|

市場調查報告書

商品編碼

1851095

5G企業:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030年)5G Enterprise - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

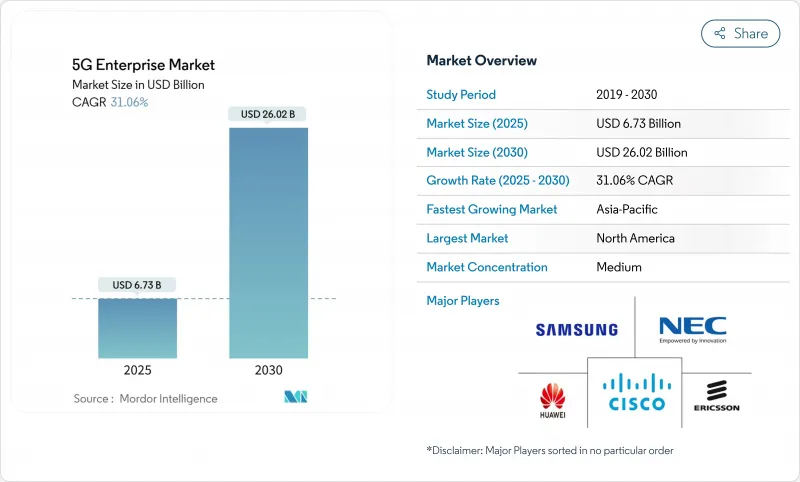

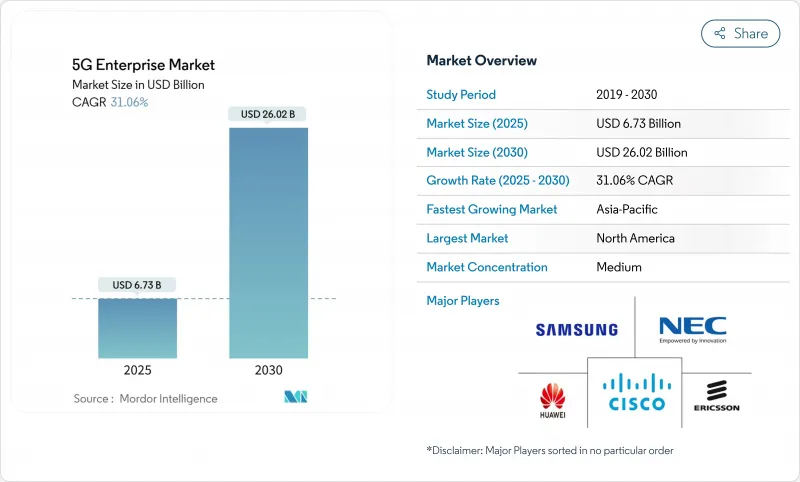

預計到 2025 年,5G 企業市場規模將達到 67.3 億美元,到 2030 年將達到 260.2 億美元,預測期(2025-2030 年)複合年成長率為 31.06%。

推動這一擴張的因素是企業將 5G 視為自動化、分析和身臨其境型配置的數位骨幹。目前已有 47 家行動通訊業者,市場對此表現出濃厚的興趣,加速了網路切片和超可靠、低延遲通訊等功能的普及。私人部署和邊緣架構正在消除效能瓶頸,而免授權共用頻譜存取則降低了准入門檻。此外,通訊5G夥伴關係已覆蓋 43 個國家,進一步擴大了覆蓋範圍。然而,巨額資本支出、棕地整合的複雜性以及跨產業 5G/OT 人才的嚴重短缺,都限制了 5G 在短期內的普及。

全球5G企業市場趨勢與洞察

開放免許可/共用頻譜改變了企業存取方式

監管機構開放中頻段頻譜,使得先前因頻譜費用而對私有5G網路望而卻步的企業也能部署私有5G網路。在美國,公民頻段無線電服務已支援超過25萬台工業設備的啟用,歐洲也在3.8-4.2 GHz頻段支援類似的框架。西門子預測,隨著協調工作的推進,部署將在2025年從試點階段過渡到規模化階段。更高的靈活性將使工廠、物流中心和能源設施能夠自訂其覆蓋範圍,從而提高運作和安全性。頻譜共用也將促進「網路一體化解決方案」(Network-in-a-Box)供應商生態系統的發展,這些供應商將無線電模組、邊緣核心網和管理工具打包成交承包套件。這些因素的累積效應將擴大進入5G企業市場的潛在客戶群,並縮短供應商的獲利時間。

邊緣運算和網路切片重新定義企業架構

企業正在重構其網路,以確保對延遲敏感的工作負載位於距離連接資產幾公尺之內的位置。 T-Mobile 等通訊業者透過為緊急應變人員提供優先網路切片來闡述這一概念。目前,已有 47 個營運商集團制定了標準化的 API,向開發人員開放切片配置,從而減少了編配工作量。透過將專用切片與本地運算節點結合,製造商可以將決策循環縮短至亞毫秒級,從而實現同步機器人和影像檢查。 Wray Castle 的一項研究發現,網路切片可以將整體頻寬利用率提高 40%。這些優勢可直接轉化為營運成本的節省,從而增強了私有邊緣架構在 5G 企業市場的價值提案。

高昂的資本支出和整合複雜性導致採用速度緩慢。

獨立組網的5G核心網、多頻段無線電和工業閘道器可望將中等規模的現有棕地部署專案推向數百萬美元的規模。根據Kyndryl 2024年的一項調查,許多公司正在推遲計劃,直到為其傳統的SCADA和MES層設計出遷移方案。如《開放式無線接取網路整合手冊》所述,開放式無線接取網路(Open RAN)承諾帶來供應商多樣性,同時也引進了新的互通性測試。網路即服務(NaaS)模式正在興起,透過將支出從資本支出(CapEx)轉移到營運支出(OpEx)來平滑現金流高峰,但關於服務等級承諾的清晰度仍然存在差異。這種財務和技術上的惰性正在削弱利潤率極低的細分市場的早期成長。

細分市場分析

5G無線接取網路領域因其在連接終端節點方面的關鍵作用,預計將在2024年實現36.00%的最大收入成長。這項基礎性投資使通訊業者和整合商能夠搶得先機,實現覆蓋義務的變現。企業對確定性效能日益成長的需求,推動了對雲端原生5G核心網的關注,預計該領域將以32.69%的複合年成長率成長。隨著獨立部署超越試驗階段,5G企業核心網解決方案的市場規模預計將迅速擴大。網路功能虛擬化將使企業能夠添加低程式碼策略引擎、融合計費和人工智慧主導的保障,從而提高每個站點的平均每用戶收入(ARPU)。

傳輸和回程傳輸雖然絕對規模較小,但發展迅速。愛立信-瞻博網路和ECI電信等合作專案凸顯了行動通訊基地台和資料中心之間對高容量資料包傳輸的需求。 E波段和新興的W波段鏈路釋放多Gigabit的吞吐量,並與密集工業的現有光纖網路形成互補。這些創新消除了曾經阻礙遠端視覺分析的瓶頸。因此,核心網和傳輸網的聯繫日益緊密,市場佔有率不斷擴大。

到2024年,私有部署將佔總收入的38.30%,這表明用戶越來越傾向於本地部署。私有部署的5G企業市場規模將以36.2%的複合年成長率成長,主要成長動力來自工廠、醫院和物流中心等優先考慮確定性服務品質(QoS)的場所。 2024年《數位化世界》的研究預測,到2027年,全球私人5G收入將達到60億美元。這與公共5G形成鮮明對比,後者更適用於那些對覆蓋範圍要求高於低延遲的應用場景。

混合模式也日益受到重視,企業採用公共網路切片處理非敏感流量,同時為機器人和自動導引車 (AGV) 預留園區級微核心網路。中立主機解決方案允許場館所有者共用基礎設施成本,並促進快速多租戶部署。這種方法使營運商無需重新部署整個技術堆疊即可進入新的垂直領域,從而擴大 5G 企業市場的潛在收入來源。

區域分析

北美將在2024年成為最大的區域,佔據37.80%的收入佔有率,這得益於頻譜的早期釋放和充滿活力的系統整合生態系統。在美國,76%的製造商計劃建造專用網路,但近期政策的變化使短期內的熱情下降了11%。一項價值90億美元的公共資金提案旨在將5G寬頻擴展到農村地區,從而擴大基本客群。加拿大也緊隨其後,為工業4.0測試平台提供了強力的獎勵。這些舉措將鞏固北美的領先地位,即使其覆蓋目標日趨成熟。

亞太地區將實現最快成長,到2030年複合年成長率將達到33.5%。中國的5G+智慧工廠專案在提高產能和減少缺陷方面已展現出顯著成效。日本和韓國正利用其長期累積的工業自動化經驗,將5G技術融入現有的精實生產實務。印度電訊業存在超過240萬個技能缺口,政策制定者正透過技能再培訓宣傳活動來解決這個問題。儘管人才短缺,但設備價格的下降正在推動中型企業增加招募。

儘管存在覆蓋盲區,歐洲的整體發展勢頭強勁。德國競標了3.8-4.2 GHz頻段的牌照,業界先驅也開始試用園區網路。歐盟範圍內的協調統一簡化了設備認證流程,但總資本支出七年來首次下降,至579億歐元。開放式無線存取網路(Open RAN)和邊緣雲端計劃吸引了新的參與者,並有助於該領域的多元化發展。全球行動通訊系統協會(GSMA)預計,到2030年,5G將為歐洲GDP貢獻超過1,600億歐元。這些數據證實了歐洲5G領域穩定發展,儘管發展並不均衡。

受沙烏地阿拉伯新頻譜競標的推動,中東和非洲市場正呈現強勁成長勢頭,諾基亞2024年第四季的廠商營收預計將成長9%。拉丁美洲的5G應用仍處於早期階段,但已受益於基於衛星的5G網路在採礦和農業領域的覆蓋範圍。整體而言,全球需求的多元化預計將推動5G企業市場的全面擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 為工業場所釋放免許可/共用頻譜

- 邊緣運算和網路切片實現超低延遲應用

- 智慧製造工廠的工業IoT蓬勃發展

- 淨零排放目標將推動即時節能型私有5G網路的發展。

- 融合 5G 和 TSN 實現棕地確定性控制

- 5G非地面電波網路為企業擴展無縫覆蓋範圍

- 市場限制

- 高昂的資本支出和整合複雜性

- 5G/OT工程師短缺

- 設備認證生態系碎片化

- 地方頻譜法規阻礙跨國擴張

- 價值/供應鏈分析

- 監管環境

- 技術展望

- MEC和5G技術標準分析

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按通訊基礎設施類型

- 5G無線接入網路(RAN)

- 5G核心網

- 傳輸/回程傳輸網路

- 按部署模式

- 專用5G網路

- 公共5G網路

- 混合/共用網路

- 按頻譜許可證類型

- 授權頻譜

- 免授權/共用(CBRS、LAA 等)

- 混合許可

- 按行業

- 資訊科技/通訊

- BFSI

- 離散製造

- 製造程序

- 零售與電子商務

- 衛生保健

- 能源與公共產業

- 運輸與物流

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems

- Ericsson

- Huawei Technologies

- Nokia

- NEC Corporation

- Samsung Electronics

- ZTE Corporation

- Qualcomm

- Intel Corporation

- Hewlett Packard Enterprise(Aruba)

- Dell Technologies

- Juniper Networks

- Mavenir

- Rakuten Symphony

- CommScope

- ATandT

- Verizon Communications

- Deutsche Telekom AG

- Siemens AG

- Fujitsu

第7章 市場機會與未來展望

The 5G Enterprise Market size is estimated at USD 6.73 billion in 2025, and is expected to reach USD 26.02 billion by 2030, at a CAGR of 31.06% during the forecast period (2025-2030).

This expansion springs from enterprises treating 5G as the digital backbone for automation, analytics, and immersive applications. Robust interest in standalone 5G, already offered by 47 mobile operators, is speeding up adoption of features such as network slicing and ultra-reliable low-latency communications. Private deployments and edge architectures are removing performance bottlenecks, while unlicensed and shared spectrum access is lowering entry barriers. Early industrial rollouts show measurable productivity gains, and satellite-5G partnerships now span 43 countries, broadening coverage footprints. Even so, high capital outlays, brown-field integration complexity, and a pronounced shortage of cross-disciplinary 5G/OT talent temper the near-term uptake.

Global 5G Enterprise Market Trends and Insights

Release of Unlicensed/Shared Spectrum Transforms Enterprise Access

Regulators opening mid-band frequencies have made private 5G viable for firms that once shied away from spectrum fees. In the United States, the Citizens Band Radio Service has already supported more than 250,000 industrial device activations, encouraging similar frameworks in Europe's 3.8-4.2 GHz band. Siemens anticipates deployments moving from pilots to scale during 2025 as harmonization progresses. Greater flexibility allows factories, logistics hubs, and energy sites to customize coverage footprints, improving uptime and security. Shared spectrum also stimulates a growing ecosystem of network-in-a-box vendors that package radios, edge cores, and management tools as turnkey kits. The cumulative effect is a wider funnel of prospects entering the 5G enterprise market, accelerating time to revenue for suppliers.

Edge Computing and Network Slicing Redefine Enterprise Architectures

Enterprises are refactoring networks so that latency-sensitive workloads sit within meters of connected assets. Operators such as T-Mobile illustrate the concept through priority slices for first responders. Forty-seven operator groups are now standardizing APIs that expose slice configuration to developers, lowering orchestration effort. Combining dedicated slices with on-premises compute nodes helps manufacturers push decision loops below 1 ms, enabling synchronous robotics and vision inspection. A Wray Castle study indicates network slicing can boost overall spectrum utilisation by 40%. These gains feed directly into OpEx savings, reinforcing the value proposition of private-edge architecture inside the 5G enterprise market.

High CAPEX and Integration Complexity Slow Adoption

Standalone 5G cores, multi-band radios, and industrial gateways can push a mid-sized brown-field deployment into multi-million-dollar territory. A 2024 Kyndryl survey showed many firms deferring projects until they blueprint migration paths for legacy SCADA and MES layers. Open RAN promises vendor diversity yet introduces fresh interoperability testing, as flagged by the Open RAN Integration Playbook. Network-as-a-Service models are emerging to smooth cash-flow peaks by shifting spend from capex to OpEx, but clarity around service-level commitments still varies. This financial and technical inertia trims early growth in segments with razor-thin margins.

Other drivers and restraints analyzed in the detailed report include:

- Industrial IoT Accelerates Manufacturing Transformation

- Net-Zero Mandates Drive Energy-Optimized Deployments

- Scarcity of 5G/OT Engineering Talent Creates Implementation Bottleneck

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 5G Radio Access Network segment generated the largest slice of revenue in 2024 at 36.00%, reflecting its indispensable role in linking endpoints. This foundational investment gave operators and integrators a head starts in monetizing coverage obligations. Rising enterprise need for deterministic performance now shifts attention to cloud-native 5G cores, which are on course for a 32.69% CAGR. The 5G enterprise market size for core solutions is projected to expand sharply as standalone deployments move beyond trials. Network function virtualization lets firms bolt on low-code policy engines, converged charging, and AI-driven assurance, driving higher ARPU per site.

Transport and backhaul, though smaller in absolute terms, are evolving rapidly. Partnerships such as Ericsson with Juniper and ECI Telecom confirm demand for high-capacity packet transport between cell sites and data centers. E-band and emerging W-band links unlock multi-gigabit throughput, complementing fibre in dense industrial parks. These innovations reduce bottlenecks that once throttled remote-vision analytics. As a result, core and transport segments are becoming tightly coupled, expanding their combined wallet share inside the 5G enterprise market.

Private deployments captured 38.30% of revenue in 2024, reinforcing the preference for on-premises control. With a 36.2% CAGR, the 5G enterprise market size for private deployments is set to multiply, led by factories, hospitals, and logistics yards that value deterministic Quality of Service. A 2024 Digitalization World survey forecasts global private-5G revenues at USD 6 billion by 2027. Contrast that with public 5G, which suits use cases where coverage breadth outweighs micro latency needs.

Hybrid models are also standing out. Enterprises employ public slices for non-sensitive traffic while reserving a campus-wide micro-core for robotics or AGVs. Neutral-host solutions enable venue owners to share infrastructure costs, facilitating rapid multi-tenant coverage. This approach helps operators penetrate new verticals without redeploying full stacks, broadening addressable revenue streams across the 5G enterprise market.

The Enterprise 5G Market Report is Segmented by Communication Infrastructure Type (5G Radio Access Networks [RAN], 5G Core Networks, and More), Deployment Mode (Private 5G Networks, Public 5G Networks, and More), Spectrum Licensing Type (Licensed Spectrum, Unlicensed/Shared, and Mixed Licensing), Enterprise Vertical (IT and Telecommunication, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded the largest regional footprint at 37.80% revenue share in 2024, anchored by early spectrum releases and active systems-integration ecosystems. The United States sees 76% of manufacturers planning private networks, though a recent policy shift caused an 11% dip in short-term enthusiasm. Public funding proposals worth USD 9 billion aim to extend 5G broadband into rural zones, which will widen the customer base. Canada follows with strong incentives for Industry 4.0 testbeds. Together, these initiatives reinforce leadership even as North American coverage ambitions mature.

Asia-Pacific is the fastest climber with a 33.5% CAGR through 2030. China's 5G+ Smart Factory programs show quantifiable gains in throughput and defect reduction. Japan and South Korea exploit longstanding industrial automation cultures, layering 5G over existing lean-manufacturing cells. India's telecom-sector skills gap tops 2.4 million workers, which policy makers address via reskilling campaigns lightreading. Despite talent constraints, lower equipment prices bolster adoption among mid-tier enterprises.

Europe retains a solid foothold despite coverage gaps. Germany's auction of 3.8-4.2 GHz licenses directly to industry pioneers expanded campus network pilots. Pan-EU harmonization simplifies device certification, although total capital investment slid for the first time in seven years to EUR 57.9 billion. Open RAN and edge cloud projects attract new entrants, fueling competitive variety. GSMA expects 5G to contribute over EUR 160 billion to European GDP by 2030. These figures underscore steady, if uneven, progression.

The Middle East and Africa witness growing momentum led by Saudi Arabia's fresh spectrum auctions, driving vendor revenue up 9% in Q4 2024 for Nokia. Latin America remains in the early adoption phase but benefits from satellite-backed 5G coverage for mining and agriculture. Collectively, global demand diversity positions the 5G enterprise market for broad-based expansion.

- Cisco Systems

- Ericsson

- Huawei Technologies

- Nokia

- NEC Corporation

- Samsung Electronics

- ZTE Corporation

- Qualcomm

- Intel Corporation

- Hewlett Packard Enterprise (Aruba)

- Dell Technologies

- Juniper Networks

- Mavenir

- Rakuten Symphony

- CommScope

- ATandT

- Verizon Communications

- Deutsche Telekom AG

- Siemens AG

- Fujitsu

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Release of unlicensed/shared spectrum for industrial sites

- 4.2.2 Edge computing and network-slicing enable ultra-low-latency apps

- 4.2.3 Industrial-IoT boom in smart manufacturing plants

- 4.2.4 Net-zero mandates drive real-time energy-optimised private 5G

- 4.2.5 Convergence of 5G and TSN for deterministic control in brown-fields

- 4.2.6 5G non-terrestrial networks extend seamless enterprise coverage

- 4.3 Market Restraints

- 4.3.1 High CAPEX and integration complexity

- 4.3.2 Scarcity of 5G/OT engineering talent

- 4.3.3 Fragmented device-certification ecosystem

- 4.3.4 Local-spectrum rules hinder multi-national roll-outs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 MEC and 5G Technical Standards Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Communication Infrastructure Type

- 5.1.1 5G Radio Access Networks (RAN)

- 5.1.2 5G Core Networks

- 5.1.3 Transport/Backhaul Networks

- 5.2 By Deployment Model

- 5.2.1 Private 5G Networks

- 5.2.2 Public 5G Networks

- 5.2.3 Hybrid/Shared Networks

- 5.3 By Spectrum Licensing Type

- 5.3.1 Licensed Spectrum

- 5.3.2 Unlicensed/Shared (e.g., CBRS, LAA)

- 5.3.3 Mixed Licensing

- 5.4 By Enterprise Vertical

- 5.4.1 IT and Telecommunications

- 5.4.2 BFSI

- 5.4.3 Manufacturing - Discrete

- 5.4.4 Manufacturing - Process

- 5.4.5 Retail and E-commerce

- 5.4.6 Healthcare

- 5.4.7 Energy and Utilities

- 5.4.8 Transportation and Logistics

- 5.4.9 Other Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Cisco Systems

- 6.4.2 Ericsson

- 6.4.3 Huawei Technologies

- 6.4.4 Nokia

- 6.4.5 NEC Corporation

- 6.4.6 Samsung Electronics

- 6.4.7 ZTE Corporation

- 6.4.8 Qualcomm

- 6.4.9 Intel Corporation

- 6.4.10 Hewlett Packard Enterprise (Aruba)

- 6.4.11 Dell Technologies

- 6.4.12 Juniper Networks

- 6.4.13 Mavenir

- 6.4.14 Rakuten Symphony

- 6.4.15 CommScope

- 6.4.16 ATandT

- 6.4.17 Verizon Communications

- 6.4.18 Deutsche Telekom AG

- 6.4.19 Siemens AG

- 6.4.20 Fujitsu

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment