|

市場調查報告書

商品編碼

1850336

實驗室過濾:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Laboratory Filtration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

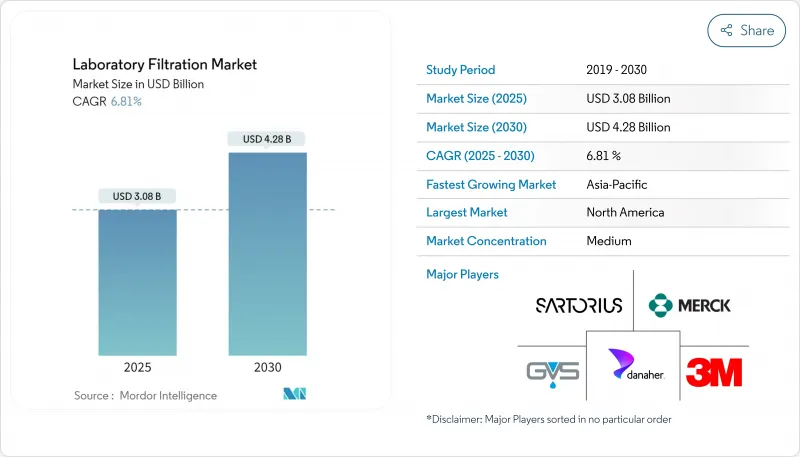

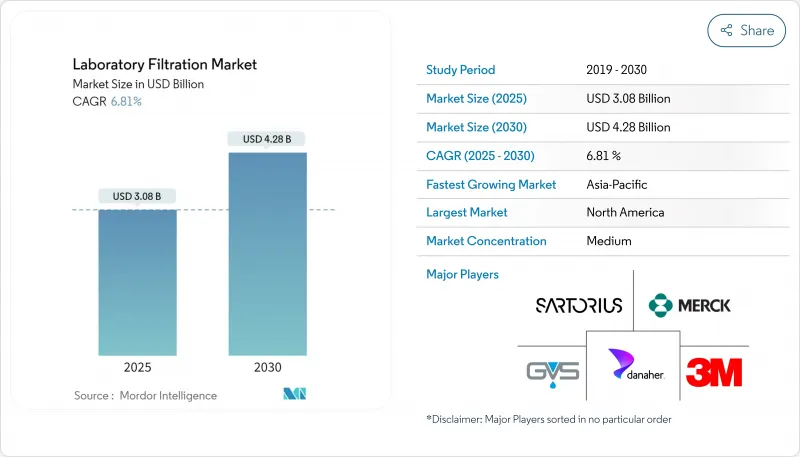

實驗室過濾市場規模預計在 2025 年達到 47 億美元,預計到 2030 年將達到 69.1 億美元,預測期(2025-2030 年)複合年成長率為 8.02%。

生物製藥產量不斷成長、一次性處理技術的快速普及以及先進研究工作流程中對純度要求的日益提高,都推動了這一市場的擴張。精密級微過濾繼續支持常規澄清步驟,而創新的奈米過濾平台則被用於細胞和基因治療流程中的分子級分離。外包給契約製造組織 (CRDMO) 的增加、靈活過濾組件的普及以及永續性舉措,都在加速向無 PFAS 膜的轉變。如今,競爭優勢主要體現在病毒截留率、自動化相容性和數位化相容性上,這促使實驗室過濾市場不斷進行產品升級和平台整合。

全球實驗室過濾市場趨勢與洞察

生技藥品生產的快速擴張

生技藥品產品線正迅速擴展,涵蓋單株抗體、重組蛋白、疫苗和細胞療法。下游純化製程需要無菌、病毒截留過濾器,能夠在不損害生物分子完整性的前提下處理更高滴度的病毒。旭化成醫療(Asahi Kasei Medical)於2024年10月推出的Planova FG1過濾器,在維持病毒清除性能的同時,可將抗體處理的體積通量提高七倍。隨著製造商建造靈活的工廠以實現產品快速切換,對整合式袋裝一次性濾芯的強勁需求將進一步推動實驗室過濾市場的發展。

基因組學和蛋白質組學工作流程的小型化

高通量定序和多重蛋白質體學技術已將樣品用量從毫升級縮小至微升級。相容於96孔盤和384孔盤的過濾裝置已成為次世代定序(NGS)文庫製備和生物標記驗證實驗的標準配置。 Cytiva公司的Whatman Mini-UniPrep G2無針過濾器可一步完成蛋白質沉澱、顆粒去除和自動取樣器管瓶整合,滿足超高效液相層析法(UHPLC)的高精度需求,同時減少塑膠用量和人工操作時間。這種易於自動化的設計使實驗室過濾市場能夠永續地採用數位化、無人值守的基因組學平台。

重複使用消毒級過濾器及其高成本

面臨財務壓力的實驗室往往會重複使用昂貴的滅菌級濾膜,雖然這樣可以降低高達 50% 的耗材成本,但卻增加了污染和驗證的風險。在規模較小的學術實驗室和資源匱乏的地區,由於缺乏濾膜完整性檢測基礎設施,這種情況尤其嚴重。

細分市場分析

預計到2024年,微過濾將佔全球收入的40.2%,證實了其在微生物去除和樣品澄清應用中的廣泛應用。然而,隨著實驗室採用分子級截留技術進行病毒去除、選擇性鹽分離和治療級緩衝液生產,奈米過濾過濾在2030年前以每年9.6%的速度成長。杜邦公司的FilmTec LiNE-XD元件正是這一轉變的例證,它在實現高鋰滲透性的同時,還能有效阻隔對電池材料品管至關重要的多效價離子。

超過濾和逆滲透分別是蛋白質濃縮和超純水生產的基礎技術。將氧化石墨烯通道與聚合物骨架結合的混合膜代表了下一波跨學科突破。這些創新模糊了傳統界限,迫使供應商清楚地展示與生物治療、半導體清洗、環境測試等相關的性能指標。

區域分析

由於北美擁有先進的製藥研發能力、生技產業群聚和嚴格的品質監管,預計到2024年,北美將佔據實驗室過濾市場36.4%的佔有率。波士頓的肯德爾廣場、舊金山灣區和聖地牙哥都在建造高通量生技藥品研發管線,從而確保了對滅菌級濾材、深度過濾器和一次性濾芯的穩定訂單。加拿大的生技藥品產能擴張計畫和墨西哥具有成本競爭力的填充包裝設施也進一步推動了該地區的生產。

亞太地區是最具活力的市場,預計到2030年將以10.7%的複合年成長率成長。中國各省的生命科學園區正在為待開發區工廠配備一次性過濾裝置,以支持mRNA疫苗和基因編輯細胞療法的生產。新加坡的生物醫學科學計畫和韓國的醫藥獎勵策略舉措提振當地對自動化過濾設備的需求,而日本將繼續以超精密膜產品佔據高階市場。印度學名藥生產商正在擴大其原料藥過濾能,並專注於符合PIC/S協調指南且經濟高效的過濾介質。

歐洲在全球實驗室過濾市場佔有重要地位。德國的工程技術傳統推動了先進膜組件的穩定普及,而英國的細胞治療製造生態系統則推動了針對病毒載體純化而最佳化的專用過濾器設計。法國、瑞士和北歐國家正憑藉強大的分析測試能力擴大在該地區的業務。在南美洲,巴西是疫苗灌裝生產線投資的中心,而中東和非洲則因國家免疫和水質計畫而吸引了更多投資。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 生技藥品和細胞療法生產的快速擴張需要無菌過濾

- 基因組學和蛋白質組學工作流程的小型化推動了對基於微孔盤的過濾的需求。

- CRO 和 CDMO 的成長推動了成本效益型過濾組件的發展

- 生技產業的研發成本不斷上升

- 實驗室過濾技術進步。

- 永續性過濾

- 市場限制

- 重複使用殺菌級過濾器以及特殊過濾器的高成本

- 奈米多孔膜的變異性限制了生技藥品檢測的重現性。

- 醫藥採購商整合加劇濾芯供應商利潤壓力

- PFAS修復成本

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(美元)

- 依技術

- 微過濾

- 超過濾

- 逆滲透

- 真空過濾

- 奈米過濾

- 按產品

- 過濾材料

- 薄膜過濾器

- 濾紙

- 過濾微孔盤

- 無針頭過濾器

- 針頭過濾器

- 囊式過濾器

- 過濾組件

- 微過濾組件

- 超過濾裝置

- 真空過濾組件

- 逆滲透組件

- 奈米過濾組件

- 過濾配件

- 過濾材料

- 最終用戶

- 製藥和生物技術公司

- 學術研究機構

- 合約研究組織 (CRO) 和合約研發生產力組織 (CDMO)

- 醫院和診斷實驗室

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- 3M

- Merck KGaA

- Danaher Corporation

- Sartorius AG

- Thermo Fisher Scientific Inc.

- GVS SpA

- Cole-Parmer Instrument LLC

- Agilent Technologies Inc.

- Ahlstrom-Munksjo

- Abcam PLC

- Purolite Corp.

- Repligen Corp.

- Parker Hannifin

- Sterlitech Corp.

- Advantec MFS Inc.

- GE Healthcare

- Cobetter Filtration Equipment Co.

- Graver Technologies LLC

- Meissner Filtration Products

- Porvair Filtration Group

第7章 市場機會與未來展望

The Laboratory Filtration Market size is estimated at USD 4.70 billion in 2025, and is expected to reach USD 6.91 billion by 2030, at a CAGR of 8.02% during the forecast period (2025-2030).

Rising biopharmaceutical production volumes, rapid adoption of single-use process technologies, and escalating purity requirements in advanced research workflows underpin this expansion. Precision-grade microfiltration continues to anchor routine clarification steps, while breakthrough nanofiltration platforms are gaining traction for molecular-level separations in cell and gene therapy pipelines. Heightened outsourcing to contract research and development manufacturing organizations (CRDMOs) is widening access to flexible filtration assemblies, and sustainability initiatives are accelerating the shift toward PFAS-free membranes. Competitive differentiation now revolves around virus-retentive performance, automation readiness, and digital compatibility, encouraging a steady wave of product upgrades and platform integrations across the laboratory filtration market.

Global Laboratory Filtration Market Trends and Insights

Rapid expansion of biologics manufacturing

Biologics pipelines are scaling quickly in monoclonal antibodies, recombinant proteins, vaccines, and cell-based therapies. Downstream purification now demands sterile, virus-retentive filters that handle higher titers without compromising biomolecule integrity. Asahi Kasei Medical's Planova FG1 filter, released in October 2024, demonstrates a seven-fold increase in volumetric throughput for antibody processing while preserving virus clearance performance. Strong demand for single-use bag-integrated cartridges further propels the laboratory filtration market as manufacturers build flexible plants capable of rapid product changeovers.

Miniaturization of genomics & proteomics workflows

High-throughput sequencing and multiplexed proteomics have condensed sample volumes from milliliters to microliters. Filtration devices compatible with 96- and 384-well plates are now standard in next-generation sequencing (NGS) library preparation and biomarker validation assays. Cytiva's Whatman Mini-UniPrep G2 syringeless filters combine protein precipitation, particulate removal, and autosampler vial integration in one step, cutting plastic use and hands-on time while meeting the precision needs of ultrahigh-performance liquid chromatography (UHPLC). Automation-friendly formats position the laboratory filtration market for sustained uptake in digital, walk-away genomics platforms.

Reuse of sterilizing-grade filters & high cost

Laboratories under fiscal pressure often attempt to recycle expensive sterilizing-grade membranes, reducing consumable spend by up to 50% but amplifying contamination and validation risks. The burden is acute in small academic labs and resource-limited geographies, where filter integrity testing infrastructure may be lacking.

Other drivers and restraints analyzed in the detailed report include:

- Growth of CROs & CDMOs

- Rise in R&D spending by biotechnology industries

- Variability in nanoporous membranes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The laboratory filtration market size for microfiltration amounted to 40.2% of global revenue in 2024, underscoring its ubiquity in microorganism removal and sample clarification tasks. Nanofiltration, however, is on pace to compound at 9.6% annually to 2030 as laboratories adopt molecular-level cutoffs for virus clearance, salt-selective separations, and therapeutic-grade buffer production. The FilmTec LiNE-XD element from DuPont illustrates this shift, achieving high lithium passage while excluding multivalent ions critical to battery-material quality control.

Ultrafiltration and reverse osmosis remain cornerstones for protein concentration and ultrapure water generation respectively. Hybrid membranes combining graphene oxide channels with polymer backbones point toward the next wave of cross-disciplinary breakthroughs. Such innovations blur legacy boundaries, compelling vendors to articulate performance metrics in terms relevant to biotherapeutics, semiconductor rinsing, and environmental testing alike.

The Laboratory Filtration Market Report is Segmented by Technology (Microfiltration, Ultrafiltration, Reverse Osmosis, and More), Product (Filtration Media, Filtration Assemblies, and Filtration Accessories), End User (Pharmaceutical and Biotechnology Companies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest share 36.4% of the laboratory filtration market in 2024 owing to its advanced pharmaceutical R&D, dense biotech clusters, and strict quality regulations. Boston's Kendall Square, the San Francisco Bay Area, and San Diego collectively orchestrate high-throughput biologics discovery pipelines, securing recurring orders for sterilizing-grade media, depth filters, and disposable capsules. Canada's biologics capacity expansion programs and Mexico's cost-competitive fill-finish facilities further elevate regional unit volumes.

Asia-Pacific is the most dynamic arena, advancing at a 10.7% CAGR through 2030. China's provincial life-science parks are outfitting greenfield plants with single-use filtration trains to support mRNA vaccines and gene-edited cell therapies. Singapore's Biomedical Sciences Initiative and South Korea's pharmaceutical stimulus packages intensify local demand for automation-ready filtration units, while Japan sustains premium segments with ultra-high precision membrane grades. India's generics producers reinforce bulk-drug filtration throughput, emphasizing cost-efficient media that maintain compliance with PIC/S harmonization guidelines.

Europe maintains significant weight in the global laboratory filtration market. Germany's engineering heritage fosters steady adoption of advanced membrane modules, and the United Kingdom's cell therapy manufacturing ecosystem drives specialty filter designs optimized for viral vector purification. France, Switzerland, and the Nordic countries extend the region's footprint with strong analytical testing sectors. In South America, Brazil anchors investment in vaccine fill-finish lines, whereas the Middle East & Africa are witnessing incremental gains tied to national immunization and water-quality programs.

- 3M

- Merck

- Danaher

- Sartorius

- Thermo Fisher Scientific

- GVS SpA

- Cole-Parmer Instrument LLC

- Agilent Technologies

- Ahlstrom-Munksjo

- Abcam

- Purolite Corp.

- Repligen Corp.

- Parker Hannifin

- Sterlitech Corp.

- Advantec MFS

- GE Healthcare

- Cobetter Filtration Equipment Co.

- Graver Technologies LLC

- Meissner Filtration Products

- Porvair Filtration Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Expansion of Biologics & Cell-Therapy Manufacturing Requiring Sterile Filtration

- 4.2.2 Miniaturization of Genomics & Proteomics Workflows Fueling Microplate-Based Filtration Demand

- 4.2.3 Growth of CROs & CDMOs Boosting Cost-Effective Filtration Assemblies

- 4.2.4 Rise in Research and Development Spending by the Biotechnology Industries

- 4.2.5 Technological Advancements in Laboratory Filtration

- 4.2.6 Sustainability-driven Filtration Innovation

- 4.3 Market Restraints

- 4.3.1 Reuse of Sterilizing-grade Filters and High Cost of Specialized Filters

- 4.3.2 Variability in Nanoporous Membranes Limiting Reproducibility for Biologics Assays

- 4.3.3 Consolidation of Pharma Buyers Increasing Margin Pressure on Filter Vendors

- 4.3.4 PFAS-Driven Reformulation Costs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Technology

- 5.1.1 Microfiltration

- 5.1.2 Ultrafiltration

- 5.1.3 Reverse Osmosis

- 5.1.4 Vacuum Filtration

- 5.1.5 Nanofiltration

- 5.2 By Product

- 5.2.1 Filtration Media

- 5.2.1.1 Membrane Filters

- 5.2.1.2 Filter Papers

- 5.2.1.3 Filtration Microplates

- 5.2.1.4 Syringeless Filters

- 5.2.1.5 Syringe Filters

- 5.2.1.6 Capsule Filters

- 5.2.2 Filtration Assemblies

- 5.2.2.1 Microfiltration Assemblies

- 5.2.2.2 Ultrafiltration Assemblies

- 5.2.2.3 Vacuum Filtration Assemblies

- 5.2.2.4 Reverse Osmosis Assemblies

- 5.2.2.5 Nanofiltration Assemblies

- 5.2.3 Filtration Accessories

- 5.2.1 Filtration Media

- 5.3 By End User

- 5.3.1 Pharmaceutical and Biotechnology Companies

- 5.3.2 Academic and Research Institutes

- 5.3.3 CRO and CDMO

- 5.3.4 Hospital and Diagnostic Laboratories

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Merck KGaA

- 6.4.3 Danaher Corporation

- 6.4.4 Sartorius AG

- 6.4.5 Thermo Fisher Scientific Inc.

- 6.4.6 GVS SpA

- 6.4.7 Cole-Parmer Instrument LLC

- 6.4.8 Agilent Technologies Inc.

- 6.4.9 Ahlstrom-Munksjo

- 6.4.10 Abcam PLC

- 6.4.11 Purolite Corp.

- 6.4.12 Repligen Corp.

- 6.4.13 Parker Hannifin

- 6.4.14 Sterlitech Corp.

- 6.4.15 Advantec MFS Inc.

- 6.4.16 GE Healthcare

- 6.4.17 Cobetter Filtration Equipment Co.

- 6.4.18 Graver Technologies LLC

- 6.4.19 Meissner Filtration Products

- 6.4.20 Porvair Filtration Group

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment