|

市場調查報告書

商品編碼

1851123

雷射清洗:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Laser Cleaning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

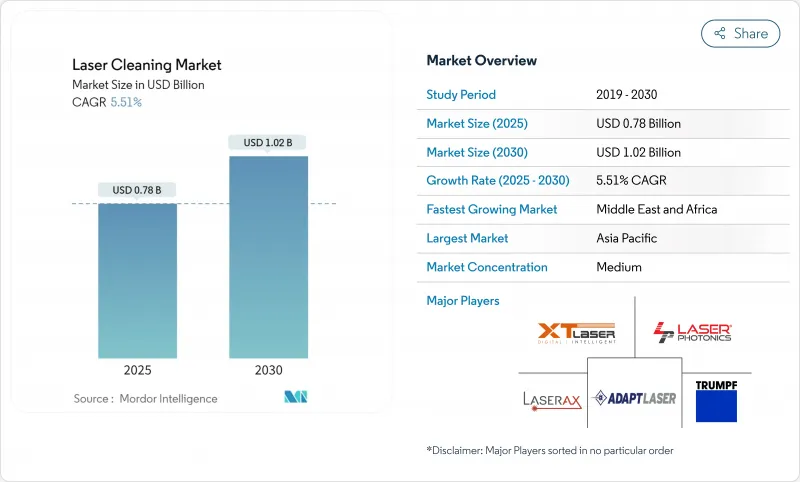

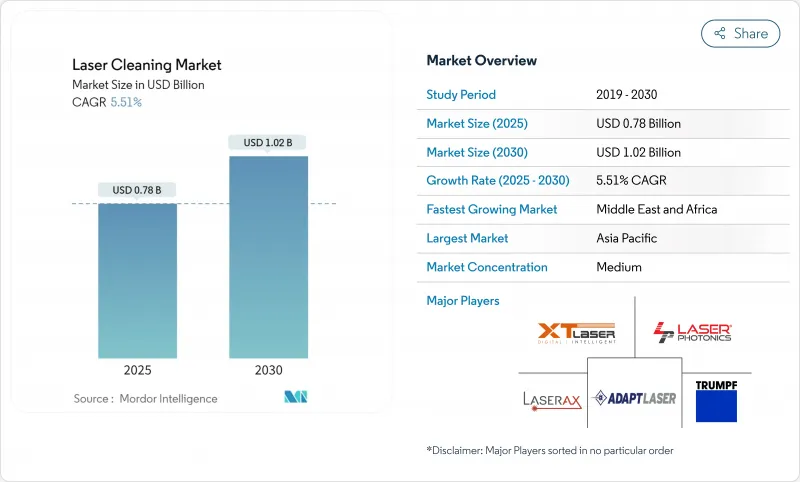

預計到 2025 年,雷射清洗市場規模將達到 7.8 億美元,到 2030 年將達到 10.2 億美元,複合年成長率為 5.51%。

北美和歐洲對化學溶劑的限制日益嚴格,亞洲光纖雷射的每瓦成本不斷下降,以及汽車、航太和半導體工廠對非接觸式表面處理的需求不斷成長,共同推動了該領域的發展。超快脈衝技術正在拓展其在微電子和文化遺產修復等領域的精密應用,而與機器人技術的快速融合正在重塑生產線。儘管隨著零件價格的下降,資本投資有所放緩,但高功率系統在發展中地區仍然價格昂貴。

全球雷射清洗市場趨勢與洞察

嚴格的環境法規取代了化學溶劑

美國環保署(EPA)關於高氯酸乙烯酯的法規將於2024年12月最終確定,屆時將禁止其大部分工業用途,從而加速從化學清洗到雷射清洗的轉變。類似的有害空氣污染物法規將於2025年1月實施,將加大合規壓力。雷射清洗解決方案不會產生二次廢棄物,從而降低了以往依賴溶劑的工廠的處置成本和報告義務。這種政策環境縮短了雷射清洗的投資回收期,直接促進了雷射清洗市場的成長。供應商正在調整其產品以符合政府支持低排放設備升級的補貼計畫。

非接觸式表面處理自動化需求日益成長

大型製造工廠正將光纖雷射與協作機器人結合,以減少工時並實現一致的表面品質。 IPG 光電於 2024 年 5 月推出的 LightWELD 機器人單元,展示了一種即插即用系統,只需輕觸螢幕即可在焊接和清洗之間切換。自動化也緩解了技術純熟勞工短缺的問題,使一名操作員能夠管理多個工位。這種效率的提升預計將推動機器人雷射工作單元實現 14.6% 的複合年成長率,顯著高於雷射清洗市場的整體成長速度。供應商正在整合視覺軟體和人工智慧技術,以自動調整參數,從而縮短操作員培訓時間並提高其應用普及率。

高昂的資本投資障礙阻礙了市場發展

功率超過1千瓦的高功率雷射售價可能高達30萬至50萬美元。如此高昂的價格令小型製造商的預算捉襟見肘,並減緩了印尼、巴西和肯亞等國的訂單。儘管二極體價格的下降導致擁有成本逐年降低,但資金籌措障礙仍然存在。租賃方案正在興起,但利率推高了總支出。各國政府提供的綠色設備稅額扣抵提高了設備的可負擔性,但在大型工業場所之外,其普及速度仍然緩慢。因此,儘管存在安全和環境方面的缺陷,許多新興經濟體的買家仍然依賴噴砂進行重型清潔,這阻礙了雷射清洗市場的滲透。

細分市場分析

到2024年,光纖光源將佔據雷射清洗市場58%的收入佔有率。這是因為其內部二極體耦合可提供40%的電能轉換效率,密封的光路可避免污染,且設備無需維護即可運作5萬小時。中國加工廠正在採購300W的設備用於模具維護,德國電動車工廠則正在安裝3kW的雷射頭用於車軸除垢。隨著二極體價格降至10美元/瓦以下,甚至越南的紡織機械翻新商也加入了客戶行列,這表明雷射清洗市場已在全球範圍內蓬勃發展。

超快脈衝雷射設備以6.6%的複合年成長率成長,利用冷燒蝕技術去除矽晶圓上20奈米的氧化層,而不會熔化基板。供應商正在出貨用於手錶機芯的50瓦飛秒雷射頭和用於高密度互連基板的100瓦皮秒鑽機,這凸顯了該技術已從學術界擴展到大規模生產領域。固體雷射和二氧化碳雷射仍然佔據著特定的應用領域。石材雕刻清洗使用波長較長的雷射,可以有效地與碳酸鹽基質結合;而塑膠加工則依賴於10.6微米的二氧化碳雷射,以避免加熱金屬基板。

到2024年,中功率(100W-1kW)的雷射清洗設備將佔據46%的市場佔有率,其去除率足以滿足汽車副車架的清洗需求,並且能夠連接標準的工廠電源。據一級供應商稱,500W手持式雷射槍去除氧化皮的速度比120目砂紙打磨快60%,而且無需使用耗材砂碟。這種高效的性能能夠促進重複訂單,並在資本預算緊張時增強市場韌性。

隨著造船廠和鐵路船廠尋求更快速的船體除垢方法,高功率(1kW以上)雷射清洗設備市場將以7.1%的複合年成長率成長。澳洲的Precision Laser Cleaning公司展示了每小時20平方公尺的防污塗層去除能力,從而縮短了船舶的乾船塢維修時間並節省了燃料。 Gold Mark公司的四合一3kW平台整合了焊接、清洗、切割和紋理處理功能,促使製造商用一台多功能設備取代多台機器。低功率(100W以下)設備則滿足珠寶商和檔案管理員去除亞微米級污染物的需求,在這些應用中,熱敏感性比循環時間更為重要。

區域分析

亞太地區佔2024年銷售額的41%,反映了中國、日本和韓國的電子產業群聚和汽車供應鏈的優勢。該地區各國政府正在推行高科技製造業獎勵,使企業更容易證明對雷射的資本支出是合理的。隨著二極體價格的下降,該地區的中小型企業正在擴大採用300W光纖雷射。三井物產的紅外線雷射除鏽系統等先導計畫凸顯了業界對更清潔船舶維護的需求。

歐洲在永續製造和文物保護領域持續保持強勁的成長動能。嚴格的溶劑禁令恰逢雷射清洗市場蓬勃發展。歐盟致力於實現淨零排放的工業政策,為工廠升級改造提供了資金籌措支持;同時,博物館也開始部署飛秒雷射設備,用於精細修復壁畫。德國弗勞恩霍夫雷射技術研究所(Fraunhofer ILT)透過其IDEEL計劃,正在展示卷軸式雷射乾燥技術,以輔助電池生產線中的電極清洗。

北美正充分利用其成熟的航太、國防和核能產業。津貼,雷射清洗技術能夠去除渦輪葉片上的氧化膜,並對核子反應爐容器進行消毒。墨西哥新萊昂州和瓜納華托州的汽車產業叢集正在投資300瓦手持式設備,以升級焊接夾具。中東和非洲地區以6.1%的複合年成長率領先,這主要得益於各國石油公司對防腐蝕技術的投資以及文物保護機構對考古遺址的修復。拉丁美洲的巴西汽車工廠和智利的礦業輸送帶發展勢頭強勁,但由於資金籌措有限,規模較小的經濟體採用該技術的速度較為緩慢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟和北美地區嚴格的環境法規正在取代化學溶劑。

- 汽車車體修理廠對自動化非接觸式表面處理的需求日益成長

- 歐洲和亞洲歷史建築修復計劃的成長

- 對需要遠程雷射去污的核能設施退役投資

- 電動車電池生產線需要無殘留電極清洗

- 光纖雷射每瓦成本的下降促使亞洲中小企業更多地採用該技術。

- 市場限制

- 開發中國家對高功率系統的大量資本投資

- 海上維護的現場便攜性有限

- 熱敏性材料基板有熱損傷風險

- 新興市場認證雷射清洗技術人員短缺

- 生態系分析

- 技術展望

- 超短脈衝(Ps/Fs)源的進展

- 協作機器人整合

- 監理展望

- 全球揮發性有機化合物與危險化學品指令

- OSHA 和 IEC 雷射安全標準

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(金額)

- 依雷射類型

- 光纖雷射

- 固體(Nd:YAG/Yb:YAG)雷射器

- 二氧化碳雷射

- 超短脈衝(皮秒/飛秒)雷射

- 按輸出範圍

- 高功率(超過1千瓦)

- 中等功率(100瓦-1千瓦)

- 低功率(小於100瓦)

- 可移植性

- 手持/可攜式系統

- 桌面/固定式系統

- 機器人/自動化堆疊單元

- 脈衝時間

- 共同波

- 奈秒脈衝

- 超短脈衝(Ps/Fs)

- 透過使用

- 油漆和塗層去除

- 除銹除氧化物

- 表面和焊接準備

- 黴菌清潔和黴菌維護

- 文化遺產與藝術修復

- 微電子、精密清洗

- 核能污染清除

- 按最終用戶行業分類

- 汽車和運輸設備

- 航太/國防

- 造船/海洋

- 基礎設施和建築

- 能源與電力

- 石油和天然氣

- 核能

- 可再生能源

- 電子和半導體

- 文化遺產

- 製造和工業機械

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 其他南美洲

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- TRUMPF Group

- IPG Photonics Corporation

- Clean-Lasersysteme GmbH

- Laser Photonics Corporation

- P-Laser NV

- Laserax Inc.

- Adapt Laser Systems LLC

- Jinan Xintian Technology Co. Ltd(XT Laser)

- HGLaser Engineering Co. Ltd

- Han's Laser Technology Industry Group Co. Ltd

- Coherent Corp.

- Scantech Laser Pvt. Ltd

- Anilox Roll Cleaning Systems

- Shenzhen Riselaser Technology Co. Ltd

- Sukjin Laser Co.

- Allied Scientific Pro

- CyCleanLaser GmbH

- PharosQuartz(Light Conversion)

- Suresh Industech Pvt. Ltd

- RMA Technik GmbH

- Jinan Vmade CNC Machine Co., Ltd

- Shanghai Mactron Technology Co. Ltd

- Lynton Lasers Ltd

第7章 市場機會與未來展望

The laser cleaning market size stands at USD 0.78 billion in 2025 and is forecast to reach USD 1.02 billion by 2030, reflecting a 5.51% CAGR.

Growth is propelled by strict limits on chemical solvents in Europe and North America, falling cost-per-watt of fiber lasers in Asia, and rising demand for contact-free surface preparation across automotive, aerospace, and semiconductor plants. Rapid integration with robotics is reshaping production lines, while ultrashort-pulse technology broadens precision applications in micro-electronics and cultural heritage restoration. Capital spending is easing as component prices decline, yet high-power systems remain cost-intensive in developing regions.

Global Laser Cleaning Market Trends and Insights

Stringent Environmental Regulations Replacing Chemical Solvents

EPA restrictions on perchloroethylene, finalized in December 2024, prohibit most industrial uses and accelerate the shift from chemical cleaning to lasers.Similar limits on hazardous air pollutants introduced in January 2025 add compliance pressure. Laser solutions generate no secondary waste, trimming disposal fees and reporting burdens for plants that once relied on solvents. The policy environment therefore shortens payback periods for laser installations and directly fuels laser cleaning market growth. Suppliers are aligning products with government rebate programs that support low-emission equipment upgrades.

Rising Automation Demand for Non-contact Surface Preparation

High-volume factories now pair fiber lasers with collaborative robots to cut labor time and achieve consistent surface quality. IPG Photonics' LightWELD robotic cell launched in May 2024 illustrates a plug-and-play system that toggles between welding and cleaning at the tap of a screen.Automotive body shops adopt similar cells for seam preparation before welding aluminum body panels. Automation also mitigates skilled-worker shortages, letting one operator supervise multiple stations. This efficiency edge underpins the 14.6% CAGR projected for robotic laser work cells-well above the overall laser cleaning market trajectory. Vendors are integrating vision software and AI to auto-adjust parameters, reducing operator training time and widening adoption.

High Capital Expenditure Barriers in Developing Markets

High-power lasers above 1 kW cost USD 300,000-500,000, a sum that strains small manufacturers' budgets and delays orders in Indonesia, Brazil, and Kenya usni.org. Although falling diode prices reduce ownership costs each year, financing hurdles remain. Leasing programs are emerging, yet interest rates elevate total outlay. Governments that offer green-equipment tax credits improve affordability, but uptake is slow outside large industrial hubs. As a result, many buyers in emerging economies continue to rely on abrasive blasting for heavy-duty cleaning despite safety and environmental drawbacks, moderating laser cleaning market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Restoration Projects of Historical Monuments

- EV Battery Production Lines Necessitating Residue-free Electrode Cleaning

- Field Deployment Challenges for Remote Applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber sources delivered 58% of 2024 revenue for the laser cleaning market because internal diode coupling yields 40% wall-plug efficiency and sealed optical paths avert contamination, letting units run 50,000 hours without realignment. Chinese job shops buy 300 W units for mold maintenance, while German EV factories deploy 3 kW heads for axle de-scaling, illustrating versatility across power classes. As diode prices dip below USD 10/W, even textile-machinery rebuilders in Vietnam join the customer roster, broadening global reach of the laser cleaning market.

Ultrashort-pulse machines, growing 6.6% CAGR, exploit cold-ablation to lift 20 nm oxides from silicon wafers without melting substrates.Vendors ship 50 W femtosecond heads for watch-movement restoration and 100 W picosecond rigs for high-density interconnect boards, highlighting expansion beyond academia into volume manufacturing. Solid-state and CO2 lasers maintain niche roles: stone sculpture cleaning makes use of longer wavelengths that couple efficiently into carbonate matrices, whereas plastics processors rely on 10.6 µm CO2 energy to avoid metal substrate heating.

Medium-power (100 W-1 kW) units controlled 46% of the 2024 laser cleaning market size, offering removal rates suitable for automotive subframes yet plugging into standard factory mains. Tier-1 suppliers report that 500 W handheld guns strip mill scale 60% faster than 120 grit sanding while eliminating consumable discs. This productivity sweet spot drives repeat orders and underpins market resilience when capital budgets tighten.

High-power segments above 1 kW grow 7.1% CAGR as shipyards and rail depots seek faster hull descaling. Precision Laser Cleaning in Australia demonstrates 20 m2/h removal of antifouling coatings, cutting dry-dock time and saving fuel on cleaned vessels.au. Gold Mark's 4-in-1 3 kW platform combines welding, cleaning, cutting, and texturing, persuading fabricators to replace multiple machines with a single multipurpose asset. Low-power (<100 W) devices cater to jewelers and archivists for sub-micron contaminant removal where heat sensitivity overrides cycle-time concerns.

The Laser Cleaning Market Report is Segmented by Laser Type (Fiber Lasers, Solid-State (Nd:YAG/Yb:YAG) Lasers, and More), Portability (Handheld/Portable Systems, and More), Pulse Duration (Continuous-Wave, and More), Application (Paint and Coating Removal, and More), Power Range (High, Medium, and Low), End-User Industry (Automotive and Transport, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated 2024 revenue with 41%, reflecting dense electronics clusters and automotive supply chains in China, Japan, and South Korea. Regional governments promote high-tech manufacturing incentives that make capital spending on lasers easier to justify. The region's small-to-medium enterprises increasingly embrace 300 W fiber tools as diode prices fall. Pilot projects such as Mitsui O.S.K. Lines' InfraLaser rust-removal system confirm industry appetite for cleaner ship maintenance.

Europe follows with strong adoption across sustainable manufacturing and heritage conservation. Strict solvent bans align with laser cleaning market momentum. The EU's focus on net-zero industry policies creates funding channels for plant upgrades, while museums deploy femtosecond units to delicately restore frescoes. Germany's Fraunhofer ILT, through the IDEEL project, demonstrates roll-to-roll laser drying that complements electrode cleaning in battery lines.

North America leverages mature aerospace, defense, and nuclear sectors. Laser cleaning removes oxide films from turbine blades and decontaminates reactor vessels, supported by Department of Energy R&D grants. Mexico's auto clusters in Nuevo Leon and Guanajuato invest in 300 W handheld gear to upgrade welding jigs. The Middle East & Africa leads growth at 6.1% CAGR as national oil companies invest in corrosion control and heritage authorities restore archaeological sites. Latin America grows steadily in Brazil's auto plants and Chile's mining conveyors, but limited financing slows penetration in smaller economies.

- TRUMPF Group

- IPG Photonics Corporation

- Clean-Lasersysteme GmbH

- Laser Photonics Corporation

- P-Laser NV

- Laserax Inc.

- Adapt Laser Systems LLC

- Jinan Xintian Technology Co. Ltd (XT Laser)

- HGLaser Engineering Co. Ltd

- Han's Laser Technology Industry Group Co. Ltd

- Coherent Corp.

- Scantech Laser Pvt. Ltd

- Anilox Roll Cleaning Systems

- Shenzhen Riselaser Technology Co. Ltd

- Sukjin Laser Co.

- Allied Scientific Pro

- CyCleanLaser GmbH

- PharosQuartz (Light Conversion)

- Suresh Industech Pvt. Ltd

- RMA Technik GmbH

- Jinan Vmade CNC Machine Co., Ltd

- Shanghai Mactron Technology Co. Ltd

- Lynton Lasers Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Environmental Regulations Replacing Chemical Solvents in EU and North America

- 4.2.2 Rising Automation Demand for Non-contact Surface Preparation in Automotive Body Shops

- 4.2.3 Growth in Restoration Projects of Historical Monuments in Europe and Asia

- 4.2.4 Investments in Nuclear Facility Decommissioning Requiring Remote Laser Decontamination

- 4.2.5 EV Battery Production Lines Necessitating Residue-free Electrode Cleaning

- 4.2.6 Falling Cost-per-Watt of Fiber Lasers Broadening SME Adoption in Asia

- 4.3 Market Restraints

- 4.3.1 High Capital Expenditure for High-power Systems in Developing Economies

- 4.3.2 Limited Field Portability for Offshore Maintenance

- 4.3.3 Substrate Thermal Damage Risk on Heat-Sensitive Materials

- 4.3.4 Scarcity of Certified Laser Cleaning Technicians in Emerging Markets

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.5.1 Advances in Ultrashort-Pulse (Ps/Fs) Sources

- 4.5.2 Integration with Collaborative Robots

- 4.6 Regulatory Outlook

- 4.6.1 Global VOC and Hazardous-Chemical Directives

- 4.6.2 OSHA and IEC Laser-Safety Standards

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Laser Type

- 5.1.1 Fiber Lasers

- 5.1.2 Solid-state (Nd:YAG/Yb:YAG) Lasers

- 5.1.3 CO2 Lasers

- 5.1.4 Ultrashort-Pulse (Picosecond/Femtosecond) Lasers

- 5.2 By Power Range

- 5.2.1 High Power (Greater than 1 kW)

- 5.2.2 Medium Power (100 W-1 kW)

- 5.2.3 Low Power (Less than 100 W)

- 5.3 By Portability

- 5.3.1 Handheld/Portable Systems

- 5.3.2 Benchtop/Stationary Systems

- 5.3.3 Robotic/Automated Integrated Cells

- 5.4 By Pulse Duration

- 5.4.1 Continuous-Wave

- 5.4.2 Nanosecond Pulsed

- 5.4.3 Ultrashort-Pulse (Ps/Fs)

- 5.5 By Application

- 5.5.1 Paint and Coating Removal

- 5.5.2 Rust and Oxide Removal

- 5.5.3 Surface Pretreatment and Welding Preparation

- 5.5.4 Mold Cleaning and Tooling Maintenance

- 5.5.5 Cultural Heritage and Artwork Restoration

- 5.5.6 Micro-electronics and Precision Cleaning

- 5.5.7 Nuclear Decontamination

- 5.6 By End-user Industry

- 5.6.1 Automotive and Transport

- 5.6.2 Aerospace and Defense

- 5.6.3 Shipbuilding and Marine

- 5.6.4 Infrastructure and Construction

- 5.6.5 Energy and Power

- 5.6.5.1 Oil and Gas

- 5.6.5.2 Nuclear

- 5.6.5.3 Renewables

- 5.6.6 Electronics and Semiconductor

- 5.6.7 Cultural Heritage Institutions

- 5.6.8 Manufacturing and Industrial Machinery

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 South East Asia

- 5.7.3.6 Australia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 TRUMPF Group

- 6.4.2 IPG Photonics Corporation

- 6.4.3 Clean-Lasersysteme GmbH

- 6.4.4 Laser Photonics Corporation

- 6.4.5 P-Laser NV

- 6.4.6 Laserax Inc.

- 6.4.7 Adapt Laser Systems LLC

- 6.4.8 Jinan Xintian Technology Co. Ltd (XT Laser)

- 6.4.9 HGLaser Engineering Co. Ltd

- 6.4.10 Han's Laser Technology Industry Group Co. Ltd

- 6.4.11 Coherent Corp.

- 6.4.12 Scantech Laser Pvt. Ltd

- 6.4.13 Anilox Roll Cleaning Systems

- 6.4.14 Shenzhen Riselaser Technology Co. Ltd

- 6.4.15 Sukjin Laser Co.

- 6.4.16 Allied Scientific Pro

- 6.4.17 CyCleanLaser GmbH

- 6.4.18 PharosQuartz (Light Conversion)

- 6.4.19 Suresh Industech Pvt. Ltd

- 6.4.20 RMA Technik GmbH

- 6.4.21 Jinan Vmade CNC Machine Co., Ltd

- 6.4.22 Shanghai Mactron Technology Co. Ltd

- 6.4.23 Lynton Lasers Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment