|

市場調查報告書

商品編碼

1851056

工具工具機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Machine Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

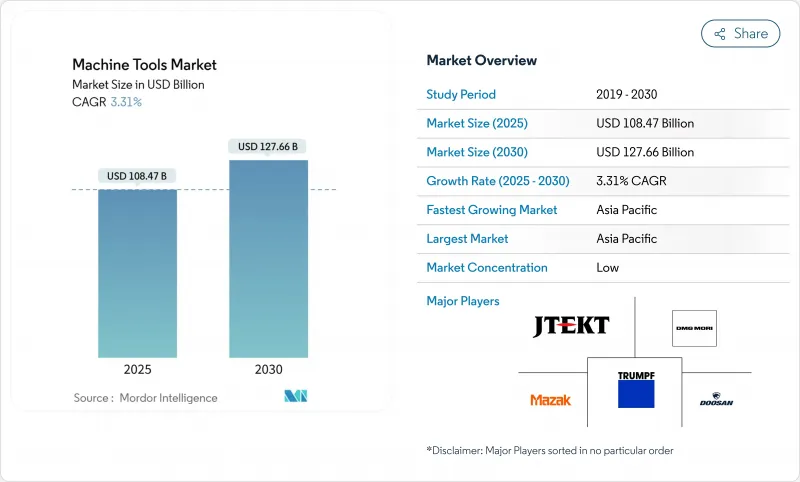

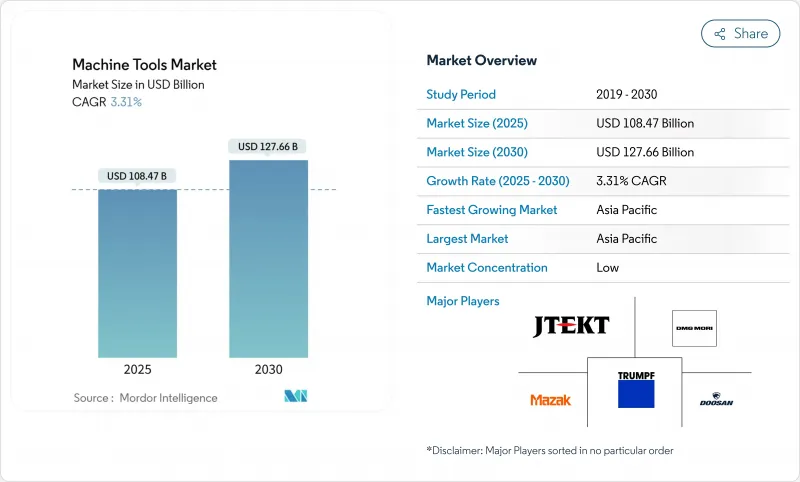

預計工具機市場將從 2025 年的 1,084.7 億美元成長到 2030 年的 1,276.6 億美元,複合年成長率為 3.31%。

此次市場擴張的驅動力來自供應鏈重組、更嚴格的貿易規則以及半導體工廠創紀錄的投資,而這些都對超精密加工能力提出了更高的要求。 ASML 的高數值孔徑 EUV 系統,每台售價超過 4 億美元,充分展現了新一代微影術如何提升奈米級金屬切削和精加工的性能標準。工業 4.0計劃也越來越多採用人工智慧驅動的數控系統,實現進給速度和刀具路徑的自我最佳化。區域投資格局顯示,亞洲佔據了新增產能的大部分,但美國的回流獎勵和歐洲關稅的不確定性正促使未來的需求轉向更多元化的工廠。儘管直銷仍然是全球分銷的主導方式,但電商平台正在加速中價格分佈數控機床和替換刀具的採購週期。

全球工具機市場趨勢與洞察

電氣化推動精密電動動力傳動系統總成加工

電動車電機工廠通常採用五軸加工中心,將公差控制在微米級,並透過自動定子插入和髮夾式繞線,省去了二次表面處理工程。採埃孚的目標是到2030年實現其電動車動力總成生產線70%的自動化,而中國供應商預測,到2034年,年產量將超過1.2億台。通用汽車和梅賽德斯-奔馳正在內部資源,並傾向於使用能夠無振動振動的鋁矽合金加工機床。市場對製程測量、封閉式管理以及用於抑制微米級形狀誤差產生的電磁雜訊的閉迴路補償技術的需求日益成長。

半導體工廠的擴張需要超精密設備

預計到2027年,全球300毫米晶圓廠投資將達到1,370億美元,其中美洲地區的投資每三年翻倍。 ASML的多噸級投影光學元件需要鑽石車削和氣浮研磨系統,以確保每公尺行程的形狀誤差小於50奈米。台積電在亞利桑那州投資1,650億美元的工廠項目,充分展現了「自主晶片計畫」如何為超精密加工工廠創造在地化需求,從而在組裝過程中實現重型零件的本土化生產。潔淨室相容性、靜壓滑軌和無污染潤滑方法,如今已成為服務於此細分市場的設備製造商的標準配置。

先進的數控系統需要高額的資本投入和較長的投資回收期。

根據亞特蘭大聯邦儲備銀行的一項調查,80%的製造商在購買資本設備前會將利率視為重要因素,而2025年基準利率的上升將進一步加劇這一趨勢。一台頂級的五軸加工中心成本可能超過300萬美元,這意味著中型加工廠的損益平衡點可能需要五年以上的時間。設備即服務(EaaS)合約已成為過渡解決方案,但許多財務長擔心,軟體升級會導致舊一代控制器過時,從而帶來殘值風險。

細分市場分析

到2025年,多軸工具機精加工複雜殼體的五軸聯動平台。汽車製造商正在用電力驅動殼體單元取代內燃機汽缸體生產線,並採用多軸工具機來減少佔地面積和搬運成本。一家主要的航太製造商正在增加一台高扭矩傾斜主軸中心,用於銑削鈦合金翼梁,同時保持1.2米長度上0.015毫米的平面度。工具車間操作員仍然依賴三軸立式銑床,但帶有數字顯示計數器和探針的改裝套件正在幫助他們在維護作業中保持競爭力。

隨著人工智慧引導的參數嚮導降低薄板不銹鋼的廢品率,雷射切割系統的需求正在回升。電火花加工在需要小半徑角落的模具型腔加工領域仍然佔據一席之地,而銑床難以經濟高效地完成此類加工。結合指向性能量沉積技術和精銑的混合型工具機正在原型實驗室中投入使用,因為縮短加工週期帶來的效益超過了設備成本。面向重型加工場所的等離子切割和水刀切割平台正開始整合閉合迴路高度控制功能,以確保在翹曲金屬板上的切割品質。

到2024年,CNC平台將佔總營收的68.98%,複合年成長率達6.20%,鞏固在工具機市場的核心地位。新興控制器採用GPU加速演算法,可直接將STEP檔案轉換為最佳化的刀具路徑,進而縮短小批量零件的程式時間。中國第一自動化獲得了約1億元的資金,用於伺服驅動器和PLC堆疊的在地化,凸顯了其避免依賴海外韌體風險的戰略舉措。雖然傳統的手動機床仍然在小型車間和職業學校中使用,但越來越多的新工具機正在向伺服機架過渡,即使最初購買時未配備控制設備,也是為了應對未來的維修。混合增材-減材系統處於領先地位,它將雷射金屬沉積與五軸銑削相結合,從而省去了航太支架的支撐結構去除步驟。

數位雙胞胎系統可模擬刀具撓曲和熱漂移,從而實現離線檢驗,防止首件試製過程中發生碰撞。 ChatCNC™ 外掛程式可辨識稜柱形狀並自動產生從粗加工到精加工的加工序列,即使是經驗不足的程式設計人員也能達到專業級的加工週期。預測分析平台可在發生災難性故障之前標記主軸異常。

工具機市場報告按產品類型(金屬切削刀具、金屬成形刀具)、技術類型(傳統工具機機、數控工具機、其他)、終端用戶產業類型(汽車、航太與國防、其他)、銷售管道類型(直銷、其他)和地區類型(北美、亞太、歐洲、其他)進行細分。報告提供了上述所有細分市場的市場規模和預測(以美元計)。

區域分析

亞太地區引領戰略轉型,北美地區復甦,歐洲地區克服逆境不斷創新。預計到2025年,亞太地區將佔全球營收的45.43%,複合年成長率達6.20%。中國正將其小批量生產設施升級為高階CNC單元工廠,以抵銷美國即將對中階設備徵收的25%關稅的影響。印度的生產掛鉤激勵計畫正引導資金流向300毫米晶圓廠和國防飛機機身製造,從而為精密臥式和立式加工中心創造訂單。日本正利用其數十年的運動控制技術,出口可在多班次作業週期內保持亞微米級重複精度的超精密研磨;韓國電子集團則投資於折疊式行動電話鉸鏈板和相機模組的加工能力。隨著原始設備製造商(OEM)採用「中國+1」採購模式,強調地域風險分散,越南和泰國等東南亞國協正在擴大其市場佔有率。

北美受惠於旨在重組戰略製造業的回流政策。美國工具機消費佔有率達到11.9%,創2001年以來新高,這主要得益於區域工具製造商提高了用於航太發射結構的大型立式車床的產能。墨西哥9.1%的成長主要由離岸汽車組裝推動,新萊昂州的一個州立工業提供24小時核准。加拿大在採礦業和低碳能源計劃中贏得了工具工具機訂單,但技術純熟勞工短缺阻礙了整體成長勢頭,這也是整個北美大陸通用的限制因素。

歐洲雖然面臨電費上漲和外匯波動帶來的利潤壓力,但在高精度五軸加工中心和雷射金屬沉積設備領域仍保持絕對領先地位。德國製造商正透過推廣售後服務合約和改裝來應對國內訂單疲軟的局面,其中包括主軸更換計劃,該計劃保證48小時內交付。通快(Trumpf)計劃在2025年投資5.3億歐元用於研發,儘管銷售額下降了9%,但在光束源效率方面仍保持領先地位。北歐企業則透過在每台新機器交付時提供碳足跡證書,來強調其在永續性的領導地位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電氣化浪潮推動高精度電動動力傳動系統總成加工

- 工業4.0的普及推動了對智慧數控平台的需求

- 輕質合金和複合材料的普及需要高速多軸加工工具

- 半導體工廠的擴張需要超精密設備

- 全球老舊(20年以上)工具機的更換週期

- 適用於自動化多品種、小批量生產的靈活加工

- 市場限制

- 特種鋼材和直線運動部件成本上漲

- 先進的數控系統需要高額的資本投入和較長的投資回收期。

- 全球熟練的CNC程式設計師/操作員短缺

- 利用積層製造

- 價值/供應鏈分析

- 監管環境(主要政府法規和舉措)

- 技術概覽

- 互聯自動化機器

- 先進控制/運動系統

- 數位化和工業4.0

- 利用人工智慧提高金屬切削精度

- 金屬加工產業概況

- 地緣政治對工具機市場的影響

- 產業吸引力—五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品

- 金屬切削工具

- 銑床

- 鑽孔機

- 車床

- 研磨

- 雷射切割機

- 電火花加工工具機(EDM)

- 水刀切割機

- 電漿切割機

- 多軸加工中心

- 其他(保齡球等)

- 金屬成型工具

- 壓力機(機械式、液壓式、伺服)

- 鍛造機

- 折彎機

- 其他(剪切、擠壓、軋延等)

- 金屬切削工具

- 透過技術

- 傳統機器(手動或半手動)

- CNC工具機

- 積層製造/混合型機器

- 按最終用戶行業分類

- 車

- 航太/國防

- 電氣和電子

- 工業機械及設備

- 醫療設備

- 造船/海洋

- 精密工程

- 能源與電力

- 金屬加工(單件加工車間等)

- 其他行業(鐵路、其他一般製造業等)

- 按銷售管道

- 直接銷售(OEM 直接面向最終用戶)

- 經銷商和分銷商

- 線上/電子商務

- 其他(系統整合商、活動和展覽、翻新商和翻新產品等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 秘魯

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- Nordix(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東協(印尼、泰國、菲律賓、馬來西亞、越南)

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 土耳其

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Yamazaki Mazak Corporation

- DMG MORI Co. Ltd

- TRUMPF Group

- JTEKT Corporation

- Doosan Machine Tools

- Okuma Corporation

- Makino Milling Machine Co. Ltd

- Haas Automation Inc.

- FANUC Corporation

- Hyundai Wia Corp.

- Schuler AG

- Sandvik AB(Seco & Walter)

- GF Machining Solutions

- Fives Group

- GROB-Werke GmbH & Co. KG

- Hermle AG

- EMAG GmbH & Co. KG

- Hardinge Inc.

- HURCO Companies Inc.

- Amada Co. Ltd

第7章 市場機會與未來展望

The Machine Tools Market is valued at USD 108.47 billion in 2025 and is set to reach USD 127.66 billion by 2030, advancing at a 3.31% CAGR.

This expansion occurs against a backdrop of realigned supply chains, stricter trade rules, and record investment in semiconductor fabs, each of which demands ultra-precision machining capacity. ASML's High-NA EUV systems, which cost more than USD 400 million apiece, exemplify how next-generation lithography is lifting the performance bar for nanometer-level metal cutting and finishing . Electrification in automotive and ongoing aerospace modernization are spurring purchases of multi-axis machining centers, while Industry 4.0 projects increasingly bundle AI-enabled CNC controls that self-optimize feed rates and tool paths. Regional investment patterns show Asia drawing the bulk of new capacity additions, yet reshoring incentives in the United States and tariff uncertainty in Europe are tilting future demand toward more diversified plant footprints. Direct sales still dominate the global distribution mix, but e-commerce portals are accelerating procurement cycles for mid-ticket CNC models and replacement tooling.

Global Machine Tools Market Trends and Insights

Electrification Surge Driving Precision e-Powertrain Machining

Electric-vehicle motor plants are pushing tolerances to micro-scale ranges, often pairing automated stator insertion and hairpin winding with five-axis machining centers that eliminate secondary finishing steps. ZF targets 70% automation for EV drive-train lines by 2030, and Chinese suppliers project annual output exceeding 120 million e-motors by 2034. General Motors and Mercedes-Benz have both insourced e-motor housing production, favouring machines that cut aluminum-silicon alloys without creating pass-off chatter. Demand is intensifying for in-process gauging, coolant management, and closed-loop compensation to suppress electromagnetic noise that would otherwise arise from micron-level form errors.

Semiconductor Fab Expansion Necessitating Ultra-Precision Equipment

Global 300 mm fab spending is forecast to hit USD 137 billion in 2027, with the Americas doubling outlays in three years. ASML's multi-ton projection optics require diamond-turning and air-bearing grinding systems that hold sub-50 nm form error over 1 m travel. TSMC's USD 165 billion Arizona complex exemplifies how sovereign chip programs create local pull for ultraprecision machine shops that can keep heavy components in-state during assembly. Clean-room compatibility, hydrostatic slideways, and contamination-free lubrication schemes are now baseline specifications for equipment makers serving this niche.

High Capex & Lengthy Payback for Advanced CNC Systems

Atlanta Fed surveys reveal that 80% of manufacturers weigh interest rates heavily before committing to capital equipment, a dynamic amplified by prime-rate increases in 2025. A top-tier five-axis cell can exceed USD 3 million installed, pushing breakeven past five years for medium-volume job shops. Equipment-as-a-service contracts are emerging as an interim solution, though many CFOs remain wary of residual value risk once software upgrades render early-generation controllers obsolete.

Other drivers and restraints analyzed in the detailed report include:

- Industry 4.0 Adoption Boosting Demand for Smart CNC Platforms

- Lightweight Alloy & Composite Uptake Requiring High-Speed Multi-Axis Tools

- Surging Specialty Steel & Linear-Motion Component Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The multi-axis segment started 2025 commanding USD 24.6 billion of the machine tools market size and is heading toward a 7.00% CAGR to 2030. Milling machines retain the biggest revenue pool with 28.23% share in 2024, yet growth now concentrates on simultaneous five-axis platforms that finish complex housings in one clamp. Automakers replacing ICE cylinder-block lines with e-drive casing cells embrace multi-axis machines to lower floor-space and handling costs. Aerospace primes add high-torque tilt-spindle centres to mill titanium spars while maintaining 0.015 mm flatness over 1.2 m lengths. Toolroom operators still rely on three-axis knee mills, but retrofit kits with digital readouts and probing keep them competitive for maintenance work.

Demand for laser cutting systems is rebounding as AI-guided parameter wizards reduce scrap rates on thin-gauge stainless. Electrical-discharge machining maintains a niche in tool-and-die cavities that require micro-corner radii which mills cannot reach economically. Hybrid machines that mix directed-energy deposition with finish milling are entering prototype labs where cycle-time savings outweigh equipment cost. Plasma and waterjet platforms serve heavy-fabrication yards; however, both are starting to integrate closed-loop height control to maintain cut quality on warped plates.

CNC platforms represented 68.98% revenue in 2024 and will climb at 6.20% CAGR, solidifying their position at the heart of the machine tools market. Emerging controllers employ GPU-accelerated algorithmsthat translate STEP files directly to optimized toolpaths, slashing programming time for short-run parts. China's First Automation secured nearly RMB 100 million to localize servo drives and PLC stacks, highlighting strategic efforts to de-risk foreign firmware dependencies. Conventional manual machines endure in small workshops and vocational schools, yet new builds are trending toward servo-ready frames even when purchased without controls, anticipating future retrofits. Hybrid additive-subtractive systems occupy the cutting edge, combining laser metal deposition with five-axis milling to eliminate support-structure removal steps in aerospace brackets.

Digital twins now simulate tool deflection and thermal drift, allowing off-machine validation that prevents collision during first-article runs. ChatCNC(TM) plug-ins recognise prismatic features and auto-generate rough-to-finish sequences, enabling less-experienced programmers to achieve veteran-level cycle times. Predictive analytics platforms flag spindle anomalies well before catastrophic failure, an especially valuable feature for lights-out processing where operator oversight is minimal.

The Machine Tools Market Report is Segmented by Product (Metal Cutting Tools, Metal Forming Tools), by Technology (Conventional Machines, CNC Machines, and More), by End-User Industry (Automotive, Aerospace & Defense, and More), by Sales Channel (Direct Sales, and More), and by Geography (North America, Asia-Pacific, Europe, and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

Geography Analysis

Asia-Pacific Leads Amid Strategic Shifts, While North America Reshores and Europe Innovates Through Headwinds. Asia-Pacific entered 2025 with 45.43% of global revenue and a 6.20% CAGR outlook as governments funnel incentives into EV, aerospace, and semiconductor clusters. China is upgrading small-batch workshops into high-end CNC cell factories to offset looming 25% U.S. tariffs on mid-range machinery. India's production-linked incentive program is steering capital toward 300 mm wafer fabs and defence airframe work, generating orders for precision horizontals and vertical machining centres. Japan leverages decades of motion-control know-how to export ultra-precision grinders that hold sub-micron repeatability across multi-shift duty cycles, while South Korea's consumer-electronics conglomerates invest in machining capacity for foldable-phone hinge plates and camera modules. ASEAN nations such as Vietnam and Thailand gain share as OEMs adopt a China-plus-one sourcing model that values geographic risk dispersion.

North America benefits from reshoring policies aimed at rebuilding strategic manufacturing self-reliance. United States consumption reached its highest 11.9% share since 2001 as regional tool builders added capacity for large-format vertical lathes used in space-launch structures. Mexico's 9.1% uptick stems from near-shore vehicle assembly, with state-backed industrial parks in Nuevo Leon offering 24-hour permit approvals. Canada draws machine-tool orders from the mining sector and low-carbon energy projects, though overall momentum is tempered by skilled-labour shortages, a constraint echoed across the entire continent.

Europe faces margin erosion from elevated electricity costs and currency volatility, yet it preserves a commanding lead in high-accuracy five-axis and laser-metal-deposition systems. German builders are responding to soft domestic orders by pushing into after-sales contracts and retrofits, including spindle-exchange programmes that guarantee 48-hour turnaround. TRUMPF invested EUR 530 million in R&D during 2025 to maintain its edge in beam-source efficiency despite a 9% revenue dip. Nordic firms highlight sustainability leadership by offering carbon-footprint certificates with each new machine shipment, a feature increasingly mandated in public-sector tenders.

- Yamazaki Mazak Corporation

- DMG MORI Co. Ltd

- TRUMPF Group

- JTEKT Corporation

- Doosan Machine Tools

- Okuma Corporation

- Makino Milling Machine Co. Ltd

- Haas Automation Inc.

- FANUC Corporation

- Hyundai Wia Corp.

- Schuler AG

- Sandvik AB (Seco & Walter)

- GF Machining Solutions

- Fives Group

- GROB-Werke GmbH & Co. KG

- Hermle AG

- EMAG GmbH & Co. KG

- Hardinge Inc.

- HURCO Companies Inc.

- Amada Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification Surge Driving Precision e-Powertrain Machining

- 4.2.2 Industry 4.0 Adoption Boosting Demand for Smart CNC Platforms

- 4.2.3 Lightweight Alloy & Composite Uptake Requiring High-Speed Multi-Axis Tools

- 4.2.4 Semiconductor Fab Expansion Necessitating Ultra-Precision Equipment

- 4.2.5 Global Replacement Cycle of Ageing (>20 yrs) Machine Tool Fleet

- 4.2.6 Automation of High-Mix/Low-Volume Production Via Flexible Machining

- 4.3 Market Restraints

- 4.3.1 Surging Specialty Steel & Linear-Motion Component Costs

- 4.3.2 High Capex & Lengthy Payback for Advanced CNC Systems

- 4.3.3 Worldwide Shortage of Skilled CNC Programmers/Operators

- 4.3.4 Capital Diversion to Additive Manufacturing Technologies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook (Key Government Regulations & Initiatives)

- 4.6 Technology Snapshot

- 4.6.1 Connected & Automated Machines

- 4.6.2 Advanced Controls / Motion Systems

- 4.6.3 Digitalisation & Industry 4.0

- 4.6.4 AI-Enhanced Metal Cutting Accuracy

- 4.7 Metalworking Industry Snapshot

- 4.8 Impact of Geopolitics on the Machine Tools Market

- 4.9 Industry Attractiveness - Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Product

- 5.1.1 Metal Cutting Tools

- 5.1.1.1 Milling Machines

- 5.1.1.2 Drilling Machines

- 5.1.1.3 Turning (Lathe) Machines

- 5.1.1.4 Grinding Machines

- 5.1.1.5 Laser Cutting Machines

- 5.1.1.6 Electrical Discharge Machines (EDM)

- 5.1.1.7 Waterjet Cutting Machines

- 5.1.1.8 Plasma Cutting Machines

- 5.1.1.9 Multi-Axis Machining Centres

- 5.1.1.10 Others (Boring, etc.)

- 5.1.2 Metal Forming Tools

- 5.1.2.1 Presses (Mechanical, Hydraulic, Servo)

- 5.1.2.2 Forging Machines

- 5.1.2.3 Bending Machines

- 5.1.2.4 Others (Shearing, Extrusion, Rolling, etc.)

- 5.1.1 Metal Cutting Tools

- 5.2 By Technology

- 5.2.1 Conventional Machines (Manually or Semi-Manually)

- 5.2.2 CNC Machines

- 5.2.3 Additive Manufacturing / Hybrid Machines

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace & Defence

- 5.3.3 Electrical & Electronics

- 5.3.4 Industrial Machinery & Equipment

- 5.3.5 Medical Devices

- 5.3.6 Shipbuilding & Marine

- 5.3.7 Precision Engineering

- 5.3.8 Energy & Power

- 5.3.9 Metal Fabrication (Job Shops, etc.)

- 5.3.10 Other Industries (Railway, Other General Manufacturing, etc.)

- 5.4 By Sales Channel

- 5.4.1 Direct Sales (OEMs to End Users)

- 5.4.2 Dealers & Distributors

- 5.4.3 Online / E-commerce

- 5.4.4 Others (System Integrators, Events & Exhibitions, Rebuilders & Refurbished, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Peru

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Kuwait

- 5.5.5.5 Turkey

- 5.5.5.6 Egypt

- 5.5.5.7 South Africa

- 5.5.5.8 Nigeria

- 5.5.5.9 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Yamazaki Mazak Corporation

- 6.4.2 DMG MORI Co. Ltd

- 6.4.3 TRUMPF Group

- 6.4.4 JTEKT Corporation

- 6.4.5 Doosan Machine Tools

- 6.4.6 Okuma Corporation

- 6.4.7 Makino Milling Machine Co. Ltd

- 6.4.8 Haas Automation Inc.

- 6.4.9 FANUC Corporation

- 6.4.10 Hyundai Wia Corp.

- 6.4.11 Schuler AG

- 6.4.12 Sandvik AB (Seco & Walter)

- 6.4.13 GF Machining Solutions

- 6.4.14 Fives Group

- 6.4.15 GROB-Werke GmbH & Co. KG

- 6.4.16 Hermle AG

- 6.4.17 EMAG GmbH & Co. KG

- 6.4.18 Hardinge Inc.

- 6.4.19 HURCO Companies Inc.

- 6.4.20 Amada Co. Ltd