|

市場調查報告書

商品編碼

1850322

密碼管理:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Password Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

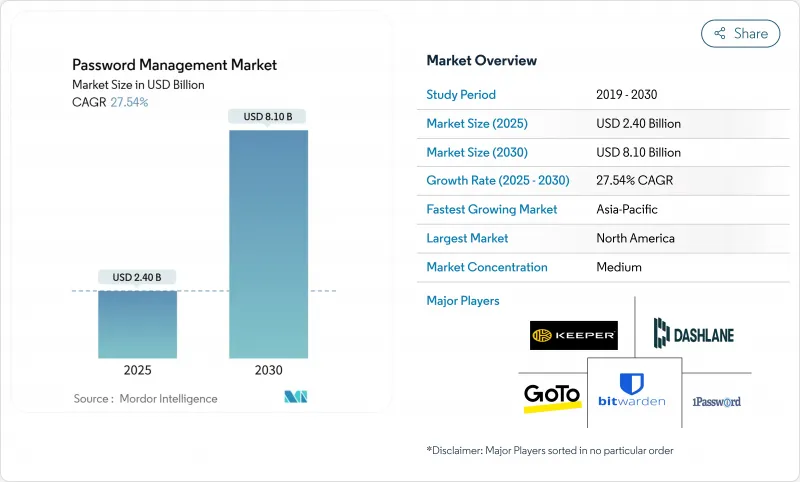

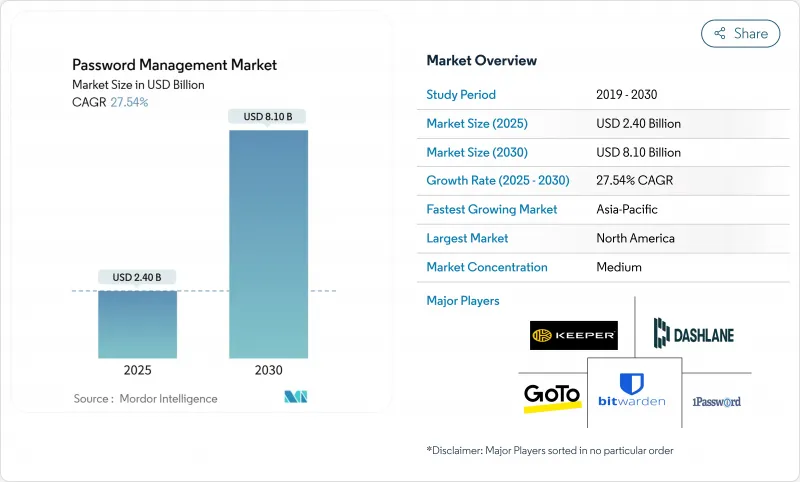

密碼管理器市場預計將在 2025 年達到 24 億美元,在 2030 年達到 81 億美元,複合年成長率高達 27.54%,證實了憑證保護已成為網路風險前線的優先事項。

成長的驅動力在於企業正從單一用途的金鑰庫轉向能夠協調特權存取、自動化審核證據並藉助 FIDO2 和 Passkey 實現無密碼存取的平台。為了因應保險法規、零信任參考架構以及 SaaS 的持續普及,企業正在加強其身分管理。開放原始碼產品憑藉透明度不斷擴大市場佔有率,而現有供應商則競相將特權管理、金鑰自動化和 SaaS 發現功能整合到單一體驗中,加劇了競爭。因此,即使消費者需求放緩,創新週期仍在不斷擴大企業領域的市場機會。

全球密碼管理市場趨勢與洞察

零信任計畫推動特權庫的普及

北美金融機構正以「永不信任,始終檢驗」為原則重建其安全基礎。到2024年,90%的機構將至少通報一次身分外洩事件,其中31%與特權憑證監管不力有關。監管機構和董事會如今將特權存取管理視為根本,敦促銀行採用即時輪調、即時升級和高可靠性金鑰交付等方式對靜態金庫進行現代化改造。 SSH和CYE的夥伴關係正是這一轉變的體現。供應商正在將風險量化與無密碼管道結合,以滿足營運彈性要求。因此,預算將從網路工具轉向身分安全平台,密碼管理器市場在特權層將迎來顯著成長。

歐盟GDPR和NIS-2強制密碼審核

NIS-2 指示要求關鍵產業實體實施多因素身分驗證 (MFA)、協調憑證策略並證明持續合規性。歐洲網路安全組織的一項研究發現,各國規則的不一致造成了實施上的難題。因此,企業正在部署集中式憑證庫,用於收集審核證據、統一現有標準並縮短補救週期。 Hypervault審核審核。

備受矚目的違規事件會破壞信任。

2022 年 LastPass 資料外洩事件以及 2025 年 1 月 PowerSchool 和 TalkTalk 資料外洩事件再次引發了人們對集中式資料儲存庫的質疑。德國、奧地利和瑞士 (DACH) 地區注重隱私的買家正在加強實質審查,這增加了供應商流失的風險。雖然開放原始碼供應商透過發布加密審核來應對這些擔憂,但買家仍在權衡營運收益與監管處罰。隨著各委員會審查供應商選擇並更加重視零知識架構和獨立認證,市場成長將暫時放緩。

細分市場分析

自助式密碼管理產品佔了65%的市場。然而,受零信任架構要求和審核對管理權限的嚴格審查的推動,特權用戶密碼管理正以28%的複合年成長率快速成長。這一差異表明,儘管自助式功能仍然重要,但密碼管理市場的規模分佈將向特權管理傾斜。

企業將特權存取視為新的安全隱患。 One Identity 宣布將於 2024 年推出 Cloud PAM Essentials,該方案整合了發現、會話隔離和合規性分析功能。管理團隊將資料保險庫升級為事件回應平台,並將存取事件與 SIEM遠端檢測關聯起來。風險負責人量化資料外洩的成本,並將預算導向以特權為中心的產品,這些產品能夠透過自適應身份驗證和不可篡改的審核追蹤來保護高價值機密資訊。

到2024年,桌面用戶端將佔總收入的一半,而行動訂閱用戶正以29.8%的複合年成長率成長,這印證了智慧型手機作為一種安全身份驗證方式的崛起。增強的生物辨識技術和硬體隔離區提高了安全性,而跨裝置同步則減少了使用者操作的不便。北歐和北美企業的自帶設備辦公室(BYOD)滲透率已達73%,加速了這一趨勢。供應商正透過整合WebAuthn API和推送授權工作流程,將行動裝置提升為密碼金鑰的補充。

業界對 AutoSpill 漏洞的快速反應促成了修補程式的迅速發布,並透過展現供應商間的透明合作,提振了密碼管理器產業的信心。隨著用戶將資料儲存與原生生物辨識技術結合,行動電話正轉變為下一代多因素身份驗證流程的啟動平台,從而拓寬了行動端的收益空間。

區域分析

北美是最大的區域,佔2024年總收入的38%。這得益於零信任架構的早期應用、嚴格的資訊揭露法律以及保險監理。網路保險公司將保單資格與保險庫的使用合格掛鉤,使風險管理人員實際上成為了銷售冠軍。儘管如此,一些備受矚目的資料外洩事件暫時抑制了企業的積極性,並凸顯了透明加密設計和第三方認證的必要性。

亞太地區正經歷最快的成長,複合年成長率高達 28.1%。 SaaS 的快速普及推動了憑證儲存數量的成長,使得密碼安全成為數位經濟政策的基石。澳洲和日本的政府框架已將資料保險庫指定為關鍵基礎設施,企業也正在利用本地託管叢集來滿足資料居住要求。印度和新加坡的新興企業生態系統正在將保險庫 SDK 直接整合到其金融科技技術堆疊中,擴大了密碼管理器市場的潛在用戶群。

歐洲的監管格局以監管主導。 GDPR 和 NIS-2 正在將關鍵產業的保險箱從可選項轉變為強制性選項。然而,泛歐平台透過為每個監管機構提供客製化的政策模板,正在獲得規模經濟效益。德語區(德國、奧地利和瑞士)採取謹慎的態度,但也透過獎勵那些公開原始碼或委託獨立審核的供應商,來充分利用開放原始碼的優勢。

隨著數位國家計劃的推進,中東和非洲地區實現了兩位數的成長。對主權的需求推動了混合敘事的出現:阿拉伯聯合大公國的試點計畫表明,本地化的SaaS節點可以與全球支持網路共存。沙烏地阿拉伯的「2030願景」預算增加了身分安全的投入,這預示著最佳實踐庫將長期成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 零信任計畫加速北美銀行、金融服務和保險業採用特權密碼庫。

- 歐盟GDPR和NIS-2的強制規定將導致企業範圍內的密碼審核和升級成為強制性要求。

- SaaS身分服務的普及推動了亞太地區中型企業對跨平台身分儲存的需求。

- 員工行動辦公室和自帶設備辦公室 (BYOD) 推動北歐地區行動優先密碼管理器的發展

- 美國網路保險承保要求使用自動身份驗證資訊來證明安全性。

- 開放原始碼安全審核(例如 Argon-2、PBKDF2)增強了人們對社區主導工具的信任。

- 市場限制

- 備受矚目的資料外洩事件(例如 LastPass 2022)已經削弱了用戶信任,尤其是在德語區(德國、奧地利和瑞士)。

- Passkey/FIDO2 普及率的提高降低了消費者市場的未來潛在市場規模

- 中東和北非地區監管資料儲存規則使雲端儲存庫的部署變得複雜。

- 持久性影子IT密碼儲存會增加大型企業的遷移成本

- 價值/供應鏈分析

- 監理與技術展望

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 新冠疫情與混合辦公室模式的影響

第5章 市場規模與成長預測

- 按解決方案類型

- 自助密碼管理

- 特權使用者密碼管理

- 按接入類型/技術

- 桌面

- 行動裝置

- 語音密碼重設

- 瀏覽器擴充功能和網路保險庫

- 透過部署模式

- 雲端主機

- 本地部署

- 混合

- 按公司規模

- 主要企業

- 小型企業

- 最終用戶

- 銀行、金融服務和保險(BFSI)

- 醫療保健和生命科學

- 資訊科技/通訊

- 政府和公共部門

- 零售與電子商務

- 製造業

- 教育

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 北歐國家

- 其他歐洲地區

- 中東

- GCC

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 東南亞

- 大洋洲

- 澳洲

- 紐西蘭

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- LastPass(GoTo)

- 1Password(AgileBits)

- Dashlane

- Keeper Security

- Bitwarden

- CyberArk Software

- Delinea(Centrify/Thycotic)

- Microsoft

- IBM

- Apple Inc.

- CA Technologies(Broadcom)

- Okta Inc.

- SailPoint Technologies

- Quest Software

- Hitachi ID Systems

- FastPassCorp A/S

- Avatier

- Trend Micro

- Ivanti

- Steganos GmbH

- AceBIT GmbH

- Siber Systems(RoboForm)

- EmpowerID

- Intuitive Security Systems

第7章 市場機會與未來展望

The password manager market size sits at USD 2.40 billion in 2025 and is forecast to climb to USD 8.10 billion by 2030, reflecting a powerful 27.54% CAGR that underscores how credential protection has become a frontline cyber-risk priority.

Growth is underpinned by the pivot from single-purpose vaults to platforms that orchestrate privileged access, automate audit evidence, and enable passwordless journeys through FIDO2 and passkeys. Enterprises are tightening identity controls in response to insurer mandates, zero-trust reference architectures, and a relentless rise in SaaS adoption. Competitive intensity is escalating as open-source offerings win mindshare on transparency, while incumbent vendors race to bundle privilege management, secrets automation, and SaaS discovery into one experience. The resulting innovation cycle is expanding the addressable opportunity in the business segment even as consumer demand moderates.

Global Password Management Market Trends and Insights

Zero-trust programs driving privileged vault rollouts

Financial institutions in North America are refactoring security baselines around "never trust, always verify." In 2024, 90% of organizations reported at least one identity breach, with 31% tied to weak oversight of privileged credentials. Regulators and boards now treat privileged access management as foundational, pushing banks to modernize static vaults with real-time rotation, just-in-time elevation and high-assurance secrets delivery. SSH's partnership with CYE illustrates the shift: vendors bundle risk quantification with passwordless channels to satisfy operational resilience rules. The immediate result is a budget reallocation from network tools to identity security platforms, positioning the password manager market for outsized growth in the privileged tier.

EU GDPR & NIS-2 mandated password audits

The NIS-2 directive obliges critical-sector entities to enforce MFA, unify credential policies and demonstrate continuous compliance. A European Cyber Security Organisation survey confirms that inconsistent national rules create execution pain points. Enterprises therefore deploy centrally managed vaults that collect evidence for auditors, reconcile legacy standards and cut remediation cycles. Hypervault highlights how automated rotation paired with granular reports lowers breach risk and audit costs hypervault.com. Heightened scrutiny compresses the procurement timeline, boosting near-term revenue visibility for vendors serving Europe-based headquarters and global subsidiaries alike.

High-profile breaches eroding trust

The 2022 breach at LastPass and fresh compromises at PowerSchool and TalkTalk in January 2025 reignited skepticism toward centralized vaults. Privacy-sensitive DACH buyers display heightened due diligence, amplifying churn risk. Open-source vendors address the concern by publishing cryptographic audits, yet buyers still weigh regulatory penalties against operational gains. Market growth slows temporarily as committees reassess vendor selection, driving an emphasis on zero-knowledge architectures and independent certifications.

Other drivers and restraints analyzed in the detailed report include:

- SaaS identity sprawl accelerating cross-platform vault demand

- Cyber-insurance underwriting demanding automated credential hygiene

- Rapid passkey/FIDO2 adoption shrinking consumer TAM

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Self-Service products retaining a 65% grip on the password manager market. Privileged User Password Management, however, is expanding at a 28% CAGR, pushed by zero-trust directives and auditor scrutiny over administrator rights. The differential implies that password manager market size allocations will skew toward privilege controls, even as self-service features remain table stakes.

Enterprises view privileged identity as the new blast radius. One Identity surfaced Cloud PAM Essentials in 2024, bundling discovery, session isolation and compliance analytics. Administration teams elevate vaults into incident-response platforms, correlating access events with SIEM telemetry. As risk officers quantify breach costs, budgets flow into privilege-centric offerings that can wrap high-value secrets with adaptive authentication and immutable audit trails.

Desktop clients still generated half of 2024 revenue, yet mobile subscriptions are on a 29.8% CAGR, confirming the smartphone's rise as a secure authenticator. Enhanced biometrics and hardware enclaves deepen assurance, while cross-device sync counters user friction. A notable 73% BYOD penetration in Nordic and North American companies. accelerates uptake. Vendors elevate mobile as the passkey companion, embedding WebAuthn APIs and push-to-approve workflows.

Industry response to the AutoSpill flaw spurred rapid patch cycles and injected password manager industry confidence by demonstrating transparent coordination among vendors. As users couple vaults with native biometrics, the handset transforms into the launchpad for next-generation multi-factor flows, widening the mobile revenue corridor.

The Password Management Market is Segmented by Solution Type (Self-Service Password Management, and More), Technology Type (Desktop, and More), Deployment Mode (Cloud-Hosted, and More), Enterprise Size (Large Enterprises, and More), End-User Vertical (BFSI, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America wields the largest regional footprint at 38% of 2024 revenue, buoyed by early zero-trust adoption, stringent breach disclosure laws and insurance oversight. Cyber-insurers tie policy eligibility to demonstrable vault usage, converting risk managers into de facto sales champions. Nevertheless, headline breaches temporarily check enterprise enthusiasm, reinforcing the need for transparent cryptographic design and third-party attestations.

Asia Pacific delivers the sharpest trajectory with a 28.1% CAGR. Rapid SaaS onboarding multiplies credential stores, turning password hygiene into a foundational pillar of digital-economy policy. Government frameworks in Australia and Japan explicitly list vaulting in critical infrastructure baselines, and enterprises leverage locally hosted clusters to satisfy data-residency clauses. Startup ecosystems in India and Singapore embed vault SDKs directly into fintech stacks, expanding the password manager market addressable base.

Europe's profile is regulatory-driven. GDPR and NIS-2 transform vault procurement from discretionary to mandatory in critical sectors. Fragmented national interpretations complicate rollout, but pan-European platforms capture scale advantage by offering policy templates aligned to each supervisory authority. The DACH region, while cautious, rewards vendors that expose source code or commission independent audits, a stance that plays to open-source strengths.

Middle East and Africa register double-digit expansion as digital-nation initiatives progress. Sovereignty demands push the hybrid narrative: UAE pilots demonstrate that localized SaaS nodes can coexist with global support networks. Saudi Arabia's Vision 2030 budgets elevate identity security line items, signaling longer-run upside for best-practice vaults.

- LastPass (GoTo)

- 1Password (AgileBits)

- Dashlane

- Keeper Security

- Bitwarden

- CyberArk Software

- Delinea (Centrify/Thycotic)

- Microsoft

- IBM

- Apple Inc.

- CA Technologies (Broadcom)

- Okta Inc.

- SailPoint Technologies

- Quest Software

- Hitachi ID Systems

- FastPassCorp A/S

- Avatier

- Trend Micro

- Ivanti

- Steganos GmbH

- AceBIT GmbH

- Siber Systems (RoboForm)

- EmpowerID

- Intuitive Security Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Zero-Trust Programs Accelerating Privileged Password Vault Deployments in North American BFSI

- 4.2.2 EU GDPR & NIS-2 Mandates Triggering Enterprise-wide Password Audits and Upgrades

- 4.2.3 Surge in SaaS Identity Sprawl Creating Demand for Cross-Platform Vaults in APAC Mid-market

- 4.2.4 Workforce Mobility & BYOD Driving Mobile-First Password Managers in Nordics

- 4.2.5 Cyber-Insurance Underwriting Requiring Automated Credential Hygiene Proof in U.S.

- 4.2.6 Open-Source Security Audits (e.g., Argon-2, PBKDF2) Elevating Trust in Community-Led Tools

- 4.3 Market Restraints

- 4.3.1 High-Profile Breaches (e.g., LastPass 2022) Undermining User Trust, Especially in DACH Region

- 4.3.2 Rising Adoption of Passkeys/FIDO2 Reducing Future TAM in Consumer Segment

- 4.3.3 Regulatory Data-Residency Rules Complicating Cloud Vault Roll-Outs in MENA

- 4.3.4 Persistent Shadow-IT Password Stores Inflating Migration Costs for Large Enterprises

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

- 4.8 Impact of COVID-19 & Hybrid Work Patterns

5 MARKET SIZE & GROWTH FORECASTS (VALUE, USD)

- 5.1 By Solution Type

- 5.1.1 Self-Service Password Management

- 5.1.2 Privileged User Password Management

- 5.2 By Access/Technology Type

- 5.2.1 Desktop

- 5.2.2 Mobile Devices

- 5.2.3 Voice-Enabled Password Reset

- 5.2.4 Browser Extensions & Web Vaults

- 5.3 By Deployment Mode

- 5.3.1 Cloud-Hosted

- 5.3.2 On-Premises

- 5.3.3 Hybrid

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small & Medium Enterprises (SMEs)

- 5.5 By End-user Vertical

- 5.5.1 Banking, Financial Services & Insurance (BFSI)

- 5.5.2 Healthcare & Life Sciences

- 5.5.3 IT & Telecommunications

- 5.5.4 Government & Public Sector

- 5.5.5 Retail & E-commerce

- 5.5.6 Manufacturing

- 5.5.7 Education

- 5.5.8 Other Verticals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Nordics

- 5.6.3.5 Rest of Europe

- 5.6.4 Middle East

- 5.6.4.1 GCC

- 5.6.4.2 Turkey

- 5.6.4.3 Israel

- 5.6.4.4 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Nigeria

- 5.6.5.3 Rest of Africa

- 5.6.6 Asia

- 5.6.6.1 China

- 5.6.6.2 India

- 5.6.6.3 Japan

- 5.6.6.4 South Korea

- 5.6.6.5 Southeast Asia

- 5.6.7 Oceania

- 5.6.7.1 Australia

- 5.6.7.2 New Zealand

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 LastPass (GoTo)

- 6.4.2 1Password (AgileBits)

- 6.4.3 Dashlane

- 6.4.4 Keeper Security

- 6.4.5 Bitwarden

- 6.4.6 CyberArk Software

- 6.4.7 Delinea (Centrify/Thycotic)

- 6.4.8 Microsoft

- 6.4.9 IBM

- 6.4.10 Apple Inc.

- 6.4.11 CA Technologies (Broadcom)

- 6.4.12 Okta Inc.

- 6.4.13 SailPoint Technologies

- 6.4.14 Quest Software

- 6.4.15 Hitachi ID Systems

- 6.4.16 FastPassCorp A/S

- 6.4.17 Avatier

- 6.4.18 Trend Micro

- 6.4.19 Ivanti

- 6.4.20 Steganos GmbH

- 6.4.21 AceBIT GmbH

- 6.4.22 Siber Systems (RoboForm)

- 6.4.23 EmpowerID

- 6.4.24 Intuitive Security Systems

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-Space & Unmet-Need Assessment