|

市場調查報告書

商品編碼

1851104

維護、維修和營運 (MRO):市場佔有率分析、行業趨勢、統計數據和成長預測 (2025-2030)Maintenance, Repair, And Operations (MRO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

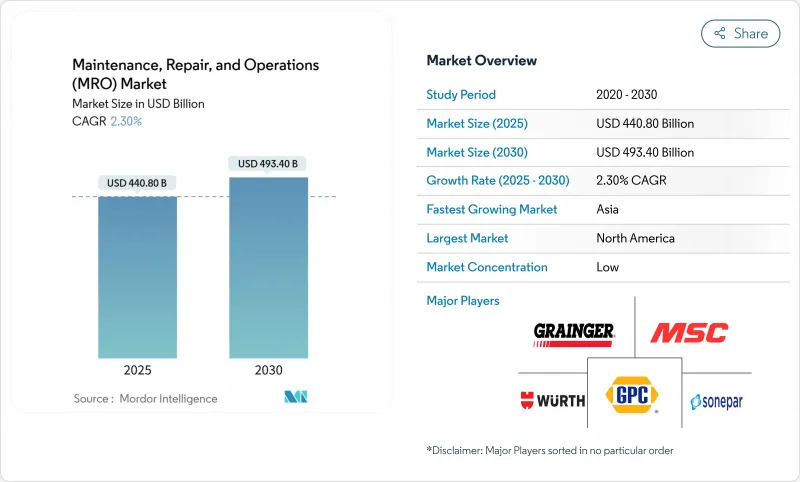

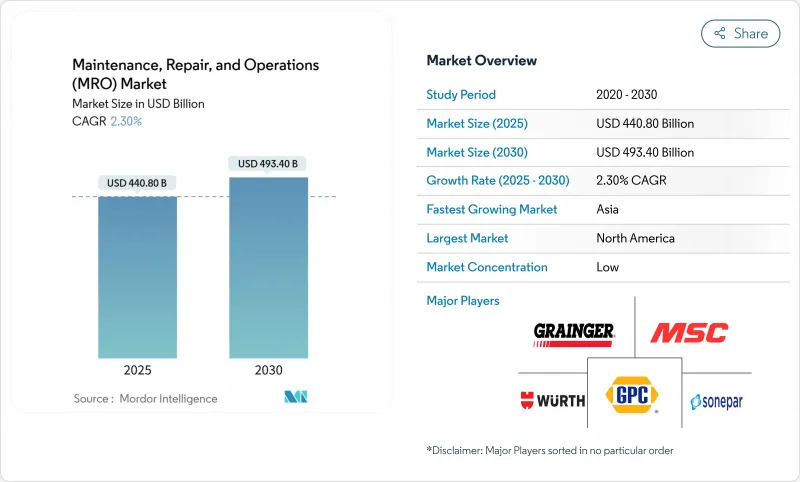

預計到 2025 年,維護、維修和營運市場規模將達到 4,408 億美元,到 2030 年將達到 4,934 億美元,年複合成長率為 2.3%。

由於工廠、醫院、發電廠和航空公司無法承受計劃外停機,市場成長穩步推進。工業4.0項目透過實現預測性維護,減少庫存並延長資產壽命,從而加速發展。企業也在擴大安全庫存以應對供應衝擊,美國四年一度的供應鏈評估報告也強調了這項做法。同時,技能短缺和日益成長的網路風險抑制了市場前景,但對互聯維護平台的投資並未阻礙市場發展。總體而言,維護、維修和營運市場正受益於其在關鍵基礎設施價值鏈中的重要地位。

全球維護、維修和營運 (MRO) 市場趨勢與洞察

工業4.0智慧工廠的普及率不斷提高

配備豐富感測器的生產線使工程師能夠根據設備狀況精確安排維護計劃。德國政府的一項調查發現,95% 的企業將工業 4.0 視為機遇,91% 的企業認為工業 4.0 對提升競爭力至關重要。機器學習系統能夠以 95% 的準確率在故障發生前四天就偵測到故障。 BMW集團的雲端平台數據顯示,有針對性的干涉措施在兩年內將過濾器成本從 14,400 歐元降至 6,600 歐元(約 15,300 美元至 7,000 美元)。這些成本節約正在推動維護、維修和營運市場對分析軟體、高精度感測器和整合服務的需求。

供應鏈韌性計畫增加MRO庫存

美國每四年一次的供應鏈評估鼓勵在盟國進行國內採購和生產,以降低供應鏈脆弱性。製造商正透過擴大關鍵儲備、安裝自動化倉庫和採用供應商管理庫存合約來應對這項挑戰。儘管客戶都在努力減少營運資金,但提供配套服務和現場倉儲服務的經銷商的市場佔有率卻在不斷成長。

熟練工程師持續短缺

儘管新畢業生的認證率提高了31%,但預計未來三年內,航空維修技師的需求量仍將比供應量高出近20%。波音公司預測,未來20年將需要額外69萬名技師。勞動力市場緊張推高了工資成本,迫使雇主投資於加速培訓和知識獲取工具,從而擠壓了整個維修、修理和營運市場的淨利率。

細分市場分析

到2024年,工業MRO將佔據維護、維修和營運市場佔有率的33.4%,凸顯其在重型製造環境中的核心地位。汽車、化工和金屬工廠24小時運作,停機時間直接影響收入。這些工廠需要專業的軸承、密封件和流體處理解決方案,並且必須在嚴格的反應時間內交付。設施MRO雖然規模較小,但到2030年將以4.9%的複合年成長率成長,因為建築業主維修暖通空調系統以節省能源並部署智慧建築感測器。伍爾特工業的自動化高架倉庫和iPLACER®系統表明,服務創新而非產品廣度才是供應商脫穎而出的關鍵。

工業MRO供應商正擴大將數位孿生技術與行動現場應用程式結合,即時記錄扭矩、間隙和振動值。這些數據隨後被導入企業資源計劃(ERP)系統,使預測演算法能夠觸發耗材的採購訂單。因此,買家將維護、維修和營運(MRO)市場中更大的佔有率分配給了那些能夠將庫存細節與分析洞察相結合的供應商。

到2024年,製造業將佔總支出的42%,成為維護、維修和營運市場中最大的細分領域。高速加工中心、自動化組裝和嚴格的流程控制法規正在推動零件需求的持續成長。醫療保健產業雖然規模較小,但預計將以4.8%的複合年成長率成長。醫院在認證壓力下運作老化的影像設備和維生系統,而耗材成本已佔醫院預算的10.5%。

磁振造影掃描儀和手術機器人的原廠配件價格不菲。專業分銷商透過捆綁銷售校準、軟體修補程式和合規性文件等服務來贏得合約。這種配套服務標誌著維護、維修和營運市場正在從單純的產品轉售模式轉向以結果為導向的模式。

區域分析

北美擁有龐大的先進製造業資產基礎和嚴格的法律規範,預計2024年將佔全球支出的28%。近期可靠性評估顯示電力短缺風險增加,促使電力公司撥出新的預算用於電網維護。聯邦和州政府的能源計畫也向工業效率提升提供津貼,刺激了對控制設備、感測器和改裝服務的新訂單。電子和國防生產的持續回流正在擴大該地區的維護、維修和營運市場,買家更傾向於選擇能夠在待開發區工廠附近儲存庫存的經銷商。

預計到2030年,亞洲的複合年成長率將達到5.3%,這反映了中國、印度和東南亞的快速工業化進程。飛機機隊成長尤為強勁——僅空中巴士一家就為全球數萬台引擎提供支援——隨著客運量屢創新高,服務合約也不斷增加。該地區的汽車零件製造商、電子園區和石化聯合企業正在簽署多年期契約,將零件、培訓和數位化診斷服務打包在一起。包括高速鐵路走廊和下一代電網在內的國家基礎設施規劃,將進一步擴大維護、維修和營運市場的潛在需求。

在工業4.0的普及、永續性指令的推動以及嚴格的工人安全法規的實施下,歐洲經濟保持著穩健成長。 BMW集團的預測性維護平台確保了生產線的運作,充分展現了資料驅動型維護所帶來的營運效益。諸如In.Stand2024等展會展示了旨在降低碳排放、提高資產可靠性的改裝套件和模組化服務合約。儘管面臨嚴重的技能短缺,但公私合作的培訓夥伴關係正在穩定勞動力供應,並擴大學徒計劃,從而支持維護、維修和營運市場的長期成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大與工業4.0相容的智慧工廠的應用

- 供應鏈韌性計畫提升MRO庫存

- 預測性維護與向工業物聯網感測器的轉變

- 電子商務在B2B MRO分銷領域的滲透

- 北美和歐洲的製造業離岸外包

- 對老舊設施進行節能改造的維修正在增加。

- 市場限制

- 熟練工程師持續短缺

- SKU分散化會推高庫存成本

- 互聯維護系統中的網路安全風險

- 通貨膨脹導致工業投入品價格波動。

- 價值/供應鏈分析

- 監管環境

- 科技展望(人工智慧、工業物聯網、數位孿生)

- 波特的五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按MRO類型

- 工業維護、維修和運行

- 電氣維護、維修和運行

- 設施維護、維修和大修

- 其他MRO類型

- 按最終用途行業分類

- 製造業

- 能源與公共產業

- 航太與國防

- 建造

- 衛生保健

- 其他行業

- 依採購模式

- 內部

- 外包(第三方/IFM)

- 一體化供應(VMI/一體化MRO)

- 透過維護方法

- 預防/定期

- 修復/反應

- 預測性/基於條件的

- 透過分銷管道

- 線下經銷商

- 線上/電子商務

- 直接來自原廠設備製造商

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 非洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性措施(併購、合資、數位化措施)

- 市佔率分析

- 公司簡介

- WW Grainger Inc.

- Wrth Group

- MSC Industrial Direct Co. Inc.

- Motion Industries(Genuine Parts Co.)

- RS Group plc(RS Components)

- Fastenal Company

- HD Supply(Home Depot)

- Ferguson plc

- Sonepar SA

- WESCO International Inc.

- Airgas Inc.(Air Liquide)

- Applied Industrial Technologies

- Rubix Ltd.

- ERIKS NV

- Hayley Group Ltd.

- McMaster-Carr

- Amazon Business

- Rexel SA

- Cromwell Group(Industrial)

- Anixter(WESCO)

- VEVOR

第7章 市場機會與未來展望

The Maintenance, Repair & Operations market size reached USD 440.8 billion in 2025 and is forecast to reach USD 493.4 billion by 2030, advancing at a 2.3% CAGR.

Growth remains steady because factories, hospitals, power plants, and airlines cannot tolerate unplanned downtime. Industry 4.0 programs add momentum by enabling predictive maintenance that trims inventory and extends asset life. Corporations are also widening safety stocks to guard against supply shocks, a practice reinforced by the United States Quadrennial Supply-Chain Review. Meanwhile, technician shortages and rising cyber-risk temper the outlook but have not derailed investment in connected maintenance platforms. Overall, the Maintenance, Repair & Operations market benefits from its essential status within every critical infrastructure value chain.

Global Maintenance, Repair, And Operations (MRO) Market Trends and Insights

Rising Adoption of Industry 4.0-Enabled Smart Factories

Sensor-rich production lines allow engineers to schedule maintenance exactly when asset condition dictates. A German ministry survey found that 95% of firms now view Industry 4.0 as an opportunity and 91% see it as essential for competitiveness. Machine-learning systems reach 95% accuracy in spotting failures up to four days before stoppage. BMW Group's cloud platform shows that targeted interventions cut filter costs from EUR 14,400 to EUR 6,600 (USD 15,300 to USD 7,000) within two years. These savings are fueling demand for analytic software, high-precision sensors, and integration services across the Maintenance, Repair & Operations market.

Supply-Chain Resiliency Programs Boosting MRO Stocking

The United States Quadrennial Supply-Chain Review urges domestic sourcing and allied production to limit vulnerabilities . Manufacturers are responding by expanding critical spare inventories, installing automated warehouses, and adopting vendor-managed inventory agreements. Distributors offering kitting and on-site crib services are capturing incremental wallet share even as clients strive to lower working capital.

Persistent Skilled-Technician Shortages

Aviation maintenance technician demand is set to exceed supply by nearly 20% within three years despite a 31% rise in recent graduate certifications. Boeing projects the need for 690,000 additional technicians over two decades. Tight labor markets elevate wage expense and force employers to invest in accelerated training and knowledge-capture tools, thereby compressing margins across the Maintenance, Repair & Operations market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Predictive Maintenance & IIoT Sensors

- E-Commerce Penetration in B2B MRO Distribution

- Fragmented SKU Universe Inflating Inventory Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial MRO captured 33.4% of the Maintenance, Repair & Operations market share in 2024, underscoring its central role in heavy-duty production environments. Automotive, chemical, and metals plants run around the clock, so downtime carries direct revenue penalties. These sites demand specialized bearings, seals, and fluid-handling solutions delivered within narrow response windows. Facility MRO, although smaller, is expanding at a 4.9% CAGR through 2030 as building owners retrofit HVAC systems for energy savings and introduce smart-building sensors. Wurth Industrie's automated high-bay warehouse and iPLACER(R) system illustrate how service innovation rather than product breadth differentiates suppliers.

Industrial MRO vendors increasingly couple digital twins with mobile field apps that record torque, gap, and vibration values in real time. This data then feeds enterprise resource planning suites, allowing predictive algorithms to trigger purchase orders for consumables. As a result, purchasers allocate a larger share of the Maintenance, Repair & Operations market to providers capable of combining inventory depth with analytic insight.

Manufacturing accounted for 42% of overall 2024 spend, representing the largest slice of the Maintenance, Repair & Operations market. High-speed machining centers, automated assembly lines, and strict process-control regulations encourage consistent parts demand. Healthcare, while representing a smaller base, is expected to grow at 4.8% CAGR. Hospitals keep aging imaging devices and life-support systems operational under intense accreditation pressure, and supply expenses already equal 10.5% of hospital budgets.

OEM parts for magnetic resonance scanners and surgical robots carry premium price tags. Specialized distributorships win contracts by bundling calibration, software patching, and compliance documentation. These bundled services demonstrate how the Maintenance, Repair & Operations market is tilting toward outcome-based models rather than pure product resale.

The Maintenance, Repair, and Operations (MRO) Market is Segmented by MRO Type (Industrial MRO, Electrical MRO, and More), End-Use Industry (Manufacturing and More), Sourcing Model (In-House and More), Maintenance Approach (Preventive/Scheduled and More), Distribution Channel (Offline Distributors, Online/E-Commerce and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 28% of global spending in 2024 due to its extensive installed base of advanced manufacturing assets and tight regulatory oversight. A recent reliability assessment revealed growing risks of electricity shortfalls, prompting utilities to allocate fresh budget for grid maintenance. Federal and state energy programs are also channeling grants into industrial efficiency upgrades, spurring new orders for controls, sensors, and retrofit services. Continued reshoring of electronics and defense production is expanding the Maintenance, Repair & Operations market in the region, with buyers favoring distributors that can stage inventory near green-field plants.

Asia is anticipated to record a 5.3% CAGR through 2030, reflecting rapid industrialization across China, India, and Southeast Asia. Aircraft fleet growth is especially strong; Airbus alone supports tens of thousands of engines worldwide, and service contracts are rising as passenger volumes set new records. Automotive suppliers, electronics campuses, and petrochemical complexes across the region are signing multi-year agreements that bundle parts, training, and digital diagnostics. National infrastructure plans, including high-speed rail corridors and next-generation power grids, further extend addressable demand for the Maintenance, Repair & Operations market

Europe maintains healthy expansion powered by Industry 4.0 adoption, sustainability mandates, and strict worker-safety legislation. BMW Group's predictive maintenance platform keeps production lines humming and demonstrates the operational returns available from data-driven maintenance. Events like In.Stand 2024 showcased retrofit kits and modular service contracts aimed at lowering carbon footprints while boosting asset reliability. Although technician shortages are acute, public-private training partnerships are scaling apprentice programs that stabilize labor supply and support long-term Maintenance, Repair & Operations market growth.

- W.W. Grainger Inc.

- Wrth Group

- MSC Industrial Direct Co. Inc.

- Motion Industries (Genuine Parts Co.)

- RS Group plc (RS Components)

- Fastenal Company

- HD Supply (Home Depot)

- Ferguson plc

- Sonepar SA

- WESCO International Inc.

- Airgas Inc. (Air Liquide)

- Applied Industrial Technologies

- Rubix Ltd.

- ERIKS N.V.

- Hayley Group Ltd.

- McMaster-Carr

- Amazon Business

- Rexel SA

- Cromwell Group (Industrial)

- Anixter (WESCO)

- VEVOR

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of Industry 4.0-enabled smart factories

- 4.2.2 Supply-chain resiliency programs boosting MRO stocking

- 4.2.3 Shift towards predictive maintenance & IIoT sensors

- 4.2.4 E-commerce penetration in B2B MRO distribution

- 4.2.5 Near-shoring of manufacturing in North America & Europe

- 4.2.6 Surge in energy-efficiency retrofits of aging facilities

- 4.3 Market Restraints

- 4.3.1 Persistent skilled-technician shortages

- 4.3.2 Fragmented SKU universe inflating inventory costs

- 4.3.3 Cyber-security risks in connected maintenance systems

- 4.3.4 Inflation-driven price volatility of industrial inputs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI, IIoT, Digital Twins)

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By MRO Type

- 5.1.1 Industrial MRO

- 5.1.2 Electrical MRO

- 5.1.3 Facility MRO

- 5.1.4 Other MRO Types

- 5.2 By End-Use Industry

- 5.2.1 Manufacturing

- 5.2.2 Energy & Utilities

- 5.2.3 Aerospace & Defense

- 5.2.4 Construction

- 5.2.5 Healthcare

- 5.2.6 Other Industries

- 5.3 By Sourcing Model

- 5.3.1 In-house

- 5.3.2 Outsourced (3rd-party/IFM)

- 5.3.3 Integrated Supply (VMI/Integrated-MRO)

- 5.4 By Maintenance Approach

- 5.4.1 Preventive / Scheduled

- 5.4.2 Corrective / Reactive

- 5.4.3 Predictive / Condition-based

- 5.5 By Distribution Channel

- 5.5.1 Offline Distributors

- 5.5.2 Online / E-commerce

- 5.5.3 Direct from OEM

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.5 Middle East & Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.2 Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Digital Initiatives)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 W.W. Grainger Inc.

- 6.4.2 Wrth Group

- 6.4.3 MSC Industrial Direct Co. Inc.

- 6.4.4 Motion Industries (Genuine Parts Co.)

- 6.4.5 RS Group plc (RS Components)

- 6.4.6 Fastenal Company

- 6.4.7 HD Supply (Home Depot)

- 6.4.8 Ferguson plc

- 6.4.9 Sonepar SA

- 6.4.10 WESCO International Inc.

- 6.4.11 Airgas Inc. (Air Liquide)

- 6.4.12 Applied Industrial Technologies

- 6.4.13 Rubix Ltd.

- 6.4.14 ERIKS N.V.

- 6.4.15 Hayley Group Ltd.

- 6.4.16 McMaster-Carr

- 6.4.17 Amazon Business

- 6.4.18 Rexel SA

- 6.4.19 Cromwell Group (Industrial)

- 6.4.20 Anixter (WESCO)

- 6.4.21 VEVOR

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment