|

市場調查報告書

商品編碼

1850297

汽車綠色輪胎市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Green Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

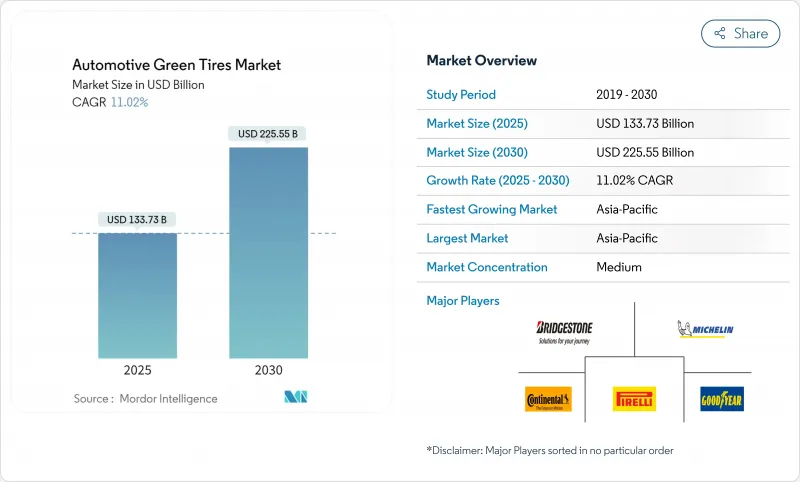

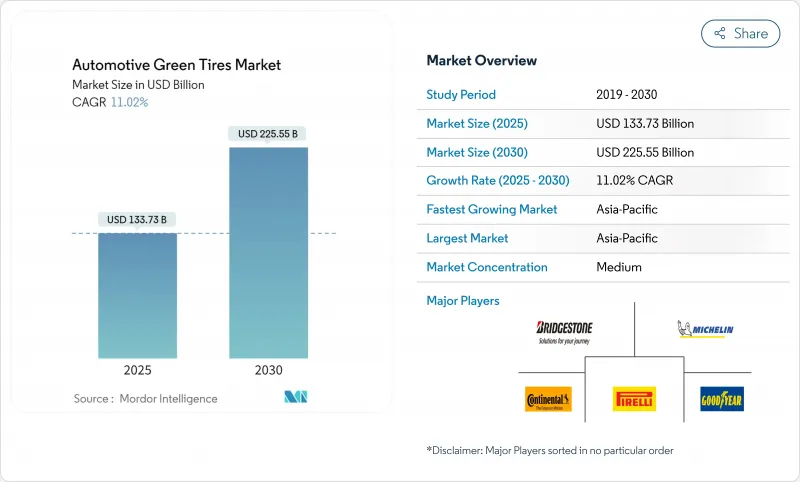

預計到 2025 年,汽車綠色輪胎市場規模將達到 1,337.3 億美元,到 2030 年將達到 2,255.5 億美元,年複合成長率為 11.02%。

全球車輛電氣化、歐7輪胎顆粒物排放法規以及企業範圍3脫碳目標,已使環境績效成為核心設計指標。東協大規模生產稻殼灰二氧化矽、智慧感測器的快速普及以及政府對生物基聚合物的資助,正在降低生命週期成本並擴大潛在需求。隨著主要製造商獲得循環經濟能力並確保生物橡膠原料供應,企業整合正在加速。供應鏈對東南亞乳膠的依賴以及輪胎顆粒物全球檢測方法尚未統一,仍是關鍵的執行風險。

全球汽車綠色輪胎市場趨勢與洞察

電動車產量激增

全球電動車組裝需要能夠支援瞬時扭力、低噪音和最小滾動阻力的輪胎。將於2025年12月生效的新版FMVSS 305a法規將輪胎安全與電池電力傳動系統的要求一致。通用汽車計劃在2025年在美國每年生產100萬輛電動車,這將擴大對特種輪胎化合物的需求。美國環保署(EPA)2027-2032年的多項污染物排放標準旨在將輕型車輛的溫室氣體排放量減少50%,進一步強化了這項轉變。這些法規將以電動車為中心的功能融入所有新型乘用車和商用車平台。隨著汽車製造商競相延長續航里程,針對電池效率最佳化的輪胎已成為採購的優先事項。

更嚴格的全球二氧化碳排放法規和輪胎標籤法規將大幅改變產品開發。

歐盟7標準將於2028年7月起在全球率先對輪胎磨損產生的顆粒物排放設定上限。永續產品的生態設計法規將在2025年4月前為輪胎添加數位產品護照,以追蹤其全生命週期。中國2024年的碳足跡標準將要求輪胎製造商在生產過程中量化排放。美國輪胎工業協會已確定五種潛在的6PPD(六苯並噻唑啉酮)替代品,以滿足加州的《更安全消費品法規》。合規性現在將帶來切實的品牌優勢,獎勵那些將環境指標納入核心設計而非附加標籤的公司。

高昂的初始成本溢價是市場滲透的一大挑戰。

美國環保署(EPA)的有害空氣污染物法規每年為美國輪胎工廠增加1,330萬美元的遵循成本。中國的《2024-2025年節能行動計畫》強化了工業排放,並提高了本地生產成本。美國能源部8,800萬美元的車輛技術津貼承認,綠色出行仍需補貼以彌補成本差距。高昂的價格給那些優先考慮短期投資回報而非輪胎壽命的購車預算帶來了壓力。新興經濟體信貸准入的困難進一步減緩了綠色出行的普及。

細分分析

到2024年,乘用車將保持最大佔有率,達到63.31%,而商用車將以12.48%的複合年成長率新增一條成長通道。智慧感測器組件和低滾動阻力使營運商能夠降低燃油成本,抵消價格溢價。美國環保署(EPA)公司平均燃油經濟性(CAFE)的提升和車輛電氣化指令將進一步擴大這一成長空間。相較之下,消費者的採用將取決於品牌訊息和經銷商的影響力。隨著商業測試檢驗了輪胎的耐用性,永續輪胎市場將持續多元化,推動銷售擴張,所有類別都將從中受益。隨著時間的推移,乘用車的採用將受益於貨運業已建立的成本曲線。

商用平台也使輪胎暴露在電力傳動系統的高扭力之下,加速了複合材料創新。車隊管理人員利用遠端資訊處理技術分析輪胎磨損情況,從而增強了對數據驅動型低碳車型的需求。加州和歐盟的政策將商用車排放與採購額度掛鉤,進一步推動了永續技術的決策。乘用車市場成長仍然強勁,但面臨收入彈性較大的購買行為,導致補貼地區以外的市場轉型速度放緩。

售後市場項目正以 9.82% 的複合年成長率成長,逐漸蠶食原始設備製造商 68.45% 的市佔率。汽車製造商將輪胎碳排放數據嵌入供應商記分卡,以實現範圍 3 目標。通用汽車在 2040 年實現碳中和的承諾指明了方向。大批量合約為輪胎公司提供了可見性,並支持長期研發回報。同時,售後市場管道依賴消費者認知和安裝人員推薦,這使得它們成為快速採用的可靠因素。

OEM廠商的成長改變了議價能力,迫使製造商調整策略以適應車輛開發週期和數位化通行證的要求。達到汽車製造商閾值的供應商可以在每次新車發佈時獲得重複銷售和品牌曝光。售後市場需求仍然強勁,尤其是在老舊車輛更換方面,但隨著OEM廠商在首次銷售時就鎖定永續的解決方案,售後市場的成長速度將會放緩。

汽車綠色輪胎市場按車輛類型(乘用車和商用車)、終端用戶類型(原廠配套和售後市場)、材料類型(天然橡膠輪胎、合成橡膠輪胎、二氧化矽複合輪胎、生物基聚合物輪胎等)、配銷通路(線下和線上)以及地區進行細分。市場預測以價值(美元)和銷售量(單位)為單位。

區域分析

預計到2024年,亞太地區將佔據永續輪胎市場49.42%的佔有率,並在2030年前以9.64%的複合年成長率成長。中國的「十四五」規劃旨在將資源生產力提高20%,並將輪胎和橡膠回收列為優先事項。印度正在實施濕地抓地力、滾動阻力和噪音方面的法規,以使國內生產與出口預期保持一致。日本正在資助一條纖維素奈米纖維試點生產線,該生產線可以減少輪胎化合物的全生命週期排放。這些合作政策正在建立區域供應鏈,降低進口風險,並確保亞太地區繼續保持永續輪胎創新中心的地位。

歐洲正透過將環境標準直接寫入法律來穩定經濟成長,從而為製造商提供對低環境影響化合物的可預測需求。歐7顆粒物排放法規和生態設計數位護照很快就會要求提供輪胎磨損和碳足跡的檢驗數據。投資回收炭黑和熱解叢集可以幫助企業實現材料循環並獲得合規積分。隨著許多新興市場採用歐盟標準,達到這些標準的企業將享有出口優勢。

在北美,聯邦研究津貼和各州回收激勵措施的結合,正在推動永續輪胎市場向循環模式轉型。美國能源部對生物丁二烯的資助以及加州的輪胎激勵計劃,體現了上游創新與下游需求刺激相結合的概念。車隊營運商正在評估數據豐富的輪胎,以簡化重型車輛遵守更嚴格的溫室氣體法規的流程,並鼓勵其在遠距運輸中採用。雖然在南美、中東和非洲的擴張緩慢,但他們正在採用歐盟標籤來保護出口管道。針對跨國公司的原始設備製造商採購指南正在促進永續技術在這些價格敏感地區的傳播,逐步將永續輪胎市場拓展到其傳統據點之外。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概況

- 市場促進因素

- 電動車產量快速成長

- 收緊全球二氧化碳排放和輪胎標籤法規

- 從2024年起,替換輪胎的需求將激增。

- 透過整合智慧輪胎感測器降低生命週期成本

- OEM Scope 3 會計推廣更環保的材料

- 東協稻殼灰二氧化矽的商業化

- 市場限制

- 與傳統輪胎相比,初始成本更高

- 大型商用車輛的承載極限

- 醫用手套與生物橡膠原料之間的競爭

- 歐盟顆粒物排放限制延後了新化合物的引入

- 價值鏈/供應鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元)及銷售量(單位))

- 按車輛類型

- 搭乘用車

- 商用車

- 按最終用戶

- OEM

- 售後市場

- 依材料類型

- 富含天然橡膠的輪胎

- 富含合成橡膠的輪胎

- 二氧化矽基複合輪胎

- 生物基聚合物輪胎

- 再生材料輪胎

- 按分銷管道

- 線下(經銷商和零售連鎖店)

- 線上(電子商務平台)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Michelin Group

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Pirelli & C. SpA

- Yokohama Rubber Co. Ltd.

- Apollo Tyres Ltd.

- Hankook Tire & Technology

- Sumitomo Rubber Industries Ltd.

- Nokian Tyres plc

- Toyo Tire Corporation

- Kumho Tire Co. Inc.

- Giti Tire

- Linglong Tire

- CEAT Ltd.

第7章 市場機會與未來展望

The Automotive Green Tires Market size is valued at USD 133.73 billion in 2025 and is forecast to climb to USD 225.55 billion by 2030, advancing at an 11.02% CAGR.

Electrification of global vehicle fleets, Euro 7 tire particulate limits, and corporate Scope-3 decarbonization targets have turned environmental performance into a core design metric. Scaling of rice-husk-ash silica in ASEAN, rapid smart-sensor deployment, and government funding for bio-based polymers are lowering lifecycle costs and widening addressable demand. Consolidation is accelerating as large manufacturers acquire circular-economy capabilities and secure bio-rubber feedstocks. Supply-chain exposure to Southeast-Asian latex and pending global test-method harmonization for tire particulates remains the principal execution risk.

Global Automotive Green Tires Market Trends and Insights

Surging Electric-Vehicle (EV) Production

Global EV assembly lines require tires that handle instant torque, low noise, and minimal rolling resistance. New FMVSS 305a rules, effective December 2025, align tire safety with battery-electric drivetrains . General Motors plans 1 million EV units of annual North American capacity by 2025, magnifying demand for specialized compounds. Environmental standards for 2027-2032, EPA multi-pollutant standards target a 50% GHG cut in light-duty vehicles, reinforcing the shift. These regulations embed EV-centric performance in every new passenger and commercial platform. As automakers race to extend driving range, tires optimized for battery efficiency become a procurement priority

Stricter global CO2 & Tire-Labelling Regulations Reshape Product Development

Euro 7 introduces the world's first mandatory tire-wear particulate caps beginning July 2028 . The Ecodesign for Sustainable Products Regulation will add digital product passports for tires by April 2025, capturing the end-to-end lifecycle. China's 2024 carbon footprint standard obliges tire producers to quantify emissions across manufacturing stages. The U.S. Tire Manufacturers Association has identified five potential 6PPD alternatives to meet California's Safer Consumer Products rule. Compliance now confers a tangible branding advantage, rewarding firms that embed environmental metrics into core design rather than bolt-on labeling.

High Upfront Cost Premium Challenges Market Penetration

EPA hazardous-air-pollutant rules add USD 13.3 million in annual compliance expense to U.S. tire plants . China's 2024-2025 Energy Conservation action plan tightens industrial emissions, raising local production costs. DOE's USD 88 million Vehicle Technologies grants acknowledge that greener mobility still needs subsidies to close cost gaps. Premium pricing strains fleet budgets that prioritize payback horizons shorter than tire life. Credit access in emerging economies further slows uptake.

Other drivers and restraints analyzed in the detailed report include:

- Booming Replacement-Tire Demand Creates Aftermarket Opportunities

- Smart-Tire Sensor integration Transforms Lifecycle Economics

- Load-Bearing Limits in Heavy Commercial Fleets Constrain Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Commercial vehicles added a 12.48% CAGR growth lane, even though passenger cars retained the largest share with 63.31% in 2024. Smart-sensor packages and lower rolling resistance allow operators to cut fuel bills, offsetting the price premium. EPA CAFE increments and fleet electrification mandates amplify this calculus. In contrast, consumer uptake depends on brand messaging and dealership influence. As commercial trials validate durability, the sustainable tire market continues diversifying, encouraging volume scaling that benefits all categories. Over time, passenger-vehicle adoption will gain from cost curves established in freight.

Commercial platforms also expose tires to higher torque from electric drivetrains, accelerating compound innovation. Fleet managers use telematics to analyze wear, reinforcing demand for data-ready, low-carbon models. California and the EU policies link commercial-fleet emissions to procurement credits, further tipping decisions toward sustainable technologies. Passenger market growth remains steady but faces income-elastic buying behavior, slowing conversion outside subsidized jurisdictions.

Aftermarket programs are growing at a 9.82% CAGR, slowly eroding the OEM's 68.45% hold. Automakers embed tire carbon data in supplier scorecards to hit Scope-3 targets. GM's carbon-neutral pledge by 2040 exemplifies the direction. Large volume contracts give tire firms forecast clarity, supporting long R&D paybacks. Meanwhile, aftermarket channels rely on consumer awareness and installer recommendations, factors less reliable for rapid penetration.

OEM growth shifts bargaining power, requiring manufacturers to align with vehicle development cycles and digital passport requirements. Suppliers that meet automaker thresholds gain repeat volume and brand exposure on every new model. Aftermarket demand remains sizeable, especially for replacement in aging vehicle parks, but growth moderates as OEM fitments lock in sustainable options at first sale.

The Automotive Green Tires Market is Segmented by Vehicle Type (Passenger Vehicles and Commercial Vehicles), End-User Type (OEM and Aftermarket), Material Type (Natural Rubber-Rich Tires, Synthetic Rubber-Rich Tires, Silica-Based Composite Tires, Bio-Based Polymer Tires, and More), and Distribution Channel (Offline and Online) Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific held 49.42% of the sustainable tire market share in 2024 and is projected to grow at a 9.64% CAGR through 2030. China's 14th Five-Year Plan seeks a 20% rise in resource productivity and identifies tire-rubber recycling as a priority. India enforces wet-grip, rolling-resistance, and noise limits that align domestic production with export expectations. Japan funds cellulose-nanofiber pilot lines that can cut lifecycle emissions in tire compounds. These coordinated policies build localized supply chains, buffer import risks, and keep Asia-Pacific at the center of sustainable tire innovation.

Europe anchors growth by writing environmental criteria directly into law, giving manufacturers predictable demand for low-impact compounds. Euro 7 particulate caps and the Ecodesign digital passport will soon require verifiable data on tire wear and carbon footprints. Investments in recovered carbon black and pyrolysis clusters help companies close material loops and secure compliance credits. Firms that meet these benchmarks gain export leverage because many emerging markets adopt EU norms.

North America blends federal research grants with state recycling incentives, steering the sustainable tire market toward circular models. DOE funding for bio-butadiene and California's Tire Incentive Program illustrate the mix of upstream innovation and downstream demand pulls. Fleet operators value data-rich tires that simplify compliance with tighter heavy-duty greenhouse-gas standards, lifting uptake on long-haul routes. South America, the Middle East, and Africa expand more slowly yet adopt EU labeling to safeguard export access. Multinational OEM procurement guidelines diffuse sustainable technologies into these price-sensitive regions, gradually lifting the sustainable tire market size beyond its traditional strongholds.

- Michelin Group

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Pirelli & C. SpA

- Yokohama Rubber Co. Ltd.

- Apollo Tyres Ltd.

- Hankook Tire & Technology

- Sumitomo Rubber Industries Ltd.

- Nokian Tyres plc

- Toyo Tire Corporation

- Kumho Tire Co. Inc.

- Giti Tire

- Linglong Tire

- CEAT Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging electric-vehicle (EV) production

- 4.2.2 Stricter global CO2 and tire-labelling regulations

- 4.2.3 Booming replacement-tire demand post-2024

- 4.2.4 Smart-tire sensor integration lowers lifecycle cost

- 4.2.5 OEM Scope-3 accounting pushes greener materials

- 4.2.6 ASEAN rice-husk-ash silica commercialisation

- 4.3 Market Restraints

- 4.3.1 High upfront cost premium vs. conventional tires

- 4.3.2 Load-bearing limits in heavy commercial fleets

- 4.3.3 Bio-rubber feedstock competition with medical gloves

- 4.3.4 EU particulate-emission caps delaying new compounds

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.2 By End-User

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 By Material Type

- 5.3.1 Natural-Rubber-Rich Tires

- 5.3.2 Synthetic-Rubber-Rich Tires

- 5.3.3 Silica-Based Composite Tires

- 5.3.4 Bio-Based Polymer Tires

- 5.3.5 Recycled-Material Tires

- 5.4 By Distribution Channel

- 5.4.1 Offline (Dealers & Retail Chains)

- 5.4.2 Online (E-commerce Platforms)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Michelin Group

- 6.4.2 Bridgestone Corporation

- 6.4.3 Continental AG

- 6.4.4 Goodyear Tire & Rubber Company

- 6.4.5 Pirelli & C. SpA

- 6.4.6 Yokohama Rubber Co. Ltd.

- 6.4.7 Apollo Tyres Ltd.

- 6.4.8 Hankook Tire & Technology

- 6.4.9 Sumitomo Rubber Industries Ltd.

- 6.4.10 Nokian Tyres plc

- 6.4.11 Toyo Tire Corporation

- 6.4.12 Kumho Tire Co. Inc.

- 6.4.13 Giti Tire

- 6.4.14 Linglong Tire

- 6.4.15 CEAT Ltd.