|

市場調查報告書

商品編碼

1851146

無塵室照明:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Cleanroom Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

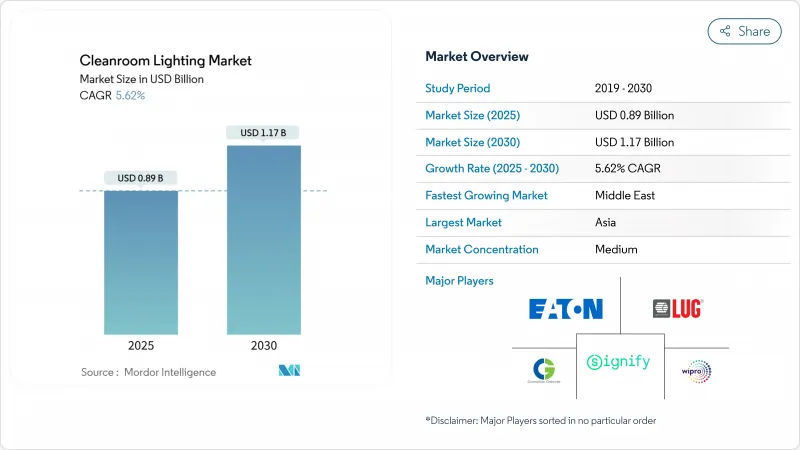

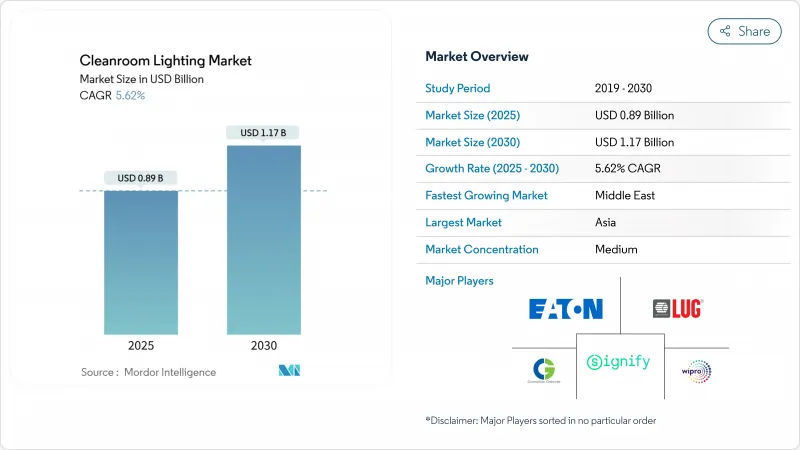

預計無塵室照明市場規模將在 2025 年達到 8.9 億美元,在 2030 年達到 11.7 億美元,年複合成長率為 5.62%。

半導體製造廠、生物製藥車間和先進實驗室日益嚴格的污染控制要求支撐了當前的市場需求,而歐盟生態設計法規和北美螢光禁令推動的LED維修則進一步鞏固了未來五年的市場前景。儘管半導體製造商仍然是最大的買家,生技藥品和細胞治療營運商正在縮小與半導體製造商的差距,因為他們正在為精細的細胞培養採用無閃爍、密封的燈具。整合UV-C的LED燈具在醫院和製藥隔離器的應用也日益普及,這反映了後疫情時代感染控制的重要性。在供應方面,成熟照明品牌之間的垂直整合有助於抵消原料的波動性和認證成本,同時,一些專注於危險場所和遠UV-C領域的專業公司也正在出現。

全球無塵室照明市場趨勢與洞察

歐洲製藥廠面臨越來越大的GMP和ISO 14644合規壓力

歐盟GMP附件1修訂後的要求,收緊了無菌製藥生產實驗室的顆粒物排放法規,迫使操作人員用IP65防護等級的LED面板燈取代傳統的螢光,以最大限度地減少顆粒物脫落並能耐受強效消毒劑。契約製造、疫苗生產商和新興基因治療公司都在經歷設備更新換代,以確保在歐盟市場進入。

東亞地區300毫米晶圓廠擴建需要ISO 1級照明燈具

台灣、日本和中國當地對極紫外光微影術線的創紀錄投資,推動了對配備超低損耗光刻(ULPA)濾光片、可在ISO 1級環境下運行的EUV兼容燈具的需求。南亞耗資96億美元的雙層工廠便是此類計劃的典型代表,其照明方案在早期就已確定,以滿足嚴格的頻譜和天花板標準。

鋁和聚碳酸酯價格波動

低揮發性鋁合金和無塵室級聚碳酸酯等大宗商品價格的快速波動推高了材料成本,並給固定價格計劃合約帶來了壓力。供應商數量有限加劇了成本敏感性,迫使垂直整合的照明品牌提前採購原料並重新設計外殼。

細分市場分析

到2024年,LED將佔總收入的80.4%,顯著超越螢光和無電極LED技術。目前規模較小的紫外線(UV)細分市場預計將成長8.7%,這主要得益於遠紫外線(遠UVC)和殺菌LED將照明和消毒功能相結合。能源效率需求、即時調光功能和卓越的色彩穩定性都促使LED成為市場首選,而智慧感測器封裝則為ISO級空間中的預測性維護提供了可能。

第二代LED燈具在密封的石英窗口後方整合了222nm波長的發送器,無需通風即永續消毒。這種雙重功能既提高了燈具的平均售價,也減少了天花板龍骨的擁擠程度。由於歐盟生態設計禁令將於2025年生效,螢光正逐步被淘汰,僅用於改裝設備。隨著高階UV-C產品的普及,預計到2030年,基於LED的無塵室照明市場規模將超過10億美元。

到2024年,面板式和儲油式照明燈具將佔總銷售額的45.1%,其中嵌入式安裝方式更受歡迎,因為它可以最大限度地減少層架和顆粒物滯留。採用快速拆卸齒輪托盤的模組化面板系統可以縮短檢驗週期並簡化墊圈更換,從而滿足精益設施管理的目標。

目前,危險場所照明燈具的市佔率僅佔個位數,但正以6.5%的複合年成長率快速成長。製藥溶劑室和鋰電池生產線均指定使用符合ATEX、IECEx和NEC認證的1區/1類LED燈具。認證產品的供應緊張推高了現有供應商的利潤率,同時也提升了提供防爆燈具的供應商在無塵室照明市場的佔有率。

區域分析

亞太地區仍將是最大的市場,預計到2024年將佔全球收入的27.8%,這主要得益於台灣、日本、韓國和中國沿海地區半導體產業的集中。台積電在熊本的合資項目以及南亞新北市的巨型晶圓廠等計劃,確保了未來多年的照明封裝產品供應。太陽能製造商也將ISO 7電池標準應用於異質結太陽能組件,擴大了對可再生能源供應鏈的需求。印度正在崛起為一個分散且價格敏感的細分市場,與當地原始設備製造商(OEM)的合作有望加速該技術的普及。

到2030年,中東地區將以6.7%的複合年成長率引領成長,這主要得益於醫療私有化和疫苗自給自足計劃推動了大型醫院和製藥企業的蓬勃發展。利雅德和阿布達比部署遠紫外線消毒設備,印證了該地區有能力為高階感染控制解決方案提供資金。沙烏地阿拉伯一家生物製藥廠的溶劑處理相關危險場所訂單進一步提振了該地區的收入,但認證產品的短缺可能會延誤計劃進度。

北美受益於強勁的生技藥品研發管線以及《晶片與科學法案》推動的晶圓廠建設復甦。FUJIFILM在北卡羅來納州的擴建項目體現了新建生物製造園區對高規格照明的需求。合格電工的短缺構成短期瓶頸,但模組化面板系統安裝時間僅為傳統安裝方式的一半,有效緩解了工期風險。受生態設計法規的推動,歐洲掀起了一波改裝,該法規規定將於2025年逐步淘汰T8螢光。即便宏觀經濟的不確定性抑制了待開發區案的支出,這些改造項目仍能帶來穩定的收入。北歐國家、德國和法國在合規方面仍處於領先地位,要求ISO和GMP可追溯性,並優先考慮已獲得認證的成熟擁有者。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲製藥公司面臨越來越大的壓力,需要遵守GMP和ISO 14644標準。

- 東亞地區300毫米半導體工廠擴建需要ISO 1級照明燈具

- 北美生技藥品和細胞治療設施的成長對無閃爍密封LED的需求日益成長

- 波灣合作理事會成員國醫院中用於感染控制的UV-C整合照明裝置的普及情況

- 歐盟生態設計-2023和強制改裝加速了以LED燈具取代傳統螢光具的進程。

- 南美洲一條高速食品飲料包裝生產線需要IP65+防碎照明設備。

- 市場限制

- 鋁和聚碳酸酯價格波動影響照明燈具物料清單

- ATEX/IECEx認證照明設備短缺導致中東製藥計劃延誤

- ISO 3級環境下高流明LED的溫度控管極限

- 非洲封閉式電網照明燈具熟練安裝人員短缺

- 生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測數據

- 透過光源

- LED

- 螢光

- 就職

- 紫外線

- 按固定裝置設計/外形規格

- 控制板

- 環繞式/條狀

- 下照燈

- 危險場所設備

- 按安裝類型

- 凹

- 表面

- 吊墜/吊掛

- 按最終用戶行業分類

- 半導體和電子學

- 醫療保健和生命科學

- 食品和飲料加工

- 研究和學術實驗室

- 航太/國防

- 汽車塗料和電池製造

- 其他行業

- 按銷售管道

- 直接 OEM

- 系統整合商

- 經銷商

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 其他南美洲

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Signify Holding

- Cooper Lighting Solutions

- Wipro Lighting

- Eaton Lighting

- LUG Light Factory

- Terra Universal

- Solite Europe

- Paramount Industries

- Kenall Manufacturing

- AB Fagerhult

- Waldmann Lighting

- Glamox AS

- Hubbell Lighting

- Cree Lighting

- Philips Cleanroom Lighting

- HE Williams Inc.

- Clean Air Lighting LLC

- Admiral Lighting

- Boyd Cleanroom Lighting

- Hefei Kejia Purification

- Shenzhen Sansi Lighting

- Beghelli SpA

第7章 市場機會與未來展望

The cleanroom lighting market size stood at USD 0.89 billion in 2025 and is forecast to reach USD 1.17 billion by 2030, advancing at a 5.62% CAGR.

Heightened contamination-control requirements in semiconductor fabs, biopharmaceutical suites, and advanced research labs anchor current demand, while aggressive LED retrofits driven by EU EcoDesign rules and North American fluorescent bans reinforce the five-year outlook. Semiconductor manufacturers remain the single largest buyers, yet biologics and cell-therapy operators are closing the gap as they standardize flicker-free, sealed luminaires for sensitive cell cultures. Uptake of UV-C-integrated LED fixtures is gaining momentum in hospitals and pharmaceutical isolators, reflecting post-pandemic infection-control priorities. On the supply side, vertical integration among established lighting brands is helping offset raw-material volatility and certification costs, whereas niche specialists are finding headroom in hazardous-location and Far-UVC segments.

Global Cleanroom Lighting Market Trends and Insights

Increasing GMP and ISO 14644 compliance pressure on European pharma plants

Revised EU GMP Annex 1 requirements tighten particulate limits across sterile drug-manufacturing suites, forcing operators to swap legacy fluorescents for sealed IP65 LED panels that minimize shedding and withstand aggressive sanitizing agents. Contract manufacturers, vaccine producers, and emerging gene-therapy firms are all advancing replacement cycles to safeguard market access in the European Union.

300 mm fab expansion in East Asia needing ISO Class 1 luminaires

Record capital outlays for extreme-ultraviolet lithography lines in Taiwan, Japan, and mainland China are driving demand for ULPA-filtered, EUV-compatible luminaires able to operate in ISO Class 1 environments. Nanya Technology's USD 9.6 billion double-deck fab typifies these projects, with lighting packages specified early to meet rigorous spectral and sealing criteria.

Volatile aluminum & polycarbonate pricing

Rapid swings in commodity prices for low-outgassing aluminum alloys and cleanroom-grade polycarbonates inflate bills of material and strain fixed-price project contracts. Limited supplier pools amplify cost sensitivity, compelling vertically integrated lighting brands to forward-buy raw materials or redesign housings.

Other drivers and restraints analyzed in the detailed report include:

- Biologics and cell-therapy build-out in North America

- UV-C-integrated hospital fixtures in Gulf Cooperation Council states

- Scarcity of ATEX/IECEx-certified lights

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LEDs anchored 80.4% of 2024 revenue within the cleanroom lighting market, far outstripping fluorescent and induction technologies. UV sub-segments, although modest today, are growing at an 8.7% clip as Far-UVC and germicidal LEDs merge illumination and disinfection. Energy-efficiency mandates, instant-dimming capability, and superior color stability underpin LED preference, with smart-sensor packages enabling predictive maintenance for ISO-classified spaces.

Second-generation LEDs integrate 222 nm emitters behind sealed quartz windows, allowing continuous sterilization without room evacuation. This dual-functionality increases fixture ASPs while shrinking ceiling-grid congestion. Fluorescents, constrained by EU EcoDesign bans taking force in 2025, are relegated to retrofit niches set for phased retirement. As premium UV-C products scale, the cleanroom lighting market size for LED-based solutions is forecast to exceed USD 1 billion by 2030.

Panel and troffer luminaires represented 45.1% of 2024 revenue, favored for flush mounting that minimizes ledges and particle traps. Modular panel systems with quick-disconnect gear trays shorten validation cycles and simplify gasket replacement, aligning with lean facility-management goals.

Hazardous-location fixtures, though only a mid-single-digit share today, are advancing at 6.5% CAGR. Pharmaceutical solvent suites and lithium-battery lines specify Zone 1/Division 1 LEDs certified under ATEX, IECEx, or NEC. Supply tightness in certified products raises margins for incumbents, boosting the cleanroom lighting market share of vendors offering explosion-proof lines.

The Clean Room Lighting Market Report is Segmented by Light Source (LED, Fluorescent, and More), Fixture Design/Form Factor (Panel/Troffer, Wrap-around/Strip, and More), Mounting Type (Recessed, Surface, and Pendant/Suspended), End-User Industry (Semiconductor and Electronics, Healthcare and Life Sciences, and More), Sales Channel (Direct OEM, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific remained the largest territory, holding 27.8% of 2024 revenue thanks to dense semiconductor clustering in Taiwan, Japan, Korea, and coastal China. Projects such as TSMC's Kumamoto joint venture and Nanya's New Taipei City megafab secure multi-year lighting-package pipelines. Photovoltaic manufacturers are also standardizing ISO 7 cells for heterojunction solar modules, extending addressable demand into renewable-energy supply chains. India is emerging as a fragmented, price-sensitive sub-market where local OEM alliances can accelerate penetration.

The Middle East leads growth at 6.7% CAGR through 2030 as healthcare privatization and vaccine self-sufficiency programs drive large hospital and pharma complexes. Far-UVC deployments in Riyadh and Abu Dhabi underscore the region's readiness to fund premium infection-control solutions. Hazardous-location orders tied to solvent handling in Saudi biopharma plants further buoy regional revenue, though scarcity of certified products can delay project milestones.

North America benefits from a robust biologics pipeline and resurgent wafer-fab construction under the CHIPS and Science Act. Fujifilm's North Carolina expansion exemplifies high-spec lighting demand in new biomanufacturing campuses. Labor shortages among certified electricians present a short-term bottleneck, yet modular panel systems that install in half the time of legacy housings mitigate schedule risk. Europe's retrofit wave, catalyzed by EcoDesign rules that shutter T8 fluorescents in 2025, provides steady replacement revenue even as macro uncertainty tempers greenfield spending. Nordic countries, Germany, and France remain compliance leaders, requiring ISO and GMP traceability that favors established certificate holders.

- Signify Holding

- Cooper Lighting Solutions

- Wipro Lighting

- Eaton Lighting

- LUG Light Factory

- Terra Universal

- Solite Europe

- Paramount Industries

- Kenall Manufacturing

- AB Fagerhult

- Waldmann Lighting

- Glamox AS

- Hubbell Lighting

- Cree Lighting

- Philips Cleanroom Lighting

- H.E. Williams Inc.

- Clean Air Lighting LLC

- Admiral Lighting

- Boyd Cleanroom Lighting

- Hefei Kejia Purification

- Shenzhen Sansi Lighting

- Beghelli S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing GMP and ISO 14644 compliance pressure on European pharma manufacturers

- 4.2.2 Expansion of 300 mm semiconductor fabs in East Asia requiring ISO Class 1 luminaires

- 4.2.3 Growth of biologics and cell-therapy facilities in North America demanding flicker-free sealed LEDs

- 4.2.4 Uptake of UV-C-integrated luminaires for infection control in Gulf Cooperation Council Countries hospitals

- 4.2.5 EU EcoDesign-2023 retrofit mandates accelerating LED replacement of legacy fluorescent fixtures

- 4.2.6 High-speed F&B packaging lines in South America needing IP65+ shatter-proof lighting

- 4.3 Market Restraints

- 4.3.1 Volatile aluminium and polycarbonate prices inflating fixture BOMs

- 4.3.2 Scarcity of ATEX/IECEx-certified lights delaying Middle-East pharma projects

- 4.3.3 Thermal-management limits of high-lumen LEDs in ISO Class 3 environments

- 4.3.4 Shortage of skilled installers for sealed grid luminaires in Africa

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Light Source

- 5.1.1 LED

- 5.1.2 Fluorescent

- 5.1.3 Induction

- 5.1.4 UV

- 5.2 By Fixture Design/Form Factor

- 5.2.1 Panel/Troffer

- 5.2.2 Wrap-around/Strip

- 5.2.3 Downlights

- 5.2.4 Hazardous-Location Fixtures

- 5.3 By Mounting Type

- 5.3.1 Recessed

- 5.3.2 Surface

- 5.3.3 Pendant/Suspended

- 5.4 By End-User Industry

- 5.4.1 Semiconductor and Electronics

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Food and Beverage Processing

- 5.4.4 Research and Academic Laboratories

- 5.4.5 Aerospace and Defense

- 5.4.6 Automotive Paint and Battery Manufacturing

- 5.4.7 Other Industries

- 5.5 By Sales Channel

- 5.5.1 Direct OEM

- 5.5.2 System Integrators

- 5.5.3 Distributors

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify Holding

- 6.4.2 Cooper Lighting Solutions

- 6.4.3 Wipro Lighting

- 6.4.4 Eaton Lighting

- 6.4.5 LUG Light Factory

- 6.4.6 Terra Universal

- 6.4.7 Solite Europe

- 6.4.8 Paramount Industries

- 6.4.9 Kenall Manufacturing

- 6.4.10 AB Fagerhult

- 6.4.11 Waldmann Lighting

- 6.4.12 Glamox AS

- 6.4.13 Hubbell Lighting

- 6.4.14 Cree Lighting

- 6.4.15 Philips Cleanroom Lighting

- 6.4.16 H.E. Williams Inc.

- 6.4.17 Clean Air Lighting LLC

- 6.4.18 Admiral Lighting

- 6.4.19 Boyd Cleanroom Lighting

- 6.4.20 Hefei Kejia Purification

- 6.4.21 Shenzhen Sansi Lighting

- 6.4.22 Beghelli S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment