|

市場調查報告書

商品編碼

1850365

自動駕駛卡車:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Autonomous Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

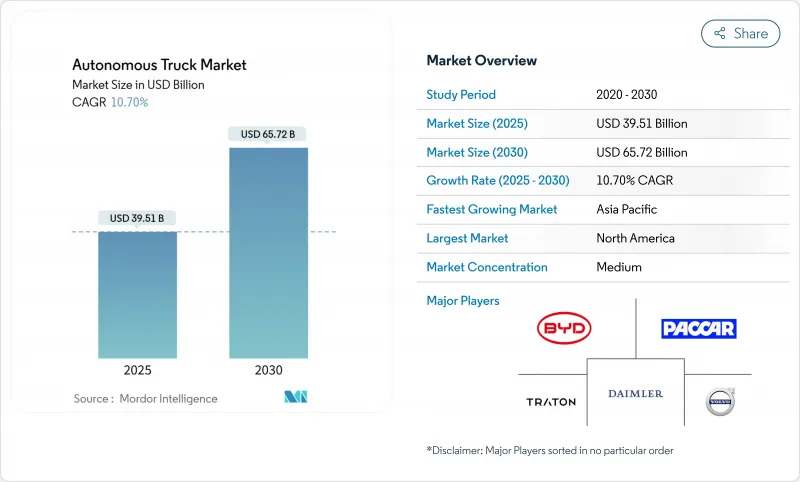

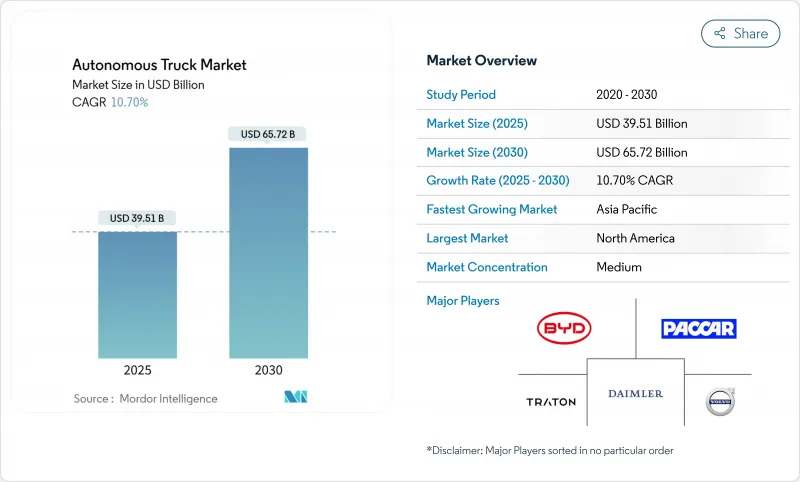

預計到 2025 年,自動駕駛卡車市場規模將達到 395.1 億美元,到 2030 年將達到 657.2 億美元,預測期(2025-2030 年)的複合年成長率為 10.70%。

司機短缺和人事費用上漲給傳統車隊帶來了巨大挑戰,促使企業採用資產利用率更高的重型平台。緊急煞車系統等監管要求以及感測器價格的下降正在加速現代化進程和商業試點。隨著L4級自動駕駛卡車在遠距運輸中展現出可靠性,相關人員將受益於更快的投資回收期、更高的拖車周轉率以及燃油和排放氣體的節省,從而推動自動駕駛卡車市場走向廣泛部署。

全球自動駕駛卡車市場趨勢與洞察

公路運輸司機短缺和人事費用上升

美國卡車運輸協會報告稱,到2024年,將有超過8萬名重型卡車司機失業,而且隨著司機退休人數超過新入職人數,預計這一缺口還會擴大。強制休息時間和高額加班費推高了車輛總擁有成本,因此,對於超過500英里的線路而言,全天候自動駕駛在經濟上更具吸引力。德克薩斯一條走廊上成功的L4級自動駕駛試點項目,使拖車週轉率加倍,並將每英里的人事費用降低了35%以上。物流巨頭們正在重新設計他們的運輸網路,採用自動駕駛主幹線,並輔以人工操作的「最後一公里」環線。

對全天候樞紐間物流的需求

電子商務的履約窗口和即時生產模式需要全天候的運能。州際公路的管控通行有利於感測器感知和冗餘配置,使車隊能夠以預期路線調度自動駕駛的8級牽引車。 Aurora公司於2024年完成了達拉斯至休士頓之間1200英里的無人駕駛測試,檢驗了樞紐到樞紐模式的執行時間承諾。零售商將由此帶來的等待時間縮短與庫存減少聯繫起來,從而推動了專用自動駕駛運力的長期合約簽訂。

全球法規和跨國責任的零碎化

加州AB316法案限制重量超過10,000磅的無人駕駛卡車必須在無人駕駛人員的操控下行駛,凸顯了美國政策的碎片化。儘管布魯塞爾方面力推在2026年前建立統一的框架,但歐盟成員國之間也存在類似的政策不一致。這些不一致導致需要分別辦理許可證、購買保險附加條款以及建立數據報告流程,從而削弱了規模經濟效益,並延緩了全歐範圍內的推廣。

細分市場分析

到2024年,重型牽引車將佔自動駕駛卡車市場規模的64.5%,這反映了遠距線路自動化帶來的經濟效益,因為在長途運輸中,人事費用是最大的支出項目,超過了燃油成本。車隊財務長模型預測,對於運行里程超過500英里且運轉率達到95%的L4級自動駕駛系統,其投資回收期不到四年。中型卡車將專注於區域性雜貨和小包裹運輸,需要在更嚴格的車輛重量限制和日益嚴格的都市區通行限制之間取得平衡。受電子商務業務量成長的推動,輕型自動駕駛貨車將以15.1%的複合年成長率實現最快成長。

技術合作鞏固了戴姆勒在重型車輛領域的領先地位:戴姆勒卡車向Torc Robotics公司交付了一批具備自動駕駛能力的Freightliner Cascadia牽引車,用於在德克薩斯州進行測試,這體現了這家汽車製造商致力於在工廠預裝冗餘架構的決心。同時,輕型車輛製造商則利用僅基於攝影機的感知技術來降低材料成本,並隨著政府法規的演變,為「最後一公里」自動駕駛做好準備。這種發展軌跡的分化預示著市場將呈現啞鈴狀的碎片化模式。

儘管SAE 1-2級駕駛輔助系統將在2024年佔據自動駕駛卡車市場58.2%的佔有率,但市場焦點將轉向L4級自動駕駛,預計到2030年,L4級自動駕駛將以26.25%的複合年成長率成長。 2024年至2025年,年度無人駕駛試點部署數量將成長140%,而擁有L4級藍圖的公司將獲得更多資金。沃爾沃的VNL自動駕駛平台計劃於2025年交付客戶,顯示該汽車製造商堅信全路線自動駕駛將帶來加值服務合約。雖然L3級自動駕駛仍然是法規要求具備備用方案的過渡解決方案,但隨著監管機構堅持在某些路段完全取消駕駛員,其商業性窗口正在縮小。

投資者正在支持這項轉型:Waabi 在由 Uber 和英偉達主導的B 輪融資中獲得了 2 億美元,用於完善其人工智慧優先的模擬技術,並將道路測試里程減少 80%。這筆資金的注入鞏固了人們的信念:可擴展的虛擬訓練將加快 L4 級參與企業的認證速度,並縮短其實現收益所需的時間。隨著高清地圖成本的下降,市場分析師預計,到 2030 年,L4 級自動駕駛的貨運里程佔比將超過 30%,從而重塑資產調度邏輯和保險承保規則。

自動駕駛卡車市場按卡車類型(輕型卡車、其他)、自動駕駛等級(SAE 1-2級(駕駛輔助)、其他)、ADAS功能(主動車距控制巡航系統、車道偏離預警、其他)、組件(雷射雷達、雷達、攝影機、其他)、驅動方式(內燃機、純電動、混合動力、其他)和地區進行細分。市場預測以價值(美元)和銷售(輛)為單位。

區域分析

北美在2024年佔據了33.7%的自動駕駛卡車市場佔有率,這主要得益於各州推行的試點框架以及支援車道中心自動駕駛的4.8萬英里州際公路系統。德克薩斯州擁有連接達拉斯、休士頓、埃爾帕索和鳳凰城的商業路線,Aurora、Kodiak、Volvo和DHL等公司都在經營這些路線,並創造了收益的收入。資金籌措依然強勁,新興企業在2024年至2025年間籌集了超過10億美元的資金,反映出投資人對近期收益的信心。

歐洲在2024年貢獻了約三分之一的收益。德國、瑞典和荷蘭在測試方面處於領先地位,率先採用了聯合國歐洲經濟委員會(UNECE)的網路安全和車道維持指令。沃爾沃和戴姆勒的軟體合資企業將為歐盟原始設備製造商(OEM)提供一個可透過空中升級的平台,以便在2026年全球安全路線(GSR)分階段推出之前進行升級。跨境貨運正透過諸如斯堪的斯堪地那維亞-漢堡路線等數位化走廊試點計畫向前推進,但各國的認證時間表仍然不均衡,阻礙了整個歐洲大陸的規模化發展。

亞太地區仍是成長最快的地區,複合年成長率高達21.4%。中國交通運輸運輸部核准一項全國性的智慧高速公路計劃,旨在幫助中國企業在2025年中期實現2000萬公里的行駛里程。日本的目標是到2027年實現主要道路L4級自動駕駛覆蓋,並結合自動駕駛獎勵以及對氫燃料電池和電池充電站的支援。韓國的「K-Mobility 2030」計畫正在加速車載資訊服務技術的應用,而印度則將目光投向了自動駕駛採礦和港口運輸這兩個先行領域。像Autoware這樣的開放原始碼堆疊為區域整合商提供了立足點,使其能夠針對左舵駕駛的城市道路網路客製化感知系統。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 遠距運輸面臨司機短缺和勞動成本上升的問題

- 對全天候樞紐間物流的需求

- 加強安全法規(例如,美國的自動駕駛汽車法案、歐盟的車輛安全法規)

- 編隊行駛可節省燃油並控制排放氣體

- 自動駕駛與零排放動力系統之間的協同效應

- 開放原始碼自主協定棧降低了准入門檻

- 市場限制

- 國際監管不完善和跨境責任

- 網路安全與OTA更新風險

- LiDAR/感測器套件高成本

- 除一級走廊外,缺乏高解析度高清地圖

- 價值鏈/供應鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元)及銷售量(單位))

- 按卡車類型

- 小型貨車

- 中型卡車

- 大型卡車

- 依自主程度

- SAE 1-2級(駕駛輔助)

- SAE 3級(有條件)

- SAE 4級(進階)

- SAE 5級(完整版)

- 透過ADAS功能

- 主動車距控制巡航系統

- 車道偏離預警

- 交通壅塞輔助

- 高速公路導航

- 自動緊急制動

- 盲點偵測

- 車道維持輔助

- 按組件

- 騎士

- 雷達

- 相機

- 超音波和其他感測器

- AI運算模組

- 按驅動類型

- 內燃機

- 電池驅動

- 混合

- 氫燃料電池

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 中東和非洲

- GCC

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AB Volvo

- Daimler Truck AG

- Traton SE

- PACCAR Inc.

- BYD Co. Ltd.

- Tesla, Inc.

- TuSimple

- Aurora Innovation

- Waymo Via

- Plus.ai

- Torc Robotics

- Kodiak Robotics

- Nikola Corp.

- Einride

- Embark Technology

- Hyzon Motors

- Gatik AI

- Volvo-Uber ATG JV

- Scania

- Navistar

第7章 市場機會與未來展望

The Autonomous Truck Market size is estimated at USD 39.51 billion in 2025, and is expected to reach USD 65.72 billion by 2030, at a CAGR of 10.70% during the forecast period (2025-2030).

Persistent driver shortages and rising labor costs challenge traditional fleets, driving the adoption of heavy-duty platforms with high asset utilization. Regulatory mandates, such as emergency-braking systems, and falling sensor prices are accelerating modernization and commercial pilots. As Level 4 trucks prove reliable on long-haul routes, stakeholders benefit from faster pay-back cycles, increased trailer turnover, and fuel and emission savings, advancing the autonomous truck market toward scaled deployment.

Global Autonomous Truck Market Trends and Insights

Driver Shortage & Rising Line-Haul Labor Cost

The American Trucking Associations reported more than 80,000 unfilled heavy-duty positions in 2024, a gap expected to widen as driver retirements outpace new entrants. Mandatory rest breaks and overtime premiums inflate total cost of ownership, making 24/7 autonomous operation financially attractive on routes exceeding 500 miles. Successful Level 4 pilots along Texas corridors have doubled trailer turns and cut per-mile labor spend by over 35%. Logistics majors are now redesigning networks with autonomous trunk lines complemented by human-driven last-mile loops.

Demand for 24/7 Hub-to-Hub Logistics

E-commerce fulfillment windows and just-in-time manufacturing call for clock-round capacity. The controlled access of interstate highways suits sensor perception and redundancy targets, allowing fleets to dispatch autonomous Class 8 tractors on predictable lanes. Aurora completed a 1,200-mile driver-out run between Dallas and Houston in 2024, validating the uptime promise of hub-to-hub models. Retail shippers link the resulting latency reductions to inventory shrink, propelling long-term contracts for dedicated autonomous capacity.

Patchwork Global Regulation & Cross-Border Liability

California's AB 316, which restricts autonomous trucks above 10,000 lb without on-board human operators, underscores the fragmented U.S. policy landscape. Similar inconsistencies appear across EU member states despite Brussels' push for a unified framework by 2026. These mismatches require separate permitting, insurance riders, and data-reporting workflows, diluting economies of scale and postponing continent-wide deployments.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Safety Regulations

- Platooning-Driven Fuel Savings & Emission Mandates

- Cyber-Security & OTA Update Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heavy-duty tractors accounted for 64.5% of the autonomous truck market size in 2024, reflecting the economic leverage of automating long-haul lanes where labor costs eclipse fuel as the largest expense line. Fleet CFO models show pay-back periods under four years when Level 4 systems pass 500-mile duty cycles at 95% uptime. Medium-duty units focus on regional grocery and parcel runs, balancing tighter curbweight limits with growing urban-access restrictions. Light-duty autonomous vans, boosted by e-commerce volumes, post the fastest growth at a 15.1% CAGR, aided by simplified form-factor sensor integration.

Technology partnerships reinforce heavy-duty leadership. Daimler Truck shipped a batch of autonomous-ready Freightliner Cascadia tractors to Torc Robotics for Texas trials, demonstrating OEM commitment to factory-installed redundancy architectures. Meanwhile, light-duty builders exploit camera-only perception to trim bill-of-material costs, positioning for last-mile autonomy once municipal rules evolve. The divergent trajectories suggest a barbell market split: high-value interstate rigs on one end and agile city vans on the other.

SAE 1-2 driver-assist suites represented 58.2% of the autonomous truck market share 2024, but the spotlight is shifting to Level 4 and set to foresee a growth of 26.25% CAGR by 2030. Annualized deployments of driver-out pilots rose 140% between 2024 and 2025, and capital inflows favor companies with L4 roadmaps. Volvo's VNL Autonomous platform, slated for customer delivery in 2025, illustrates OEM faith that full-route autonomy will unlock premium service contracts. Level 3 remains a bridging solution where regulations require fallback readiness, yet its commercial window is narrowing as regulators warm to complete driver removal in set corridors.

Investors endorse the transition: Waabi secured USD 200 million in a Series B round led by Uber and Nvidia to refine AI-first simulation, cutting road-test miles by 80%. This influx underscores the belief that scalable virtual training will speed homologation and compress time-to-revenue for Level 4 entrants. As high-definition mapping costs fall, market analysts expect Level 4 to pass 30% share of active freight miles by 2030, reshaping asset-scheduling logic and insurance underwriting norms.

The Autonomous Truck Market is Segmented by Truck Type (Light-Duty Trucks, and More), Level of Autonomy (SAE Level 1-2 (Driver Assist), and More), ADAS Features (Adaptive Cruise Control, Lane Departure Warning, and More), Component (LIDAR, RADAR, Cameras, and More), Drive Type (IC Engine, Battery-Electric, Hybrid, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America captured 33.7% of the autonomous truck market share in 2024 due to permissive state-level pilot frameworks and a 48,000-mile Interstate system favoring lane-centered autonomy. Texas hosts commercial routes linking Dallas, Houston, El Paso, and Phoenix, where Aurora, Kodiak, Volvo, and DHL operate revenue-generating loads. Venture funding remains robust: start-ups raised more than USD 1 billion across 2024-2025, reflecting investor confidence in near-term monetisation.

Europe contributed roughly one-third of the 2024 revenue. Germany, Sweden, and the Netherlands spearhead testing thanks to early adoption of UNECE cybersecurity and lane-keeping directives. The Volvo-Daimler software JV positions EU OEMs to deliver over-the-air-upgradable platforms ahead of the 2026 GSR phase-in. Cross-border freight edges forward via digital corridor pilots such as Scandinavia-Hamburg, yet variable national certification timelines still hamper continent-wide scale.

Asia-Pacific remains the fastest-growing region at a 21.4% CAGR. China's Ministry of Transport endorsed nationwide smart-highway projects, enabling local players to rack up 20 million driver-out kilometres by mid-2025. Japan targets Level 4 coverage of trunk lines by 2027, pairing autonomy incentives with support for hydrogen and battery charging depots. South Korea's K-Mobility 2030 plan accelerates telematics coverage, while India eyes autonomous mining and port haulage as first-mover niches. Open-source stacks like Autoware give regional integrators a springboard to customise perception for left-hand-drive urban grids.

- AB Volvo

- Daimler Truck AG

- Traton SE

- PACCAR Inc.

- BYD Co. Ltd.

- Tesla, Inc.

- TuSimple

- Aurora Innovation

- Waymo Via

- Plus.ai

- Torc Robotics

- Kodiak Robotics

- Nikola Corp.

- Einride

- Embark Technology

- Hyzon Motors

- Gatik AI

- Volvo-Uber ATG JV

- Scania

- Navistar

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Driver shortage & rising line-haul labor cost

- 4.2.2 Demand for 24/7 hub-to-hub logistics

- 4.2.3 Tightening safety regulations (e.g., U.S. AV bills, EU GSR)

- 4.2.4 Platooning-driven fuel savings & emission mandates

- 4.2.5 Synergy of autonomy with zero-emission powertrains

- 4.2.6 Open-source autonomy stacks lowering entry barriers

- 4.3 Market Restraints

- 4.3.1 Patchwork global regulation & cross-border liability

- 4.3.2 Cyber-security & OTA update risks

- 4.3.3 High LiDAR / sensor-suite costs

- 4.3.4 Scarcity of high-resolution HD maps beyond Tier-1 corridors

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Truck Type

- 5.1.1 Light-Duty Trucks

- 5.1.2 Medium-Duty Trucks

- 5.1.3 Heavy-Duty Trucks

- 5.2 By Level of Autonomy

- 5.2.1 SAE Level 1-2 (Driver Assist)

- 5.2.2 SAE Level 3 (Conditional)

- 5.2.3 SAE Level 4 (High)

- 5.2.4 SAE Level 5 (Full)

- 5.3 By ADAS Feature

- 5.3.1 Adaptive Cruise Control

- 5.3.2 Lane Departure Warning

- 5.3.3 Traffic Jam Assist

- 5.3.4 Highway Pilot

- 5.3.5 Automatic Emergency Braking

- 5.3.6 Blind-Spot Detection

- 5.3.7 Lane-Keeping Assist

- 5.4 By Component

- 5.4.1 LiDAR

- 5.4.2 RADAR

- 5.4.3 Cameras

- 5.4.4 Ultrasonic & Other Sensors

- 5.4.5 AI Compute Modules

- 5.5 By Drive Type

- 5.5.1 Internal-Combustion

- 5.5.2 Battery-Electric

- 5.5.3 Hybrid

- 5.5.4 Hydrogen Fuel-Cell

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 Turkey

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AB Volvo

- 6.4.2 Daimler Truck AG

- 6.4.3 Traton SE

- 6.4.4 PACCAR Inc.

- 6.4.5 BYD Co. Ltd.

- 6.4.6 Tesla, Inc.

- 6.4.7 TuSimple

- 6.4.8 Aurora Innovation

- 6.4.9 Waymo Via

- 6.4.10 Plus.ai

- 6.4.11 Torc Robotics

- 6.4.12 Kodiak Robotics

- 6.4.13 Nikola Corp.

- 6.4.14 Einride

- 6.4.15 Embark Technology

- 6.4.16 Hyzon Motors

- 6.4.17 Gatik AI

- 6.4.18 Volvo-Uber ATG JV

- 6.4.19 Scania

- 6.4.20 Navistar

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment