|

市場調查報告書

商品編碼

1851102

印度金屬加工:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)India Metal Fabrication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

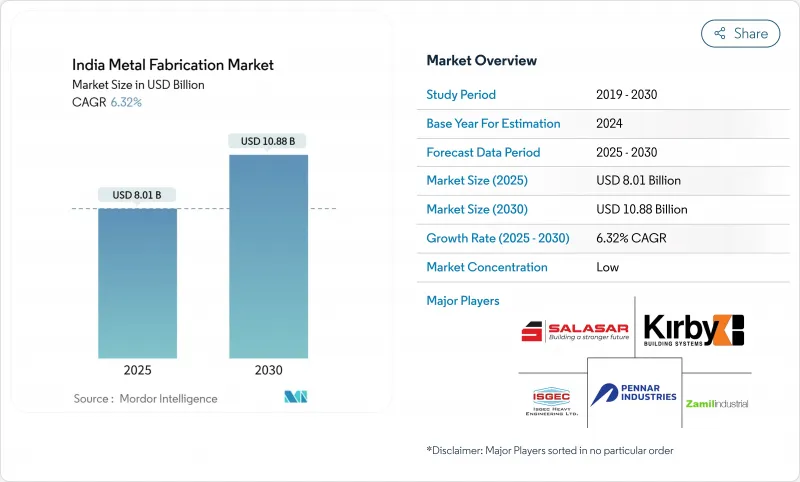

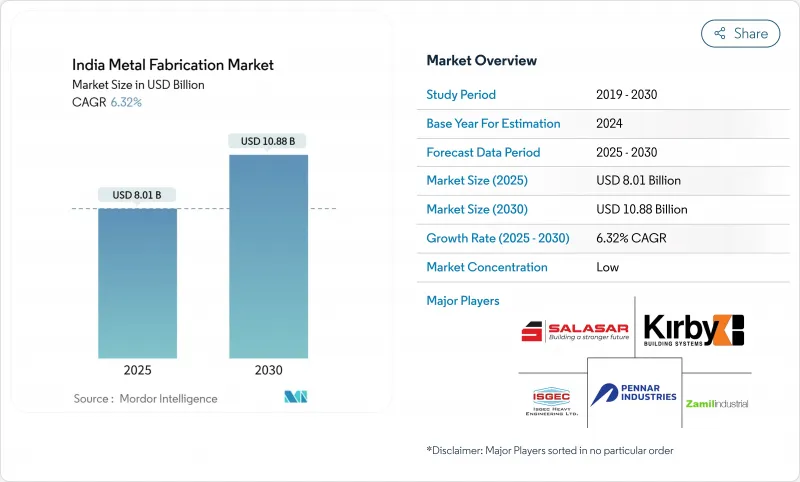

印度金屬加工市場預計到 2025 年將達到 80.1 億美元,到 2030 年將達到 108.8 億美元,年複合成長率為 6.32%。

在總理加蒂·沙克蒂的領導下,印度金屬加工產業將迎來重大發展,基礎設施建設將得到大力推進,國防抵消貿易額的增加以及可再生能源設施規模的擴大也將推動產業擴張。機械加工仍然是行業主導服務,但焊接和鋁材加工行業正在蓬勃發展,因為航太、資料中心和綠色氫能計劃對更輕、更精確的組件提出了更高的要求。南部地區的製造叢集受惠於國防走廊和工業4.0的普及,而西部地區則持續吸引大部分大型鋼鐵和物流投資。印度的金屬加工市場仍然青睞那些能夠為資料中心和預製建築提供模組化解決方案,同時又能規避焦煤價格波動風險並遵守日益嚴格的環境標準的一體化企業。

印度金屬加工市場趨勢與洞察

對可再生能源設備製造的需求快速成長

到2026年,國內太陽能組件產能將達到110吉瓦,從而確保安裝框架、追蹤器和逆變器外殼等精密加工零件的穩定供應。受可再生能源廣泛應用的推動,2024年鋼鐵需求將成長7.7%。國家綠色氫能計畫已累計146.6億印度盧比(約1.7663億美元)用於綠色氫能一體化,並已啟動電解槽框架和壓力容器的前置作業時間。風力發電機製造商目前已在地採購,並正在國內生產塔筒和機艙,出口到美國。這些項目將為印度金屬加工市場提供未來數年的供應量,因為計劃開發商優先考慮縮短交貨週期和提高在地採購率。

政府的「Gati Shakti」基礎設施管道將加速鋼鐵加工

此總體規劃協調了200多個計劃,滿足了橋面、車站屋頂和公共電氣化龍門架等建設需求。 12個新的工業節點,投資額達2860.2億印度盧比(約34.5億美元),預計為物流園區和公用設施走廊帶來重型和輕型製造配套訂單。預計到2047年,鋼鐵產能將成長三倍,達到5億噸,這將增加對鋼板切割、軋延和截面焊接的需求。德里-孟買工業走廊的開發已經吸引了塔塔電子等主要租戶,並擴大了下游加工合約。

焦煤進口成本波動推高了投入價格。

2025會計年度上半年,印度煉焦煤進口量達到六年來的最高點2,960萬噸,其中俄羅斯進口量年增200%,原因是鋼廠尋求折扣。儘管澳洲的進口佔有率從2022會計年度的80%下降至54%,但對海底煤的依賴仍佔總需求的85%以上。雖然政府正在探索聯合採購和利用蒙古走廊來降低價格波動,但短期內鋼板價格仍然脆弱。熱軋捲板價格上漲可能會使加工商的毛利率下降80-120個基點,迫使他們將成本轉嫁給EPC客戶或推遲小額訂單。因此,儘管印度金屬加工市場面臨暫時的壓力,但從長遠來看,發展國產焦炭將使其受益。

細分市場分析

2024年,機械加工將佔印度金屬加工市場佔有率的33.4%,這主要得益於航太、汽車和國防領域的多軸數控加工中心。採用人工智慧CAM軟體(例如Hurco的ChatCNC)可縮短編程時間、提高主軸運轉率,並加快出口召回的反應速度。自動化升級緩解了技術純熟勞工短缺的問題,並實現了高價值組件的單件生產。

儘管焊接規模較小,但由於高層建築、風力塔和液化天然氣模組等項目對專業化、無損檢測接頭的需求,其複合年成長率(CAGR)仍高達7.01%,成為成長最快的產業。一體化企業採用機器人MIG焊接生產線和即時熔池分析技術,以滿足品質法規要求和緊迫的計劃工期。切割服務採用光纖雷射系統,能夠以3米/分鐘的速度切割25毫米厚的碳鋼;成型單元則使用伺服彎折壓床來彎曲先進的高強度鋼。沖壓、沖孔和精加工流程也正在升級,採用線上集塵機和水性噴漆室,以滿足環保標準。 SAMARTH Udyog Bharat 4.0計劃透過位於浦那和班加羅爾的體驗中心為這些升級提供支持,並將新訂單引導至印度金屬加工市場中具備技術能力的研討會。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對可再生能源設備製造的需求快速成長

- 政府的「Gati Shakti」基礎設施管道將加速鋼鐵加工

- 國防補償和「印度製造」計畫促進了精密加工的發展。

- 快速建造資料中心需要重型結構模組

- 二、三線城市採用預製建築

- 市場限制

- 焦煤進口成本波動推高了投入價格。

- 中小微型企業製造商長期面臨電力供應瓶頸問題

- 分散的供應鏈限制了出口級品質保證

- 環境(EPR 和碳)成本負擔

- 價值/供應鏈分析

- 政府法規和重大舉措

- 技術展望

- 產業吸引力—五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 近期全球動盪對印度金屬加工市場的影響

第5章 市場規模與成長預測

- 按服務類型

- 切割

- 成型/彎曲

- 焊接

- 加工

- 沖壓/沖壓

- 表面處理/精加工

- 其他(組裝等)

- 材料

- 碳鋼

- 不銹鋼和合金鋼

- 鋁

- 其他(銅、黃銅、特殊合金、金屬薄板(冷軋鋼板、鍍鋅鋼板、熱軋鋼板))

- 按最終用戶行業分類

- 建築和基礎設施

- 汽車及汽車零件

- 鐵路和地鐵

- 電力/公共產業

- 航太/國防

- 石油、天然氣和煉油廠

- 海洋/造船

- 製造業(重型機械和耐用消費品)

- 其他(加工車間、農業設備、電器、耐用消費品等)

- 按地區

- 印度西部(馬哈拉斯特拉邦、古吉拉突邦、果阿邦)

- 南印度(泰米爾納德邦、卡納塔克邦、特倫甘納邦、安得拉邦、喀拉拉邦)

- 印度北部(德里 NCR、哈里亞納邦、旁遮普邦、北方邦、北阿坎德邦、喜馬偕爾邦、拉賈斯坦邦)

- 印度東部(西孟加拉邦、賈坎德邦、奧裡薩邦、比哈爾邦)

- 印度中部(中央邦、恰蒂斯加爾邦)

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Larsen & Toubro Ltd

- Kirby Building Systems India

- Zamil Industrial Investment Co.

- ISGEC Heavy Engineering Ltd

- Pennar Industries Ltd

- Salasar Techno Engineering Ltd

- JSW Severfield Structures Ltd

- Godrej Process Equipment

- Diamond Engineering(India)Pvt Ltd

- TEMA India Ltd

- Novatech Projects(India)Pvt Ltd

- Karamtara Engineering Pvt Ltd

- Bharat Heavy Electricals Ltd(Fabrication Div.)

- Tata Projects Ltd

- Welspun Corp Ltd

- Hindustan Dorr-Oliver Ltd

- Jindal Stainless-Fabrication Unit

- Bharat Forge Ltd(Fabrication Business)

- Essar Heavy Engineering Services

- Techno-Fab Engineering Ltd*

第7章 市場機會與未來展望

The India Metal Fabrication Market size stands at USD 8.01 billion in 2025 and is forecast to reach USD 10.88 billion by 2030 while advancing at a 6.32% CAGR.

Expansion is guided by large-scale infrastructure roll-outs under PM Gati Shakti, rising defense offsets, and the scale-up of renewable-energy equipment. Machining remains the dominant service, yet welding and aluminum processing are the fastest climbers as aerospace, data-center, and green-hydrogen projects demand lighter, high-precision assemblies. Southern fabrication clusters benefit from defense corridors and Industry 4.0 adoption, whereas Western hubs still attract the bulk of mega-steel and logistics investments. The India metal fabrication market continues to favor integrated players that can hedge volatile coking coal costs and comply with tightening environmental norms while supplying modular solutions for data centers and pre-engineered buildings.

India Metal Fabrication Market Trends and Insights

Surge in Renewable-Energy Equipment Manufacturing Demand

Domestic solar module capacity is set to hit 110 GW by 2026, ensuring a steady pipeline of mounting structures, trackers, and inverter housings that require precision fabrication. Steel demand increased 7.7% in 2024 on the back of renewable roll-outs. The National Green Hydrogen Mission earmarks INR 14.66 billion(USD 176.63 million) for green hydrogen integration, opening contracts for electrolyzer frames and pressure vessels. Wind turbine manufacturers, who already source 70-80% of components locally, keep tower and nacelle fabrication work onshore for export shipments to the United States. Collectively, these programs channel multi-year volumes to the India metal fabrication market as project developers prioritise short lead times and local content.

Government "Gati Shakti" Infrastructure Pipeline Accelerating Steel Fabrication

The master plan synchronises 200-plus projects, driving the need for bridge decks, station roofs, and overhead electrification gantries. Twelve new industrial nodes, cleared with INR 28,602 crore(USD 3.45 billion), promise ancillary orders for heavy and light fabrications across logistics parks and utility corridors. Steelmaking capacity is planned to triple to 500 million tonnes by 2047, ushering in incremental demand for plate cutting, rolling, and section welding. Progress on the Delhi-Mumbai Industrial Corridor has already secured anchor tenants such as Tata Electronics, broadening downstream fabrication contracts.

Volatile Coking-Coal Import Costs Inflating Input Prices

Coking-coal imports hit a six-year peak of 29.6 million tonnes in H1 FY25, and Russian cargoes surged 200% year-on-year as mills hunted discounts. Australian share slipped to 54% from 80% in FY 2022, yet reliance on seaborne coal still tops 85% of total demand. The government is exploring consortium-scale buying and Mongolian corridors to tame volatility, but near-term plate prices remain susceptible. Fabricators' gross margins drop by 80-120 basis points when hot-rolled coil prices spike, forcing them to pass costs to EPC clients or defer smaller orders. The India metal fabrication market thus faces temporary pressures yet benefits long-term from eventual domestic coke development.

Other drivers and restraints analyzed in the detailed report include:

- Defense Offsets & "Make in India" Stimulating Precision Fabrication

- Rapid Data-Center Build-outs Requiring Heavy Structural Modules

- Chronic Power-Supply Bottlenecks for MSME Fabricators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Machining accounted for 33.4% of India metal fabrication market share in 2024, supplied by a network of multi-axis CNC shops that serve aerospace, automotive, and defense contracts. Adoption of AI-enabled CAM software, typified by Hurco's ChatCNC, cuts programming time and improves spindle utilization, letting shops respond quickly to export call-offs. Automation upgrades soften the skilled-labour deficit and allow lot-size-one production for high-value assemblies.

Welding, although smaller, registers the fastest 7.01% CAGR as high-rise infrastructure, wind towers, and LNG modules need specialized non-destructive-tested joints. Integrated players embed robotic MIG lines and real-time weld-pool analytics to meet both quality codes and compressed project schedules. Cutting services benefit from fiber-laser systems that slice 25 mm carbon steel at 3 m/min, while forming cells use servo-press brakes to bend advanced-high-strength steel. Punching, stamping, and finishing segments upgrade to inline dust-collection and water-borne paint booths to align with environmental norms. The SAMARTH Udyog Bharat 4.0 program backs these upgrades through experiential centres in Pune and Bengaluru, steering fresh orders to tech-ready workshops within the India metal fabrication market.

The India Metal Fabrication Market is Segmented by Service Type (Cutting, and Others), by Material (Carbon Steel, and Others), by End-User Industry (Construction & Infrastructure, and Others), and by Region (Western India, Southern India, Northern India, Eastern India, and Central India). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Larsen & Toubro Ltd

- Kirby Building Systems India

- Zamil Industrial Investment Co.

- ISGEC Heavy Engineering Ltd

- Pennar Industries Ltd

- Salasar Techno Engineering Ltd

- JSW Severfield Structures Ltd

- Godrej Process Equipment

- Diamond Engineering (India) Pvt Ltd

- TEMA India Ltd

- Novatech Projects (India) Pvt Ltd

- Karamtara Engineering Pvt Ltd

- Bharat Heavy Electricals Ltd (Fabrication Div.)

- Tata Projects Ltd

- Welspun Corp Ltd

- Hindustan Dorr-Oliver Ltd

- Jindal Stainless - Fabrication Unit

- Bharat Forge Ltd (Fabrication Business)

- Essar Heavy Engineering Services

- Techno-Fab Engineering Ltd*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Renewable-Energy Equipment Manufacturing Demand

- 4.2.2 Government "Gati Shakti" Infrastructure Pipeline Accelerating Steel Fabrication

- 4.2.3 Defence Offsets & "Make in India" Stimulating Precision Fabrication

- 4.2.4 Rapid Data-Center Build-outs Requiring Heavy Structural Modules

- 4.2.5 Adoption of Pre-Engineered Buildings in Tier-2 & 3 Cities

- 4.3 Market Restraints

- 4.3.1 Volatile Coking-Coal Import Costs Inflating Input Prices

- 4.3.2 Chronic Power-Supply Bottlenecks for MSME Fabricators

- 4.3.3 Fragmented Supply Chain Limits Export-Grade Quality Assurance

- 4.3.4 Environmental-Compliance (EPR & Carbon) Cost Burden

- 4.4 Value / Supply-Chain Analysis

- 4.5 Government Regulations & Key Initiatives

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Recent Global Disruptions on the India Metal Fabrication Market

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Service Type

- 5.1.1 Cutting

- 5.1.2 Forming / Bending

- 5.1.3 Welding

- 5.1.4 Machining

- 5.1.5 Punching / Stamping

- 5.1.6 Finishing / Surface Treatment

- 5.1.7 Others (Assembling, etc.)

- 5.2 By Material

- 5.2.1 Carbon Steel

- 5.2.2 Stainless & Alloy Steel

- 5.2.3 Aluminium

- 5.2.4 Others (Copper, Brass, Specialty Alloys, Sheet Metal (CRCA, GI, HR))

- 5.3 By End-User Industry

- 5.3.1 Construction & Infrastructure

- 5.3.2 Automotive & Auto Components

- 5.3.3 Railways & Metro

- 5.3.4 Power & Utilities

- 5.3.5 Aerospace & Defence

- 5.3.6 Oil, Gas & Refinery

- 5.3.7 Marine and Shipbuilding

- 5.3.8 Manufacturing (Heavy Machinery & Consumer Durables)

- 5.3.9 Others (Job shops, Agricultural Equipment, Electricals, Consumer Durables, etc.)

- 5.4 By Region

- 5.4.1 Western India (Maharashtra, Gujarat, and Goa)

- 5.4.2 Southern India (Tamil Nadu, Karnataka, Telangana, Andhra Pradesh, and Kerala)

- 5.4.3 Northern India (Delhi NCR, Haryana, Punjab, Uttar Pradesh, Uttarakhand, Himachal Pradesh, and Rajasthan)

- 5.4.4 Eastern India (West Bengal, Jharkhand, Odisha, and Bihar)

- 5.4.5 Central India (Madhya Pradesh and Chhattisgarh)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Larsen & Toubro Ltd

- 6.4.2 Kirby Building Systems India

- 6.4.3 Zamil Industrial Investment Co.

- 6.4.4 ISGEC Heavy Engineering Ltd

- 6.4.5 Pennar Industries Ltd

- 6.4.6 Salasar Techno Engineering Ltd

- 6.4.7 JSW Severfield Structures Ltd

- 6.4.8 Godrej Process Equipment

- 6.4.9 Diamond Engineering (India) Pvt Ltd

- 6.4.10 TEMA India Ltd

- 6.4.11 Novatech Projects (India) Pvt Ltd

- 6.4.12 Karamtara Engineering Pvt Ltd

- 6.4.13 Bharat Heavy Electricals Ltd (Fabrication Div.)

- 6.4.14 Tata Projects Ltd

- 6.4.15 Welspun Corp Ltd

- 6.4.16 Hindustan Dorr-Oliver Ltd

- 6.4.17 Jindal Stainless - Fabrication Unit

- 6.4.18 Bharat Forge Ltd (Fabrication Business)

- 6.4.19 Essar Heavy Engineering Services

- 6.4.20 Techno-Fab Engineering Ltd*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment