|

市場調查報告書

商品編碼

1850301

三防膠:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Conformal Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

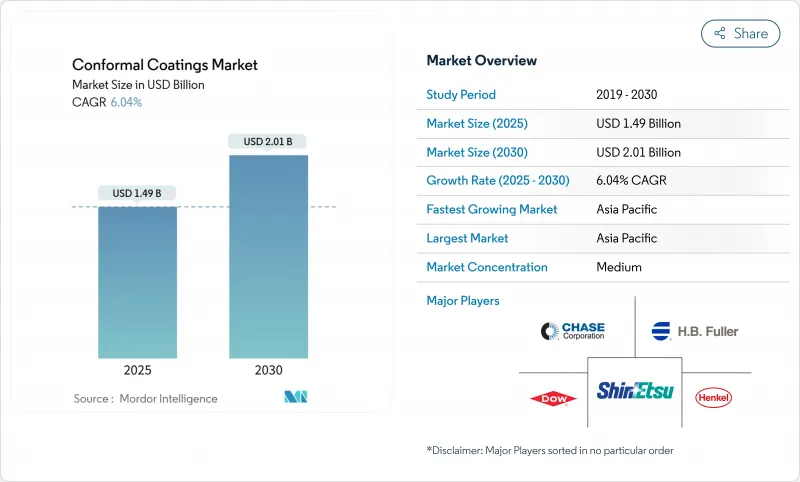

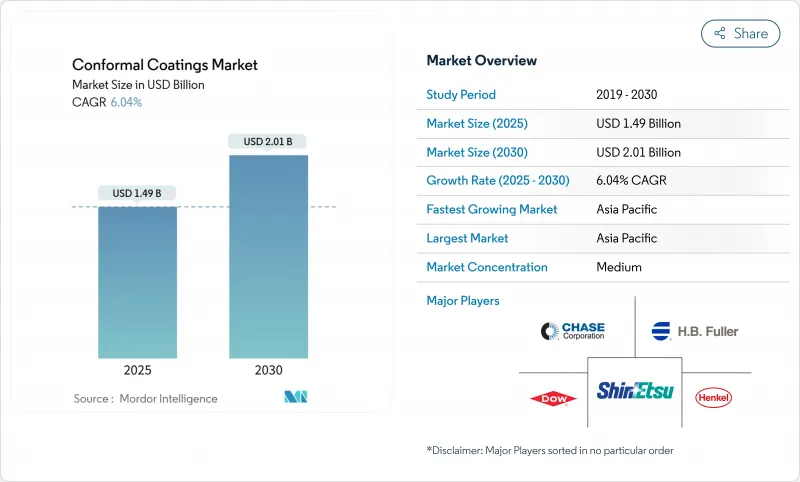

全球三防膠市場預計到 2025 年將達到 14.9 億美元,到 2030 年將達到 20.1 億美元,預測期內複合年成長率為 6.04%。

智慧型手機、5G基地台、電動車和衛星有效載荷對電路保護的需求強勁,且需求量不斷成長。家用電子電器的微型化,元件間距縮小了30%至40%,推動了對能夠阻隔水分、化學物質和離子污染的超薄膜的研究。對揮發性有機化合物(VOC)的更嚴格監管,促使配方師專注於水性配方和紫外光固化配方,這些配方既能減少排放,又能縮短製程時間。同時,選擇性機器人點膠和化學沉澱透過僅塗覆最容易受損的線路和通孔,為設計釋放了新的自由度。市場競爭適中,供應商正利用專有化學技術、線上等離子表面處理和本地技術中心來應對電子製造業不斷擴大的地域覆蓋範圍。

全球三防膠市場趨勢與洞察

亞洲5G智慧型手機和物聯網穿戴裝置推動小型電路保護的發展

用於下一代手持設備的高密度基板需要厚度為 5 至 25 微米的保形塗層,同時也要保持訊號完整性。亞洲領先的封裝商正在使用等離子體表面活化技術來提高附著力,從而實現對微型 BGA 和堆疊晶粒的可靠塗層。機器人選擇系統可將塗層用量減少 25%,並省去遮罩步驟,進而緩解生產瓶頸。這些進步使品牌能夠在不增加重量的情況下保護更薄的設備,從而推動該地區三防膠市場的發展勢頭。

低地球軌道衛星和航空電子設備需要高性能塗層。

衛星群營運商越來越傾向於選擇熱穩定性塗層,這種塗層能夠承受-65 度C至+200 度C的溫度升高,並且耐原子氧侵蝕。 MAP Space Coatings 為主要整合商提供超低釋氣、真空相容的薄膜,以提高機載電子設備的可靠性。日益擴大的環境要求促使北美和歐洲的頂級航空供應商繼續堅持使用優質化學材料,從而推動了專業航太三防膠市場的發展。

紫外光固化不透明薄膜返工與檢驗的複雜性

不透明配方會掩蓋焊點,需要使用 X 光或紅外線工具進行品管,從而增加資本投入。去除通常依賴於微磨損或化學剝離,但這可能會損壞墊片或導致晶片開裂,從而延長使用壽命。這些限制抑制了紫外線化學在混合晶片製造廠的應用,暫時限制了三防膠的市場滲透,直到透明或可示蹤染料的版本得到更廣泛的應用。

細分市場分析

到2024年,丙烯酸類三防膠市場總收入的44%,這主要得益於其均衡的防潮性能、易於返工以及具有競爭力的成本優勢。預計該細分市場將以6.81%的複合年成長率成長,這主要得益於大批量智慧型手機生產線對快速、不黏手塗層的需求。 Electrolube的HFAC系列產品不含鹵素且氣味低,深受對空氣品質要求嚴格的汽車和國防工廠的青睞。矽酮塗料在電動車電池組和胺甲酸乙酯等嚴苛的熱負荷環境下越來越受歡迎,而環氧樹脂和胺甲酸乙酯則在化學密集型應用和引擎室內應用領域保持著一定的市場佔有率。新型奈米氟聚合物混合物有望實現小於10微米的疏水性,凸顯了輕量化塗料在微型化應用的持續發展趨勢。

由於雷達、LiDAR和高功率轉換器的應用,三防膠市場規模正在擴大。相較之下,環氧樹脂由於其不可逆性(這會增加基板返工的難度),成長速度較為緩慢。胺甲酸乙酯作為一種柔韌且耐化學腐蝕的防護材料,正重新受到青睞,用於驅動系統控制器和農業機械印刷電路基板。總體而言,材料多樣化使原始設備製造商 (OEM) 能夠根據設備的風險狀況選擇合適的防護等級,從而鞏固了三防膠行業內多材料策略的有效性。

到2024年,溶劑型固化方法將佔銷售額的55%,但歐盟和加州排放嚴格的排放法規正在加速向更環保平台的轉型。紫外光固化技術成長最快,複合年成長率達7.01%,其優勢在於即時黏性和VOC含量≤50 g/L。漢高的無溶劑紫外光固化生產線展現了產業對線上固化的需求,可將占地面積減少一半。水性化學品可實現1-24小時固化,滿足那些優先考慮設備簡易性的生產線的需求。

由於加工速度快、能耗低、VOC排放量極低,紫外光固化塗料預計將成為成長最快的細分市場,2025年至2030年的複合年成長率將達到7.01%。德國和美國對該技術的採用最為積極,因為節能固化技術符合企業淨零排放的承諾。

地理分析

亞太地區將在2024年以42%的市佔率引領三防膠市場,並在2030年之前維持7.54%的複合年成長率。中國作為ODM中心以及5G小型基地台的日益普及將使該地區的市場佔有率保持在高位。印度和越南將透過激勵措施吸引新的PCB產能,進而提振塗層需求。例如,Plasmatreat在德國國際電子製造展覽會(productronica China)上展示的REDOX-Tool等本地演示,凸顯了該地區與製程工程師和供應商的持續合作。

北美仍是嚴苛環境電子產品的高階市場。太空探勘、先進航空電子設備和植入式醫療設備都需要符合NASA和FDA通訊協定的合格塗層。這種對關鍵任務可靠性的重視推動了平均售價的上漲和合約量的穩定成長。在更北的地區,各國政府持續資助5G和雷達研究,深化了塗層巨頭與國防相關企業的夥伴關係。這些因素共同推動了歐洲大陸三防膠市場的成長動能。

歐洲嚴格的環境管理體制正在加速向水性及紫外線平台的轉型。德國的汽車供應鏈正在採用紫外線和水基混合化學製程來處理引擎室基板。隨著汽車電氣化進程的推進,每輛車的基板數量不斷增加,預計該地區的三防膠市場規模將穩定成長。在其他地區,南美洲以及中東和非洲仍在發展中,但隨著5G宏基地台和太陽能逆變器在需要耐腐蝕電子產品的氣候條件下日益增多,這些市場也不斷發展。供應商通常會將成套的塗層生產線運送給當地的代工製造商,以縮短Start-Ups時間並確保售後維護收入。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲5G智慧型手機和物聯網穿戴裝置推動小型電路保護的發展

- 北美和歐洲的低地球軌道衛星和航空電子設備需要高性能塗層。

- 向符合 RoHS 標準的低 VOC 水/紫外線系統過渡

- 通訊基礎設施擴建和5G部署。

- 在航太和國防領域的應用日益廣泛

- 市場限制

- 紫外光固化不透明薄膜返工與檢驗的複雜性

- 矽酮單體價格波動

- 歐盟關於溶劑型揮發性有機化合物的法規降低了對傳統產品的需求。

- 用於醫療和航太航太領域的高純度聚對二甲苯二聚體短缺

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依材料類型

- 丙烯酸纖維

- 環氧樹脂

- 胺甲酸乙酯/聚氨酯

- 矽酮

- 其他化學物質(氟聚合物、奈米塗層)

- 透過技術

- 溶劑型

- 水溶液

- 紫外線固化

- 混合/其他先進系統

- 透過操作方法

- 噴塗(霧化/薄膜)

- 浸塗

- 刷塗

- 其他(選擇性/機器人點膠和化學沉澱(CVD))

- 按最終用戶行業分類

- 消費性電子產品

- 汽車(內燃機汽車、電動車、先進駕駛輔助系統)

- 航太與國防

- 醫療與生命科學電子

- 其他(工業、電力、能源)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- 3M

- Actnano Inc.

- Altana AG

- Bostik(Arkema)

- Chase Corporation

- Chemtronics(KEMET)

- CHT UK Ltd

- Dow

- Dymax Corporation

- Electrolube

- Europlasma NV

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MG Chemicals

- Nordson Corporation

- Panacol-Elosol GmbH

- PVA

- Shin-Etsu Chemical Co., Ltd.

第7章 市場機會與未來展望

The global conformal coatings market is valued at USD 1.49 billion in 2025 and is set to reach USD 2.01 billion in 2030, reflecting a 6.04% CAGR through the forecast window.

Robust demand for circuit protection across smartphones, 5G base stations, electric vehicles, and satellite payloads keeps volume requirements on an upward trajectory. Miniaturization in consumer electronics continues to shrink component spacing by 30-40%, steering research toward ultra-thin films that still block moisture, chemicals, and ionic contamination. Regulatory curbs on volatile organic compounds are redirecting formulator attention to water-borne and UV-cured options that lower emissions while cutting process time. At the same time, selective robotic dispensing and chemical vapor deposition are unlocking new design freedom by coating only the most vulnerable traces and vias, a capability that reduces material use and rework. Competitive intensity is moderate, and suppliers are leveraging proprietary chemistries, in-line plasma surface preparation, and local technical centers to match the expanding geographic footprint of electronics manufacturing.

Global Conformal Coatings Market Trends and Insights

5G Smartphones and IoT Wearables Driving Miniaturized Circuit Protection in Asia

High-density boards in next-generation handhelds require conformality at 5-25 μm while preserving signal integrity. Leading Asian assemblers rely on plasma surface activation to raise adhesion, enabling reliable coverage on micro-BGAs and stacked dies. Robotic selective systems further trim coating volume by 25% and cut masking steps, easing throughput bottlenecks. Together, these advances let brands protect thinner devices without adding weight, which sustains the conformal coatings market momentum in the region.

LEO Satellites and Avionics Electronics Demanding High-Performance Coatings

Constellation operators increasingly specify thermally stable coatings that withstand -65 °C to +200 °C excursions and resist atomic oxygen. MAP Space Coatings supplies vacuum-compatible films with ultralow outgassing to major integrators, reinforcing reliability of on-board electronics. Extended environmental envelopes keep North American and European tier-one aero suppliers loyal to premium chemistries, lifting the conformal coatings market in specialized aerospace segments.

Rework and Inspection Complexity for UV-Cured Opaque Films

Opaque formulations mask solder joints, mandating X-ray or infrared tools for quality control, which raises capital outlays. Removal often relies on micro-abrasion and chemical stripping that can lift pads or crack chips, extending service cycles. These constraints slow momentum for UV chemistries in high-mix factories, temporarily capping conformal coatings market penetration until transparent or dye-traceable versions proliferate.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Shift to RoHS-Compliant Low-VOC Water/UV Systems

- Expansion of Telecom Infrastructure and 5G Rollout

- Silicone Monomer Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylic subset of the conformal coatings market held 44% revenue in 2024, supported by balanced moisture protection, easy rework, and competitive cost profiles. The segment is expected to grow at a 6.81% CAGR, helped by high-volume smartphone lines that favor fast, tack-free times. Electrolube's HFAC series delivers halogen-free performance with low odor, appealing to automotive and defense plants that maintain strict air-quality guidelines. Silicone garners attention for harsh thermal loads in EV packs and avionics, while epoxy and urethane preserve niche roles in chemical-rich and under-hood niches. Emerging nano-fluoropolymer blends promise hydrophobicity at sub-10 μm, underscoring a constant push toward lighter coatings that align with miniaturization.

The conformal coatings market size is growing because of the installation of radar, lidar, and high-power converters that rely on -65 °C to +200 °C resilience. In contrast, epoxies grow at a muted clip because irreversibility complicates board rework. Urethane sees renewed interest as a flexible yet chemical-tough shield for drivetrain controllers and agricultural machinery printed circuit boards. Collectively, material diversification lets OEMs match protection levels to equipment risk profiles, cementing multi-material strategies within the broader conformal coatings industry.

Solvent-borne methods still anchor 55% of 2024 revenue, yet legislation in the EU and California tightens allowable emissions, accelerating migration to greener platforms. UV-cure technology logs the swiftest expansion at 7.01% CAGR, leveraging instant tack and <=50 g/L VOC. Henkel's solvent-free UV line attests to industrial appetite for in-line curing that halves floor space. Water-borne chemistries capture production lines that tolerate 1-24 hour cures and value equipment simplicity. Hybrid UV-moisture systems extend these gains to shadowed areas, preventing uncured pockets under tall components.

UV-cured coatings are emerging as the fastest-growing segment at 7.01% CAGR (2025-2030), driven by their rapid processing times, reduced energy consumption, and minimal VOC emissions. Adoption is most aggressive in Germany and the United States, where energy-efficient curing dovetails with corporate net-zero pledges. The conformal coatings market benefits as regulatory policy dovetails with production efficiency, aligning environmental stewardship and cost reduction.

The Conformal Coatings Market Report Segments the Industry by Material Type (Acrylic, Epoxy, Urethane/Polyurethane, and More), Technology (Solvent-Based, Water-Based, and More), Operation Method (Spray Coating, Dip Coating, Brush Coating, and Others), End-User Industry (Consumer Electronics, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific led the conformal coatings market with 42% share in 2024 and posts a 7.54% CAGR to 2030. China's ODM hub and increasing penetration of 5G small cells keep regional line utilization high. India and Vietnam lure new PCB capacity through incentive schemes, driving coatings demand upward. Local demonstrations, such as Plasmatreat's REDOX-Tool at productronica China, underscore sustained supplier engagement with the region's process engineers.

North America remains a premium market for harsh-environment electronics. Space exploration, advanced avionics, and implantable medical devices require qualified coatings that meet NASA and FDA protocols. This focus on mission-critical reliability supports higher average selling prices and stable contractual volumes. Further north, governments continue to sponsor 5G and radar research that deepens partnerships between coating giants and defense primes. Together, these elements reinforce the conformal coatings market growth momentum on the continent.

Europe, occupying an environmentally stringent regulatory regime, hastens the shift to water-borne and UV platforms. German automotive supply chains deploy hybrid UV-moisture chemistries for under-hood control boards. The conformal coatings market size in the bloc is forecast to climb steadily as vehicle electrification raises board counts per car. Elsewhere, South America and the Middle East and Africa remain nascent but are evolving as 5G macro towers and photovoltaic inverters multiply in climates that demand corrosion-proof electronics. Suppliers often ship pre-packaged coating lines to local contract manufacturers to shorten start-up time and secure after-sales maintenance revenue.

- 3M

- Actnano Inc.

- Altana AG

- Bostik (Arkema)

- Chase Corporation

- Chemtronics (KEMET)

- CHT UK Ltd

- Dow

- Dymax Corporation

- Electrolube

- Europlasma NV

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MG Chemicals

- Nordson Corporation

- Panacol-Elosol GmbH

- PVA

- Shin-Etsu Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G Smartphones and IoT Wearables Driving Miniaturized Circuit Protection in Asia

- 4.2.2 LEO Satellites and Avionics Electronics Demanding High-Performance Coatings in North America and Europe

- 4.2.3 Regulatory Shift to RoHS-Compliant Low-VOC Water/UV Systems

- 4.2.4 Expansion of Telecom Infrastructure and 5G Rollout.

- 4.2.5 Increasing Use in Aerospace and Defense Sectors

- 4.3 Market Restraints

- 4.3.1 Rework and Inspection Complexity for UV-Cured Opaque Films

- 4.3.2 Silicone Monomer Price Volatility

- 4.3.3 EU Solvent-Based VOC Caps Shrinking Legacy Product Demand

- 4.3.4 Scarcity of High-Purity Parylene Dimer for Medical/Aerospace

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Urethane/Polyurethane

- 5.1.4 Silicone

- 5.1.5 Other Chemistries (Fluoropolymer, Nano-coatings)

- 5.2 By Technology

- 5.2.1 Solvent-Based

- 5.2.2 Water-Based

- 5.2.3 UV-Cured

- 5.2.4 Hybrid/Other Advanced Systems

- 5.3 By Operation Method

- 5.3.1 Spray Coating (Atomised / Film)

- 5.3.2 Dip Coating

- 5.3.3 Brush Coating

- 5.3.4 Others (Selective/Robotic Dispense and Chemical Vapour Deposition (CVD))

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Automotive (ICE, EV, ADAS)

- 5.4.3 Aerospace and Defense

- 5.4.4 Medical and Life-Sciences Electronics

- 5.4.5 Others (Industrial, Power and Energy)

- 5.5 By Geography

- 5.5.1 Asia Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Actnano Inc.

- 6.4.3 Altana AG

- 6.4.4 Bostik (Arkema)

- 6.4.5 Chase Corporation

- 6.4.6 Chemtronics (KEMET)

- 6.4.7 CHT UK Ltd

- 6.4.8 Dow

- 6.4.9 Dymax Corporation

- 6.4.10 Electrolube

- 6.4.11 Europlasma NV

- 6.4.12 H.B. Fuller Company

- 6.4.13 Henkel AG & Co. KGaA

- 6.4.14 Illinois Tool Works Inc.

- 6.4.15 MG Chemicals

- 6.4.16 Nordson Corporation

- 6.4.17 Panacol-Elosol GmbH

- 6.4.18 PVA

- 6.4.19 Shin-Etsu Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Demand from Sensors and Displays