|

市場調查報告書

商品編碼

1850952

地工織物:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Geotextile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

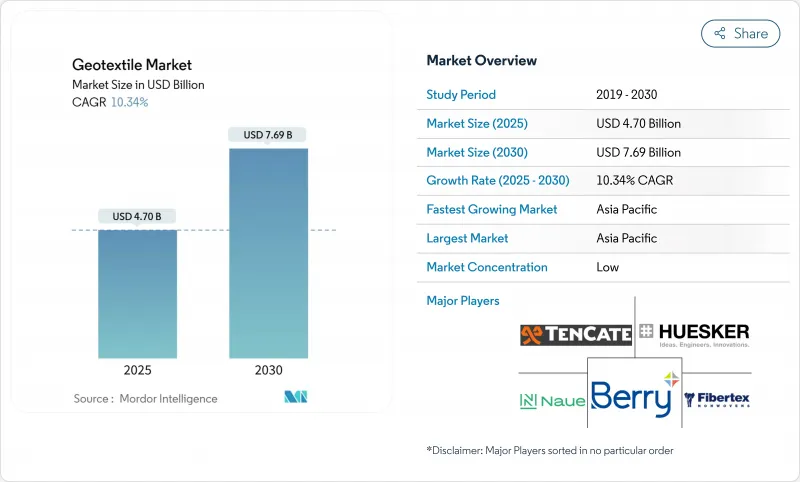

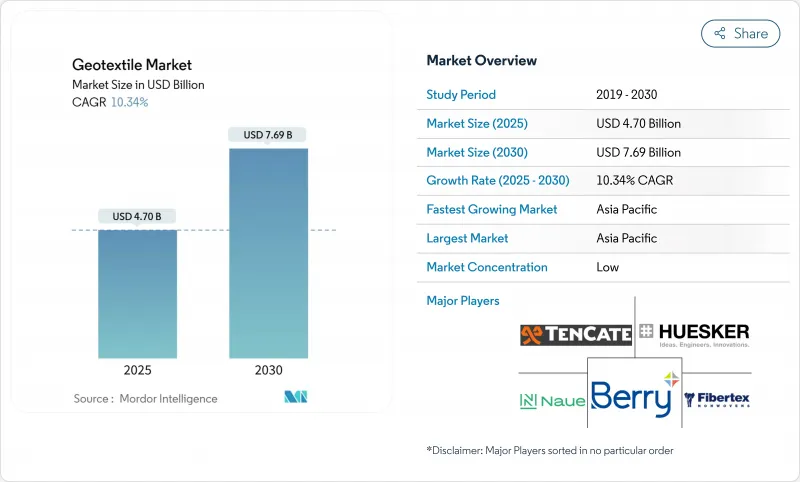

預計到 2025 年,地工織物市場規模將達到 47 億美元,到 2030 年將達到 76.9 億美元,在此期間的複合年成長率為 10.34%。

地工織物產業日益成為土木工程、環境保護和資源效率三者交匯的領域。即使考慮到通貨膨脹因素,新建道路、鐵路和防洪系統的絕對支出也比先前預期更快擴大了潛在市場,這意味著供應商擁有持續的採購管道。同時,製造商正在投資建造產能更高的生產線,這表明他們對需求彈性能夠抵消短期原料價格波動充滿信心。近期授予的合約表明,公共機構正在將基於性能的規範與再生材料含量條款捆綁在一起,使地工織物成為永續性目標的體現,而不僅僅是一種純粹的技術產品。

全球地工織物市場趨勢與洞察

建築業的擴張推動了地工織物的應用

交通運輸預算的持續成長正推動地工織物規範從公路合約中的可選項目轉變為標準配置。根據美國聯邦公路管理局的現場數據,78%的美國新建公路計劃已至少採用一層地工織物,該機構的工程師報告稱,路基材料用量最多可節省五分之一。鐵路的情況也類似,美國土木工程師學會的一篇論文指出,使用隔離織物可使安定器穩定性提高兩個數量級,因為一旦將地工織物納入設計,就更容易對材料用量進行建模。

採礦業的整合將提高永續性。

智利、澳洲和南非的銅鋰生產商正在尾礦倉儲設施中鋪設地工織物,以限制滲漏並減少淡水抽取。營運商現在指定使用配備感測器的不織布層,這些非織造層可將即時數據傳輸到整合在大壩上的儀錶板中,這一特性縮短了檢查週期,並滿足了日益嚴格的資訊揭露法規。該行業願意試用更高規格的產品,顯示合規風險而非商品價格波動正在影響採購優先事項。其附帶結果是在主要礦區附近建立了本地製造工廠,這表明地工織物行業正在出現分散式供應模式。

丙烯價格波動威脅利潤率穩定性

聚丙烯原料合約價格在過去一年中經歷了兩位數的波動,擠壓了生產商的利潤空間,也使固定價格競標變得更加複雜。規模較小、避險能力有限的工廠正在轉向按訂單模式,將成本波動轉嫁給下游企業,但由於買家優先考慮前置作業時間的確定性,這些工廠面臨著失去市場佔有率的風險。由此產生的連鎖反應是,高密度聚苯乙烯等替代聚合物在防護應用中的佔有率正在不斷成長,這並非因為其技術優勢,而是因為其投入成本更可預測。一種新興理論認為,採購負責人可能會開始將合約分配給聚合物組合,而不是單一單體,以平衡價格風險。

細分市場分析

到2024年,聚丙烯地工織物將佔據最大的地工織物佔有率,達到57.30%,預計到2030年,該材料的市場規模將以11.30%的複合年成長率成長。地工織物之所以廣受歡迎,是因為其具有優異的耐化學性和良好的強度重量比。近期,實驗室對地工織物進行了高溫和紫外線老化試驗,證實了這些特性,結果顯示其拉伸強度仍高於規範標準。目前市場上已有與機械回收相容的穩定劑,隨著循環經濟設計的推進,聚丙烯的領先地位可望進一步鞏固。

由於聚酯纖維在增強墊材中具有高拉伸模量,因此佔據了較大的市場佔有率,但由於再生聚酯(rPET)供應有限,其市場佔有率仍然較低。供應鏈壓力正促使企業轉向混合材料,將原生聚酯纖維與生物基纖維結合,以平衡性能和採購風險。聚乙烯的銷售量佔比接近八分之一,主要面向化學品密封領域,在該領域,抗應力開裂性能比模量更為重要。新興的天然和可生物分解聚合物佔據了剩餘市場佔有率,儘管成本較高且報廢處理面臨挑戰,但它們在敏感生態系統中仍能獲得訂單。從邏輯上講,將耐用的合成樹脂層與可生物分解的犧牲層相結合的雙材料設計,預計將在中價格分佈開闢新的應用前景。

由於機織地工織物在道路基層中具有優異的荷載分佈性能,預計到2024年,其市佔率將達到45%。隨著公共機構對延長道路設計壽命的需求日益成長,市場規模預計將穩步擴大。新型梭織車間配置增加了生產幅寬,減少了重複施工和工時。目前的推測表明,即使在傳統上由不織布主導的應用領域,更寬的捲材幅寬也可能使成本效益分析結果向機織地工布傾斜。

不織布地工織物正以11.50%的複合年成長率快速成長,其在雨水過濾系統的應用日益廣泛。針刺地工織物能夠在不犧牲滲透性的前提下解決不均勻沉降問題,填補了先前限制其在鐵路道安定器下應用的性能空白。針織地工織物為地工格網-地工織物材料提供了超高強度,而定向加固在其中至關重要。製造商正在將針織層與不織布濾料結合,製造多層複合材料,實現三合一的應用方案。這一趨勢表明,買家可能很快就會指定“系統”而非“織物”,這也預示著市場統計數據的編制方式將發生轉變。

區域分析

亞太地區將在2024年佔據地工織物市場39.5%的佔有率,引領市場。中國憑藉其積極的基礎設施擴張和日益嚴格的環境法規,成為該地區地工織物需求的主要來源。印度將佔據四分之一的市場佔有率,受惠於2025年4月生效的品管令。該命令預計將提高基礎技術標準,而日本、韓國和澳洲正在推廣先進的抗震抗旋設計,這些設計通常採用複合地工織物。品管將佔據剩餘的市場佔有率,官民合作關係將成為推動地工織物初期應用的關鍵因素。新的預測表明,不斷成長的國內產能將使亞太地區在未來十年內從淨進口地區轉變為貿易平衡地區。

地工織物地區以美國為派餅,計劃《美國-運轉率-工業...

歐洲對總銷售額貢獻巨大,其中德國、法國和英國發揮關鍵作用,這得益於其嚴格的排放通訊協定,這些協議有利於使用可回收和低碳地工織物。南歐正致力於提高抗旱能力的侵蝕控制計劃,而東歐則利用歐盟凝聚基金修復鐵路和公路。像Sioen Industries這樣的製造商正在宣傳其在循環經濟方面的成就,這表明品牌差異化正在從成本指標轉向永續性指標。如果經濟狀況好轉,長期未完成的維護工作可能會引發第二波需求激增。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 建設產業中地工織物的使用日益增多

- 採礦活動中地工織物的使用日益增多

- 嚴格的環境保護法規結構

- 歐洲掩埋指令規定的強制性土壤覆蓋層促進了地工合成襯墊的廣泛應用。

- 沙烏地阿拉伯的NEOM和計劃正在推動海灣合作理事會地區的沙漠土壤穩定解決方案。

- 市場限制

- 波動性丙烯合約價格

- 從rPET配額到飲料包裝,聚酯供應趨緊

- 新興經濟體工程技能短缺阻礙了設計建造模式的採用

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 材料

- 聚丙烯

- 聚酯纖維

- 聚乙烯

- 其他成分

- 按布料類型

- 編織

- 不織布

- 針織

- 按功能

- 分離

- 引流

- 濾

- 加強

- 保護

- 透過使用

- 道路建設和路面維修

- 侵蝕

- 引流

- 鐵路建設

- 農業

- 其他用途(採礦作業、海岸和水道保護等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 其他亞洲地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐國家

- 俄羅斯

- 土耳其

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ACE Geosynthetics

- AFITEXINOV

- AGRU America Inc.

- Asahi Kasei Advance Corporation

- Berry Global Inc.

- Carthage Mills

- CMC

- Fibertex Nonwovens A/S

- Freudenberg Performance Materials

- HUESKER International

- Industrial Fabrics, Inc.

- KayTech

- Mattex Geosynthetics

- Naue GmbH & Co. KG

- Officine Maccaferri Spa

- Owens Corning

- Solmax

- TenCate Geosynthetics

- Thrace Group

- TYPAR Geosynthetics

第7章 市場機會與未來展望

The geotextiles market size is estimated at USD 4.70 billion in 2025 and is forecast to climb to USD 7.69 billion by 2030, reflecting a CAGR of 10.34% over the period.

The strong expansion is rooted in the material's ability to boost infrastructure resilience while supporting circular-economy targets, so the geotextiles industry increasingly sits at the intersection of civil engineering, environmental stewardship and resource efficiency. Even after adjusting for inflation, the absolute spending on new roads, railbeds and flood-control systems is widening the addressable market faster than previously projected, implying sustained procurement pipelines for suppliers. In parallel, manufacturer investments in higher-throughput lines signal confidence that demand elasticity outweighs short-term raw-material volatility. A fresh inference from recent contract awards is that public agencies now bundle performance-based specifications with recycled-content clauses, effectively making geotextiles a proxy for sustainability goals instead of a purely technical item.

Global Geotextile Market Trends and Insights

Construction Sector Expansion Fuels Geotextile Adoption

Persistent growth in transportation budgets is pushing geotextile specifications from optional to standard practice on highway contracts. Field data from the Federal Highway Administration show that 78% of new U.S. highway projects already integrate at least one geotextile layer, and agency engineers report aggregate savings of up to one-fifth on sub-base volumes. The pattern is similar in rail, where American Society of Civil Engineers papers document a two-digit improvement in ballast stability when separation fabrics are used. A fresh inference is that cost predictability, not just headline savings, is driving faster contractor uptake because material quantities become easier to model once geotextiles are part of the design.

Mining Sector Integration Enhances Operational Sustainability

Copper and lithium producers in Chile, Australia and South Africa are embedding geotextiles into tailings-storage facilities to limit seepage and reduce freshwater withdrawals. Operators now specify sensor-ready non-woven layers that feed real-time data into dam-integrity dashboards, a capability that shortens inspection cycles and satisfies increasingly stringent disclosure rules. The industry's willingness to pilot higher-spec products indicates that compliance risk, rather than commodity price swings, is shaping procurement priorities. An observed secondary effect is the creation of local fabrication units near major mine clusters, hinting at an emerging decentralised supply model for the geotextiles industry.

Propylene Price Volatility Threatens Margin Stability

Contract prices for polypropylene feedstock have shown double-digit intra-year swings, compressing producer margins and complicating fixed-price bids. Smaller mills with limited hedging capacity are shifting toward make-to-order models, which pass cost volatility downstream but risk eroding market share when buyers prioritise lead-time certainty. The ripple effect is that alternative polymers such as high-density polyethylene are gaining incremental share in containment applications, not due to technical superiority but because of more predictable input costs. One fresh inference is that procurement officers may start indexing contracts to polymer baskets rather than single monomers to balance price risk.

Other drivers and restraints analyzed in the detailed report include:

- Environmental Regulations Drive Material Innovation

- European Landfill Directive Elevates Geosynthetic Demand

- Engineering Skills Gap Hampers Technical Implementation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The polypropylene segment accounts for the largest geotextiles market share at 57.30% in 2024, with the market size in this material forecast to climb at an 11.30% CAGR through 2030. Its popularity stems from chemical resistance and a favourable strength-to-weight ratio, attributes recently confirmed by laboratory aging tests under elevated temperature and ultraviolet exposure that showed retained tensile strength above specification thresholds. A fresh inference is that the ongoing shift to circular design will further cement polypropylene's lead, because stabiliser packages compatible with mechanical recycling are already commercially available.

Polyester holds a significant share prized for high tensile modulus in reinforcement mats but held back by constrained rPET supply. Supply-chain stress is encouraging diversification into blends that mix virgin polyester with bio-sourced fibres, balancing performance and procurement risk. Polyethylene captures close to one-eighth of volume, targeting chemical-containment niches where stress-crack resistance matters more than modulus. Emerging natural and biodegradable polymers make up the balance and, though costlier, secure purchase orders in sensitive ecosystems where removal after service life is difficult. The logical inference is that dual-material specifications, combining a durable synthetic layer with a biodegradable sacrificial layer, could open new mid-price adoption avenues.

Woven geotextiles command a 45% market share in 2024, driven by superior load-distribution in road sub-bases. Their market size is expected to expand steadily as public agencies prioritise long design lives. New shuttle-loom configurations have increased productive width, lowering installation overlaps and labour hours. A current inference is that the wider rolls may tilt cost-benefit analyses in favour of woven fabrics even in applications traditionally dominated by non-wovens.

Non-woven geotextiles grow faster, at an 11.50% CAGR, and increasingly integrate into stormwater filtration systems. Needle-punched variants address differential settlement without sacrificing permeability, bridging a performance gap that once limited use beneath rail ballast. Knitted fabrics, supply ultra-high strength for geogrid-geotextile composites where directional reinforcement is prized. Manufacturers are bundling knitted layers with non-woven filters into multi-layer laminates, an approach that delivers three functions in one installation step. That trend implies buyers may soon specify "systems" rather than "fabrics", altering how market statistics are compiled.

The Geotextiles Market Report Segments the Industry by Material (Polypropylene, Polyester, and More), Fabric Type (Woven, Non-Woven, and Knitted), Function (Separation, Drainage, and More), Application (Road Construction and Pavement Repair, Erosion, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads with a 39.5% geotextiles market share in 2024. China generates significant of regional demand, marrying aggressive infrastructure expansion with stricter environmental codes. India contributes one-quarter and benefits from its Quality Control Order scheduled for April 2025, which is expected to raise baseline technical standardsJapan, South Korea, and Australia collectively contribute a significant portion to the regional expenditure, deploying sophisticated earthquake- and cyclone-resilient designs that often rely on composite geotextiles. The remainder rests with Southeast Asia, where public-private partnerships are catalysing first-time adoption. An emerging inference is that domestic capacity additions will convert Asia-Pacific from a net importer to a balanced trade zone by decade-end.

North America, dominated by the United States, where BABA rules require domestic manufacture for federally funded projects from March 2025. Canada holds one-fifth of the regional pie, leveraging geotextiles for cold-region roads and mining applications, while Mexico's share grows with industrial-park construction along the near-shoring corridor. Adoption of sensor-embedded fabrics is highest here, an indicator that digital infrastructure strategies are translating into premium product demand. A fresh inference is that U.S. highway re-authorisation cycles lock in multi-year procurement visibility, allowing mills to operate at higher utilisation rates than global averages.

Europe contributes significantly to total sales, with Germany, France, and the UK playing a major role in this contribution, propelled by stringent emissions protocols that favour recycled and low-carbon geotextiles. Southern Europe focuses on erosion-control projects linked to drought resilience, while Eastern states channel EU cohesion funds into rail and road rehabilitation. Manufacturers such as Sioen Industries publicise circular-economy achievements, suggesting brand differentiation is shifting from cost to sustainability metrics. The inference is that once economic conditions improve, deferred maintenance backlogs could trigger a second-wave demand surge.

- ACE Geosynthetics

- AFITEXINOV

- AGRU America Inc.

- Asahi Kasei Advance Corporation

- Berry Global Inc.

- Carthage Mills

- CMC

- Fibertex Nonwovens A/S

- Freudenberg Performance Materials

- HUESKER International

- Industrial Fabrics, Inc.

- KayTech

- Mattex Geosynthetics

- Naue GmbH & Co. KG

- Officine Maccaferri Spa

- Owens Corning

- Solmax

- TenCate Geosynthetics

- Thrace Group

- TYPAR Geosynthetics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of Geotextiles in Construction Industry

- 4.2.2 Increase Usage of Geotextiles in Mining Activities

- 4.2.3 Stringent Regulatory Framework for Environmental Protection

- 4.2.4 Mandatory Capping Layers in Europe Landfill Directive Boosting Geosynthetic Liners

- 4.2.5 Saudi NEOM and Giga-Projects Driving Desert Soil-Stabilisation Solutions in GCC region

- 4.3 Market Restraints

- 4.3.1 Volatile Propylene Contract Prices

- 4.3.2 Polyester Supply Tightness from rPET Allocation to Beverage Packaging

- 4.3.3 Engineering-Skills Gap Curtailing Design-Build Adoption in Emerging Economies

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Polypropylene

- 5.1.2 Polyester

- 5.1.3 Polyethylene

- 5.1.4 Other Materials

- 5.2 By Fabric Type

- 5.2.1 Woven

- 5.2.2 Non-woven

- 5.2.3 Knitted

- 5.3 By Function

- 5.3.1 Separation

- 5.3.2 Drainage

- 5.3.3 Filtration

- 5.3.4 Reinforcement

- 5.3.5 Protection

- 5.4 By Application

- 5.4.1 Road Construction and Pavement Repair

- 5.4.2 Erosion

- 5.4.3 Drainage

- 5.4.4 Railworks

- 5.4.5 Agriculture

- 5.4.6 Other Applications (Mining Operations, Coastal and Waterway Protection,etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Thailand

- 5.5.1.6 Malaysia

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Russia

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ACE Geosynthetics

- 6.4.2 AFITEXINOV

- 6.4.3 AGRU America Inc.

- 6.4.4 Asahi Kasei Advance Corporation

- 6.4.5 Berry Global Inc.

- 6.4.6 Carthage Mills

- 6.4.7 CMC

- 6.4.8 Fibertex Nonwovens A/S

- 6.4.9 Freudenberg Performance Materials

- 6.4.10 HUESKER International

- 6.4.11 Industrial Fabrics, Inc.

- 6.4.12 KayTech

- 6.4.13 Mattex Geosynthetics

- 6.4.14 Naue GmbH & Co. KG

- 6.4.15 Officine Maccaferri Spa

- 6.4.16 Owens Corning

- 6.4.17 Solmax

- 6.4.18 TenCate Geosynthetics

- 6.4.19 Thrace Group

- 6.4.20 TYPAR Geosynthetics

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Rising Awareness about Water Conservation in the Manufacturing Sector