eliminate the need for torque retention after installation, simplifying commissioning tasks. Although this sub-segment trails in absolute revenue, higher unit pricing lifts gaskets and seals market value whenever operators retrofit older assets with premium products. Equipment builders increasingly specify gasket-seal kits during quoting, ensuring cross-compatibility and minimizing reorder complexity.

Metals contributed a 35% share of the gaskets and seals market size in 2024. Stainless steel spiral-wound gaskets and Inconel spring-energized seals remain default choices for severe service. However, rubber compounds show the fastest momentum with a 6.3% CAGR forecast. TFE maintains a strategic niche for ultra-low friction valves, but PFAS scrutiny drives parallel testing of modified PEKK and PEEK blends. Over the forecast window, mixed-material solutions that pair metal carriers with elastomer overlays are expected to gain share, balancing rigidity and elasticity for differential thermal expansion.

Manufacturers segment product lines by material origin, granting buyers transparent options to meet internal sustainability targets. Large buyers, especially in Europe, embed life-cycle analysis thresholds into tenders, which favors suppliers able to validate bio-attributed content. These dynamics increase differentiation inside the gaskets and seals market and create pricing corridors that reward documented carbon savings.

The Gaskets and Seals Market Report Segments the Industry by Product (Gaskets and Seals), Material (Fiber, Graphite and Flexible Graphite, and More), Sales Channel (OEM and After-market/MRO), Application (Aerospace and Defense, Automotive OEM, Electronics, Oil and Gas, Power Generation, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific dominated the gaskets and seals market with a 47% revenue share in 2024 and is tracking 6.2% CAGR to 2030. Industrialization programs in China, India, and Southeast Asia underpin large volumes of rotating equipment that rely on shaft seals and gasket sets. Government incentives in India for petrochemical capacity spur fresh demand, and regional suppliers align portfolios with strict local content rules.

The United States' deepwater exploration and shale processing in North America need robust gasket materials to prevent blowouts, raising average selling prices. Adoption of Perceptiv-enabled seals spreads across food processing and pulp and paper mills, proving the commercial value of digital maintenance platforms. Mexico's expanding automotive clusters absorb high-volume molded seals, aided by trade agreements that tighten regional content thresholds.

Europe presents a mature yet innovation-driven landscape. Automakers push fire-resistant battery-module gaskets while off-highway equipment producers convert to PFAS-free hydraulic seals ahead of regulatory deadlines.

- AMG Sealing

- BRUSS

- Cooper Standard

- Dana Limited

- Datwyler Holding Inc.

- Dechengwang

- ElringKlinger AG

- Enpro Inc. (Garlock)

- Flowserve Corporation

- Freudenberg Sealing Technologies

- IGP

- James Walker Group

- KLINGER Holding

- NICHIAS Corporation

- PARKER HANNIFIN CORP

- Phelps

- SKF

- Smiths Group plc (John Crane)

- Tenneco Inc.

- Trelleborg AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in the Use of Gaskets and Seals in the Oil and Gas Industry

- 4.2.2 Growing Demand from the Chemical and Petrochemical Sectors

- 4.2.3 Increasing Demand from the Automotive Industry

- 4.2.4 Rise in Industrial Automation

- 4.2.5 Surge in Aerospace and Defense Investments

- 4.3 Market Restraints

- 4.3.1 Regular Maintenance and Lubrication

- 4.3.2 Volatility in Fluoro-Rubber Feedstock (HF and F-Alkenes) Prices

- 4.3.3 Stringent Quality Standards

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Gaskets

- 5.1.1.1 Metallic Gasket

- 5.1.1.2 Rubber Gasket

- 5.1.1.3 Cork Gasket

- 5.1.1.4 Non-asbestos Gasket

- 5.1.1.5 Spiral Wound Gasket

- 5.1.1.6 Other Gaskets (Semi-Metallic Gasket)

- 5.1.2 Seals

- 5.1.2.1 Shaft Seals

- 5.1.2.2 Molded Seals

- 5.1.2.3 Motor Vehicle Body Seals

- 5.1.2.4 Other Seals (Fork Seal and Piston Seal)

- 5.1.1 Gaskets

- 5.2 By Material

- 5.2.1 Fiber

- 5.2.2 Graphite and Flexible Graphite

- 5.2.3 PTFE

- 5.2.4 Rubbers

- 5.2.5 Others

- 5.3 By Sales Channel

- 5.3.1 OEM

- 5.3.2 After-market / MRO

- 5.4 By Application

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive OEM

- 5.4.3 Electronics

- 5.4.4 Oil and Gas

- 5.4.5 Power Generation

- 5.4.6 Others

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AMG Sealing

- 6.4.2 BRUSS

- 6.4.3 Cooper Standard

- 6.4.4 Dana Limited

- 6.4.5 Datwyler Holding Inc.

- 6.4.6 Dechengwang

- 6.4.7 ElringKlinger AG

- 6.4.8 Enpro Inc. (Garlock)

- 6.4.9 Flowserve Corporation

- 6.4.10 Freudenberg Sealing Technologies

- 6.4.11 IGP

- 6.4.12 James Walker Group

- 6.4.13 KLINGER Holding

- 6.4.14 NICHIAS Corporation

- 6.4.15 PARKER HANNIFIN CORP

- 6.4.16 Phelps

- 6.4.17 SKF

- 6.4.18 Smiths Group plc (John Crane)

- 6.4.19 Tenneco Inc.

- 6.4.20 Trelleborg AB

7 Market Opportunities and Future Outlook

- 7.1 Government is Increasing Investments to Enhance Domestic Manufacturing Capabilities

- 7.2 White-space and Unmet-need Assessment