|

市場調查報告書

商品編碼

1851106

以人為本的照明:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Human Centric Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

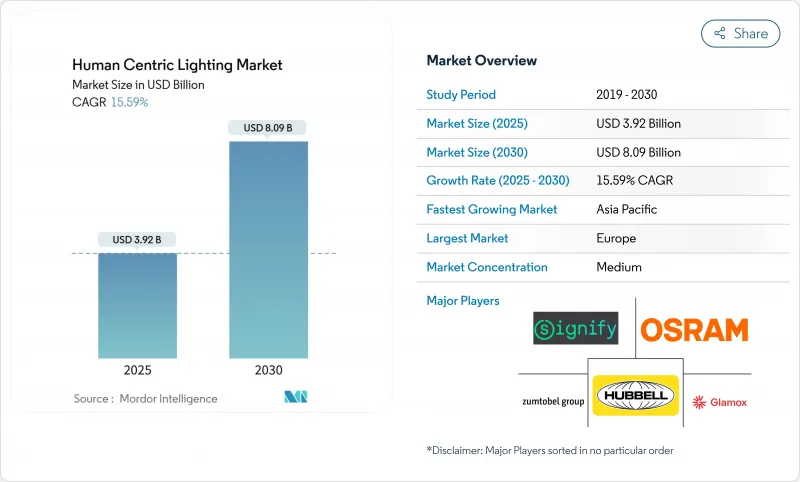

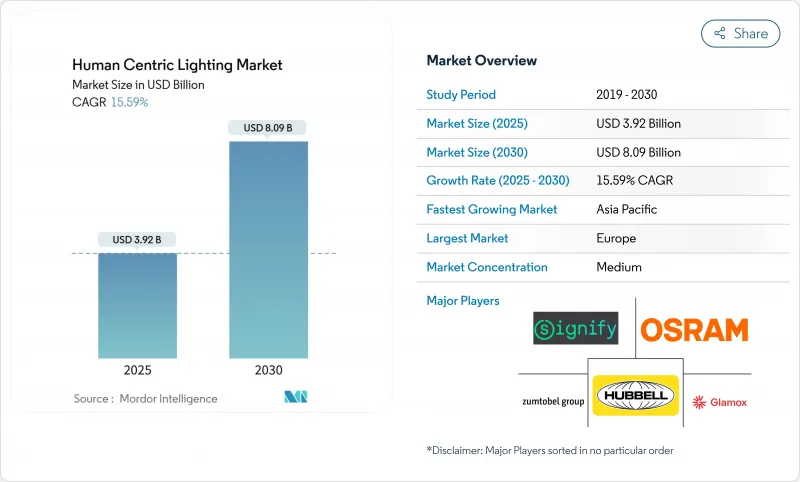

預計到 2025 年,以人為中心的照明市場價值將達到 39.2 億美元,到 2030 年將達到 80.9 億美元,年複合成長率為 15.59%。

照明方式正從簡單的照明轉向能夠提升健康、生產力和舒適度的生物調節系統。具有可調頻譜和物聯網控制功能的先進LED平台,已將照明轉變為辦公室、醫院和家庭中提升健康水平的重要戰略手段。到2024年,歐洲將以37.4%的市場佔有率佔據主導地位,這主要得益於企業積極響應日益嚴格的職場健康法規;而亞太地區將實現最快成長,這主要得益於LED價格的快速下降以及人們對光照與健康之間聯繫的認知不斷提高。對包含硬體、軟體和維護服務的訂閱模式的需求正在加速成長,而諸如黑視素當量日光照度(mEDI)等科學指標的出現,也使得效能聲明更加清晰明確。

全球以人為本照明市場趨勢與洞察

歐洲職場健康保障政策日益受到重視

歐洲的政策正從基本的職業安全轉向整體福祉,鼓勵在辦公室快速採用可調光照明。牛津大學的一項研究表明,員工福祉評分越高,績效越好,這進一步強化了其商業合理性。歐盟薪酬透明指令擴大了企業資料的範圍,將環境品質納入其中,並對照明進行了更嚴格的審查。實地研究表明,在辦公室試點計畫中,適當的頻譜調節使缺勤率降低了4.5%,創造性提高了15%。如今,企業將照明昇級視為提升員工福祉和實現永續性的雙重途徑,並加速在新計畫和大型維修中採用以人性化系統。

推動北美節能建築法規

美國的目標是到2035年將建築業的溫室氣體排放減少65%,並將先進的照明控制視為關鍵手段。最近被聯邦政府支持的住房計畫採納的2021年國際節能規範(International Energy Conservation Code)規定了嚴格的能源效率要求,鼓勵採用整合照明和控制系統(federalregister.gov)。與僅使用LED燈的升級方案相比,連網系統可節能49%,從而同時實現脫碳和提升居住者福祉的目標。為了滿足建築整體的性能指標,設計師們擴大採用支持晝夜節律的燈具,並配合日光和運作感應器。

供應商之間的互通性有限

分散的控制標準推高了整合成本,並延緩了多站點部署。美國能源局研究發現,術語和通訊持續存在的不一致阻礙了互聯照明的表現。建築業主常常面臨供應商鎖定,或必須為閘道器付費,這會增加系統生命週期內的複雜性。 DALI-2認證項目,例如西門子KNX/DALI閘道器中的認證,提高了即插即用的可能性。然而,統一的全球標準仍然難以實現,這限制了批量採購和跨產品組合分析。

細分市場分析

到2024年,硬體將佔總收入的71.7%,主要包括燈具、驅動器和感測器等頻譜調節設備。隨著資金籌措模式的演變,客戶越來越傾向於將設備、軟體和維護服務捆綁在一起的績效合約。訂閱模式可以降低前期資本投入,並將成本與實際收益掛鉤。一些跨國供應商現在透過多年服務合約來確保照明性能指標。因此,以人為本的照明市場正轉向符合輕資產企業策略的經常性收益源。

預計到2030年,服務收入將以23.4%的複合年成長率成長,成為以人為本照明市場中成長最快的組成部分。供應商可以遠端監控安裝情況,利用雲端分析最佳化場景,並透過無線方式更新韌體,以確保持續符合健康標準。這種數據主導的方法有助於提高客戶留存率,並為交叉銷售空氣品質和空間利用率分析服務鋪平道路。

到2024年,維修工程的比例將達到60.4%,因為企業會升級現有設施,以期在提升員工福祉和能源效率方面帶來立竿見影的效果。此類計劃只需進行極少的結構改動,即可快速見效,並強化了對符合晝夜節律照明的依賴。然而,建築師現在更早將頻譜設計納入建築規劃中。因此,預計到2030年,新增照明設備的年複合成長率將達到18.2%,超過維修的成長速度。

在設計階段融入人性化的照明概念,可以實現與暖通空調、遮陽和建築幕牆系統的整體協調。燈具級照明控制簡化了試運行,並創建了支援精細化個人化設定的自足式節點。研究表明,將暖通空調和照明控制相結合,在滿足晝夜節律目標的同時,照明能耗降低了69%。這些結果進一步證實了將動態照明納入綠建築認證的必要性。

區域分析

到2024年,歐洲將以37.4%的市場佔有率引領以人為本的照明市場,這主要得益於完善的工人福利法規和市政智慧照明專案。哥本哈根已維修了18,800個照明點,在提升安全性和施工便利性的同時,實現了55%的節能效果。隨著歐盟建築性能指令不斷提高最低照明標準,產業協會歐洲照明協會(Lighting Europe)預計,以人性化的解決方案有望滿足該地區7%的照明需求。

亞太地區在2025年至2030年間將以20.1%的複合年成長率成長,主要受都市化和可調光LED價格下降的推動。中國在酒店和企業領域的高階照明安裝方面處於領先地位,利用照明品質來提升賓客和租戶的體驗。國際金融公司預測,到2035年,亞洲新興市場將在綠建築領域投資1.5兆美元,為晝夜節律照明的發展創造有利條件。勞動力發展和互通性障礙將減緩這一速度,但上升趨勢仍然存在。

在北美,強制建築脫碳的趨勢正在加速前進。美國能源部已將先進照明技術視為降低商業建築電力需求的關鍵工具,而公用事業公司也正透過市場轉型計畫推廣燈具級控制系統。加拿大各地區也正朝著類似的方向發展,將健康指標納入能源法規的更新中。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲職場健康保障政策日益受到重視

- 北美地區大力推動節能建築

- 亞洲LED價格快速下降,推動HCL改裝。

- 對符合晝夜節律的醫療照明的需求

- 智慧城市試點計畫推動智慧城市技術在北歐各市鎮的推廣

- 基於SaaS的寫作即服務(LaaS)收入模式

- 市場限制

- 跨廠商通訊協定的互通性有限

- 工業環境中人為因素檢驗的高度複雜性

- 新興國家缺乏安裝人員技能

- 大型住宅安裝專案投資報酬率的不確定性

- 生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測(價值)

- 報價

- 硬體

- 軟體

- 服務

- 按安裝類型

- 新設備

- 改裝

- 透過光源

- LED

- 有機發光二極體

- 螢光

- 其他

- 依設備類型

- 下照燈

- 槽型板和麵板

- 吊掛式

- 線性條帶和包裝

- 其他

- 透過連接技術

- 有線連接(DALI、PoE、KNX 等)

- 無線連線(藍牙、Zigbee、Wi-Fi、Li-Fi)

- 透過使用

- 商業的

- 辦公室和公司

- 零售和超級市場

- 飯店業

- 醫療機構

- 教育機構

- 工業的

- 製造工廠

- 倉儲和物流

- 住宅

- 公共基礎設施和智慧城市

- 商業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家(丹麥、瑞典、挪威、芬蘭)

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Signify Lighting NV

- ams OSRAM AG

- Zumtobel Group AG

- Hubbell Inc.

- Glamox AS

- Trilux GmbH and Co. KG

- Wipro Lighting

- Fagerhult Group

- Legrand SA

- Waldmann Lighting

- Helvar Oy Ab

- Lutron Electronics Co. Inc.

- Acuity Brands Inc.

- LG Electronics(LG Innotek)

- Sharp Corp.

- Feilo Sylvania

- Seoul Semiconductor Co. Ltd.

- Cree Lighting

- Lumitech GmbH

- PhotonStar LED Group

- R2 Innovative Lighting

- PureEdge Lighting

第7章 市場機會與未來展望

The human centric lighting market is valued at USD 3.92 billion in 2025 and is forecast to advance at a 15.59% CAGR to reach USD 8.09 billion by 2030.

Adoption is shifting from simple illumination to biologically tuned systems that elevate health, productivity, and comfort. Advanced LED platforms with tunable spectra and IoT-based controls have turned lighting into a strategic wellness lever across offices, hospitals, and homes. Europe dominated uptake with a 37.4% share in 2024 as firms responded to strict workplace-wellbeing rules, while Asia Pacific posted the quickest expansion on the back of rapid LED price declines and rising awareness of light-health links. Demand for subscription models that bundle hardware, software, and maintenance is accelerating, and the arrival of scientific metrics such as melanopic equivalent daylight illuminance (mEDI) is bringing new clarity to performance claims.

Global Human Centric Lighting Market Trends and Insights

Accelerated Workplace-Wellbeing Mandates in Europe

European policy has moved beyond basic occupational safety toward holistic wellbeing, prompting rapid adoption of tunable lighting in offices. Oxford University research linked higher employee well-being scores with stronger financial performance, reinforcing the business rationale. The EU Pay Transparency Directive has broadened corporate disclosures to include environmental quality, placing lighting under greater scrutiny. Field studies showed that appropriate spectral tuning cut absenteeism by 4.5% and lifted creative output by 15% in office pilots , alconlighting. Companies now view lighting upgrades as a dual lever for wellbeing and sustainability, accelerating the specification of human-centric systems in new projects and major retrofits.

Regulatory Push for Energy-Positive Buildings in North America

The United States targets a 65% reduction in building-sector greenhouse-gas emissions by 2035, positioning advanced lighting controls as a pivotal lever. The 2021 International Energy Conservation Code, recently adopted for federally backed housing, imposes stringent efficiency requirements that reward integrated lighting and controls federalregister.gov. Networked systems have delivered 49% energy savings compared with LED-only upgrades, meeting both decarbonization and occupant-wellbeing objectives . Designers increasingly specify circadian-supportive luminaires alongside daylight and occupancy sensors to satisfy whole-building performance metrics.

Limited Interoperability Across Vendor Protocols

Fragmented control standards raise integration costs and slow multi-site rollouts. United States Department of Energy studies found persistent terminology and communication mismatches that impede connected-lighting performance. Building owners often face vendor lock-in or must fund gateways that add complexity over the system lifecycle. DALI-2 certification programs improve prospects for plug-and-play operation, as seen in Siemens' KNX/DALI gateway.Yet a unified global standard remains elusive, constraining volume procurement and cross-portfolio analytics.

Other drivers and restraints analyzed in the detailed report include:

- Rapid LED Price Erosion Enabling Retrofits in Asia

- Demand for Circadian-Aligned Healthcare Lighting

- Inadequate Installer Skill-Set in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware contributed 71.7% of 2024 revenue, anchored by luminaires, drivers, and sensors that enable spectral tuning. As financing models evolve, customers increasingly favor outcome-based contracts that bundle equipment, software, and maintenance. Subscription models reduce upfront capital, aligning costs with realized benefits. Several multinational providers now guarantee lighting performance metrics under multi-year service agreements. The human centric lighting market is therefore pivoting toward recurring revenue streams that appeal to asset-light corporate strategies.

Service revenue is forecast to climb at 23.4% annually through 2030, making it the fastest-growing component of the human centric lighting market. Providers monitor installations remotely, optimize scenes via cloud analytics, and update firmware over-the-air, ensuring continuous compliance with wellbeing standards. This data-driven approach strengthens client retention and opens pathways for cross-selling air-quality and space-use analytics.

Retrofits held a 60.4% share in 2024 as organizations upgraded existing facilities to capture immediate wellbeing and energy gains. These projects delivered quick wins with minimal structural changes, reinforcing confidence in circadian-tuned lighting. However, architects now embed spectral design early in building programs. As a result, new installations are projected to grow at 18.2% CAGR through 2030, surpassing retrofit growth.

Integrating human-centric lighting at the design stage allows holistic coordination with HVAC, shading, and facade systems. Luminaire-level lighting controls create self-contained nodes that simplify commissioning and support granular personalization. Studies of integrated HVAC and lighting controls recorded a 69% drop in lighting energy use while maintaining circadian targets. Such gains reinforce the inclusion of dynamic lighting in green-building certifications.

The Human Centric Lighting Market Report is Segmented by Offering (Hardware, Software, and Services), Installation Type (New Installations, and Retrofit Installations), Light Source (LED, OLED, Fluorescent, and More), Fixture Type (Downlights, and More), Connectivity Technology (Wired, and Wireless), Application (Commercial, Residential, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe led the human centric lighting market with a 37.4% share in 2024, propelled by strong worker-wellbeing regulation and municipal smart-lighting programs. Copenhagen's retrofit of 18,800 light points demonstrated 55% energy savings while improving perceived safety and construction. EU directives on building performance continue to raise minimum lighting standards, and industry group Lighting Europe estimated that human-centric solutions could reach 7% of the region's total lighting demand.

Asia Pacific is expanding at a 20.1% CAGR from 2025 to 2030, driven by urbanization and price declines in tunable LEDs. China spearheads premium installations in hospitality and corporate sectors, leveraging lighting quality to differentiate guest and tenant experience . The International Finance Corporation projected USD 1.5 trillion in green-building investment by 2035 across emerging Asian markets, creating fertile ground for circadian-aligned lighting. Workforce training and interoperability barriers temper the pace but do not alter the uptrend.

North America shows robust momentum under building-decarbonization mandates. The Department of Energy frames advanced lighting as a primary instrument for cutting electricity demand in commercial properties , Utilities promote luminaire-level controls through market-transformation initiatives, exemplified by the Ameren Illinois program that links rebates to connected-lighting adoption aceee. Canadian jurisdictions follow a similar trajectory, blending wellness metrics into energy-code updates.

- Signify Lighting NV

- ams OSRAM AG

- Zumtobel Group AG

- Hubbell Inc.

- Glamox AS

- Trilux GmbH and Co. KG

- Wipro Lighting

- Fagerhult Group

- Legrand SA

- Waldmann Lighting

- Helvar Oy Ab

- Lutron Electronics Co. Inc.

- Acuity Brands Inc.

- LG Electronics (LG Innotek)

- Sharp Corp.

- Feilo Sylvania

- Seoul Semiconductor Co. Ltd.

- Cree Lighting

- Lumitech GmbH

- PhotonStar LED Group

- R2 Innovative Lighting

- PureEdge Lighting

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Workplace-Wellbeing Mandates in Europe

- 4.2.2 Regulatory Push for Energy-Positive Buildings in North America

- 4.2.3 Rapid LED Price Erosion Enabling HCL Retrofits in Asia

- 4.2.4 Demand for Circadian-Aligned Healthcare Lighting

- 4.2.5 Smart-City Pilots Driving Municipal Adoption in Nordics

- 4.2.6 SaaS-based Lighting-as-a-Service (LaaS) Revenue Models

- 4.3 Market Restraints

- 4.3.1 Limited Inter-operability Across Vendor Protocols

- 4.3.2 High Complexity of Human Factors Validation in Industrial Sites

- 4.3.3 Inadequate Installer Skill-set in Emerging Economies

- 4.3.4 ROI Uncertainty for Large-Scale Residential Deployments

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Installation Type

- 5.2.1 New Installations

- 5.2.2 Retrofit Installations

- 5.3 By Light Source

- 5.3.1 LED

- 5.3.2 OLED

- 5.3.3 Fluorescent

- 5.3.4 Others

- 5.4 By Fixture Type

- 5.4.1 Downlights

- 5.4.2 Troffers and Panels

- 5.4.3 Suspended Luminaires

- 5.4.4 Linear Strips and Wraps

- 5.4.5 Others

- 5.5 By Connectivity Technology

- 5.5.1 Wired (DALI, PoE, KNX, etc.)

- 5.5.2 Wireless (Bluetooth, Zigbee, Wi-Fi, Li-Fi)

- 5.6 By Application

- 5.6.1 Commercial

- 5.6.1.1 Offices and Corporate

- 5.6.1.2 Retail and Supermarkets

- 5.6.1.3 Hospitality

- 5.6.1.4 Healthcare Facilities

- 5.6.1.5 Educational Institutions

- 5.6.2 Industrial

- 5.6.2.1 Manufacturing Plants

- 5.6.2.2 Warehouses and Logistics

- 5.6.3 Residential

- 5.6.4 Public Infrastructure and Smart Cities

- 5.6.1 Commercial

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 Southeast Asia

- 5.7.3.6 Australia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East

- 5.7.5.1 Gulf Cooperation Council Countries

- 5.7.5.2 Turkey

- 5.7.5.3 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify Lighting NV

- 6.4.2 ams OSRAM AG

- 6.4.3 Zumtobel Group AG

- 6.4.4 Hubbell Inc.

- 6.4.5 Glamox AS

- 6.4.6 Trilux GmbH and Co. KG

- 6.4.7 Wipro Lighting

- 6.4.8 Fagerhult Group

- 6.4.9 Legrand SA

- 6.4.10 Waldmann Lighting

- 6.4.11 Helvar Oy Ab

- 6.4.12 Lutron Electronics Co. Inc.

- 6.4.13 Acuity Brands Inc.

- 6.4.14 LG Electronics (LG Innotek)

- 6.4.15 Sharp Corp.

- 6.4.16 Feilo Sylvania

- 6.4.17 Seoul Semiconductor Co. Ltd.

- 6.4.18 Cree Lighting

- 6.4.19 Lumitech GmbH

- 6.4.20 PhotonStar LED Group

- 6.4.21 R2 Innovative Lighting

- 6.4.22 PureEdge Lighting

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment