|

市場調查報告書

商品編碼

1851066

受眾分析:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Audience Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

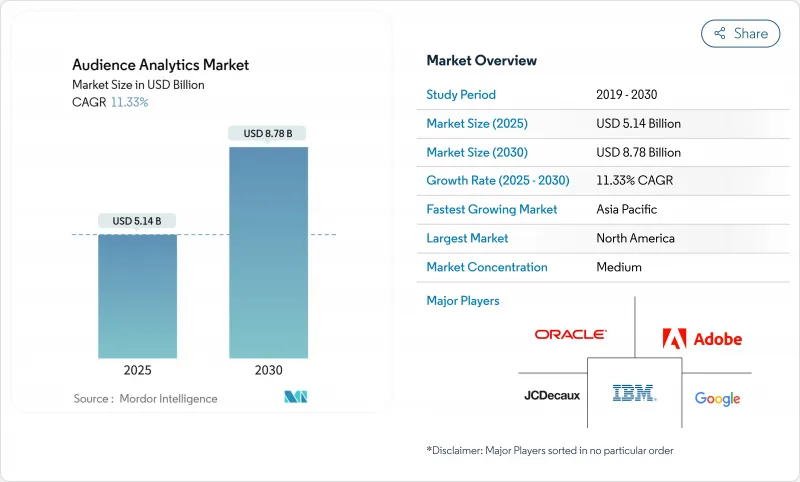

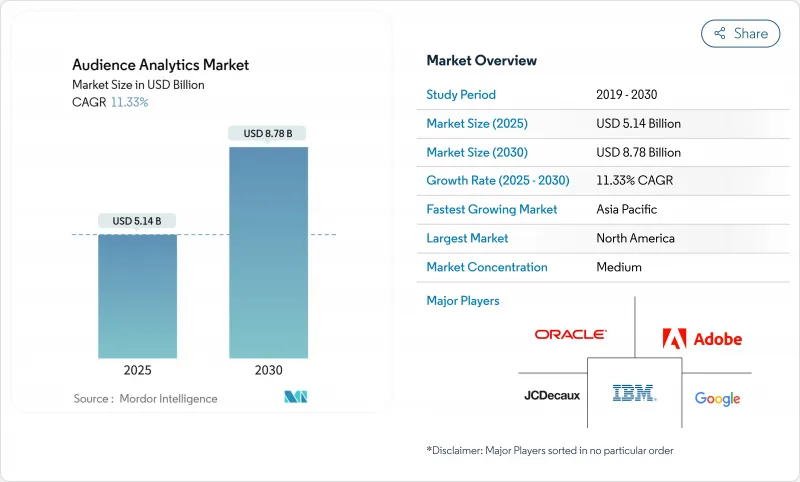

預計到 2025 年,受眾分析市場規模將達到 51.4 億美元,到 2030 年將達到 87.8 億美元,年複合成長率為 11.3%。

對基於用戶許可的身份解析、強大的AI套件以及零售媒體網路中第一方數據快速變現的需求日益成長,正在推動這一領域的擴張。企業正擴大採用基於邊緣的即時分析技術,在用戶互動點產生可執行的洞察,同時保護用戶隱私。儘管解決方案仍然是最大的收入來源,但隨著企業尋求擴充性和成本最佳化,雲端原生服務正以最快的速度成長。同時,儘管大型企業佔據了支出主導地位,但降低高階分析進入門檻的無程式碼介面和基於使用量的定價模式正在加速中小企業採用這些技術。

全球受眾分析市場趨勢與洞察

全通路第一方資料收集正在蓬勃發展

品牌正圍繞自有互動點重建資料架構,整合來自店內行為、行動裝置互動和連網裝置的訊號。零售商如今經營著複雜的媒體網路,將線上線下體驗無縫銜接,從而開闢了曾經由第三方數據仲介主導的、以美元為單位的收入管道。整合線上線下洞察的能力提升了客戶終身價值建模水平,並提高了客戶細分的精確度。

利用人工智慧/機器學習進行預測分析的快速普及

如今,機器學習演算法已在主流平台上為行為建模、轉換預測和自動用戶群組創建提供支援。 Google Analytics 4 和 Adobe Experience Cloud 展示的 AI 引擎可將預測準確率提高 30% 以上,同時將洞察延遲從數週縮短至數分鐘。雲端傳輸使這些功能得以惠及先前受制於基礎設施成本和人才短缺的中型企業。

日益注重隱私的監管

GDPR、CPRA 和《數位市場法案》迫使企業重組資料流,通常需要將 15% 到 20% 的分析預算用於合規工作。諸如無 cookie 網路分析之類的隱私權保護解決方案,既能減少對個人識別資訊的依賴,又能維持行為洞察的品質。供應商正在大力推廣情境定向和邊緣處理技術,以平衡法規要求和商業性目標。

細分市場分析

解決方案仍將是受眾分析市場的支柱,預計到 2024 年將佔總收入的 67.8%。這些解決方案包括資料整合中心、客戶資料平台和人工智慧推理引擎,能夠實現跨通路洞察。企業需要對可擴展的基礎設施進行大量前期投資,承擔高昂的轉換成本,並建立強大的供應商關係。然而,身分解析、模型管治和合規性審核方面的外包專業知識將推動服務以 12.7% 的複合年成長率成長。託管服務能夠實現持續最佳化並彌補資料工程人才缺口,從而提高整體計劃成功率。

分析即服務 (AaaS) 的興起標誌著策略模式正從永久授權轉向基於使用量的合約。顧問公司和系統整合商正在將諮詢支援服務整合到其技術堆疊中,使業務目標能夠驅動實施方案的選擇。日益嚴格的隱私保護條例正在推高諸如同意管理和邊緣配置等專業服務的定價,加速收入結構向經常性專業支援的轉變。

到2024年,本地部署系統將佔據受眾分析市場65.8%的佔有率,這反映出人們對高容量串流分析中資料主權和延遲問題的持續擔憂。銀行和政府機構等行業依賴自託管平台來保護敏感的個人識別資訊。然而,隨著供應商推出區域性加密、主權雲端選項和高級合規認證,雲端實例將以13.1%的複合年成長率成長。 Adobe和AWS共同推出的雲端解決方案是專為即時客戶畫像量身訂製的解決方案。

混合架構正逐漸成為主流模式,它將關鍵客戶畫像保留在本地,同時將運算密集型工作負載遷移到雲端。這不僅降低了基礎設施資本支出,也為季節性宣傳活動和突發資料擷取提供了彈性處理能力。隨著人們對公共雲端安全性的信心日益增強,預計從2030年起,基於雲端的受眾分析市場規模將超過本地部署市場的收入。

受眾分析市場報告按組件(解決方案和服務)、部署類型(本地部署和雲端部署)、組織規模(大型企業和中小企業)、應用程式(銷售和行銷最佳化、客戶體驗管理等)、最終用戶垂直行業(媒體和娛樂、零售和電子商務等)以及地區進行細分。

區域分析

北美地區預計到2024年將佔全球收入的40.3%,這得益於其成熟的廣告生態系統、巨額技術投資以及對隱私優先工具的早期應用。在美國,沃爾瑪和塔吉特等零售商在零售媒體產生收入處於領先地位,而加拿大則受益於進步的隱私法,這些法律引導企業採用合規的分析架構。墨西哥的電子商務普及率正在加速成長,可擴展的雲端洞察引擎的用戶群也不斷擴大。

在GDPR和數位市場法規的推動下,歐洲正處於穩步成長階段,這帶動了對基於用戶許可、最大限度減少個人資料依賴的解決方案的需求。德國和英國正在支援邊緣處理試點項目,以確保資料本地化並降低跨境傳輸的複雜性。法國和義大利正在探索情境導向技術,以維持廣告效率。能夠與多種身分框架互通的獨立供應商正在吸引尋求靈活合規性的中端市場用戶。

亞太地區是成長最快的區域,年複合成長率高達12.2%,這得益於其8,800億美元的行動經濟規模和18億行動用戶。中國在社群商務分析領域處於領先地位,將影片、通訊和支付融合在一起,打造精細的即時洞察流。印度的金融科技蓬勃發展,交易資料集不斷擴大;日本和韓國則將受眾分析融入遊戲生態系統,以最佳化用戶留存率。澳洲和紐西蘭正在採用企業分析來支援全通路零售和公共服務的現代化。在東南亞,智慧型手機普及率的不斷提高和政府數位化政策的推進,進一步推動了市場需求,鞏固了受眾分析市場的長期發展勢頭。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全通路第一方資料收集的快速成長

- 快速採用人工智慧/機器學習驅動的預測分析

- 媒體和娛樂產業轉向即時受眾貨幣化

- 無 Cookie 行銷推動了對基於使用者授權的身份圖譜的需求

- 零售媒體網路拓展第一方消費者洞察

- 利用設備端邊緣分析實現隱私保護洞察

- 市場限制

- 加強隱私優先法規(GDPR、CPRA、DMA)

- 中小企業用戶缺乏數據工程技能

- Petabyte級分析工作負載的雲端運算成本不斷上漲

- 碎片化的身份解決方案阻礙了互通性

- 價值鏈分析

- 技術展望

- 監管環境

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 服務

- 透過部署模式

- 本地部署

- 雲

- 按公司規模

- 主要企業

- 中小企業

- 透過使用

- 銷售和行銷最佳化

- 客戶體驗管理

- 競爭/媒體訊息

- 產品和內容開發

- 詐欺和風險分析

- 按最終用戶行業分類

- 媒體與娛樂

- 零售與電子商務

- BFSI

- 電訊和資訊技術

- 醫療保健與生命科學

- 政府和公共部門

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Adobe Inc.

- Oracle Corporation

- Google LLC

- International Business Machines Corp.

- comScore, Inc.

- SAS Institute Inc.

- Microsoft Corp.

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Nielsen Holdings Plc

- JCDecaux Group

- Akamai Technologies, Inc.

- Cxense ASA

- Meltwater

- Audiense Ltd.

- Upwave

- Mixpanel, Inc.

- Amplitude, Inc.

- Chartbeat, Inc.

- Piwik PRO

第7章 市場機會與未來展望

The audience analytics market stands at USD 5.14 billion in 2025 and is expected to reach USD 8.78 billion by 2030, advancing at an 11.3% CAGR.

Heightened demand for consent-based identity resolution, powerful AI toolkits, and the rapid monetisation of first-party data in retail media networks underpin this expansion. Organisations increasingly deploy real-time, edge-based analytics that protect privacy while generating actionable insights at the point of engagement. Solutions remain the largest revenue contributor, yet cloud-native services record the quickest growth as firms seek scalability and cost optimisation. Meanwhile, large enterprises dominate spending, but small and medium enterprises accelerate adoption thanks to no-code interfaces and consumption-based pricing models that lower entry barriers to sophisticated analytics.

Global Audience Analytics Market Trends and Insights

Rapid Growth in Omnichannel First-Party Data Collection

Brands are rebuilding data architectures around owned interaction points, integrating in-store behaviour, mobile engagement, and connected-device signals. Retailers now operate sophisticated media networks that align physical and digital journeys, opening USD-level revenue channels once dominated by third-party data brokers. The ability to merge offline and online insights improves lifetime value modelling and elevates segmentation precision.

Surging Adoption of AI/ML-Powered Predictive Analytics

Machine-learning algorithms now underpin behavioural modelling, conversion prediction, and automated cohort creation across mainstream platforms. Google Analytics 4 and Adobe Experience Cloud showcase AI engines that slash insight latency from weeks to minutes while improving forecast accuracy by more than 30%. Cloud delivery makes these functions accessible to mid-market firms previously constrained by infrastructure costs and talent shortages.

Increasing Privacy-First Regulation

GDPR, CPRA, and the Digital Markets Act compel firms to re-engineer data flows, often diverting 15-20% of analytics budgets to compliance efforts. Privacy-preserving solutions, such as cookieless web analytics, reduce dependence on personal identifiers while sustaining behavioural insight quality. Vendors tout contextual targeting and edge processing to balance regulatory demands with commercial goals.

Other drivers and restraints analyzed in the detailed report include:

- Media and Entertainment Shift to Real-Time Audience Monetisation

- Cookieless Marketing Pushes Demand for Consent-Based Identity Graphs

- Data-Engineering Skill Shortages Among SME Users

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 67.8% of 2024 revenue and remain the backbone of the audience analytics market. They comprise data-integration hubs, customer data platforms, and AI inference engines that enable cross-channel insight generation. Organisations invest heavily at the outset in scalable infrastructures, creating high switching costs and entrenched vendor relationships. Services, however, achieve a 12.7% CAGR as firms outsource expertise in identity resolution, model governance, and compliance auditing. Managed offerings deliver continuous optimisation and bridge the data-engineering talent gap, elevating overall project success rates.

The rise of analytics-as-a-service signals a strategic shift from perpetual licences to consumption-based engagements. Consultancies and system integrators package technology stacks with advisory support, ensuring business objectives drive implementation choices. As privacy regulation tightens, specialised services in consent management and edge deployment command premium pricing, accelerating the revenue mix transition toward recurring professional support.

On-premises systems held 65.8% of the audience analytics market share in 2024, reflecting enduring concerns over data sovereignty and latency for high-volume streaming analyses. Sectors such as banking and government rely on self-hosted platforms to retain sensitive personally identifiable information. Nevertheless, cloud instances grow at a 13.1% CAGR as vendors implement region-specific encryption, sovereign-cloud options, and advanced compliance certifications. Adobe's joint offering with AWS exemplifies tailored cloud solutions for real-time customer profiling.

Hybrid architectures surface as the prevailing model, retaining golden customer profiles on-premises while bursting compute-intensive workloads to the cloud. This arrangement curbs infrastructure capital expenditure and unlocks elastic processing for seasonal campaigns and sudden surges in data ingestion. The audience analytics market size represented by cloud deployments is forecast to overtake on-premises revenue in the post-2030 horizon as confidence in public-cloud security matures.

The Audience Analytics Market Report is Segmented by Component (Solutions and Services), Deployment Mode (On-Premises and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Application (Sales and Marketing Optimisation, Customer Experience Management, and More), End-User Industry (Media and Entertainment, Retail and ECommerce, and More), and Geography.

Geography Analysis

North America held 40.3% revenue in 2024, anchored by a sophisticated advertising ecosystem, heavy technology investment, and early adoption of privacy-first tools. United States retailers such as Walmart and Target lead in retail media revenue generation, while Canada benefits from progressive privacy laws that nudge firms toward compliant analytics architectures. Mexico's accelerating e-commerce adoption widens the regional user base for scalable, cloud-delivered insight engines.

Europe sits in a steady growth phase shaped by GDPR and the Digital Markets Act, which elevate demand for consent-based solutions that minimise personal data dependence. Germany and the United Kingdom endorse edge-processing pilots that keep data resident, reducing cross-border transfer complexity. France and Italy explore contextual targeting to maintain advertising efficiency. Independent vendors that can interoperate across multiple identity frameworks attract mid-market adopters seeking flexible compliance.

Asia-Pacific is the fastest-growing region at a 12.2% CAGR, supported by a USD 880 billion mobile economy and 1.8 billion mobile subscribers. China pioneers social commerce analytics that blend video, messaging, and payments, creating granular, real-time insight streams. India's fintech boom expands transactional datasets, while Japan and South Korea integrate audience analytics into gaming ecosystems to optimise retention. Australia and New Zealand embrace enterprise analytics to support omnichannel retail and public-service modernisation. Rising smartphone penetration and government digital initiatives propel additional demand across Southeast Asia, reinforcing long-term momentum for the audience analytics market.

- Adobe Inc.

- Oracle Corporation

- Google LLC

- International Business Machines Corp.

- comScore, Inc.

- SAS Institute Inc.

- Microsoft Corp.

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Nielsen Holdings Plc

- JCDecaux Group

- Akamai Technologies, Inc.

- Cxense ASA

- Meltwater

- Audiense Ltd.

- Upwave

- Mixpanel, Inc.

- Amplitude, Inc.

- Chartbeat, Inc.

- Piwik PRO

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth in omnichannel first-party data collection

- 4.2.2 Surging adoption of AI/ML-powered predictive analytics

- 4.2.3 Media and entertainment shift to real-time audience monetisation

- 4.2.4 Cookieless marketing pushes demand for consent-based identity graphs

- 4.2.5 Retail media networks scaling first-party shopper insights

- 4.2.6 Edge analytics on devices enabling privacy-preserving insights

- 4.3 Market Restraints

- 4.3.1 Increasing privacy-first regulation (GDPR, CPRA, DMA)

- 4.3.2 Data-engineering skill shortages among SME users

- 4.3.3 Rising cloud-compute costs for petabyte-scale analytics workloads

- 4.3.4 Fragmentation of identity solutions hinders interoperability

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.3 By Organisation Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Application

- 5.4.1 Sales and Marketing Optimisation

- 5.4.2 Customer Experience Management

- 5.4.3 Competitive/Media Intelligence

- 5.4.4 Product and Content Development

- 5.4.5 Fraud and Risk Analytics

- 5.5 By End-user Industry

- 5.5.1 Media and Entertainment

- 5.5.2 Retail and eCommerce

- 5.5.3 BFSI

- 5.5.4 Telecom and IT

- 5.5.5 Healthcare and Life Sciences

- 5.5.6 Government and Public Sector

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 Oracle Corporation

- 6.4.3 Google LLC

- 6.4.4 International Business Machines Corp.

- 6.4.5 comScore, Inc.

- 6.4.6 SAS Institute Inc.

- 6.4.7 Microsoft Corp.

- 6.4.8 Amazon Web Services, Inc.

- 6.4.9 Salesforce, Inc.

- 6.4.10 Nielsen Holdings Plc

- 6.4.11 JCDecaux Group

- 6.4.12 Akamai Technologies, Inc.

- 6.4.13 Cxense ASA

- 6.4.14 Meltwater

- 6.4.15 Audiense Ltd.

- 6.4.16 Upwave

- 6.4.17 Mixpanel, Inc.

- 6.4.18 Amplitude, Inc.

- 6.4.19 Chartbeat, Inc.

- 6.4.20 Piwik PRO

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment