|

市場調查報告書

商品編碼

1851061

資料保護即服務 (DPaaS):市場佔有率分析、產業趨勢、統計資料和成長預測 (2025-2030)Data Protection As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

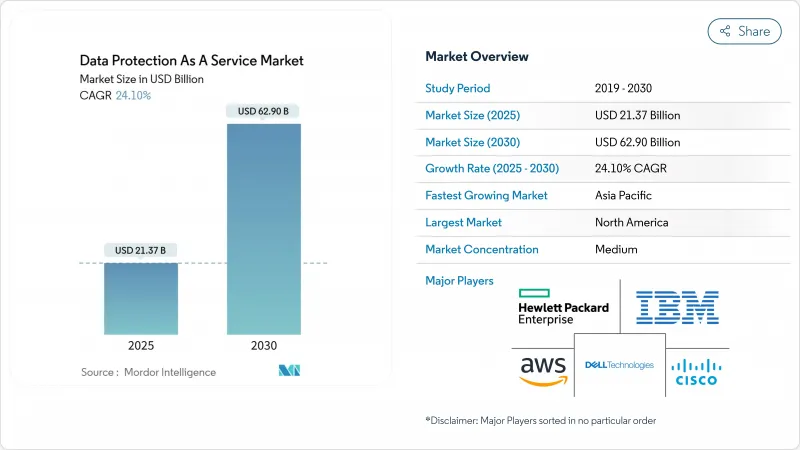

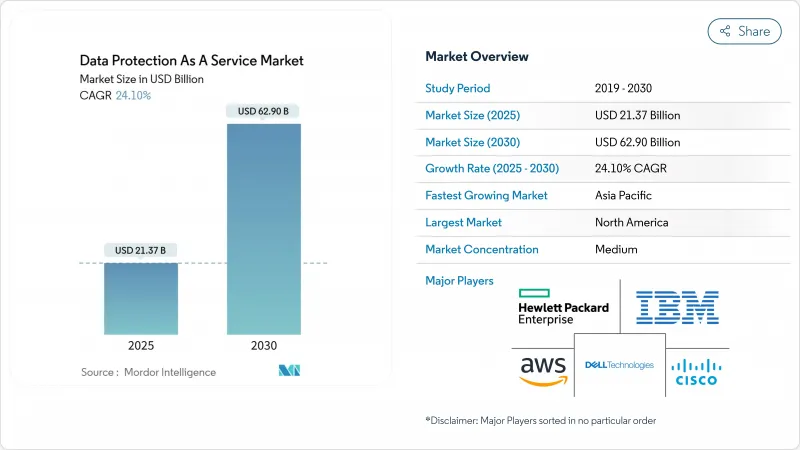

預計到 2025 年,資料保護即服務 (DPaaS) 市場規模將達到 213.7 億美元,到 2030 年將達到 629 億美元,預測期(2025-2030 年)的複合年成長率為 24.10%。

非結構化資料的爆炸性成長、零信任安全策略的強制推行以及企業董事會對勒索軟體風險日益成長的擔憂,共同推動了雲端服務市場的發展。企業正迅速用基於使用量的雲端訂閱服務取代資本密集的本地備份硬體,這些服務提供彈性擴充性。自主雲端投資、量子安全加密測試和網路保險需求正在融合重塑產品藍圖,而供應商整合則壓縮了市場結構並加速了功能整合。

全球資料保護即服務 (DPaaS) 市場趨勢與洞察

嚴格的資料主權法規再形成全球保護

從巴西到印度,類似GDPR的框架正在逐步推廣,迫使企業將資料儲存在地化、採用精確的資料映射,並建立基於策略的控制措施來管理跨境資料流。歐盟的《數位營運彈性法案》已於2025年1月生效,要求金融機構提供近乎即時的事件報告。在美國,新規限制了敏感資料傳輸給外國對手,這增加了跨國公司的複雜性。因此,採購團隊在選擇資料保護即服務(DPaaS)供應商時,越來越重視主權控制以及復原點目標(RPO)/復原時間目標(RTO)指標。為了滿足國家監管機構和內部風險委員會的要求,供應商正在提供區域特定的金鑰管理、雙重加密選項和區域內復原庫等解決方案。

邊緣運算革新防護架構

邊緣部署將處理能力轉移到更靠近感測器端點和分店,使工作負載無需將流量路由到集中式資料中心即可滿足延遲目標。到 2025 年底,40% 的大型企業計劃在邊緣運行關鍵業務應用程式。這種轉變需要輕量級、策略驅動的本機運行備份代理,並且能夠非同步同步。此外,一些新產品也開始將基於人工智慧的異常檢測整合到邊緣閘道器中,以縮短勒索軟體入侵時的停留時間。醫療保健系統正在醫院內試點這些功能,以遵守嚴格的患者資料本地化規則,同時為臨床醫生提供即時存取權限。

隱藏的雲端成本會削弱多重雲端策略

流量費用波動和按 API 呼叫計費會對預算造成壓力,尤其對於需要頻繁恢復的分析密集或監管查詢而言更是如此。在規模較小的雲端區域中,議價能力有限的企業受到的影響最大。儘管財務營運團隊已投入資金開發成本監控儀表板,但儲存層級間分散的計費方式以及冷熱遷移仍然是預算的一大挑戰。

細分市場分析

到2030年,災害復原服務)細分市場的複合年成長率將達到29.5%,超過其他服務,因為企業領導層已將勒索軟體回應提升為策略指標。超過70%的企業計劃在容錯移轉。雖然儲存即服務(STaaS)在2024年將佔據資料保護即服務(DPaaS)市場佔有率的43.2%,但它正朝著智慧分層和基於策略的不可變性方向發展,並與零信任架構保持一致。融合平台現在將備份即服務(BaaS)、儲存即服務(STaaS)和災難復原即服務(DRaaS)捆綁在一個統一的策略引擎下,從而簡化了採購和管治。

儘管人們對災難復原即服務 (DRaaS) 的熱情日益高漲,但儲存訂閱市場依然強勁。物件儲存的成長勢頭強勁,這主要得益於人工智慧模型訓練集和視訊分析的興起,它們導致非結構化資料量激增。為了應對這項挑戰,服務供應商正在大力推廣Petabyte級資料去重和壓縮技術。雲端超大規模雲端服務供應商的全端產品現在整合了自主威脅掃描功能,這意味著勒索軟體只會攻擊受影響的資料區塊,而不是整個資料磁碟區。這種功能的整合預示著未來將朝著以平台為中心的採購模式發展,在這種模式下,恢復自動化、資料分類和合規性映射等功能都將整合在一個統一的控制平面中。

混合模式成長最快,複合年成長率高達 31.5%。監管機構傾向於採用能夠在受監管的公共領域進行突發性分析,同時將敏感資料集保留在本地私有私有雲端中的架構。這種模式在歐洲銀行中尤其明顯,這些銀行受數位營運彈性法律的約束,這些法律要求為第三方服務制定書面應急安排。策略自動化會根據資料分類標籤選擇儲存目標,從而最佳化延遲和合規性。隨著企業使用雲端連線的資料儲存庫對其傳統磁帶歸檔進行現代化改造,預計到 2028 年,混合解決方案的資料保護即服務 (DPaaS) 市場規模將翻倍。

私有雲端私有雲端部署維持了 43.7% 的市場佔有率,尤其受到國防、公共產業和醫療保健機構的青睞,因為這些機構必須對加密金鑰擁有控制權。提供私有雲端設備的供應商正擴大整合 FIPS 認證的硬體安全模組 (HSM)、基於角色的存取控制和空氣間隙的組態管理。對於那些重視區域多樣性而非完全主權的數位原民企業而言,公共雲端方案仍然很受歡迎。然而,像 AWS 歐洲主權雲端這樣的主權雲端舉措正在模糊兩者之間的界限,在本地法律控制下提供公有雲的敏捷性,並將受監管的工作負載引入到以前無法進入的環境中。

資料保護即服務 (DPaaS) 市場按服務類型(儲存即服務、備份即服務、災難復原即服務)、部署模式(公共雲端、私有雲端、混合混合雲端)、組織規模(大型企業、中小企業)、最終用戶業(銀行、金融服務和保險、醫療保健、生命科學等)以及地區進行細分。市場預測以美元計價。

區域分析

北美地區維持了37.8%的收入佔有率,這得益於雲端運算的強勁普及以及聯邦政府的強制性規定,例如CISA約束性操作指令25-01,該指令要求各機構對SaaS應用安全配置基準。 《保護美國資料免受外國敵對勢力侵害法案》限制了敏感個人資料的跨境傳輸,從而刺激了對國內資料保險庫和金鑰託管服務的需求。企業優先考慮能夠為審核產生自動化認證報告的合規性對應功能。

亞太地區正以31.4%的複合年成長率實現最快成長,這主要得益於日本、印度和韓國的數位化政府專案推動了數據在地化規則的訂定。印度的《數位個人資料保護法》明確規定了敏感個人資訊的在地化,並促使雲端服務提供者推出國內恢復區。超大規模雲端服務商與國內通訊合作,建立自主設施,在遵守法律儲存限制的前提下,實現來自海外的備份服務。新加坡和澳洲的新興企業正在推出資料保護即服務(DPaaS),將安全的小型資料庫與全球容錯移轉選項相結合,吸引那些需要在貿易和合規之間尋求平衡的中型出口商。

在歐洲,GDPR、DORA、《網路彈性法案》和歐盟資料法案(將於2025年9月生效)正在推動相關技術的快速普及。法國的「信任雲」(Cloud de Confiance)和德國的「Gaia-X」等國家級計畫正在資助基於標準的基礎設施建設,這些基礎設施強調透明度和供應商可移植性。服務提供者透過提供區域內元資料處理、歐盟居住者營運人員和可導出的審核追蹤來凸顯自身優勢。自主選擇權可以減少監管摩擦,並提高公共機構的連結率。

拉丁美洲、中東和非洲等新興市場的雲端技術應用規模較小。波灣合作理事會政府正在資助主權雲端平台,以實現經濟多元化並吸引金融科技新興企業。巴西銀行正在跨國複製鏈路上試行量子安全加密技術,以因應未來的加密需求。非洲通訊業者正在部署SaaS備份,以保護快速發展的行動支付平台,彌補本地資料中心容量的不足。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的資料主權法規(GDPR、CCPA、DORA 等)

- 邊緣和雲端非結構化資料爆炸性成長

- 勒索軟體抵禦能力日益受到董事會的重視

- 與網路保險定價相關的雲端原生網路復原庫

- 為中東和亞太地區的超大規模資料中心業者主權雲

- 量子安全加密試點計畫將推動資料保護即服務 (DPaaS) 合約續約

- 市場限制

- 多重雲端儲存中的隱藏退出和 API 成本

- 透過專有備份格式實現供應商鎖定

- AI壓縮會減少備份檔案大小並延遲升級。

- 雙邊貿易協定中的資料居住條款限制了跨境災難復原即服務 (DRaaS)。

- 產業價值鏈分析

- 監管環境

- 技術展望

- 產業吸引力:波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模及成長預測(金額)

- 按服務類型

- Storage-as-a-Service(STaaS)

- Backup-as-a-Service(BaaS)

- Disaster-Recovery-as-a-Service(DRaaS)

- 按部署模式

- 公有雲

- 私有雲端

- 混合雲

- 按組織規模

- 主要企業

- 小型企業

- 按最終用戶行業分類

- BFSI

- 醫療保健和生命科學

- 政府/國防

- 資訊科技和電訊

- 零售與電子商務

- 製造業

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 新加坡

- 馬來西亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Company

- Dell Technologies Inc.

- Cisco Systems Inc.

- Oracle Corporation

- VMware Inc.

- Commvault Systems Inc.

- Veritas Technologies LLC

- Asigra Inc.

- Quantum Corporation

- Quest Software Inc.

- NxtGen Datacenter & Cloud Technologies Pvt Ltd

- Hitachi Vantara LLC

- Acronis International GmbH

- Rubrik Inc.

- Druva Inc.

- Cohesity Inc.

- HYCU Inc.

- Backblaze Inc.

- Wasabi Technologies Inc.

- NetApp Inc.

- Zerto LLC

- N-able Inc.

- Arcserve LLC

第7章 市場機會與未來趨勢

- 閒置頻段與未滿足需求評估

The Data Protection As A Service Market size is estimated at USD 21.37 billion in 2025, and is expected to reach USD 62.90 billion by 2030, at a CAGR of 24.10% during the forecast period (2025-2030).

Growth is propelled by a surge in unstructured data, zero-trust mandates, and rising board-level concern over ransomware exposure. Enterprises are rapidly replacing capital-intensive, on-premises backup hardware with cloud-delivered subscriptions that offer usage-based pricing and elastic scale. Sovereign-cloud investments, quantum-safe encryption pilots, and cyber-insurance requirements are converging to reshape product roadmaps, while vendor consolidation is compressing market structure and accelerating feature integration.

Global Data Protection As A Service Market Trends and Insights

Stringent Data-Sovereignty Regulations Reshape Global Protection

The roll-out of GDPR look-alike frameworks from Brazil to India is forcing firms to localize storage, adopt precise data-mapping, and build policy-based controls that govern cross-border flows. The EU Digital Operational Resilience Act took effect in January 2025, mandating near-real-time incident reporting for financial institutions. In the United States, new rules restrict sensitive data transfers to foreign adversaries, adding complexity for multinationals. As a result, procurement teams now rank sovereignty controls alongside RPO/RTO metrics when selecting DPaaS vendors. Providers are responding with region-specific key management, double-encryption options, and in-region recovery vaults that satisfy both national regulators and internal risk committees.

Edge Computing Revolutionizes Protection Architectures

Edge deployments move processing closer to sensor endpoints and branch locations, allowing workloads to meet latency targets without routing traffic back to centralized data hubs. Forty percent of large enterprises plan to run mission-critical applications at the edge by end-2025; that shift necessitates lightweight, policy-driven backup agents capable of executing locally and synchronizing asynchronously. Emerging offerings embed AI-based anomaly detection at edge gateways, reducing dwell time for ransomware incursions. Healthcare systems are piloting these capabilities in hospital campuses to comply with strict patient-data localization rules while ensuring immediate access for clinicians.

Hidden Cloud Costs Undermine Multi-Cloud Strategies

Variable traffic fees and per-API call pricing can inflate budgets, especially for analytics-heavy or regulatory inquiries that require frequent restores. Enterprises with limited negotiation leverage in smaller cloud regions feel the pinch most acutely. FinOps teams are investing in cost-observability dashboards, yet fragmented billing across storage tiers and hot-cold transitions remains a budgetary hazard.

Other drivers and restraints analyzed in the detailed report include:

- Ransomware Resilience Becomes a Board Priority

- Cloud-Native Recovery Vaults Transform Resilience Economics

- Proprietary Formats Create Vendor Lock-In

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Disaster-Recovery-as-a-Service segment recorded a 29.5% CAGR outlook through 2030, outpacing other offerings as leadership teams elevate ransomware readiness to a strategic metric. More than 70% of enterprises intend to integrate DRaaS with SIEM telemetry by 2026, enabling automated failover based on threat scoring. Continuous data protection streams shrink recovery-point objectives to seconds, appealing to finance and healthcare workloads where data loss equates to compliance fines. Storage-as-a-Service, though still capturing 43.2% of the 2024 data protection as a service market share, is evolving toward intelligent tiering and policy-based immutability that aligns with zero-trust architectures. Converged platforms now bundle BaaS, STaaS, and DRaaS under unified policy engines, easing procurement and governance.

While DRaaS enthusiasm rises, storage subscriptions remain foundational. Object-store growth stays strong due to AI model training sets and video analytics that balloon unstructured data volumes. In response, providers are pushing petabyte-scale deduplication and compression to control the footprint. Full-stack offerings from cloud hyperscalers now integrate autonomous threat scanning, meaning that ransomware reels only the affected blocks rather than entire volumes. Such feature alignment signals a longer-term move toward platform-centric purchasing in which recovery automation, data classification, and compliance mapping exist inside a single control plane.

Hybrid models show the fastest expansion at 31.5% CAGR. Regulators endorse architectures that keep sensitive datasets on local private clouds while allowing burstable analytics in regulated public regions. These patterns are especially evident among European banks subject to the Digital Operational Resilience Act, which mandates documented contingency arrangements for third-party services. Policy automation selects storage targets based on data-classification labels, optimizing both latency and compliance. The data protection as a service market size for hybrid solutions is forecast to double by 2028 as enterprises modernize legacy tape archives into cloud-connected vaults.

Private-cloud deployments retain a 43.7% share, favored by defense, utilities, and healthcare agencies that must assert custody over encryption keys. Vendors supplying private-cloud appliances increasingly embed FIPS-validated HSMs, role-based access, and air-gapped configuration management. Public-cloud approaches remain popular among digital-native firms that value region diversity over full sovereignty. However, sovereign-cloud initiatives, such as the AWS European Sovereign Cloud, blur lines: they deliver public-cloud agility under local legal control, pulling regulated workloads into environments previously deemed off-limits.

Data Protection As A Service Market is Segmented by Service Type (Storage-As-A-Service, Backup-As-A-Service, and Disaster-Recovery-As-A-Service), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size (Large Enterprises and Small and Medium-Sized Enterprises), End-User Industry (BFSI, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America preserves a 37.8% revenue share, anchored by robust cloud adoption and federal directives such as CISA Binding Operational Directive 25-01, which compels agencies to apply secure configuration baselines for SaaS. The Protecting Americans' Data from Foreign Adversaries Act restricts cross-border transfers of sensitive personal data, spurring demand for in-country vaults and key escrow. Enterprises prioritize compliance mapping features that generate automated attestation reports for auditors.

Asia-Pacific posts the fastest trajectory at 31.4% CAGR as digital-government programs in Japan, India, and Korea push data-localization rules. The Indian Digital Personal Data Protection Act codifies explicit localization for critical personal information, pressuring cloud providers to launch domestic recovery zones. Hyperscalers partner with domestic telecom carriers to establish sovereign facilities that allow foreign backup services while respecting legal custody constraints. Start-ups in Singapore and Australia roll out DPaaS offerings that combine secure local storage with global failover options, appealing to mid-market exporters balancing trade and compliance.

Europe remains a sophisticated adopter shaped by GDPR, DORA, the Cyber Resilience Act, and the EU Data Act, effective September 2025. National programs such as France's Cloud de Confiance and Germany's Gaia-X channel funding into federated, standards-based infrastructure that prizes transparency and vendor portability. Providers differentiate by offering in-region metadata processing, EU resident-only operations staff, and exportable audit trails. Sovereign options reduce regulatory friction, driving higher attach rates among public-sector entities.

Emerging markets in Latin America, the Middle East, and Africa register rising adoption from smaller bases. Gulf Cooperation Council governments finance sovereign-cloud platforms to diversify economies and lure fintech start-ups. Brazilian banks pilot quantum-safe encryption on cross-border replication links, anticipating future cryptographic requirements. African telcos deploy SaaS backup to protect rapidly expanding mobile money platforms, offsetting limited local data-center capacity.

- IBM Corporation

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Company

- Dell Technologies Inc.

- Cisco Systems Inc.

- Oracle Corporation

- VMware Inc.

- Commvault Systems Inc.

- Veritas Technologies LLC

- Asigra Inc.

- Quantum Corporation

- Quest Software Inc.

- NxtGen Datacenter & Cloud Technologies Pvt Ltd

- Hitachi Vantara LLC

- Acronis International GmbH

- Rubrik Inc.

- Druva Inc.

- Cohesity Inc.

- HYCU Inc.

- Backblaze Inc.

- Wasabi Technologies Inc.

- NetApp Inc.

- Zerto LLC

- N-able Inc.

- Arcserve LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent data-sovereignty regulations (GDPR, CCPA, DORA, etc.)

- 4.2.2 Explosive growth of unstructured data across edge and cloud

- 4.2.3 Board-level focus on ransomware resiliency

- 4.2.4 Cloud-native cyber-recovery vaults tied to cyber-insurance pricing

- 4.2.5 Sovereign-cloud build-outs in Middle-East and APAC hyperscaler

- 4.2.6 Quantum-safe encryption pilots driving refresh of DPaaS contracts

- 4.3 Market Restraints

- 4.3.1 Hidden egress and API costs in multi-cloud storage

- 4.3.2 Vendor lock-in due to proprietary backup formats

- 4.3.3 AI-driven compression reducing backup volumes, delaying upgrades

- 4.3.4 Data-residency clauses in bilateral trade pacts limiting cross-border DRaaS

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Storage-as-a-Service (STaaS)

- 5.1.2 Backup-as-a-Service (BaaS)

- 5.1.3 Disaster-Recovery-as-a-Service (DRaaS)

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-sized Enterprises (SMEs)

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Government and Defense

- 5.4.4 IT and Telecom

- 5.4.5 Retail and E-commerce

- 5.4.6 Manufacturing

- 5.4.7 Other End-User Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Malaysia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Amazon Web Services Inc.

- 6.4.3 Hewlett Packard Enterprise Company

- 6.4.4 Dell Technologies Inc.

- 6.4.5 Cisco Systems Inc.

- 6.4.6 Oracle Corporation

- 6.4.7 VMware Inc.

- 6.4.8 Commvault Systems Inc.

- 6.4.9 Veritas Technologies LLC

- 6.4.10 Asigra Inc.

- 6.4.11 Quantum Corporation

- 6.4.12 Quest Software Inc.

- 6.4.13 NxtGen Datacenter & Cloud Technologies Pvt Ltd

- 6.4.14 Hitachi Vantara LLC

- 6.4.15 Acronis International GmbH

- 6.4.16 Rubrik Inc.

- 6.4.17 Druva Inc.

- 6.4.18 Cohesity Inc.

- 6.4.19 HYCU Inc.

- 6.4.20 Backblaze Inc.

- 6.4.21 Wasabi Technologies Inc.

- 6.4.22 NetApp Inc.

- 6.4.23 Zerto LLC

- 6.4.24 N-able Inc.

- 6.4.25 Arcserve LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment