|

市場調查報告書

商品編碼

1851084

印度電動三輪車市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)India Electric Rickshaw - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

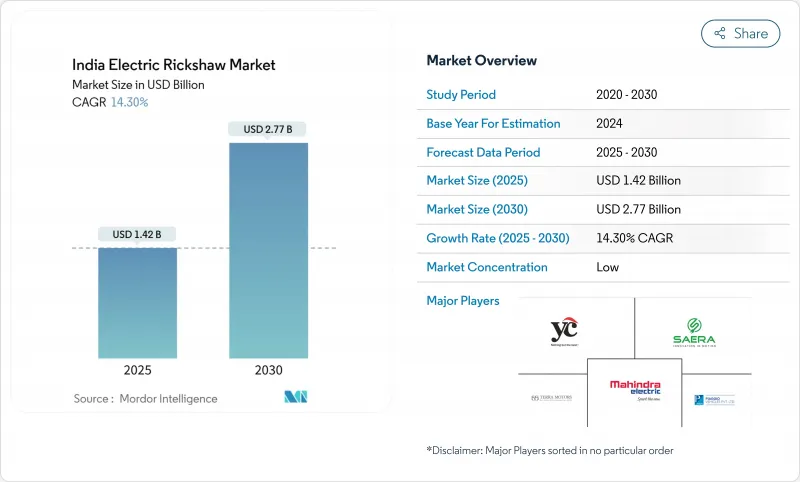

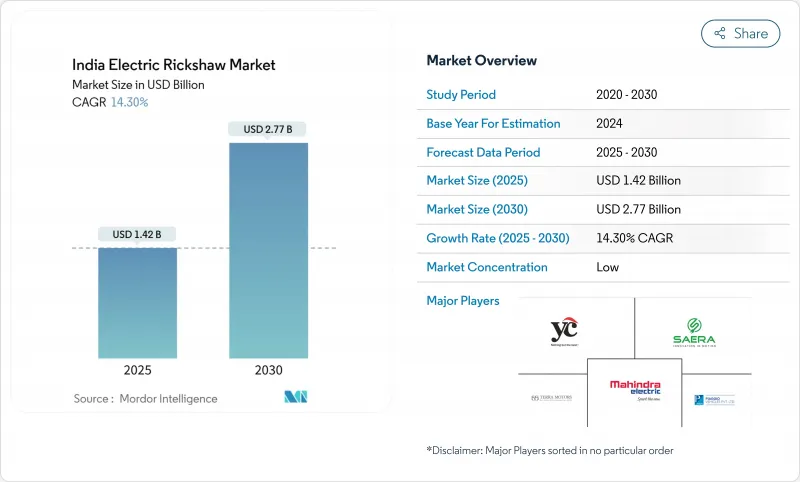

據估計,2025 年印度電動三輪車市場規模為 14.2 億美元,預計到 2030 年將達到 27.7 億美元,預測期(2025-2030 年)複合年成長率為 14.30%。

這項快速擴張反映了政府獎勵、積極的州級政策、不斷成長的電子商務需求以及日益嚴格的都市區空氣品質目標。客運企業的主導地位、鉛酸電池強勁的回收利用經濟效益以及電子商務物流向電動貨運的快速轉型,都支撐著這一成長勢頭。電池化學、模組化融資模式和動力傳動系統效率的同步進步,正將目標市場從一線城市擴展到二線和三線城市。隨著傳統汽車製造商、創新新興企業和全球汽車製造商投入資金和工程人才,試圖抓住下一波成長浪潮,競爭日趨激烈。

印度電動三輪車市場趨勢與洞察

FAME-II 撥款延期和州政府獎勵加速二級標準的採用

聯邦政府在延長的FAME-II計劃和2024年電動出行促進計劃之間保持了政策的連續性,維持了單車補貼不變,降低了主要城市以外地區駕駛員的准入門檻。馬哈拉斯特拉邦、卡納塔克邦和德里等邦政府提供的購車補貼和道路稅減免等激勵措施進一步降低了成本,使電動三輪車在銷售時能夠與燃油車型在價格上競爭。補貼力道與註冊量密切相關,邦政府補貼力道每增加一個標準差,銷售量就會增加46.16%。當地金融機構報告稱,貸款回收期縮短,鼓勵了更廣泛的信貸參與。這些綜合財政支持措施進一步推動印度電動三輪車市場進入對成本敏感的二線叢集,該市場非正式的轉換需求正在激增。

快速都市化城市對最後一公里共用出行的需求日益成長

印度不斷擴張的中型城市網路嚴重依賴電動三輪車來彌合公共交通的「最後一公里」和「首公里」差距。與汽油或CNG車輛每公里3-4盧比的營運成本相比,電動車的營運成本更低,每公里僅需0.50-0.70盧比,這使得車主能夠快速獲利。優步(Uber)和Rapido等共用出行平台正在引入電動三輪車,以滿足市政清潔空氣標準和乘客對價格的敏感度。高日利用率放大了燃料成本套利空間,加快了高額前期投資的報酬。便利的數位化預訂提高了資產利用率,進一步提升了營運商的獲利能力,並推動了印度電動三輪車市場的整體普及。

分散且非正式的融資管道阻礙了駕駛員的購買意願。

由於缺乏充足的貸款管道,實際利率高企,貸款價值比低,這阻礙了依賴每日車費收入維持生計的獨立司機購買電動三輪車的意願。對技術風險的擔憂導致許多金融機構將電動三輪車視為非標準資產,儘管其運作成本低廉,但貸款能力受到限制。非正規貸款機構填補了這一空白,但收取高額利息,抵消了電動三輪車的整體擁有成本優勢。發展金融機構一直倡導建立混合融資池以降低零售貸款風險,但在主要城市以外的地區,這種模式的推廣仍然緩慢。在主流銀行規範電動三輪車貸款業務之前,在對前期投資和價格分佈最敏感的細分市場,電動三輪車的成長可能仍將低於預期。

細分市場分析

目前,客運領域在印度電動三輪車市場佔據主導地位,預計2024年將佔總銷售量的83.92%,鞏固了其作為城市共享出行支柱的地位。密集的城市路線和全天候的使用使得駕駛員能夠以每公里僅1元的能源成本營運,增強了該領域的韌性。然而,隨著線上零售推動對輕便、零排放「最後一公里」配送的需求,貨運電動三輪車的複合年成長率(CAGR)高達29.44%,成為成長最快的領域。亞馬遜印度、Flipkart和其他電商平台正在與現有原始設備製造商(OEM)建立規範的採購管道,確保銷售量的穩定成長。冷藏車等細分市場拓展了食品配送和醫藥領域的市場潛力。不斷提升的有效負載容量和遠端資訊處理技術的整合,使貨運電動三輪車成為未來城市物流藍圖的重要組成部分。

從絕對數量來看,搭乘用型仍將主導印度電動三輪車市場,但由於高階配置的推出,貨運車型的價值貢獻有望穩步成長。針對商用車的稅收優惠以及二線城市微型倉配中心的建設,可望提升貨運車型的累積滲透率。隨著城市堵塞費的日益嚴格,貨運公司可能會更傾向於選擇電動三輪車而非輕型卡車,從而鞏固該細分市場的長期成長趨勢。

以功率輸出計算,1-1.5kW馬達將佔據印度電動三輪車市場佔有率的54.35%,預計到2024年將達到這一比例。此功率頻寬非常適合典型的乘客出行,能夠提供充足的扭矩,滿足頻繁啟動的城市駕駛需求,同時還能延長電池壽命。營運商尤其青睞提案經濟實惠的初始成本和實用的續航里程,尤其是在都市區高強度營運的情況下。

同時,印度電動三輪車市場中,功率超過1.5kW的動力傳動系統成長最為迅猛,年複合成長率高達32.12%,這主要得益於市場對負載容量和更高爬坡能力的需求不斷成長。此細分市場受益於電力驅動橋技術的進步,例如整合式馬達控制器和IP防護等級機殼,這些技術提高了車輛在印度惡劣季風氣候條件下的耐用性,並提升了車隊的可靠性。

高功率的車型迎合了高階叫車市場的需求,該市場需要運輸冷藏貨物、應對更陡峭的坡道以及更快的周轉時間。零件供應商正逐步實現磁鐵和定子的本地化生產,從而減少進口並穩定價格分佈。隨著單車經濟效益的提升,預計印度1.5kW以上功率等級的電動三輪車市場規模將擴大,市場佔有率也將隨之成長,並催生以性能而非成本為核心的全新競爭格局。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- FAME-II 撥款延期和州政府獎勵加速二級標準的採用

- 快速都市化城市對最後一公里共用出行的需求日益成長

- 電子商務物流引進電動三輪車進行市內配送

- 降低整體擁有成本的鉛酸電池回收生態系統

- 電池即服務訂閱模式降低了前期投資。

- 2030年,德里-NCR地區將強制逐步淘汰內燃機三輪車

- 市場限制

- 分散且非正式的資金籌措管道限制了駕駛員的購買。

- 鄉村道路上底盤完整性的安全隱患

- 非正規鉛酸電池供應鏈中的品質差異

- 可更換電池標準的緩慢推廣阻礙了互通性

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按車輛類型

- 客運公司

- 貨運代理

- 透過輸出

- 小於1千瓦

- 1~1.5 kW

- 1.5千瓦或以上

- 依電池類型

- 鉛酸

- 鋰離子(NMC/NCA)

- 鋰離子電池(LFP)

- 其他化學物質(鋰聚合物、鎳氫化物)

- 按電池容量

- 小於3千瓦時

- 3~6 kWh

- 6度或以上

- 透過充電模式

- 插電式充電

- 更換電池

- 自有車型

- 私人車主司機

- 車隊營運商

- 聚合器/出行即服務平台

- 按州

- 北方邦

- 德里

- 馬哈拉斯特拉邦

- 比哈爾邦

- 拉賈斯坦邦

- 卡納塔克邦

- 泰米爾納德邦

- 旁遮普邦

- 特倫甘納邦

- 印度其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Terra Motors India Corp.

- Piaggio Vehicles Pvt. Ltd.

- Mahindra Electric Mobility Ltd.

- Kinetic Green Energy & Power Solutions Ltd.

- ATUL Auto Ltd.

- Saera Electric Auto Pvt. Ltd.

- YC Electric Vehicle

- Goenka Electric Motor Vehicles Pvt. Ltd.

- Udaan E-Rickshaw

- Thukral Electric Bikes

- Mini Metro EV LLP

- E-Ashwa Automotive Pvt. Ltd.

- CityLife EV

- Adapt Motors Pvt. Ltd.

- Vani Electric Vehicles Pvt. Ltd.(Jezza Motors)

- Omega Seiki Mobility

- Euler Motors

- Lohia Auto Industries

- Bajaj Auto Ltd.(Electric 3W Division)

- Altigreen Propulsion Labs

- Gayam Motor Works

- Lectrix EV

- Saarthi E-Rickshaw

第7章 市場機會與未來展望

The Indian electric rickshaw market size is estimated at USD 1.42 billion in 2025, and is expected to reach USD 2.77 billion by 2030, at a CAGR of 14.30% during the forecast period (2025-2030).

This rapid expansion reflects government incentives, aggressive state-level policies, growing e-commerce demand, and heightened urban air-quality goals. Passenger carrier dominance, strong recycling economics for lead-acid batteries, and the swift pivot of e-commerce logistics toward electric cargo variants are sustaining volume momentum. Parallel advances in battery chemistry, modular finance models, and power-train efficiency are widening the total addressable base beyond Tier-I metros into Tier-II and Tier-III towns. Competitive rivalry intensifies as legacy OEMs, innovative start-ups, and global automakers commit capital and engineering talent to capture the next wave of growth.

India Electric Rickshaw Market Trends and Insights

FAME-II Subsidy Extension and State Incentives Accelerating Tier-II Adoption

Federal continuity between the extended FAME-II program and the Electric Mobility Promotion Scheme 2024 keeps per-vehicle subsidies intact, lowering acquisition cost barriers for drivers outside major metros. State top-ups-ranging from purchase rebates to road-tax waivers in Maharashtra, Karnataka, and Delhi-stack further savings, making electric three-wheelers price-competitive with ICE models at the point of sale. Subsidy density correlates strongly with registrations; assessments reveal a 46.16% sales uplift for each standard-deviation rise in state support intensity. Local financiers report shorter payback periods, encouraging broader credit participation. Combined, these fiscal levers push the Indian electric three-wheeler market deeper into cost-sensitive Tier-II clusters where informal transit demand is surging.

Rising Demand for Last-Mile Shared Mobility in Rapidly Urbanising Towns

India's expanding network of mid-sized cities relies heavily on auto-rickshaws to bridge first- and last-mile gaps in public transit. Electric variants cut running expenses to INR 0.50-0.70/km against INR 3-4/km for petrol or CNG, creating immediate earnings upside for owner-drivers. Shared-mobility aggregators such as Uber and Rapido are onboarding e-rickshaws to meet municipal clean-air mandates and rider price sensitivity. High daily utilization amplifies fuel-cost arbitrage, accelerating payback on the higher upfront purchase. Seamless digital booking elevates asset productivity, further reinforcing operator economics and boosting adoption across the Indian electric three-wheeler market.

Fragmented & Informal Financing Channels Constraining Driver Purchases

The lack of scale credit pipelines keeps effective interest rates high and loan-to-value ratios low, dampening uptake among independent drivers whose livelihood depends on daily fare receipts. Technology-risk perceptions lead many lenders to treat electric variants as non-standard assets, constricting credit lines despite lower running costs. Informal money-lenders bridge the gap but charge punitive rates, eroding total cost of ownership benefits. Development-finance institutions advocate blended-finance pools to de-risk retail lending, yet implementation remains slow outside major cities. Until mainstream banks normalize underwriting for electric three-wheelers, growth will undershoot potential in segments most sensitive to up-front affordability.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce Logistics Embracing Cargo E-Rickshaws for Intra-City Delivery

- Lead-Acid Battery Recycling Ecosystem Lowering Total Cost of Ownership

- Safety Concerns Over Chassis Integrity on Rural Roads

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

India electric rickshaw market share is currently dominated by the passenger carrier segment, which accounted for 83.92% of unit sales in 2024, cementing its role as the backbone of intra-city shared mobility. Dense urban routes and all-day utilization let drivers exploit penny-per-kilometer energy costs, reinforcing segment resilience. Goods carriers, however, are registering the fastest 29.44% CAGR as online retail pushes demand for nimble, emissions-free last-mile delivery. Amazon India, Flipkart, and quick-commerce players are formalizing procurement pipelines with established OEMs, ensuring predictable volume growth. Segment-specific designs such as refrigerated bodies widen addressable markets in food distribution and pharmaceuticals. Higher payload ratings and telematics integration make cargo e-rickshaws an essential piece of future city-logistics blueprints.

In absolute volume terms, passenger variants will continue to dominate the Indian electric three-wheeler market, yet the value contribution from cargo units will rise steadily through premium specification mixes. Tax breaks for commercial vehicles and dedicated micro-fulfillment hubs in Tier-II cities will push cumulative cargo penetration higher. As urban congestion charges tighten, freight operators will prefer electric three-wheelers over light trucks, cementing the segment's long-term upside.

India electric rickshaw market share by power output was led by the 1-1.5 kW motor segment, which accounted for 54.35% of total demand in 2024. This power band delivers sufficient torque for frequent stop-start city driving while conserving battery life, making it ideal for typical passenger operations. Operators value its balanced offering-affordable upfront cost with practical range-especially in high-usage urban duty cycles.

In contrast, powertrains rated above 1.5 kW are witnessing the fastest growth in the India electric rickshaw market, expanding at a 32.12% CAGR as payload demands and gradient-handling requirements rise. The segment is benefiting from advancements in e-axle technologies, including integrated motor controllers and IP-rated enclosures, which enhance durability during India's heavy monsoon conditions and boost fleet confidence.

The higher-powered bracket supports refrigerated cargo, steep-gradient hill-stations, and premium ride-hailing tiers that demand faster trip times. Component suppliers are localizing magnets and stators, cutting imported content and stabilizing price points. As unit economics improve, the Indian electric three-wheeler market size for the above-1.5 kW class is projected to widen its revenue share, ushering in a new competitiveness layer focused on performance rather than solely cost.

The India Electric Rickshaw Market Report is Segmented by Vehicle Type (Passenger Carriers and More), Power Output ( Up To 1 KW and More), Battery Type (Lead-Acid and More), Battery Capacity (Up To 3 KWh and More), Charging Mode (Plug-In Charging and More), Ownership Model (Individual Owner-Drivers and More), and States (Uttar Pradesh, Delhi, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Terra Motors India Corp.

- Piaggio Vehicles Pvt. Ltd.

- Mahindra Electric Mobility Ltd.

- Kinetic Green Energy & Power Solutions Ltd.

- ATUL Auto Ltd.

- Saera Electric Auto Pvt. Ltd.

- YC Electric Vehicle

- Goenka Electric Motor Vehicles Pvt. Ltd.

- Udaan E-Rickshaw

- Thukral Electric Bikes

- Mini Metro EV LLP

- E-Ashwa Automotive Pvt. Ltd.

- CityLife EV

- Adapt Motors Pvt. Ltd.

- Vani Electric Vehicles Pvt. Ltd. (Jezza Motors)

- Omega Seiki Mobility

- Euler Motors

- Lohia Auto Industries

- Bajaj Auto Ltd. (Electric 3W Division)

- Altigreen Propulsion Labs

- Gayam Motor Works

- Lectrix EV

- Saarthi E-Rickshaw

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 FAME-II Subsidy Extension and State Incentives Accelerating Tier-II Adoption

- 4.2.2 Rising Demand for Last-Mile Shared Mobility in Rapidly Urbanising Towns

- 4.2.3 E-Commerce Logistics Embracing Cargo E-Rickshaws for Intra-City Delivery

- 4.2.4 Lead-Acid Battery Recycling Ecosystem Lowering Total Cost of Ownership

- 4.2.5 Battery-as-a-Service Subscription Models Reducing Up-front Capex

- 4.2.6 Mandatory Phase-Out of ICE Three-Wheelers in Delhi-NCR by 2030

- 4.3 Market Restraints

- 4.3.1 Fragmented & Informal Financing Channels Constraining Driver Purchases

- 4.3.2 Safety Concerns Over Chassis Integrity on Rural Roads

- 4.3.3 Quality Variability in Unorganised Lead-Acid Battery Supply Chain

- 4.3.4 Slow Roll-Out of Swappable Battery Standards Hindering Interoperability

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Carriers

- 5.1.2 Goods Carriers

- 5.2 By Power Output

- 5.2.1 Up to 1 kW

- 5.2.2 1 - 1.5 kW

- 5.2.3 Above 1.5 kW

- 5.3 By Battery Type

- 5.3.1 Lead-Acid

- 5.3.2 Lithium-ion (NMC/NCA)

- 5.3.3 Lithium-ion (LFP)

- 5.3.4 Other Chemistries (Li-Polymer, Ni-MH)

- 5.4 By Battery Capacity

- 5.4.1 Up to 3 kWh

- 5.4.2 3 - 6 kWh

- 5.4.3 Above 6 kWh

- 5.5 By Charging Mode

- 5.5.1 Plug-in Charging

- 5.5.2 Battery Swapping

- 5.6 By Ownership Model

- 5.6.1 Individual Owner-Drivers

- 5.6.2 Fleet Operators

- 5.6.3 Aggregators / MaaS Platforms

- 5.7 By State

- 5.7.1 Uttar Pradesh

- 5.7.2 Delhi

- 5.7.3 Maharashtra

- 5.7.4 Bihar

- 5.7.5 Rajasthan

- 5.7.6 Karnataka

- 5.7.7 Tamil Nadu

- 5.7.8 Punjab

- 5.7.9 Telangana

- 5.7.10 Rest of India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Terra Motors India Corp.

- 6.4.2 Piaggio Vehicles Pvt. Ltd.

- 6.4.3 Mahindra Electric Mobility Ltd.

- 6.4.4 Kinetic Green Energy & Power Solutions Ltd.

- 6.4.5 ATUL Auto Ltd.

- 6.4.6 Saera Electric Auto Pvt. Ltd.

- 6.4.7 YC Electric Vehicle

- 6.4.8 Goenka Electric Motor Vehicles Pvt. Ltd.

- 6.4.9 Udaan E-Rickshaw

- 6.4.10 Thukral Electric Bikes

- 6.4.11 Mini Metro EV LLP

- 6.4.12 E-Ashwa Automotive Pvt. Ltd.

- 6.4.13 CityLife EV

- 6.4.14 Adapt Motors Pvt. Ltd.

- 6.4.15 Vani Electric Vehicles Pvt. Ltd. (Jezza Motors)

- 6.4.16 Omega Seiki Mobility

- 6.4.17 Euler Motors

- 6.4.18 Lohia Auto Industries

- 6.4.19 Bajaj Auto Ltd. (Electric 3W Division)

- 6.4.20 Altigreen Propulsion Labs

- 6.4.21 Gayam Motor Works

- 6.4.22 Lectrix EV

- 6.4.23 Saarthi E-Rickshaw

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment