|

市場調查報告書

商品編碼

1850384

汽車線束:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Wiring Harness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

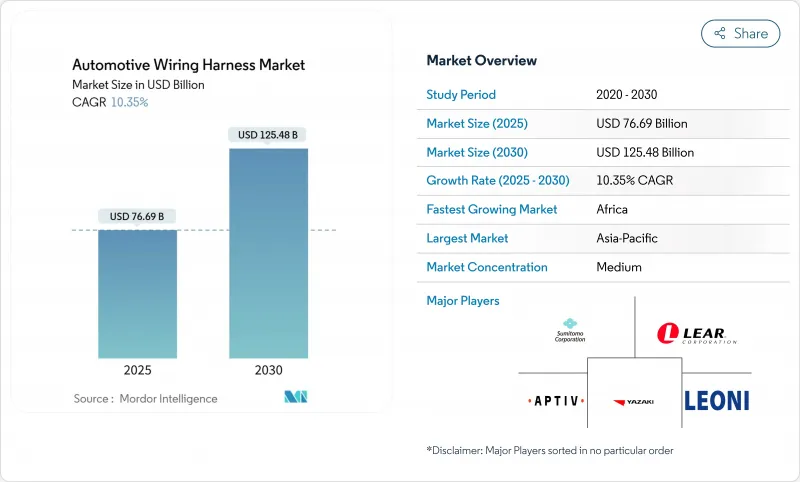

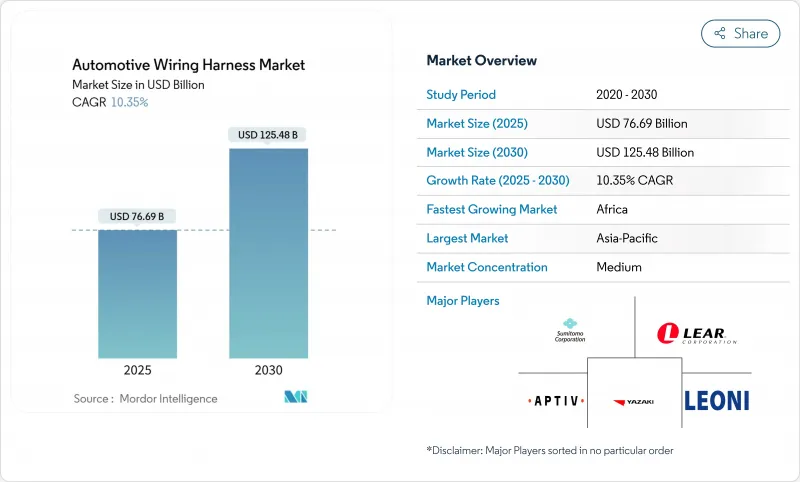

據估計,汽車線束市場規模將在 2025 年達到 766.9 億美元,到 2030 年達到 1,254.8 億美元,在預測期(2025-2030 年)內複合年成長率為 10.35%。

隨著每輛車電子元件含量的不斷提高,市場正穩步擴張,但表面上的成長掩蓋了兩個截然不同的趨勢:用於純電動車的高壓線束需求正以兩位數的速度成長,而用於內燃機汽車的傳統低壓線束則面臨價格下行壓力。從區域來看,亞洲仍然是生產和消費中心;非洲憑藉有利的勞動力市場和在地採購政策吸引了新的產能;而北美和歐洲等成熟市場則正在轉向區域電氣架構,這種架構可以縮短電纜長度,同時提高每條剩餘線路的價值。

全球汽車線束市場趨勢與洞察

由於電氣化,對高壓線束的需求迅速成長。

電池組電壓正攀升至 800V 甚至 1000V,這催生了一種新型電纜組件,它們在滿足嚴格的電磁相容性 (EMC) 要求的同時,還能承受更大的熱負荷。許多中國品牌現在都指定在其主牽引電纜中使用鋁基導體,而材料創新與降低電動車成本直接相關。鋁材需要重新思考連接技術,因此供應商正以五年前前所未有的速度投資摩擦焊接和雷射焊接設備。一種新興理論認為,焊接技術很快就會成為一項重要的競爭壁壘,其重要性甚至超過銅材採購。

輕量化鋁製和光纖線束OEM趨勢

汽車製造商持續致力於減輕車重,豪華車的線束重量甚至超過20公斤。鋁導體比銅導體輕約60%,但其品質易受銅價波動的影響。雖然導電性有所降低,但多股線束設計和雙金屬端子可以彌補這一不足,使接觸電阻保持在規格範圍內。隨著連接技術的日益成熟,一些原始設備製造商(OEM)開始採用混合導體線束,將鋁製電源線與光纖數據傳輸線結合使用。

銅和樹脂價格波動導致利潤率承壓

銅佔傳統織布機總材料成本的一半以上,因此近期的價格波動給供應商的毛利率帶來了壓力。雖然大多數生產線組裝合約都包含轉嫁條款,但汽車製造商越來越不願意接受週期中期的價格上漲。因此,供應商正在商品交易所進行避險,並轉向鋁材業務以降低風險。這種情況凸顯了複雜的金融工程和採購,以及核心工程技術,在確保盈利日益成長的重要性。

細分市場分析

車身、照明和座艙舒適系統將佔據汽車線束市場最大佔有率,到2024年將佔市場規模的35.90%。 LED的高普及率、電動尾門和多區域自動空調模組是強勁需求的根本原因。值得注意的是,這些推動銷售的舒適性配置也增加了整車組裝的複雜性,促使汽車製造商要求預先配置的子空間能夠安裝在儀表板和車門面板內。

預計到2030年,充電和電源系統線束的複合年成長率將達到26.50%,成為成長最快的細分市場,隨著更多電動車車型展示室,成長率將維持在15%左右。由於這些線束必須承受電池組周圍的高溫和機械振動,因此高等級絕緣材料正逐漸成為主流。專門生產液冷套管和薄屏蔽層的供應商可能會獲得更高的價格。隨著時間的推移,高壓佈線的專業知識可能會促成電池管理系統的交叉銷售。

銅憑藉其無與倫比的導電性和百年工藝積累,如今佔據了汽車線束市場93.90%的佔有率。然而,其高密度和波動性的成本持續迫使OEM廠商的採購部門尋找替代方案。一種新興趨勢是將銅製數據線對和鋁製電源線芯捆綁在同一主幹線束中,從而在不犧牲訊號完整性的前提下減輕重量。

預計到2030年,鋁的複合年成長率將達到12.13%,輕鬆超過整個汽車線束產業的成長軌跡。防腐蝕端子和摩擦焊接接頭技術的進步消除了以往的可靠性隱患。鋁相對於銅的價格穩定性促使財務團隊擴大將鋁作為一種對沖工具。這種轉變表明,材料科學的選擇與主要供應商的財務風險管理策略直接相關。

區域分析

亞太地區是全球營收成長最快的地區,佔近48.83%的市場。中國憑藉其龐大的輕型汽車生產能力和完善的電動車供應鏈,成為該地區的支柱;而日本和韓國則在數據和高壓應用領域貢獻了高等級的研發力量。印度和東南亞各國政府對電動車發展的激勵措施,預計在全球經濟成長趨於正常化的情況下,維持該地區的強勁需求。值得注意的是,多家中國汽車製造商正向歐洲出口電動車,這些車輛需要符合歐盟監管標準的統一線束規範,使亞洲供應商的合規水準提升至全球標準。

2025年至2030年間,非洲的複合年成長率將達11.97%,位居全球之首。具競爭力的人事費用、透過貿易協定進入歐盟市場、政府的工業政策,正吸引新的線束投資。多家歐洲一級企業正在將勞動密集型次組件位置到該地區,從而騰出本國工廠進行自動化生產。針對當地工人的電纜壓接和品質檢驗技能提升項目正在湧現,這顯示人力資本策略與區域經濟成長息息相關。

北美和歐洲的成長速度較慢,但仍處於技術領先地位。區域架構試點計畫主要集中在德國奢侈品牌和北美電氣新興企業,慕尼黑、斯圖加特和矽谷的設計中心則成為下一代織布機概念的研發樞紐。這種模式意味著智慧財產權的創造與勞力密集生產脫鉤。這強化了全球雙速佈局:研發叢集形成於原始設備製造商(OEM)總部附近,而大批量組裝則轉移到成本最優的地區。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 電氣化導致對高壓線束的需求迅速成長(亞洲)

- 推廣輕量化鋁合金和光學線束的OEM業務

- 高階汽車向集中式分區電子電氣架構的過渡(歐盟)

- ADAS線路冗餘的監管要求(美國、日本)

- 加強在地採購規則,促進線束的本地在地採購(印度、墨西哥)

- 自動駕駛汽車的發展推動了冗餘電路架構的建構。

- 市場限制

- 銅和樹脂價格波動導致利潤率承壓

- 電動車特有的熱學和電磁相容性挑戰增加了檢驗成本。

- 設計複雜性與熟練勞動力供應不符(東協)

- 製造自動化的限制阻礙了生產力的提高

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過使用

- 點火系統

- 充電和供電系統

- 傳動系統和動力傳動系統(內燃機)

- 高壓牽引線束(xEV)

- 資訊娛樂系統、駕駛座和遠端資訊處理系統

- ADAS和安全控制

- 車身、照明和座艙舒適性

- 按導體材料

- 銅

- 鋁

- 按額定電壓

- 低電壓(低於 60 伏特)

- 高壓(60至1000伏特)

- 依推進類型

- 內燃機車輛

- 電池電動車

- 插電式混合動力汽車汽車和混合動力汽車

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 大型卡車和巴士

- 按銷售管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 策略舉措

- 市佔率分析

- 公司簡介

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- LEONI AG

- Lear Corporation

- Motherson Wiring Harness Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Kyungshin Corporation

- Draexlmaier Group

- Kromberg & Schubert

- Nexans Autoelectric

- PKC Group(Motherson)

- Coroplast Fritz Muller GmbH & Co.

- THB Group

- Prestolite Wire LLC

- Lear Yangzhou(China)

- Guangdong Hivolt Wiring Harness

- BizLink Holding Inc.

- Shanghai Shenglong Automotive Harness

- Samvardhana Motherson Reydel

- Korea Electric Terminal Co.

第7章 市場機會與未來展望

The Automotive Wiring Harness Market size is estimated at USD 76.69 billion in 2025, and is expected to reach USD 125.48 billion by 2030, at a CAGR of 10.35% during the forecast period (2025-2030).

The market is expanding steadily on the back of rising electronic content per vehicle, but the headline growth masks two contrasting currents: demand for high-voltage harnesses used in battery-electric vehicles is rising at a double-digit pace, while traditional low-voltage ICE looms are seeing price compression. Regionally, Asia remains the production and consumption hub, Africa is attracting new capacity thanks to favorable labor economics and local-content rules, and mature markets in North America and Europe are pivoting toward zonal electrical architectures that shorten cable runs yet increase the value of each remaining line.

Global Automotive Wiring Harness Market Trends and Insights

Electrification-Driven Surge in High-Voltage Harness Demand

Rising battery pack voltages to 800 V and even 1000 V are spurring a new class of cable assemblies that carry greater thermal loads while meeting tight electromagnetic-compatibility (EMC) targets. Many Chinese brands now specify aluminum-based conductors for main traction lines, directly linking material innovation to EV cost reduction. Because aluminum requires revised joining techniques, suppliers are investing in friction and laser welding cells at a pace unseen five years ago. An emerging inference is that welding know-how may soon overshadow raw copper sourcing as the key competitive barrier.

OEM Push for Lightweight Aluminum and Optical Harnesses

Automakers continue to chase every gram of weight saving, and wiring can account for more than 20 kg in premium cars. Aluminum conductors slash mass by roughly 60% relative to copper and also cut exposure to copper-price swings. The downside-lower conductivity-is being offset through multi-strand designs and bimetal terminals that keep contact resistance within specification. As connection technology matures, several OEMs have introduced mixed conductor looms that pair aluminum power lines with optical fibres for data, hinting that the next frontier will lie in hybrid composite bundles rather than single-metal solutions.

Margin Pressure from Volatile Copper and Resin Prices

Copper accounts for well over half of total bill-of-materials cost in a conventional loom, so recent price gyrations have compressed supplier gross margin. Although most line-fit contracts include pass-through clauses, automakers are increasingly reluctant to accept mid-cycle price increases. Suppliers are therefore hedging on commodity exchanges and diversifying into aluminum as a risk-spreading measure. The situation underscores that financial engineering and procurement sophistication are becoming as important as core engineering in safeguarding profitability.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Centralized Zonal E/E Architectures in Premium Cars

- Regulatory Mandates for ADAS Wiring Redundancy

- EV-Specific Thermal and EMC Challenges Raising Validation Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Body, Lighting, and Cabin Comfort systems command the largest share of the Automotive Wiring Harness market size in 2024, accounting for 35.90% of the market size. High LED adoption, power lift-gates, and multi-zone climate modules explain persistent demand. An interesting observation is that the same comfort features that boost volume also complicate final vehicle assembly, nudging OEMs to request pre-configured sub-looms that snap into dashboards and door panels.

Charging and power supply system harnesses show the fastest forecast CAGR expanding at an 26.50% through 2030, expanding in the mid-teens as more electric models reach showrooms. These harnesses must endure temperature spikes and mechanical vibration around battery packs, so higher-grade insulation materials are becoming mainstream. Suppliers that master liquid-cooling sleeves and low-profile shielding will likely command premium price points. Over time, expertise in high-voltage routing may provide cross-selling entry into battery management systems.

Copper retains around 93.90% of the Automotive Wiring Harness market share today, supported by unmatched conductivity and a century of process know-how. Yet its density and volatile cost profile keep pressure on OEM purchasing departments to pursue alternatives. An emerging pattern is the bundling of copper data pairs with aluminum power cores in the same trunk line, achieving weight reduction without sacrificing signal integrity.

Aluminum's forecast CAGR is 12.13% by 2030, easily outpacing the broader Automotive Wiring Harness industry trajectory. Advances in anti-corrosion terminals and friction-weld splice techniques have removed earlier reliability concerns. Because aluminum is price-stable relative to copper, finance teams increasingly model its use as a hedge. The shift indicates that material science choices now intersect directly with treasury risk management strategies inside large suppliers.

The Automotive Wiring Harness Market Report is Segmented by Application Type (Ignition System, and More), Conductor Material (Copper, and More), Voltage Rating (Low-Voltage [less Than 60V] and More), Propulsion Type (Internal Combustion Engine Vehicles and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific holds almost 48.83% Automotive Wiring Harness market share and boasts the fastest absolute revenue expansion. China anchors the region through its vast light-vehicle output and deep EV supply chains, while Japan and South Korea contribute high-grade R&D for data and high-voltage applications. Government incentives for electrification in India and Southeast Asia suggest that regional demand will remain resilient even as global growth normalises. A noteworthy development is that multiple Chinese OEMs are exporting EVs to Europe, requiring harmonised wiring specifications that meet European Union regulatory norms and thus elevating Asia-based suppliers to global compliance standards.

Africa, records the highest CAGR of 11.97% between 2025-2030. Competitive labour costs, trade-agreement access to the European Union, and government industrial-park policies together attract fresh harness investment. Several European tier-1 firms are locating high-labour-content sub-assemblies in the region, freeing up home-market plants for automated processes. Local workforce up-skilling programs in cable crimping and quality inspection are emerging, indicating that human-capital strategy is entwined with regional growth.

North America and Europe grow more modestly but remain technology front-runners. Zonal architecture pilots are concentrated in German luxury brands and North American electric start-ups, so design offices in Munich, Stuttgart, and Silicon Valley serve as nerve centres for next-generation loom concepts. This pattern implies that intellectual property creation is decoupling from labour-intensive production. This reinforces the two-speed global footprint in which R&D clusters near OEM headquarters and large-batch assembly migrate to cost-optimised regions.

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- LEONI AG

- Lear Corporation

- Motherson Wiring Harness Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Kyungshin Corporation

- Draexlmaier Group

- Kromberg & Schubert

- Nexans Autoelectric

- PKC Group (Motherson)

- Coroplast Fritz Muller GmbH & Co.

- THB Group

- Prestolite Wire LLC

- Lear Yangzhou (China)

- Guangdong Hivolt Wiring Harness

- BizLink Holding Inc.

- Shanghai Shenglong Automotive Harness

- Samvardhana Motherson Reydel

- Korea Electric Terminal Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Electrification-Driven Surge in High-Voltage Harness Demand (Asia)

- 4.1.2 OEM Push for Lightweight Aluminum & Optical Harnesses

- 4.1.3 Shift Toward Centralized Zonal E/E Architectures in Premium Cars (EU)

- 4.1.4 Regulatory Mandates for ADAS Wiring Redundancy (US, Japan)

- 4.1.5 Rising Local Content Rules Fueling Wire-Harness Localization (India, Mexico)

- 4.1.6 Autonomous Vehicle Development Driving Redundant Circuit Architectures

- 4.2 Market Restraints

- 4.2.1 Margin Pressure From Volatile Copper & Resin Prices

- 4.2.2 EV-Specific Thermal & EMC Challenges Raising Validation Costs

- 4.2.3 Mismatch Between Design Complexity & Skilled Labor Availability (ASEAN)

- 4.2.4 Manufacturing Automation Limitations Constraining Productivity Gains

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Ignition System

- 5.1.2 Charging & Power Supply System

- 5.1.3 Drivetrain & Powertrain (ICE)

- 5.1.4 High-Voltage Traction Harness (xEV)

- 5.1.5 Infotainment, Cockpit & Telematics

- 5.1.6 ADAS & Safety Control

- 5.1.7 Body, Lighting & Cabin Comfort

- 5.2 By Conductor Material

- 5.2.1 Copper

- 5.2.2 Aluminum

- 5.3 By Voltage Rating

- 5.3.1 Low-Voltage (<60 V)

- 5.3.2 High-Voltage (60-1,000 V)

- 5.4 By Propulsion Type

- 5.4.1 Internal Combustion Engine Vehicles

- 5.4.2 Battery Electric Vehicles

- 5.4.3 Plug-in Hybrid & Hybrid Vehicles

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Light Commercial Vehicles

- 5.5.3 Heavy-duty Trucks & Buses

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Russia

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia Pacific

- 5.7.4 Middle East

- 5.7.4.1 GCC

- 5.7.4.2 Turkey

- 5.7.4.3 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Strategic Initiatives

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yazaki Corporation

- 6.3.2 Sumitomo Electric Industries Ltd.

- 6.3.3 LEONI AG

- 6.3.4 Lear Corporation

- 6.3.5 Motherson Wiring Harness Ltd.

- 6.3.6 Furukawa Electric Co. Ltd.

- 6.3.7 Fujikura Ltd.

- 6.3.8 Kyungshin Corporation

- 6.3.9 Draexlmaier Group

- 6.3.10 Kromberg & Schubert

- 6.3.11 Nexans Autoelectric

- 6.3.12 PKC Group (Motherson)

- 6.3.13 Coroplast Fritz Muller GmbH & Co.

- 6.3.14 THB Group

- 6.3.15 Prestolite Wire LLC

- 6.3.16 Lear Yangzhou (China)

- 6.3.17 Guangdong Hivolt Wiring Harness

- 6.3.18 BizLink Holding Inc.

- 6.3.19 Shanghai Shenglong Automotive Harness

- 6.3.20 Samvardhana Motherson Reydel

- 6.3.21 Korea Electric Terminal Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment