|

市場調查報告書

商品編碼

1851064

智慧財產權管理軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Intellectual Property Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

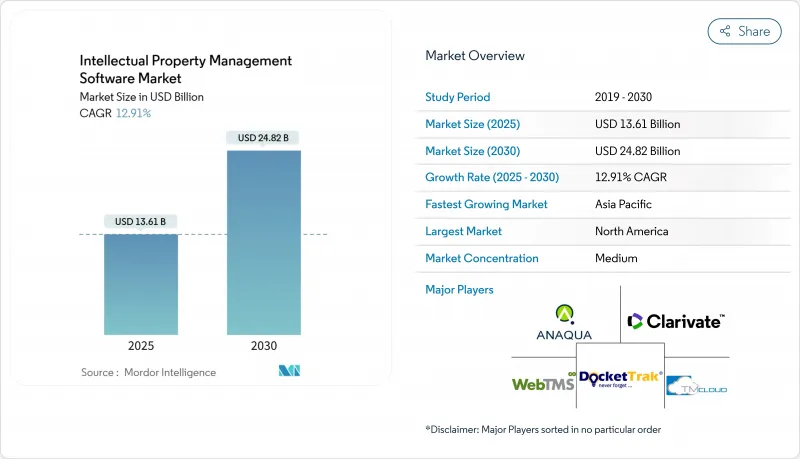

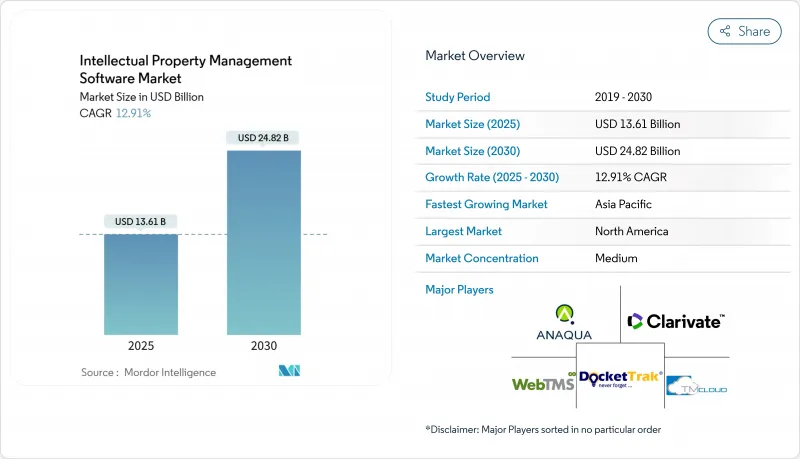

預計到 2025 年,智慧財產權管理軟體市場規模將達到 136.1 億美元,到 2030 年將達到 248.2 億美元,複合年成長率為 12.91%。

對人工智慧驅動的專利分析、符合ESG標準的智慧財產權估值工具以及跨境監控模組日益成長的需求正在重塑該平台的功能藍圖。這項新功能的推出恰逢德國專利商標局記錄的2024年國內專利申請量成長4%,顯示核心技術領域對創新的持續需求。諸如美國半導體訴訟、印度的加速審查計畫以及世界智慧財產權組織(WIPO)中小企業的智慧財產權管理診所等政策獎勵,正在擴大智慧財產權管理軟體市場的潛在用戶群。儘管供應商整合速度仍然緩慢,但大型策略買家和私募股權基金正在投入新資金收購專注於分析的資產,這些資產能夠加快企業用戶實現價值的速度。

全球智慧財產權管理軟體市場趨勢與洞察

人工智慧專利分析技術的應用推動北美地區套件升級

北美企業正從簡單的專利對接轉向預測性專利格局分析,這種分析融合了大規模語言模型搜尋、自動撰寫和自由實施檢查。美國專利商標局 (USPTO) 於 2024 年發布的《關於在專利文件中負責任地使用人工智慧的指南》鼓勵法律團隊採用人工智慧撰寫助手,從而將準備時間縮短高達 60%。 Lucinity 等供應商持有的聯邦學習專利證明,聯邦分析無需損害資料主權。這正在加速財富 500 強科技公司的更換週期,並擴大智慧財產權管理軟體的市場。

亞洲D2C品牌商標的激增正在推動SaaS智慧財產權的採用。

預計到2025年,亞太地區的電子商務經濟將佔全球線上零售額的61%,這將推動D2C品牌商標申請量的成長,而這些品牌需要自動化、跨司法管轄區的流程。先前沒有內部法律顧問的中小型企業對相關平台的需求最為旺盛,訂閱式商標模組的使用者數量實現了四位數的成長。此外,一些電商平台要求賣家在入駐前維護有效的智慧財產權組合,這也促進了智慧財產權管理軟體市場的蓬勃發展。

歐盟數據標準碎片化阻礙了投資組合整合

儘管統一專利法院推出,但商標和設計仍然依賴國家申請系統,這迫使企業在自動化工作流程中處理至少14個不同的專利類別。合規團隊報告稱,全部區域推廣時,設定時間增加了30%至40%,抑制了智慧財產權管理軟體市場的短期成長。

細分市場分析

預計到2030年,私有雲端解決方案將以18.6%的複合年成長率成長。作為私有雲解決方案的輔助工具,智慧財產權管理軟體的收入預計將超過公有雲。在智慧財產權管理軟體市場中,私有雲端公共雲端公共雲端。然而,截至2024年,公共雲端仍佔58%的市場。儘管包括航太和國防在內的大型受監管行業仍然依賴空氣間隙的本地節點,但混合雲模式——即在雲端沙箱中運行分析引擎,同時將主資料保留在防火牆後——正在贏得跨司法管轄區的競標。 Synchronoss Technologies等供應商擁有保護這些架構技術基礎的專利組合,凸顯了市場進入障礙。

這種轉變反映出人們日益意識到智慧財產權資料蘊含地緣政治風險。跨國公司的法務團隊現在要求資料庫層內建精細的資料駐留控制和自動刪除策略。因此,招標書(RFP)更強調靜態資料加密、區域容錯移轉能力和零信任存取模型,而非許可折扣。隨著合規負擔的加重,私有雲端供應商正在將安全認證貨幣化,從而推動智慧財產權管理軟體市場的價值成長。

儘管軟體在2024年仍將佔據60.1%的收入佔有率,但諮詢和分析服務將以19.3%的複合年成長率加速成長。企業正努力將傳統的對接工作流程與人工智慧主導的語意搜尋和自動起草功能相協調。實施團隊將知識產權套件與企業資源計劃(ERP)、電子帳單和合約生命週期系統整合,以便在財務長(CFO)的儀錶板上呈現投資組合洞察。雖然SaaS授權帶來可預測的收入,但服務線卻能獲得更高的計費費率,從而擴大了解決方案整合商的整體智慧財產權管理軟體市場規模。

在智慧財產權管理軟體市場,各種細分領域的微服務(例如自動化領先技術摘要、權利要求映射引擎和綠色專利篩選器)正透過API進行捆綁銷售,推動軟體供應商轉型為市場模式。供應商可以利用客戶鎖定效應來獲得資料網路效應,而最終使用者則可以自由配置客製化的技術堆疊。這種模組化加劇了核心對接功能的價格競爭,同時也為擁有專有AI訓練資料的現有企業開闢了利潤更為豐厚的分析管道。

區域分析

2024年,北美將維持39.1%的智慧財產權管理軟體市場佔有率,這得益於其強大的專利訴訟體係以及財富500強企業對高階分析服務的付費意願。美國專利商標局(USPTO)頒發的圖形使用者介面(GUI)和汽車零件設計專利數量將激增40%,進一步擴大其支援的工作負載範圍。不斷上漲的網路保險費用將推動企業對私有雲端的偏好,而區域供應商會將SOC-2合規性與零信任架構捆綁銷售。

亞太地區將引領成長,到2030年複合年成長率將達到18.9%,主要得益於創紀錄的商標申請量、印度快速的審查流程以及中國持續的研發投入。商標積壓問題促使新興企業轉向基於SaaS的自動化分類和即時狀態追蹤解決方案。在日本,智慧財產權分析人才短缺,推動了將專利文本轉化為易於理解的商業視覺化圖表的自動化儀錶板的發展,從而擴大了該地區的智慧財產權管理軟體市場。

儘管數據標準分散,歐洲的發展軌跡依然穩定。統一專利法院簡化了歐洲範圍內的專利執法流程,但商標工作流程仍因國家而異,迫使企業智慧財產權體系採用多租戶架構。德國的專利申請量增加了4%,汽車創新也蓬勃發展,這維持了本地需求,但也導致企業在適應歐盟資料管治法律義務的過程中,專利推廣週期延長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人工智慧專利分析技術的應用推動北美地區套件升級

- 亞洲D2C品牌商標的激增正在推動SaaS智慧財產權的採用。

- 中美半導體專利戰刺激跨境監控需求

- ESG掛鉤的IP評級要求吸引投資者使用綜合套件

- 印度和巴西的快速起訴制度可能會鼓勵中小企業利用這些制度。

- 市場限制

- 歐盟數據標準碎片化阻礙了投資組合整合

- 網路保險保費上漲推高了雲端運算總體擁有成本。

- IP分析人才短缺導致日本服務能力下降

- 區塊鏈註冊表採用的延遲會延緩互通性投資。

- 價值鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢的影響

第5章 市場規模與成長預測(價值)

- 透過部署

- 本地部署

- 雲

- 按組件

- 軟體

- 智慧財產權組合管理套件

- 專利和商標搜尋資料庫

- IP 分析儀表板

- 對接和工作流程自動化

- 服務

- 實施與整合

- 諮詢與分析

- 支援與維護

- 軟體

- 按 IP 類型

- 專利

- 商標

- 版權

- 設計

- 商業機密

- 按組織規模

- 大型公司(員工超過1000人)

- 中小企業(員工人數少於1000人)

- 按最終用戶行業分類

- BFSI

- 醫療保健和生命科學

- 汽車與出行

- 資訊科技和電信

- 家用電器和半導體

- 政府/公共部門

- 學術和研究機構

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家(丹麥、瑞典、挪威、芬蘭)

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他南美洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Anaqua Inc.

- Clarivate PLC

- DoketTrak

- WebTMS Ltd.

- TM Cloud Inc.

- CPA Global Ltd.

- Alt Legal Inc.

- Questel SAS

- Gridlogics Technologies Pvt. Ltd

- AppColl Inc.

- Patrix AB

- Patsnap Pte Ltd

- MaxVal Group Inc.

- LexisNexis IP(RELX)

- Inteum Company LLC

- IPfolio(Zenith IP)

- Minesoft Ltd.

- TechInsights Inc.

- Ambercite Pty Ltd.

- Dennemeyer Group

- Dolcera Corp.

第7章 市場機會與未來展望

The intellectual property management software market size is valued at USD 13.61 billion in 2025 and is projected to advance to USD 24.82 billion by 2030, registering a 12.91% CAGR.

Rising demand for AI-powered patent analytics, ESG-linked IP valuation tools, and cross-border monitoring modules is reshaping platform feature roadmaps. The new functionality coincides with a 4% rise in domestic patent applications recorded by the German Patent and Trade Mark Office in 2024, signaling sustained innovation appetite across core technology sectors. Semiconductor litigation between the United States and China, policy incentives such as India's fast-track prosecution program, and WIPO's SME-focused IP Management Clinics together widen the addressable base for the intellectual property management software market. Vendor consolidation remains moderate, yet large strategic buyers and private-equity funds are allocating fresh capital to acquire analytics-heavy assets that can shorten time-to-value for corporate users.

Global Intellectual Property Management Software Market Trends and Insights

Adoption of AI-Powered Patent Analytics Driving Suite Upgrades Across North America

Enterprises across North America are moving beyond docketing toward predictive patent-landscape mapping that embeds large-language-model search, automated drafting, and freedom-to-operate checks. The USPTO's 2024 guidelines on responsible AI use in patent documents encouraged legal teams to adopt AI drafting assistants that cut preparation time by up to 60%. Federated-learning patents held by vendors such as Lucinity prove that collaborative analytics does not have to compromise data sovereignty. Replacement cycles inside Fortune 500 technology firms are therefore accelerating, expanding the intellectual property management software market.

D2C Brand Trademark Surge in Asia Accelerating SaaS IP Adoption

Asia-Pacific's e-commerce economy, forecast to reach 61% of global online retail sales by 2025, is fueling trademark filings among D2C brands that require automated, multi-jurisdictional workflows. Platform demand is strongest among SMEs that previously lacked in-house counsel, driving quadruple-digit user growth for subscription-based trademark modules. The intellectual property management software market benefits from marketplace mandates that sellers maintain validated IP portfolios before onboarding.

Fragmented EU Data Standards Hindering Portfolio Consolidation

Despite the Unified Patent Court launch, trademarks and designs still depend on national filing systems, forcing corporates to juggle at least 14 flexibility categories inside automated workflows. Compliance teams report 30-40% extra configuration time when rolling out region-wide deployments, dampening near-term growth for the intellectual property management software market.

Other drivers and restraints analyzed in the detailed report include:

- U.S.-China Semiconductor Patent Wars Spurring Cross-Border Monitoring Demand

- ESG-Linked IP Valuation Mandates Attracting Investors to Integrated Suites

- Rising Cyber-Insurance Premiums Inflating Cloud TCO

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Private-cloud solutions are registering 18.6% CAGR to 2030 as firms seek scalability without relinquishing data sovereignty. The intellectual property management software market size attached to private-cloud offerings is forecast to outpace public-cloud revenues even though public configurations held 58% market share in 2024. Large regulated industries, including aerospace and defense, continue relying on air-gapped on-premise nodes, but hybrid philosophies-where analytics engines run in cloud sandboxes while master data stays inside firewalls-are winning cross-jurisdictional bids. Vendors such as Synchronoss Technologies hold patent portfolios that protect the technical underpinnings of these architectures, emphasizing market entry barriers.

The shift reflects growing awareness that IP data carries geopolitical risk. Multinational legal teams now require granular residency controls and automated deletion policies embedded at the database layer. Consequently, RFPs increasingly weight encryption-at-rest, regional failover capabilities, and zero-trust access models over marginal license discounts. As compliance burdens rise, private-cloud providers monetize security certifications, contributing incremental value to the intellectual property management software market.

Software continued to dominate with 60.1% revenue share in 2024, yet consulting and analytics services are accelerating at 19.3% CAGR. Enterprises struggle to reconcile legacy docketing workflows with AI-driven semantic search and automated drafting; advisory engagements thus balloon in scope. Implementation squads integrate IP suites with ERP, e-billing, and contract-lifecycle systems to surface portfolio insights inside CFO dashboards. Where SaaS licensing yields predictable revenue, services lines earn premium bill rates, enlarging the overall intellectual property management software market size for solution integrators.

The intellectual property management software market also sees niche micro-services-prior-art auto-summarizers, claim-mapping engines, and green-patent screeners-bundled through APIs, pushing software providers toward marketplace models. End-users gain the freedom to compose bespoke stacks, while vendors enjoy data network effects that lock in customers. This modularity intensifies price competition for core docketing seats yet opens higher-margin analytics lanes for incumbents with proprietary AI training data.

The IP Management Software Market Report is Segmented by Deployment (On-Premise, Cloud), Component (Software, Service), IP Type (Patent, Trademark, Copyright, and More), Organization Size (Large Enterprises, Small and Medium Enterprises), End-User Industry (BFSI, Healthcare and Lifesciences, Automotive and Mobility, IT and Telecom, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 39.1% share of the intellectual property management software market in 2024, anchored by robust patent litigation infrastructure and Fortune 500 propensity to pay for premium analytics. The USPTO's 40% jump in design patent issuances across GUI and automotive components further expands addressable workloads. Private-cloud preferences grow as cyber-insurance costs inflate, driving regional vendors to bundle SOC-2 compliance and zero-trust architectures.

Asia-Pacific leads growth at 18.9% CAGR through 2030, thanks to record trademark filings, India's fast-track prosecution, and China's sustained R&D spending. Trademark backlogs push startups toward SaaS-based auto-classification and real-time status tracking. Japan's talent shortage in IP analytics creates pull for automated dashboards that translate patent texts into business-ready visuals, widening the intellectual property management software market size within the region.

Europe's trajectory remains steady despite fragmented data standards. The Unified Patent Court simplifies enforcement for pan-European patents, yet trademark workflows still differ by country, forcing multi-tenant architecture within enterprise IP suites. Germany's 4% rise in patent applications and ongoing automotive innovations preserve local demand, although rollout cycles lengthen while firms adapt to EU Data Governance Act obligations.

- Anaqua Inc.

- Clarivate PLC

- DoketTrak

- WebTMS Ltd.

- TM Cloud Inc.

- CPA Global Ltd.

- Alt Legal Inc.

- Questel SAS

- Gridlogics Technologies Pvt. Ltd

- AppColl Inc.

- Patrix AB

- Patsnap Pte Ltd

- MaxVal Group Inc.

- LexisNexis IP (RELX)

- Inteum Company LLC

- IPfolio (Zenith IP)

- Minesoft Ltd.

- TechInsights Inc.

- Ambercite Pty Ltd.

- Dennemeyer Group

- Dolcera Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of AI-Powered Patent-Analytics Driving Suite Upgrades Across North America

- 4.2.2 D2C Brand Trademark Surge in Asia Accelerating SaaS IP Adoption

- 4.2.3 U.S.-China Semiconductor Patent Wars Spurring Cross-Border Monitoring Demand

- 4.2.4 ESG-Linked IP Valuation Mandates Attracting Investors to Integrated Suites

- 4.2.5 India and Brazil Fast-Track Prosecution Schemes Unlocking SME Uptake Potentially

- 4.3 Market Restraints

- 4.3.1 Fragmented EU Data Standards Hindering Portfolio Consolidation

- 4.3.2 Rising Cyber-Insurance Premiums Inflating Cloud TCO

- 4.3.3 IP-Analytics Talent Shortage Capping Services Capacity in Japan

- 4.3.4 Slow Blockchain Registry Adoption Delaying Inter-operability Investments

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Impact of Macroeconomic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Component

- 5.2.1 Software

- 5.2.1.1 IP Portfolio Management Suites

- 5.2.1.2 Patent and Trademark Search Databases

- 5.2.1.3 IP Analytics Dashboards

- 5.2.1.4 Docketing and Workflow Automation

- 5.2.2 Services

- 5.2.2.1 Implementation and Integration

- 5.2.2.2 Consulting and Analytics

- 5.2.2.3 Support and Maintenance

- 5.2.1 Software

- 5.3 By IP Type

- 5.3.1 Patent

- 5.3.2 Trademark

- 5.3.3 Copyright

- 5.3.4 Design

- 5.3.5 Trade Secret

- 5.4 By Organization Size

- 5.4.1 Large Enterprises (>=1 000 Emp.)

- 5.4.2 Small and Medium Enterprises ( <1 000 Emp.)

- 5.5 By End-User Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare and Lifesciences

- 5.5.3 Automotive and Mobility

- 5.5.4 IT and Telecom

- 5.5.5 Consumer Electronics and Semiconductor

- 5.5.6 Government and Public Sector

- 5.5.7 Academia and Research Institutes

- 5.5.8 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 South-East Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Mexico

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 GCC

- 5.6.5.2 Turkey

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)}

- 6.4.1 Anaqua Inc.

- 6.4.2 Clarivate PLC

- 6.4.3 DoketTrak

- 6.4.4 WebTMS Ltd.

- 6.4.5 TM Cloud Inc.

- 6.4.6 CPA Global Ltd.

- 6.4.7 Alt Legal Inc.

- 6.4.8 Questel SAS

- 6.4.9 Gridlogics Technologies Pvt. Ltd

- 6.4.10 AppColl Inc.

- 6.4.11 Patrix AB

- 6.4.12 Patsnap Pte Ltd

- 6.4.13 MaxVal Group Inc.

- 6.4.14 LexisNexis IP (RELX)

- 6.4.15 Inteum Company LLC

- 6.4.16 IPfolio (Zenith IP)

- 6.4.17 Minesoft Ltd.

- 6.4.18 TechInsights Inc.

- 6.4.19 Ambercite Pty Ltd.

- 6.4.20 Dennemeyer Group

- 6.4.21 Dolcera Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment