|

市場調查報告書

商品編碼

1850306

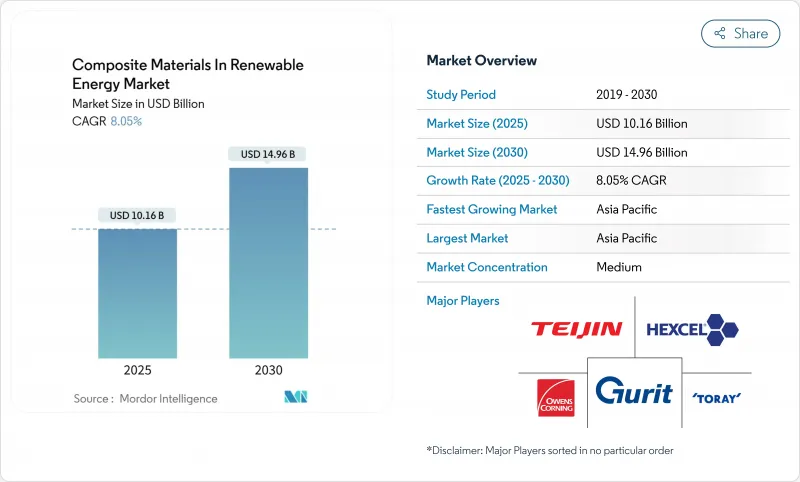

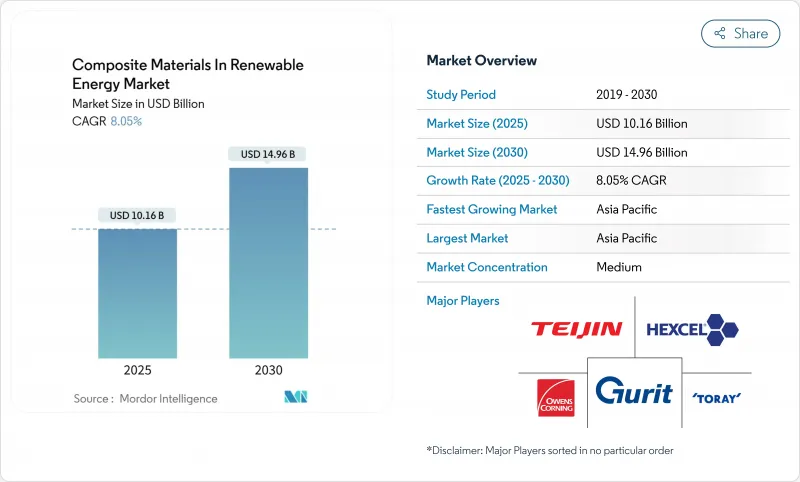

可再生能源複合材料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Composite Materials In Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計到 2025 年,可再生能源複合材料市場規模將達到 101.6 億美元,到 2030 年將達到 149.6 億美元,年複合成長率為 8.05%。

風能、太陽能和氫能計劃的快速產能擴張,對更輕、更堅固的結構提出了更高的要求,以延長零件壽命並減少碳排放。政府的清潔能源政策、可回收熱塑性平台的興起,以及對能夠承受惡劣海上和沙漠氣候的輕量材料的需求,都在加速採購週期。自動化纖維鋪放、3D列印和其他工業4.0製程正在縮短生產週期並減少廢料。同時,垂直整合的供應商正在將纖維紡絲、樹脂配製和零件製造相結合,以確保在供應鏈緊張的情況下獲得關鍵原料。這些因素的交匯有望推動可再生能源複合材料在未來十年實現穩定、創新主導的成長。

全球可再生能源複合材料市場趨勢與洞察

比金屬結構更輕

在離岸風力發電、氫氣罐和潮汐發電設備領域,複合材料的替代可以減輕結構質量,提高負載效率並簡化運輸物流。潮汐葉片重量減輕13.76%,與鋼製替代方案相比,功率輸出提高了46.1%。在航太領域,無內襯V形碳複合材料儲槽的開發支援向液氫推進的過渡,間接增加了對可再生級纖維的需求。三菱化學的C/SiC陶瓷基質複合材料可承受1500°C的高溫,為定日鏡接收器和核融合反應器硬體的應用鋪平了道路。這些進展凸顯了為什麼在高溫、高腐蝕性環境中,可再生能源領域的複合材料正在不斷取代鋁和鋼。

對更長風力發電機葉片的需求不斷成長

西門子能源公司21兆瓦原型機轉子直徑達276米,顯示葉片長度接近150米時,需要使用碳纖維翼梁帽才能達到玻璃纖維無法達到的剛度重量比目標。採用高韌性環氧樹脂黏合的分段式葉片結構,既便於運輸,又能保持氣動彈性完整性。 ZEBRA聯盟利用阿科瑪公司的Elium樹脂,完成了全球最大的完全可回收熱塑性葉片,證明了閉合迴路平台的工業化應用已準備就緒。混合積層法,即天然纖維和合成纖維的混合,提高了抗衝擊性並降低了體積碳含量。

高昂的研發和模具成本

自動化纖維鋪放生產線每條造價500萬至1000萬美元,而用於生產100米以上葉片的模具每套造價超過200萬美元,這意味著在投資回收期到來之前,企業需要投入數年資金。認證課程通常需要五到七年,這會加劇中型創新企業的流動資金壓力。 Hexcel公司計劃在2025年發行3億美元債券,這便是其維持製程技術領先地位所需雄厚財力的一個例證。熱塑性塑膠的生產成本較高,是因為其烘箱、壓機和焊接設備與熱固性塑膠生產線截然不同。

細分市場分析

到2024年,玻璃纖維增強複合材料(GFRP)將佔可再生能源複合材料市場55.25%的佔有率,成為該細分市場最大的收入貢獻者。碳纖維的複合年成長率(CAGR)為8.62%,這主要反映了轉子直徑超過120米的市場需求,因為在這些應用中,碳纖維的剛度和疲勞性能使其5-10倍的成本溢價是合理的。 SGL Carbon公司簽訂的80公尺以上葉片的供應合約表明,碳纖維的應用正從航太垂直擴展到能源領域。混合玄武岩纖維和天然纖維的纖維混鋪層積層法,在保持所需模量的同時降低了體積碳含量,從而拓展了中型渦輪機的選擇範圍。德國對生物基木質素纖維的研究雖然目前商業性規模有限,但具有未來降低成本的潛力。透過機械回收,再生碳纖維可以保留其60-70%的原始拉伸強度,這種再生碳纖維正被逐步應用於二次結構中,從而實現原料多樣化並降低原料價格波動。

由於環氧樹脂擁有成熟的供應鏈和優異的抗疲勞性能,預計到2024年,其市佔率將維持在45.86%。然而,隨著原始設備製造商(OEM)競相滿足循環經濟的需求,生物基和再生樹脂的年可再生材料含量高達35%。熱塑性基材(例如Elium)還具有可修復性和熔融回收性等優勢,推動可再生能源複合材料朝向閉合迴路經濟模式發展。

區域分析

至2024年,亞太地區將佔可再生能源複合材料市場規模的44.68%,並在2030年之前以8.12%的複合年成長率成長。中國以端到端的供應鏈支持該地區的發展,但2024年實施的回收標準將增加合規成本,這將有利於當地的一體化企業。印度24億美元的氫能計畫和國防領域對碳纖維的大力投入將增強國內生產的獎勵。日本的鈣鈦礦藍圖旨在2040年利用軟性複合材料基板實現38.3吉瓦的裝置容量,這可能是重塑全球太陽能組件架構的關鍵因素。韓國正利用其造船技術進軍離岸風電複合材料領域,而澳洲正在內陸水庫上測試浮體式太陽能,展現了該地區終端應用案例的多樣性。

北美地區受益於《通膨抑制法案》提供的3,690億美元資金籌措,而在地化獎勵政策則刺激了德克薩斯州、紐約州和安大略省的工廠擴張。通用電氣Vernova公司投資6億美元的製造擴張項目便是將生產遷回國內以降低跨太平洋物流風險的一個例子。加拿大的航太複合材料叢集正協助其從高壓釜轉型至潮汐渦輪機外殼生產,而墨西哥具有成本競爭力的勞動力資源正吸引拉擠成型企業前來生產太陽能支架出口產品。該地區面臨的挑戰是擴大紡織品生產規模,以避免過度依賴進口,而多家合資企業的目標是在2027年前彌合這一缺口。

歐洲正利用其監管影響力引導全球在可回收性和體積碳排放方面的標準。 ZEBRA計劃熱塑性葉片的成功使歐洲大陸成為該領域的技術領導者。德國的木質素纖維試點生產線代表研發領域的領先地位,而法國則正利用其航太的傳統優勢來改善高模量預浸料。英國國家複合材料中心的SusWIND計畫正在檢驗多種回收途徑,並為原始設備製造商(OEM)提供設計彈性。北海和波羅的海離岸風力發電的建設正在推動纖維需求的持續成長,但不斷上漲的能源成本迫使企業採用自動化技術來確保利潤。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 與金屬結構相比,重量更輕

- 對更長壽命風力發電機葉片的需求不斷成長

- 政府關於引入可再生能源的意圖

- 熱塑性可回收葉片平台的商業化

- 3D列印複合材料零件在浮體式太陽能和潮汐能裝置的應用日益廣泛

- 市場限制

- 高額研發與工具投資

- 回收和掩埋合規成本

- 人們對某些複合材料的耐久性和耐火性表示擔憂

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依纖維類型

- 玻璃纖維增強塑膠(GFRP)

- 碳纖維增強塑膠(CFRP)

- 纖維增強聚合物(FRP)

- 其他纖維類型(例如,混紡織物和其他纖維)

- 樹脂基

- 環氧樹脂

- 聚酯纖維

- 聚氨酯

- 熱塑性塑膠

- 生物樹脂和再生樹脂

- 透過製造程序

- 真空噴射

- 預浸料/高壓釜

- 拉擠成型

- 自動化纖維鋪放/3D列印

- 壓縮成型(SMC、BMC)

- 透過使用

- 風力

- 太陽能發電

- 水力發電

- 其他應用(綠氫能和儲能)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Changzhou Tiansheng New Materials Co. Ltd

- EPSILON Composite SAS

- EURO-COMPOSITES

- Evonik Industries AG

- Exel Composites

- GE Vernova

- Gurit Services AG

- Jiangsu Hengshen Co.,Ltd

- Hexcel Corporation

- HS HYOSUNG ADVANCED MATERIALS

- LM WIND POWER

- Mitsubishi Chemical Group Corporation

- Norco Composites & GRP

- Owens Corning

- Plastic Reinforcement Fabrics Ltd

- SGL Carbon

- Siemens Gamesa Renewable Energy, SAU

- Solvay

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

第7章 市場機會與未來展望

The composite materials in the renewable energy market were valued at USD 10.16 billion in 2025 and are forecast to expand at an 8.05% CAGR, reaching USD 14.96 billion by 2030.

Rapid capacity additions in wind, solar, and hydrogen projects demand lighter, stronger structures that extend component lifetimes and shrink carbon footprints. Government clean-energy mandates, breakthroughs in recyclable thermoplastic platforms, and the need for lightweight materials that endure harsh offshore and desert climates combine to accelerate procurement cycles. Automated fibre placement, 3D printing, and other Industry 4.0 processes are compressing production timelines while trimming manufacturing scrap. At the same time, vertically integrated suppliers are consolidating fibre spinning, resin synthesis, and part fabrication to secure critical inputs amid supply-chain tension. These intersecting forces position the composite materials in the renewable energy market for a decade of steady, innovation-driven growth.

Global Composite Materials In Renewable Energy Market Trends and Insights

Reduced Weight Versus Metallic Structures

Composite substitution cuts structural mass in offshore wind, hydrogen tanks, and tidal devices, boosting payload efficiency and easing transport logistics. Weight savings of 13.76% on tidal blades have lifted power output by 46.1% versus steel alternatives. In aerospace, the development of liner-less Type V carbon-composite tanks supports the transition to liquid-hydrogen propulsion, indirectly increasing demand for renewable-grade fibres. Mitsubishi Chemical's C/SiC ceramic matrix composite endures 1,500 °C, opening paths for heliostat receivers and fusion-reactor hardware. These advances underline why the composite materials in the renewable energy market continue to displace aluminum and steel in high-temperature, corrosive environments.

Growing Demand for Longer Wind-Turbine Blades

Siemens Energy's 21 MW prototype with a 276 m rotor diameter illustrates how blade lengths nearing 150 m require carbon-fibre spar caps for stiffness-to-weight targets unattainable with glass fibre alone. Segmented blade architectures, enabled by high-toughness epoxy joints, ease transport while maintaining aeroelastic integrity. The ZEBRA consortium completed the world's largest fully recyclable thermoplastic blade using Arkema's Elium resin, signalling industrial readiness for closed-loop platforms. Hybrid lay-ups that mix natural and synthetic fibres improve impact resistance and lower embodied carbon, aligning with EU offshore wind targets of 150 GW by 2050 that could double global carbon-fibre demand.

High Research and Development and Tooling CAPEX

Automated fibre-placement lines cost USD 5-10 million each, while molds for >100 m blades exceed USD 2 million per set, tying up capital for years before payback. Certification programs often run 5-7 years, stretching working-capital needs for mid-tier innovators. Hexcel's USD 300 million bond issue in 2025 exemplifies the financial firepower required to retain process-technology leadership. Thermoplastic adoption compounds costs, since ovens, presses, and welding equipment differ from thermoset lines, creating parallel asset footprints that hamper small manufacturers' competitiveness.

Other drivers and restraints analyzed in the detailed report include:

- Government Inclination Towards Adoption of Renewable Energy

- Commercialization of Thermoplastic Recyclable Blade Platforms

- Recycling & Landfill-Ban Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment generated the largest revenue contribution in 2024, when GFRP held 55.25% of composite materials in the renewable energy market share. Carbon fibre's 8.62% CAGR reflects rotor diameters that eclipse 120 m, where stiffness and fatigue performance justify its 5-10X cost premium. SGL Carbon's supply agreements for 80 m-plus blades illustrate vertical moves into energy from aerospace. Fibre-hybrid lay-ups blending basalt and natural fibre reduce embodied carbon yet maintain required modulus, expanding options for mid-range turbine classes. Bio-based lignin fibre research in Germany offers a future cost-reduction lever, although commercial volumes remain limited. Recycled carbon fibre is steadily integrating into secondary structures as mechanical recycling preserves 60-70% original tensile strength, further diversifying feedstocks and tempering raw material price swings.

Epoxy maintained a 45.86% revenue share in 2024 thanks to mature supply chains and high fatigue resistance. Yet bio-resins and recycled resins are expanding at an 8.04% CAGR as OEMs race to satisfy circular-economy mandates. Dow and Vestas have qualified polyurethane spar-cap chemistries that enable rapid pultrusion while elevating interlaminar toughness. Sicomin's SGi 128 bio-epoxy gel coat demonstrates fire-safe solutions with 35% renewable content. Thermoplastic matrices such as Elium offer the added benefit of repairability and melt recycling, pivoting the composite materials in the renewable energy market toward closed-loop economics.

The Composite Materials in Renewable Energy Market Report Segments the Industry by Fibre Type (Glass-Fibre-Reinforced Plastics (GFRP), and More), Resin Matrix (Epoxy, Polyester, and More), Manufacturing Process (Vacuum Infusion, Prepreg/Autoclave, and More), Application (Wind Power, Solar Power, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 44.68% of the composite materials in the renewable energy market size in 2024 and is on track for an 8.12% CAGR through 2030. China anchors the region with end-to-end supply chains, yet its 2024 recycling standards raise compliance costs that favor integrated local champions. India's USD 2.4 billion Hydrogen Mission and defense-sector carbon-fibre push reinforce domestic production incentives. Japan's perovskite roadmap aims for 38.3 GW by 2040 via flexible composite substrates, a pivot that may recalibrate global solar module architectures. South Korea leverages shipbuilding know-how to enter offshore wind composites, while Australia tests floating solar on inland reservoirs, showcasing regional diversity in end-use cases.

North America benefits from USD 369 billion of Inflation Reduction Act funding, with domestic-content bonuses catalyzing plant expansion in Texas, New York, and Ontario. GE Vernova's USD 600 million manufacturing buildout exemplifies reshoring moves that cut trans-Pacific logistics risk. Canada's aerospace-composite cluster supports the transfer of out-of-autoclave methods to tidal-turbine shells, while Mexico's cost-competitive labor pool draws pultruders for solar-rack exports. The region's challenge is scaling fibre production to prevent over-dependence on imports, a gap several joint ventures aim to close by 2027.

Europe wields regulatory clout, steering global norms on recyclability and embodied carbon. The ZEBRA project's thermoplastic blade success positions the continent as a technology frontrunner. Germany's lignin-fibre pilot lines symbolize R&D leadership, whereas France leverages aerospace heritage to refine high-modulus prepregs. The UK National Composites Centre's SusWIND program validates multiple recycling routes, giving OEMs design flexibility. Offshore wind buildout in the North Sea and Baltic drives sustained fibre demand, though high energy costs compel automation to defend margins.

- Changzhou Tiansheng New Materials Co. Ltd

- EPSILON Composite SAS

- EURO-COMPOSITES

- Evonik Industries AG

- Exel Composites

- GE Vernova

- Gurit Services AG

- Jiangsu Hengshen Co.,Ltd

- Hexcel Corporation

- HS HYOSUNG ADVANCED MATERIALS

- LM WIND POWER

- Mitsubishi Chemical Group Corporation

- Norco Composites & GRP

- Owens Corning

- Plastic Reinforcement Fabrics Ltd

- SGL Carbon

- Siemens Gamesa Renewable Energy, S.A.U

- Solvay

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Reduced weight versus metallic structures

- 4.2.2 Growing demand for longer wind-turbine blades

- 4.2.3 Government inclination towards the adoption of renwable energy

- 4.2.4 Commercialisation of thermoplastic recyclable blade platforms

- 4.2.5 Rising adoption of 3-D printed composite parts in floating solar & tidal devices

- 4.3 Market Restraints

- 4.3.1 High research and development and tooling CAPEX

- 4.3.2 Recycling & landfill-ban compliance costs

- 4.3.3 Concerns regarding the durability and fire resistance of some composite materials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Fibre Type

- 5.1.1 Glass-Fibre-Reinforced Plastics (GFRP)

- 5.1.2 Carbon-Fibre-Reinforced Plastics (CFRP)

- 5.1.3 Fibre-Reinforced Polymers (FRP)

- 5.1.4 Other Fibre Types (Hybrid and Other Fibres, etc.)

- 5.2 By Resin Matrix

- 5.2.1 Epoxy

- 5.2.2 Polyester

- 5.2.3 Polyurethane

- 5.2.4 Thermoplastic

- 5.2.5 Bio-resins and Recycled Resins

- 5.3 By Manufacturing Process

- 5.3.1 Vacuum Infusion

- 5.3.2 Prepreg/Autoclave

- 5.3.3 Pultrusion

- 5.3.4 Automated Fibre Placement / 3-D Printing

- 5.3.5 Compression Moulding (SMC, BMC)

- 5.4 By Application

- 5.4.1 Wind Power

- 5.4.2 Solar Power

- 5.4.3 Hydroelectricity

- 5.4.4 Other Applications (Green-Hydrogen & Energy-Storage Vessels)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Changzhou Tiansheng New Materials Co. Ltd

- 6.4.2 EPSILON Composite SAS

- 6.4.3 EURO-COMPOSITES

- 6.4.4 Evonik Industries AG

- 6.4.5 Exel Composites

- 6.4.6 GE Vernova

- 6.4.7 Gurit Services AG

- 6.4.8 Jiangsu Hengshen Co.,Ltd

- 6.4.9 Hexcel Corporation

- 6.4.10 HS HYOSUNG ADVANCED MATERIALS

- 6.4.11 LM WIND POWER

- 6.4.12 Mitsubishi Chemical Group Corporation

- 6.4.13 Norco Composites & GRP

- 6.4.14 Owens Corning

- 6.4.15 Plastic Reinforcement Fabrics Ltd

- 6.4.16 SGL Carbon

- 6.4.17 Siemens Gamesa Renewable Energy, S.A.U

- 6.4.18 Solvay

- 6.4.19 TEIJIN LIMITED

- 6.4.20 TORAY INDUSTRIES, INC.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment