|

市場調查報告書

商品編碼

1851025

EHS軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030年)EHS Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

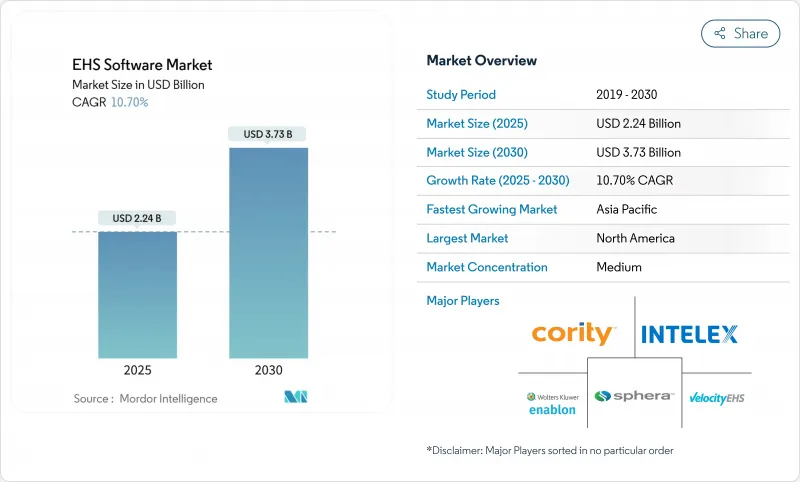

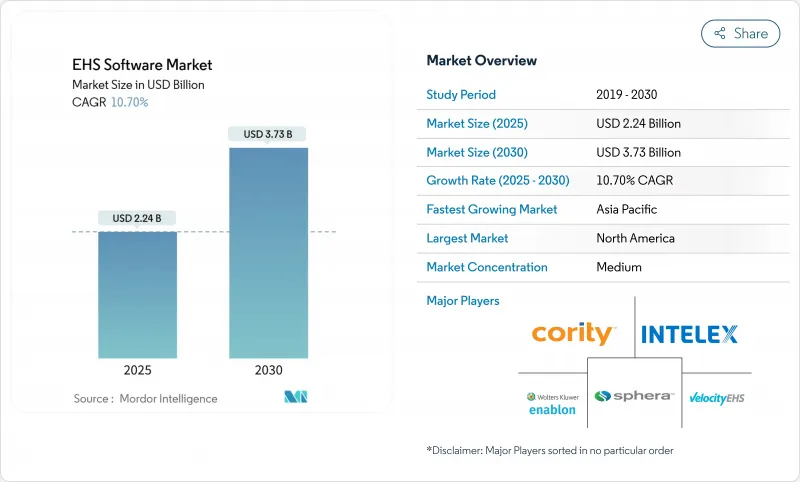

環境健康與安全 (EHS) 軟體市場預計將從 2025 年的 22.4 億美元成長到 2030 年的 37.3 億美元,複合年成長率為 10.7%。

監管力度的持續收緊、ESG規範的快速規範化以及向人工智慧驅動的安全分析的轉變,都推動了這一成長。歐洲企業永續發展報告指令(CSRD)實施的延遲,也促使企業對自動化合規工作流程的需求增加。在營運層面,企業傾向採用SaaS架構以降低整體擁有成本。雲端部署已佔活躍部署的62%,其中服務佔60%,顯示部署專業知識對於SaaS的普及仍然至關重要。大型企業正在利用各種平台來應對跨境風險,而中小企業則以最快的速度進行遷移,因為訂閱模式消除了前期投資的障礙。

全球EHS軟體市場趨勢與洞察

更嚴格的監管和更高的問責制

歐盟的企業社會責任數據(CSRD)顯著擴大了資訊揭露的範圍和頻率,迫使跨國公司實現跨司法管轄區報告工作流程的自動化。同時,美國也出現了類似的舉措,例如紐約州強制要求報告溫室氣體排放,這導致企業因違規承擔的責任日益加重。因此,企業紛紛轉向環境、健康與安全(EHS)軟體市場尋求解決方案,以作為先發制人的法律保障。日本的網路安全戰略要求建立軟體材料清單)以保護供應鏈,從而推動了對整合風險平台的需求。由此產生的結構化資料量空前龐大,已遠遠超出人工處理能力。

擴大ESG和永續性報告要求

強制性ESG資訊揭露已從投資者的期望發展成為法律義務。歐盟的碳邊境調節機制要求進口商追蹤隱含排放,並強制全球供應商將環境資料收集制度化。英國僅有19%的中小企業具備ESG意識,隨著新的處罰措施生效,在閒置頻段推廣應用的潛力日益凸顯。肯亞的綠色金融分類法鼓勵貸款機構投資氣候友善計劃,並建立了一套資訊揭露框架。因此,業內相關人員將環境健康與安全軟體市場視為一種擴充性的途徑,可以將符合審核要求的ESG分析融入日常營運,從而實現合規。

高昂的初始實施和變更管理成本

義大利小型製造商認為,採購價格、系統遷移的複雜性以及員工培訓是阻礙他們採用數位安全技術的主要因素。 40%的中小企業收集環境數據,但只有18%將其整合到績效指標中。儘管供應商正在提供打包的入門服務和模板化配置來應對這項挑戰,但預算限制仍會減緩轉換速度,並限制EHS軟體市場近期的成長。

細分市場分析

到2024年,服務將佔EHS軟體市場佔有率的60%。法規解讀、資料遷移和使用者培訓決定著計劃的成敗。 ERA Environmental定義的實施生命週期(評估、同步部署和檢驗)闡明了諮詢人才的重要性。在預測期內,隨著人工智慧和ESG模組的出現,EHS軟體的複雜性日益增加,許多公司選擇將這些複雜性外包,因此與服務相關的EHS軟體市場規模將穩定成長。

隨著企業向雲端原生套件和行動擴展轉型,軟體收入將以 10.7% 的複合年成長率成長。供應商正在整合可配置的 ESG 模板和基於人工智慧的風險引擎,以縮短設定時間並提高採用率。因此,長期利潤率的提升將有利於平台授權商,而短期規模的擴大則取決於服務合作夥伴能否加速企業部署。

至2024年,雲端解決方案將佔EHS軟體市場規模的62%。集中式資料管理、彈性儲存和即時修補程式等優勢,足以抵消長期以來的安全隱患。日本企業正邁入數位轉型的第三階段:數據分析,凸顯了雲端基礎設施如何協助提升效率。

在延遲、主權或客製化工作流程需要本地控制的情況下,本地部署仍然存在,但其成長速度比雲端運算慢了6個百分點。按行業分類,供應商正逐步放棄原生桌面版本,鼓勵高度監管的產業採用混合策略。隨著跨國公司對其伺服器設施進行精簡,EHS軟體市場將更加傾向於基於使用量的定價模式,以使成本與規模相符。

EHS軟體市場按部署類型(雲端、本地部署)、元件(軟體、服務)、最終用戶產業(石油天然氣、能源公共產業、其他)、解決方案類型(事故與安全管理、審核與檢查、其他)、組織規模(大型企業、其他)和地區進行細分。市場預測以美元計價。

區域分析

到2024年,北美將維持37.5%的EHS(環境、健康與安全)軟體市場佔有率,這得益於成熟的OSHA合規文化以及各州交通機構對人工智慧的早期應用。像加州大學聖地牙哥分校醫療中心這樣的醫療網路正在投資2,200萬美元用於人工智慧以改善病患治療效果,這表明各級經營團隊對數位安全工具的廣泛承諾。聯邦政府關於網路安全衛生的指南將進一步加速人們對雲端平台的信任。

亞太地區是成長引擎,預計到2030年將以10.1%的複合年成長率成長。日本的「數位社會優先計畫」以及每季1.54兆日圓(約107億美元)的軟體投資,便是公私合作提升生產力的典範。從越南到印度,各區域監管機構正在協調化學品和氣候框架,從而擴大了環境、健康與安全(EHS)軟體市場的潛在用戶群。

隨著共同體永續發展指令(CSRD)最後期限的臨近,歐洲經濟正經歷謹慎成長。各公司正積極調動審核團隊,將永續性指標納入財務報表,進而持續推升對彙報模組的需求。歐盟的碳邊境調節機制將間接促進貿易夥伴採用相關指標,擴大環境、健康與安全(EHS)軟體產業的使用者基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 更嚴格的監管和更高的問責制

- 擴大環境、社會及公司治理(ESG)及永續性報告義務

- 以SaaS和行動裝置優先的EHS平台可降低整體擁有成本

- 人工智慧驅動的預測分析助力安全與合規

- 與數位雙胞胎/資產管理堆疊整合

- 市場限制

- 高昂的初始實施和變更管理成本

- 雲端部署中的網路安全和資料隱私問題

- 下一代EHS工具面臨資料科學人才短缺問題。

- 供應商整合帶來的整合鎖定風險

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特的五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 軟體

- 服務

- 透過部署模式

- 雲

- 本地部署

- 按解決方案類型

- 事故與安全管理

- 審核和檢查

- 合規與風險管理

- ESG/碳管理

- 培訓與學習

- 按組織規模

- 主要企業

- 中小企業

- 按最終用戶行業分類

- 能源與公共產業

- 石油和天然氣

- 化工/石油化工

- 醫療保健與生命科學

- 建築/製造

- 採礦和金屬

- 飲食

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 其他南美洲

- 歐洲

- 德國

- 法國

- 英國

- 俄羅斯

- 其他歐洲地區

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 其他亞洲地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Enablon(Wolters Kluwer NV)

- Intelex Technologies ULC

- VelocityEHS Holdings Inc.

- Cority Software Inc.

- Sphera Solutions Inc.

- Sai Global Pty Ltd(Intertek Group PLC)

- Dakota Software Corporation

- Benchmark Digital Partners LLC

- ProcessMAP Corporation

- Quentic GmbH

- IsoMetrix

- SAP SE

- iPoint-Systems GmbH

- Evotix(SHE Software)

- DNV Business Assurance

- EcoOnline

- ETQ, part of Hexagon

- Origami Risk LLC

- Alcumus Group

- Ideagen PLC

- Vector Solutions

- KPA

- EHS Insight

- Quber Tech

第7章 市場機會與未來展望

The environmental health safety software market is valued at USD 2.24 billion in 2025 and is forecast to reach USD 3.73 billion by 2030, advancing at a 10.7% CAGR.

Persistent regulatory tightening, rapid ESG formalization and the shift toward AI-enabled safety analytics collectively anchor this expansion. European delays in the Corporate Sustainability Reporting Directive (CSRD) are generating pent-up demand for automated compliance workflows, while New York's mandatory greenhouse-gas disclosures preview similar obligations in other jurisdictions. At an operational level, enterprises favor software-as-a-service architectures to reduce total cost of ownership; cloud deployments already account for 62% of active installations, and services commanding 60% illustrate that implementation expertise remains critical for adoption.Large enterprises leverage platform breadth to address cross-border risk, yet small and mid-sized firms are the fastest movers because subscription pricing removes upfront capital barriers.

Global EHS Software Market Trends and Insights

Stringent regulatory enforcement & rising liability exposure

The European Union's CSRD markedly widens disclosure scope and frequency, compelling multinationals to automate multi-jurisdictional reporting workflows. Parallel action in the United States-such as New York's greenhouse-gas reporting requirement-signals rising liability for non-compliance. Businesses therefore treat environmental health safety software market solutions as a pre-emptive legal safeguard. Asian regulators are converging; Japan's cybersecurity strategy now requires Software Bills of Materials to protect supply chains, elevating demand for integrated risk platforms . The cumulative result is an unprecedented volume of structured data that exceeds manual processing capacity, turning automation into necessity rather than choice.

Expansion of ESG & sustainability reporting mandates

Mandatory ESG disclosures have expanded from investor-led expectations to statutory obligations. The EU's Carbon Border Adjustment Mechanism forces importers to track embedded emissions, compelling global suppliers to institutionalize environmental data capture. Only 19% of UK SMEs have any ESG awareness, revealing white-space adoption potential as new penalties take hold. Emerging economies are aligning; Kenya's Green Finance Taxonomy now directs lenders toward climate-aligned projects, institutionalizing disclosure frameworks. Industry practitioners therefore view the environmental health safety software market as a scalable route to compliance, embedding audit-ready ESG analytics into day-to-day operations.

High upfront implementation & change-management cost

Small manufacturers in Italy cite purchase price, system migration complexity and workforce training as principal inhibitors to digital safety adoption. Similar feedback is recorded across, economies, where 40% of SMEs collect environmental data but only 18% integrate it into performance metrics . Vendors respond with packaged onboarding services and templated configurations, yet budget constraints still delay conversions and trim near-term growth in the environmental health safety software market.

Other drivers and restraints analyzed in the detailed report include:

- SaaS-first, mobile-first EHS platforms reduce TCO

- AI-driven predictive safety & compliance analytics

- Cyber-security & data-privacy concerns in cloud roll-outs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services held 60% of environmental health safety software market share in 2024 . Organizations acknowledge that platform acquisition addresses only a fraction of compliance complexity; regulatory interpretation, data migration and user training determine project success. The implementation lifecycle set out by ERA Environmental-assessment, tandem deployment and validation-illustrates why consultancy talent remains integral. Over the forecast period, the environmental health safety software market size linked to Services will expand steadily as AI and ESG modules add intricacy that many firms outsource.

Software revenue grows at an aligned 10.7% CAGR as buyers progress toward cloud-native suites and mobile extensions. Vendors embed configurable ESG templates and AI-based risk engines, compressing setup time and increasing stickiness. Consequently, long-term margin expansion favors platform licensors, yet near-term scale depends on service partners to accelerate enterprise roll-outs.

Cloud solutions commanded 62% of environmental health safety software market size in 2024. Centralized data management, elastic storage and instant patching outweigh long-standing security concerns. Japanese corporates have progressed to the third stage of digital transformation-data analytics underscoring how cloud infrastructure underpins efficiency gains .

On-premise installations persist where latency, sovereignty or bespoke workflows require localized control, but growth lags cloud by six percentage points. Vendors increasingly sunset native desktop editions, encouraging hybrid strategies in heavily regulated verticals. As multinationals rationalize server estates, the environmental health safety software market tilts further toward usage-based pricing that aligns cost with scale.

EHS Software Market is Segmented by Deployment Mode (Cloud, On-Premise), by Component (Software, Services) by End-User Vertical (Oil and Gas, Energy and Utilities, and More), by Solution Type (Incident and Safety Management, Audit and Inspection and More), by Organization Size (Large Enterprises and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains 37.5% of environmental health safety software market size in 2024, underpinned by mature OSHA compliance culture and early AI adoption by state transportation agencies. Healthcare networks such as UC San Diego Health invest USD 22 million in AI to elevate patient outcomes, demonstrating broad management commitment to digital safety tools . Federal guidance on cyber hygiene further accelerates trust in cloud platforms

Asia-Pacific is the growth engine, poised for 10.1% CAGR through 2030. Japan's Digital Society priority program and JPY 1.54 trillion (USD 10.7 billion) quarterly software investments exemplify government-private collaboration on productivity gains. Regional regulators-from Vietnam to India-are rolling out harmonized chemical and climate frameworks, expanding the environmental health safety software market addressable base.

Europe shows measured growth as CSRD deadlines loom. Corporates mobilize audit teams to integrate sustainability metrics with financial statements, creating recurring demand for reporting modules . The EU Carbon Border Adjustment Mechanism indirectly pulls adoption in trading partners, broadening the environmental health safety software industry footprint.

- Enablon (Wolters Kluwer NV)

- Intelex Technologies ULC

- VelocityEHS Holdings Inc.

- Cority Software Inc.

- Sphera Solutions Inc.

- Sai Global Pty Ltd (Intertek Group PLC)

- Dakota Software Corporation

- Benchmark Digital Partners LLC

- ProcessMAP Corporation

- Quentic GmbH

- IsoMetrix

- SAP SE

- iPoint-Systems GmbH

- Evotix (SHE Software)

- DNV Business Assurance

- EcoOnline

- ETQ, part of Hexagon

- Origami Risk LLC

- Alcumus Group

- Ideagen PLC

- Vector Solutions

- KPA

- EHS Insight

- Quber Tech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent regulatory enforcement & rising liability exposure

- 4.2.2 Expansion of ESG & sustainability reporting mandates

- 4.2.3 SaaS-first, mobile-first EHS platforms reduce TCO

- 4.2.4 AI-driven predictive safety & compliance analytics

- 4.2.5 Convergence with digital-twin/asset-management stacks

- 4.3 Market Restraints

- 4.3.1 High upfront implementation & change-management cost

- 4.3.2 Cyber-security & data-privacy concerns in cloud roll-outs

- 4.3.3 Shortage of data-science talent for next-gen EHS tools

- 4.3.4 Vendor consolidation creating integration lock-in risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Solution Type

- 5.3.1 Incident & Safety Management

- 5.3.2 Audit & Inspection

- 5.3.3 Compliance & Risk Management

- 5.3.4 ESG / Carbon Management

- 5.3.5 Training & Learning

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small & Mid-Sized Enterprises (SME)

- 5.5 By End-user Industry

- 5.5.1 Energy & Utilities

- 5.5.2 Oil & Gas

- 5.5.3 Chemicals & Petro-chemicals

- 5.5.4 Healthcare & Life Sciences

- 5.5.5 Construction & Manufacturing

- 5.5.6 Mining & Metals

- 5.5.7 Food & Beverages

- 5.5.8 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia

- 5.6.5 Middle East & Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Enablon (Wolters Kluwer NV)

- 6.4.2 Intelex Technologies ULC

- 6.4.3 VelocityEHS Holdings Inc.

- 6.4.4 Cority Software Inc.

- 6.4.5 Sphera Solutions Inc.

- 6.4.6 Sai Global Pty Ltd (Intertek Group PLC)

- 6.4.7 Dakota Software Corporation

- 6.4.8 Benchmark Digital Partners LLC

- 6.4.9 ProcessMAP Corporation

- 6.4.10 Quentic GmbH

- 6.4.11 IsoMetrix

- 6.4.12 SAP SE

- 6.4.13 iPoint-Systems GmbH

- 6.4.14 Evotix (SHE Software)

- 6.4.15 DNV Business Assurance

- 6.4.16 EcoOnline

- 6.4.17 ETQ, part of Hexagon

- 6.4.18 Origami Risk LLC

- 6.4.19 Alcumus Group

- 6.4.20 Ideagen PLC

- 6.4.21 Vector Solutions

- 6.4.22 KPA

- 6.4.23 EHS Insight

- 6.4.24 Quber Tech

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-Need Assessment