|

市場調查報告書

商品編碼

1850974

環境照明:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Ambient Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

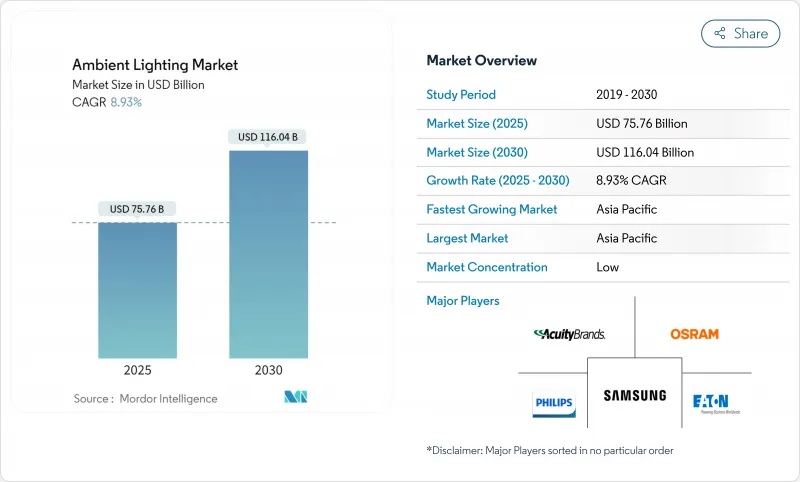

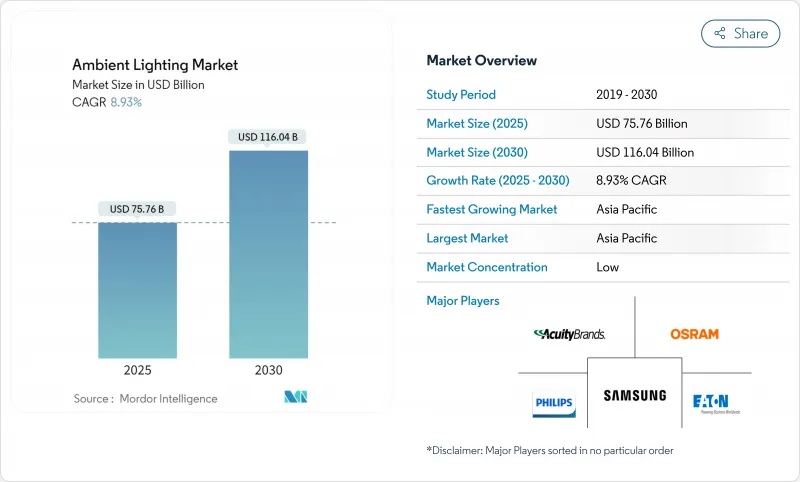

預計到 2025 年,環境照明市場規模將達到 757.6 億美元,到 2030 年將達到 1,160.4 億美元,年複合成長率為 8.93%。

全球能源效率標準、LED的快速普及以及將照明與更廣泛的智慧建築平台連接起來的互聯系統日益成長的吸引力,共同推動了照明行業的成長。 LED產品已佔照明總收入的90%,其價值鏈正向軟體、感測器和服務領域轉移。亞太地區佔全球收入的近一半,並在都市化規劃和政府資助的智慧城市建設的推動下,繼續保持兩位數的成長速度。產品結構正在發生變化,燈具仍然佔據主導地位,但隨著終端用戶對節能、數據和以人性化的功能的需求不斷成長,控制系統正成為重要的戰略成長引擎,這些功能能夠提高生產力。

全球環境照明市場趨勢與洞察

歐盟和澳洲強制推行LED改裝計劃,加速商業建築升級改造

歐盟生態設計指令和澳洲國家建築規範等嚴格的政策框架正在推動傳統燈具逐步淘汰。如今,合規性而非投資報酬率已成為關鍵因素,建築業主紛紛採用符合最低能源效率標準的LED燈具。受強制性升級和對智慧互聯控制日益成長的需求推動,僅商業領域預計將從2024年的170.7億美元飆升至2030年的273.8億美元。供應商正積極回應,推出快速安裝燈具、無驅動燈管和現場編程改造套件,以最大限度地減少停機時間和人事費用。

亞洲智慧城市投資推動路燈互聯維修

中國、印度和日本的國家智慧城市計畫正將自適應路燈置於其數位基礎設施的核心位置。市政當局正用連網的LED燈具取代傳統的高壓鈉燈,這些LED燈具可以搭載5G小型基地台、空氣品質感測器和交通攝影機。 Zigbee和BLE Mesh等無線通訊協定無需鋪設新電纜即可實現擴充性。提供開放API節點的硬體專家能夠很好地幫助城市將照明與更廣泛的物聯網服務捆綁在一起。

大規模LED燈條部署存在高湧入電流危險

在多串燈系統中,數千個驅動器同時啟動會產生有害的電流尖峰,導致斷路器跳脫並引發保固索賠。軟啟動電源和連續式控制器可以降低風險,但會增加成本。在物流樞紐中,線性照明通常綿延數百米,可靠性問題可能會延緩部署進度。

細分市場分析

燈具仍將是重要的收入來源,預計到2024年將維持71%的市場佔有率,這主要得益於螢光和鹵素燈大規模被LED燈取代。獲得能源之星認證的燈具比白熾燈節能90%,使用壽命長15倍,降低了維護成本和碳排放。儘管單價有所下降,但辦公室、住宅和倉庫的燈具更換活動仍保持了市場需求的穩定。

照明控制是市場成長的加速器,預計年增率將達到 9.4%。開放式 DALI 閘道、低功耗藍牙 (BLE) 網路和雲端儀錶板嵌入的資料洞察功能遠不止於能源管理。 Signify 的一份報告預測,到 2024 年,互聯系統和服務將佔企業收入的 30%,這印證了客戶對以軟體為中心的提案日益成長的需求。隨著建築規範強制要求配備居住者感應和日間行車燈採集功能,互聯控制的環境照明市場規模也將隨之擴大。

2024年,房屋整修和重建計劃貢獻了63%的銷售額,因為業主紛紛升級其大量老舊的設備。 2022年,美國家裝市場規模超過6,000億美元,其中34%的支出用於節能升級,包括照明設備。紐約市第97號地方法律等城市碳排放上限法規加劇了這一趨勢,從2025年起,低效率行為將面臨罰款。美國總務管理局的指導核准, LED燈管、改裝套件和整套燈具更換都是認可的節能途徑,從而促進了照明設備的更換。

新建建築的市佔率雖然會縮小,但維修將達到9.1%,超過改造工程。建築師現在會在設計流程的早期階段就對照明進行編程,以獲得WELL和LEED認證積分、整合感測器並簡化試運行。智慧商業園區正將連網燈具作為基礎,推動環境照明市場滲透到綜合用途大樓、資料中心和醫療設施等場所。新建建築環境照明市場的擴張也得益於規模經濟,這使得硬體和軟體的捆綁銷售成為可能。

區域分析

亞太地區預計到2024年將佔全球銷售額的46%,並在2030年之前以12.8%的複合年成長率成長,這主要得益於各國政府對高效照明的補貼、大規模的住宅建設以及其在全球LED元件生產領域的領先地位。中國憑藉其強大的製造能力和龐大的智慧城市試點項目,在智慧路燈領域佔據領先地位,從而支撐了市場需求。印度的「百城計畫」和日本的「社會5.0」願景正在加強該地區在控制系統、感測器和平台整合方面的供應。

北美市場成熟且主導創新活力。根據昕諾飛(Signify)2024年的數據,美國銷售額將達到22億美元,約佔全球銷售額的三分之一。住宅翻新市場依然強勁,但新冠疫情後辦公空間縮減導致部分維修計畫延期。 WELL和LEED認證的普及推動了以人性化的升級改造,使高階設備和先進控制系統得以應用,從而保持了市場對高階產品的認可。

歐洲以設計為中心,監管嚴格。生態設計指令強制要求商業建築全面採用LED照明,該地區偏好高顯色性產品,並專注於視覺舒適度。德國和法國的汽車製造商正在將環境照明封裝技術推廣到更遠的地方,鼓勵零件製造商提供成本最佳化的RGB模組。

南美洲和中東及非洲的市場佔有率雖小,但成長勢頭良好。海灣合作理事會(GCC)的飯店整修優先考慮營造引人注目的氛圍,而非洲的基礎設施規劃則將公共資金投入到高效的街道照明系統中,這些照明系統同時也是通往智慧城市的門戶。隨著各國政府採納綠建築標準並吸引外國直接投資,環境照明市場可望迎來長期成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟和澳洲強制推行LED維修計劃,加速商業建築升級改造

- 亞洲智慧城市投資推動智慧路燈維修

- 中階車型(亞洲和歐洲)的OEM主導環境套件

- WELL和LEED v4標準推進美國辦公大樓以人性化的照明

- 酒店業品牌重塑週期導致美學預算增加(波灣合作理事會國家)

- 快速建設電商倉庫需要低眩光照明設備

- 市場限制

- 大規模LED燈條部署存在高湧入電流危險

- 無線通訊協定碎片化推高了控制系統整合成本。

- 新冠疫情後北美和歐洲的辦公室規模縮減和維修工程減少

- 稀土元素供應鏈緊張推高了磷光體和驅動裝置的價格。

- 產業生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 報價

- 燈具和照明設備

- 白熾燈泡

- 鹵素燈

- 螢光

- 發光二極體(LED)

- 照明控制

- 燈具和照明設備

- 安裝階段

- 新建工程

- 維修和重建

- 按類型

- 表面黏著技術燈

- 軌道燈

- 條形燈

- 吊掛

- 嵌入式照明

- 按流明輸出

- 小於 3,000 流明(住宅)

- 3,001~10,000 流明(商業用途)

- 超過 10,000 流明(工業和戶外)

- 連結性別

- 有線(DALI、KNX)

- 無線(Zigbee、BLE Mesh、Thread)

- 最終用戶

- 住房

- 車

- 飯店和零售業

- 衛生保健

- 工業與物流

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 其他南美洲

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Signify NV(Philips Lighting)

- Acuity Brands, Inc.

- ams OSRAM AG

- Hubbell Incorporated

- Eaton Corporation plc(Cooper Lighting)

- Cree Lighting(Savant Systems)

- Zumtobel Group

- GE Lighting, a Savant company

- Panasonic Life Solutions

- Wipro Lighting

- Samsung Electronics(LED Division)

- LG Innotek

- Bridgelux, Inc.

- Helvar Oy

- Dialight plc

- Fagerhult Group

- Legrand SA

- Lutron Electronics

- SPI Lighting

- Amerlux, LLC

第7章 市場機會與未來展望

The ambient lighting market stands at USD 75.76 billion in 2025 and is forecast to reach USD 116.04 billion by 2030, advancing at an 8.93% CAGR.

Growth is anchored in global efficiency mandates, rapid LED penetration, and the widening appeal of connected systems that link lighting with broader smart-building platforms. LED-based products already account for 90% of total lighting sales, reshaping value chains toward software, sensors, and services. Asia Pacific owns nearly one-half of worldwide revenue and continues to expand at double-digit speed on the back of urbanization programs and state-funded smart-city rollouts. Product mix is shifting: lamps and luminaires still dominate, yet controls are now the strategic growth engine as end users seek energy savings, data, and human-centric functions that raise productivity.

Global Ambient Lighting Market Trends and Insights

LED retrofit mandates accelerating commercial upgrades in EU and Australia

Stringent policy frameworks such as the European Union Ecodesign Directive and Australia's National Construction Code are forcing the phase-out of legacy lamps. Compliance rather than payback is now the tipping point, pushing building owners to adopt LED fixtures that satisfy minimum efficacy thresholds. The commercial segment alone is projected to jump from USD 17.07 billion in 2024 to USD 27.38 billion by 2030 as mandated upgrades converge with rising demand for connected controls. Suppliers are responding with quick-fit lamps, driverless tubes, and field-programmed retrofit kits that minimize downtime and labor costs.

Smart-city investments driving connected street-light retrofits in Asia

National smart-city missions across China, India, and Japan place adaptive street lighting at the core of digital infrastructure. Municipalities are replacing conventional high-pressure sodium fixtures with networked LEDs that can host 5G small cells, air-quality sensors, and traffic cameras. Wireless protocols such as Zigbee and BLE Mesh offer scalability without trenching new cables, a decisive factor in dense urban cores. Hardware specialists that deliver open-API nodes are well-positioned as cities bundle lighting with broader IoT services.

High inrush-current failures in large-scale LED strip deployments

Multi-string strip systems can draw damaging current spikes when thousands of drivers power up simultaneously, triggering breaker trips and warranty claims. Soft-start power supplies and sequential controllers mitigate risk but add cost. Reliability concerns may delay rollouts in logistics hubs where linear lighting often spans hundreds of meters.

Other drivers and restraints analyzed in the detailed report include:

- OEM-triggered ambient packages in mid-segment autos

- WELL and LEED v4 standards pushing human-centric lighting in US offices

- Fragmented wireless protocols elevating control-system integration cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lamps and luminaires remain the revenue cornerstone, holding 71% in 2024 thanks to the mass conversion from fluorescent and halogen to LED. ENERGY STAR-rated fixtures consume 90% less power than incandescent alternatives and last 15 times longer, slashing maintenance budgets and carbon footprints. Replacement activity across offices, homes, and warehouses keeps demand stable even as unit prices fall.

Lighting controls are the market's accelerant, forecast to grow 9.4% annually. Open DALI gateways, Bluetooth LE networks, and cloud dashboards embed data insights that extend beyond energy management. Signify reports that connected systems and services delivered 30% of company sales in 2024, confirming rising customer appetite for software-centric propositions. The ambient lighting market size for connected controls is set to widen as building codes mandate occupancy sensing and daylight harvesting.

Retrofit and renovation projects generated 63% of 2024 revenue as owners upgraded vast stocks of outdated fixtures. The United States residential remodeling market surpassed USD 600 billion in 2022, with 34% of spend flowing into energy-related upgrades that include lighting. City carbon caps such as New York Local Law 97 amplify urgency, imposing fines starting in 2025 for inefficiency breaches. Guidance from the U.S. General Services Administration lists LED tubes, retrofit kits, or full luminaire swaps as approved pathways, fueling a deep replacement funnel.

New construction accounts for a smaller base but will outpace retrofits at 9.1% CAGR. Architects now program lighting early in design workflows to capture WELL and LEED credits, integrate sensors, and streamline commissioning. Smart commercial campuses specify network-ready fixtures as baseline, propelling ambient lighting market penetration in mixed-use towers, data centers, and healthcare facilities. Ambient lighting market size gains in new builds are also supported by economies of scale that allow bundled hardware-plus-software contracts.

The Ambient Lighting Market Report is Segmented by Offering (Lamps and Luminaires, and Lighting Controls), Installation Phase (New Construction, Retrofit and Renovation), Type (Surface-Mounted Light, Track Light, Sand More), Lumen Output (<=3 000 Lm (Residential), and More), Connectivity (Wired, and Wireless), End User (Residential, Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific controls 46% of 2024 revenue and will grow at 12.8% CAGR through 2030, driven by state subsidies for efficient lighting, sprawling residential construction, and global leadership in LED component production. China spearheads both manufacturing prowess and giant smart-city pilots that anchor connected street-light demand. India's 100-city mission and Japan's Society 5.0 vision reinforce the regional pipeline for controls, sensors, and platform integration.

North America is a mature but innovation-led arena. Signify's 2024 data show that the United States contributed USD 2.20 billion, roughly one-third of its global sales. Residential remodels remain strong, yet office downsizing after COVID slows some retrofit schedules. WELL and LEED adoption maintains momentum for human-centric upgrades that justify premium fixtures and advanced controls.

Europe occupies a design-centric and regulation-heavy position. The Ecodesign Directive obliges LED transitions across commercial estates, and the region champions high color-rendering products that align with its emphasis on visual comfort. Automakers in Germany and France extend ambient packages downrange, spurring component suppliers to deliver cost-optimized RGB modules.

South America and the Middle East & Africa together contribute a smaller share but post healthy growth. GCC hospitality refurbishments prioritize dramatic ambience, while African infrastructure programs channel public funds into efficient street lighting that doubles as a smart-city gateway. The ambient lighting market gains long-term upside as governments apply green-building codes and attract foreign direct investment.

- Signify N.V. (Philips Lighting)

- Acuity Brands, Inc.

- ams OSRAM AG

- Hubbell Incorporated

- Eaton Corporation plc (Cooper Lighting)

- Cree Lighting (Savant Systems)

- Zumtobel Group

- GE Lighting, a Savant company

- Panasonic Life Solutions

- Wipro Lighting

- Samsung Electronics (LED Division)

- LG Innotek

- Bridgelux, Inc.

- Helvar Oy

- Dialight plc

- Fagerhult Group

- Legrand S.A.

- Lutron Electronics

- SPI Lighting

- Amerlux, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 LED Retrofit Mandates Accelerating Commercial Up-grades in EU and Australia

- 4.2.2 Smart-city Investments Driving Connected Street-light Retrofits in Asia

- 4.2.3 OEM-Triggered Ambient Packages in Mid-segment Autos (Asia and Europe)

- 4.2.4 WELL and LEED v4 Standards Pushing Human-Centric Lighting in United States Offices

- 4.2.5 Hospitality Re-brand Cycles Increasing Aesthetic Ambient Budgets (Gulf Cooperation Council Countries)

- 4.2.6 Rapid e-commerce Warehouse Build-outs Needing Low-glare Luminaires

- 4.3 Market Restraints

- 4.3.1 High Inrush-Current Failures in Large-scale LED Strip Deployments

- 4.3.2 Fragmented Wireless Protocols Elevating Control-System Integration Cost

- 4.3.3 Post-COVID Office Downsizing Reducing Retrofit Pipelines (NA and EU)

- 4.3.4 Tight Rare-earth Supply Chain Inflating Phosphor and Driver Prices

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Lamps and Luminaires

- 5.1.1.1 Incandescent Lamps

- 5.1.1.2 Halogen Lamps

- 5.1.1.3 Fluorescent Lamps

- 5.1.1.4 Light-Emitting Diode (LED)

- 5.1.2 Lighting Controls

- 5.1.1 Lamps and Luminaires

- 5.2 By Installation Phase

- 5.2.1 New Construction

- 5.2.2 Retrofit and Renovation

- 5.3 By Type

- 5.3.1 Surface-mounted Light

- 5.3.2 Track Light

- 5.3.3 Strip Light

- 5.3.4 Suspended Light

- 5.3.5 Recessed Light

- 5.4 By Lumen Output

- 5.4.1 Sub 3 000 lm (Residential)

- 5.4.2 3 001 - 10 000 lm (Commercial)

- 5.4.3 Above10 000 lm (Industrial and Outdoor)

- 5.5 By Connectivity

- 5.5.1 Wired (DALI, KNX)

- 5.5.2 Wireless (Zigbee, BLE Mesh, Thread)

- 5.6 By End User

- 5.6.1 Residential

- 5.6.2 Automotive

- 5.6.3 Hospitality and Retail

- 5.6.4 Healthcare

- 5.6.5 Industrial and Logistics

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Nordics

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 South East Asia

- 5.7.3.6 Australia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Signify N.V. (Philips Lighting)

- 6.4.2 Acuity Brands, Inc.

- 6.4.3 ams OSRAM AG

- 6.4.4 Hubbell Incorporated

- 6.4.5 Eaton Corporation plc (Cooper Lighting)

- 6.4.6 Cree Lighting (Savant Systems)

- 6.4.7 Zumtobel Group

- 6.4.8 GE Lighting, a Savant company

- 6.4.9 Panasonic Life Solutions

- 6.4.10 Wipro Lighting

- 6.4.11 Samsung Electronics (LED Division)

- 6.4.12 LG Innotek

- 6.4.13 Bridgelux, Inc.

- 6.4.14 Helvar Oy

- 6.4.15 Dialight plc

- 6.4.16 Fagerhult Group

- 6.4.17 Legrand S.A.

- 6.4.18 Lutron Electronics

- 6.4.19 SPI Lighting

- 6.4.20 Amerlux, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment