|

市場調查報告書

商品編碼

1851041

雲端整合軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Cloud Integration Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

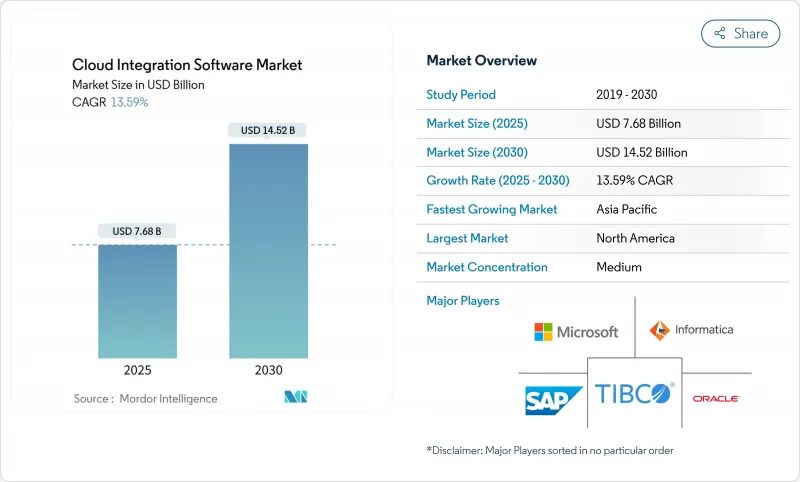

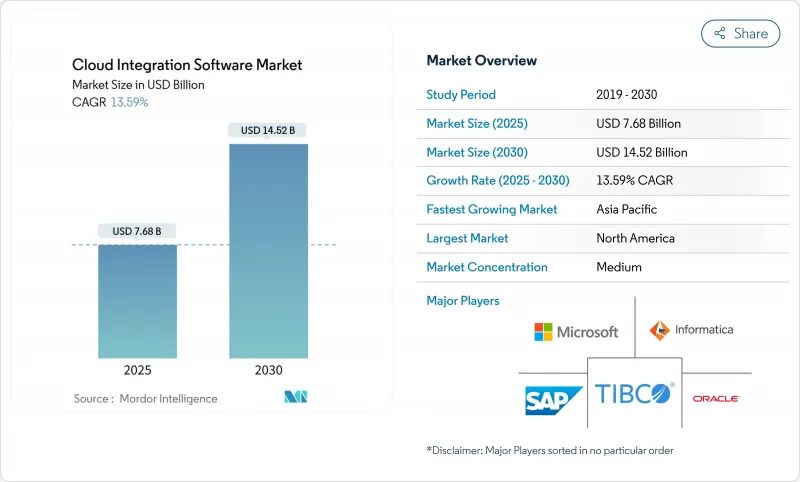

預計到 2025 年,雲端整合軟體市場規模將達到 76.8 億美元,到 2030 年將達到 145.2 億美元,複合年成長率為 13.6%。

如今,大多數企業至少會將工作負載分佈在兩個超大規模資料中心,從而減少供應商鎖定,並根據實際用例需求量身訂做運算配置。不斷擴展的SaaS產品組合需要即時數據交換,事件驅動型分析引擎的日益普及,以及將邊緣感測器與雲端AI平台連接起來的工廠現代化計劃,都將推動成長。低程式碼工具能夠縮短價值實現時間,同時也推動應用普及,此外,供應商整合將API管理、資料管道和管治整合到單一合約中,也扮演了重要角色。跨境資料管理和超大規模資料中心出口流量費用等不利因素,正促使服務供應商轉向混合部署模式,以支援全球協作,同時在本地處理敏感記錄。

全球雲端整合軟體市場趨勢與洞察

多重雲端的興起

企業正將多重雲端視為競爭優勢而非保險,利用GPU密集型節點進行AI訓練,同時將受監管的資料託管在主權區域。超大規模資料中心供應商正積極回應,提供跨雲端資料庫和網路服務,以降低延遲並消除出口流量費用,從而刺激了對能夠抽象化提供者間策略執行的控制平面的需求。統一管治能夠加速合作夥伴的入駐流程,因為無論工作負載位於何處,加密和日誌記錄都保持一致。

大量SaaS應用程式需要整合

如今,平均每個企業運行超過 360 個 SaaS 應用,點對點連結在大規模部署下會失效,導致資料碎片化,並對合規性產生負面影響。現代整合平台即服務 (iPaaS) 捆綁了預先建置的連接器、模式映射和版本控制功能,使團隊無需編寫腳本即可即時同步記錄。供應商也不斷推出 API 市場,客戶可以在這裡銷售自己的連接器,從而將整合從後勤部門成本轉變為收入來源。

資料主權與合規性的複雜性

分散的隱私法律迫使團隊按地區建立管道,雖然供應商透過主權雲端區域和基於策略的路由來解決這個問題,但合規性審核會延長部署時間並增加營運成本。

細分市場分析

由於大型企業需要高度客製化服務,平台即服務 (PaaS) 預計在 2024 年仍將保持 58.3% 的市場佔有率。然而,由於即時擴展、內建可觀測性和降低資本支出的訂閱定價模式,軟體即服務 (SaaS) 整合將實現 15.3% 的年成長率。供應商正在將基於人工智慧的資料映射和異常檢測功能整合到 SaaS 層,使非專業開發者無需編寫程式碼即可建立流程,同時安全團隊也能保持控制。

在監管領域,基礎設施即服務 (IaaS) 整合透過將工作負載綁定到專用主機並接受嚴格審核來確保其有效性。此類配置通常依賴 Kubernetes Operator 來強制執行策略範本並在叢集間複製金鑰。

以ERP和CRM整合為基礎的應用整合將在2024年佔據36.7%的收入佔有率。然而,隨著企業實現數位資產變現並採用微服務,API管理將以14.2%的複合年成長率成長。如今,閘道器具備自助式開發者入口網站、配額執行和模式自省等功能,可將合作夥伴的進駐時間從數月縮短至數天。

EDI現代化也正在加速推進,製造商們正在用即時事件流取代批量平面文件交換,以提高存貨周轉並減少缺貨情況。

雲端整合軟體市場報告按類型(PaaS、IaaS、SaaS)、整合類型(應用程式整合、資料整合、其他)、公司規模(大型企業、中小企業)、服務類型(專業服務、託管服務)、最終用戶產業(銀行、金融服務和保險、IT和電信、其他)和地區進行細分。

區域分析

到2024年,北美將佔據36.4%的市場佔有率,這主要得益於其深厚的雲端運算專業知識、寬鬆的資料流機制以及由於靠近廠商總部而能夠更早地獲取尖端技術。該地區的企業正積極採用人工智慧主導的統一可觀測性,將API呼叫、訊息佇列和資料管道整合到一個統一的管理平台中。

預計到2030年,亞太地區將以14.5%的複合年成長率成為全球成長最快的地區。主權雲端專案需要混合平台,既能確保資料駐留,又能實現全球研發工作負載的同步。中國、日本和韓國5G的快速部署和物聯網的普及將產生大量遙測數據,這些數據需要在邊緣進行清洗,然後再歸檔到中央數據湖中。

歐洲憑藉其嚴格的隱私保護法規(強調審核日誌、使用者許可流程和不可篡改的資料沿襲),佔據了較大的市場佔有率。即將訂定的《數位營運彈性法案》可能會促使金融機構採用能夠抵禦單點故障的事件流架構。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 多重雲端的興起

- 大量SaaS應用程式需要整合

- 對即時數據分析和API主導連接的需求

- 微服務中的事件驅動架構

- 面向工業4.0的邊緣到雲編配

- 市場連接器(iPaaS)貨幣化

- 市場限制

- 資料主權與合規性的複雜性

- 傳統本地整合的複雜性

- 超大規模資料中心出口費用上漲

- 雲端原生整合人才短缺

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 按類型

- PaaS

- IaaS

- SaaS

- 透過整合

- 應用整合

- 資料整合

- API管理

- 流程整合與編配

- B2B/EDI整合

- 按公司規模

- 主要企業

- 中小企業

- 按服務類型

- 專業服務

- 託管服務

- 按最終用戶行業分類

- BFSI

- 資訊科技和電信

- 零售與電子商務

- 教育

- 醫療保健和生命科學

- 製造業

- 政府/公共部門

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Microsoft

- Salesforce(MuleSoft)

- IBM

- Boomi

- Informatica

- SAP

- Oracle

- TIBCO

- SnapLogic

- Software AG

- Workato

- Celigo

- Jitterbit

- Talend

- WSO2

- Red Hat

- Axway

- Kong Inc.

- Accenture

- Deloitte

第7章 市場機會與未來展望

The cloud integration software market size reached USD 7.68 billion in 2025 and is projected to climb to USD 14.52 billion by 2030, reflecting a 13.6% CAGR.

Most enterprises now distribute workloads across at least two hyperscalers to contain vendor lock-in while matching compute profiles to use-case needs. Growth is amplified by sprawling SaaS portfolios that must exchange data in real time, rising adoption of event-driven analytics engines, and factory modernisation initiatives that link edge sensors with cloud AI platforms. Uptake is further helped by low-code tooling that reduces time-to-value, plus vendor consolidation that bundles API management, data pipelines, and governance in a single contract. Headwinds such as cross-border data controls and hyperscaler egress fees are pushing providers toward hybrid deployment models that process sensitive records locally while still supporting global collaboration.

Global Cloud Integration Software Market Trends and Insights

Proliferation of Multi-Cloud Adoption

Enterprises treat multi-cloud as a competitive lever rather than an insurance policy, matching GPU-dense nodes to AI training while housing regulated data in sovereign regions. Hyperscalers respond with cross-cloud database and networking services that trim latency and erase egress fees, spurring demand for control planes that abstract policy enforcement across providers. Unified governance hastens partner onboarding because encryption and logging remain consistent no matter where workloads land.

SaaS Application Sprawl Requiring Unified Integration

With the average enterprise now running more than 360 SaaS apps, point-to-point links crack under scale, fragmenting data and harming compliance. Modern iPaaS bundles pre-built connectors, schema mapping, and version control so teams can sync records instantly without scripting. Vendors further add API marketplaces that let customers sell curated connectors, turning integration from back-office cost into incremental revenue.

Data-Sovereignty and Compliance Complexity

Fragmented privacy laws force teams to build region-specific pipelines that keep regulated data resident while still enabling global analytics. Vendors answer with sovereign cloud zones and policy-based routing, but compliance audits prolong rollouts and inflate operating costs.

Other drivers and restraints analyzed in the detailed report include:

- Need for Real-Time Data Analytics and API-Led Connectivity

- Event-Driven Architectures in Microservices

- Legacy On-Premises Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform-as-a-Service kept 58.3% share in 2024 because large enterprises need advanced customisation. Yet SaaS integration will grow 15.3% annually, thanks to instant scaling, built-in observability, and subscription pricing that slashes CapEx. Vendors weave AI-based data mapping and anomaly detection into their SaaS layers, letting citizen developers build flows without code while security teams remain in control.

For regulated sectors, Infrastructure-as-a-Service integration maintains relevance by anchoring workloads on dedicated hosts under strict audit. These deployments often rely on Kubernetes operators that enforce policy templates and replicate secrets across clusters.

Application Integration dominated revenue at 36.7% in 2024, underpinning ERP and CRM linkages. API Management, however, will post a 14.2% CAGR as firms monetise digital assets and adopt microservices. Gateways now ship with self-service developer portals, quota enforcement, and schema introspection, shrinking partner onboarding windows from months to days.

EDI modernisation also gains steam: manufacturers replace batch flat-file exchanges with real-time event streams that improve inventory turns and reduce stock-outs.

The Cloud Integration Software Market Report is Segmented by Type (PaaS, Iaas, and SaaS), Integration (Application Integration, Data Integration, and More), Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Service Type (Professional Service and Managed Services), End-User Industry (BFSI, IT and Telecom, and More), and Geography.

Geography Analysis

North America held 36.4% market share in 2024, buoyed by deep cloud expertise, permissive data-flow regimes, and proximity to vendor headquarters that grants early access to bleeding-edge features. Enterprises here adopt AI-driven integration observability that correlates API calls, message queues, and data pipelines under one pane of glass.

Asia-Pacific is forecast for the fastest 14.5% CAGR through 2030. Sovereign cloud programs require hybrid platforms able to enforce data-residency while still syncing R and D workloads globally. Rapid 5G deployment and IoT proliferation in China, Japan, and South Korea generate telemetry bursts that must be cleansed at the edge before archive to central data lakes.

Europe keeps sizable share due to strict privacy mandates that emphasise audit logs, consent workflows, and immutable data lineage. The upcoming Digital Operational Resilience Act will push financial institutions to adopt event-streaming architectures that survive single-point failures.

- Microsoft

- Salesforce (MuleSoft)

- IBM

- Boomi

- Informatica

- SAP

- Oracle

- TIBCO

- SnapLogic

- Software AG

- Workato

- Celigo

- Jitterbit

- Talend

- WSO2

- Red Hat

- Axway

- Kong Inc.

- Accenture

- Deloitte

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of multi-cloud adoption

- 4.2.2 SaaS application sprawl requiring unified integration

- 4.2.3 Need for real-time data analytics and API-led connectivity

- 4.2.4 Event-driven architectures in micro-services

- 4.2.5 Edge-to-cloud orchestration for Industry 4.0

- 4.2.6 Monetisation of marketplace connectors (iPaaS)

- 4.3 Market Restraints

- 4.3.1 Data-sovereignty and compliance complexity

- 4.3.2 Legacy on-prem integration complexity

- 4.3.3 Rising hyperscaler egress charges

- 4.3.4 Scarcity of cloud-native integration talent

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 PaaS

- 5.1.2 IaaS

- 5.1.3 SaaS

- 5.2 By Integration

- 5.2.1 Application Integration

- 5.2.2 Data Integration

- 5.2.3 API Management

- 5.2.4 Process Integration and Orchestration

- 5.2.5 B2B/EDI Integration

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Service Type

- 5.4.1 Professional Services

- 5.4.2 Managed Services

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Retail and E-commerce

- 5.5.4 Education

- 5.5.5 Healthcare and Life Sciences

- 5.5.6 Manufacturing

- 5.5.7 Government and Public Sector

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft

- 6.4.2 Salesforce (MuleSoft)

- 6.4.3 IBM

- 6.4.4 Boomi

- 6.4.5 Informatica

- 6.4.6 SAP

- 6.4.7 Oracle

- 6.4.8 TIBCO

- 6.4.9 SnapLogic

- 6.4.10 Software AG

- 6.4.11 Workato

- 6.4.12 Celigo

- 6.4.13 Jitterbit

- 6.4.14 Talend

- 6.4.15 WSO2

- 6.4.16 Red Hat

- 6.4.17 Axway

- 6.4.18 Kong Inc.

- 6.4.19 Accenture

- 6.4.20 Deloitte

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment